UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): October 23, 2014

Merit Medical Systems, Inc.

(Exact name of registrant as specified in its charter)

|

| | | | |

Utah | | 0-18592 | | 87-0447695 |

(State or other jurisdiction of | | (Commission | | (I.R.S. Employer |

incorporation or organization) | | File Number) | | Identification No.) |

|

| | |

1600 West Merit Parkway | | |

South Jordan, Utah | | 84095 |

(Address of principal executive offices) | | (Zip Code) |

(801) 253-1600

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On October 23, 2014, Merit Medical Systems, Inc. ("Merit") issued a press release announcing its operating and financial results for the quarter ended September 30, 2014. The full text of Merit's press release, including unaudited financial information, is furnished herewith as Exhibit 99.1.

The information in this Current Report on Form 8-K (including the exhibit attached hereto) is furnished pursuant to General Instruction B.2. of Form 8-K and shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by Merit under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

99.1 Press Release issued by Merit, dated October 23, 2014, entitled "Merit Medical Announces Results for the Quarter Ended September 30, 2014," including unaudited financial statements.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| MERIT MEDICAL SYSTEMS, INC. |

| | |

| | |

Date: October 23, 2014 | By: | /s/ Rashelle Perry |

| | Rashelle Perry |

| | Chief Legal Officer |

EXHIBIT INDEX

|

| | |

EXHIBIT NUMBER | | DESCRIPTION |

| | |

99.1 | | Press Release, dated October 23, 2014, "Merit Medical Announces Results for the Quarter Ended September 30, 2014," including unaudited financial information. |

Exhibit 99.1

1600 West Merit Parkway • South Jordan, UT 84095

Telephone: 801-253-1600 • Fax: 801-253-1688

PRESSRELEASE

FOR IMMEDIATE RELEASE

|

| |

Date: | October 23, 2014 |

Contact: | Anne-Marie Wright, Vice President, Corporate Communications |

Phone: | (801) 208-4167 e-mail: awright@merit.com Fax: (801) 253-1688 |

MERIT MEDICAL ANNOUNCES RESULTS

FOR THE QUARTER ENDED SEPTEMBER 30, 2014

Revenues Up 12% for Third Quarter

Gross Margin Up 140 Basis Points Sequentially from Second Quarter

Income from Operations Improves to 9.4% for Third Quarter

Third Quarter SG&A Expenses Down 180 Basis Points Sequentially

Non-GAAP EPS $0.25 for Third Quarter

Relocation to Pearland, Texas Completed

PreludeEASE™ Hydrophilic Sheath Receives 510(k) Clearance

SOUTH JORDAN, UTAH- Merit Medical Systems, Inc. (NASDAQ: MMSI), a leading manufacturer and marketer of proprietary disposable medical devices used in interventional and diagnostic procedures, particularly in cardiology, radiology and endoscopy, today announced revenues of $128.8 million for the quarter ended September 30, 2014, an increase of 12% over revenues of $115.2 million for the third quarter of 2013. Revenues for the nine-month period ended September 30, 2014 were a record $376.9 million, compared with $329.0 million for the comparable nine-month period in 2013, an increase of 15%.

Merit’s non-GAAP net income for the quarter ended September 30, 2014, adjusted to eliminate non-recurring costs and amortization of intangibles, was a record $10.7 million, or $0.25 per share, compared to $10.5 million, or $0.25 per share, for the quarter ended September 30, 2013.

Merit’s non-GAAP net income for the nine months ended September 30, 2014, adjusted to eliminate non-recurring costs and amortization of intangibles, was $22.5 million, or $0.52 per share, compared to $21.1 million, or $0.49 per share, for the corresponding period of 2013.

GAAP net income for the quarter ended September 30, 2014 was a record $7.8 million, or $0.18 per share, compared to $5.6 million, or $0.13 per share, for the comparable quarter of 2013.

GAAP net income for the nine-month period ended September 30, 2014 was $14.3 million, or $0.33 per share, compared to $10.0 million, or $0.23 per share, for the corresponding period of 2013.

For both the three- and nine-month periods ended September 30, 2014, GAAP operating income and net income were affected by a net non-recurring, non-cash impairment of approximately $329,000 ($204,000 after tax). Merit recorded a write-down of intangible assets related to the decreased future revenue forecast of an acquired product.

In the third quarter of 2014, compared to the third quarter of 2013, BioSphere sales increased 25%; catheter sales grew 20%; stand-alone device sales increased 14%; inflation device sales were up 13%; Merit Endotek sales rose 6%; custom kit and tray sales were up 5%; and Malvern sales were down 9%.

