Current Report Filing (8-k)

October 31 2014 - 11:29AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of report (Date of

earliest event reported): October 31, 2014

WEIS MARKETS,

INC.

(Exact Name of Registrant as Specified in

Charter)

Pennsylvania

(State or Other Jurisdiction

of Incorporation)

1-5039

(Commission File Number) |

|

24-0755415

(IRS Employer Identification

No.) |

1000 South Second Street

Sunbury, PA

(Address of Principal

Executive Offices) |

|

17801

(Zip Code) |

Registrant's telephone number,

including area code: (570) 286-4571

N/A

(Former Name or Former Address, if Changed Since Last

Report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing

obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

[ ] Written communications

pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

[ ] Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule

14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule

13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Item 2.02 Results of Operations and

Financial Condition.

On

October 31, 2014, the Company released its earnings for

the third quarter ended September 27, 2014. A copy of the

news release is attached hereto as Exhibit 99.1 and is

incorporated herein by this reference.

Item 9.01 Financial Statements and

Exhibits.

(c)

Exhibit.

99.1

Weis Markets, Inc. October 31, 2014

news release announcing the

third quarter 2014 earnings.

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused

this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

|

WEIS MARKETS,

INC. |

|

| |

|

|

|

| |

|

|

|

| |

|

By: /s/Scott F.

Frost |

|

| |

|

Name: Scott F.

Frost |

|

| |

|

Title: Senior Vice

President, Chief Financial Officer |

|

| |

|

and

Treasurer |

|

| |

|

(Principal

Financial Officer) |

|

| |

|

|

|

| Dated: October 31,

2014 |

|

|

|

EXHIBIT

INDEX

| |

|

| Exhibit

No. |

Description |

| 99.1 |

Weis Markets,

Inc. October 31, 2014

news release announcing the

third quarter 2014 earnings. |

| |

|

Exhibit 99.1

News Release

| Contact: |

FOR IMMEDIATE

RELEASE |

| Dennis

Curtin |

|

| Weis Markets,

Inc. |

|

| 570-847-3636 |

|

| dcurtin@weismarkets.com |

|

| Twitter:

@WMKSpokesman |

|

WEIS MARKETS ISSUES THIRD QUARTER

RESULTS

Sales and Comp Store Sales

continue to increase

Sunbury, PA (October 31, 2014) - Weis

Markets, Inc. (NYSE:WMK) today announced its third quarter

sales increased 3.4% to $683.9 million while its

comparable store sales increased 2.6% compared to the

same period in 2013.

The Company's third quarter net

income increased 17.2% to $13.7 million compared to $11.7

million for the same period in 2013. During the same

period, its earnings per share increased to $0.51

compared to $0.43 in 2013.

"Our company continues to make

progress in a market impacted by a stagnant economy. We

attribute our increased sales to our continued

investments in lower pricing and disciplined sales

building programs. Our results also benefited from

increased operational efficiencies and improved in-stock

conditions at store level," said Jonathan Weis, Weis

Markets' President and CEO. "As a result, we are

generating an increased customer count and higher sales

per customer. It is also important to note that we

continue to achieve these sales increases despite a

significant amount of self-imposed grocery deflation. We

hope to build on our sales momentum in the fourth

quarter, particularly during the key holiday sales

period."

The Company's third quarter net

income benefited from a favorable comparison to the same

period in 2013 when its net income was impacted by $8.2

million in one-time charges related to an executive

severance agreement and the impairment loss for four

properties.

Year-to-Date

The Company's year-to-date sales

increased 2.8% to $2.1 billion while comparable store

sales are up 1.4% for the year compared to the same

period in 2013. The Company's year-to-date net income

totaled $41.3 million, down 26.3%. During the same

period, the Company's earnings per share totaled $1.53,

compared to $2.08 per share in 2013.

