UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8‑K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 4, 2014

RED ROBIN GOURMET BURGERS, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | 001-34851 |

84-1573084 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

|

| |

6312 S. Fiddler’s Green Circle, Suite 200N Greenwood Village, Colorado | 80111 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (303) 846-6000

Not Applicable

(Former name or former address, if changed since last report.)

___________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

ITEM 2.02 | Results of Operations and Financial Condition |

On November 4, 2014, Red Robin Gourmet Burgers, Inc. issued a press release describing selected financial results for the third fiscal quarter ended October 5, 2014. A copy of this press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. A copy of the supplemental financial information for the third fiscal quarter ended October 5, 2014, that will be referred to during today’s investor conference call and webcast, is being furnished as Exhibit 99.2 to this Form 8-K.

The information in this Item 2.02, including the information set forth in Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

ITEM 9.01 Financial Statements and Exhibits

(d) Exhibits

|

| |

Exhibit No. | Description |

99.1 | Red Robin Gourmet Burgers, Inc. Press Release dated November 4, 2014. |

99.2 | Supplemental Financial Information dated November 4, 2014, provided by Red Robin Gourmet Burgers, Inc. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

RED ROBIN GOURMET BURGERS, INC.

Date: November 4, 2014

By: /s/ Stuart B. Brown

Name: Stuart B. Brown

Title: Senior Vice President and Chief Financial Officer

EXHIBIT INDEX

|

| |

Exhibit No. | Description |

99.1 | Red Robin Gourmet Burgers, Inc. Press Release dated November 4, 2014. |

99.2 | Supplemental Financial Information dated November 4, 2014, provided by Red Robin Gourmet Burgers, Inc. |

Red Robin Gourmet Burgers Reports Results for the Fiscal Third Quarter Ended October 5, 2014

Greenwood Village, CO – November 4, 2014– Red Robin Gourmet Burgers, Inc., (NASDAQ: RRGB), a casual dining restaurant chain serving an innovative selection of high-quality gourmet burgers in a family-friendly atmosphere, today reported financial results for the 12 weeks ended October 5, 2014 compared to the 12 weeks ended October 6, 2013.

Third Quarter Financial Highlights

| |

• | Revenues were $267.4 million, an increase of 15.9% over the same period a year ago |

| |

• | Comparable restaurant revenue increased 0.9% over the same period a year ago |

| |

• | Excluding acquired restaurants, restaurant-level operating profit, as a percent of restaurant revenue, was 20.1% compared to 20.4% in the third quarter of 2013. Total reported restaurant-level operating profit was 19.5% (See Schedule II) |

| |

• | Earnings per diluted share were $0.50, an increase of 56.3% compared to $0.32 for the same period a year ago |

Net income was $7.2 million compared to $4.7 million for the same period a year ago. Third quarter results included $0.4 million or $0.03 per diluted share of after-tax acquisition costs and $0.5 million or $0.04 per diluted share from a tax credit. Year to date through the Company’s fiscal third quarter 2014, net income was $28.6 million compared to $25.3 million for the same period a year ago. Year to date adjusted net income of $29.0 million excludes an after-tax adjustment for executive transition costs of $0.4 million or $0.03 per diluted share. Year to date adjusted earnings per diluted share was $2.00, compared to $1.75 a year ago. See Schedule I for a reconciliation of adjusted net income and earnings per share.

“We are pleased with our performance during the third quarter,” said Steve Carley, Red Robin Gourmet Burgers, Inc. chief executive officer. “We continue to focus on delivering superior value to our guests with great menu items and transforming our restaurants with new environments and elevated service.”

Operating Results

Total Company revenues, which include Company-owned restaurant revenue and franchise royalties, increased $36.7 million or 15.9% to $267.4 million in the third quarter of 2014 from $230.7 million in the third quarter of 2013. Restaurants acquired in 2014 had $23.1 million of restaurant revenue.

System-wide restaurant revenue (including franchised units) for the third quarter of 2014 totaled $330.9 million, compared to $314.5 million for the third quarter in 2013 at constant currency rates.

Comparable restaurant revenue increased 0.9% in the third quarter of 2014 compared to the prior year. In the third quarter, guest counts decreased 2.3%, while average guest check increased 3.2%. Comparable restaurants are those Company-owned restaurants that have achieved five full quarters of operations during the period presented, and such restaurants are only included in our comparable metrics if they are comparable for the entirety of both periods presented.

Restaurant-level operating profit margins (a non-GAAP financial measure) were 19.5% in the third quarter of fiscal year 2014 compared to 20.4% in the third quarter of fiscal year 2013, a decline of 90 basis points. Excluding acquired restaurants, restaurant-level operating profit margins decreased 30 basis points to 20.1%, primarily due to higher food and beverage costs as a percentage of sales. Schedule II of this earnings release defines restaurant-level operating profit, discusses why it is a useful metric for investors, and reconciles this metric to income from operations and net income.

