UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

November 10, 2014

(Date of earliest event reported)

CONSOLIDATED WATER CO. LTD.

(Exact Name of Registrant as Specified in

Charter)

| Cayman Islands, B.W.I. |

0-25248 |

98-0619652 |

| (State or Other Jurisdiction of |

(Commission File No.) |

(IRS Employer Identification No.) |

| Incorporation) |

|

|

Regatta Office Park

Windward Three, 4th

Floor

West Bay Road, P.O. Box 1114

Grand Cayman, KY1-1102

Cayman Islands

(Address of Principal Executive Offices)

(345) 945-4277

(Registrant’s telephone number, including

area code)

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instructions A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02. | Results of Operations and Financial Condition. |

On November 10, 2014, Consolidated Water

Co. Ltd. (the “Company”) issued a press release announcing its results of operations for the third quarter ended September

30, 2014. A copy of the press release is attached as Exhibit 99.1 to this report. This information is not deemed to be “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934 and is not incorporated by reference into any Securities

Act registration statements.

| Item 9.01. | Financial Statements and Exhibits. |

| Exhibit No. |

|

Title |

| |

|

|

| 99.1 |

|

Press release issued by the Company on November 10, 2014. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CONSOLIDATED WATER CO. LTD. |

| |

|

|

| |

By: |

/s/ David W. Sasnett |

| |

Name: |

David W. Sasnett |

| |

Title: |

Executive Vice President & Chief Financial Officer |

| |

|

|

| Date: November 11, 2014 |

|

|

EXHIBIT INDEX

| Exhibit |

|

Description |

| |

|

|

| 99.1 |

|

Press release issued by the Company on November 10, 2014. |

Exhibit 99.1

CONSOLIDATED

WATER CO. LTD.

REPORTS

HIGHER THIRD QUARTER REVENUE AND EARNINGS

NET INCOME ATTRIBUTABLE TO STOCKHOLDERS

INCREASES 107% FROM

PRIOR-YEAR PERIOD

GEORGE TOWN, Grand Cayman, Cayman Islands

(November 10, 2014) — Consolidated Water Co. Ltd. (NASDAQ Global Select Market: “CWCO”) (“Consolidated

Water” or “the Company”), which develops and operates seawater desalination plants and water distribution systems

in areas of the world where naturally occurring supplies of potable water are scarce or nonexistent, today reported its operating

results for the third quarter and first nine months of 2014. The Company will host an investor conference call on Tuesday, November

11, 2014 at 11:00 a.m. EST (see details below) to discuss its operating results and other topics of interest.

Third Quarter Operating Results

Net income attributable to the Company’s

stockholders increased 107% to $1,882,692, or $0.13 per diluted share, for the three months ended September 30, 2014, compared

with net income attributable to CWCO stockholders of $908,690, or $0.06 per diluted share, for the three months ended September

30, 2013.

Total revenues for the third quarter of

2014 increased 10% to approximately $17.0 million, compared with approximately $15.4 million in the third quarter of 2013.

Retail water revenues increased 18% to

approximately $5.9 million in the most recent quarter, versus approximately $5.0 million in the third quarter of 2013. The increase

in retail revenues was primarily due to an approximate 17% increase in the number of gallons of water sold by the Company’s

retail operations in the Cayman Islands.

Bulk water revenues declined 3% to approximately

$9.9 million in the third quarter of 2014, compared with approximately $10.2 million in the prior-year quarter. The reduction in

bulk water revenues was attributable to a decrease in the volume of water sold by the Company’s Bahamas operations to the

Water and Sewerage Corporation of The Bahamas (“WSC”), partially offset by an increase in revenues from the Cayman

bulk water operations. In 2013, the WSC purchased water volumes from the Company’s Blue Hills plant that were significantly

higher than the minimum amounts it was required to purchase under the water supply agreement for the plant. However, as a result

of water conservation and loss mitigation efforts it has conducted since that time, the WSC has reduced the amount of water lost

by its distribution system and consequently in 2014 decreased the volume of water it purchased from the Blue Hills plant. However,

the WSC continued to purchase more than the minimum amount stipulated in its contract with the Company.

