UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

| Filed by the Registrant |

[X] |

| Filed by a party other than the Registrant |

[ ] |

| Check the appropriate box: |

| |

| [X] |

Preliminary Proxy Statement |

| [ ] |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] |

Definitive Proxy Statement |

| [ ] |

Definitive Additional Materials |

| [ ] |

Soliciting Material under § 240.14a-12 |

| |

CirTran Corporation |

| |

(Name of Registrant as Specified in its Charter) |

| |

|

| |

n/a |

| |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| |

| [X] |

No fee required. |

| [ ] |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

|

| |

1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

2) |

Aggregate number of securities to which transaction applies: |

| |

|

|

| |

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

| |

4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

5) |

Total fee paid: |

| |

|

|

| [ ] |

Fee paid previously with preliminary materials. |

| [ ] |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

|

| |

1) |

Amount Previously Paid: |

|

| |

2) |

Form, Schedule or Registration Statement No.: |

|

| |

3) |

Filing Party: |

|

| |

4) |

Date Filed: |

|

CIRTRAN CORPORATION

4125 South 6000 West

West Valley City, Utah 84128

(801) 963-5112

December [__], 2014

Dear Fellow Stockholder:

You are cordially invited to attend a Special

Meeting of Stockholders to be held [weekday], December [__], 2014, at 10:00 a.m., MST, at 4125 South 6000 West, West Valley

City, Utah. The business to be conducted at the Special Meeting is explained in the accompanying Notice of Special Meeting of Stockholders

and Proxy Statement. At the Special Meeting, we will also discuss our results for the past year.

We urge you to review and consider each proposal

carefully. We believe adoption of each proposal is in the best interests of our stockholders. Thank you for your continued support.

| |

Sincerely, |

| |

|

| |

CirTran Corporation |

| |

|

| |

|

| |

Iehab Hawatmeh |

| |

Chief Executive Officer and |

| |

Chairman of the Board of Directors |

TABLE OF CONTENTS

CIRTRAN CORPORATION

4125 South 6000 West

West Valley City, Utah 84128

(801) 963-5112

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON [WEEKDAY], DECEMBER [__], 2014

The Special Meeting of Stockholders (the “Special Meeting”)

of CirTran Corporation (the “Company”) will be held on [weekday], December [__], 2014, at 10:00 a.m., MST, at 4125

South 6000 West, West Valley City, Utah. The purposes of the Special Meeting are to:

| |

(1) |

consider and act upon a proposed amendment to the Company’s articles of incorporation to recapitalize the Company, by reverse-splitting the outstanding common stock 1,000-to-one and reducing the authorized common stock to 100,000,000 shares, par value $0.001; |

| |

|

|

| |

(2) |

consider and act upon a proposed amendment to the Company’s articles of incorporation to authorize a class of 5,000,000 shares of preferred stock and to authorize the Board to fix the number of shares and rights, preferences, and limitations of each series; |

| |

|

|

| |

(3) |

consider and act upon a proposal to recess the Special Meeting on one or more occasions, if necessary or appropriate, to solicit additional proxies; and |

| |

|

|

| |

(4) |

transact such other business as may properly come before the Special Meeting or at any postponement or recess thereof. |

Only Company stockholders of record at the close of business on

November [__], 2014, have the right to receive notice of, and to vote at, the Special Meeting and any recess thereof.

The items of business are more fully described in the Proxy Statement

accompanying this Notice of Special Meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY

OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON DECEMBER [__], 2014:

The Proxy Statement, the Company’s

Annual Report on Form 10-K for the year ended December 31, 2013, and the Company’s Quarterly Report on Form 10-Q for the

quarter ended June 30, 2014, for stockholders are included with this Proxy Statement.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU EXPECT TO ATTEND THE

SPECIAL MEETING, YOU ARE REQUESTED TO SIGN, DATE, AND RETURN THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE IN THE ENCLOSED STAMPED

ENVELOPE.

| |

By Order of the Board of Directors, |

| |

|

| |

|

| |

Iehab Hawatmeh, Chief Executive Officer |

| |

and Chairman of the Board of Directors |

Salt Lake City, Utah

November [__], 2014

CIRTRAN CORPORATION

4125 South 6000 West

West Valley City, Utah 84128

(801) 963-5112

PROXY STATEMENT

This Proxy Statement and the accompanying proxy

card are being furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of

CirTran Corporation (the “Company”) from the holders of shares of common stock of the Company to be voted at a Special

Meeting of Stockholders (the “Meeting”) to be held on [weekday], December [__], 2014, at 10:00 a.m., MST, at 4125 South

6000 West, West Valley City, Utah. Distribution of this Proxy Statement and the accompanying proxy card is scheduled to begin on

or about November [__], 2014.

IMPORTANT NOTICE REGARDING THE AVAILABILITY

OF PROXY MATERIALS FOR THE SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON DECEMBER [__], 2014:

This Proxy Statement, the Company’s Annual

Report on Form 10-K for the year ended December 31, 2013, and the Company’s Quarterly Report on Form 10-Q for the quarter

ended June 30, 2014, are available for viewing, printing, and downloading at [http://____________________.com] using the information

provided on the form of notice provided. Copies of the Company’s Annual Report on Form 10-K for the year ended December 31,

2013, and the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2014, as filed with the Securities and

Exchange Commission (“SEC”), will be furnished without charge to any stockholder upon written request to CirTran Corporation,

4125 South 6000 West, West Valley City, Utah 84128, ATTN: Investor Relations. This proxy statement and the Company’s 2010

Annual Report on Form 10-K and quarterly report on Form 10-Q for the quarter ended September 30, 2014, for the fiscal year ended

December 31, 2010, are also available on the SEC’s website at www.sec.gov.