For the nine-month period ended September 30, 2014, compared to the nine-month period ended September 30, 2013, BioSphere sales increased 33%; stand-alone device sales grew 17%; catheter sales rose 17%; inflation device sales were up 14%; Malvern sales increased 14%; custom kit and tray sales grew 6%; and Merit Endotek sales rose 6%.

Merit's non-GAAP gross margin was 46.7% of sales for the quarter ended September 30, 2014, compared to 46.5% of sales for the quarter ended September 30, 2013. Non-GAAP gross margin was 46.0% of sales for the nine months ended September 30, 2014, compared to 45.2% of sales for the nine months ended September 30, 2013. GAAP gross margin for the third quarter of 2014 was 44.6% of sales, compared to 44.3% of sales for the third quarter of 2013. Gross margin was up 140 basis points sequentially from 43.2% of sales from the second quarter of 2014. GAAP gross margin for the nine-month period ended September 30, 2014 was 43.8% of sales, compared to 42.9% of sales for the comparable period of 2013. The increase in gross margin from the three- and nine-month periods ended September 30, 2013 to the corresponding periods of 2014 was primarily related to lower average fixed overhead unit costs resulting from higher production volumes and a favorable product mix (primarily from sales of BioSphere products).

Non-GAAP selling, general and administrative expenses for the third quarter of 2014 were 27.1% of sales, compared to 26.2% of sales for the third quarter of 2013. Non-GAAP SG&A expenses for the nine months ended September 30, 2014 were 28.6% of sales, compared to 27.3% of sales for the nine months ended September 30, 2013. GAAP SG&A expenses for the third quarter of 2014 were 28.2% of sales, compared to 27.2% of sales for the third quarter of 2013. For the nine-month period ended September 30, 2014, GAAP SG&A expenses were 29.6% of sales, compared to 28.9% of sales for the first nine months of 2013. The increase in SG&A expenses for both periods was primarily related to headcount additions and the costs to support Merit’s domestic sales force reorganization, as well as international sales expansion and costs associated with the launch of Merit’s new facility in Pearland, Texas, which are currently being recorded as SG&A expenses during a transition period of approximately nine months as Merit completes the movement and qualification of production equipment from the old facility in Angleton, Texas to the new Pearland facility.

Research and development costs during the third quarter of 2014 were 6.7% of sales, compared to 6.3% of sales for the third quarter of 2013. Research and development costs were 7.2% of sales for the first nine months of 2014, compared to 7.6% of sales for the comparable period of 2013. The increase in research and development costs for the third quarter of 2014 can be attributed primarily to headcount additions and an Irish government research and development benefit in the third quarter of 2013 related to the completion of Merit’s new building in Galway, Ireland. The decrease in research and development expenses as a percentage of sales for the nine months ended September 30, 2014 was primarily the result of a higher rate of sales growth (15%), and a reduced rate of R&D expense growth (8%), compared to the same period in 2013.

“We are pleased with the progress we delivered in the third quarter, which is historically our slowest quarter,” said Fred P. Lampropoulos, Merit’s Chairman and Chief Executive Officer. “We believe our investments in automation and facilities are starting to pay off, and we still have a long way to go to reach the potential of our company.”

“Our relocation in Texas from Angleton to Pearland was completed in late September,” Lampropoulos continued. “We believe this move to a state-of-the-art facility will help protect our catheter and extrusion assets from regional weather risks and provide a larger talent pool for recruiting and retention.”

“We recently received 510(k) clearance for our PreludeEASE™ hydrophilic radial sheath,” Lampropoulos said. “We believe that the radial approach will continue to receive increased acceptance in the United States and that our recently launched ThinkRadial™ website will enhance our radial initiatives. We also expect that our ‘stick to stitch’ product offering and our robust product pipeline will continue to fuel growth.”

Merit’s income from operations was $12.1 million for the third quarter of 2014, compared to $8.4 million for the third quarter of 2013. For the nine-month period ended September 30, 2014, income from operations was $25.9 million, compared to $16.9 million for the corresponding period of 2013.

Merit’s income tax expense for the third quarter of 2014 reflected an effective tax rate of 24.3%, compared to an effective tax rate of 12.9% for the third quarter of 2013. For the nine-month period ended September 30, 2014, Merit’s effective tax rate was 25.6%, compared to 14.0% for the comparable period of 2013. The increase in the effective tax rate for both periods was primarily the result of a higher mix of earnings from Merit's U.S. operations, which are taxed at a higher rate than Merit's foreign operations (primarily Ireland).

