UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

October 16, 2014

CONSOLIDATED COMMUNICATIONS HOLDINGS, INC.

(Exact name of registrant as specified in its

charter)

| |

|

|

|

|

| Delaware |

|

000-51446 |

|

02-0636095 |

| (State of Incorporation) |

|

(Commission File Number) |

|

(IRS employer identification no.) |

| 121 South 17th Street |

|

|

| Mattoon, Illinois |

|

61938-3987 |

| (Address of principal executive offices) |

|

(Zip code) |

Registrant’s telephone number, including

area code: (217) 235-3311

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| [ ] | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425) |

| [ ] | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b)) |

| [ ] | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c)) |

Item 1.01. Entry into a Material Definitive

Agreement.

The information set forth below under Item 2.01 of this Current

Report on Form 8-K is hereby incorporated into this Item 1.01 by reference.

Item 2.01. Completion of Acquisition or Disposition of

Assets.

On October 16, 2014, the Company completed its acquisition

of Enventis Corporation, formerly Hickory Tech Corporation (“Enventis”). Pursuant to an Agreement and Plan of Merger,

dated as of June 29, 2014 (the “Merger Agreement”), among the Company, Sky Merger Sub Inc., a Minnesota corporation

and wholly-owned subsidiary of the Company (“Merger Sub”), and Enventis, Merger Sub merged with and into Enventis (the

“Merger”), with Enventis as the surviving company.

At

the effective time of the Merger, each share of Enventis common stock converted into the right to receive 0.7402 shares of common

stock of the Company, or an approximate aggregate total of 10,144,959 shares of the Company’s common stock.

No fractional shares of Company common stock will be issued

to any Enventis shareholder in the Merger. Each Enventis shareholder who would otherwise have been entitled to receive a fraction

of a share of Company common stock in the Merger will receive an amount in cash (without interest), rounded to the nearest whole

cent, equal to the product obtained by multiplying (i) the fractional share of Company common stock to which such holder would

otherwise be entitled by (ii) $25.40 (which represents the last reported sale price of Company common stock on the Nasdaq Stock

Market on the last complete trading day prior to the date of the effective time of the Merger).This description of the Merger is

qualified in its entirety by reference to the Merger Agreement, a complete copy of which was filed as Exhibit 2.1 to the Current

Report on Form 8-K filed by the Company on June 30, 2014 and is incorporated herein by reference.

A

copy of the press release, dated October 16, 2014, announcing the completion of the Merger is included as Exhibit 99.1 to

this Current Report on Form 8-K and incorporated into this Item 2.01 by reference.

In addition, as previously disclosed by the Company in a Current

Report on Form 8-K filed on September 24, 2014, on September 18, 2014, Consolidated Communications Finance II Co. (“Finance

Co.”), an indirect wholly owned subsidiary of the Company, completed an offering of $200.0 million aggregate principal amount

of its 6.50% Senior Notes due 2022 (the “Notes”). The Notes were issued pursuant to an indenture, dated as of September

18, 2014 (the “Indenture”), between Finance Co. and Wells Fargo Bank, National Association (“Wells Fargo”),

as trustee (the “Trustee”). On October 16, 2014, the net proceeds of the offering were released from escrow and used

to (i) pay the fees and expenses in connection with the Company’s acquisition of Enventis discussed above (the “Acquisition”),

(ii) repay existing indebtedness of Enventis, and (iii) repurchase, together with cash on hand, $46.754 million in principal amount

of Consolidated Communications, Inc.’s, a direct, wholly owned subsidiary of the Company (“CCI”), outstanding

10.875% senior notes due 2020 (the “2020 Notes”), at a price of 116.75%, including premium, accrued interest and fees,

of the principal amount, for $56.492 million.

