Current Report Filing (8-k)

October 23 2014 - 7:50AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 23, 2014

ALTISOURCE PORTFOLIO SOLUTIONS S.A.

(Exact name of Registrant as specified in its charter)

|

Luxembourg |

|

001-34354 |

|

98-0554932 |

|

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

40, avenue Monterey

L-2163 Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive offices including zip code)

+352 2469 7900

(Registrant’s telephone number, including area code)

NOT APPLICABLE

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition

On October 23, 2014, Altisource Portfolio Solutions S.A. (“Altisource”) issued a press release announcing financial results for its quarter ended September 30, 2014. A copy of the press release is attached hereto as Exhibit 99.1.

The information in this Item 2.02, including the information in Exhibit 99.1, is furnished solely pursuant to Item 2.02 of this Form 8-K. Consequently, it is not deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of that Section. It may only be incorporated by reference in another filing under the Securities Exchange Act of 1934 or Securities Act of 1933 if such subsequent filing specifically references this Item 2.02 of this Form 8-K.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

|

Exhibit No. |

|

Description |

|

Exhibit 99.1 |

|

Press Release of Altisource Portfolio Solutions S.A. dated October 23, 2014 |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: October 23, 2014

|

|

Altisource Portfolio Solutions S.A. |

|

|

|

|

|

By: |

/s/ Michelle D. Esterman |

|

|

Name: |

Michelle D. Esterman |

|

|

Title: |

Chief Financial Officer |

3

Exhibit 99.1

|

|

|

|

|

|

|

FOR IMMEDIATE RELEASE |

FOR FURTHER INFORMATION CONTACT: |

|

|

|

|

|

Michelle D. Esterman |

|

|

Chief Financial Officer |

|

|

T: +352 2469 7950 |

|

|

E: Michelle.Esterman@altisource.lu |

ALTISOURCE ANNOUNCES THIRD QUARTER RESULTS

Luxembourg, October 23, 2014 - Altisource Portfolio Solutions S.A. (“Altisource” and NASDAQ: ASPS) today reported strong third quarter year-over-year growth in service revenue, net income attributable to shareholders and diluted earnings per share.

Third Quarter 2014 Results Compared to Third Quarter 2013:

· Service revenue of $247.7 million, a 37% increase

· Net income attributable to Altisource of $42.3 million, a 17% increase

· Diluted earnings per share of $1.79, a 26% increase

“During the third quarter 2014, we continued to execute on our objective of increasing shareholder value by repurchasing Altisource shares, making acquisitions that support our vision to become the premier real estate and mortgage marketplace and investing in the organic development of new and next generation products and services,” said Chairman William Erbey.

William Shepro, Chief Executive Officer, further commented, “We continue our track record of year-over-year revenue and earnings growth and remain focused on our strategic initiatives to achieve longer-term revenue growth with a diversified customer base. Compared to the second quarter of 2014, we believe a portion of the lower service revenue in the third quarter of 2014 is not lost, but will be shifted to future periods. Further, operating income as a percentage of service revenue in our segments remained relatively consistent in the third quarter of 2014 compared to the second quarter of 2014, except for Technology Services where we continue investing in the development of our new and next generation products. Unlike many companies, we expense internal software development costs.”

Third quarter 2014 highlights include:

· The average number of loans serviced by Ocwen on REALServicing was 2.3 million for the third quarter of 2014, an increase of 83% compared to the third quarter of 2013

· The average number of delinquent non-Government-Sponsored Enterprise loans serviced by Ocwen on REALServicing was 347 thousand for the third quarter of 2014, an increase of 15% compared to the third quarter of 2013

· On September 12, 2014, we acquired Mortgage Builder for $15.7 million in cash at closing and up to $7.0 million of additional consideration (subject to attaining certain revenue targets)

1

· We repurchased 1.3 million shares of our common stock under our stock repurchase program at an average price of $102.45 per share during the third quarter of 2014