CONFERENCE CALL

Merit invites all interested parties to participate in its conference call today, (Thursday, October 23rd, 2014) at 5:00 p.m. Eastern (4:00 p.m. Central, 3:00 p.m. Mountain, and 2:00 p.m. Pacific). The domestic telephone number to call is (888) 428-9490, and the international number is (719) 325-2494. A live webcast will also be available for the conference call at merit.com.

BALANCE SHEET

(In thousands)

|

| | | | | | | |

| September 30,

2014 | | December 31,

2013 |

| (Unaudited) | | |

ASSETS | | | |

Current Assets | | | |

Cash and cash equivalents | $ | 6,438 |

| | $ | 7,459 |

|

Trade receivables, net | 69,387 |

| | 60,186 |

|

Employee receivables | 181 |

| | 224 |

|

Other receivables | 4,221 |

| | 3,279 |

|

Inventories | 92,931 |

| | 82,378 |

|

Prepaid expenses | 5,687 |

| | 5,121 |

|

Prepaid income taxes | 1,199 |

| | 1,232 |

|

Deferred income tax assets | 5,626 |

| | 5,638 |

|

Income tax refunds receivable | 315 |

| | 398 |

|

Total Current Assets | 185,985 |

| | 165,915 |

|

| | | |

Property and equipment, net | 247,655 |

| | 243,270 |

|

Other intangibles, net | 111,237 |

| | 119,987 |

|

Goodwill | 184,505 |

| | 184,505 |

|

Deferred income tax assets | 799 |

| | 800 |

|

Other assets | 16,328 |

| | 13,806 |

|

Total Assets | $ | 746,509 |

| | $ | 728,283 |

|

| | | |

LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

Current Liabilities | | | |

Trade payables | 26,709 |

| | 26,511 |

|

Accrued expenses | 32,374 |

| | 27,702 |

|

Current portion of long-term debt | 10,318 |

| | 10,000 |

|

Advances from employees | 894 |

| | 292 |

|

Income taxes payable | 3,805 |

| | 1,089 |

|

Total Current Liabilities | 74,100 |

| | 65,594 |

|

| | | |

Deferred income tax liabilities | 2,335 |

| | 2,548 |

|

Liabilities related to unrecognized tax benefits | 1,187 |

| | 2,031 |

|

Deferred compensation payable | 8,477 |

| | 7,833 |

|

Deferred credits | 2,934 |

| | 3,065 |

|

Long-term debt | 230,484 |

| | 238,854 |

|

Other long-term obligation | 2,741 |

| | 2,652 |

|

Total Liabilities | 322,258 |

| | 322,577 |

|

| | | |

Stockholders' Equity | | | |

Common stock | 182,614 |

| | 177,775 |

|

Retained earnings | 241,291 |

| | 226,988 |

|

Accumulated other comprehensive income | 346 |

| | 943 |

|

Total stockholders' equity | 424,251 |

| | 405,706 |

|

Total Liabilities and Stockholders' Equity | $ | 746,509 |

| | $ | 728,283 |

|

INCOME STATEMENT

(Unaudited, in thousands except per share amounts)

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2014 | | 2013 | | 2014 | | 2013 |

| | | | | | | |

SALES | $ | 128,808 |

| | $ | 115,210 |

| | $ | 376,909 |

| | $ | 329,033 |

|

| | | | | | | |

COST OF SALES | 71,387 |

| | 64,180 |

| | 211,821 |

| | 188,025 |

|

| | | | | | | |

GROSS PROFIT | 57,421 |

| | 51,030 |

| | 165,088 |

| | 141,008 |

|

| | | | | | | |

OPERATING EXPENSES | | | | | | | |

Selling, general and administrative | 36,328 |

| | 31,350 |

| | 111,682 |

| | 95,002 |

|

Research and development | 8,688 |

| | 7,308 |

| | 27,109 |

| | 25,064 |

|

Intangible asset impairment charge | 1,102 |

| | 8,089 |

| | 1,102 |

| | 8,089 |

|

Contingent consideration benefit | (773 | ) | | (4,108 | ) | | (754 | ) | | (4,075 | ) |

