The ETF industry continues to evolve, as more unique products

make their debut; however, the exchange-traded landscape is still

dominated by passive, index-based instruments. This shouldn’t come

as a surprise, because after all, investors have embraced this

product wrapper for its unparalleled ease-of-use and

cost-efficiency, with many of these funds earning

themselves the reputation as “core holdings” in countless

portfolios. On the other end of the spectrum, actively-managed ETFs

haven’t exactly been in the spotlight as many criticize their

above-average expense ratios and failure to deliver exceptional

returns. While this may be true for some, it’s certainly not the

case when it comes to the TrimTabs Float Shrink ETF (TTFS).

Inside TTFS’s Strategy

TTFS takes an entirely different approach to security selection

when compared to other actively-managed equity ETFs or even

so-called “smart beta” products; for the most part, these other

funds start with a broad universe of securities, apply a number of

fundamental filters, and ultimately end up with a basket of

holdings that is more-or-less a trimmed down version of some

broader index out there. While there is nothing inherently wrong

with this approach, it does help to illustrate why TTFS is unique

[see also TrimTabs Insights: What "Float-Shrink" Means to

Investors].

The TrimbTabs Float Shrink ETF separates itself from the pack in

that it relies on supply and demand criteria to select its

underlying securities rather than fundamental metrics, such as

dividend yield or earnings growth. At the root of TTFS’s

methodology is a liquidity-based approach that revolves around

three main criteria:

1. Float Shrink – the

management team tracks the number of shares outstanding for

more than 3,000 securities. This is where supply-demand theory

kicks in; securities with a decreasing number of shares

outstanding, or a shrinking float, are selected as candidates

because all else being equal, the same amount of money chasing a

fewer number of shares should translate into price

appreciation.

1. Float Shrink – the

management team tracks the number of shares outstanding for

more than 3,000 securities. This is where supply-demand theory

kicks in; securities with a decreasing number of shares

outstanding, or a shrinking float, are selected as candidates

because all else being equal, the same amount of money chasing a

fewer number of shares should translate into price

appreciation.

2. Profitability – TTFS does employ some fundamental screening

criteria; for starters, a company’s profitability as measured by

free cash flow is considered. The more cash flow positive a stock

is, the better, since that hints at a potential uptick in

demand for that security.

3. Leverage Ratio – The management team also looks to avoid

companies with fragile balance sheets; to do so, TTFS aims to focus

on securities with a stable leverage ratio.

In summary, TTFS’s strategy is actually quite straightforward;

the management team aims to select securities with a contracting

supply, as evidenced by a decreasing number of shares outstanding,

and those that have the potential to see an increase in demand, as

evidenced by increasing profitability and a stable leverage ratio.

Simply put, if supply is decreasing and demand is increasing,

logic points to higher prices.

Under the Hood of TTFS

When all is said and done, TTFS is left with 100 securities from

a starting universe of approximately 3,000. The securities that

make the cut are those that boast the most favorable of all three

criteria outlined in the strategy section above. Aside from

employing such a rigorous screening methodology, TFFS’s underlying

portfolio also separates itself from many other funds in the equity

space in that its equal-weighted rather than market

capitalization-weighted. In essence, every security

receives roughly the same allocation, which results in a tilt

towards small- and mid-cap stocks that might otherwise be more

neglected when it comes to allocations in other market cap-weighted

funds [see also Comparing Alternative Weighting Methodologies].

Digging deeper, let’s see what made the cut in TTFS; keep in

mind however that because the portfolio is actively-managed, it’s

allocations are bound to evolve over time and the holdings

are re-balanced on a monthly basis.

At the time of writing, some of the top holdings in TTFS

include: Allied World Assurance (AWH), Ross Stores (ROST), Axis

Capital Holdings (AXS), Expeditors International (EXPD), and TJX

Companies (TJX). In terms of sectors, TTFS holds the biggest

allocations in the Information Technology and Consumer

Discretionary sectors, at around 20% each, while Healthcare,

Industrials, and Financials make up the next biggest chunks.

Overall, because of its rigorous screening coupled with

an equal-weighted approach, this ETF’s underlying

portfolio is well-balanced.

Considerations for TTFS’s Performance

Investors should note that, generally, TTFS’s performance will

be very similar to the broader U.S. equity market. As an

actively-managed product, this ETF’s performance should be compared

to its stated benchmark, which is the Russell 3000 Index. Below,

let’s consider how this ETF has performed versus the iShares

Russell 3000 ETF (IWV) since its inception on October 5th of

2011 through mid-October of 2014:

Over the years, TTFS has managed to

return approximately 46%, outperforming the Russell 3000 ETF, which

has returned approximately 34% in that same time frame. While it’s

true that TTFS is more expensive, charging 0.99% in management fees

compared to IWV’s 0.20%, this wide of a margin in performance since

it debuted is enough to make you forget about its steeper expense

ratio [see The Cheapest ETF for Every Investment

Objective].

Over the years, TTFS has managed to

return approximately 46%, outperforming the Russell 3000 ETF, which

has returned approximately 34% in that same time frame. While it’s

true that TTFS is more expensive, charging 0.99% in management fees

compared to IWV’s 0.20%, this wide of a margin in performance since

it debuted is enough to make you forget about its steeper expense

ratio [see The Cheapest ETF for Every Investment

Objective].

How to Use TTFS in a Portfolio

In light of TTFS’s above-average expense ratio, it’s difficult

to recommend this as a core holding over the long-haul, especially

for cost-conscious investors. With that being said, those that lack

U.S. equity exposure and find the liquidity-based approach

compelling (and the impressive track record thus far) may consider

this is a viable alternative to other passive, index-based

equity funds.

All in all, TTFS is perhaps best utilized as a tactical holding

for those looking to build out their equity exposure. For some,

this can certainly be a core holding; however, the actively-managed

approach does introduce a degree of risk that may steer away more

conservative investors, and especially those looking to minimize

costs.

The Bottom Line

The methodology employed by TTFS makes it one of the most

unique ETFs on the market; more importantly, its impressive track

record should serve as a testament that actively-managed

products can in fact deliver stellar results that are worth the

higher management fees. For anyone looking to diversify their

equity exposure with a one-of-a-kind strategy, TTFS most certainly

warrants a closer look.

Follow me on Twitter @Sbojinov

[For more ETF analysis, make sure to

sign up for our free ETF newsletter]

Disclosure: No positions at time of

writing.

Click here to read the original article on ETFdb.com.

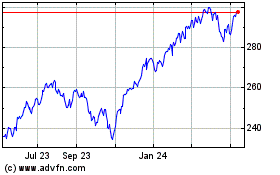

iShares Russell 3000 (AMEX:IWV)

Historical Stock Chart

From Mar 2024 to Apr 2024

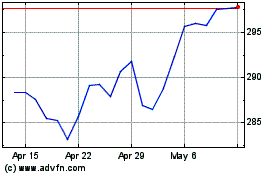

iShares Russell 3000 (AMEX:IWV)

Historical Stock Chart

From Apr 2023 to Apr 2024