UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14C

INFORMATION

Information

Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

Check the appropriate box:

☐ Preliminary Information

Statement

☐ Confidential, for

Use of the Commission Only (as permitted by Rule 14c- 5(d)(2))

☒ Definitive Information

Statement

Labor Smart, Inc.

(Name of Registrant as Specified in its Charter)

Nevada

(State or other jurisdiction of incorporation)

| |

|

| 000-54654 |

45-2433287 |

| (Commission File Number) |

(IRS Employer Identification No.) |

3270 Florence Road, Suite 200

Powder Springs,

GA 30127

(Address of principal executive offices

and zip code)

(770) 222-5888

(Registrant's telephone

number including area code)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required

☐ Fee computed on table

below per Exchange Act Rules 14c-5(g) and 0-11.

(1) Title of each class of securities to which transaction applies:

N/A.

(2) Aggregate number of securities to which transaction applies:

N/A.

(3) Per unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

N/A.

(4) Proposed maximum aggregate value of transaction: N/A.

(5) Total fee paid: N/A.

☐ Fee paid previously

with preliminary materials.

☐ Check box if any part

of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid

previously. Identify the previous filing by registration number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid: $0.

(2) Form, Schedule or Registration Statement No.: N/A

(3) Filing Party: N/A

(4) Date Filed: N/A

Contact Person:

Ryan Schadel, 3270 Florence Road, Suite 200, Powder Springs,

GA 30127

THIS INFORMATION STATEMENT IS BEING PROVIDED

TO

YOU BY THE BOARD OF DIRECTORS OF LABOR SMART,

INC.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU

ARE

REQUESTED NOT TO SEND US A PROXY

Labor Smart, Inc.

3270 Florence Road

Suite 200

Powder Springs, GA 30127

INFORMATION STATEMENT

INTRODUCTION

This Information Statement is being filed with

the Securities and Exchange Commission and is being furnished to the holders of common stock (the “Shareholders”) of

Labor Smart, Inc., a Nevada corporation (the “Company,” “we,” “our,” “us,” or words

of similar import), pursuant to Section 14C of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)

to notify such Shareholders of a proposed amendment to our Articles of Incorporation. The Company proposed an amendment to our

Articles of Incorporation that would increase the number of authorized shares of the Company’s common stock from 150,000,000

to 1,000,000,000 (the “Authorized Increase Amendment”).

The Board of Directors has fixed October 22, 2014, as the record

date (the “Record Date”) for determining those of our shareholders entitled to receive this Information Statement.

The Authorized Increase Amendment was unanimously

adopted and approved on October 22, 2014 by written consent of our Board of Directors, and recommended to Ryan Schadel, the holder

of 15,079,800 shares of common stock of the Company and 51 shares of the Series A Preferred Stock of the Company (the “Majority

Shareholder”) that he approve the Authorized Increase Amendment. As of October 22, 2014, the Majority Shareholder had 69.77%

of the total voting power of all issued and outstanding voting capital of the Company. On October 22, 2014, the Majority Shareholder

approved the Authorized Increase Amendment by written consent in lieu of a meeting in accordance with Nevada law. No other votes

were required or necessary to adopt the Authorized Increase Amendment, and none is being solicited hereunder. See the captions

“Voting Securities and Principal Holders Thereof” and “Vote Required for Approval,” herein.

The Authorized Increase Amendment

will become effective on or after the opening of business on November 25, 2014, a date that is at least 21 days from the

mailing of this Information Statement to our shareholders.

This Information Statement is first being mailed on or about November

4, 2014, to our shareholders and is being delivered to inform you of the corporate action described herein in accordance with

Section 78.390 of the Nevada Revised Statutes and Rule 14c-2 of the Securities Exchange Act of 1934. We are not aware

of any substantial interest, direct or indirect, by security holders or otherwise, that is in opposition to matters of action taken. In

addition, pursuant to the laws of Nevada, the actions taken by majority written consent in lieu of a special shareholder meeting

do not create appraisal or dissenters’ rights. The entire cost of furnishing this Information Statement will be borne by

us.

APPROXIMATE DATE OF MAILING: November

4, 2014.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU

ARE REQUESTED NOT TO SEND A PROXY.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

Voting Securities

The securities that would have been entitled to vote if a meeting was required to have been held regarding the amendments to our Articles of Incorporation consist of shares of our common stock and our Series A Preferred Stock. Each share of our common stock is entitled to one vote and each share of our Series A Preferred Stock is has voting rights equal to: (x) 0.019607 multiplied by the total issued and outstanding shares of Common Stock eligible to vote at the time of the respective vote (the “Numerator”), divided by (y) 0.49, minus (z) the Numerator. The number of outstanding shares of our common stock at the close of business on October 22, 2014, the record date for determining our shareholders who would have been entitled to notice of and to vote on the amendment to our Articles of Incorporation, was 39,359,330 shares and the number of votes of the Series A Preferred Stock was 40,964,072. As of October 22, 2014, the Majority Shareholder had 56,143,872 votes, or 69.77% of the votes.