The enclosed proxy is solicited by the Board

of Directors.

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING

Why did I receive this Proxy Statement?

The Company has sent you the Notice of Special

Meeting of Stockholders, this Proxy Statement, and the accompanying proxy or voting instruction card because the Board is soliciting

your proxy to vote at a Special Meeting on December [__], 2014. This Proxy Statement contains information about the matters to

be voted on at the Special Meeting.

Who is entitled to vote?

The Board has designated November [__], 2014,

as the record date for the Special Meeting (the “Record Date”). You may vote if you owned common stock as of the close

of business on the Record Date. On the Record Date, there were 4,498,891,910 shares of the Company’s common stock outstanding

and entitled to vote at the Special Meeting.

How many votes do I have?

Each share of common stock that you own at the

close of trading on the Record Date entitles you to one vote.

What am I voting on?

You will be voting on proposals to:

| |

· |

amend the Company’s articles of incorporation to recapitalize the Company, by reverse-splitting the outstanding common stock 1,000-to-one and reducing the authorized common stock to 100,000,000 shares, par value $0.001 (the “Recapitalization”); |

| |

|

|

| |

· |

amend the Company’s articles of incorporation to authorize a class of 5,000,000 shares of preferred stock and to authorize the Board to fix the number of shares and rights, preferences, and limitations of each series; |

| |

|

|

| |

· |

recess the Special Meeting on one or more occasions for the purpose of soliciting additional Proxies, if necessary or appropriate; and |

| |

|

|

| |

· |

consider and act upon such other business as may properly come before the Special Meeting or at any postponement or recess thereof. |

How do I vote?

You may vote by mail. You do this by

completing and signing your proxy card, using the prepaid and addressed envelope included with this Proxy Statement. If you mark

your voting instructions on the proxy card, your shares will be voted:

| |

· |

as you instruct; and |

| |

|

|

| |

· |

at the discretion of Mr. Hawatmeh, if a proposal properly comes up for a vote at the Special Meeting that is not on the proxy card. |

For your voting instructions to be effective, your proxy card

must be received no later than the close of business on [proxy receipt date].

You may vote by Internet. If you have

Internet access, you may submit your proxy by following the instructions provided in the notice, or if you requested printed proxy

materials, by following the instructions provided with your proxy materials and on your proxy card or voting instruction card.

On the Internet voting site, you can confirm that your instructions have been properly recorded. If you vote on the Internet, you

can also request electronic delivery of future proxy materials. If you vote on the Internet, please note that there may be costs

associated with electronic access, such as usage charges from Internet access providers and telephone companies, for which you

will be responsible.

You may vote by telephone. You can also

vote by telephone by following the instructions provided on the Internet voting site, or if you requested printed proxy materials,

by following the instructions provided with your proxy materials and on your proxy card or voting instruction card. Easy-to-follow

voice prompts allow you to vote your shares and confirm that your instructions have been properly recorded.

You may vote at the Special Meeting.

If you are planning to attend the Special Meeting and wish to vote your shares in person, the Company will give you a ballot at

the Special Meeting. If your shares are held in a street name, you need to bring an account statement or letter from your broker,

bank, or other nominee, indicating that you are the beneficial owner of the shares on the Record Date. Even if you plan to be present

at the Special Meeting, the Company encourages you to complete and mail the enclosed card in advance of the Special Meeting to

vote your shares by proxy.

What if I return my proxy or voting instruction card but do not

mark it to show how I am voting?

Your shares will be voted according to the instructions

you have indicated on your proxy or voting instruction card. You can specify whether you approve, disapprove, or abstain from the

proposals. If no direction is indicated, your shares will be voted FOR an amendment to the Company’s articles of incorporation

to effect the Recapitalization, FOR an amendment to the Company’s articles of incorporation to authorize a class of preferred

stock; and FOR the proposal to recess the Special Meeting on one or more occasions for the purpose of soliciting additional

Proxies, if necessary; provided that, no proxy that is specifically marked “AGAINST” the proposal to amend the

Company’s articles of incorporation to recapitalize the Company will be voted in favor of the recess proposal, unless it

is specifically marked “FOR” the recess proposal.

May I revoke my proxy or change my vote after I return my proxy

card or voting instruction card?

You may revoke your proxy or change your vote

at any time before it is exercised in one of three ways:

| |

· |

notify our Corporate Secretary in writing before the Special Meeting that you are revoking your proxy; |

| |

|

|

| |

· |

submit another proxy card (or voting instruction card if you hold your shares in street name) with a later date; or |

| |

|

|

| |

· |

vote in person at the Special Meeting on December [__], 2014. |

What does it mean if I receive more than one proxy or voting

instruction card?

It means that you have multiple accounts at

the transfer agent and/or with banks and stockbrokers. Please vote all of your shares by returning all proxy and voting instruction

cards you receive.

What constitutes a quorum?

A quorum must be present to properly convene

the Special Meeting. The presence, in person or by proxy, of the holders of a majority of the outstanding shares that are entitled

to vote at the Special Meeting constitutes a quorum. You will be considered part of the quorum if you return a signed and dated

proxy or voting instruction card or if you attend the Special Meeting. Abstentions and broker nonvotes will be counted as shares

present at the Special Meeting for purposes of determining whether a quorum exists, but not as shares cast for any proposal. Because

abstentions and broker nonvotes are not treated as shares cast, they would have no impact on any of the proposals.

