UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 10, 2014

Athersys, Inc.

(Exact

Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

001-33876 |

|

20-4864095 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 3201 Carnegie Avenue, Cleveland, Ohio |

|

44115-2634 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (216) 431-9900

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02. |

Results of Operations and Financial Condition. |

On November 10, 2014, Athersys,

Inc. issued a press release announcing financial results for its third quarter ended September 30, 2014. A copy of this press release is attached hereto as Exhibit 99.1.

The information contained in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished to

the Securities and Exchange Commission and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section. Furthermore, the information

contained in Item 2.02 of this Current Report on Form 8-K shall not be deemed to be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933.

| Item 9.01. |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

No. |

|

Exhibit Description |

|

|

| 99.1 |

|

Press Release dated November 10, 2014 |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date: November 10, 2014

|

|

|

|

|

| ATHERSYS, INC. |

|

|

| By: |

|

/s/ Laura K. Campbell |

|

|

Name: |

|

Laura K. Campbell |

|

|

Title: |

|

Vice President of Finance |

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Exhibit Description |

|

|

| 99.1 |

|

Press Release dated November 10, 2014 |

Exhibit 99.1

Contacts:

|

|

|

| William (B.J.) Lehmann, J.D. |

|

Investor Relations: |

| President and Chief Operating Officer |

|

Lisa M. Wilson |

| Tel: (216) 431-9900 |

|

In-Site Communications |

| bjlehmann@athersys.com |

|

Tel: (917) 543-9932 |

|

|

lwilson@insitecony.com |

ATHERSYS REPORTS THIRD QUARTER 2014 RESULTS

Management to host conference call at 4:30pm EST today

CLEVELAND, November 10, 2014 – Athersys, Inc. (NASDAQ: ATHX) today announced its financial results for the three months ended

September 30, 2014. Highlights of the third quarter of 2014 and recent events include:

| • |

|

Enrollment nearly complete in Phase 2 clinical trial of MultiStem® cell therapy for treatment of ischemic stroke; |

| • |

|

Confirmation by the Japanese Pharmaceutical and Medical Devices Agency (PMDA) that MultiStem product manufacturing is suitable for clinical development – an important regulatory milestone; |

| • |

|

Preparations for Phase 2 acute myocardial infarction (AMI) study nearing completion, with several clinical sites progressing toward site initiation |

| • |

|

Multiple grants awarded in the United States and Europe directed at process development and non-clinical and clinical development in central nervous system and pulmonary areas; |

| • |

|

Third quarter 2014 revenues of $0.3 million and net loss of $4.7 million, which includes non-cash income of $2.5 million related to the change in fair value of warrant liabilities and non-cash expense of $0.7 million in

stock-based compensation for quarter ended September 30, 2014; and |

| • |

|

Ended the quarter with $32.4 million in cash and cash equivalents. |

“We have focused in the past several

months on completing enrollment of our ongoing Phase 2 study of MultiStem cell therapy as a treatment for ischemic stroke,” said Gil Van Bokkelen, Chairman and Chief Executive Officer of Athersys. “Enrollment is nearly completed and we

anticipate having data from the trial around the end of the first quarter of 2015, several weeks after our last patient completes the ninety-day follow-up visit. We believe that MultiStem therapy has the potential to greatly improve outcomes for

stroke patients and represents a substantial market opportunity given the limited treatment options available today, and we eagerly await the results of this study.

“In Japan, we continue to build relationships with the PMDA and potential Japanese collaborators to better

position Athersys in this important market,” added Dr. Van Bokkelen. “We are pleased that the PMDA recently confirmed that our manufacturing is suitable for Japanese clinical development, which represents an important regulatory

milestone that helps facilitate our development efforts there. Importantly, the new regulations regarding the accelerated regulatory pathway are expected to be implemented in Japan by the end of this year, paving the way for accelerated development

and commercialization of regenerative medicines, such as MultiStem therapy.

“We have also made great strides in preparing for our Phase 2 clinical

trial of MultiStem to treat acute myocardial infarction,” added Dr. Van Bokkelen. “This study builds on promising Phase 1 clinical and supporting non-clinical data that suggests MultiStem could provide a meaningful benefit to patients

that have suffered serious damage from a heart attack. Our first study sites are expected to be ready to go by the end of this year, and we look forward to substantial clinical study activity in 2015.

“Additionally, we are engaged in preparation activities for clinical work in other targeted areas where we believe MultiStem therapy may be well-suited.

