Envestnet (NYSE:ENV), a leading provider of unified wealth

management technology and services to financial advisors, today

reported financial results for its third quarter ended September

30, 2014.

Three Months Ended

Nine Months Ended Key

Financial Metrics September 30, % September

30, % (in millions except per share data)

2014 2013

Change 2014 2013

Change Adjusted Revenues(1) $

88.6 $ 69.9 27 % $ 251.9 $ 168.3 50 % Adjusted EBITDA(1) $ 14.7 $

10.0 46 % $ 39.3 $ 27.6 43 % Adjusted Net Income per Share(1) $

0.21 $ 0.14 50 % $ 0.57 $ 0.39 46 %

Financial Results for the Third Quarter of 2014 Compared to

the Third Quarter of 2013:

- Adjusted Revenues(1) increased 27% to

$88.6 million for the third quarter of 2014 from $69.9 million for

the third quarter of 2013.

- Revenues from assets under management

(AUM) or assets under administration (AUA) increased 26% to $74.9

million for the third quarter of 2014 from $59.6 million for the

third quarter of 2013; total revenues, which include licensing and

professional services fees, increased 27% to $88.6 million for the

third quarter of 2014 from $69.9 million for the third quarter of

2013.

- Adjusted EBITDA(1) increased 46% to

$14.7 million for the third quarter of 2014 compared to $10.0

million for the third quarter of 2013.

- Adjusted Net Income(1) was $7.9

million, or $0.21 per diluted share, for the third quarter of 2014

compared to $5.1 million, or $0.14 per diluted share, for the third

quarter of 2013.

- Net income attributable to Envestnet,

Inc. was $3.8 million, or $0.10 per diluted share, for the third

quarter of 2014 compared to $1.3 million, or $0.04 per diluted

share, for the third quarter of 2013.

“Envestnet provides truly integrated wealth management solutions

to advisors and advisory firms looking to provide better client

outcomes and profitably grow their business,” said Jud Bergman,

Chairman and CEO.

“During the third quarter, Envestnet onboarded a record $46

billion in new assets from conversions, reflecting strong demand

for our unified offerings from large institutions and registered

investment advisors. We believe Envestnet will continue to grow

organically through ongoing adoption of our wealth management

solutions by advisors, and to accelerate that growth over time with

disciplined strategic activity, such as the recently completed

Placemark acquisition,” concluded Mr. Bergman.

Key Operating Metrics (AUM/A Only) as of and for the Quarter

Ended September 30, 2014:

- Assets: $219.6 billion, up 37% from

September 30, 2013

- Accounts: 897,551, up 37% from

September 30, 2013

- Advisors: 24,887, up 14% from September

30, 2013

- Gross sales: $31.2 billion, resulting

in net flows of $16.9 billion

The following table summarizes the changes in AUM and AUA for

the quarter ended September 30, 2014:

Gross

Redemp- Net Market

Reclass to In Millions Except

Accounts 6/30/14 Sales tions

Flows Impact Licensing

9/30/14 Assets under Management (AUM) $ 53,063

$ 5,404 $ (2,345 ) $ 3,059 $ (1,187 ) $ - $ 54,935

Assets under

Administration (AUA) 156,723 25,765

(11,945 ) 13,820 (2,746 )

(3,158 ) 164,639

Total AUM/A $ 209,786

$ 31,169 $ (14,290

) $ 16,879 $

(3,933 ) $ (3,158 ) $

219,574 Fee-Based Accounts 836,253 84,708 (23,410 ) 897,551

During the third quarter, Envestnet added $12.8 billion of

conversions included in the above AUM/A gross sales figures, and an

additional $33.6 billion of conversions in Licensing. Also during

the third quarter, approximately $3.2 billion in assets were

reclassified from AUA to Licensing in connection with client

conversion activity.

Review of Third Quarter 2014 Financial Results

Adjusted revenues increased 27% to $88.6 million for the third

quarter of 2014 from $69.9 million for the third quarter of 2013.

The increase was primarily due to a 26% increase in revenues from

AUM or AUA to $74.9 million from $59.6 million in the prior year

period.

