UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 10, 2014

Commission File Number: 000-50768

ACADIA Pharmaceuticals Inc.(Exact name of small business issuer as specified in its charter)

Delaware

(State or other jurisdiction of incorporation or organization)

061376651

(IRS Employer Identification No.)

11085 Torreyana Road #100, San Diego, California 92121

(Address of principal executive offices)

858-558-2871

(Registrant's Telephone number)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On November 10, 2014, ACADIA Pharmaceuticals Inc. issued a press release announcing its financial results for the third quarter and nine months ended September 30, 2014. A copy of this press release is furnished herewith as Exhibit 99.1. Pursuant to the rule and regulations of the Securities and Exchange Commission, such exhibit and the information set forth therein and in this Item 2.02 have been furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to liability under that section nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing regardless of any general incorporation language.

Item 9.01 Financial Statements and Exhibits.

(d) The following exhibit is furnished herewith:

99.1 Press release dated November 10, 2014.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

ACADIA Pharmaceuticals Inc.

|

Date: November 10, 2014

| By: |

/s/ Glenn F. Baity |

|

| Name: Glenn F. Baity |

| Title: Executive Vice President & General Counsel |

Exhibit Index

|

Exhibit No.

|

|

Description

|

|

EX-99.1

|

|

Press Release dated November 10, 2014

|

| Investor Contacts:

ACADIA Pharmaceuticals Inc.

Steve Davis, Executive Vice President,

Chief Financial Officer and Chief Business Officer

Lisa Barthelemy, Director of Investor Relations

(858) 558-2871

Media Contact:

Russo Partners

David Schull

(212) 845-4271 or (858) 717-2310

david.schull@russopartnersllc.com

|

|

ACADIA PHARMACEUTICALS REPORTS

THIRD QUARTER 2014 FINANCIAL RESULTS AND UPDATES TIMING OF NUPLAZID™ NDA SUBMISSION

SAN DIEGO, CA November 10, 2014 – ACADIA Pharmaceuticals Inc. (NASDAQ: ACAD), a biopharmaceutical company focused on the development and commercialization of innovative medicines to address unmet medical needs in neurological and related central nervous system disorders, today announced its unaudited financial results for the third quarter ended September 30, 2014 and provided an update on the timing of its NUPLAZID™ (pimavanserin) New Drug Application (NDA) submission.

ACADIA plans to submit its NUPLAZID NDA for Parkinson’s disease psychosis in the first quarter of 2015. The company had previously planned to submit the NDA near the end of 2014. The decision to move back the planned submission is based on additional time required to complete preparations needed to support the U.S. Food and Drug Administration’s (FDA) review of NUPLAZID. The change in submission timing is not a result of any change to NUPLAZID’s clinical or safety profile, nor is it a result of any interaction with or request for information from the FDA. Additionally, ACADIA reported that it has successfully completed its drug-drug interaction program and its registration stability program.

“While we had hoped to submit our NDA for NUPLAZID near the end of this year, we believe it is prudent to push back our planned submission to the first quarter of 2015,” said Uli Hacksell, Ph.D., Chief Executive Officer of ACADIA. “We are confident in our safety and efficacy data package supporting the NUPLAZID NDA and are working diligently on completing preparations for the NDA submission and review.

“Additionally, the recent decision by the FDA to grant Breakthrough Therapy designation for NUPLAZID reinforces the large unmet medical need for the treatment of Parkinson’s disease psychosis and the importance of the NUPLAZID program. With no FDA-approved treatment for Parkinson’s disease psychosis, NUPLAZID has the potential to transform the treatment landscape for patients with this debilitating disorder.”

Third Quarter Financial Results

ACADIA reported a net loss of $24.8 million, or $0.25 per common share, for the third quarter of 2014 compared to a net loss of $10.7 million, or $0.12 per common share, for the third quarter of 2013. Net losses for the third quarters of 2014 and 2013 included $3.9 million and $1.9 million, respectively, in non-cash, stock-based compensation expense. For the nine months ended September 30, 2014, ACADIA reported a net loss of $64.1 million, or $0.66 per common share, compared to a net loss of $25.9 million, or $0.31 per common share, for the comparable period of 2013. Net losses for the nine-month periods ended September 30, 2014 and 2013 included $11.4 million and $3.5 million, respectively, in non-cash, stock-based compensation expense.