What vote is required in order to approve each proposal?

The proposals for the approval of the amendment

to the Company’s articles of incorporation to effect the Recapitalization and to authorize a class of preferred stock require

the affirmative vote of the holders of at least a majority of the Company’s outstanding shares of common stock. Stockholders

may vote in favor or against each proposal, or they may abstain. Abstentions and broker nonvotes will be counted for purposes of

determining the presence or absence of a quorum. Abstentions are deemed to be “votes cast” and have the same effect

as a vote against this proposal. Broker nonvotes are not deemed to be votes cast and, therefore, have no effect on the vote respecting

this proposal.

What is the Board’s recommendation?

The Board’s recommendations are set forth

together with a description of the proposals in this Proxy Statement. In summary, the Board recommends that you vote:

| |

· |

FOR the approval of the amendment to the Company’s articles of incorporation to effect the Recapitalization; |

| |

|

|

| |

· |

FOR the approval of a proposed amendment to the Company’s articles of incorporation to authorize a class of 5,000,000 shares of preferred stock and to authorize the Board to fix the number of shares and rights, preferences, and limitations of each series; and |

| |

|

|

| |

· |

FOR the proposal to recess the Special Meeting on one or more occasions for the purpose of soliciting additional Proxies, if necessary or appropriate. |

How will voting on any other business be conducted?

The Company does not know of any business or

proposals to be considered at the Special Meeting other than those that are described in this Proxy Statement. If any other business

is proposed and the Company decides to allow it to be presented at the Special Meeting, the proxies that the Company receives from

its stockholders give the proxy holders the authority to vote on that matter according to their best judgment.

Who will count the votes?

Representatives of the Company will tabulate

the votes that are received prior to the Special Meeting, will act as the inspectors of election, and will tabulate the votes,

if any, that are cast in person at the Special Meeting.

Who pays to prepare, mail, and solicit the proxies?

The Company will pay all of the costs of soliciting

these proxies. The Company will ask banks, brokers, and other nominees and fiduciaries to forward the proxy materials to the beneficial

owners of its common stock and to obtain the authority of executed proxies. The Company will reimburse them for their reasonable

expenses. In addition to the use of the mail, proxies may be solicited by the Company’s officers, directors, and other employees

by telephone or by personal solicitation. The Company will not pay additional compensation to these individuals in connection with

their solicitation of proxies.

What do I need for admission to the Meeting?

You may attend the Special Meeting only

if you are a stockholder of record or a beneficial owner as of the Record Date, or you hold a valid proxy for the Special Meeting.

You should be prepared to present photo identification for admittance. If you are a stockholder of record, your name will be verified

against the list of stockholders of record prior to your being admitted to the Meeting. If you hold your shares in street name,

you should provide proof of beneficial ownership on the record date, such as a brokerage account statement showing that you owned

CirTran common stock as of the record date, a copy of the voting instruction card provided by your broker, bank, or other nominee,

or other similar evidence of ownership as of the record date. If you do not provide photo identification or comply with the other

procedures outlined above upon request, you will not be admitted to the Special Meeting.

Whom should I call if I have questions?

If you have questions about the proposals or

the Special Meeting, you may call Iehab Hawatmeh at (801) 963-5112. You may also send an e-mail to iehab@cirtran.com.

PROPOSAL NO. 1

PROPOSED AMENDMENT TO THE ARTICLES OF INCORPORATION

TO RECAPITALIZE THE COMPANY BY REVERSE-SPLITTING

ITS OUTSTANDING COMMON STOCK 1,000-TO-ONE AND REDUCING ITS AUTHORIZED COMMON STOCK TO

100,000,000 SHARES, PAR VALUE $0.001

The Board has determined that it is in the Company’s

best interest to amend its articles of incorporation to recapitalize the Company by reverse-splitting its outstanding common stock

1,000-to-one and reducing its authorized common stock to 100,000,000 shares, par value $0.001 (the “Recapitalization”).

As discussed below, if the Company’s stockholders as of the Record Date approve the amendment, the Board will file an amendment

to the articles of incorporation, substantially in the form set forth in Appendix 1 to this Proxy Statement, with the Nevada Secretary

of State, at which time the amendment will take effect.

General

As of the Record Date, pursuant to the Company’s

articles of incorporation (as amended to date), the Company had the authority to issue 4,500,000,000 shares of common stock, of

which 4,498,891,910 shares were issued and outstanding. As of the Record Date, there were warrants and similar rights exercisable

or convertible to 25,000 shares of common stock. This figure does not include common stock issuable upon conversion of the outstanding

debenture.

As described in the Company’s periodic

filings, one of its main sources of funding historically has been through the sales of convertible debt and equity instruments,

including convertible debentures and notes. The large number of authorized and outstanding shares is cumbersome for the Company

and its stockholders in a trading and securities markets not accustomed to dealing in billions or hundreds of millions of shares,

particularly when their price is expressed in several decimal places, so that the aggregate value of a large number of shares is

quite small. For example, the stock has recently been quoted at $0.0002 bid, $0.0003 asked, so the aggregate bid for 1,000,000

shares would be $200 and the aggregate asked would be $300. Selling 10,000,000 shares at the bid would generate gross proceeds

of $2,000. Expression of quotations in four decimal places also results in relatively large spreads between the bid and asked quotations.