Security Ownership of Principal Holders and Management

The following table sets forth certain information as of October 22, 2014, regarding current beneficial ownership of the shares of our common stock by: (i) each person known by us to own more than 5% of the outstanding shares of our voting stock, (ii) each of our executive officers and directors, and (iii) all of our executive officers and directors as a group. Except as noted, each person has sole voting and sole investment or dispositive power with respect to the shares shown. The address for all officers and directors listed below is 3270 Florence Road, Suite 200, Powder Springs, GA 30127, which is the principal executive office address of the Company. The information presented is based upon 39,359,330 outstanding shares of our common stock.

Ownership of Officers and Directors and Principal Shareholders

| |

|

Common Stock |

|

|

Series A Preferred Stock |

|

|

All Stock |

| |

|

Number of Shares Owned (3) |

|

|

Percentage Owned (3) |

|

|

Number of Shares Owned (3) |

|

|

Percentage Owned (3) |

|

|

Number of Votes (3) |

|

|

Percentage Owned (3) |

| Name of Beneficial Owner |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ryan Schadel, CEO and Director |

|

|

15,339,800(1) |

|

|

|

38.77 |

% |

|

|

51 |

|

|

|

100 |

% |

|

|

56,043,872 |

|

|

|

69.77% |

|

Matthew Rodgers, Director |

|

|

100,000(2) |

|

|

|

0.25 |

% |

|

|

0 |

|

|

|

0 |

% |

|

|

100,000 |

|

|

|

0.18% |

|

All officers and directors as a group |

|

|

0 |

|

|

|

0 |

% |

|

|

51 |

|

|

|

100 |

% |

|

|

56,143,872 |

|

|

|

69.95% |

| (1) | This number includes 15,079,800 shares held directly plus 50,000 shares of common stock

held by Dana Schadel and 210,000 shares of common stock issuable upon the exercise of 210,000 options granted to Dana Schadel,

the wife of Ryan Schadel. |

| (2) | 100,000 shares of common stock issuable upon the exercise of 100,000 options granted. |

| (3) | Applicable percentage of ownership is based on 39,359,330 shares

of our common stock and 51 shares of our Series A preferred stock. Beneficial ownership is determined in accordance with rules

of the Securities and Exchange Commission and means voting or investment power with respect to securities. Shares of our common

stock issuable upon the exercise of stock options exercisable currently or within 60 days of October 22, 2014 are deemed outstanding

and to be beneficially owned by the person holding such option for purposes of computing such person’s percentage ownership,

but are not deemed outstanding for the purpose of computing the percentage ownership of any other person. Shares of our Series

A preferred stock |

are deemed outstanding and to be

beneficially owned by the person holding such shares for purposes of computing such person’s percentage ownership. As of

October 22, 2014, due to the super voting rights of the Series A preferred stock, the total number of votes were 80,323,402.

Changes in Control

There are no present contractual arrangements

or pledges of our securities that may result in a change in control of the Company.

VOTE REQUIRED FOR APPROVAL AND EFFECTIVE

DATE

Nevada Law

Pursuant to the Nevada Revised Statutes, amendments to the Articles of Incorporation are required to be approved by a majority of our shareholders. This approval could be obtained either by the written consent of the holders of a majority of our issued and outstanding voting securities, or it could be considered by our shareholders at a special shareholders' meeting convened for the specific purpose of approving the name change. The Company's voting securities consist of common stock and Series A Preferred Stock. Each share of common stock is entitled to one vote per share on any matter requiring shareholder vote and each share of Series A Preferred Stock has voting rights equal to: (x) 0.019607 multiplied by the total issued and outstanding shares of Common Stock eligible to vote at the time of the respective vote (the ""Numerator"), divided by (y) 0.49, minus (z) the Numerator. In order to eliminate the costs and management time involved in holding a special meeting, our Board of Directors voted to utilize the written consent of the majority shareholders. The elimination of the need for a meeting of shareholders to approve this action is made possible by Section 78.320 of the Nevada Revised Statutes, as may be amended, which provides that the written consent of the holders of a majority of the outstanding shares of voting capital stock, having no less than the minimum number of votes which would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present.

Resolutions to effect the amendments were unanimously

adopted by our Board of Directors and the Majority Shareholder on October 22, 2014. The Majority Shareholder owns 69.77% of our

outstanding voting securities. No other votes or consents are required or necessary to effect the amendments to our Articles of

Incorporation.

Effective Date of Amendment

The effective date of the amendments to our Articles of Incorporation will be on the opening of business on November 25, 2014, or a date that is 21 days from the mailing of this Information Statement to our shareholders, subject to the filing of Articles of Amendment to our Articles of Incorporation with the State of Nevada, Division of Corporations.

AMENDMENT TO OUR ARTICLES OF INCORPORATION

TO INCREASE AUTHORIZED SHARES

The Authorized Increase Amendment is being

sought to enhance corporate flexibility and to advance to the Company’s business plan. Similarly, we believe that for us

to successfully execute our business strategy we may need to raise investment capital and it may be preferable or necessary to

issue additional shares of common stock to investors and or to retain key personnel. Accordingly, in order to grant us the flexibility

to issue our equity securities in the manner best suited for our Company, or as may be required by the capital markets, the Authorized

Increase Amendment will create increase the authorized shares of common stock to 1,000,000,000 shares.