At September 30, 2014, ACADIA’s cash, cash equivalents, and investment securities totaled $337.8 million compared to $185.8 million at December 31, 2013. This increase was primarily due to $196.8 million in net proceeds raised from a public offering of common stock in March 2014, offset in part by cash used to fund ACADIA’s operations.

Research and development expenses increased to $17.0 million for the third quarter of 2014, including $1.4 million in stock-based compensation expense, from $7.3 million for the comparable quarter of 2013, including $690,000 in stock-based compensation expense. This increase was primarily due to an increase of $8.4 million in external service costs, including increased development costs incurred in our Phase III program for NUPLAZID. Increases in costs associated with our expanded research and development organization, including $882,000 in increased personnel costs and $668,000 in increased stock-based compensation expense, also contributed to the quarter-over-quarter increase.

General and administrative expenses increased to $8.1 million for the third quarter of 2014, including $2.5 million in stock-based compensation expense, from $3.8 million for the comparable quarter of 2013, including $1.2 million in stock-based compensation expense. This increase was due to a $1.4 million increase in external service costs largely related to ACADIA’s commercial preparations for the planned launch of NUPLAZID. Also contributing to the quarter-over-quarter increase in general and administrative expenses was a $1.4 million increase in personnel expenses largely related to ACADIA’s preparations for the planned launch of NUPLAZID, as well as a $1.3 million increase in stock-based compensation expense.

Conference Call and Webcast Information

ACADIA management will review its third quarter financial results and development programs via conference call and webcast later today at 5:00 p.m. Eastern Time. The conference call may be accessed by dialing 866-318-8615 for participants in the United States or Canada and 617-399-5134 for international callers (reference passcode 86826740). A telephone replay of the conference call may be accessed through November 24, 2014 by dialing 888-286-8010 for callers in the United States or Canada and 617-801-6888 for international callers (reference passcode 62605343). The conference call also will be webcast live on ACADIA’s website, www.acadia-pharm.com, under the investors section and will be archived there through November 24, 2014.

About NUPLAZID™ (pimavanserin)

NUPLAZID is ACADIA’s proprietary small molecule that is a selective serotonin inverse agonist preferentially targeting 5-HT2A receptors that play an important role in psychosis. ACADIA has reported positive Phase III trial results with NUPLAZID, which has the potential to be the first drug approved in the United States for psychosis associated with Parkinson’s disease. NUPLAZID is administered orally once-a-day. ACADIA discovered NUPLAZID and holds worldwide rights to this new chemical entity. The trade name NUPLAZID has been provisionally accepted by the FDA.

About ACADIA Pharmaceuticals

ACADIA is a biopharmaceutical company focused on the development and commercialization of innovative medicines to address unmet medical needs in neurological and related central nervous system disorders. ACADIA has a pipeline of product candidates led by NUPLAZID (pimavanserin), for which we have reported positive Phase III trial results in Parkinson’s disease psychosis and which has the potential to be the first drug approved in the United States for this disorder. Pimavanserin is also in Phase II development for Alzheimer’s disease psychosis and has successfully completed a Phase II trial in schizophrenia. ACADIA also has clinical-stage programs for chronic pain and glaucoma in collaboration with Allergan, Inc. and two preclinical programs directed at Parkinson’s disease and other neurological disorders. All product candidates are small molecules that emanate from internal discoveries. ACADIA maintains a website at www.acadia-pharm.com to which we regularly post copies of our press releases as well as additional information and through which interested parties can subscribe to receive e-mail alerts.

Forward-Looking Statements

Statements in this press release that are not strictly historical in nature are forward-looking statements. These statements include but are not limited to statements related to the timing of the submission of an NDA for NUPLAZID (pimavanserin); the potential for pimavanserin to be the first drug approved in the United States for Parkinson’s disease psychosis (PDP) and the potential timing of such approval, if approved at all; the importance of the NUPLAZID program based on the Breakthrough Therapy designation; the potential for NUPLAZID to transform the treatment landscape for patients with PDP; ACADIA’s ongoing pre-commercial activities and plans to commercially launch pimavanserin; and the progress, timing and results of ACADIA’s drug discovery and development programs, either alone or with a partner, including the progress and expected timing of clinical trials. These statements are only predictions based on current information and expectations and involve a number of risks and uncertainties. Actual events or results may differ materially from those projected in any of such statements due to various factors, including the risks and uncertainties inherent in drug discovery, development, approval, and commercialization, and collaborations with others, and the fact that past results of clinical trials may not be indicative of future trial results. For a discussion of these and other factors, please refer to ACADIA’s annual report on Form 10-K for the year ended December 31, 2013 as well as ACADIA’s subsequent filings with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. This caution is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All forward-looking statements are qualified in their entirety by this cautionary statement and ACADIA undertakes no obligation to revise or update this press release to reflect events or circumstances after the date hereof, except as required by law.