Total operating expenses increased 21% to $82.6 million in the

third quarter of 2014 from $68.1 million in the third quarter of

2013. Cost of revenues increased 30% to $39.1 million in the third

quarter of 2014 from $30.2 million in the third quarter of 2013 due

to the increase in revenue from AUM or AUA and a higher mix of AUM

products which carry a relatively high cost of revenue.

Compensation and benefits increased 23% to $25.8 million in the

third quarter of 2014 from $21.1 million in the prior year period

primarily due to an increase in headcount to support growth in the

business. General and administration expenses increased 12% to

$13.4 million in the third quarter of 2014 from $12.0 million in

the prior year period.

Income from operations was $6.0 million for the third quarter of

2014 compared to $1.7 million for the third quarter of 2013. Net

income attributable to Envestnet, Inc. was $3.8 million, or $0.10

per diluted share, for the third quarter of 2014 compared to $1.3

million, or $0.04 per diluted share, for the third quarter of 2013.

Adjusted EBITDA(1) in the third quarter of 2014 was $14.7 million,

compared to $10.0 million in the third quarter of 2013. Adjusted

Net Income(1) was $7.9 million, compared to $5.1 million in the

third quarter of 2013. Adjusted Net Income Per Share(1) was $0.21,

compared to $0.14 in the third quarter of 2013.

At September 30, 2014, Envestnet had $105.9 million in cash and

cash equivalents and $30.0 million in debt. On October 1, 2014,

Envestnet completed its acquisition of Placemark Holdings, Inc. for

approximately $66 million in cash.

Conference Call

Envestnet will host a conference call to discuss third quarter

2014 financial results today at 5:00 p.m. ET. The live webcast can

be accessed from Envestnet’s investor relations website at

http://ir.envestnet.com/. The call can also be accessed live over

the phone by dialing (888) 481-2844, or for international callers

(719) 325-2402. A replay will be available one hour after the call

and can be accessed by dialing (877) 870-5176 or (858) 384-5517 for

international callers; the conference ID is 9381195. The dial-in

replay will be available for one week and the webcast replay will

be available for one month following the date of the conference

call.

About Envestnet

Envestnet, Inc. (NYSE: ENV) is a leading provider of unified

wealth management technology and services to investment advisors.

Our open-architecture platforms unify and fortify the wealth

management process, delivering unparalleled flexibility, accuracy,

performance and value. Envestnet solutions enable the

transformation of wealth management into a transparent,

independent, objective and fully-aligned standard of care, and

empower advisors to deliver better results.

Envestnet’s Advisor Suite® software empowers financial advisors

to better manage client outcomes and strengthen their practice.

Envestnet provides institutional-quality research and advanced

portfolio solutions through our Portfolio Management Consultants

group, Envestnet | PMC®. Envestnet | Tamarac provides leading

rebalancing, reporting and practice management software.

(1) Non-GAAP Financial Measures

“Adjusted revenues” exclude the effect of purchase accounting on

the fair value of acquired deferred revenue. Under United States

generally accepted accounting principles (GAAP), we record at fair

value the acquired deferred revenue for contracts in effect at the

time the entities were acquired. Consequently, revenue related to

acquired entities for periods subsequent to the acquisition does

not reflect the full amount of revenue that would have been

recorded by these entities had they remained stand-alone

entities.

“Adjusted EBITDA” represents net income before deferred revenue

fair value adjustment, interest income, imputed interest on

contingent consideration, income tax provision, depreciation and

amortization, non-cash compensation expense, restructuring charges

and transaction costs, re-audit related expenses, severance, fair

market value adjustment on contingent consideration, litigation

related expense, other income and pre-tax loss attributable to

non-controlling interest.

“Adjusted net income” represents net income before deferred

revenue fair value adjustment, imputed interest on contingent

consideration, non-cash compensation expense, restructuring charges

and transaction costs, re-audit related expenses, severance, fair

market value adjustment on contingent consideration, amortization

of acquired intangibles, litigation related expense, other income

and net loss attributable to non-controlling interest. Reconciling

items are tax effected using the income tax rates noted in the

reconciliation table found in this release.

“Adjusted net income per share” represents adjusted net income

divided by the diluted number of weighted-average shares

outstanding.

