Additional Proxy Soliciting Materials (definitive) (defa14a)

October 31 2014 - 8:28AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the

Registrant x Filed by

a Party other than the Registrant ¨

Check the appropriate box:

|

|

|

| ¨ |

|

Preliminary Proxy Statement |

|

|

| ¨ |

|

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

| ¨ |

|

Definitive Proxy Statement |

|

|

| ¨ |

|

Definitive Additional Materials |

|

|

| x |

|

Soliciting Material Pursuant to Section 240.14a-12 |

VISTAPRINT

N.V.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

| x |

|

No fee required. |

|

|

| ¨ |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

|

|

1) |

|

Title of each class of securities to which transaction applies:

|

|

|

2) |

|

Aggregate number of securities to which transaction applies:

|

|

|

3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

|

|

|

4) |

|

Proposed maximum aggregate value of transaction:

|

|

|

5) |

|

Total fee paid:

|

|

|

| ¨ |

|

Fee paid previously with preliminary materials: |

|

|

| ¨ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the form or schedule and the date of its filing. |

|

|

|

|

|

1) |

|

Amount previously paid:

|

|

|

2) |

|

Form, Schedule or Registration Statement No.:

|

|

|

3) |

|

Filing Party:

|

|

|

4) |

|

Date Filed:

|

Vistaprint N.V. intends to send the following email message and PowerPoint presentation to some

of its shareholders in connection with discussions it plans to have with shareholders to solicit support for proposals outlined in the definitive proxy statement for Vistaprint’s annual general meeting of shareholders on November 12, 2014,

which was filed with the Securities and Exchange Commission on October 22, 2014.

****

Dear [Shareholder]:

On October 22, 2014, Vistaprint publicly filed with the Securities and Exchange Commission our definitive proxy statement for our upcoming annual general

meeting of shareholders on November 12, 2014. We would like to set up a time to talk with you about some of the proposals included in this year’s proxy statement, specifically those in the attached file, although we are happy to discuss

any of the other proposals as well. Though each proposal is important, and we are seeking your support for them all, we would like to highlight two specific proposals, which are included in the attached discussion outline:

| |

1. |

Authorization to Repurchase Shares (Proposal 7): Shareholder approval of this proposal will give us flexibility to repurchase up to 20% of our outstanding shares at times when we believe it makes sense for

Vistaprint and our shareholders. |

| |

2. |

Name change to Cimpress N.V. (Proposal 8): We have proposed amending our articles of association to change our company name to Cimpress N.V. to distinguish the parent company from the Vistaprint brand and to

reflect and help articulate our strategy and ambition to build the world’s leading mass customization platform that we market via multiple, differentiated brands. |

Please let me know when you are available for a discussion. We value the opportunity to engage with you on these proposals and any other questions you may

have about the upcoming shareholder vote.

Best,

[Vistaprint representative]

|

|

|

Vistaprint N.V. Proxy

Proposal Highlights

Annual General Meeting of

Shareholders on November 12,

2014 |

|

|

|

Vistaprint’s Definitive Proxy Statement filed on

October 22, 2014

This presentation is intended to highlight certain sections of Vistaprint’s

definitive proxy statement that was filed on October 22, 2014. The proxy

statement contains more detailed information about Vistaprint and the

proposals; please refer to the full text of the proxy statement as you

consider your vote.

1 |

|

|

| Proposal

7: Authorization to Repurchase Shares

•

Authorize us to repurchase up to 6.4M shares until May 12, 2016 (18

months)

–

We believe that share repurchases can be an attractive investment for Vistaprint

and our shareholders

–

Because as a Dutch company we must obtain shareholder approval to repurchase

shares (unlike a U.S. based company), this authorization would provide us

with flexibility to decide to purchase shares over the 18 month

period •

The 6.4M shares represent approximately 20% of outstanding shares

–

Although some proxy advisory firms recommend against repurchases

over 10% of

outstanding shares, we believe the ability to repurchase up to 20% gives us more

flexibility to make additional repurchases, should we decide that such an

allocation of our capital would be beneficial to the company

–

If our shareholders do not approve this proposal, we will rely on the previous

share repurchase authorization that our shareholders approved in

2013, which expires in

May 2015

2 |

|

|

| Proposal

7 (cont.): Authorization to Repurchase Shares

•

Shareholder approval of this proposal 7 does not necessarily mean we

will repurchase 20% of our outstanding shares

–

We may repurchase fewer than 20% of our shares, including 0 shares

–

Our Supervisory and Management Boards look at multiple factors when

determining whether to repurchase shares, including:

»

Share price relative to anticipated future cash flows

»

Ability to use operating cash flow and/or debt to repurchase shares while

staying within our debt covenants

»

The amount of cash and/or debt capacity we have for other uses

»

Market trading and regulatory considerations

3 |

|

|

|

Proposal

to

change

the

name

of

the

corporate

parent

to

Cimpress

N.V.

Impact of the name change

Proposal 8:

Amend articles of association to change name

4

–

Align the entire company around the vision of becoming the undisputed mass

customization leader with a shared CIM platform

–

Distinguish the parent company from the Vistaprint brand

–

Preserve the differentiation and independence of acquired company brands, as well

as the Vistaprint brand

–

If

shareholders

approve

this

proposal,

expect

the

change

to

take

effect

shortly

after

the

Annual

General

Meeting

of

Shareholders

–

Corresponding

change

to

ticker

symbol

to

CMPR

–

All

customer-facing

brands

will

retain

their

own

brand

names

and

unique

value

proposition |

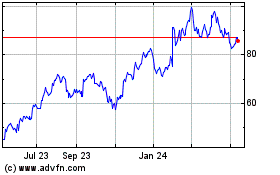

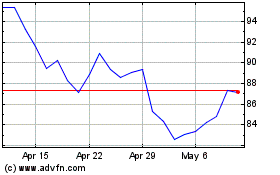

Cimpress (NASDAQ:CMPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cimpress (NASDAQ:CMPR)

Historical Stock Chart

From Apr 2023 to Apr 2024