Forward-Looking Statements

This press release contains forward-looking statements that involve a number of risks and uncertainties. Those forward-looking statements include all statements that are not historical fact, including statements about management’s beliefs and expectations. Forward-looking statements are based on management’s beliefs as well as assumptions made by and information currently available to management. Because such statements are based on expectations as to future economic performance and are not statements of historical fact, actual results may differ materially from those projected. The Company undertakes no obligation to update any forward-looking statements whether as a result of new information, future events or otherwise. The risks and uncertainties to which forward-looking statements are subject include, but are not limited to: Altisource’s ability to retain existing customers and attract new customers; general economic and market conditions; governmental regulations, taxes and policies; availability of adequate and timely sources of liquidity; and other risks and uncertainties detailed in the “Forward-Looking Statements,” “Risk Factors” and other sections of the Company’s Form 10-K and other filings with the Securities and Exchange Commission.

Webcast

Altisource will host a webcast at 11:00 a.m. EDT today to discuss our third quarter results. A link to the live audio webcast will be available on the Company’s website through the Investor Relations home page. Those who want to listen to the call should go to the website fifteen minutes prior to the call to register, download and install any necessary audio software. A replay of the conference call will be available via the website approximately two hours after the conclusion of the call and will remain available for approximately 30 days.

About Altisource

Altisource is a premier marketplace and transaction solutions provider for the real estate, mortgage and consumer debt industries offering both distribution and content. We leverage proprietary business process, vendor and electronic payment management software and behavioral science based analytics to improve outcomes for marketplace participants. Additional information is available at www.altisource.com.

2

ALTISOURCE PORTFOLIO SOLUTIONS S.A.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(unaudited)

|

|

|

Three months ended |

|

Nine months ended |

|

|

|

|

September 30, |

|

September 30, |

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Service revenue |

|

|

|

|

|

|

|

|

|

|

Mortgage Services |

|

$ |

170,018 |

|

$ |

134,317 |

|

$ |

504,989 |

|

$ |

350,581 |

|

|

Financial Services |

|

26,803 |

|

27,168 |

|

76,496 |

|

66,259 |

|

|

Technology Services |

|

61,726 |

|

25,175 |

|

167,213 |

|

70,189 |

|

|

Eliminations |

|

(10,836 |

) |

(6,268 |

) |

(27,863 |

) |

(17,411 |

) |

|

|

|

247,711 |

|

180,392 |

|

720,835 |

|

469,618 |

|

|

Reimbursable expenses |

|

39,149 |

|

29,496 |

|

100,220 |

|

73,061 |

|

|

Non-controlling interests |

|

828 |

|

947 |

|

1,974 |

|

3,093 |

|

|

Total revenue |

|

287,688 |

|

210,835 |

|

823,029 |

|

545,772 |

|

|

Cost of revenue |

|

149,575 |

|

104,765 |

|

420,308 |

|

275,134 |

|

|

Reimbursable expenses |

|

39,149 |

|

29,496 |

|

100,220 |

|

73,061 |

|

|

Gross profit |

|

98,964 |

|

76,574 |

|

302,501 |

|

197,577 |

|

|

Selling, general and administrative expenses |

|

46,748 |

|

31,519 |

|

139,303 |

|

80,027 |

|

|

Income from operations |

|

52,216 |

|

45,055 |

|

163,198 |

|

117,550 |

|

|

Other income (expense), net: |

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

(6,480 |

) |

(6,188 |

) |

(16,040 |

) |

(14,302 |

) |

|

Other income (expense), net |

|

131 |

|

(253 |

) |

135 |

|

529 |

|

|

Total other income (expense), net |

|

(6,349 |

) |

(6,441 |

) |

(15,905 |

) |

(13,773 |

) |

|

Income before income taxes and non-controlling interests |

|

45,867 |

|

38,614 |

|

147,293 |

|

103,777 |

|

|

Income tax provision |

|

(2,752 |

) |

(1,659 |

) |

(9,300 |

) |

(6,227 |

) |

|

Net income |

|

43,115 |

|

36,955 |

|

137,993 |

|

97,550 |

|

|

Net income attributable to non-controlling interests |

|

(828 |

) |

(947 |

) |

(1,974 |

) |

(3,093 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Altisource |

|

$ |

42,287 |

|

$ |

36,008 |

|

$ |

136,019 |

|

$ |

94,457 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

1.96 |

|

$ |

1.56 |

|

$ |

6.16 |

|

$ |

4.07 |

|

|

Diluted |

|

$ |

1.79 |

|

$ |

1.42 |

|

$ |

5.63 |

|

$ |

3.77 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

21,626 |

|

23,025 |

|

22,071 |

|

23,185 |

|

|

Diluted |

|

23,640 |

|

25,333 |

|

24,152 |

|

25,070 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Transactions with related parties included above: |

