- Third Quarter EPS from Continuing

Operations up 10 Percent to $1.15

- Third Quarter New Awards of $6.0

Billion; Backlog Rises to $42.3 Billion

- 2015 EPS Guidance Established at a

Range of $4.50 to $5.00

Fluor Corporation (NYSE: FLR) today announced financial results

for its third quarter ended September 30, 2014. Net earnings

attributable to Fluor from continuing operations rose to $183

million, or $1.15 per diluted share, from $173 million, or

$1.05 per diluted share a year ago. Consolidated segment

profit for the quarter was $335 million, up 8 percent from $311

million in the third quarter of 2013. Improved segment profit

results were primarily driven by a 65 percent increase in Oil &

Gas, which was partly offset by a decline in the Industrial &

Infrastructure segment. Revenue for the third quarter was $5.4

billion, down from $6.7 billion a year ago, mainly due to continued

reductions in the Industrial & Infrastructure segment’s mining

and metals business line.

New awards for the quarter were $6.0 billion, including $4.5

billion in Oil & Gas, $700 million in Government, $460 million

in Industrial & Infrastructure and $382 million in Power.

Consolidated backlog at the end of the quarter rose to $42.3

billion, up 5 percent over last quarter and up 16 percent from

$36.5 billion a year ago.

"Despite recent volatility in oil prices, our energy industry

clients continue to invest in strategically important long-term

initiatives," said Chairman and Chief Executive Officer David

Seaton. "As we look ahead to 2015, we continue to be encouraged by

our growing Oil & Gas business, augmented by modest

improvements in prospects in mining and metals, infrastructure,

power and Government.”

Corporate G&A expense for the third quarter of 2014 was $35

million, compared with $46 million a year ago. Reduced expenses in

the quarter were largely a result of lower stock-based compensation

costs. During the quarter, the Company committed $100 million

to share repurchases, and paid out $33 million in dividends to

shareholders. Fluor’s cash and marketable securities balance at the

end of the third quarter was $2.4 billion, down from $2.7 billion

last quarter, primarily due to increased working capital balances

at quarter end and the share repurchases mentioned above.

Business Segments

Fluor’s Oil & Gas business reported segment profit of $179

million, rising 65 percent from the third quarter of 2013. Strong

segment profit results reflect favorable project performance and

increased contributions from upstream and petrochemical projects.

Revenue for the quarter was $3.2 billion, a 12 percent increase

over the third quarter of 2013, reflecting rising contributions

from major projects. Third quarter new awards for the segment

totaled $4.5 billion, including a refinery project in Malaysia and

an oil sands project in Canada. Ending backlog for the Oil &

Gas segment was a record $26.5 billion, up 41 percent from $18.7

billion a year ago.

The Industrial & Infrastructure group reported segment

profit of $101 million, compared with $132 million in the third

quarter of 2013. Revenue for the quarter was $1.2 billion, down

from $2.7 billion a year ago. Revenue and segment profit results

reflect a continued decline in contributions from the mining and

metals business line. The decline in segment profit was partly

offset by growth in the infrastructure business line. New awards

for the third quarter were $460 million, including awards in the

mining and metals and industrial services business lines. Backlog

for the quarter was $8.7 billion, down from $13.8 billion a year

ago, mainly due to substantially lower mining and metals new awards

over the past two years.

The Government group reported segment profit of $30 million,

down from $38 million a year ago as a result of a decline in task

order volume on the LOGCAP IV contract in Afghanistan. Revenue for

the quarter declined 9 percent to $615 million, due to the lower

LOGCAP IV task order volume. New awards in the third quarter

totaled $700 million, including a multi-year award from the

Department of Energy for the Paducah Gaseous Diffusion Plant in

Kentucky. Ending backlog was $5.2 billion, compared with $1.8

billion a year ago and $5.2 billion last quarter.

Segment profit for Global Services was $19 million in the third

quarter, which compares to $25 million a year ago. Revenue declined

modestly to $141 million from $150 million a year ago. Lower

results in the quarter were mainly driven by reductions in the

equipment business line’s mining-related activities in Latin

America and reduced equipment demand in Afghanistan.