Restaurant Revenue Performance

|

| | | | | | | |

Casual Dining Restaurants (1) | Q3-2014 | | Q3-2013 |

Average weekly sales per unit: | | | |

Company-owned – Total | $ | 54,684 |

| | $ | 55,029 |

|

Company-owned – Comparable | $ | 55,458 |

| | $ | 54,947 |

|

Franchised units (2) | $ | 57,011 |

| | $ | 54,196 |

|

Total operating weeks: | | | |

Company-owned units(3) | 4,803 |

| | 4,108 |

|

Franchised units(3) | 1,176 |

| | 1,618 |

|

_________________________________________________________

(1) Excludes Red Robin Burger Works® fast casual restaurants which had 84 and 60 operating weeks in the third quarter of 2014 and 2013

(2) Calculated at constant currency rates

(3) Inclusive of the acquisition of 32 franchised restaurants in the U.S. and Canada that was completed on July 14, 2014

Other Results

Depreciation and amortization costs increased $1.8 million to $15.2 million in the third quarter of 2014 compared to $13.4 million in the third quarter of 2013. The increased depreciation was primarily related to new restaurants acquired and opened since the third quarter 2013 and restaurants remodeled under our brand transformation initiative.

General and administrative costs were $20.1 million, a decrease of $0.5 million from the third quarter of fiscal year 2013, due mainly to a decrease in incentive compensation.

Selling expenses were $7.7 million, or 2.9% of revenue, in the third quarter of fiscal year 2014, compared to $6.8 million or 3.0% of revenue a year ago. The increase in selling expenses is primarily due to increased marketing program costs and gift card program growth.

Pre-opening and acquisition costs in the fiscal third quarter of 2014 totaled $2.6 million compared to $2.5 million in the comparable period a year ago. Acquisition costs totaled $0.6 million in the third quarter of 2014 related to the purchase of 32 Red Robin franchised restaurants.

The Company had an effective tax rate of 12.5% in the third quarter of fiscal year 2014, bringing the year to date effective tax rate to 23.9%, compared to 24.2% a year ago.

Restaurant Development and Acquisitions

As of the end of the third quarter of 2014, there were 402 Company-owned Red Robin® restaurants, seven Red Robin Burger Works® and 98 franchised Red Robin restaurants for a total of 507 restaurants. A year ago, there were 345 Company-owned restaurants, five Red Robin Burger Works and 135 franchised locations. In the third quarter of fiscal 2014, the Company opened six new Red Robin restaurants, closed one restaurant, and acquired 32 restaurants.

As previously announced, on July 14, 2014, the Company completed the acquisition of 32 franchised restaurants in the U.S. and Canada for $40 million. The 32 franchised restaurants generate approximately $90 million in restaurant revenue on an annualized basis.

Balance Sheet and Liquidity

As of October 5, 2014, the Company had cash and cash equivalents of $19.9 million and total debt of $156.1 million, including $8.7 million of capital lease liabilities. The Company increased debt by $19.0 million during the third quarter.

During the third quarter, the Company purchased 326,157 shares of treasury stock for $17.6 million. As of October 5, 2014, there were approximately $19.3 million remaining under the current board authorization for stock repurchases.

Updated Outlook for 2014

Red Robin’s 2014 fiscal year consists of 52 weeks and will end on December 28, 2014.

In fiscal year 2014, the Company expects comparable restaurant revenue growth approaching 3.0%. The Company plans to open 19 new Red Robin restaurants and three Red Robin Burger Works resulting in operating week growth of over 6.0%. Restaurants acquired in 2014 are expected to add revenues of $24 million in the fourth quarter of 2014 and will reduce franchise royalties by approximately $0.7 million.

Capital investments in fiscal year 2014 are expected to be approximately $100 million, excluding approximately $51 million related to acquisitions. In addition to the new restaurant openings, the Company also plans to remodel at least 65 Red Robin restaurants as part of its brand transformation initiative as well as expand patio seating in a few locations.

Restaurant-level operating profit margins in fiscal year 2014 are expected to be approximately 21.3%.

General and administrative costs are expected to be approximately $93 million, while selling expenses are expected to be approximately 3.3% of sales considering increased gift card sales. Pre-opening and acquisition costs are expected to total near $8.5 million in fiscal 2014, of which $2.5 million relates to acquisition and integration costs. Depreciation and amortization is projected to be approximately $64.5 million.

Interest expense is expected to be approximately $3.2 million while the income tax rate in fiscal year 2014 is expected to be approximately 24.5%.

The sensitivity of the Company’s earnings per diluted share to a 1% change in guest counts for fiscal year 2014 is estimated to be $0.30 on an annualized basis. Additionally, a 10 basis point change in restaurant-level operating margin is expected to impact earnings per diluted share by approximately $0.07, and a change of approximately $190,000 in pre-tax income or expense is equivalent to approximately $0.01 per diluted share.

Investor Conference Call and Webcast

Red Robin will host an investor conference call to discuss its third quarter 2014 results today at 10:00 a.m. ET. The conference call number is (877) 780-3381, or for international callers (719) 325-2313. The financial information that the Company intends to discuss during the conference call is included in this press release and will be available on the “Investors” link of the Company’s website at www.redrobin.com. Prior to the conference call, the Company will post supplemental financial information that will be discussed during the call and live webcast.