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

178,151 |

|

$ |

143,557 |

|

$ |

502,736 |

|

$ |

354,889 |

|

|

Cost of revenue |

|

11,062 |

|

5,045 |

|

27,904 |

|

13,959 |

|

|

Selling, general and administrative expenses |

|

267 |

|

613 |

|

(464 |

) |

329 |

|

|

Other income |

|

— |

|

— |

|

— |

|

773 |

|

3

ALTISOURCE PORTFOLIO SOLUTIONS S.A.

CONSOLIDATED BALANCE SHEETS

(in thousands, except per share data)

(unaudited)

|

|

|

September 30, |

|

December 31, |

|

|

|

|

2014 |

|

2013 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

176,589 |

|

$ |

130,429 |

|

|

Accounts receivable, net |

|

159,965 |

|

104,787 |

|

|

Prepaid expenses and other current assets |

|

17,454 |

|

10,891 |

|

|

Deferred tax assets, net |

|

2,837 |

|

2,837 |

|

|

Total current assets |

|

356,845 |

|

248,944 |

|

|

|

|

|

|

|

|

|

Premises and equipment, net |

|

115,773 |

|

87,252 |

|

|

Deferred tax assets, net |

|

158 |

|

622 |

|

|

Goodwill |

|

72,384 |

|

99,414 |

|

|

Intangible assets, net |

|

250,315 |

|

276,162 |

|

|

Other assets |

|

21,117 |

|

17,658 |

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

816,592 |

|

$ |

730,052 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

99,598 |

|

$ |

84,706 |

|

|

Current portion of long-term debt |

|

5,945 |

|

3,975 |

|

|

Deferred revenue |

|

13,504 |

|

36,742 |

|

|

Other current liabilities |

|

9,683 |

|

10,131 |

|

|

Total current liabilities |

|

128,730 |

|

135,554 |

|

|

|

|

|

|

|

|

|

Long-term debt, less current portion |

|

584,028 |

|

391,281 |

|

|

Other non-current liabilities |

|

14,572 |

|

45,476 |

|

|

|

|

|

|

|

|

|

Equity: |

|

|

|

|

|

|

Common stock ($1.00 par value; 100,000 shares authorized; 25,413 issued and 20,747 outstanding as of September 30, 2014; 25,413 issued and 22,629 outstanding as of December 31, 2013) |

|

25,413 |

|

25,413 |

|

|

Additional paid-in capital |

|

90,911 |

|

89,273 |

|

|

Retained earnings |

|

369,952 |

|

239,561 |

|

|

Treasury stock, at cost (4,666 shares as of September 30, 2014 and 2,784 shares as of December 31, 2013) |

|

(398,217 |

) |

(197,548 |

) |

|

Altisource equity |

|

88,059 |

|

156,699 |

|

|

|

|

|

|

|

|

|

Non-controlling interests |

|

1,203 |

|

1,042 |

|

|

Total equity |

|

89,262 |

|

157,741 |

|

|

|

|

|

|

|

|

|

Total liabilities and equity |

|

$ |

816,592 |

|

$ |

730,052 |

|

4

ALTISOURCE PORTFOLIO SOLUTIONS S.A.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