Segment profit for the Power business was $6 million, which

compares to $8 million a year ago. NuScale expenses in the current

quarter, net of the U.S. Department of Energy cost sharing award,

were $17 million which compares with $13 million a year ago. Power

revenue for the quarter declined to $237 million, from

$302 million a year ago, as two solar projects and a gas-fired

power plant neared completion. New awards for the quarter were $382

million, including a new gas-fired power plant in the United

States, and compares with $846 million in the third quarter of

2013. Ending backlog was $1.8 billion, compared with $2.1 billion a

year ago.

Results for the Nine

Months

Net earnings attributable to Fluor from continuing operations

for the nine months ended September 30, 2014 were

$495 million, or $3.08 per diluted share. This compares with

$501 million, or $3.05 per diluted share, for the first nine months

of 2013. Revenue declined to $16.1 billion, compared with $21.1

billion for the first nine months of 2013, mainly due to a decline

in contributions from the mining and metals business line.

Other Matters

Discontinued Operations

In October 2014, the Company entered into a settlement agreement

with counsel for a number of plaintiffs who had filed lawsuits

against the Company relating to the Doe Run lead business, which

the Company sold in 1994. As a result, the Company updated its

assessment of its loss contingency and has recorded an additional

after-tax charge in the third quarter of approximately $114

million, or $0.71 per diluted share from discontinued operations.

For the nine months ended September 30, 2014, the after-tax charge

from discontinued operations is approximately $199 million, or

$1.24 per diluted share. This charge is expected to result in cash

outflows upon the receipt of releases from the plaintiffs. The

Company continues to seek to enforce its rights to indemnification

from the buyer pursuant to the terms of the 1994 sale

agreement.

U.S. Defined Benefit Pension Plan

On October 29, 2014, the Company’s Board of Directors approved

the termination of the U.S. defined benefit pension plan effective

December 31, 2014. The settlement of the plan, subject to

regulatory approval, is expected to be complete in 2015.

Outlook

The Company is narrowing its 2014 guidance for EPS from

continuing operations to a range of $4.10 to $4.30 per diluted

share, from the previous range of $4.10 to $4.45 per diluted share.

For 2015, the Company is establishing its initial EPS guidance at a

range of $4.50 to $5.00 per diluted share, excluding any pension

settlement-related charges which are not fully estimable at this

time. EPS guidance for 2015 reflects a rising backlog and solid

growth opportunities in Oil & Gas and stable to moderate

improvement in the Company’s other end markets.

Third Quarter Conference

Call

Fluor will host a conference call at 5:30 p.m. Eastern time on

Thursday, October 30, which will be webcast live on the Internet

and can be accessed by logging onto http://investor.fluor.com. A

supplemental slide presentation will be available shortly before

the call begins. The webcast and presentation will be archived for

30 days following the call. Certain non-GAAP financial measures, as

defined under SEC rules, are included in this press release and may

be discussed during the conference call. A reconciliation of these

measures is included in this press release which will be posted in

the investor relations section of the Company’s website.

About Fluor Corporation

Fluor Corporation (NYSE: FLR) is a global engineering and

construction firm that designs and builds some of the world's most

complex projects. The company creates and delivers innovative

solutions for its clients in engineering, procurement, fabrication,

construction, maintenance and project management on a global basis.

For more than a century, Fluor has served clients in the energy,

chemicals, government, industrial, infrastructure, mining and power

market sectors. Headquartered in Irving, Texas, Fluor ranks 109 on

the FORTUNE 500 list. With more than 40,000 employees worldwide,

the company's revenue for 2013 was $27.4 billion. Visit Fluor at

www.fluor.com and follow on Twitter @FluorCorp.