To access the supplemental financial information and webcast, please visit www.redrobin.com and select the “Investors” link from the menu. A replay of the live conference call will be available from two hours after the call until midnight on Tuesday, November 11, 2014. The replay can be accessed by dialing (877) 870-5176, or (858) 384-5517 for international callers. The conference ID is 5775183.

About Red Robin Gourmet Burgers, Inc. (NASDAQ: RRGB)

Red Robin Gourmet Burgers, Inc. (www.redrobin.com), a casual dining restaurant chain founded in 1969 that operates through its wholly-owned subsidiary, Red Robin International, Inc., is the Gourmet Burger Authority™, famous for serving more than two dozen craveable, high-quality burgers with Bottomless Steak Fries® in a fun environment welcoming to guests of all ages. In addition to its many burger offerings, Red Robin serves a wide variety of salads, soups, appetizers, entrees, desserts, and signature Mad Mixology® Beverages. Red Robin offers a variety of options behind the bar, including its extensive selection of local and regional beers, and innovative adult beer shakes and cocktails, recently earning the restaurant the 2014 VIBE Vista Award for Best Beer Program in a Multi-Unit Chain Restaurant. There are more than 500 Red Robin restaurants across the United States and Canada, including those operating under franchise agreements. Red Robin… YUMMM®! Connect with Red Robin on Facebook and Twitter.

Forward-Looking Statements

Forward-looking statements in this press release regarding our expectations related to strategic initiatives, restaurant revenue (including from acquired franchised restaurants), franchise royalties, new restaurant openings and operating weeks, capital investments including our brand transformation initiative and restaurant remodeling, future economic performance, anticipated costs, expenses, tax rate, sensitivity of earnings per share, and other financial measures, statements under the heading “Updated Outlook for 2014” and all other statements that are not historical facts, are made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements are based on assumptions believed by the Company to be reasonable and speak only as of the date on which such statements are made. Without limiting the generality of the foregoing, words such as “expect,” “anticipate,” “intend,” “plan,” “project,” “will” or “estimate,” or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. We undertake no obligation to update such statements to reflect events or circumstances arising after such date, and we caution investors not to place undue reliance on any such forward-looking statements. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those described in the statements based on a number of factors, including but not limited to the following: the effectiveness of the Company’s marketing strategies, loyalty program, and guest count initiatives to achieve restaurant sales growth; the ability to fulfill planned expansion and restaurant remodeling; the ability to successfully integrate and achieve anticipated revenues from recently acquired restaurants; the cost and availability of key food products, labor and energy; the ability to achieve anticipated revenue and cost savings from our anticipated new technology systems and other initiatives; the macro economic and competitive environment; availability of capital or credit facility borrowings; the adequacy of cash flows or available debt resources to fund operations and growth opportunities; federal, state and local regulation of our business; and other risk factors described from time to time in the Company’s Form 10-K, Form 10-Q, and Form 8-K reports (including all amendments to those reports) filed with the U.S. Securities and Exchange Commission.

For media relations questions contact:

Jennifer DeNick, Coyne PR

(973) 588-2000

For investor relations questions contact:

Stuart Brown, Chief Financial Officer

(303) 846-6000

RED ROBIN GOURMET BURGERS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(Unaudited)

|

| | | | | | | | | | | | | | | | |

| | Twelve Weeks Ended | | Forty Weeks Ended |

| | October 5, 2014 | | October 6, 2013 | | October 5, 2014 | | October 6, 2013 |

Revenues: | | | | | | | | |

Restaurant revenue | | $ | 263,883 |

| | $ | 226,844 |

| | $ | 850,696 |

| | $ | 762,647 |

|

Franchise royalties, fees and other revenue | | 3,493 |

| | 3,829 |

| | 13,297 |

| | 12,674 |

|

Total revenues | | 267,376 |

| | 230,673 |

| | 863,993 |

| | 775,321 |

|

| | | | | | | | |

Costs and expenses: | | | | | | | | |

Restaurant operating costs (exclusive of depreciation and amortization shown separately below): | | | | | | | | |