ACADIA PHARMACEUTICALS INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

(Unaudited)

| |

|

Three Months Ended

September 30,

|

|

|

Nine Months Ended

September 30,

|

|

| |

|

2014

|

|

|

2013

|

|

|

2014

|

|

|

2013

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Collaborative revenues

|

|

$ |

15 |

|

|

$ |

240 |

|

|

$ |

72 |

|

|

$ |

1,108 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development (includes stock-based compensation expense of $1,358, $690, $3,452, and $1,417, respectively)

|

|

|

16,952 |

|

|

|

7,254 |

|

|

|

42,420 |

|

|

|

18,797 |

|

|

General and administrative (includes stock-based compensation expense of $2,544, $1,201, $7,942, and $2,120, respectively)

|

|

|

8,057 |

|

|

|

3,797 |

|

|

|

22,328 |

|

|

|

8,444 |

|

|

Total operating expenses

|

|

|

25,009 |

|

|

|

11,051 |

|

|

|

64,748 |

|

|

|

27,241 |

|

|

Loss from operations

|

|

|

(24,994 |

) |

|

|

(10,811 |

) |

|

|

(64,676 |

) |

|

|

(26,133 |

) |

|

Interest income, net

|

|

|

208 |

|

|

|

116 |

|

|

|

567 |

|

|

|

234 |

|

|

Net loss

|

|

$ |

(24,786 |

) |

|

$ |

(10,695 |

) |

|

$ |

(64,109 |

) |

|

$ |

(25,899 |

) |

|

Net loss per common share, basic and diluted

|

|

$ |

(0.25 |

) |

|

$ |

(0.12 |

) |

|

$ |

(0.66 |

) |

|

$ |

(0.31 |

) |

|

Weighted average common shares outstanding, basic and diluted

|

|

|

99,497 |

|

|

|

89,504 |

|

|

|

97,210 |

|

|

|

83,946 |

|

ACADIA PHARMACEUTICALS INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

(Unaudited)

| |

|

September 30,

2014

|

|

|

December 31,

2013(1)

|

|

| |

|

|

|

|

|

|

|

Assets

|

|

|

|

|

|

|

|

Cash, cash equivalents, and investment securities

|

|

$ |

337,799 |

|

|

$ |

185,790 |

|

|

Prepaid expenses, interest, and other receivables

|

|

|

3,266 |

|

|

|

2,570 |

|

|

Total current assets

|

|

|

341,065 |

|

|

|

188,360 |

|

|

Other non-current assets

|

|

|

698 |

|

|

|

758 |

|

|

Total assets

|

|

$ |

341,763 |

|

|

$ |

189,118 |

|

|

Liabilities and stockholders’ equity

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

$ |

11,274 |

|

|

$ |

6,987 |

|

|

Stockholders’ equity

|

|

|

330,489 |

|

|

|

182,131 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

341,763 |

|

|

$ |

189,118 |

|

|

(1) The condensed consolidated balance sheet at December 31, 2013 has been derived from the audited financial statements at such date but does not include all of the information and footnotes required by accounting principles generally accepted in the United States for complete financial statements.

|

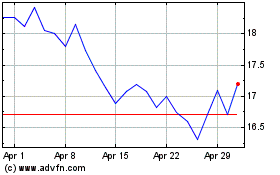

Acadia Pharmaceuticals (NASDAQ:ACAD)

Historical Stock Chart

From Mar 2024 to Apr 2024

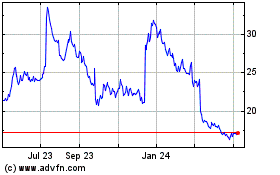

Acadia Pharmaceuticals (NASDAQ:ACAD)

Historical Stock Chart

From Apr 2023 to Apr 2024