See reconciliation of Non-GAAP Financial Measures at the end of

this press release. These measures should not be viewed as a

substitute for revenues, net income or net income per share

determined in accordance with GAAP.

Cautionary Statement Regarding Forward-Looking

Statements

The forward-looking statements made in this press release and

its attachments concerning, among other things, Envestnet, Inc.’s

(the “Company”) expected financial performance and outlook, its

strategic operational plans and growth strategy are made pursuant

to the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. These statements involve risks and

uncertainties and the Company’s actual results could differ

materially from the results expressed or implied by such

forward-looking statements. Furthermore, reported results should

not be considered as an indication of future performance. The

potential risks, uncertainties and other factors that could cause

actual results to differ from those expressed by the

forward-looking statements in this press release include, but are

not limited to, difficulty in sustaining rapid revenue growth,

which may place significant demands on the Company’s

administrative, operational and financial resources, fluctuations

in the Company’s revenue, the concentration of nearly all of the

Company’s revenues from the delivery of investment solutions and

services to clients in the financial advisory industry, the

Company’s reliance on a limited number of clients for a material

portion of its revenue, the renegotiation of fee percentages or

termination of the Company’s services by its clients, the Company’s

ability to identify potential acquisition candidates, complete

acquisitions and successfully integrate acquired companies, the

impact of market and economic conditions on the Company’s revenues,

compliance failures, regulatory actions against the Company, the

failure to protect the Company’s intellectual property rights, the

Company’s inability to successfully execute the conversion of its

clients’ assets from their technology platform to the Company’s

technology platform in a timely and accurate manner, general

economic conditions, changes to the Company’s previously reported

financial information as a result of political and regulatory

conditions, as well as management’s response to these factors. More

information regarding these and other risks, uncertainties and

factors is contained in the Company’s filings with the Securities

and Exchange Commission (“SEC”) which are available on the SEC’s

website at www.sec.gov or the Company’s Investor Relations website

at http://ir.envestnet.com/. You are cautioned not to unduly rely

on these forward-looking statements, which speak only as of the

date of this press release. All information in this press release

and its attachments is as of November 6, 2014 and, unless required

by law, the Company undertakes no obligation to publicly revise any

forward-looking statement to reflect circumstances or events after

the date of this press release or to report the occurrence of

unanticipated events.

Envestnet, Inc. Condensed

Consolidated Balance Sheets (in thousands)

(unaudited) September 30, December 31,

2014 2013 Assets Current assets: Cash and cash

equivalents $ 105,899 $ 49,942 Fees and other receivables, net

24,514 19,848 Deferred tax assets, net 4,380 2,462 Prepaid expenses

and other current assets 6,357 7,155 Total current

assets 141,150 79,407 Property and equipment,

net 16,438 12,766 Internally developed software, net 6,740 5,740

Intangible assets, net 32,210 35,698 Goodwill 77,918 74,335

Deferred tax assets, net 8,367 8,367 Other non-current assets

4,710 4,929 Total assets $ 287,533 $ 221,242

Liabilities and Equity Current liabilities: Accrued expenses

$ 38,584 $ 35,242 Accounts payable 7,537 5,528 Bank indebtedness

30,000 - Contingent consideration 6,095 6,008 Deferred revenue

5,958 6,245 Total current liabilities 88,174

53,023 Contingent consideration 8,981 11,297 Deferred

revenue 4,270 1,148 Deferred rent 2,910 2,051 Lease incentive 5,726

3,547 Other non-current liabilities 2,682 2,404 Total

liabilities 112,743 73,470 Redeemable units in

ERS, LLC 1,500 - Equity: Stockholders' equity 172,734

147,772 Non-controlling interest 556 - Total

liabilities and equity $ 287,533 $ 221,242

Envestnet, Inc.