Forward-Looking Statements: This

release may contain forward-looking statements (including without

limitation statements to the effect that the Company or its

management "believes," "expects," "anticipates," "plans" or other

similar expressions). These forward-looking statements, including

statements relating to future backlog, revenue and earnings,

expected performance of the Company's business and the outlook of

the markets which the Company serves are based on current

management expectations and involve risks and uncertainties. Actual

results may differ materially as a result of a number of factors,

including, among other things, difficulties or delays incurred in

the execution of contracts, resulting in cost overruns or

liabilities, including those caused by the performance of the

Company’s clients, subcontractors, suppliers and joint venture or

teaming partners; intense competition in the global engineering,

procurement and construction industry, which can place downward

pressure on the Company’s contract prices and profit margins; the

Company's failure to receive anticipated new contract awards and

the related impacts on revenues, earnings, staffing levels and

costs; the cyclical nature of many of the markets the Company

serves, including the Company’s commodity-based business lines, and

the Company’s vulnerability to downturns; failure to obtain

favorable results in existing or future litigation or dispute

resolution proceedings; current economic conditions affecting our

clients, partners, subcontractors and suppliers, which may result

in decreased capital investment or expenditures by the Company’s

clients or may increase costs or delay project schedules; client

cancellations of, or scope adjustments to, existing contracts, and

the related impacts on staffing levels and cost; foreign economic

and political uncertainties that could lead to project disruptions,

increased costs and potential losses; international security risks;

delays or defaults in client payments; failure to meet timely

completion or performance standards that could result in higher

costs, reduced profits or, in some cases, losses on projects;

liabilities arising from faulty services; the impact of

anti-bribery and international trade laws and regulations; risks or

uncertainties associated with events outside of our control, such

as the effects of severe weather, which may result in project

delays, increased costs, liabilities or losses on projects; the

potential impact of certain tax matters including, but not limited

to, those from foreign operations and ongoing audits by tax

authorities; possible information technology interruptions or

inability to protect intellectual property; foreign exchange risks;

failure to maintain safe worksites; the impact of environmental,

health and safety regulations or other laws; possible limitations

on bonding or letter of credit capacity; the Company’s ability to

secure appropriate insurance; the availability of credit and

restrictions imposed by credit facilities, both for the Company and

our clients, suppliers, subcontractors or other partners; and risks

or uncertainties associated with acquisitions, dispositions and

investments. Caution must be exercised in relying on these and

other forward-looking statements. Due to known and unknown risks,

the Company’s results may differ materially from its expectations

and projections.

Additional information concerning these and other factors can be

found in press releases as well as the Company's public periodic

filings with the Securities and Exchange Commission, including the

discussion under the heading "Item 1A. Risk Factors" in the

Company's Form 10-K filed on February 18, 2014. Such filings are

available either publicly or upon request from Fluor's Investor

Relations Department: (469) 398-7220. The Company disclaims any

intent or obligation other than as required by law to update its

forward-looking statements in light of new information or future

events.

FLUOR CORPORATION

CONSOLIDATED FINANCIAL RESULTS (in millions, except per

share amounts) Unaudited CONSOLIDATED

OPERATING RESULTS THREE MONTHS ENDED SEPTEMBER 30

2014 2013 Revenue $ 5,440.1 $ 6,684.2 Cost and

expenses: Cost of revenue 5,060.0 6,329.7 Corporate general and

administrative expense 35.1 46.1 Interest expense, net 1.6

3.7 Total cost and expenses 5,096.7

6,379.5 Earnings from continuing operations before taxes

343.4 304.7 Income tax expense 114.6 87.4

Earnings from continuing operations 228.8 217.3 Loss from

discontinued operations, net of taxes (113.9 ) - Net

earnings 114.9 217.3 Less: Net earnings attributable to

noncontrolling interests 45.4 44.3 Net

earnings attributable to Fluor Corporation $ 69.5 $ 173.0

Amounts attributable to Fluor Corporation: Earnings from continuing

operations $ 183.4 $ 173.0 Loss from discontinued operations, net

of taxes (113.9 ) - Net earnings $ 69.5 $

173.0 Basic earnings (loss) per share attributable to Fluor

Corporation: Earnings from continuing operations $ 1.17 $ 1.06 Loss

from discontinued operations, net of taxes (0.73 ) -

Net earnings $ 0.44 $ 1.06 Weighted average shares 157.3

162.9 Diluted earnings (loss) per share attributable to Fluor

Corporation: Earnings from continuing operations $ 1.15 $ 1.05 Loss

from discontinued operations, net of taxes (0.71 ) -

Net earnings $ 0.44 $ 1.05 Weighted average shares 159.5

164.8 New awards $ 6,011.4 $ 5,605.7 Backlog $ 42,269.8 $ 36,481.1

Work performed $ 5,299.5 $ 6,534.6

NINE MONTHS

ENDED SEPTEMBER 30 2014 2013 Revenue $ 16,076.4 $

21,060.2 Cost and expenses: Cost of revenue 15,038.7 20,030.9

Corporate general and administrative expense 129.6 110.6 Interest

expense, net 8.0 8.9 Total cost and expenses

15,176.3 20,150.4 Earnings from continuing

operations before taxes 900.1 909.8 Income tax expense 282.9

271.8 Earnings from continuing operations 617.2 638.0

Loss from discontinued operations, net of taxes (199.0 )