For example, in the above quotations the asked is 50% larger than the bid. No smaller spread is numerically possible without using

a five-decimal-place number. In addition, stockholders encounter difficulties in effecting transactions in their securities because

of the deposit requirements of clearing agencies, which require that broker-dealers make substantial cash deposits to clear transactions

executed in the Corporation’s securities. This limits stockholder liquidity. Some broker-dealers are unable to express quotations

or effect transactions in five decimal places. The Board believes that the low market price for the Company’s common stock

expressed in four decimal places adversely affects securities broker-dealer and potential interest and may tend to depress the

market price.

The Board believes that the reverse split may

result in higher price quotations for the Company’s common stock, although there can be no assurance that this will be the

case. Accordingly, the reverse split may reduce the value of a stockholder’s shares. The Board believes, however, that the

reverse split, as an integral component of the Recapitalization, is critical to enabling the Company to continue to have a presence

in the securities trading market and to be able to obtain required cash and reduce indebtedness.

The Reverse Split

The Recapitalization includes a 1,000-to-one

reverse split of the Company’s outstanding common stock. As a result of this reverse split, the 4,498,891,910 shares issued

and outstanding as of the Record Date will be reverse-split into 4,498,891 shares. The Company will not issue fractional shares.

Instead, fractional shares will be round to the nearest whole share.

Convertible Debentures and Warrants

Consolidated

Debenture

As

of September 30, 2014, the Company had an outstanding Consolidated Debenture (as defined below) issued to YA Global Investments,

L.P., formerly known as Cornell Capital Partners, L.P. (“YA Global”), with an aggregate outstanding balance of $2,390,528,

including accrued interest of $748,291, which was then in default.

The

terms of the Company’s outstanding Consolidated Debenture are governed by a February 22, 2013, Ratification Agreement with

YA Global. Under this Ratification Agreement, the Company ratified the obligations under three existing convertible debentures

dated May 26, 2005, December 30, 2005, and August 23, 2006, and agreed to amend, restate, and consolidate the obligations evidenced

thereby into a single “Consolidated Debenture.”

Under

the Ratification Agreement and Consolidated Debenture payment schedule, the Company was required to make monthly payments, to

be applied first to accrued interest and then to principal, in the amount of $100,000 per month, commencing in April 2013. The

amount of its required monthly cash payment would be reduced in an amount equal to the amount credited to the lender against the

obligation as a result of the lender’s exercise of the right to convert the outstanding balance due under the debentures

into common stock, as provided in the original convertible debentures as well as in the Consolidated Debenture. Any amount credited

against the debenture obligation in excess of $100,000 per month would be credited against the amounts due in the next succeeding

month, with the entire unpaid balance of principal and interest due on January 31, 2014.

During

2013, a total of $1,284,412 was credited against required payments due YA Global for the conversion of indebtedness to common

stock. Since 2009, the Company has had insufficient funds to pay cash to YA Global and has had to rely exclusively on the conversion

of the obligation to common stock. However, no further conversions can be effected because the Company has insufficient authorized

but unissued common stock. Based on the prevailing market price for its common stock, which has ranged from a high bid of $0.0006

to a low bid of $0.0002 during the past six months, the terms of the Consolidated Debenture would require a conversion price of

$0.001 per share, which is lower than the per-share par value, so the Company would be obligated to issue shares at $0.001 par

value. As of the date of this Proxy Statement, the entire approximately $2.4 million debenture is past due and in default, which

would require the issuance of 2.4 billion shares of the Company’s current common stock. The Company has only 81,016 authorized

but unissued shares. The Consolidated Debenture provides that the holder cannot convert indebtedness to common stock if, as a

result of such conversion, the holder would own more than 9.99% of the Company’s outstanding common stock. Sales of common

stock that would reduce the holder’s ownership would enable the holder to convert additional amounts due under the Consolidated

Debenture.

The

obligation under the Company’s Consolidated Debentures is secured by liens and security interests in all of the Company’s

assets, so the continuation of the Company is dependent of meeting this obligation. If YA Global were to exercise its collection

remedies and execute on its collateral, it could take all of the Company’s assets and leave nothing for other creditors

or shareholders.

Management

believes that the proposed amendment would benefit the Company by providing greater flexibility to the Board to honor conversion

notices by YA Global and exercise notices from warrant holders, to issue additional equity securities to raise additional capital,

to pursue strategic investment partners, to facilitate possible future acquisitions, and to provide stock-related employee benefits.

As noted above, the Company’s primary sources of financing have been private sales of common stock or other equity or debt

securities convertible into common stock. The Company requires additional capital to fund its pending legal disputes with Plavboy

Enterprises, Inc., to support its energy drink beverage distribution activities, and to identify and pursue other business opportunities

of which it may become aware. To facilitate these transactions, management believes that a recapitalization of the Company will

provide additional shares that may be issued in accordance with the Company’s contractual commitments or on such terms as

the Board may deem appropriate.

Warrants

In

addition to the shares issuable on the conversion of the Consolidated Debenture, as of September 30, 2014, the Company had the

following issued and outstanding warrants exercisable for the number of shares of common stock at the weighted-average exercise

price indicated below. The table also reflects the number of shares issuable and the weighted-average exercise price of the warrants,

after giving effect to the proposed 1,000-to-one reverse stock split:

| | |

Now,

Before Reverse Split | | |

After

Reverse Split | |

| | |

Number | | |

Weighted-Average Exercise

Price | | |

Number | | |

Weighted-Average Exercise

Price | |

| | |

| | | |

| | | |

| | | |

| | |

| YA Global warrants | |

| 25,000,000 | | |

$ | 5,041.28 | | |

| 25,000 | | |

$ | 0.20 | |

As

of the date of this Proxy Statement, the Company had essentially no additional shares to issue under its authorized capital limits.