Services segment revenues increased to

$1,178,710 in the quarter ended September 30, 2014, compared with $175,438 in the year-earlier quarter, primarily due to construction

revenues generated from contracts with the Water Authority-Cayman to refurbish its Lower Valley plant and to build a plant on the

island of Cayman Brac.

Consolidated gross profit improved 9% to

approximately $5.7 million (33% of total revenues) in the most recent quarter, versus approximately $5.2 million (34% of total

revenues) in the third quarter of 2013. Gross profit on retail revenues increased 27% to approximately $3.0 million (50% of retail

revenues) in the quarter ended September 30, 2014, compared with approximately $2.4 million (47% of retail revenues) in the prior-year

period. The increase in retail gross profit margin as a percentage of sales reflected an increase in water sales, as a significant

portion of the Company’s water production expenses are fixed in nature. Gross profit on bulk revenues declined 6% to approximately

$2.8 million (28% of bulk revenues), compared with approximately $3.0 million (29% of bulk revenues) a year earlier. Gross profit

as a percentage of bulk water sales remained relatively constant, despite the decrease in revenues, because the water sales made

in 2013 by the Company’s Bahamas operation that exceeded the contractual minimum for the Blue Hills plant generated relatively

small gross profits. The services segment generated a negative gross profit of ($83,236) in the third quarter of 2014, compared

with a negative gross profit of ($94,644) in the third quarter of 2013.

Consolidated general and administrative

expenses (“G&A”) declined 8% to approximately $4.0 million in the third quarter of 2014, compared with approximately

$4.3 million in the year-earlier quarter. Project development expenses incurred by the Company’s Mexico subsidiary, N.S.C.

Agua, S.A. de C.V. (“NSC”) decreased by approximately $538,000. Other G&A categories with significant fluctuations

included professional fees, which rose by approximately $145,000 due to consulting services, and banking fees, which increased

$134,000 from prior-year levels as a result of wire/exchange fees incurred to transfer funds out of The Bahamas to repay intercompany

loans.

Interest income increased to $334,499 for

the third quarter of 2014, up from $232,820 in the third quarter of 2013, due to interest on past due accounts receivables from

the WSC. Interest expense decreased to $70,515 for the three months ended September 30, 2014, versus $117,242 in the prior-year

quarter, reflecting the early redemption in February 2014 of the remaining outstanding balance on the Company’s bonds payable.

The Company recognized earnings and profit

sharing on its investment in OC-BVI of $111,855 in the most recent quarter, compared with $75,609 in the third quarter of 2013.

Management Comments

“We are

very pleased to report that our net income attributable to Consolidated Water stockholders more than doubled in the most recent

quarter, when compared with the third quarter of 2013,” stated Mr. Rick McTaggart, Chief Executive Officer of Consolidated

Water Co. Ltd. “Gross profit margins from our retail business improved, reflecting a healthy 17% increase in the volume of

water sold by our retail operations in the Cayman Islands. We are encouraged that retail water volume sales have increased

during the past two quarters relative to prior-year periods, reversing a three-year downtrend that began in 2010. We believe that

drier weather conditions and an increase in tourist arrivals in the Cayman Islands have contributed to a greater demand for potable

water in this key market.”

“We have continued to make significant

progress on our 100 million gallon-per-day desalination plant and conveyance pipeline project in northern Baja California, Mexico.

In the third quarter of 2014, we benefited from lower development costs when compared with the prior-year period, reflecting the

completion of certain outsourced engineering and technical work that was underway a year ago.”

“We recently received initial comments

from the Mexican regulator on our environmental impact studies for the project and are pleased that no major issues were identified

in this first round of comments,” continued Mr. McTaggart. “We will work diligently to address the regulator’s

comments and hope to obtain the necessary permits in due course.”