# # #

About Weis Markets

Founded in 1912, Weis Markets,

Inc. is a Mid Atlantic food retailer operating 163 stores

in Pennsylvania, Maryland, New Jersey, New York and West

Virginia. For more information, please visit:

WeisMarkets.com or

Facebook.com/WeisMarkets.

In addition to historical

information, this news release may contain

forward-looking statements, which are included pursuant

to the "safe harbor" provisions of the Private Securities

Litigation Reform Act of 1995. Any forward-looking

statements contained herein are subject to certain risks

and uncertainties that could cause actual results to

differ materially from those projected. For example,

risks and uncertainties can arise with changes in:

general economic conditions, including their impact on

capital expenditures; business conditions in the retail

industry; the regulatory environment; rapidly changing

technology and competitive factors, including increased

competition with regional and national retailers; and

price pressures. Readers are cautioned not to place undue

reliance on forward-looking statements, which reflect

management's analysis only as of the date hereof. The

Company undertakes no obligation to publicly revise or

update these forward-looking statements to reflect events

or circumstances that arise after the date hereof.

Readers should carefully review the risk factors

described in other documents the Company files

periodically with the Securities and Exchange

Commission.

WEIS MARKETS,

INC.

COMPARATIVE SUMMARY OF

SALES & EARNINGS

Third Quarter -

2014

(Unaudited)

| |

|

13

Week |

|

13

Week |

|

|

|

| |

|

Period

Ended |

|

Period

Ended |

|

Increase |

|

| |

|

September 27,

2014 |

|

September 28,

2013 |

|

(Decrease) |

|

| Net

Sales |

$ |

683,893,000 |

$ |

661,412,000 |

|

3.4 |

% |

| Income Before

Income Taxes |

|

20,301,000 |

|

18,973,000 |

|

7.0 |

% |

| Provision for

Income Taxes |

|

6,594,000 |

|

7,281,000 |

|

(9.4) |

% |

| Net

Income |

$ |

13,707,000 |

$ |

11,692,000 |

|

17.2 |

% |

| Weighted-Average |

|

|

|

|

|

|

|

| Shares

Outstanding |

|

26,898,000 |

|

26,898,000 |

|

--- |

|

| Basic and

Diluted |

|

|

|

|

|

|

|

| Earnings Per

Share |

$ |

0.51 |

$ |

0.43 |

$ |

0.08 |

|

| |

|

|

|

|

|

|

|

| |

|

39

Week |

|

39

Week |

|

|

|

| |

|

Period

Ended |

|

Period

Ended |

|

Increase |

|

| |

|

September 27,

2014 |

|

September 28,

2013 |

|

(Decrease) |

|

| Net

Sales |

$ |

2,062,894,000 |

$ |

2,006,196,000 |

|

2.8 |

% |

| Income Before

Income Taxes |

|

63,451,000 |

|

90,308,000 |

|

(29.7) |

% |

| Provision for

Income Taxes |

|

22,180,000 |

|

34,308,000 |

|

(35.4) |

% |

| Net

Income |

$ |

41,271,000 |

$ |

56,000,000 |

|

(26.3) |

% |

| Weighted-Average |

|

|

|

|

|

|

|

| Shares

Outstanding |

|

26,898,000 |

|

26,898,000 |

|

--- |

|

| Basic and

Diluted |

|

|

|

|

|

|

|

| Earnings Per

Share |

$ |

1.53 |

$ |

2.08 |

$ |

(0.55) |

|

| |

|

|

|

|

|

|

|

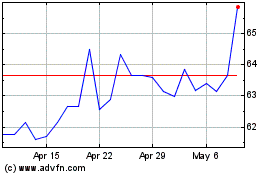

Weis Markets (NYSE:WMK)

Historical Stock Chart

From Mar 2024 to Apr 2024

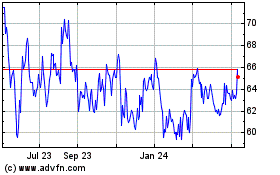

Weis Markets (NYSE:WMK)

Historical Stock Chart

From Apr 2023 to Apr 2024