Condensed Consolidated Statements of Operations (in

thousands, except share and per share information)

(unaudited) Three Months Ended Nine Months

Ended September 30, September 30, 2014

2013 2014 2013 Revenues: Assets under

management or administration $ 74,899 $ 59,580 $ 212,707 $ 137,150

Licensing and professional services 13,678

10,300 39,238 30,987 Total revenues 88,577

69,880 251,945 168,137 Operating

expenses: Cost of revenues 39,111 30,154 111,503 66,600

Compensation and benefits 25,833 21,063 74,449 55,475 General and

administration 13,428 11,985 38,514 30,840 Depreciation and

amortization 4,253 4,467 13,290 10,666 Restructuring charges

- 474 - 474 Total operating expenses

82,625 68,143 237,756 164,055

Income from operations 5,952 1,737 14,189 4,082 Other income

(expense) (11 ) 4 1,909 195 Income

before income tax provision 5,941 1,741 16,098 4,277 Income tax

provision 2,173 435 5,812 1,312

Net income 3,768 1,306 10,286 2,965 Add: Net loss

attributable to non-controlling interest - -

195 - Net income attributable to Envestnet, Inc. $

3,768 $ 1,306 $ 10,481 $ 2,965 Net income per share

attributable to Envestnet, Inc.: Basic $ 0.11 $ 0.04 $ 0.30

$ 0.09 Diluted $ 0.10 $ 0.04 $ 0.28 $ 0.08 Weighted

average common shares outstanding: Basic 34,674,245

33,686,112 34,447,619 32,912,084 Diluted

37,006,796 35,871,975 36,832,154

35,260,044

Envestnet,

Inc. Condensed Consolidated Statements of Cash Flows

(in thousands) (unaudited) Nine Months

Ended September 30, 2014

2013 OPERATING ACTIVITIES: Net income $ 10,286

$ 2,965

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization 13,290 10,666 Deferred rent and lease

incentive 173 (784 ) Provision for doubtful accounts - 153 Deferred

income taxes - (1,375 ) Stock-based compensation expense 8,443

6,281 Excess tax benefits from stock-based compensation expense

(5,086 ) (2,704 ) Imputed interest expense 1,108 392 Fair market

value adjustment on contingent consideration (342 ) - Changes in

operating assets and liabilities: Fees and other receivables, net

(4,613 ) (8,302 ) Prepaid expenses and other current assets 3,966

(2,993 ) Other non-current assets (736 ) (1,265 ) Accrued expenses

3,212 7,946 Accounts payable 2,009 1,891 Deferred revenue 2,835 754

Other non-current liabilities 278 960

Net cash provided by operating activities 34,823

14,585

INVESTING ACTIVITIES: Purchase

of property and equipment (5,249 ) (4,301 ) Capitalization of

internally developed software (2,562 ) (2,293 ) Acquisition of

businesses, net of cash acquired (1,288 ) (8,992 )

Net cash used in investing activities (9,099 )

(15,586 )

FINANCING ACTIVITIES: Proceeds from bank

indebtedness 30,000 - Payment of contingent consideration (6,000 )

- Proceeds from exercise of warrants - 4 Proceeds from exercise of

stock options 3,146 5,578 Issuance of ERS, LLC redeemable units

1,500 - Payment of promissory note (1,500 ) - Issuance of

restricted stock - 1 Purchase of treasury stock for stock-based

minimum tax withholdings (1,999 ) (586 ) Excess tax benefits from

stock-based compensation expense 5,086 2,704

Net cash provided by financing activities 30,233

7,701

INCREASE IN CASH AND CASH

EQUIVALENTS 55,957 6,700

CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD 49,942 29,983

CASH AND CASH EQUIVALENTS, END OF PERIOD $

105,899 $ 36,683

Envestnet, Inc.

Reconciliation of Non-GAAP Financial Measures (in

thousands, except share and per share information)