Finally, we continue to have discussions with potential partners focused on several areas, driven both by the strength of our programs and technology, as well as promising trends in the regulatory area,” concluded Dr. Van Bokkelen.

Third Quarter Results

For the three months ended

September 30, 2014, total revenues were $0.3 million compared to $0.6 million in the comparable period in 2013, reflecting primarily a decrease in grant revenue. Grant revenue may fluctuate from period to period due to the timing of

grant-related activities and the award and expiration of grants, while contract revenues will be driven by license, royalty and milestone payments from existing and possibly new business collaborations.

Research and development expenses were $5.8 million for the third quarter of 2014 compared to $4.7 million for the third quarter of 2013. The difference

reflects increases in preclinical and clinical development costs, personnel costs, research supplies, and stock-based compensation. General and administrative expenses increased to $1.7 million during the third quarter of 2014 compared to $1.5

million in the same period of 2013 due to increases in personnel costs and legal and professional fees.

Net loss for the three months ended

September 30, 2014 was $4.7 million compared to a net loss of $5.6 million for the three months ended September 30, 2013. The difference reflects the impact of a $2.5 million increase in non-cash income from the change in the fair value of

our warrant liabilities, less the $1.3 million aggregate increase in research and development and general and administrative expenses, and the $0.3 million decrease in revenues.

As of September 30, 2014, we had $32.4 million in cash and cash equivalents, compared to $31.9 million at December 31, 2013. During the nine-month

period ended September 30, 2014, cash used in operating activities was $19.7 million and was $18.3 million in the comparable period of 2013.

Conference Call

As previously announced, Gil Van Bokkelen, Chairman and Chief Executive Officer, and William (B.J.) Lehmann, President and Chief Operating Officer, will host a

conference call today to review the results as follows:

|

|

|

| Date |

|

November 10, 2014 |

| Time |

|

4:30 p.m. (Eastern Time) |

| Telephone access: U.S. and Canada |

|

800-273-1254 |

| Telephone access: International |

|

973-638-3440 |

| Access code |

|

22692627 |

| Live webcast |

|

www.athersys.com, under the Investors section |

A replay will be available for on-demand listening shortly after the completion of the call until 11:59 PM (Eastern Time) on

November 24, 2014 by dialing 800-585-8367 or 855-859-2056 (U.S. and Canada), or 404-537-3406, and entering access code 22692627. The archived webcast will be available for one year at the aforementioned URL.

About Athersys

Athersys is a clinical stage

biotechnology company engaged in the discovery and development of therapeutic product candidates designed to extend and enhance the quality of human life. The Company is developing its

MultiStem® cell therapy product, a patented, adult-derived “off-the-shelf” stem cell product platform for disease indications in the cardiovascular, neurological, inflammatory and

immune disease areas. The Company currently has several clinical stage programs involving MultiStem, including for treating inflammatory bowel disease, ischemic stroke, damage caused by myocardial infarction, and for the prevention of

graft-versus-host disease. Athersys has also developed a diverse portfolio that includes other technologies and product development opportunities, and has forged strategic partnerships and collaborations with leading pharmaceutical and biotechnology

companies, as well as world-renowned research institutions in the United States and Europe to further develop its platform and products. More information is available at www.athersys.com.

The Athersys, Inc. logo is available at: http://www.globenewswire.com/newsroom/prs/?pkgid=4548.

Forward-Looking Statements

This press release

contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. These forward-looking statements relate to, among other things, the expected timetable for

development of our product candidates, our growth strategy, and our future financial performance, including our operations, economic performance, financial condition, prospects, and other future events. We have attempted to identify forward-looking

statements by using such words as “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,”

“potential,” “should,” “suggest,” “will,” or other similar expressions. These forward-looking statements are only predictions and are largely based on our current expectations. A number of known and unknown

risks, uncertainties, and other factors could affect the accuracy of these statements. Some of the more significant known risks that we face that could cause actual results to differ materially from those implied by forward-looking statements are

the risks and uncertainties inherent in the process of discovering, developing, and commercializing products that are safe and effective for use as human therapeutics, such as the uncertainty regarding market acceptance of our product candidates and

our ability to generate revenues, including MultiStem for the treatment of inflammatory bowel disease, acute myocardial infarction, stroke

and other potential indications, including lysosomal storage disorders and the prevention of graft-versus-host disease. These risks and uncertainties may cause our actual results, levels of

activity, performance, or achievements to differ materially from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. Other important factors to consider in evaluating our