The Authorized Increase Amendment may have

the effect of preventing or delaying the acquisition by third parties of a controlling interest in us, even though the Majority

Shareholder owns approximately 69.77% of our currently outstanding voting securities. Our ability to issue a vastly increased number

of voting securities may lead to an increase in the number of votes required in order to approve a future change in control and

may make it substantially more difficult for third parties to gain control of us through a tender offer, proxy contest, merger

or other transaction. The ability to prevent a change in control may deprive our shareholders of any benefits that may result from

such a change in control, including the potential realization of a premium over the market price for our common stock that such

a transaction may cause. Furthermore, the issuance of a large block of additional shares to

parties who may be deemed “friendly”

to our Board of Directors may make it more difficult to remove incumbent directors from office, even if such removal would benefit

our common shareholders. Despite these potential anti-takeover effects, however, the Board of Directors believed that the financial

flexibility afforded by any increase in our authorized common stock outweighed any potential disadvantages. Our management and

our Board of Directors have no present intention to use the increased number of authorized common shares for any anti-takeover

purpose.

Our issuance of any additional shares of our

common stock in the future may dilute both the equity interests and the earnings per share of our existing common shareholders.

Such dilution may be substantial, depending on the number of shares issued. Any newly authorized shares of common stock will have

voting and other rights identical to those of the currently authorized shares of common stock.

DISSENTERS’ RIGHTS

There are no dissenters’ rights applicable

with respect to the amendments to our Articles of Incorporation.

INTEREST OF CERTAIN PERSONS IN MATTERS TO

BE ACTED UPON

No director, executive officer, nominee for

election as a director, associate of any director, executive officer or nominee or any other person has any substantial interest,

direct or indirect, by security holdings or otherwise, in the amendments to our Articles of Incorporation, which is not shared

by all other shareholders.

WHERE YOU CAN OBTAIN ADDITIONAL INFORMATION

We file annual and special reports and other information with the

SEC. Certain of our SEC filings are available over the Internet at the SEC's web site at http://www.sec.gov. You may also read

and copy any document we file with the SEC at its public reference facilities:

Public Reference Room Office

100 F Street, N.E.

Room 1580

Washington, D.C. 20549

You may also obtain copies of the documents at prescribed rates

by writing to the Public Reference Section of the SEC at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Callers in the

United States can also call 1-202-551-8090 for further information on the operations of the public reference facilities.

DELIVERY OF DOCUMENTS TO SECURITY HOLDERS

SHARING AN ADDRESS

If hard copies of the materials are requested, we will send only

one Information Statement and other corporate mailings to stockholders who share a single address unless we received contrary instructions

from any stockholder at that address. This practice, known as “householding,” is designed to reduce our printing and

postage costs. However, the Company will deliver promptly upon written or oral request a separate copy of the Information Statement

to a stockholder at a shared address to which a single copy of the Information Statement was delivered. You may make such a written

or oral request by (a) sending a written notification stating (i) your name, (ii) your shared address and (iii) the address to

which the Company should direct the additional copy of the Information Statement, to the Company at 5604 Wendy Bagwell Parkway,

Suite 223, Hiram, Georgia 30141

If multiple stockholders sharing an address

have received one copy of this Information Statement or any other corporate mailing and would prefer the Company to mail each stockholder

a separate copy of future mailings, you may mail notification to, or call the Company at, its principal executive offices. Additionally,

if current stockholders with a shared address received multiple copies of this Information Statement or other corporate mailings

and would prefer the Company to mail one copy of future mailings to stockholders at the shared address, notification of such request

may also be made by mail or telephone to the Company’s principal executive offices.

This Information Statement is provided to the

holders of Common Stock of the Company only for information purposes in connection with the Actions, pursuant to and in accordance

with Rule 14c-2 of the Exchange Act. Please carefully read this Information Statement.

NOTICE

THE MAJORITY SHAREHOLDER OF OUR COMPANY HAS CONSENTED TO THE

ADOPTION OF THE AMENDMENT TO OUR ARTICLES OF INCORPORATION BY OWNING IN EXCESS OF THE REQUIRED NUMBER OF OUR OUTSTANDING VOTING

SECURITIES TO ADOPT THE AMENDMENT UNDER NEVADA LAW, AND HAS DONE SO. NO FURTHER CONSENTS, VOTES OR PROXIES ARE NEEDED, AND NONE

ARE REQUESTED.

BY ORDER OF THE BOARD OF DIRECTORS

| Date: November 4, 2014 |

/s/ Ryan Schadel

|

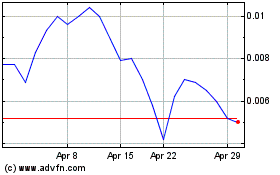

Labor Smart (PK) (USOTC:LTNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Labor Smart (PK) (USOTC:LTNC)

Historical Stock Chart

From Apr 2023 to Apr 2024