UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 31, 2014

Move, Inc.

(Exact name

of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

000-26659 |

|

95-4438337 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

10 Almaden Boulevard, Suite 800

San Jose, California 95113

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number, including area code: (408) 558-7100

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 8.01. Other Events.

On October 31, 2014, Move, Inc. (“Move”) issued a joint press release with News Corporation (“Parent”) announcing the

expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, in connection with the previously announced merger agreement between Move, Parent and Magpie Merger Sub, Inc. (“Merger Sub”). A

copy of the joint press release announcing the expiration of the waiting period is attached hereto as Exhibit 99.1 and is incorporated herein by reference herein.

Item 9.01. Financial Statements and Exhibits.

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press Release, issued by Move, Inc. and News Corporation, dated October 31, 2014. |

Notice to Investors

This announcement is neither an offer to purchase nor a solicitation of an offer to sell securities. On October 15, 2014, Parent and

Merger Sub, a wholly owned subsidiary of Parent, filed a Tender Offer Statement on Schedule TO with the Securities and Exchange Commission (the “SEC”) (including all amendments, collectively, “Schedule TO”), and Move filed a

Solicitation/Recommendation Statement on Schedule 14D-9 (including all amendments, collectively, “Schedule 14D-9”), with respect to the tender offer. Schedule TO and Schedule 14D-9 contain important information that should be read

carefully before any decision is made with respect to the tender offer. Those materials were made available to Move’s stockholders at no expense to them by the information agent for the tender offer. In addition, all of those materials (and all

other offer documents filed with the SEC) are available at no charge on the SEC’s website at www.sec.gov.

Forward-Looking Statements

Statements included in this report that are not a description of historical facts are forward-looking statements. Words or phrases such as

“believe,” “may,” “could,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “seek,” “plan,” “expect,” “should,”

“would” or similar expressions are intended to identify forward-looking statements, and are based on Move’s current beliefs and expectations. These forward-looking statements include without limitation statements regarding the planned

completion of the offer and the merger. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Move’s actual future results may differ materially from Move’s current

expectations due to the risks and uncertainties inherent in its business. These risks include, but are not limited to: uncertainties as to the timing of the offer and the merger; uncertainties as to the percentage of Move’s stockholders

tendering their shares in the offer; the possibility that competing offers will be made; the possibility that various closing conditions for the offer or the merger may not be satisfied or waived, including that a governmental entity may prohibit,

delay or refuse to grant approval for the consummation of the merger; the effects of disruption caused by the transaction making it more difficult to maintain relationships with employees, collaborators, customers, vendors and other business

partners; the risk that stockholder litigation in connection with the offer or the merger may result in significant costs of defense, indemnification and liability; and risks and uncertainties pertaining to the business of Move, including the risks

detailed under “Risk Factors” and elsewhere in Move’s public periodic filings with the SEC, as well as the tender offer materials filed by Parent and Merger Sub and the Schedule 14D-9 filed by Move in connection with the offer. All

forward-looking statements are qualified in their entirety by this cautionary statement and Move undertakes no obligation to revise or update this report to reflect events or circumstances after the date hereof, except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

MOVE, INC. |

|

|

|

|

| Date: October 31, 2014 |

|

|

|

By: |

|

/s/ James S. Caulfield |

|

|

|

|

Name: |

|

James S. Caulfield |

|

|

|

|

Title: |

|

Executive Vice President, General Counsel and Secretary |

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press Release, issued by Move, Inc. and News Corporation, dated October 31, 2014. |

Exhibit 99.1

NEWS CORP AND MOVE ANNOUNCE EXPIRATION OF

HART-SCOTT-RODINO WAITING PERIOD

NEW

YORK (October 31, 2014) – News Corp and Move, Inc. (“Move”) announced today that the required waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), with respect to

News Corp’s previously announced cash tender offer for Move expired at 11:59 p.m., New York City time, on October 30, 2014, without any action having been taken by the United States Federal Trade Commission or the Antitrust Division of the

US Department of Justice.

The expiration satisfies the tender offer condition with respect to the expiration of the applicable waiting period under the

HSR Act. The tender offer continues to be subject to the satisfaction of other customary conditions, including a minimum tender of at least a majority of the outstanding Move shares. As previously announced, unless the tender offer is extended, the

offer and withdrawal rights will expire at the end of the day, 12:00 midnight, New York City time, on November 13, 2014.

Additional Information

Regarding the Proposed Transaction

This communication does not constitute an offer to buy or a solicitation of an offer to sell any securities. Magpie

Merger Sub, Inc. (“Merger Sub”) has filed a Tender Offer Statement on Schedule TO with the U.S. Securities and Exchange Commission (“SEC”) containing an offer to purchase all of the outstanding shares of common stock of Move for

$21.00 per share. The tender offer is being made solely by means of the offer to purchase, and the exhibits filed with respect thereto (including the letter of transmittal), which contain the full terms and conditions of the tender offer.

