Revenue up 28% Year over

Year

Gross Margins Improve by 800

Basis Points

ATLANTA, GA /

ACCESSWIRE / November 11, 2014 / Labor SMART, Inc. (LTNC)

(the "Company"), a leader in providing on-demand blue collar

staffing primarily in the southeastern United States, today

announced it has filed its 10Q for the quarter ending September 26,

2014. The company will host its third quarter earnings call on

November 13, 2014 at 4:30pm EDT.

Third Quarter 2014 Highlights:

- Revenues up 28% to $6.8 million vs. $5.3 million a year

ago

- Same branch revenue up 12.5% year-over-year

- Gross profit margins improve to 25% vs. 17% a year ago

- Added 315 new customers

- EBITDA* of $121,577

- Adjusted EBITDA* of $344,731

- 30 branches, up from 15 at year end 2013

"I am very pleased with our financial results from the third

quarter," said Ryan Schadel, President and CEO of Labor SMART. "The

Labor SMART team delivered on all of our key metrics. Becoming

substantially self-insured, combined with our culling of low margin

accounts this summer has boosted our gross profit margins above

internal expectations. I am also pleased with our growth as

reflected in our EBITDA of $121,577. The attainment of positive

EBITDA for two consecutive quarters evidences our business strategy

is paying off." Schadel added that the company continues to grow

and is working to strengthen its presence, management team,

financial resources and capital structure.

During the remainder of 2014, Labor SMART does not expect to

open any new branches, however, it is aggressively pursuing

acquisitions that fit well with its culture and will continue to

seek more acquisition opportunities than in prior years. This major

shift in focus is directly related to the new large deductible

worker's compensation policy. The industry is very fragmented. The

Company has invested heavily in its corporate infrastructure in the

last two years and believes it can execute acquisitions to

immediately recognize economies of scale. Labor SMART believes it

can successfully execute and close acquisitions totaling $20-$40

million in revenue in 2015.

Financial Results:

Third Quarter 2014 Compared to Third Quarter

2013

Revenue for the three months ended September 26, 2014 increased

28% to $6.8 million as compared to $5.3 million for the three

months ended September 30, 2013. This increase was due to improved

revenue from existing branches and the opening of new branches in

the first half of fiscal 2014 as well as our acquisition of

Shirley's Employment. Of the 15 branches that were open at

September 30, 2013, revenue for the three months ended September

26, 2014 was $6.0 million, representing a 12.50% increase in same

branch revenue in a year-over-year comparison.

Gross profit margin improved 800 basis points to 25% for the

three months ended September 26, 2014, from 17% for the three

months ended September 30, 2013.

Operating loss for the third quarter of 2014 was $0.1 million,

an improvement from $0.2 million in the third quarter of 2013. Net

loss for the third quarter of 2014 was $1.1 million, an increase

from $0.4 million in the third quarter of 2013. This net loss

increase was due to non-cash interest and finance expense offset by

gain on change in fair value in derivative liability of $1.0

million. In the comparable third quarter 2013, such non-cash

interest and finance expense and gain on change in fair value in

derivative liability was $0.3 million. The resulting EPS is

($0.04), as compared to ($0.02) a year earlier, due to an increase

in average shares outstanding to 26.8 million, from 19.4

million.

Year-to-Date 2014 Compared to Year-to-Date

2013

Revenue for the nine months ended September 26, 2014 increased

52% to $18.1 million as compared to $11.9 million for the nine

months ended September 30, 2013.

Gross profit margin improved 700 basis points to 23% for the

nine months ended September 26, 2014, from 16% for the nine months

ended September 30, 2013.

Operating loss for the nine months ended September 26, 2014 was

$0.5 million, an improvement from $1.1 million in the nine months

ended September 30, 2013. Net loss for the nine months ended

September 26, 2014 was $3.1 million, an increase from $1.8 million

in the nine months ended September 30, 2013. This net loss increase

was due to non-cash interest and finance expense offset by gain on

change in fair value in derivative liability of $2.6 million. In

the comparable third quarter 2013, such non-cash interest and

finance expense and gain on change in fair value in derivative

liability was $0.7 million. The resulting EPS is ($0.13), as

compared to ($0.10) a year earlier, due to an increase in average

shares outstanding to 23.7 million, from 19.0 million.

During Thursday's earnings call management is expected to

discuss the reported third quarter results as well as other

developments at the company. Callers may dial toll-free

844-831-4027 with conference ID: 34514379 or listen online at

http://www.media-server.com/m/p/z6r4xuwg.

*EBITDA and Adjusted EBITDA are non-GAAP financial measures for

which a reconciliation is provided as part of this press release

and filed on Form 10Q.

Labor SMART, Inc.

Adjusted Earnings before Interest, Taxes, Depreciation and

Amortization (EBITDA)

September 26, 2014

|

|

Three Months Ended September 26, 2014

|

|

GAAP, net loss

|

$ (1,087,328)

|

|

Add:

|

|

|

Provision for income taxes

|

-

|

|

Interest and finance expense, net

|

1,165,075

|

|

Depreciation and amortization

|

43,830

|

|

EBITDA

|

121,577

|

|

Non-recurring acquisition and expansion costs

|

223,154

|

|

Adjusted EBITDA

|

$ 344,731

|

About Labor SMART, Inc.

Labor SMART, Inc. provides On-Demand temporary labor to a

variety of industries. The Company's clients range from small

businesses to Fortune 100 companies. Labor SMART was founded to

provide reliable, dependable and flexible resources for on-demand

personnel to small and large businesses in areas that include

construction, manufacturing, hospitality, event-staffing,

restoration, warehousing, retailing, disaster relief and cleanup,

demolition and landscaping. Labor SMART believes it can make a

positive contribution each and every day for the benefit of its

clients and temporary employees. The Company's mission is to be the

provider of choice to its growing portfolio of customers with a

service-focused approach that enables Labor SMART to be seen as a

resource and partner to its clients.

Safe Harbor Statement

This release contains statements that constitute forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. These statements appear in a number of places

in this release and include all statements that are not statements

of historical fact regarding the intent, belief or current

expectations of Labor SMART, Inc., its directors or its officers

with respect to, among other things: (i) financing plans; (ii)

trends affecting its financial condition or results of operations;

(iii) growth strategy and operating strategy. The words "may",

"would", "will", "expect", "estimate", "can", "believe",

"potential", and similar expressions and variations thereof are

intended to identify forward-looking statements. Investors are

cautioned that any such forward-looking statements are not

guarantees of future performance and involve risks and

uncertainties, many of which are beyond Labor SMART, Inc.'s ability

to control, and that actual results may differ materially from

those projected in the forward-looking statements as a result of

various factors. More information about the potential factors that

could affect the business and financial results is and will be

included in Labor SMART, Inc.'s filings with the U.S. Securities

and Exchange Commission.

Contacts:

Hayden IR

917-658-7878

hart@haydenir.com

Beverly Jedynak

Martin E. Janis & Company, Inc.

312-943-1123

bjedynak@janispr.com

SOURCE: Labor SMART, Inc.

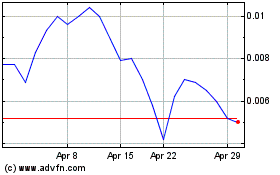

Labor Smart (PK) (USOTC:LTNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Labor Smart (PK) (USOTC:LTNC)

Historical Stock Chart

From Apr 2023 to Apr 2024