UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 31, 2014

NuStar Energy L.P.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | 001-16417 | 74-2956831 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

| 19003 IH-10 West San Antonio, Texas 78257 | |

| (Address of principal executive offices) | |

| | |

| (210) 918-2000 | |

| (Registrant’s telephone number, including area code) | |

| | |

| Not applicable | |

| (Former name or former address, if changed since last report.) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results Of Operations And Financial Condition.

On October 31, 2014, NuStar Energy L.P., a Delaware limited partnership, issued a press release announcing financial results for the quarter ended September 30, 2014. A copy of the press release announcing the financial results is furnished with this report as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

| | |

Exhibit Number | | EXHIBIT |

| | |

Exhibit 99.1 | | Press Release dated October 31, 2014. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| NUSTAR ENERGY L.P. | |

| | | | |

| By: | Riverwalk Logistics, L.P. |

| | its general partner |

| | | | |

| | By: | NuStar GP, LLC |

| | | its general partner |

| | | | |

Date: October 31, 2014 | | | By: | /s/ Amy L. Perry |

| | | Name: | Amy L. Perry |

| | | Title: | Senior Vice President, General Counsel-Corporate & Commercial Law and Corporate Secretary |

EXHIBIT INDEX

|

| | |

Exhibit Number | | EXHIBIT |

| | |

Exhibit 99.1 | | Press Release dated October 31, 2014. |

Exhibit 99.1

NuStar Energy Reports Higher EPU, EBITDA and DCF Results in the Third Quarter of 2014

Covers Third Quarter Distribution and Remains On Track to Cover Distribution for the Full-Year 2014

Quarterly Results Improved in all Three Operating Segments

Pipeline Throughput Volumes Continue to Increase

Company Plans to Finalize Joint Venture Agreements with PMI in Early 2015

SAN ANTONIO, October 31, 2014 - NuStar Energy L.P. (NYSE: NS) today announced third quarter 2014 distributable cash flow from continuing operations available to limited partners of $87.9 million, or $1.13 per unit, which is higher than the 2013 third quarter distributable cash flow from continuing operations available to limited partners of $68.5 million, or $0.88 per unit. For the nine months ended September 30, 2014, distributable cash flow from continuing operations available to limited partners was $259.4 million, or $3.33 per unit, compared to $182.5 million, or $2.34 per unit for the nine months ended September 30, 2013.

Third quarter earnings before interest, taxes, depreciation and amortization (EBITDA) from continuing operations were $145.1 million, compared to third quarter 2013 EBITDA from continuing operations of $111.0 million. For the nine months ended September 30, 2014, the partnership reported $411.9 million of EBITDA from continuing operations, compared to $319.5 million for the nine months ended September 30, 2013.

The partnership reported third quarter net income applicable to limited partners of $50.1 million, or $0.64 per unit, compared to $21.9 million, or $0.28 per unit, earned in the third quarter of 2013. For the nine months ended September 30, 2014, net income applicable to limited partners was $121.8 million, or $1.56 per unit, compared to net income applicable to limited partners of $56.8 million, or $0.73 per unit, for the nine months ended September 30, 2013.

The partnership also announced that its board of directors has declared a third quarter 2014 distribution of $1.095 per unit. The third quarter 2014 distribution will be paid on November 14, 2014, to holders of record as of November 10, 2014. Distributable cash flow from continuing operations available to limited partners covers the distribution to the limited partners by 1.03 times for the third quarter of 2014 and by 1.01 times for the nine months ended September 30, 2014.

“Strong performance in all three of our operating segments led to our solid third quarter earnings and distribution coverage of 1.03 times,” said Brad Barron, President and Chief Executive Officer of NuStar Energy L.P. and NuStar GP Holdings, LLC. “During the third quarter, we moved approximately 255,000 barrels per day of crude oil through our South Texas Crude Oil Pipeline System, which contributed to an overall 23% increase in quarterly crude oil pipeline throughput volumes compared to the third quarter of 2013. The storage segment continued to benefit from the increased Eagle Ford throughput volumes through our dock at the Corpus Christi North Beach Terminal.”