|

|

|

Nine months ended |

|

|

|

|

September 30, |

|

|

|

|

2014 |

|

2013 |

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net income |

|

$ |

137,993 |

|

$ |

97,550 |

|

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

21,086 |

|

13,791 |

|

|

Amortization of intangible assets |

|

29,290 |

|

18,857 |

|

|

Change in the fair value of Equator Earn Out |

|

(37,924 |

) |

— |

|

|

Goodwill impairment |

|

37,473 |

|

— |

|

|

Share-based compensation expense |

|

1,638 |

|

2,076 |

|

|

Equity in losses of investment in affiliate |

|

— |

|

176 |

|

|

Bad debt expense |

|

4,667 |

|

1,338 |

|

|

Amortization of debt discount |

|

191 |

|

184 |

|

|

Amortization of debt issuance costs |

|

799 |

|

702 |

|

|

Deferred income taxes |

|

464 |

|

— |

|

|

Loss on disposal of fixed assets |

|

98 |

|

1,178 |

|

|

Changes in operating assets and liabilities, net of effects of acquisitions: |

|

|

|

|

|

|

Accounts receivable |

|

(58,725 |

) |

3,762 |

|

|

Prepaid expenses and other current assets |

|

(6,525 |

) |

(6,142 |

) |

|

Other assets |

|

(1,656 |

) |

(1,871 |

) |

|

Accounts payable and accrued expenses |

|

14,968 |

|

4,574 |

|

|

Other current and non-current liabilities |

|

(18,141 |

) |

(1,535 |

) |

|

Net cash provided by operating activities |

|

125,696 |

|

134,640 |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

Additions to premises and equipment |

|

(48,119 |

) |

(20,528 |

) |

|

Acquisition of businesses, net of cash acquired |

|

(14,931 |

) |

(204,567 |

) |

|

Proceeds from loan to Ocwen |

|

— |

|

75,000 |

|

|

Proceeds from sale of equity affiliate |

|

— |

|

12,648 |

|

|

Other investing activities |

|

(294 |

) |

(50 |

) |

|

Net cash used in investing activities |

|

(63,344 |

) |

(137,497 |

) |

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

Proceeds from issuance of long-term debt |

|

198,000 |

|

201,000 |

|

|

Repayment of long-term debt and payments on capital lease obligations |

|

(3,474 |

) |

(2,736 |

) |

|

Debt issuance costs |

|

(2,608 |

) |

(2,400 |

) |

|

Proceeds from stock option exercises |

|

2,523 |

|

4,710 |

|

|

Purchase of treasury stock |

|

(208,820 |

) |

(87,418 |

) |

|

Contributions from non-controlling interests |

|

— |

|

18 |

|

|

Distributions to non-controlling interests |

|

(1,813 |

) |

(3,234 |

) |

|

Net cash (used in) provided by financing activities |

|

(16,192 |

) |

109,940 |

|

|

|

|

|

|

|

|

|

Net increase in cash and cash equivalents |

|

46,160 |

|

107,083 |

|

|

Cash and cash equivalents at the beginning of the period |

|

130,429 |

|

105,502 |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at the end of the period |

|

$ |

176,589 |

|

$ |

212,585 |

|

|

|

|

|

|

|

|

|

Supplemental cash flow information: |

|

|

|

|

|

|

Interest paid |

|

$ |

15,049 |

|

$ |

13,592 |

|

|

Income taxes paid, net |

|

12,112 |

|

2,360 |

|

|

|

|

|

|

|

|

|

Non-cash investing and financing activities: |

|

|

|

|

|

|

Increase in payables for purchases of premises and equipment |

|

$ |

482 |

|

$ |

1,947 |

|

|

Decrease in acquisition of businesses from subsequent working capital true-ups |

|

(3,711 |

) |

(2,039 |

) |

5

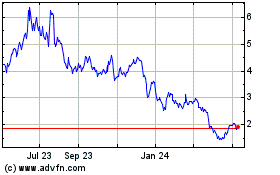

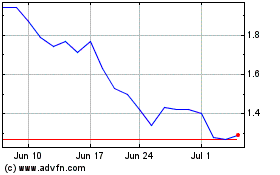

Altisource Portfolio Sol... (NASDAQ:ASPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Altisource Portfolio Sol... (NASDAQ:ASPS)

Historical Stock Chart

From Apr 2023 to Apr 2024