In connection with the closing of the issuance of the Notes, Finance

Co. entered into an Escrow and Security Agreement dated as of September 18, 2014 (the “Escrow Agreement”), by and among

Finance Co., the Trustee, Wells Fargo, as escrow agent, and Wells Fargo, as financial institution, pursuant to which the proceeds

of the Notes offering were placed in an escrow account, which proceeds were released on October 16, 2014 in connection with the

consummation of the Acquisition. In connection with the closing of the issuance of the Notes, Finance Co. and Morgan Stanley &

Co. LLC, as representative of itself, Wells Fargo Securities, LLC and RBS Securities Inc., entered into a Registration Rights Agreement

with respect to the Notes dated as of September 18, 2014 (the “Registration Rights Agreement”).

For a description of the Indenture, the Escrow Agreement and the

Registration Rights Agreement, see the Current Report on Form 8-K filed by the Company on September 24, 2014, which is incorporated

herein by reference.

The conditions to the release of the funds from the escrow account

under the Escrow Agreement included, among other things, the concurrent occurrence of the Acquisition, the merger of Finance Co.

with and into CCI, with CCI as the surviving corporation (the “Finance Co. Merger”), the assumption by CCI of all of

the obligations of Finance Co. under the Notes, the Indenture and the Registration Rights Agreement, and the Company and certain

subsidiaries of the Company (the “Guarantors”) providing guarantees under the Notes and the Indenture and becoming

parties to the Registration Rights Agreement.

On October 16, 2014, the Finance Co. Merger was consummated.

CCI, the Guarantors and the Trustee have entered into a First Supplemental Indenture, dated as of October 16, 2014, to the Indenture,

pursuant to which CCI assumed all of the obligations of Finance Co. under the Notes and the Indenture and the Guarantors guaranteed

the Notes. CCI and the Guarantors have become parties to the Registration Rights Agreement by executing a Joinder dated October

16, 2014. The First Supplemental Indenture is filed as Exhibit 4.1 to this Current Report on Form 8-K and is incorporated herein

by reference, and the Joinder is filed as Exhibit 4.3 to this Current Report on Form 8-K and is incorporated herein by reference.

On October 16, 2014, CCI, the Guarantors and the Trustee

entered into a Fourth Supplemental Indenture, dated as of October 16, 2014, to that certain indenture, dated as of May 30, 2012,

as supplemented and amended, between CCI and Wells Fargo, as Trustee, for the 2020 Notes (the “2020 Notes Indenture”)

pursuant to which the Guarantors confirmed that their respective guarantee obligations under the 2020 Note Indenture apply to the

obligations of CCI following the Finance Co. Merger (the “Fourth Supplemental Indenture”). The Fourth Supplemental

Indenture is filed as Exhibit 4.4 to this Current Report on Form 8-K and is incorporated herein by reference.

Item

5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory

Arrangements of Certain Officers.

Pursuant to the Merger Agreement, Enventis was entitled to

select, and the Company agreed to take all such action as may be reasonably necessary to cause, one individual from among the current

members of the board of directors of Enventis to be elected to the Company’s board of directors as of the effective time

of the Merger.

On October 15, 2014, at the request of Enventis’ board

of directors, the Company’s board of directors elected Dale E. Parker, age 62, as a Class II Director of the Company, with

such election to become effective as of the effectiveness of the Merger and with a term to expire at the 2016 annual meeting of

the Company’s stockholders. As a result, on October 16, 2014, when the Merger became effective, Mr. Parker’s election

as a Class II Director of the Company became effective.

As a non-employee director, Mr. Parker will participate in

the Company’s director compensation program, pursuant to which directors currently receive the following compensation: (1)

$25,000 annual cash retainer and (2) $1,250 for board meetings attended in person and $750 for committee meetings attended in person,

with meeting fees halved for each board or board committee meeting attended by means of telephone conference call. The Company

also reimburses all non-employee directors for reasonable expenses incurred to attend board or board committee meetings. In addition,

Mr. Parker will be eligible to receive an annual restricted share award pursuant to the Amended and Restated Consolidated Communications

Holdings, Inc. 2005 Long-Term Incentive Plan. The number of shares will be determined by dividing $61,000 by the 20-day average

closing price of the stock as of two trading days before the award date, and all of the restricted shares will vest on the December

5th following the date of the award.