The proposed Recapitalization is intended, in part, to permit the Company to satisfy any conversion notices that may be presented.

The

proposed Recapitalization would increase the number of shares available for issuance on the conversion of the consolidated convertible

debenture and the exercise of warrants because the reverse split would reduce the number of issued and outstanding shares to 4,498,891

shares, while reducing the authorized common stock to 100,000,000 shares of common stock. Accordingly, the Company would have

approximately 95.5 million shares available for future issuance.

The

formula for calculating the shares to be issued in connection with conversions of these securities varies, based on the market

price of its common stock. Therefore, if the Recapitalization is effected, there effectively is no limitation on the number of

shares of common stock that may be issued in connection with conversion. As such, holders of the Company’s common stock

will experience substantial dilution of their interests to the extent that the debenture is converted and shares of the Company’s

common stock are issued.

The

Board recognizes, of course, that the trading price for the Company’s securities following a reverse-stock-split may not

mathematically reflect the calculated results of the reverse-stock-split, so that a 1,000-to-one reverse-stock-split of a corporation’s

stock may not result in a 1,000-fold increase in the trading price for the common stock. Frequently, stocks do not trade at their

pre-reverse-split equivalent trading price following a reverse split. Therefore, the reverse split could result in significant

reduction in the value of the stock owned by stockholders.

Purpose

of the Recapitalization

The

Company requires additional financing, and it intends to continue to seek financing through private placements of equity and convertible

debt securities. However, as detailed above, the Company does not have sufficient shares to enable it to pursue private placements

or capital-raising transactions.

In

addition to better positioning the Company for future capitalization, management believes that the Recapitalization may make other

corporate opportunities, including potential mergers with or acquisitions of businesses or other related avenues of strategic

growth, more available to the Company. As of the date of this Proxy Statement, the Company had no plans for acquisitions or other

business combinations, although the Company continues to be open to potential opportunities for the Company.

As

of the date of this Proxy Statement, the Company’s articles of incorporation (as amended to date), authorized it to issue

up to 4,500,000,000 shares of common stock, of which 4,498,891,910 shares, or almost 100%, of its authorized shares, are outstanding.

If the reverse split and change in the authorized capital is approved, the Company would have 4,498,891 shares, or 4.5%, of its

authorized common stock outstanding and 25,000 shares, or less than 1%, of its authorized shares reserved for issuance on the

exercise of warrants and similar rights, plus an indeterminate number issuable on conversion of the Consolidated Debenture. The

Company anticipates that it may use the additional shares available to it for a variety of purposes, including conversions of

the Consolidated Debenture.

As

noted above, the issuances of shares under the Consolidated Debenture are tied to variable conversion prices. Accordingly, if

the market price of the Company’s common stock rises, the number of shares of its common stock issuable will correspondingly

decrease. Management believes that in light of market conditions and the Company’s potential to develop and market its products,

authorized capital of 100,000,000 shares of its common stock will enable the Company to meet its obligations, although there can

be no guarantee that this will be the case. As discussed above, the Consolidated Debenture includes conversion limitations, or

caps, such that YA Global is limited from converting the entire outstanding amount into shares of the Company’s common stock.

As such, it is unlikely that the Company would be required to meet conversion obligations of the Consolidated Debenture at one

time. Conversions of the Consolidated Debenture will likely have a depressive effect on prices for the Company’s common

stock in any trading market that may then exist.

If

the amendment to the Company’s articles of incorporation is approved by its stockholders, the Company will have approximately

95.5 additional shares to issue to meet its obligations as listed above. However, because the Consolidated Debenture is held by

a third party, it is not possible for management to allocate these additional shares or determine in advance how the Company will

issue the shares or reserve them. Moreover, because the Consolidated Debenture has a variable conversion price, management is

unable to determine how many shares may be issued in connection with the Consolidated Debenture, other than the warrants as listed

above. If the amendment to the Company’s articles of incorporation is approved, management intends to reserve out of the

increased authorized capital a total of 25,000 shares in connection with currently outstanding warrants. Management will continue

to report the Company’s issuances of shares in connection with the Consolidated Debenture above in its periodic reports

filed with the SEC.

There

is a risk of significant downward pressure on the price of the common stock as YA Global converts its Consolidated Debenture into

shares of the Company’s common stock and sells material amounts of common stock, which could encourage short sales. This

could place significant downward pressure on the price of the Company’s common stock. Generally, “short selling”

means selling a security, contract, or commodity not owned by the seller. The seller is committed to eventually purchase the financial

instrument previously sold. Short sales are used to capitalize on an expected decline in the security’s price. As YA Global

converts the Company’s Consolidated Debenture, the Company issues shares to it, which it then may choose to sell into the

market pursuant to Rule 144 or other exemptions from the registration requirements. Such sales have a tendency to depress the

price of a stock, which could increase the potential for short sales.

The

Company’s issuances of shares in connection with conversions of the Consolidated Debenture may result in substantial dilution

to the interests of other holders of common stock.

Because

the conversion prices of the Consolidated Debenture are based on the market price of the Company’s common stock, there is

effectively no limit on the number of shares that may be issued. As such, the Company’s stockholders are subject to the

risk of substantial dilution to their interests as a result of the Company’s issuance of shares in connection with conversions

of the Consolidated Debenture.