Nine-Month Operating Results

Net income attributable to the Company’s

stockholders for the nine months ended September 30, 2014 totaled $5,297,294, or $0.36 per diluted share, compared with net income

attributable to CWCO stockholders of $7,504,542, or $0.51 per diluted share, for the nine months ended September 30, 2013.

Total revenues for the first nine months

of 2014 increased 4% to approximately $50.3 million, compared with approximately $48.6 million in the corresponding period of the

previous year.

Retail water revenues rose 5% to approximately

$18.5 million (37% of total revenues) in the nine months ended September 30, 2014, versus approximately $17.6 million (36% of total

revenues) in the first nine months of 2013. The volume of water sold by the Company’s Cayman retail operations increased

by approximately 4% in the first nine months of 2014 when compared with the prior-year period.

Bulk water revenues declined slightly,

to approximately $29.8 million (59% of total revenues) in the first nine months of 2014, compared with approximately $30.3 million

(62% of total revenues) in the prior-year period. The reduction in bulk water revenues was attributable to a decrease in the volume

of water sold by the Company’s Bahamas operations to the WSC, as discussed earlier in this press release, partially offset

by an increase in revenues from the Cayman bulk water operations.

Services segment revenues increased to

$1,921,004 in the nine months ended September 30, 2014, compared with $706,144 in the corresponding period of 2013, primarily due

to construction revenues generated from contracts with the Water Authority-Cayman to refurbish the Lower Valley plant and to build

a plant on the island of Cayman Brac.

Consolidated gross profit improved slightly,

to approximately $18.0 million (36% of total revenues) in the first nine months of 2014, versus approximately $17.8 million (37%

of total revenues) in the first nine months of 2013. Gross profit on retail revenues increased 3% to approximately $9.6 million

(51% of retail revenues) in the nine months ended September 30, 2014, compared with approximately $9.2 million (52% of retail revenues)

in the year-earlier period. Gross profit on bulk revenues was largely unchanged at approximately $8.7 million (29% of bulk revenues)

in the first nine months of both 2014 and 2013. The services segment recorded a negative gross profit of ($222,595) in the 2014

period, compared with a negative gross profit of ($130,801) in the first nine months of 2013.

Consolidated G&A expenses increased

14% to approximately $13.1 million in the first nine months of 2014, compared with approximately $11.5 million in the year-earlier

period. Project development expenses incurred by NSC increased by approximately $1.0 million, professional fees rose by approximately

$407,000, and employee costs increased by approximately $137,000.

Interest income increased to $874,203 for

the first nine months of 2014, from $582,704 a year earlier, due to interest on past due accounts receivables from the WSC. Interest

expense increased to $413,783 in the nine months ended September 30, 2014, versus $374,512 in the prior-year period, reflecting

the prepayment premium paid for the early redemption in February 2014 of the remaining outstanding balance on the Company’s

bonds payable and the amortization of the related bond discount and deferred issuance costs.

The Company recognized earnings and profit

sharing on its investment in OC-BVI of $302,809 in the nine months ended September 30, 2014, compared with $1,254,913 in the corresponding

period of the previous year. The additional earnings and profit sharing recognized in 2013 from the equity investment in OC-BVI

resulted from the payment by the British Virgin Islands government to OC-BVI in January 2013 of $2.0 million of the amount awarded

to OC-BVI as a result of the Baughers Bay litigation.

Cash Dividends

On October 31, 2014, the Company paid

a quarterly cash dividend of $0.075 per share for the 22nd consecutive quarter. The Company has paid cash dividends

to shareholders since 1985.

Investor Conference Call

The Company will host a conference call

at 11:00 a.m. Eastern Time (EST) on Tuesday, November 11, 2014 to discuss its third quarter and nine-month operating results and

other topics of interest. Shareholders and other interested parties may participate in the conference call by dialing 877-374-8416

(international/local participants dial 412-317-6716) and requesting participation in the “Consolidated Water Co. Ltd.

Conference Call” a few minutes before 11:00 a.m. EST on November 11, 2014.