Mr. Parker was a director on the Enventis board from 2006

until the consummation of the Merger on October 16, 2014, and served as Chair of the Hickory Tech Board from January 2011 to May

2013. Mr. Parker has been the Chief Operating Officer (COO), Chief Financial Officer (CFO) and Treasurer for Image Sensing Systems

since June 2013. Mr. Parker also continues to serve on the board of Image Sensing Systems, Inc., of St. Paul, Minnesota, a technology

company focused in infrastructure improvement through the development of software–based detection solutions for the intelligent

transportation systems sector. Mr. Parker served as interim CFO for Ener1, Inc. from 2011 to 2012. Ener1, Inc. is an energy storage

technology company that develops lithium-ion-powered storage solutions for application in the electric utility, transportation

and industrial electronics markets. In 2010, Mr. Parker worked as CFO of Neenah Enterprises, Inc., an independent foundry. From

2009 to 2010 Mr. Parker was the Vice President of Finance for Paper Works, a producer of coated recycled paper board. Mr. Parker

was CFO at Forest Resources, LLC, a company focused on paper product production and conversion, from 2007 to October 2008. Mr.

Parker is a CPA and holds an MBA.

On October 17, 2014, Christopher A. Young, Chief Information

Officer of the Company, informed the Company of his decision to retire from the Company, effective March 31, 2015. Mr. Young

plans to continue as an employee of the Company until March 31, 2015 in order to ensure a smooth transition of his duties.

Stephen J. Shirar, a Senior Vice President and Secretary of the Company will become the Chief Information Officer of the Company,

effective October 17, 2014, and will continue to serve as Secretary of the Company.

Item 9.01. Financial Statements and Exhibits.

(a) Financial

statements of businesses acquired.

The financial statements required by Item 9.01(a) will be filed

with the Securities and Exchange Commission by amendment to this Current Report on Form 8-K not later than 71 days after the date

on which this Current Report on Form 8-K is required to be filed.

(b) Pro forma financial information.

The financial statements required by Item 9.01(b) will be filed

with the Securities and Exchange Commission by amendment to this Current Report on Form 8-K not later than 71 days after the date

on which this Current Report on Form 8-K is required to be filed.

(d) Exhibits.

| Exhibit No. |

|

Description |

| 2.1* |

|

Agreement

and Plan of Merger, dated as of June 29, 2014, by and among the Company, Enventis and Merger Sub (incorporated by reference

to Exhibit 2.1 to Current Report on Form 8-K dated June 30, 2014)

|

| 4.1 |

|

First Supplemental Indenture, dated as of October 16, 2014, among

the Company, CCI, Consolidated Communications Enterprise Services, Inc. (“CCES”), Consolidated Communications of Fort

Bend Company (“CCFBC”), Consolidated Communications of Pennsylvania Company, LLC (“CCPC”), Consolidated

Communications Services Company (“CCSC”), Consolidated Communications of Texas Company (“CCTC”), SureWest

Communications (“SW Communications”), SureWest Fiber Ventures, LLC (“SW Fiber Ventures”), SureWest Kansas,

Inc. (“SW Kansas”), SureWest Long Distance (“SW Long Distance”), SureWest Telephone (“SW Telephone”),

SureWest TeleVideo (“SW TeleVideo”) and Wells Fargo Bank, National Association

|

| 4.2 |

|

Form of 6.50% Senior Note due 2022 (incorporated by reference to

Exhibit A to Exhibit 4.1)

|

| 4.3 |

|

Joinder to Registration Rights Agreement, dated as of October 16,

2014, by the Company, CCI, CCES, CCFBC, CCPC, CCSC, CCTC, SW Communications, SW Fiber Ventures, SW Kansas, SW Long Distance, SW