Cost of sales | | 68,241 |

| | 57,253 |

| | 216,150 |

| | 190,259 |

|

Labor | | 88,918 |

| | 76,624 |

| | 282,410 |

| | 255,154 |

|

Other operating | | 34,124 |

| | 29,463 |

| | 105,744 |

| | 95,016 |

|

Occupancy | | 21,222 |

| | 17,132 |

| | 64,122 |

| | 56,484 |

|

Depreciation and amortization | | 15,209 |

| | 13,436 |

| | 48,216 |

| | 44,589 |

|

General and administrative | | 20,106 |

| | 20,647 |

| | 72,645 |

| | 71,480 |

|

Selling | | 7,725 |

| | 6,834 |

| | 27,928 |

| | 21,995 |

|

Pre-opening costs and acquisition costs | | 2,605 |

| | 2,482 |

| | 7,045 |

| | 4,607 |

|

Total costs and expenses | | 258,150 |

| | 223,871 |

| | 824,260 |

| | 739,584 |

|

| | | | | | | | |

Income from operations | | 9,226 |

| | 6,802 |

| | 39,733 |

| | 35,737 |

|

| | | | | | | | |

Other expense: | | | | | | | | |

Interest expense, net and other | | 986 |

| | 624 |

| | 2,134 |

| | 2,387 |

|

| | | | | | | | |

Income before income taxes | | 8,240 |

| | 6,178 |

| | 37,599 |

| | 33,350 |

|

Provision for income taxes | | 1,032 |

| | 1,517 |

| | 8,977 |

| | 8,070 |

|

Net income | | $ | 7,208 |

| | $ | 4,661 |

| | $ | 28,622 |

| | $ | 25,280 |

|

Earnings per share: | | | | | | | | |

Basic | | $ | 0.51 |

| | $ | 0.33 |

| | $ | 2.00 |

| | $ | 1.78 |

|

Diluted | | $ | 0.50 |

| | $ | 0.32 |

| | $ | 1.97 |

| | $ | 1.75 |

|

Weighted average shares outstanding: | | | | | | | | |

Basic | | 14,216 | | 14,328 | | 14,299 | | 14,189 |

Diluted | | 14,397 | | 14,600 | | 14,516 | | 14,472 |

RED ROBIN GOURMET BURGERS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

(Unaudited)

|

| | | | | | | | |

| | October 5, 2014 | | December 29, 2013 |

Assets: | | | | |

Current Assets: | | | | |

Cash and cash equivalents | | $ | 19,940 |

| | $ | 17,108 |

|

Accounts receivable, net | | 12,684 |

| | 22,568 |

|

Inventories | | 24,639 |

| | 21,992 |

|

Prepaid expenses and other current assets | | 13,817 |

| | 15,766 |

|

Deferred tax asset and other | | 3,058 |

| | 3,212 |

|

Total current assets | | 74,138 |

| | 80,646 |

|

| | | | |

Property and equipment, net | | 490,804 |

| | 444,727 |

|

Goodwill | | 86,727 |

| | 62,525 |

|

Intangible assets, net | | 43,429 |

| | 36,800 |

|

Other assets, net | | 12,849 |

| | 9,947 |

|

Total assets | | $ | 707,947 |

| | $ | 634,645 |

|

| | | | |

Liabilities and Stockholders’ Equity: | | | | |

Current Liabilities: | | | | |

Trade accounts payable | | $ | 18,891 |

| | $ | 19,117 |

|

Construction related payables | | 19,714 |

| | 14,682 |

|

Accrued payroll and payroll-related liabilities | | 42,069 |

| | 45,919 |

|

Unearned revenue | | 25,872 |

| | 35,740 |

|

Accrued liabilities and other | | 24,992 |

| | 24,454 |

|

Total current liabilities | | 131,538 |

| | 139,912 |

|

| | | | |

Deferred rent | | 56,510 |

| | 51,985 |

|

Long-term debt | | 147,375 |

| | 79,375 |

|

Long-term portion of capital lease obligations | | 8,071 |

| | 8,513 |

|

Other non-current liabilities | | 8,212 |

| | 7,457 |

|

Total liabilities | | 351,706 |

| | 287,242 |

|

| | | | |

Stockholders’ Equity: | | | | |

Common stock; $0.001 par value: 30,000 shares authorized; 17,845 and 17,851 shares issued; 14,033 and 14,350 shares outstanding | | 18 |

| | 18 |

|

Preferred stock, $0.001 par value: 3,000 shares authorized; no shares issued and outstanding | | — |

| | — |

|

Treasury stock 3,812 and 3,501 shares, at cost | | (131,898 | ) | | (110,486 | ) |

Paid-in capital | | 199,928 |

| | 197,145 |

|

Accumulated other comprehensive loss, net of tax | | (1,180 | ) | | (25 | ) |

Retained earnings | | 289,373 |

| | 260,751 |

|

Total stockholders’ equity | | 356,241 |

| | 347,403 |

|

Total liabilities and stockholders’ equity | | $ | 707,947 |

| | $ | 634,645 |

|

Schedule I

Reconciliation of Non-GAAP Results to GAAP Results

(In thousands, except per share data)

In addition to the results provided in accordance with Generally Accepted Accounting Principles (“GAAP”) throughout this press release, the Company has provided non-GAAP measurements which present the 12 and 40 weeks ended October 5, 2014 and the 12 and 40 weeks ended October 6, 2013, net income and basic and diluted earnings per share, excluding the effects of executive transition charges in the second quarter of fiscal year 2014. The Company believes that the presentation of net income and earnings per share exclusive of the identified items gives the reader additional insight into the ongoing operational results of the Company. This supplemental information will assist with comparisons of past and future financial results against the present financial results presented herein. Income tax expense related to the asset impairment charges and the loss on debt refinancing was calculated based on the change in the total tax provision calculation after adjusting for the identified items. The non-GAAP measurements are intended to supplement the presentation of the Company’s financial results in accordance with GAAP.

