UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 3, 2014

GALENA BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 001-33958 | | 20-8099512 |

(State or other jurisdiction of incorporation or organization) | | (Commission

File Number)

| | (I.R.S. Employer

Identification No.) |

| | | | |

| | 4640 S.W. Macadam Avenue Suite 270 Portland, Oregon 97239 | | |

| | (Address of Principal Executive Offices) (Zip Code)

| | |

| | | | |

Registrant’s telephone number, including area code: (855) 855-4253

|

| | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 2.02 | Results of Operations and Financial Condition. |

On November 3, 2014, Galena Biopharma, Inc. (“we,” “us,” “our” and the “company”) issued a press release announcing our financial results for the third quarter ended September 30, 2014 and an update of recent business developments. A copy of the press release is attached to this Report as Exhibit 99.1 and is incorporated herein by reference.

The information furnished under this Item 2.02, including the accompanying Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liability of such section, nor shall such information be deemed to be incorporated by reference in any subsequent filing by the company under the Securities Act of 1933 or the Exchange Act, regardless of the general incorporation language of such filing, except as specifically stated in such filing.

|

| |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits. The following exhibit is filed as a part of this Report:

|

| | | |

| | |

Exhibit No. | | Description |

| |

99.1 |

| | Press Release of Galena Biopharma, Inc. dated November 3, 2014. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | | | |

| | | | | | | | |

| | | | GALENA BIOPHARMA, INC. |

| | | | |

Date: | | November 3, 2014 | | | | By: | | /s/ Mark W. Schwartz |

| | | | | | | | Mark W. Schwartz, Ph.D. President and Chief Executive Officer |

Galena Biopharma Reports Third Quarter 2014 Results

| |

• | Clinical programs advance on multiple fronts, with trial initiation, trial enrollment, data and IP milestones achieved and anticipated |

| |

• | Commercial strategy reinforced with product acquisition and upcoming commercial launch |

| |

• | Abstral® (fentanyl) sublingual tablet net revenue was $1.6 million in Q3 2014 and $6.1 million to date this year, with reiterated guidance of $8-$10 million for the full year 2014 |

| |

• | Zuplenz® (ondansetron) Oral Soluble Film U.S. rights licensed; launch expected in Q1 2015 |

| |

• | Conference call scheduled for 5:00 pm E.T. today with details below |

Portland, Oregon, November 3, 2014 - Galena Biopharma, Inc. (NASDAQ: GALE), a biopharmaceutical company developing and commercializing innovative, targeted oncology treatments that address major unmet medical needs to advance cancer care, today reported its financial results for the quarter ended September 30, 2014 and provided a business update.

“The company continues to make excellent progress on our clinical programs, and we continue to build our commercial franchise,” said Mark W. Schwartz, Ph.D., President and Chief Executive Officer. “I believe we have turned the corner on the corporate challenges we faced this year, and we are fully focused on the progress of NeuVax™ and its portfolio of clinical trials, our development pipeline and our commercial programs including the upcoming launch of Zuplenz®. Over the next six months, we will report results from the ongoing trials with GALE-301 and GALE-401, and our NeuVax platform will expand with the initiation of two new trials plus the completion of enrollment in our pivotal, Phase 3 PRESENT study. The launch of Zuplenz in Q1 2015 enhances our commercialization efforts and we believe we will see significant sales growth for that business line in 2015.”

Galena will host a conference call today at 2:00 p.m. P.T./5:00 p.m. E.T. to discuss financial and business results. The call can be accessed by dialing (844) 825-4413 toll-free in the U.S., or (973) 638-3403 for participants outside the U.S. The Conference ID number is: 23451769. The conference call will also be webcast live and available under the Investors section/Events and Presentations on the Company's website at www.galenabiopharma.com. The archived webcast replay will be available on the Company's website for 90 days.

Third Quarter 2014 Financial Highlights

Net revenue for the third quarter of 2014 was $1.6 million compared to $1.2 million for the third quarter of 2013, an increase of 25%. Net revenue for the nine months ended September 30, 2014 was $6.1 million. The third quarter of 2013 was the first quarter that the company experienced net revenue.