Barron went on to say, “As a result of these strong third quarter results, we were able to cover our quarterly distribution, for a second consecutive quarter, and we remain on track to cover our distribution for the full-year.”

Joint Venture with PMI

NuStar and PMI, an affiliate of Pemex, continue to work toward finalizing agreements for a proposed joint venture in which the two companies will develop new pipeline infrastructure to transport liquefied petroleum gases (LPGs) and refined products from the U.S. into northern Mexico to meet the region’s growing demand for these products. We expect to finalize these agreements in early 2015 and expect the assets in the joint venture to be completed and placed into service in the second half of 2016.

Internal Growth Project Update

Phase 2 of the South Texas Crude Oil Pipeline expansion remains on schedule to come online during the first quarter of 2015 and will allow for increased throughputs of up to 65,000 barrels per day.

NuStar’s 12-inch pipeline between Mont Belvieu and Corpus Christi, Texas is expected to be in full NGL service early in the third quarter of 2015, at which time it is expected to generate an incremental $23 million in annual EBITDA, based on committed volumes.

Earnings Guidance

“Fourth quarter EBITDA results in our pipeline segment are expected to be higher than last year’s fourth quarter, while fourth quarter EBITDA results in our storage segment should be comparable to last year’s fourth quarter adjusted EBITDA results. EBITDA results in our fuels marketing segment should be comparable to the fourth quarter of 2013,” said Barron.

“For the full-year 2014, we still expect our pipeline segment EBITDA to be $40 to $60 million higher than 2013 and our storage segment adjusted EBITDA to be comparable to 2013. We continue to expect our fuels marketing segment to generate EBITDA in the range of $20 to $30 million.

“We still expect to spend $330 to $350 million on internal growth projects during 2014, the majority of which will be spent on projects in our pipeline segment. Our 2014 reliability capital spending has been reduced slightly to reflect the delay of some maintenance spending into 2015, and is now expected to be about $30 million. Based on these projections, we expect to cover our distributions for the full-year 2014.”

Looking ahead to 2015, Barron commented, “Our pipeline segment’s EBITDA should increase by an additional $25 to $45 million next year, mainly due to the increased throughputs associated with the expected completion of Phase 2 of the South Texas Crude Oil Pipeline expansion and the NuStar 12-inch pipeline between Mont Belvieu and Corpus Christi. We expect our storage segment and fuels marketing segment results to be comparable to 2014.

“With regard to capital spending projections for 2015, we plan to spend $400 to $420 million on strategic capital spending and $35 to $45 million on reliability capital spending.”

Barron concluded by saying, “Based on our projections, we again expect to cover our distribution for the full-year 2015.”

Third Quarter 2014 Earnings Conference Call Details

A conference call with management is scheduled for 10:00 a.m. ET (9:00 a.m. CT) today, October 31, 2014, to discuss the financial and operational results for the third quarter of 2014. Investors interested in listening to the presentation may call 800/622-7620, passcode 14492802. International callers may access the presentation by dialing 706/645-0327, passcode 14492802. The partnership intends to have a playback available following the presentation, which may be accessed by calling 800/585-8367, passcode 14492802. International callers may access the playback by calling 404/537-3406, passcode 14492802. The playback will be available until 11:59 p.m. ET on November 30, 2014.

Investors interested in listening to the live presentation or a replay via the internet may access the presentation directly by clicking here or by logging on to NuStar Energy L.P.’s Web site at www.nustarenergy.com.

The presentation will disclose certain non-GAAP financial measures. Reconciliations of certain of these non-GAAP financial measures to U.S. GAAP may be found in this press release, with additional reconciliations located on the Financials page of the Investors section of NuStar Energy L.P.’s Web site at www.nustarenergy.com.

NuStar Energy L.P., a publicly traded master limited partnership based in San Antonio, is one of the largest independent liquids terminal and pipeline operators in the nation. NuStar currently has 8,643 miles of pipeline and 82 terminal and storage facilities that store and distribute crude oil, refined products and specialty liquids. The partnership’s combined system has approximately 91 million barrels of storage capacity, and NuStar has operations in the United States, Canada, Mexico, the Netherlands, including St. Eustatius in the Caribbean, and the United Kingdom. For more information, visit NuStar Energy L.P.’s Web site at www.nustarenergy.com.