|

| | | | | | | | | | | | | | | | |

| | Twelve Weeks Ended | | Forty Weeks Ended |

| | October 5, 2014 | | October 6, 2013 | | October 5, 2014 | | October 6, 2013 |

Net income as reported | | $ | 7,208 |

| | $ | 4,661 |

| | $ | 28,622 |

| | $ | 25,280 |

|

Executive transition costs | | — |

| | — |

| | 544 |

| | — |

|

Income tax expense | | — |

| | — |

| | (183 | ) | | — |

|

Adjusted net income | | $ | 7,208 |

| | $ | 4,661 |

| | $ | 28,983 |

| | $ | 25,280 |

|

| | | | | | | | |

Basic net income per share: | | | | | | | | |

Net income as reported | | $ | 0.51 |

| | $ | 0.33 |

| | $ | 2.00 |

| | $ | 1.78 |

|

Executive transition costs | | — |

| | — |

| | 0.04 |

| | — |

|

Income tax expense | | — |

| | — |

| | (0.01 | ) | | — |

|

Adjusted earnings per share - basic | | $ | 0.51 |

| | $ | 0.33 |

| | $ | 2.03 |

| | $ | 1.78 |

|

| | | | | | | | |

Diluted net income per share: | | | | | | | | |

Net income as reported | | $ | 0.50 |

| | $ | 0.32 |

| | $ | 1.97 |

| | $ | 1.75 |

|

Executive transition costs | | — |

| | — |

| | 0.04 |

| | — |

|

Income tax expense | | — |

| | — |

| | (0.01 | ) | | — |

|

Adjusted earnings per share - diluted | | $ | 0.50 |

| | $ | 0.32 |

| | $ | 2.00 |

| | $ | 1.75 |

|

| | | | | | | | |

Weighted average shares outstanding | | | | | | | | |

Basic | | 14,216 |

| | 14,328 |

| | 14,299 |

| | 14,189 |

|

Diluted | | 14,397 |

| | 14,600 |

| | 14,516 |

| | 14,472 |

|

Schedule II

Reconciliation of Non-GAAP Restaurant-Level Operating Profit to Income

from Operations and Net Income

(In thousands)

The Company believes that restaurant-level operating profit is an important measure for management and investors because it is widely regarded in the restaurant industry as a useful metric by which to evaluate restaurant-level operating efficiency and performance. The Company defines restaurant-level operating profit to be restaurant revenue minus restaurant-level operating costs, excluding restaurant closures and impairment costs. The measure includes restaurant- level occupancy costs, which include fixed rents, percentage rents, common area maintenance charges, real estate and personal property taxes, general liability insurance and other property costs, but excludes depreciation related to restaurant buildings and leasehold improvements. The measure excludes depreciation and amortization expense, substantially all of which is related to restaurant-level assets, because such expenses represent historical sunk costs which do not reflect current cash outlay for the restaurants. The measure also excludes selling, general and administrative costs, and therefore excludes occupancy costs associated with selling, general and administrative functions, and pre-opening costs. The Company excludes restaurant closure costs as they do not represent a component of the efficiency of continuing operations. Restaurant impairment costs are excluded, because, similar to depreciation and amortization, they represent a non-cash charge for the Company’s investment in its restaurants and not a component of the efficiency of restaurant operations. Restaurant-level operating profit is not a measurement determined in accordance with generally accepted accounting principles (“GAAP”) and should not be considered in isolation, or as an alternative, to income from operations or net income as indicators of financial performance. Restaurant-level operating profit as presented may not be comparable to other similarly titled measures of other companies. The table below sets forth certain unaudited information for the 12 and 40 weeks ended October 5, 2014 and the 12 and 40 weeks ended October 6, 2013, expressed as a percentage of total revenues, except for the components of restaurant-level operating profit, which are expressed as a percentage of restaurant revenue.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Twelve Weeks Ended | | Forty Weeks Ended |

| | October 5, 2014 | | October 6, 2013 | | October 5, 2014 | | October 6, 2013 |

Restaurant revenue | | $ | 263,883 |

| | 98.7 | % | | $ | 226,844 |

| | 98.3 | % | | $ | 850,696 |

| | 98.5 | % | | $ | 762,647 |

| | 98.4 | % |

Restaurant operating costs (exclusive of depreciation and amortization shown separately below): | | | | | | | | | | | | | | | | |