Operating loss for the three months ended September 30, 2014 was $13.2 million, including $1.3 million in stock-based compensation charges, compared to $6.9 million, including $0.5 million in stock-based compensation charges, for the three months ended September 30, 2013.

Galena also incurs non-cash income and expense related to changes in the fair value estimates of the Company’s warrant liabilities. Non-cash income related to the change in warrant values for the three months ended September 30, 2014 was $6.7 million compared to non-cash expense of $1.6 million for the three months ended September 30, 2013.

Net loss for the three months ended September 30, 2014 was $6.2 million, or $0.05 per basic and diluted share, compared to a net loss of $9.3 million, or $0.11 per basic and diluted share, for the three months ended September 30, 2013.

As of September 30, 2014, Galena had cash and cash equivalents of $24.6 million, compared with $47.8 million as of December 31, 2013.

Business Highlights

| |

• | Announced NeuVax™ (nelipepimut-S) Phase 3 PRESENT Trial enrollment status. Galena provided the current enrollment status for the Company’s Phase 3 PRESENT (Prevention of Recurrence in Early-Stage, Node-Positive Breast Cancer with Low-to-Intermediate HER2 Expression with NeuVax Treatment) clinical trial. As of September 22, 2014, 533 of the 700 patients required by the clinical trial protocol had been treated. The Company expects to treat 700 patients by the end of January 2015 with the intention to over-enroll the study, targeting the end of Q1, 2015 to close enrollment. |

| |

• | Significantly Expanded the NeuVax Intellectual Property Position with Notice of Allowances for Three Important Patents |

| |

• | Patent will cover the use of NeuVax to prevent recurrence of any HER2/neu expressing tumor having a fluorescence in situ hybridization (FISH) rating of less than about 2.0 as a stand-alone therapy or in combination with an adjuvant and/or other agents. Currently there are no approved HER2-directed therapies for patients who express lower levels of HER2, or less than 2.0 by the FISH testing scale. Importantly, this NeuVax patent provides Galena with coverage for any tumor expressing low-to-intermediate levels of HER2. The patent, which has now issued, will expire in 2028, not including any patent term extensions. |

| |

• | Patent To Cover the Use of NeuVax in Combination With Herceptin® (trastuzumab; Genentech/Roche) for treating patients having any HER2/neu expressing cancer. The allowed claims of this patent will cover all HER2/neu expressing cancer types and patient populations. Once issued, the patent will expire in 2026, not including any patent term extensions. |

| |

• | Improvement patent in Japan will cover the use of NeuVax alone or in combination with other agents to prevent recurrence of any breast cancer tumor expressing low-to-intermediate (Immunohistochemistry (IHC) 1+ or 2+ or FISH less than about 2.0) levels of HER2. Once issued, the patent will expire in 2027, not including any patent term extensions. |

| |

• | Initiated the Phase 2 Clinical Trial for GALE-401 (Anagrelide Controlled Release). The study will treat patients with elevated platelet counts in myeloproliferative neoplasms (MPNs) including essential thrombocythemia (ET). The Phase 2 trial is an open-label, single-arm, multicenter study of GALE-401 in approximately 20 patients with MPN-related thrombocytosis. The goals of the study are to confirm the platelet-lowering activity of GALE-401 in patients with MPNs, to assess safety and tolerability, and to measure blood levels of the drug. The primary efficacy endpoint will be the proportion of subjects who achieve a complete or partial platelet response for at least four weeks during the first six months of treatment. Based on discussions with the U.S. Food and Drug Administration (FDA) and pending a successful development program, Galena would pursue approval via the 505(b)(2) regulatory pathway. |