This release serves as qualified notice to nominees under Treasury Regulation Sections 1.1446-4(b)(4) and (d). Please note that 100% of NuStar Energy L.P.’s distributions to foreign investors are attributable to income that is effectively connected with a United States trade or business. Accordingly, all of NuStar Energy L.P.’s distributions to foreign investors are subject to federal income tax withholding at the highest effective tax rate for individuals and corporations, as applicable. Nominees, and not NuStar Energy L.P., are treated as the withholding agents responsible for withholding on the distributions received by them on behalf of foreign investors.

Cautionary Statement Regarding Forward-Looking Statements

This press release includes forward-looking statements regarding future events, such as the partnership’s future performance. All forward-looking statements are based on the partnership’s beliefs as well as assumptions made by and information currently available to the partnership. These statements reflect the partnership’s current views with respect to future events and are subject to various risks, uncertainties and assumptions. These risks, uncertainties and assumptions are discussed in NuStar Energy L.P.’s and NuStar GP Holdings, LLC’s 2013 annual reports on Form 10-K and subsequent filings with the Securities and Exchange Commission. Actual results may differ materially from those described in the forward-looking statements.

-30-

NuStar Energy L.P. and Subsidiaries

Consolidated Financial Information

(Unaudited, Thousands of Dollars, Except Unit and Per Unit Data)

|

| | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2014 | | 2013 | | 2014 | | 2013 |

Statement of Income Data: | | | | | | | |

Revenues: | | | | | | | |

Service revenues | $ | 266,651 |

| | $ | 243,712 |

| | $ | 755,551 |

| | $ | 700,922 |

|

Product sales | 527,771 |

| | 534,433 |

| | 1,637,829 |

| | 1,977,423 |

|

Total revenues | 794,422 |

| | 778,145 |

| | 2,393,380 |

| | 2,678,345 |

|

Costs and expenses: | | | | | | | |

Cost of product sales | 509,794 |

| | 527,217 |

| | 1,578,508 |

| | 1,928,237 |

|

Operating expenses | 115,964 |

| | 117,101 |

| | 337,566 |

| | 341,933 |

|

General and administrative expenses | 24,967 |

| | 18,831 |

| | 68,986 |

| | 65,978 |

|

Depreciation and amortization expense | 48,599 |

| | 46,245 |

| | 142,765 |

| | 133,116 |

|

Total costs and expenses | 699,324 |

| | 709,394 |

| | 2,127,825 |

| | 2,469,264 |

|

Operating income | 95,098 |

| | 68,751 |

| | 265,555 |

| | 209,081 |

|

Equity in earnings (loss) of joint ventures | 2,749 |

| | (5,358 | ) | | 1,737 |

| | (26,629 | ) |

Interest expense, net | (33,007 | ) | | (30,823 | ) | | (100,546 | ) | | (92,849 | ) |