Total | 45,345 |

| | 42,639 |

| | 139,139 |

| | 124,080 |

|

| | | | | | | |

INCOME FROM OPERATIONS | 12,076 |

| | 8,391 |

| | 25,949 |

| | 16,928 |

|

| | | | | | | |

OTHER INCOME (EXPENSE) | | | | | | | |

Interest income | 41 |

| | 69 |

| | 187 |

| | 200 |

|

Interest (expense) | (2,008 | ) | | (1,916 | ) | | (6,967 | ) | | (5,297 | ) |

Other income (expense) | 144 |

| | (104 | ) | | 52 |

| | (174 | ) |

Total other (expense) - net | (1,823 | ) | | (1,951 | ) | | (6,728 | ) | | (5,271 | ) |

| | | | | | | |

INCOME BEFORE INCOME TAX EXPENSE | 10,253 |

| | 6,440 |

| | 19,221 |

| | 11,657 |

|

| | | | | | | |

INCOME TAX EXPENSE | 2,489 |

| | 833 |

| | 4,918 |

| | 1,627 |

|

| | | | | | | |

NET INCOME | $ | 7,764 |

| | $ | 5,607 |

| | $ | 14,303 |

| | $ | 10,030 |

|

| | | | | | | |

EARNINGS PER SHARE- | | | | | | | |

Basic | $ | 0.18 |

| | $ | 0.13 |

| | $ | 0.33 |

| | $ | 0.24 |

|

| | | | | | | |

Diluted | $ | 0.18 |

| | $ | 0.13 |

| | $ | 0.33 |

| | $ | 0.23 |

|

| | | | | | | |

AVERAGE COMMON SHARES- | | | | | | | |

Basic | 43,229 |

| | 42,596 |

| | 43,054 |

| | 42,560 |

|

| | | | | | | |

Diluted | 43,398 |

| | 42,872 |

| | 43,315 |

| | 42,793 |

|

| | | | | | | |

Although Merit’s financial statements are prepared in accordance with accounting principles which are generally accepted in the United States of America (“GAAP”), Merit’s management believes that certain non-GAAP financial measures provide investors with useful information regarding the underlying business trends and performance of Merit’s ongoing operations and can be useful for period-over-period comparisons of such operations. The following table sets forth supplemental financial data and corresponding reconciliations to GAAP financial statements for the three- and nine-month periods ended September 30, 2014 and 2013, respectively. Readers should consider these non-GAAP measures in addition to, not as a substitute for, financial reporting measures prepared in accordance with GAAP. These non-GAAP financial measures exclude some, but not all, items that affect Merit's net income. Additionally, these calculations may not be comparable with similarly titled measures of other companies.

NON-GAAP FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2014 AND 2013

|

| | | | | | | | | | | | | | | |

| | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2014 | | 2013 | | 2014 | | 2013 |

Non-GAAP ADJUSTMENTS | | | | | | | |

GAAP net income | $ | 7,764 |

| | $ | 5,607 |

| | $ | 14,303 |

| | $ | 10,030 |

|

| | | | | | | |

Acquisition costs | 3 |

| | 32 |

| | 89 |

| | 526 |

|

Mark-up on finished goods (a) | | | 164 |

| | | | 744 |

|

Severance | 28 |

| | 65 |

| | 149 |

| | 1,411 |

|

Long-term asset impairment charges (b) | 396 |

| | 27 |

| | 717 |

| | 80 |

|

Intangible asset impairment charge (c) | 1,102 |

| | 8,089 |

| | 1,102 |

| | 8,089 |

|

Long-term debt issuance charges | 247 |

| | 199 |

| | 741 |

| | 597 |

|

Amortization of intangible assets | | | | | | | |

Cost of sales | 2,790 |

| | 2,363 |

| | 8,311 |

| | 7,089 |

|

SG&A expense | 960 |

| | 1,076 |

| | 2,851 |

| | 3,322 |

|

Contingent consideration benefit (d) | (773 | ) | | (4,108 | ) | | (754 | ) | | (4,075 | ) |

Income tax effect of reconciling items (e) | (1,806 | ) | | (3,005 | ) | | (5,018 | ) | | (6,758 | ) |

| | | | | | | |

Non-GAAP net income | $ | 10,711 |

| | $ | 10,509 |

| | $ | 22,491 |

| | $ | 21,055 |

|

| | | | | | | |

Non-GAAP net income per share | $ | 0.25 |

| | $ | 0.25 |

| | $ | 0.52 |

| | $ | 0.49 |

|

| | | | | | | |

Diluted shares used to compute Non-GAAP net income per share | 43,398 |

| | 42,872 |

| | 43,315 |

| | 42,793 |

|

Merit’s non-GAAP income for adjustments referenced in the preceding table does not reflect stock-based compensation expense of approximately $341,000 and approximately $289,000 for the three months ended September 30, 2014 and 2013, respectively, and stock-based compensation of approximately $1.0 million and approximately $1.1 million for the nine months ended September 30, 2014 and 2013, respectively.