Cost of sales | | 68,241 |

| | 25.9 | % | | 57,253 |

| | 25.2 | % | | 216,150 |

| | 25.4 | % | | 190,259 |

| | 24.9 | % |

Labor | | 88,918 |

| | 33.7 | % | | 76,624 |

| | 33.8 | % | | 282,410 |

| | 33.2 | % | | 255,154 |

| | 33.5 | % |

Other operating | | 34,124 |

| | 12.9 | % | | 29,463 |

| | 13.0 | % | | 105,744 |

| | 12.4 | % | | 95,016 |

| | 12.5 | % |

Occupancy | | 21,222 |

| | 8.0 | % | | 17,132 |

| | 7.6 | % | | 64,122 |

| | 7.5 | % | | 56,484 |

| | 7.4 | % |

Restaurant-level operating profit | | 51,378 |

| | 19.5 | % | | 46,372 |

| | 20.4 | % | | 182,270 |

| | 21.4 | % | | 165,734 |

| | 21.7 | % |

| | | | | | | | | | | | | | | | |

Add – Franchise royalties, fees and other revenues | | 3,493 |

| | 1.3 | % | | 3,829 |

| | 1.7 | % | | 13,297 |

| | 1.5 | % | | 12,674 |

| | 1.6 | % |

Deduct – other operating: | | | | | | | | | | | | | | | | |

Depreciation and amortization | | 15,209 |

| | 5.7 | % | | 13,436 |

| | 5.8 | % | | 48,216 |

| | 5.6 | % | | 44,589 |

| | 5.8 | % |

General and administrative | | 20,106 |

| | 7.5 | % | | 20,647 |

| | 9.0 | % | | 72,645 |

| | 8.4 | % | | 71,480 |

| | 9.2 | % |

Selling | | 7,725 |

| | 2.9 | % | | 6,834 |

| | 3.0 | % | | 27,928 |

| | 3.2 | % | | 21,995 |

| | 2.8 | % |

Pre-opening and acquisition costs | | 2,605 |

| | 1.0 | % | | 2,482 |

| | 1.1 | % | | 7,045 |

| | 0.8 | % | | 4,607 |

| | 0.6 | % |

Total other operating | | 45,645 |

| | 17.1 | % | | 43,399 |

| | 18.8 | % | | 155,834 |

| | 18.0 | % | | 142,671 |

| | 18.4 | % |

| | | | | | | | | | | | | | | | |

Income from operations | | 9,226 |

| | 3.5 | % | | 6,802 |

| | 2.9 | % | | 39,733 |

| | 4.6 | % | | 35,737 |

| | 4.6 | % |

| | | | | | | | | | | | | | | | |

Interest expense, net and other | | 986 |

| | 0.4 | % | | 624 |

| | 0.3 | % | | 2,134 |

| | 0.2 | % | | 2,387 |

| | 0.3 | % |

Income tax expense | | 1,032 |

| | 0.4 | % | | 1,517 |

| | 0.7 | % | | 8,977 |

| | 1.0 | % | | 8,070 |

| | 1.0 | % |

Total other | | 2,018 |

| | 0.8 | % | | 2,141 |

| | 0.9 | % | | 11,111 |

| | 1.3 | % | | 10,457 |

| | 1.3 | % |

| | | | | | | | | | | | | | | | |

Net income | | $ | 7,208 |

| | 2.7 | % | | $ | 4,661 |

| | 2.0 | % | | $ | 28,622 |

| | 3.3 | % | | $ | 25,280 |

| | 3.3 | % |

Certain percentage amounts in the table above do not total due to rounding as well as the fact that components of restaurant-level operating profit are expressed as a percentage of restaurant revenue and not total revenues.

Third Quarter 2014 Results November 4, 2014

Forward-Looking Statements Forward-looking statements in this presentation regarding our restaurant revenue, restaurant-level operating profit margins, new restaurant growth and remodels, future economic performance, costs, expenses, tax rate, royalties and capital investments, promotions, statements under the heading “2014 Outlook,” and all other statements that are not historical facts, are made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements are based on assumptions believed by the Company to be reasonable and speak only as of the date on which such statements are made. Without limiting the generality of the foregoing, words such as “expect,” “anticipate,” “intend,” “plan,” “project,” or “estimate,” or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. We undertake no obligation to update such statements to reflect events or circumstances arising after such date, and we caution investors not to place undue reliance on any such forward-looking statements. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those described in the statements based on a number of factors, including but not limited to the following: the effectiveness of the Company’s marketing and menu strategies, loyalty program, and guest count initiatives to achieve restaurant sales growth; the number, cost, timing, and ability to fulfill planned expansion and restaurant remodeling; the cost and availability of key food products, labor, and energy; the ability to achieve revenue and cost savings from our anticipated new technology systems and other initiatives; the macro economic and competitive environment; the ability to successfully integrate and achieve anticipated revenues from recently acquired restaurants; availability of capital or credit facility borrowings; the adequacy of cash flows or available debt resources to fund operations and growth opportunities; federal, state, and local regulation of our business; and other risk factors described from time to time in the Company’s Form 10-K, Form 10-Q, and Form 8-K reports (including all amendments to those reports) filed with the U.S. Securities and Exchange Commission. This presentation may also contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results and providing meaningful period- to-period comparisons. For a reconciliation of non- GAAP measures presented in this document, see the Appendix of this presentation. 1

Comparable restaurant revenue up 0.9%, Guest traffic down 2.3% Acquired 32 restaurants from a franchisee on 7/14/14 Total restaurant revenue increased 16.3% (including recently acquired restaurants) Excluding acquired restaurants, restaurant-level operating profit was 20.1% compared to 20.4% a year ago Diluted EPS of $0.50, an increase of 56.3% 6 Red Robin restaurants opened, 1 closed Q3-14 Headlines 2