| |

• | Appointed Mark W. Schwartz, PhD as President and Chief Executive Officer and member of the Board of Directors. Dr. Schwartz was previously Galena's Executive Vice President and Chief Operating Officer where he worked across all of the company's programs, oversaw the initiation of the commercialization efforts, and also managed intellectual property efforts, acquisitions, and partnerships. Dr. Schwartz brings more than 30 years of experience in the biotechnology and life science industry and joined the Company following Galena's acquisition of Apthera, Inc. where he served as the company's President and CEO. Prior to Apthera, Dr. Schwartz served as President and CEO of Bayhill Therapeutics where he completed a successful partnership with Genentech around one of its compounds. Previously, he served as President and CEO of Calyx Therapeutics. Earlier in his career, Dr. Schwartz held a range of positions in R&D, marketing, sales, business development and executive management at Trega BioSciences, Incyte Genomics, Synteni, Tripos, Applied Biosystems and DuPont Diagnostics. Dr. Schwartz is currently on the advisory board for BayBio, a Director of Targazyme Pharmaceuticals, and is on the faculty of San Jose State University in the Masters of Biotechnology Program. He is also a former Board member of the Biotechnology Industry Association. Dr. Schwartz received his Bachelor of Arts in Chemistry from Grinnell College and his Ph.D. in Chemistry from Arizona State University. |

| |

• | Licensed the U.S. Rights for Zuplenz® (ondansetron) Oral Soluble Film. Zuplenz is approved by the FDA in adult patients for the prevention of highly and moderately emetogenic chemotherapy-induced nausea and vomiting (CINV), radiotherapy-induced nausea and vomiting (RINV), and post-operative nausea and vomiting (PONV). Zuplenz is also approved in pediatric patients for moderately emetogenic CINV. Zuplenz is a rapidly dissolving, oral soluble film that dissolves on the tongue in less than thirty seconds and eliminates the burden of swallowing pills during periods of emesis and in cases of oral irritation, potentially increasing patient adherence. Galena expects to launch Zuplenz in the first quarter 2015. |

GALENA BIOPHARMA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands, except share and per share data)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2014 | | 2013 | | 2014 | | 2013 |

Net revenue | $ | 1,620 |

| | $ | 1,170 |

| | $ | 6,124 |

| | $ | 1,170 |

|

Costs and expenses: | | | | | | | |

Cost of revenue (excluding amortization of certain acquired intangible assets) | 247 |

| | 258 |

| | 925 |

| | 258 |

|

Research and development | 7,243 |

| | 3,633 |

| | 22,082 |

| | 13,990 |

|

Selling, general, and administrative | 7,268 |

| | 4,129 |

| | 23,698 |

| | 8,369 |

|

Amortization of certain acquired intangible assets | 70 |

| | 43 |

| | 259 |

| | 43 |

|

Total costs and expenses | 14,828 |

| | 8,063 |

| | 46,964 |

| | 22,660 |

|

Operating loss | (13,208 | ) | | (6,893 | ) | | (40,840 | ) | | (21,490 | ) |

Non-operating income (expense): | | | | | | | |

Change in fair value of warrants potentially settleable in cash | 6,735 |

| | (1,614 | ) | | 13,174 |

| | (7,135 | ) |

Interest income (expense), net | (297 | ) | | (314 | ) | | (925 | ) | | (495 | ) |

Other income (expense) | 597 |

| | 693 |

| | (59 | ) | | 881 |

|

Total non-operating income (expense), net | 7,035 |

| | (1,235 | ) | | 12,190 |

| | (6,749 | ) |

Loss before income taxes | (6,173 | ) | | (8,128 | ) | | (28,650 | ) | | (28,239 | ) |

Income tax benefit | — |

| | 1,159 |

| | — |

| | (62 | ) |

Net loss | $ | (6,173 | ) | | $ | (9,287 | ) | | $ | (28,650 | ) | | $ | (28,177 | ) |

Net loss per common share: | | | | | | | |

Basic and diluted net loss per share | $ | (0.05 | ) | | $ | (0.11 | ) | | $ | (0.24 | ) | | $ | (0.33 | ) |