(unaudited) Three Months Ended Nine Months

Ended September 30, September 30,

2014 2013 2014

2013 Revenues $ 88,577 $ 69,880

$ 251,945 $ 168,137 Deferred revenue fair value adjustment -

- - 160 Adjusted

revenues $ 88,577 $ 69,880 $ 251,945 $ 168,297

Net income $ 3,768 $ 1,306 $ 10,286 $ 2,965 Add

(deduct): Deferred revenue fair value adjustment - - - 160 Interest

income (6 ) (4 ) (101 ) (13 ) Interest expense 22 - 22 - Imputed

interest expense on contingent consideration 285 392 1,108 392 Fair

market value adjustment on contingent consideration 118 - (342 ) -

Income tax provision 2,173 435 5,812 1,312 Depreciation and

amortization 4,253 4,467 13,290 10,666 Non-cash compensation

expense 2,676 2,015 8,443 6,462 Restructuring charges and

transaction costs 978 1,119 1,664 2,173 Re-audit related expenses -

118 - 3,005 Severance - 193 - 425 Litigation related expense - - 18

7 Other income - - (1,825 ) - Pre-tax loss attributable to

non-controlling interest 405 -

935 - Adjusted EBITDA $ 14,672 $ 10,041

$ 39,310 $ 27,554 Net income $ 3,768 $

1,306 $ 10,286 $ 2,965 Add (deduct): Deferred revenue fair value

adjustment - - - 93 Imputed interest expense on contingent

consideration 171 228 665 228 Fair market value adjustment on

contingent consideration 71 - (205 ) - Non-cash compensation

expense 1,606 1,169 5,065 3,748 Restructuring charges and

transaction costs 690 648 1,203 1,260 Re-audit related expenses -

68 - 1,742 Severance - 112 - 247 Amortization of acquired

intangibles 1,373 1,537 4,371 3,366 Litigation related expense - -

11 4 Other income - - (1,095 ) - Net loss attributable to

non-controlling interest 224 -

542 - Adjusted net income $ 7,903 $

5,068 $ 20,843 $ 13,653 Diluted number

of weighted-average shares outstanding 37,006,796

35,871,975 36,832,154 35,260,044

Adjusted net income per share - diluted $ 0.21

$ 0.14 $ 0.57 $ 0.39

Note:

Adjustments, excluding non-deductible

transaction costs, are tax effected using an income tax rate of

40.0% and 42.0% for 2014 and 2013, respectively. Pre-tax loss

attributable to non-controlling interest assumes losses are

allocated to Envestnet Retirement Solutions, LLC members pro-rata

based on ownership percentage.

Envestnet, Inc. Historical Assets, Accounts

and Advisors (in millions, except accounts and advisors)

(Unaudited) As of September 30,

December 31, March 31, June 30, September

30, 2013 2013

2014 2014 2014

Platform Assets Assets Under Management (AUM) $

41,932 $ 45,706 $ 49,383 $ 53,063 $ 54,935 Assets Under

Administration (AUA) 118,228 132,215

146,748 156,723

164,639 Subtotal AUM/A 160,160 177,921 196,131

209,786 219,574 Licensing 326,567

358,919 376,341 412,141

448,169

Total Platform Assets $ 486,727

$ 536,840 $ 572,472 $

621,927 $ 667,743

Platform Accounts AUM

200,648 211,039 226,452 239,367 255,359 AUA 456,461

524,806 566,139

596,886 642,192 Subtotal AUM/A 657,109

735,845 792,591 836,253 897,551 Licensing 1,425,102

1,508,254 1,559,188

1,659,313 1,830,678

Total

Platform Accounts 2,082,211

2,244,099 2,351,779

2,495,566 2,728,229

Advisors

AUM/A 21,759 22,838 24,369 24,945 24,887 Licensing 7,511

7,794 8,025

8,583 11,266

Total Advisors

29,270 30,632

32,394 33,528 36,153

Notes:

(1)

During the third quarter of 2014,

approximately $3.2 billion in assets, 23,000 accounts and 1,100

advisors were reclassified from AUA to Licensing in connection with

client conversion activity.

(2)

Metrics as of September 30, 2014 exclude

Placemark, which added approximately $15.4 billion in AUM, 45,000

accounts and 3,400 advisors as of October 1, 2014.

Envestnet, Inc.Investor

Relations312-827-3940investor.relations@envestnet.comorMedia

Relationsmediarelations@envestnet.com

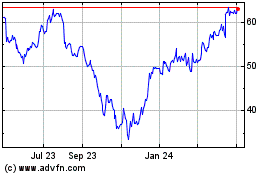

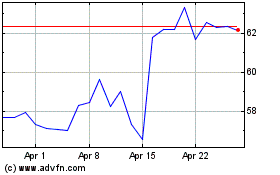

Envestnet (NYSE:ENV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Envestnet (NYSE:ENV)

Historical Stock Chart

From Apr 2023 to Apr 2024