Brand Transformation Initiative 3 95 complete by year-end Targeting 125 more in 2015

New Red Robin Burger Works locations off to promising start • Chicago − Michigan Avenue – opened 6/23 − Chicago Avenue – opened 7/7 • Washington D.C. − L’Enfant Plaza – opened 10/6 Red Robin Burger Works 4

Traffic and Trade-Up Returned to Everyday Value message on-air and Finest news to trade guests up once in restaurant 5

Tavern Double Tuesday Sports Sponsorships 6

Holiday Promo Big Sky Finest Burger LTO Added new permanent dessert item 7 2014 South Beach Wine & Food Festival

Burgers and a Movie™ & Gift Cards for Holiday 8

Plans to Transform Canadian Business 9

Financial Update 10

Q3-14 Sales Highlights (1) Excludes Red Robin Burger Works® fast casual restaurants 11 Q3 -14 (12 Weeks) Q3-13 (12 Weeks) Change Restaurant revenue $263.9 million $226.8 million +16.4% Total company revenue $267.4 million $230.7 million +15.9% Company-owned comp revenue 0.9% 5.7% -480 bps Price/Mix 3.2% 4.6% -140 bps Guest counts -2.3% 1.1% -340 bps Franchised comp revenues 2.8% 4.8% -200 bps Company avg. weekly revenue/unit(1) - total $54,684 $55,029 -0.6% Company avg. weekly revenue/unit(1) - comp $55,458 $54,947 +0.9% Red Robin operating weeks(1) 4,803 4,108 +16.9% Burger Works operating weeks 84 60 +40.0% Net sales/sq. ft (TTM) $459 $447 +2.7%

5.7% 3.7% 5.4% 1.2% 0.9% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% Q313 Q413 Q114 Q214 Q314 Comparable Restaurant Revenue Growth 12 YTD +2.9%

21.2% 21.1% 19.7% 20.6% 21.5% 23.3% 20.4% 21.7% 22.4% 22.2% 19.5% 16.0% 17.0% 18.0% 19.0% 20.0% 21.0% 22.0% 23.0% 24.0% 25.0% Q1 Q2 Q3 Q4 2012 2013 2014 (2) RLOP (1) Margins 13 (1) See reconciliation of non-GAAP restaurant-level operating profit to income from operations and net income on Schedule II of the Q3 press release posted on redrobin.com (2) Excluding acquired restaurants, restaurant-level operating profit margin was 20.1% YTD 21.4%

Q3-14 Restaurant Results 14 % of Restaurant Revenues Q3-14 % of Restaurant Revenues Q3-14 Favorable (Unfavorable) Cost of sales 25.9% 25.2% (70 bps) Labor 33.7% 33.8% 10 bps Other operating 12.9% 13.0% 10 bps Occupancy 8.0% 7.6% (40 bps) Restaurant Level Operating Profit (Non-GAAP) 19.5% 20.4% (90 bps)

$33.6 $25.0 $20.0 $25.8 $32.5 $29.7 $21.0 $25.8 $37.0 $29.3 $25.6 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 Q1 Q2 Q3 Q4 2012 2013 2014 See slide 23 for reconciliation of non-GAAP Adjusted EBITDA to Net Income (1) 13 weeks in 2012 $117.5 million trailing 4 quarters (1) Adjusted EBITDA $ in millions 15

Adjusted Net Income $10.6 $7.7 $3.5 $8.4 $9.5 $11.1 $4.7 $9.1 $11.9 $9.8 $7.2 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 Q1 Q2 Q3 Q4 2012 2013 2014 $ in millions 16 See slide 24 for reconciliation of non-GAAP Adjusted Net Income to Net Income (1) 13 weeks in 2012 (1)

Adjusted Earnings Per Diluted Share $0.71 $0.52 $0.24 $0.59 $0.66 $0.77 $0.32 $0.62 $0.82 $0.68 $0.50 $0.15 $0.25 $0.35 $0.45 $0.55 $0.65 $0.75 $0.85 $0.95 Q1 Q2 Q3 Q4 2012 2013 2014 17 See slide 24 for reconciliation of non-GAAP Adjusted Earnings Per Diluted Share to Earnings Per Diluted share (1) 13 weeks in 2012 (1)

2014 Outlook Comparable restaurant revenue growth approaching 3.0% RLOP margins expected to be approximately 21.3% Open 19 new company-owned Red Robin® restaurants plus 3 Red Robin Burger Works® Capital investments expected to be approximately $100 million, excluding acquisitions G&A costs expected to be approximately $93 million; selling expenses expected to be 3.3% of sales Pre-opening and acquisition costs expected to be near $8.5 million Depreciation and amortization costs expected to be approximately $64.5 million Tax rate projected to be approximately 24.5% 18