A replay

of the conference call will be available one hour after the call through 9:00 a.m. EST on Tuesday, November 18, 2014 by dialing

877-344-7529 (international/local participants dial 412-317-0088)

and entering the conference ID # 10055602, and on the Company’s website at www.cwco.com.

CWCO-E

About Consolidated Water Co. Ltd.

Consolidated Water Co. Ltd. develops and

operates seawater desalination plants and water distribution systems in areas of the world where naturally occurring supplies of

potable water are scarce or nonexistent. The Company operates water production and/or distribution facilities in the Cayman Islands,

Belize, the British Virgin Islands, The Commonwealth of The Bahamas, and Bali, Indonesia.

Consolidated Water Co. Ltd. is headquartered

in George Town, Grand Cayman, in the Cayman Islands. The Company’s ordinary (common) stock is traded on the NASDAQ Global

Select Market under the symbol “CWCO”. Additional information on the Company is available on its website at http://www.cwco.com.

This press release includes statements

that may constitute “forward-looking” statements, usually containing the words “believe”, “estimate”,

“project”, “intend”, “expect”, “should” or similar expressions. These statements

are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements

inherently involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements.

Factors that would cause or contribute to such differences include, but are not limited to, continued acceptance of the Company’s

products and services in the marketplace, changes in its relationships with the governments of the jurisdictions in which it operates,

the outcome of its negotiations with the Cayman government regarding a new retail license agreement, its ability to successfully

secure contracts for water projects, including the projects under development in Baja California, Mexico and Bali, Indonesia, its

ability to develop and operate such projects profitably, and its ability to manage growth and other risks detailed in the Company’s

periodic report filings with the Securities and Exchange Commission (“SEC”).

By making these forward-looking statements,

the Company undertakes no obligation to update these statements for revisions or changes after the date of this release.

For further information, please contact:

Frederick W.

McTaggart, President and CEO, at (345) 945-4277 or David W. Sasnett, Executive Vice President and CFO, at (954) 509-8200 or via

e-mail at info@cwco.com

or

RJ Falkner & Company, Inc., Investor

Relations Counsel at (800) 377-9893 or

via e-mail at info@rjfalkner.com

(Financial Highlights Follow)

CONSOLIDATED WATER CO. LTD.

CONDENSED CONSOLIDATED BALANCE SHEETS

| | |

September 30, | | |

December 31, | |

| | |

2014 | | |

2013 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 33,582,329 | | |

$ | 33,626,516 | |

| Certificate of deposit | |

| 5,000,000 | | |

| - | |

| Restricted cash | |

| 498,929 | | |

| - | |

| Marketable securities | |

| - | | |

| 8,587,475 | |

| Accounts receivable, net | |

| 12,234,168 | | |

| 18,859,560 | |

| Inventory | |

| 1,578,188 | | |

| 1,383,135 | |

| Prepaid expenses and other current assets | |

| 2,771,365 | | |

| 2,435,127 | |

| Current portion of loans receivable | |

| 1,698,576 | | |

| 1,691,102 | |

| Total current assets | |

| 57,363,555 | | |

| 66,582,915 | |

| | |

| | | |

| | |

| Property, plant and equipment, net | |

| 56,041,873 | | |

| 58,602,886 | |

| Construction in progress | |

| 2,860,402 | | |

| 1,450,417 | |

| Inventory, non-current | |

| 4,341,636 | | |

| 4,204,089 | |

| Loans receivable | |

| 6,052,985 | | |

| 7,337,177 | |

| Investment in OC-BVI | |

| 5,956,657 | | |

| 6,623,448 | |

| Intangible assets, net | |

| 966,922 | | |

| 1,096,488 | |

| Goodwill | |

| 3,499,037 | | |

| 3,499,037 | |

| Investment in land | |

| 20,557,353 | | |

| 13,175,566 | |

| Other assets | |

| 2,738,551 | | |

| 2,792,831 | |

| Total assets | |

$ | 160,378,971 | | |

$ | 165,364,854 | |

| | |

| | | |

| | |

| LIABILITIES AND EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable and other current liabilities | |