- Net earnings 418.2 638.0 Less: Net earnings attributable

to noncontrolling interests 121.8 137.0 Net

earnings attributable to Fluor Corporation $ 296.4 $ 501.0

Amounts attributable to Fluor Corporation: Earnings from continuing

operations $ 495.4 $ 501.0 Loss from discontinued operations, net

of taxes (199.0 ) - Net earnings $ 296.4 $

501.0 Basic earnings (loss) per share attributable to Fluor

Corporation: Earnings from continuing operations $ 3.12 $ 3.08 Loss

from discontinued operations, net of taxes (1.25 ) -

Net earnings $ 1.87 $ 3.08 Weighted average shares 158.7

162.7 Diluted earnings (loss) per share attributable to Fluor

Corporation: Earnings from continuing operations $ 3.08 $ 3.05 Loss

from discontinued operations, net of taxes (1.24 ) -

Net earnings $ 1.84 $ 3.05 Weighted average shares 160.8

164.3 New awards $ 22,543.0 $ 19,311.3 Backlog $ 42,269.8 $

36,481.1 Work performed $ 15,648.1 $ 20,606.2

FLUOR CORPORATION

Unaudited BUSINESS SEGMENT FINANCIAL REVIEW

($ in millions) THREE MONTHS ENDED SEPTEMBER

30 2014 2013 Revenue Oil & Gas $

3,231.6 $ 2,892.7 Industrial & Infrastructure 1,216.0 2,665.0

Government 615.1 675.2 Global Services 140.5 149.7 Power

236.9 301.6

Total revenue $

5,440.1 $ 6,684.2

Segment profit $ and margin % Oil & Gas $ 178.6 5.5 % $

108.3 3.7 % Industrial & Infrastructure 101.4 8.3 % 132.4 5.0 %

Government 29.6 4.8 % 37.8 5.6 % Global Services 19.4 13.8 % 24.5

16.4 % Power 5.7 2.4 % 7.6 2.5 %

Total segment profit $ and margin % $ 334.7

6.2 % $ 310.6 4.6 %

Corporate general and administrative expense (35.1 ) (46.1 )

Interest expense, net (1.6 ) (3.7 ) Earnings attributable to

noncontrolling interests 45.4 43.9

Earnings from continuing operations before taxes $

343.4 $ 304.7

NINE MONTHS ENDED SEPTEMBER 30 2014 2013

Revenue Oil & Gas $ 8,778.8 $ 8,518.5 Industrial &

Infrastructure 4,370.6 8,879.5 Government 1,806.9 2,101.0 Global

Services 428.3 454.0 Power 691.8 1,107.2

Total revenue $ 16,076.4

$ 21,060.2 Segment profit $ and

margin % Oil & Gas $ 483.9 5.5 % $ 319.6 3.8 % Industrial

& Infrastructure 298.8 6.8 % 388.7 4.4 % Government 56.0 3.1 %

92.7 4.4 % Global Services 58.0 13.5 % 79.8 17.6 % Power

19.2 2.8 % 11.4 1.0 %

Total segment profit

$ and margin % $ 915.9 5.7 %

$ 892.2 4.2 % Corporate general

and administrative expense (129.6 ) (110.6 ) Interest expense, net

(8.0 ) (8.9 ) Earnings attributable to noncontrolling interests

121.8 137.1

Earnings from continuing

operations before taxes $ 900.1 $

909.8 FLUOR

CORPORATION Unaudited SELECTED BALANCE SHEET

ITEMS ($ in millions, except per share amounts)