In Closing 19

Appendix 20

$29.6 $20.5 $22.3 $22.0 $40.4 $30.6 $11.2 $31.3 $36.0 $20.1 $26.8 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 $45.0 Q1 Q2 Q3 Q4 2012 2013 2014 Cash Flow from Operations $ in millions 21 (1) 13 weeks in 2012 (1)

Q3-14 Commodity Update 22 % of Total COGS in Q3-14 Market vs. Contract Ground beef 15.5% Market Poultry 10.4% Contract through 12/14; 40% through 12/15 Steak fries 10.2% Contract through 10/16 Produce 7.1% Contract through 10/14 Meat 6.7% Bacon through 12/14; Prime rib through 12/14; Riblets through 2/15 Bread 6.1% Contract through 12/14 Seafood 3.6% Cod through 6/15; Shrimp through 12/14 Fry oil 2.1% Contract through 6/15

Adjusted EBITDA Reconciliation to Net Income 23 2012 2013 2014 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Net income as reported $ 10,558 $ 7,748 $ 3,553 $ 6,492 $ 9,480 $ 11,139 $ 4,661 $ 6,959 $ 11,944 $ 9,470 $ 7,208 Adjustments to net income: Income tax expense 3,356 2,408 1,210 1,552 2,977 3,576 1,517 940 4,424 3,521 1,032 Interest expense, net 1,833 1,223 1,041 1,217 1,052 623 558 399 689 619 927 Depreciation and amortization 16,652 12,532 13,284 13,000 17,834 13,319 13,436 13,611 18,886 14,120 15,209 Non-cash stock-based compensation 1,202 1,068 894 644 1,192 1,050 857 724 1,009 1,021 1,178 Loss on debt refinancing ‒ ‒ ‒ 2,919 ‒ ‒ ‒ ‒ ‒ ‒ ‒ Impairment and closure charges ‒ ‒ ‒ ‒ ‒ ‒ ‒ 1,517 ‒ ‒ ‒ Non-recurring special bonus ‒ ‒ ‒ ‒ ‒ ‒ ‒ 1,626 ‒ ‒ ‒ Executive transition ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ 544 ‒ Adjusted EBITDA $ 33,601 $ 24,979 $ 19,962 $ 25,824 $ 32,535 $ 29,707 $ 21,029 $ 25,776 $ 36,952 $ 29,295 $ 25,554

Reconciliation of Adjusted Net Income to Net Income and Adjusted Earnings Per Diluted Share to Earnings Per Diluted Share 24 2012 2013 2014 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Net income as reported $ 10,558 $ 7,748 $ 3,553 $ 6,492 $ 9,480 $ 11,139 $ 4,661 $ 6,959 $ 11,944 $ 9,470 $ 7,208 Adjustments to net income: Loss on debt refinancing ‒ ‒ ‒ 2,919 ‒ ‒ ‒ ‒ ‒ ‒ ‒ Executive transition & severance ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ 544 ‒ Impairment and closure charges ‒ ‒ ‒ ‒ ‒ ‒ ‒ 1,517 ‒ ‒ ‒ Non-recurring special bonus ‒ ‒ ‒ ‒ ‒ ‒ ‒ 1,626 ‒ ‒ ‒ Income tax expense of adjustments ‒ ‒ ‒ (1,020) ‒ ‒ ‒ (974) ‒ (183) ‒ Adjusted net income $ 10,558 $ 7,748 $ 3,553 $ 8,931 $ 9,480 $ 11,139 $ 4,661 $ 9,128 $ 11,944 $9,831 $ 7,208 Diluted net income per share: Net income as reported $ 0.71 $ 0.52 $ 0.24 $ 0.45 $ 0.66 $ 0.77 $ 0.32 $ 0.48 $ 0.82 $ 0.65 $ 0.50 Adjustments to net income: ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ Loss on debt refinancing ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ 0.04 ‒ Executive transition & severance ‒ ‒ ‒ 0.20 ‒ ‒ ‒ ‒ ‒ ‒ ‒ Impairment and closure charges ‒ ‒ ‒ ‒ ‒ ‒ ‒ 0.10 ‒ ‒ ‒ Non-recurring special bonus ‒ ‒ ‒ ‒ ‒ ‒ ‒ 0.11 ‒ ‒ ‒ Income tax expense of adjustments ‒ ‒ ‒ (0.06) ‒ ‒ ‒ (0.07) ‒ (0.01) ‒ Adjusted EPS – diluted $ 0.71 $ 0.52 $ 0.24 $ 0.59 $ 0.66 $ 0.77 $ 0.32 $ 0.62 $ 0.82 $ 0.68 $ 0.50

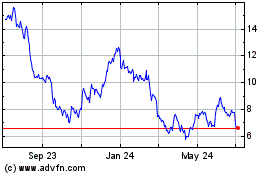

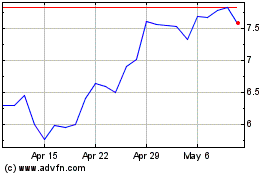

Red Robin Gourmet Burgers (NASDAQ:RRGB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Red Robin Gourmet Burgers (NASDAQ:RRGB)

Historical Stock Chart

From Apr 2023 to Apr 2024