Interest income from related party | — |

| | 1,828 |

| | 1,055 |

| | 4,560 |

|

Other (expense) income, net | (1,388 | ) | | 1,389 |

| | 1,816 |

| | 3,917 |

|

Income from continuing operations before income tax expense | 63,452 |

| | 35,787 |

| | 169,617 |

| | 98,080 |

|

Income tax expense | 4,335 |

| | 105 |

| | 10,317 |

| | 8,087 |

|

Income from continuing operations | 59,117 |

| | 35,682 |

| | 159,300 |

| | 89,993 |

|

Income (loss) from discontinued operations, net of tax (Note 1) | 2,831 |

| | (2,446 | ) | | (2,316 | ) | | 616 |

|

Net income | $ | 61,948 |

| | $ | 33,236 |

| | $ | 156,984 |

| | $ | 90,609 |

|

Net income applicable to limited partners | $ | 50,074 |

| | $ | 21,924 |

| | $ | 121,817 |

| | $ | 56,811 |

|

Net income (loss) per unit applicable to limited partners: | | | | | | | |

Continuing operations | $ | 0.61 |

| | $ | 0.31 |

| | $ | 1.59 |

| | $ | 0.71 |

|

Discontinued operations (Note 1) | 0.03 |

| | (0.03 | ) | | (0.03 | ) | | 0.02 |

|

Total | $ | 0.64 |

| | $ | 0.28 |

| | $ | 1.56 |

| | $ | 0.73 |

|

Weighted-average limited partner units outstanding | 77,886,078 |

| | 77,886,078 |

| | 77,886,078 |

| | 77,886,078 |

|

| | | | | | | |

EBITDA from continuing operations (Note 2) | $ | 145,058 |

| | $ | 111,027 |

| | $ | 411,873 |

| | $ | 319,485 |

|

DCF from continuing operations (Note 2) | $ | 100,684 |

| | $ | 81,311 |

| | $ | 297,717 |

| | $ | 220,762 |

|

| | | | | | | |

| September 30, 2014 | | | | December 31, |

| 2014 | | 2013 | | | | 2013 |

Balance Sheet Data: | | | | | | | |

Total debt | $ | 2,752,951 |

| | $ | 2,473,678 |

| | | | $ | 2,655,553 |

|

Partners’ equity | $ | 1,768,645 |

| | $ | 2,380,979 |

| | | | $ | 1,903,794 |

|

Consolidated debt coverage ratio (Note 3) | 4.0x |

| | 4.3x |

| | | | 4.4x |

|

NuStar Energy L.P. and Subsidiaries

Consolidated Financial Information - Continued

(Unaudited, Thousands of Dollars, Except Barrel Data)

|

| | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2014 |

| 2013 | | 2014 | | 2013 |

Pipeline: | | | | | | | |

Refined products pipelines throughput (barrels/day) | 514,361 |

| | 501,511 |

| | 503,059 |

| | 477,601 |

|

Crude oil pipelines throughput (barrels/day) | 471,698 |

| | 382,539 |

| | 419,824 |

| | 361,642 |

|

Total throughput (barrels/day) | 986,059 |

| | 884,050 |

| | 922,883 |

| | 839,243 |

|

Throughput revenues | $ | 125,461 |

| | $ | 111,508 |

| | $ | 346,218 |

| | $ | 301,761 |

|

Operating expenses | 39,996 |

| | 36,089 |

| | 109,685 |

| | 102,596 |

|

Depreciation and amortization expense | 19,813 |

| | 17,401 |

| | 57,655 |

| | 50,039 |

|

Segment operating income | $ | 65,652 |

| | $ | 58,018 |

| | $ | 178,878 |

| | $ | 149,126 |

|

Storage: | | | | | | | |

Throughput (barrels/day) | 914,599 |

| | 832,412 |

| | 877,052 |

| | 772,383 |

|

Throughput revenues | $ | 32,498 |

| | $ | 27,937 |

| | $ | 91,184 |

| | $ | 76,924 |

|

Storage lease revenues | 111,447 |

| | 110,671 |

| | 330,313 |

| | 346,040 |

|

Total revenues | 143,945 |

| | 138,608 |

| | 421,497 |

| | 422,964 |

|

Operating expenses | 68,244 |

| | 71,251 |

| | 202,602 |

| | 208,116 |

|

Depreciation and amortization expense | 26,300 |

| | 26,306 |

| | 77,480 |

| | 75,429 |

|

Segment operating income | $ | 49,401 |

| | $ | 41,051 |

| | $ | 141,415 |

| | $ | 139,419 |

|

Fuels Marketing: | | | | | | | |

Product sales and other revenue | $ | 531,190 |

| | $ | 534,919 |

| | $ | 1,645,812 |

| | $ | 1,978,531 |

|

Cost of product sales | 513,300 |

| | 531,481 |

| | 1,590,605 |

| | 1,944,415 |

|

Gross margin | 17,890 |

| | 3,438 |

| | 55,207 |

| | 34,116 |

|

Operating expenses | 10,367 |

| | 12,510 |

| | 33,294 |

| | 41,336 |

|

Depreciation and amortization expense | 5 |

| | 7 |

| | 16 |

| | 20 |

|

Segment operating income (loss) | $ | 7,518 |

| | $ | (9,079 | ) | | $ | 21,897 |

| | $ | (7,240 | ) |

Consolidation and Intersegment Eliminations: | | | | | | | |

Revenues | $ | (6,174 | ) | | $ | (6,890 | ) | | $ | (20,147 | ) | | $ | (24,911 | ) |