forward-looking statements include: our ability to raise additional capital; final results from our MultiStem clinical trials; the possibility of delays in, adverse results of, and excessive costs of the development process; our ability to

successfully initiate and complete clinical trials and obtain all necessary regulatory approvals; our ability to successfully initiate clinical development of MultiStem in Japan; changes in external market factors; changes in our industry’s

overall performance; changes in our business strategy; our ability to protect our intellectual property portfolio; our possible inability to realize commercially valuable discoveries in our collaborations with pharmaceutical and other biotechnology

companies; our ability to meet milestones under our collaboration agreements; our collaborators’ ability to continue to fulfill their obligations under the terms of our collaboration agreements; the success of our efforts to enter into new

strategic partnerships and advance our programs; our possible inability to execute our strategy due to changes in our industry or the economy generally; changes in productivity and reliability of suppliers; and the success of our competitors and the

emergence of new competitors. You should not place undue reliance on forward-looking statements contained in this press release, and we undertake no obligation to publicly update forward-looking statements, whether as a result of new information,

future events or otherwise.

(Tables Follow)

Athersys, Inc.

Condensed Consolidated Balance Sheets

(In thousands)

|

|

|

|

|

|

|

|

|

| |

|

September 30, |

|

|

December 31, |

|

| |

|

2014 |

|

|

2013 |

|

| |

|

(Unaudited) |

|

|

(Note) |

|

| Assets |

|

|

|

|

|

|

|

|

| Cash, cash equivalents |

|

$ |

32,368 |

|

|

$ |

31,948 |

|

| Other current assets |

|

|

1,081 |

|

|

|

907 |

|

| Equipment, net |

|

|

1,331 |

|

|

|

1,333 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

34,780 |

|

|

$ |

34,188 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and stockholders’ equity |

|

|

|

|

|

|

|

|

| Accounts payable, accrued expenses and deferred revenue |

|

$ |

4,577 |

|

|

$ |

4,368 |

|

| Warrant liabilities and note payable |

|

|

3,385 |

|

|

|

9,999 |

|

| Total stockholders’ equity |

|

|

26,818 |

|

|

|

19,821 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

34,780 |

|

|

$ |

34,188 |

|

|

|

|

|

|

|

|

|

|

Note: The Condensed Consolidated Balance Sheet Data at December 31, 2013 has been derived from the audited

financial statements as of that date.

Athersys, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(In thousands, except Share and Per Share Amounts)

|

|

|

|

|

|

|

|

|

| |

|

Three Months ended September 30, |

|

| |

|

2014 |

|

|

2013 |

|

| |

|

(Unaudited) |

|

| Revenues |

|

|

|

|

|

|

|

|

| Contract revenue |

|

$ |

75 |

|

|

$ |

87 |

|

| Grant revenue |

|

|

218 |

|

|

|

534 |

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

|

293 |

|

|

|

621 |

|

|

|

|

| Costs and Expenses |

|

|

|

|

|

|

|

|

| Research and development |

|

|

5,775 |

|

|

|

4,689 |

|

| General and administrative |

|

|

1,695 |

|

|

|

1,450 |

|

| Depreciation |

|

|

91 |

|

|

|

86 |

|

|

|

|

|

|

|

|

|

|

| Total costs and expenses |

|

|

7,561 |

|

|

|

6,225 |

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(7,268 |

) |

|

|

(5,604 |

) |

|

|

|

| Other income (expense), net |

|

|

9 |

|

|

|

(4 |

) |

| Income (expense) from change in fair value of warrants |

|

|

2,540 |

|

|

|

(6 |

) |

|

|

|

|

|

|

|

|

|

| Net loss and comprehensive loss |

|

$ |

(4,719 |

) |

|

$ |

(5,614 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share - Basic |

|

$ |

(0.06 |

) |

|

$ |

(0.10 |

) |

| Weighted average shares outstanding - Basic |

|

|

77,320,425 |

|

|

|

57,646,306 |

|

|

|

|

| Net loss per share - Diluted |

|

$ |

(0.08 |

) |

|

$ |

(0.10 |

) |

| Weighted average shares outstanding - Diluted |

|

|

78,349,840 |

|

|

|

59,248,031 |

|

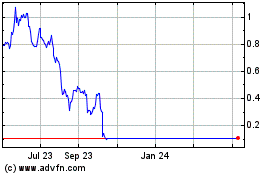

Athersys (NASDAQ:ATHX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Athersys (NASDAQ:ATHX)

Historical Stock Chart

From Apr 2023 to Apr 2024