Telephone and SW TeleVideo

|

| 4.4 |

|

Fourth Supplemental Indenture, dated as of October 16, 2014, among

the Company, CCI, CCES, CCFBC, CCPC, CCSC, CCTC, SW Communications, SW Fiber Ventures, SW Kansas, SW Long Distance, SW Telephone,

SW TeleVideo and Wells Fargo Bank, National Association

|

| 99.1 |

|

Press Release dated October 16, 2014 |

* Schedules and other attachments to the Agreement and Plan of Merger,

which are listed in the exhibit, are omitted. The Company agrees to furnish supplementally a copy of any schedule or other attachment

to the Securities and Exchange Commission upon request.

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| Date: October 22, 2014 |

|

|

| |

Consolidated Communications Holdings, Inc. |

|

|

|

| |

By: |

/s/ Steven L. Childers |

| |

Name: Steven L. Childers

Title: Chief Financial Officer |

| |

|

EXHIBIT INDEX

| Exhibit No. |

|

Description |

| 2.1* |

|

Agreement and Plan of Merger, dated as of June 29, 2014, by and among the Company, Enventis and Merger Sub (incorporated by reference to Exhibit 2.1 to Current Report on Form 8-K dated June 30, 2014) |

| 4.1 |

|

First Supplemental Indenture, dated as of October 16, 2014, among the Company, CCI, Consolidated Communications Enterprise Services, Inc. (“CCES”), Consolidated Communications of Fort Bend Company (“CCFBC”), Consolidated Communications of Pennsylvania Company, LLC (“CCPC”), Consolidated Communications Services Company (“CCSC”), Consolidated Communications of Texas Company (“CCTC”), SureWest Communications (“SW Communications”), SureWest Fiber Ventures, LLC (“SW Fiber Ventures”), SureWest Kansas, Inc. (“SW Kansas”), SureWest Long Distance (“SW Long Distance”), SureWest Telephone (“SW Telephone”), SureWest TeleVideo (“SW TeleVideo”), and Wells Fargo Bank, National Association |

| 4.2 |

|

Form of 6.50% Senior Note due 2022 (incorporated by reference to Exhibit A to Exhibit 4.1) |

| 4.3 |

|

Joinder to Registration Rights Agreement, dated as of October 16, 2014, by the Company, CCI, CCES, CCFBC, CCPC, CCSC, CCTC, SW Communications, SW Fiber Ventures, SW Kansas, SW Long Distance, SW Telephone, SW TeleVideo |

| 4.4 |

|

Fourth Supplemental Indenture, dated as of October 16, 2014, among the Company, CCI, CCES, CCFBC, CCPC, CCSC, CCTC, SW Communications, SW Fiber Ventures, SW Kansas, SW Long Distance, SW Telephone, SW TeleVideo, and Wells Fargo Bank, National Association |

| 99.1 |

|

Press Release dated October 16, 2014 |

* Schedules and other attachments to the Agreement and Plan of

Merger, which are listed in the exhibit, are omitted. The Company agrees to furnish supplementally a copy of any schedule or other

attachment to the Securities and Exchange Commission upon request.

Exhibit 4.1

FIRST SUPPLEMENTAL INDENTURE (this “Supplemental

Indenture”), dated as of October 16, 2014, among Consolidated Communications Holdings, Inc., a Delaware corporation (“Holdings”),

Consolidated Communications, Inc., an Illinois corporation and a wholly owned subsidiary of Holdings (the “Successor”),

the guarantors listed on the signature pages hereto (together with Holdings, the “Guarantors”), and Wells Fargo

Bank, National Association, a national banking association, as trustee (the “Trustee”) under the Indenture referred

to below.

W I T N E S S E T H

WHEREAS, Consolidated Communications Finance

II Co., a Delaware corporation (the “Company”), and the Trustee have heretofore executed and delivered an Indenture,

dated as of September 18, 2014 (as amended, supplemented or otherwise modified from time to time, the “Indenture”),

providing for the issuance by the Company of its 6.50% Senior Notes due 2022 (the “Notes”).