Cost of product sales | (3,506 | ) | | (4,264 | ) | | (12,097 | ) | | (16,178 | ) |

Operating expenses | (2,643 | ) | | (2,749 | ) | | (8,015 | ) | | (10,115 | ) |

Total | $ | (25 | ) | | $ | 123 |

| | $ | (35 | ) | | $ | 1,382 |

|

Consolidated Information: | | | | | | | |

Revenues | $ | 794,422 |

| | $ | 778,145 |

| | $ | 2,393,380 |

| | $ | 2,678,345 |

|

Cost of product sales | 509,794 |

| | 527,217 |

| | 1,578,508 |

| | 1,928,237 |

|

Operating expenses | 115,964 |

| | 117,101 |

| | 337,566 |

| | 341,933 |

|

Depreciation and amortization expense | 46,118 |

| | 43,714 |

| | 135,151 |

| | 125,488 |

|

Segment operating income | 122,546 |

| | 90,113 |

| | 342,155 |

| | 282,687 |

|

General and administrative expenses | 24,967 |

| | 18,831 |

| | 68,986 |

| | 65,978 |

|

Other depreciation and amortization expense | 2,481 |

| | 2,531 |

| | 7,614 |

| | 7,628 |

|

Consolidated operating income | $ | 95,098 |

| | $ | 68,751 |

| | $ | 265,555 |

| | $ | 209,081 |

|

NuStar Energy L.P. and Subsidiaries

Consolidated Financial Information - Continued

(Unaudited, Thousands of Dollars, Except Per Unit Data)

Notes:

| |

(1) | The results of operations for the following have been reported as discontinued operations for all periods presented: (i) the San Antonio Refinery and related assets, which we sold on January 1, 2013, and (ii) certain storage assets that were classified as “Assets held for sale” on the consolidated balance sheet as of December 31, 2013. |

| |

(2) | NuStar Energy L.P. utilizes financial measures, earnings before interest, taxes, depreciation and amortization (EBITDA) from continuing operations, distributable cash flow (DCF) from continuing operations and DCF from continuing operations per unit, which are not defined in U.S. generally accepted accounting principles (GAAP). Management uses these financial measures because they are widely accepted financial indicators used by investors to compare partnership performance. In addition, management believes that these measures provide investors an enhanced perspective of the operating performance of the partnership’s assets and the cash that the business is generating. None of EBITDA from continuing operations, DCF from continuing operations or DCF from continuing operations per unit are intended to represent cash flows from operations for the period, nor are they presented as an alternative to net income or income from continuing operations. They should not be considered in isolation or as substitutes for a measure of performance prepared in accordance with GAAP. For purposes of segment reporting, we do not allocate general and administrative expenses to our reported operating segments because those expenses relate primarily to the overall management at the entity level. Therefore, EBITDA reflected in the segment reconciliations exclude any allocation of general and administrative expenses consistent with our policy for determining segmental operating income, the most directly comparable GAAP measure. |

The following is a reconciliation of income from continuing operations to EBITDA from continuing operations and DCF from continuing operations:

|

| | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2014 | | 2013 | | 2014 | | 2013 |

Income from continuing operations | $ | 59,117 |

| | $ | 35,682 |

| | $ | 159,300 |

| | $ | 89,993 |

|

Plus interest expense, net and interest income from related party | 33,007 |

| | 28,995 |

| | 99,491 |

| | 88,289 |

|

Plus income tax expense | 4,335 |

| | 105 |

| | 10,317 |

| | 8,087 |

|

Plus depreciation and amortization expense | 48,599 |

| | 46,245 |

| | 142,765 |

| | 133,116 |

|

EBITDA from continuing operations | 145,058 |

| | 111,027 |

| | 411,873 |

| | 319,485 |

|

Equity in (earnings) loss of joint ventures | (2,749 | ) | | 5,358 |

| | (1,737 | ) | | 26,629 |

|

Interest expense, net and interest income from related party | (33,007 | ) | | (28,995 | ) | | (99,491 | ) | | (88,289 | ) |