$ | 5,465,197 | | |

$ | 7,157,896 | |

| Dividends payable | |

| 1,165,937 | | |

| 1,164,026 | |

| Demand loan payable | |

| 9,500,000 | | |

| - | |

| Current portion of long term debt | |

| - | | |

| 5,205,167 | |

| Land purchase obligation | |

| - | | |

| 10,050,000 | |

| Total current liabilities | |

| 16,131,134 | | |

| 23,577,089 | |

| Other liabilities | |

| 227,762 | | |

| 289,392 | |

| Total liabilities | |

| 16,358,896 | | |

| 23,866,481 | |

| Commitments and contingencies | |

| | | |

| | |

| Equity | |

| | | |

| | |

| Consolidated Water Co. Ltd. stockholders' equity | |

| | | |

| | |

| Redeemable preferred stock, $0.60 par value. Authorized 200,000 shares; issued and outstanding 37,026 and 37,408 shares, respectively | |

| 22,216 | | |

| 22,445 | |

| Class A common stock, $0.60 par value. Authorized 24,655,000 shares; issued and outstanding 14,703,098 and 14,686,197 shares, respectively | |

| 8,821,859 | | |

| 8,811,718 | |

| Class B common stock, $0.60 par value. Authorized 145,000 shares; none issued or outstanding | |

| - | | |

| - | |

| Additional paid-in capital | |

| 83,691,069 | | |

| 83,381,387 | |

| Retained earnings | |

| 49,138,412 | | |

| 47,155,548 | |

| Cumulative translation adjustment | |

| (465,833 | ) | |

| (471,983 | ) |

| Total Consolidated Water Co. Ltd. stockholders' equity | |

| 141,207,723 | | |

| 138,899,115 | |

| Non-controlling interests | |

| 2,812,352 | | |

| 2,599,258 | |

| Total equity | |

| 144,020,075 | | |

| 141,498,373 | |

| Total liabilities and equity | |

$ | 160,378,971 | | |

$ | 165,364,854 | |

CONSOLIDATED WATER CO. LTD.

CONDENSED CONSOLIDATED STATEMENTS OF

INCOME

(UNAUDITED)

| | |

Three Months Ended September 30, | | |

Nine Months Ended September 30, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| | |

| | |

| | |

| | |

| |

| Retail water revenues | |

$ | 5,936,623 | | |

$ | 5,023,591 | | |

$ | 18,548,841 | | |

$ | 17,598,200 | |

| Bulk water revenues | |

| 9,905,723 | | |

| 10,239,552 | | |

| 29,831,653 | | |

| 30,258,814 | |

| Services revenues | |

| 1,178,710 | | |

| 175,438 | | |

| 1,921,004 | | |

| 706,144 | |

| Total revenues | |

| 17,021,056 | | |

| 15,438,581 | | |

| 50,301,498 | | |

| 48,563,158 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of retail revenues | |