(a) Increase in cost of goods sold related to the mark-up of finished goods associated with Merit's acquisition of Thomas Medical Products, Inc.

(b) Amounts represent abandoned patents and some property, plant and equipment.

(c) Represents impairment of certain intangible assets.

(d) Represents changes in the fair value of contingent consideration liabilities for recent acquisitions.

(e) Reflects an estimated annual income tax rate of 38% on a non-GAAP basis.

ABOUT MERIT

Founded in 1987, Merit Medical Systems, Inc. is engaged in the development, manufacture and distribution of proprietary disposable medical devices used in interventional and diagnostic procedures, particularly in cardiology, radiology and endoscopy. Merit serves client hospitals worldwide with a domestic and international sales force totaling approximately 200 individuals. Merit employs approximately 3,000 people worldwide, with facilities in South Jordan, Utah; Pearland, Texas, Richmond, Virginia; Malvern, Pennsylvania; Maastricht and Venlo, The Netherlands; Paris, France; Galway, Ireland; Beijing, China; and Rockland, Massachusetts.

Statements contained in this release which are not purely historical, including, without limitation, statements regarding Merit's forecasted revenues, net income, financial results or anticipated acquisitions, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and are subject to risks and uncertainties such as those described in Merit's Annual Report on Form 10-K for the year ended December 31, 2013. Such risks and uncertainties include risks relating to Merit's potential inability to successfully manage growth through acquisitions, including the inability to commercialize technology acquired through completed, proposed or future transactions; product recalls and product liability claims; expenditures relating to research, development, testing and regulatory approval or clearance of Merit's products and risks that such products may not be developed successfully or approved for commercial use; greater governmental scrutiny and regulation of the medical device industry; reforms to the 510(k) process administered by the U.S. Food and Drug Administration; compliance with governmental regulations and administrative procedures; potential restrictions on Merit's liquidity or its ability to operate its business in compliance with its current debt agreements; possible infringement of Merit's technology or the assertion that Merit's technology infringes the rights of other parties; the potential of fines, penalties or other adverse consequences if Merit's employees or agents violate the U.S. Foreign Corrupt Practices Act or other laws and regulations; laws targeting fraud and abuse in the healthcare industry; potential for significant adverse changes in, or failure to comply with, governing regulations; the effect of changes in tax laws and regulations in the United States or other countries; increases in the prices of commodity components; negative changes in economic and industry conditions in the United States and other countries; termination or interruption of relationships with Merit's suppliers, or failure of such suppliers to perform; fluctuations in Euro and GBP exchange rates; Merit's need to generate sufficient cash flow to fund its debt obligations, capital expenditures, and ongoing operations; concentration of Merit's revenues among a few products and procedures; development of new products and technology that could render Merit's existing products obsolete; market acceptance of new products; volatility in the market price of Merit's common stock; modification or limitation of governmental or private insurance reimbursement policies; changes in health care markets related to health care reform initiatives; failure to comply with applicable environmental laws; changes in key personnel; work stoppage or transportation risks; uncertainties associated with potential healthcare policy changes which may have a material adverse effect on Merit; introduction of products in a timely fashion; price and product competition; availability of labor and materials; cost increases; fluctuations in and obsolescence of inventory; and other factors referred to in Merit's Annual Report on Form 10-K for the year ended December 31, 2013 and other materials filed with the Securities and Exchange Commission. All subsequent forward-looking statements attributable to Merit or persons acting on its behalf are expressly qualified in their entirety by these cautionary statements. Actual results will likely differ, and may differ materially, from anticipated results. Financial estimates are subject to change and are not intended to be relied upon as predictions of future operating results, and Merit assumes no obligation to update or disclose revisions to those estimates.

# # #

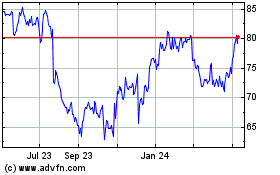

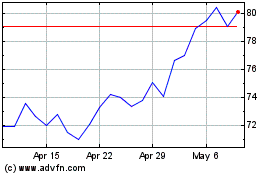

Merit Medical Systems (NASDAQ:MMSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Merit Medical Systems (NASDAQ:MMSI)

Historical Stock Chart

From Apr 2023 to Apr 2024