Reliability capital expenditures | (6,264 | ) | | (11,875 | ) | | (18,262 | ) | | (28,339 | ) |

Income tax expense | (4,335 | ) | | (105 | ) | | (10,317 | ) | | (8,087 | ) |

Distributions from joint ventures | 2,785 |

| | 1,135 |

| | 5,879 |

| | 5,787 |

|

Other items (a) | 4,177 |

| | 2,457 |

| | 8,046 |

| | (4,043 | ) |

Mark-to-market impact of hedge transactions (b) | (4,981 | ) | | 2,309 |

| | 1,726 |

| | (2,381 | ) |

DCF from continuing operations | $ | 100,684 |

| | $ | 81,311 |

| | $ | 297,717 |

| | $ | 220,762 |

|

| | | | | | | |

Less DCF from continuing operations available to general partner | 12,766 |

| | 12,766 |

| | 38,298 |

| | 38,298 |

|

DCF from continuing operations available to limited partners | $ | 87,918 |

| | $ | 68,545 |

| | $ | 259,419 |

| | $ | 182,464 |

|

| | | | | | | |

DCF from continuing operations per limited partner unit | $ | 1.13 |

| | $ | 0.88 |

| | $ | 3.33 |

| | $ | 2.34 |

|

| |

(a) | Other items consist of a net increase in deferred revenue associated with throughput deficiency payments and construction reimbursements. For the nine months ended September 30, 2013, other items also include a $6.5 million reduction of the contingent consideration recorded in association with an acquisition. |

| |

(b) | DCF from continuing operations excludes the impact of unrealized mark-to-market gains and losses that arise from valuing certain derivative contracts, as well as the associated hedged inventory. The gain or loss associated with these contracts is realized in DCF from continuing operations when the contracts are settled. |

NuStar Energy L.P. and Subsidiaries

Consolidated Financial Information - Continued

(Unaudited, Thousands of Dollars, Except Per Unit Data)

Notes (continued):

The following is a reconciliation of projected annual operating income to projected annual EBITDA for a certain project in the pipeline segment:

|

| | | |

| Houston Pipeline NGL Project |

Projected operating income | $ | 15,000 |

|

Plus projected depreciation and amortization expense | 8,000 |

|

Projected EBITDA | $ | 23,000 |

|

The following is a reconciliation of projected incremental operating income to projected incremental EBITDA for the pipeline segment:

|

| | | |

| Year Ended

December 31, 2015 | | Year Ended

December 31, 2014 |

Projected incremental operating income | $ 15,000 - 30,000 | | $ 35,000 - 50,000 |

Plus projected incremental depreciation and amortization expense | 10,000 - 15,000 | | 5,000 - 10,000 |

Projected incremental EBITDA | $ 25,000 - 45,000 | | $ 40,000 - 60,000 |

The reconciliation below shows projected operating income to projected EBITDA for the fuels marketing segment:

|

| | |

| Year Ended

December 31, 2014 |

Projected operating income | $ 20,000 - 30,000 |

|

Plus projected depreciation and amortization expense | — |

|

Projected EBITDA | $ 20,000 - 30,000 |

|

| |

(3) | The consolidated debt coverage ratio is calculated as consolidated indebtedness to consolidated EBITDA, as defined in our $1.5 billion five-year revolving credit agreement. |

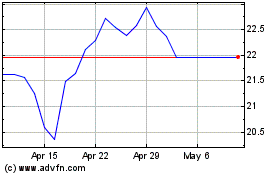

NuStar Energy (NYSE:NS)

Historical Stock Chart

From Mar 2024 to Apr 2024

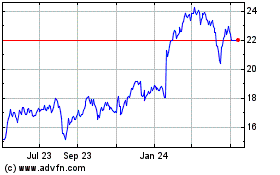

NuStar Energy (NYSE:NS)

Historical Stock Chart

From Apr 2023 to Apr 2024