| 2,945,756 | | |

| 2,661,463 | | |

| 8,996,615 | | |

| 8,366,391 | |

| Cost of bulk revenues | |

| 7,113,039 | | |

| 7,280,151 | | |

| 21,120,498 | | |

| 21,514,909 | |

| Cost of services revenues | |

| 1,261,946 | | |

| 270,082 | | |

| 2,143,599 | | |

| 836,945 | |

| Total cost of revenues | |

| 11,320,741 | | |

| 10,211,696 | | |

| 32,260,712 | | |

| 30,718,245 | |

| Gross profit | |

| 5,700,315 | | |

| 5,226,885 | | |

| 18,040,786 | | |

| 17,844,913 | |

| General and administrative expenses | |

| 3,984,956 | | |

| 4,308,851 | | |

| 13,108,750 | | |

| 11,472,549 | |

| Income from operations | |

| 1,715,359 | | |

| 918,034 | | |

| 4,932,036 | | |

| 6,372,364 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 334,499 | | |

| 232,820 | | |

| 874,203 | | |

| 582,704 | |

| Interest expense | |

| (70,515 | ) | |

| (117,242 | ) | |

| (413,783 | ) | |

| (374,512 | ) |

| Profit sharing income from OC-BVI | |

| 30,375 | | |

| 20,250 | | |

| 81,000 | | |

| 335,361 | |

| Equity in earnings of OC-BVI | |

| 81,480 | | |

| 55,359 | | |

| 221,809 | | |

| 919,552 | |

| Other | |

| (101,297 | ) | |

| (58,722 | ) | |

| (20,804 | ) | |

| 93,955 | |

| Other income (expense), net | |

| 274,542 | | |

| 132,465 | | |

| 742,425 | | |

| 1,557,060 | |

| Net income | |

| 1,989,901 | | |

| 1,050,499 | | |

| 5,674,461 | | |

| 7,929,424 | |

| Income attributable to non-controlling interests | |

| 107,209 | | |

| 141,809 | | |

| 377,167 | | |

| 424,882 | |

| Net income attributable to Consolidated Water Co. Ltd. stockholders | |

$ | 1,882,692 | | |

$ | 908,690 | | |

$ | 5,297,294 | | |

$ | 7,504,542 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic earnings per common share attributable to Consolidated Water Co. Ltd. common stockholders | |

$ | 0.13 | | |

$ | 0.06 | | |

$ | 0.36 | | |

$ | 0.51 | |

| Diluted earnings per common share attributable to Consolidated Water Co. Ltd. common stockholders | |

$ | 0.13 | | |

$ | 0.06 | | |

$ | 0.36 | | |

$ | 0.51 | |

| Dividends declared per common share | |

$ | 0.075 | | |

$ | 0.075 | | |

$ | 0.225 | | |

$ | 0.225 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares used in the determination of: | |

| | | |

| | | |

| | | |

| | |

| Basic earnings per share | |

| 14,700,939 | | |

| 14,644,740 | | |

| 14,695,446 | | |

| 14,626,755 | |

| Diluted earnings per share | |

| 14,763,914 | | |

| 14,734,916 | | |

| 14,764,127 | | |

| 14,682,186 | |

CONSOLIDATED WATER CO. LTD.

CONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME (LOSS)

(UNAUDITED)

| | |

Three Months Ended September 30, | | |

Nine Months Ended September 30, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| | |

| | |

| | |

| | |

| |

| Net Income | |

$ | 1,989,901 | | |

$ | 1,050,499 | | |

$ | 5,674,461 | | |

$ | 7,929,424 | |

| Other comprehensive income (loss) | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustment | |

| (29,873 | ) | |

| (303,195 | ) | |

| 6,473 | | |

| (357,632 | ) |

| Total other comprehensive income (loss) | |

| (29,873 | ) | |

| (303,195 | ) | |

| 6,473 | | |

| (357,632 | ) |

| Comprehensive income | |

| 1,960,028 | | |

| 747,304 | | |

| 5,680,934 | | |

| 7,571,792 | |

| Comprehensive income attributable to the non-controlling interest | |

| 105,716 | | |

| 126,649 | | |

| 377,491 | | |

| 407,000 | |

| Comprehensive income attributable to Consolidated Water Co. Ltd. stockholders | |

$ | 1,854,312 | | |

$ | 620,655 | | |

$ | 5,303,443 | | |

$ | 7,164,792 | |

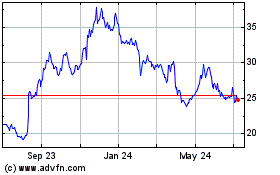

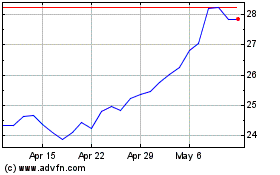

Consolidated Water (NASDAQ:CWCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Consolidated Water (NASDAQ:CWCO)

Historical Stock Chart

From Apr 2023 to Apr 2024