SEPTEMBER 30, DECEMBER 31, 2014 2013

Cash and marketable securities, including noncurrent $ 2,401.5 $

2,745.0 Total current assets 5,659.5 6,003.7 Total assets 8,048.7

8,323.9 Total short-term debt 29.8 29.8 Total current liabilities

3,303.3 3,407.2 Long-term debt 496.9 496.6 Shareholders' equity

3,558.9 3,757.0 Total debt to capitalization % (based on

shareholders' equity) 12.9 % 12.3 % Shareholders' equity per share

$ 22.74 $ 23.29

SELECTED CASH FLOW ITEMS ($

in millions) NINE MONTHS ENDED SEPTEMBER 30

2014 2013 Cash provided by operating

activities $

407.3 $

702.5

Investing activities Net (purchases) sales and maturities of

marketable securities (42.4 ) 12.1 Capital expenditures (222.6 )

(181.1 ) Proceeds from disposal of property, plant and equipment

72.5 43.7 Proceeds from sales of equity method investments 44.0 3.0

Investments in partnerships and joint ventures (34.2 ) (37.5 )

Consolidation of a variable interest entity - 24.7 Acquisitions -

(7.7 ) Other items 2.0 9.1

Cash

utilized by investing activities (180.7 )

(133.7 ) Financing activities

Repurchase of common stock (410.6 ) - Dividends paid (93.0 ) (52.5

) Repayment of 5.625% Municipal Bonds - (17.8 ) Repayment of

convertible debt and notes payable (0.1 ) (8.6 ) Distributions paid

to noncontrolling interests, net of capital contributions

(73.3

)

(78.0 ) Other Items 14.7 21.2

Cash

utilized by financing activities (562.3 )

(135.7 ) Effect of exchange rate

changes on cash (47.7 )

(50.1 ) Increase (decrease) in cash and

cash equivalents $

(383.4 ) $

383.0

Depreciation $

143.8 $

162.3

FLUOR CORPORATION

Supplemental Fact Sheet Unaudited

NEW AWARDS ($ in millions) THREE MONTHS

ENDED SEPTEMBER 30 2014 2013 % Chg

Oil & Gas $ 4,469 74 % $ 2,355 42 % 90 % Industrial &

Infrastructure 460 8 % 472 8 % (3 )% Government 700 12 % 1,933 35 %

(64 )% Power 382 6 % 846

15 % (55 )%

Total new awards $ 6,011

100 % $ 5,606

100 % 7 % NINE MONTHS

ENDED SEPTEMBER 30 2014 2013 % Chg

Oil & Gas $ 14,788 66 % $ 8,729 45 % 69 % Industrial &

Infrastructure 2,633 12 % 6,284 33 % (58 )% Government 4,536 20 %

2,945 15 % 54 % Power 586 2 % 1,353

7 % (57 )%

Total new awards $

22,543 100 % $

19,311 100 % 17 %

BACKLOG TRENDS ($ in millions)

AS OF SEPTEMBER 30 2014 2013 %

Chg Oil & Gas $ 26,503 63 % $ 18,740 51 % 41 %

Industrial & Infrastructure 8,715 21 % 13,806 38 % (37 )%

Government 5,218 12 % 1,796 5 % NM Power 1,834

4 % 2,139 6 % (14 )%

Total backlog

$ 42,270 100 % $

36,481 100 % 16 %

United States $ 11,887 28 % $ 12,551 34 % (5 )% The Americas

(excluding the United States) 14,029 33 % 10,442 29 % 34 % Europe,

Africa and the Middle East 12,776 30 % 10,916 30 % 17 % Asia

Pacific (including Australia) 3,578 9 %

2,572 7 % 39 %

Total backlog $

42,270 100 % $

36,481 100 % 16 %

NM - Not meaningful

Fluor CorporationMedia RelationsBrian Mershon,

469-398-7621orEric Krantz, 281-263-6030orInvestor RelationsKen

Lockwood, 469-398-7220orJason Landkamer, 469-398-7222

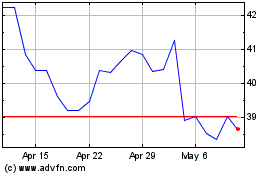

Fluor (NYSE:FLR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fluor (NYSE:FLR)

Historical Stock Chart

From Apr 2023 to Apr 2024