If

the Company’s stockholders do not approve the amendment, due to changes in the market price of the common stock affecting

conversion ratios of conversions of the Consolidated Debenture, the Company may be precluded from issuing shares of its common

stock as required, and the Company may remain in default of the Consolidated Debenture, which could continue to adversely affect

the Company’s operations and financial condition. Moreover, even if the Company were to negotiate additional merger or acquisition

transactions on terms acceptable to the Company, it would not be able to complete such transactions without an increase in authorized

capital.

Potential

Anti-Takeover Effect

Although

the increased proportion of unissued authorized shares to issued shares could, under certain circumstances, have an anti-takeover

effect (for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect a change in the

composition of the Board or contemplating a tender offer or other transaction for the combination of the Company with another

entity), the increase in the Company’s shares of common stock is not being proposed as part of a plan of additional stock

issuances. Nevertheless, management could use the additional shares that will be available following the Recapitalization to resist

or frustrate a third-party transaction.

If

the Recapitalization is approved at the Special Meeting, generally, no stockholder approval would be necessary for the issuance

of all or any portion of the additional shares of common stock unless required by law or any rules or regulations to which the

Company is subject.

Depending

upon the consideration per share received by the Company for any subsequent issuance of common stock, such issuance could have

a dilutive effect on those stockholders who paid a higher consideration per share for their stock. Also, future issuances of common

stock will increase the number of outstanding shares, thereby decreasing the percentage ownership in the Company (for voting,

distributions, and all other purposes) represented by existing shares of common stock. The availability for issuance of the additional

shares of common stock may be viewed as having the effect of discouraging an unsolicited attempt by another person or entity to

acquire control of the Company. Although the Board has no present intention of doing so, the Company’s authorized but unissued

common stock could be issued in one or more transactions that would make a takeover of the Company more difficult or costly, and

therefore less likely. Holders of common stock do not have any preemptive rights to acquire any additional securities issued by

the Company.

Consent

Required for Approval

Under

Nevada law and the Company’s articles of incorporation, as amended to date, the proposal to amend the Company’s articles

of incorporation to reverse split the outstanding common stock 1,000-to-one and reduce the authorized common stock to 100,000,000

shares, par value $0.001, must be approved by the holders of at least a majority of the Company’s outstanding shares of

common stock.

The

proposal to effectuate the Recapitalization is a “nondiscretionary” item, meaning that brokerage firms cannot vote

shares in their discretion on your behalf if you have not given the broker instructions to vote your shares held in “street”

name. Abstentions will be counted as votes against this Proposal 1. Broker nonvotes will count in determining a quorum for purposes

of conducting the Special Meeting, but will not count for or against Proposal 1.

Procedure

for Effecting Recapitalization

If

the stockholders approve the Recapitalization, the Company will file an amendment to articles of incorporation with the Nevada

Secretary of State as quickly as practicable, which will become effective at filing.

No Appraisal

or Dissenters’ Rights

Under

Nevada corporate law, the Company’s stockholders are not entitled to appraisal or dissenters’ rights respecting the

Recapitalization, and the Company will not independently provide stockholders with any such right.

RECOMMENDATION:

The Board recommends a vote “FOR” the proposal to recapitalize the Company by reverse-splitting the Company’s

outstanding common stock 1,000-to-one and reducing the Company’s authorized common stock to 100,000,000 shares, par value

$0.001.

PROPOSAL

NO. 2

PROPOSED

AMENDMENT TO THE ARTICLES OF INCORPORATION

TO

AUTHORIZE A CLASS OF 5,000,000 SHARES OF PREFERRED STOCK

The

Company proposes to amend its articles of incorporation to authorize a class of 5,000,000 shares of preferred stock. Under the

proposed amendment, the Board will be authorized, without shareholder action, to issue up to 5,000,000 shares of preferred stock

in one or more series and to fix the number of shares and rights, preferences, and limitations of each series. Among the specific

matters that may be determined by the Board are the dividend rate, the redemption price, if any, conversion rights, if any, the

amount payable in the event of any voluntary liquidation or dissolution of the Company, and voting rights, if any. The provisions

of the proposed amended articles relating to the preferred stock allow the Board to issue preferred stock with multiple votes

per share and dividend rights, which would have priority over any dividends paid to the holders of common stock. The issuance

of preferred stock with these rights may make the removal of management difficult, even if the removal would be considered beneficial

to shareholders generally, and will have the effect of limiting shareholder participation in certain transactions such as mergers

or tender offers if these transactions are not favored by management.

The

Board approved the authorization of preferred stock to provide the Company with securities other than common stock that the Company

may issue to obtain financing for its future operations. Preferred stock may have different and preferential voting, dividend,

liquidation, or other rights to attract investment. Preferred stock may be issued in transactions that do not involve a general

public offering for cash and may contain the properties of an equity and a debt instrument. Any or all rights of the preferred

stock may be greater than the rights of the common stock, and the issuance of preferred stock with voting or conversion rights

may also dilute and adversely affect the voting power of the holders of common stock. In addition, preferred stock may be issued

as a means of preventing a hostile takeover. The Board has no plans to issue, and does not contemplate issuing, any preferred

stock in the foreseeable future.

RECOMMENDATION:

The Board recommends a vote “FOR” the proposal to amend the Company’s articles of incorporation to authorize

a class of 5,000,000 shares of preferred stock and to authorize the Board to fix the number of shares and rights, preferences,

and limitations of each series.

PROPOSAL

NO. 3

RECESS

OF THE SPECIAL MEETING TO SOLICIT ADDITIONAL PROXIES.