INVESTORS AND SECURITY HOLDERS OF MOVE ARE URGED TO READ THESE AND OTHER DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR

WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Merger Sub and News Corp

through the SEC website at http://www.sec.gov or through the News Corp website at http://investors.newscorp.com.

Forward-Looking Statements

This document contains forward-looking statements based on current expectations or beliefs, as well as a number of assumptions about future events, and these

statements are subject to factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Forward-looking statements can often be identified by words such as

“anticipates,” “expects,” “intends,” “plans,” “predicts,” “believes,” “seeks,” “estimates,” “may,” “will,” “should,” “would,”

“could,” “potential,” “continue,” “ongoing,” similar expressions, and variations or negatives of these words. The reader is cautioned not to place undue reliance on these forward-looking statements, which are

not a guarantee of future performance and are subject to a number of uncertainties, risks, assumptions and other factors, many of which are outside the control of News Corporation (“News Corp”) and Move. The forward-looking statements in

this document address a variety of subjects including, for example, the expected date of closing of the acquisition and the potential benefits of the proposed acquisition, including integration plans and expected synergies. The following factors,

among others, could cause actual results to differ materially from those described in these forward-looking statements: the risk that Move’s business will not be successfully integrated with News Corp’s business; matters arising in

connection with the parties’ efforts to comply with and satisfy applicable regulatory approvals and closing conditions relating to the transaction; and other events that could adversely impact the completion of the transaction, including

industry or economic conditions outside of our control. In addition, actual results are subject to other risks and uncertainties that relate more broadly to News Corp’s overall business, including those more fully described in News Corp’s

filings with the U.S. Securities and Exchange Commission (“SEC”) including its annual report on Form 10-K for the fiscal year ended June 30, 2014, and its quarterly reports filed on Form 10-Q

for

the current fiscal year, and Move’s overall business and financial condition, including those more fully described in Move’s filings with the SEC including its annual report on Form

10-K for the fiscal year ended December 31, 2013, and its quarterly reports filed on Form 10-Q for the current fiscal year. The forward-looking statements in this document speak only as of this date. We expressly disclaim any current intention

to update or revise any forward-looking statements contained in this document to reflect any change of expectations with regard thereto or to reflect any change in events, conditions, or circumstances on which any such forward-looking statement is

based, in whole or in part.

About News Corp

News

Corp (NASDAQ: NWS, NWSA; ASX: NWS, NWSLV) is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content to consumers throughout the world. The company comprises businesses

across a range of media, including: news and information services, cable network programming in Australia, digital real estate services, book publishing, digital education, and pay-TV distribution in Australia. Headquartered in New York, the

activities of News Corp are conducted primarily in the United States, Australia, and the United Kingdom. More information: www.newscorp.com.

About Move, Inc.

Move, Inc. (NASDAQ: MOVE), a leading

provider of online real estate services, operates realtor.com®, which connects people to the essential, accurate information needed to identify their perfect home and to the REALTORS® whose expertise guides consumers through buying and selling. As the official website for the National Association of REALTORS®,

realtor.com® empowers consumers to make smart home buying, selling and renting decisions by leveraging its direct, real-time connections with more than 800 multiple listing services (MLS)

via all types of computers, tablets and smart telephones. Realtor.com® is where home happens. Move is based in the heart of the Silicon Valley — San Jose, CA. REALTOR® and REALTOR.COM® are trademarks of the National Association of REALTORS® and are

used with its permission.

Contacts:

Jim Kennedy,

Chief Communications Officer, News Corp

jkennedy@newscorp.com

@jimkennedy250

212-416-4064

Mike Florin, SVP, Head of Investor Relations, News Corp

mflorin@newscorp.com

212-416-3363

Christie Farrell, Director of Corporate Communications, Move, Inc.

Christie.farrell@move.com

408-558-7115

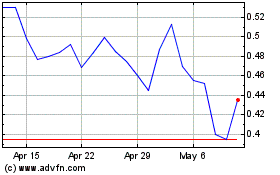

Movano (NASDAQ:MOVE)

Historical Stock Chart

From Mar 2024 to Apr 2024

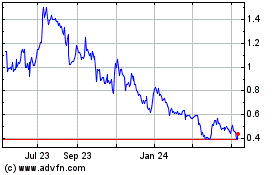

Movano (NASDAQ:MOVE)

Historical Stock Chart

From Apr 2023 to Apr 2024