WHEREAS, the Company and the Successor have

entered into an Agreement and Plan of Merger, dated of even date herewith (the “Finance Co. Merger Agreement”),

which contemplates the filing of (i) a certificate of merger with the Secretary of State of the State of Delaware and (ii) articles

of merger with the Secretary of State of the State of Illinois, in each case, providing for the merger (the “Merger”)

of the Company with and into the Successor, with the Successor continuing its corporate existence under the laws of the State of

Illinois as the surviving company of the Merger;

WHEREAS, Section 5.01 of the Indenture

provides, among other things, that the Company may merge with or into another Person; provided that, among other things,

(i) the Person formed by any merger with or into the Company (if other than the Company) expressly assumes, by a supplemental

indenture executed and delivered to the Trustee, all of the obligations of the Company under the Notes and the Indenture and (ii) the

Indenture, as so supplemented, remains in full force and effect;

WHEREAS, Section 9.01(a)(iii) of the

Indenture provides, among other things, that the Indenture and Notes may be amended or supplemented without the consent of any

Holder to provide for the assumption of the Company’s obligations to Holders in the case of a merger consummated pursuant

to Article 5 of the Indenture;

WHEREAS, the Successor desires and has requested

that the Trustee join in the execution of this Supplemental Indenture for the purpose of evidencing such assumption by the Successor;

WHEREAS, Section 4.17 of the Indenture

provides that, to the extent not a party to the Indenture upon the original execution thereof, each Person required to become a

Guarantor shall execute and deliver to the Trustee a supplemental indenture, pursuant to which it shall become a Guarantor under

Article 10 of the Indenture and shall Guarantee the obligations of the Company under the Indenture and the Notes;

WHEREAS, Section 9.01(a)(vi) of the

Indenture provides, among other things, that the Indenture and Notes may be amended or supplemented without the consent of any

Holder to add Note Guarantees with respect to the Notes;

WHEREAS, the Guarantors named herein desire

to execute this Supplemental Indenture in order to evidence the Guarantors’ Note Guarantees under Article 10 of the Indenture;

WHEREAS, the execution and delivery of this

Supplemental Indenture has been authorized by resolutions of the boards of directors of the Successor and the Guarantors; and

WHEREAS, all conditions precedent and requirements

necessary to make this Supplemental Indenture a valid and legally binding instrument in accordance with its terms have been complied

with, performed and fulfilled, and the execution and delivery hereof has been in all respects duly authorized.

NOW THEREFORE, in consideration of the foregoing

and for other good and valuable consideration, the receipt and adequacy of which is hereby acknowledged, the Successor, the Guarantors

and the Trustee mutually covenant and agree for the benefit of each other and the equal and ratable benefit of the Holders as follows:

ARTICLE 1

DEFINITIONS

Section 1.1

Defined Terms. As used in this Supplemental Indenture, terms defined in the Indenture or in the preamble or recitals

hereto are used herein as therein defined. The words “herein,” “hereof” and “hereby” and other

words of similar import used in this Supplemental Indenture refer to this Supplemental Indenture as a whole and not to any particular

section hereof.

ARTICLE 2

REPRESENTATIONS,

WARRANTIES AND AGREEMENTS OF

THE SUCCESSOR AND THE GUARANTORS

Section 2.1

The Successor and each Guarantor represents, warrants and agrees as follows:(a)

(a) It is a corporation or a limited

liability company duly organized, validly existing and in good standing under the laws of its respective state of incorporation

or formation, as applicable.

(b) The execution, delivery and performance

by it of this Supplemental Indenture has been authorized and approved by all necessary corporate or other action on its part and

this Supplemental Indenture is its valid and legally binding obligation, enforceable against it in accordance with its terms.