The

Board unanimously executed a written consent dated November [__], 2014, authorizing and recommending that the Company’s

stockholders approve a proposal to recess the Special Meeting on one or more occasions, if necessary or appropriate, to solicit

additional Proxies if there are insufficient votes at the time of the Special Meeting to approve the proposal to amend the Company’s

articles of incorporation to recapitalize the Company.

RECOMMENDATION:

The Board recommends a vote “FOR” the proposal to recess the Special Meeting on one or more occasions, if necessary

or appropriate, to solicit additional Proxies if there are insufficient votes at the time of the Special Meeting to approve the

proposal to amend the Company’s articles of incorporation to recapitalize the Company.

OTHER

MATTERS

Stockholder

Proposals

As

of the date of this Proxy Statement, the Board does not intend to present, and has not been informed that any other person intends

to present, any matter for action at the Special Meeting, other than as set forth herein and in the Notice of Meeting. If any

other matter properly comes before the Special Meeting, it is intended that the holders of proxies will act in accordance with

their best judgment on these matters. The proposal must be in accordance with the provisions of Rule 14a-8 promulgated by the

SEC under the Securities Exchange Act of 1934.

Solicitation

of Proxies

The

accompanying proxy is solicited on behalf of the Board. In addition to the solicitation of proxies by mail, certain of the Company’s

officers and employees, without extra compensation, may solicit proxies personally or by telephone and, if deemed necessary, third-party

solicitation agents may be engaged by the Company to solicit proxies by means of telephone, facsimile, or telegram, although no

such third party has been engaged by the Company, as of the date hereof.

Stockholders

who currently receive multiple copies of the Proxy Statement (and related documents) at their address and would like to request

“house holding” of their communications should contact their broker or, if a stockholder is a registered holder of

shares of common stock, he or she should submit a written request to the Company’s transfer agent for its common stock,

Interwest Stock Transfer, 1981 East 4800 South, Suite # 100, Salt Lake City, Utah 84117. Stockholders who are now “house

holding” their communications, but who wish to receive separate proxy statements (and related documents) in the future may

also notify the transfer agent. The Company will promptly deliver, upon written or oral request, a separate copy of the Proxy

Statement (and related documents) at a shared address to which a single copy was delivered.

FURTHER

INFORMATION

The

Company will provide, without charge, on the written request of any beneficial owner of shares of its common stock entitled to

vote at the Special Meeting, copies of the Copies of the Company’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2010, as filed with the Securities and Exchange Commission (“SEC”), will be furnished without charge

to any stockholder upon written request to CirTran Corporation, 4125 South 6000 West, West Valley City, Utah 84128, ATTN: Investor

Relations. This proxy statement and the Company’s 2010 Annual Report on Form 10-K for the fiscal year ended December 31,

2010, are also available on the SEC’s website at www.sec.gov.

Please

return the enclosed proxy card as soon as possible. Unless a quorum consisting of a majority of the outstanding shares entitled

to vote is represented at the Special Meeting, no business can be transacted. Therefore, please be sure to date and sign your

proxy card exactly as your name appears on your stock certificate and return it in the enclosed postage prepaid return envelope.

Please act promptly to ensure that you will be represented at this important meeting.

| |

By Order of the Board of Directors: |

| |

|

| |

|

| |

Iehab Hawatmeh |

| |

Chief Executive Officer and |

| |

Chairman of the Board of Directors |

| |

|

| Date: November ___, 2014 |

|

APPENDIX

1

SECOND

AMENDMENT

TO

THE ARTICLES OF INCORPORATION OF

CIRTRAN

CORPORATION

This

Second Amendment to the Articles of Incorporation of CirTran Corporation (hereinafter referred to as the “Corporation”),

have been duly adopted in accordance with Section 78.390 of the Nevada Revised Statutes.

1. Name.

The name of the Company is CirTran Corporation.

2. Amendment.

The text of the Articles of Incorporation is to be amended by striking Article IV, as amended to date, in its entirety, and inserting

a new Article IV reading as follows:

ARTICLE

IV

CAPITALIZATION

The

Corporation shall have the authority to issue 105,000,000 shares, of which 100,000,000 shares shall be common stock, par value

$0.001 per share (“Common Stock”), and 5,000,000 shares shall be preferred stock, par value $0.001 per share

(“Preferred Stock”). Shares of any class of stock may be issued, without stockholder action, in one or more

series, as may from time to time be determined by the board of directors. The board of directors is hereby expressly granted authority,

without stockholder action, and within the limits set forth in the Nevada Revised Statutes, to:

(a) designate,

in whole or in part, the voting powers, preferences, limitations, restrictions, and relative rights of any class of shares before

the issuance of any shares of that class;

(b) create

one or more series within a class of shares, fix the number of shares of each such series, and designate, in whole or part, the

voting powers, preferences, limitations, restrictions, and relative rights of the series, all before the issuance of any shares

of that series; or

(c) alter

or revoke the preferences, limitations, and relative rights granted to or imposed upon any wholly unissued class of shares or

any wholly unissued series of any class of shares.

The

allocation between the classes or among the series of each class of unlimited voting rights and the right to receive the Corporation’s

net assets upon dissolution shall be as designated by the board of directors. All rights accruing to the outstanding shares of

the Corporation not expressly provided for to the contrary herein or in the Corporation’s bylaws, or in any amendment hereto

or thereto, shall be vested in the Common Stock. Accordingly, unless and until otherwise designated by the board of directors,

and subject to any superior rights as so designated, the Common Stock shall have unlimited voting rights and be entitled to receive

the Corporation’s net assets upon dissolution.

