Current Report Filing (8-k)

November 12 2014 - 7:29AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 12, 2014

ALTISOURCE PORTFOLIO SOLUTIONS S.A.

(Exact name of registrant as specified in its charter)

|

Luxembourg |

|

001-34354 |

|

98-0554932 |

|

(State or other jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

|

of incorporation) |

|

File Number) |

|

Identification No.) |

|

40, avenue Monterey |

|

|

|

L-2163 Luxembourg

Grand Duchy of Luxembourg |

|

|

|

(Address of principal executive office) |

|

(Zip Code) |

Registrant’s telephone number, including area code: +352 2469 7900

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events

On November 12, 2014, Altisource Portfolio Solutions S.A. (“Altisource”) announced that it is discontinuing its Lender Placed Insurance brokerage line of business. A copy of the press release issued by Altisource is filed herewith as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

99.1 Press Release dated November 12, 2014.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Michelle D. Esterman |

|

|

|

Name: Michelle D. Esterman |

|

|

|

Title: Chief Financial Officer |

|

|

|

|

|

Date: November 12, 2014 |

|

|

3

Exhibit 99.1

|

|

|

|

|

FOR IMMEDIATE RELEASE |

|

FOR FURTHER INFORMATION CONTACT: |

|

|

|

|

|

|

|

Michelle D. Esterman |

|

|

|

Chief Financial Officer |

|

|

|

T: +352 2469 7950 |

|

|

|

E: Michelle.Esterman@altisource.lu |

ALTISOURCE DISCONTINUES LENDER PLACED INSURANCE BROKERAGE BUSINESS

LUXEMBOURG, November 12, 2014 — Altisource Portfolio Solutions S.A. (“Altisource”) (NASDAQ: ASPS) today announced that it is discontinuing its Lender Placed Insurance (“LPI”) brokerage line of business.

Altisource believes that it developed a lender placed insurance program that is unique in its benefits to consumers and investors. The program lowers premium rates compared to previous program rates, promotes ongoing premium rate competition among underwriters to further reduce premiums and will include an offer to borrowers to purchase voluntary homeowner’s insurance to avoid having their insurance placed by their servicer.

However, given the uncertainties with industry-wide litigation and the regulatory environment, Altisource believes it is in the best interest of the Company and its shareholders to discontinue this line of business and continue to focus attention and resources on developing and delivering leading innovative technology-driven products and services for the real estate and mortgage markets that will provide benefits to consumers, lenders, originators and other participants.

Homeowners with insurance policies placed via this program will experience no impact to their coverage as a result of this decision. The discontinuation of this business line is expected to reduce Altisource’s quarterly diluted earnings per share by an average of approximately $0.50 - $0.65 for the period October 1, 2014 through December 31, 2015.

Forward-Looking Statements

This press release contains forward-looking statements that involve a number of risks and uncertainties. Those forward-looking statements include all statements that are not historical fact, including statements about management’s beliefs and expectations. Forward-looking statements are based on management’s beliefs as well as assumptions made by and information currently available to management. Because such statements are based on expectations as to future economic performance and are not statements of historical fact, actual results may differ materially from those projected. The Company undertakes no obligation to update any forward-looking statements whether as a result of new information, future events or otherwise. The risks and uncertainties to which forward-looking statements are subject include, but are not limited to: Altisource’s ability to retain existing customers and attract new customers; general economic and

1

market conditions; governmental regulations, taxes and policies; availability of adequate and timely sources of liquidity; and other risks and uncertainties detailed in the “Forward-Looking Statements,” “Risk Factors” and other sections of the Company’s Form 10-K and other filings with the Securities and Exchange Commission.

About Altisource

Altisource is a premier marketplace and transaction solutions provider for the real estate, mortgage and consumer debt industries offering both distribution and content. We leverage proprietary business process, vendor and electronic payment management software and behavioral science based analytics to improve outcomes for marketplace participants. Additional information is available at www.altisource.com.

2

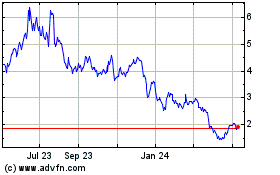

Altisource Portfolio Sol... (NASDAQ:ASPS)

Historical Stock Chart

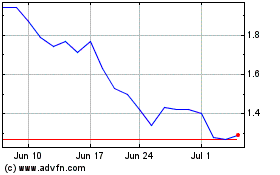

From Mar 2024 to Apr 2024

Altisource Portfolio Sol... (NASDAQ:ASPS)

Historical Stock Chart

From Apr 2023 to Apr 2024