Weighted-average common shares outstanding: basic and diluted | 119,038,656 |

| | 87,319,450 |

| | 117,767,791 |

| | 84,678,612 |

|

| | | | | | | |

GALENA BIOPHARMA, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands)

|

| | | | | | | |

| September 30, 2014 | | |

| (Unaudited) | | December 31, 2013 |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 24,647 |

| | $ | 47,787 |

|

Restricted cash | 200 |

| | 200 |

|

Accounts receivable | 1,435 |

| | 3,683 |

|

Inventories | 450 |

| | 386 |

|

Prepaid expenses | 1,789 |

| | 1,399 |

|

Total current assets | 28,521 |

| | 53,455 |

|

Equipment and furnishings, net | 589 |

| | 665 |

|

In-process research and development | 12,864 |

| | 12,864 |

|

Abstral rights, net | 14,714 |

| | 14,979 |

|

Zuplenz rights | 7,663 |

| | — |

|

GALE-401 rights | 9,155 |

| | — |

|

Goodwill | 5,898 |

| | 5,898 |

|

Deposits and other assets | 88 |

| | 115 |

|

Total assets | $ | 79,492 |

| | $ | 87,976 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

Current liabilities: | | | |

Accounts payable | $ | 3,360 |

| | $ | 2,660 |

|

Accrued expenses and other current liabilities | 15,292 |

| | 8,667 |

|

Current maturities of capital lease obligations | 6 |

| | 6 |

|

Fair value of warrants potentially settleable in cash | 8,765 |

| | 48,965 |

|

Current portion of long-term debt | 4,163 |

| | 2,149 |

|

Total current liabilities | 31,586 |

| | 62,447 |

|

Capital lease obligations, net of current maturities | 17 |

| | 26 |

|

Deferred tax liability | 5,053 |

| | 5,053 |

|

Contingent purchase price consideration, net of current portion | 6,880 |

| | 6,821 |

|

Long-term debt, net of current portion | 5,097 |

| | 7,743 |

|

Total liabilities | 48,633 |

| | 82,090 |

|

Total stockholders’ equity | 30,859 |

| | 5,886 |

|

Total liabilities and stockholders’ equity | $ | 79,492 |

| | $ | 87,976 |

|

About Galena Biopharma

Galena Biopharma, Inc. (NASDAQ: GALE) is a biopharmaceutical company developing and commercializing innovative, targeted oncology therapeutics that address major medical needs across the full spectrum of cancer care. Galena’s development portfolio ranges from mid- to late-stage clinical assets, including a robust immunotherapy program led by NeuVax™ (nelipepimut-S) currently in an international, Phase 3 clinical trial. The Company’s commercial drugs include Abstral® (fentanyl) Sublingual Tablets and Zuplenz® (ondansetron) Oral Soluble Film. Collectively, Galena’s clinical and commercial strategy focuses on identifying and advancing therapeutic opportunities to improve cancer care, from direct treatment of the disease to the reduction of its debilitating side-effects. For more information visit www.galenabiopharma.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about our 2014 revenue from the sale of Abstral®, our planned launch of Zuplenz®, the issuance of patents, and the progress of development of Galena’s product candidates, including patient enrollment in our clinical trials. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those identified under “Risk Factors” in Galena’s Annual Report on Form 10-K for the year ended December 31, 2013 and most recent Quarterly Reports on Form 10-Q filed with the SEC. Actual results may differ materially from those contemplated by these forward-looking statements. Galena does not undertake to update any of these forward-looking statements to reflect a change in its views or events or circumstances that occur after the date of this press release.

NeuVax™ is a trademark of Galena Biopharma, Inc. All other trademarks are the property of their respective owners.

Contact:

Remy Bernarda

VP, Marketing & Communications

(503) 405-8258

rbernarda@galenabiopharma.com

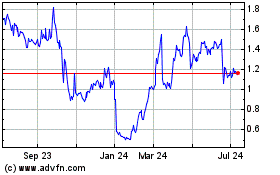

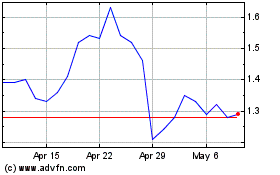

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Mar 2024 to Apr 2024

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Apr 2023 to Apr 2024