Effective

as of __________ _____, 2014, (the “Effective Time”), each block of 1,000 issued and outstanding shares of

Common Stock shall thereupon be combined into one share of validly issued, fully paid, and nonassessable Common Stock. Each stock

certificate that prior to the Effective Time represented shares of Common Stock shall, following the Effective Time, represent

the number of shares of Common Stock into which the shares represented by such certificate shall be combined. The Corporation

shall not issue fractional shares or scrip as the result of the combination of shares, but shall issue to each record holder of

Common Stock that number of shares obtained by rounding fractional shares otherwise issuable pursuant to the foregoing combination

to the next higher number of whole shares.

The

foregoing Second Amendment to the Articles of Incorporation was adopted by resolution of the Corporation’s board of directors

on _________ _____, 2014, and by the holders of a majority of the Corporation’s issued and outstanding common stock on ____________

_____, 2014, pursuant to the Nevada Revised Statutes. The Corporation has only Common Stock issued and outstanding. The number

of shares of Common Stock issued and outstanding and entitled to vote on ___________ ____, 2014, the record date for consideration

of the foregoing amendment, was ______ for, ______ against, with ______ abstaining. By executing this Second Amendment to the

Articles of Incorporation, the president and the secretary do hereby certify that on ___________ _____, 2014, the foregoing amendment

was authorized and approved pursuant to Section 78.390 of the Nevada Revised Statutes. Each of the undersigned affirms and acknowledges,

under penalties of perjury, that the foregoing instrument is his act and deed and that the facts stated herein are true.

DATED

this _____ day of _______________, 2014.

CIRTRAN

CORPORATION

| By: |

|

|

By: |

|

| |

Iehab Hawatmeh,

President |

|

|

[Name of Secretary],

Secretary |

| STATE OF |

|

) |

|

| |

: |

ss. |

| COUNTY OF |

|

) |

|

On

this _____ day of ____________________, 2014, personally appeared before me, the undersigned, a notary public, Iehab Hawatmeh

and [Name of Secretary], who being first duly sworn, declared they are the president and secretary, respectively, of CirTran Corporation

acknowledged that they signed the foregoing Second Amendment to the Articles of Incorporation, and verified that the statements

contained therein are true.

IN

WITNESS WHEREOF, I have hereunto set my hand and official seal.

CIRTRAN

CORPORATION

Special

Meeting of Stockholders

December

[__], 2014

PROXY

This

Proxy is solicited on behalf of the Board of Directors for use at the

Special

Meeting on December [__], 2014

The undersigned

appoints Iehab Hawatmeh, Chairman of the Board of Directors, or, failing him, Fadi Nora, Director, with full power of substitution,

the attorney and proxy of the undersigned, to attend the Special Meeting of stockholders of CirTran Corporation, to be held December

[__], 2014, beginning at 10:00 a.m. MDT, at its corporate offices located at 4125 South 6000 West, West Valley City, Utah 84128,

and at any recess thereof, and to vote the stock the undersigned would be entitled to vote if personally present, on all matters

set forth in the Proxy Statement sent to stockholders, a copy of which has been received by the undersigned, as follows:

| Please mark your votes as indicated [X] |

Total Number of Shares Held: ____________ |

This proxy

when properly signed will be voted in the manner directed herein by the undersigned stockholder. IF NO DIRECTION IS MADE, THIS

PROXY WILL BE VOTED FOR THE PROPOSALS.

| 1. |

To approve a proposed amendment to the Company’s Articles of Incorporation to recapitalize the Company, by reverse-splitting the outstanding common stock 1,000-to-one and reducing the authorized common stock to 100,000,000 shares, par value $0.001: |

| |

|

|

| FOR |

AGAINST |

ABSTAIN |

| [ ] |

[ ] |

[ ] |

| |

|

|

| 2. |

To

approve a proposed amendment to the Company’s articles of incorporation to authorize a class of 5,000,000

shares of preferred stock and to authorize the Board to fix the number of shares and rights, preferences,

and limitations of each series: |

| |

|

| FOR |

AGAINST |

ABSTAIN |

| [ ] |

[ ] |

[ ] |

| |

|

|

| 3. |

To approve a proposal to recess the Special Meeting on one or more occasions, if necessary or appropriate, to solicit additional Proxies: |

| |

|

| FOR |

AGAINST |

ABSTAIN |

| [ ] |

[ ] |

[ ] |

| |

|

|

|

|

|

In

their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting.

IMPORTANT

- PLEASE SIGN AND RETURN PROMPTLY. When joint tenants hold shares, both should sign. When signing as attorney, executor, administrator,

trustee, or guardian, please give full title as such. If a corporation, please sign in full corporate name by president or other

authorized officer. If a partnership, please sign in partnership name by an authorized person. Please sign exactly as your name

appears on your stock certificate(s).

| |

|

|

|

|

| Print Name |

|

Signature |

|

Date |

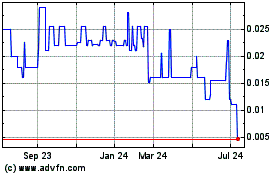

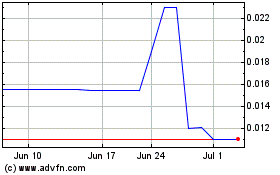

CirTran (PK) (USOTC:CIRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

CirTran (PK) (USOTC:CIRX)

Historical Stock Chart

From Apr 2023 to Apr 2024