(c) The Merger will become effective

in accordance with the laws of the State of Delaware and the State of Illinois when (i) the certificate of merger, with respect

to the Merger, is accepted by the Secretary of State of the State of Delaware and (ii) the articles of merger, with respect to

the Merger, are accepted by the Secretary of State of the State of Illinois (the time the Merger becomes effective being the “Effective

Time”). Written notice of the Effective Time shall be promptly provided by the Successor to the Trustee.

(d) The Indenture, as supplemented

by this Supplemental Indenture, shall remain in full force and effect in accordance with its terms immediately after the execution

of this Supplemental Indenture.

ARTICLE 3

ASSUMPTION AND AGREEMENTS

Section 3.1

As of the Effective Time, the Successor hereby assumes the due and punctual payment of the principal of, premium, if any,

and interest and Additional Interest, if any, on the Notes, and the due and punctual performance and observance of all other covenants,

conditions and other obligations contained in the Indenture on the part of the Company to be performed or observed.

Section 3.2

Notes authenticated and delivered after the execution of this Supplemental Indenture shall be substantially in the form

of Exhibit A hereto.

Section 3.3

The Successor shall succeed to, and be substituted for, and may exercise every right and power of, the Company under the

Indenture and the Notes, with the same effect as if the Successor had been named as “the Company” therein.

ARTICLE 4

NOTE GUARANTEES

Section 4.1

As of the Effective Time, the Guarantors named herein hereby agree, jointly and severally with all other Guarantors, to

fully, unconditionally and irrevocably Guarantee to each Holder and the Trustee, the Successor’s obligations under the Indenture

and the Notes on the terms and subject to the conditions set forth in Article 10 of the Indenture and to be bound by all other

applicable provisions of the Indenture applicable to “Guarantors.”

ARTICLE 5

MISCELLANEOUS

Section 5.1

Execution and Delivery. This Supplemental Indenture shall be effective upon execution by the parties hereto. The

Guarantors agree that the Note Guarantee shall remain in full force and effect notwithstanding any failure to endorse on each Note

a notation of the Note Guarantee.

Section 5.2

Benefits Acknowledged. Each Guarantor’s Note Guarantee is subject to the terms and conditions set forth in

the Indenture. Each Guarantor acknowledges that it will receive direct and indirect benefits from the financing arrangements contemplated

by the Indenture and this Supplemental Indenture and that the guarantee and waivers made by it pursuant to its Note Guarantee and

this Supplemental Indenture are knowingly made in contemplation of such benefits.

Section 5.3

Ratification of Indenture; Supplemental Indenture Part of Indenture. Except as expressly amended hereby, the Indenture

is in all respects ratified and confirmed and all the terms, conditions and provisions thereof shall remain in full force and effect.

This Supplemental Indenture shall form a part of the Indenture for all purposes, and every Holder of Notes heretofore or hereafter

authenticated and delivered shall be bound hereby.

Section 5.4

Severability. In case any provision in this Supplemental Indenture shall be invalid, illegal or unenforceable, the

validity, legality and enforceability of the remaining provisions shall not in any way be affected or impaired thereby and such

provision shall be ineffective only to the extent of such invalidity, illegality or unenforceability.

Section 5.5

No Recourse Against Others. Pursuant to Section 12.07 of the Indenture, no director, officer, employee, incorporator

or stockholder of the Successor or the Guarantors, as such, shall have any liability for any obligations of the Successor or the

Guarantors under the Notes, the Indenture, this Supplemental Indenture, the Note Guarantees or for any claim based on, in respect

of, or by reason of, such obligations or their creation. This waiver and release are part of the consideration for the Note Guarantee.

Section 5.6

Governing Law. THE LAWS OF THE STATE OF NEW YORK SHALL GOVERN AND BE USED TO CONSTRUE THIS SUPPLEMENTAL INDENTURE.

Section 5.7

Waiver of Jury Trial. EACH OF THE SUCCESSOR, THE GUARANTORS AND THE TRUSTEE HEREBY IRREVOCABLY WAIVES, TO THE FULLEST

EXTENT PERMITTED BY APPLICABLE LAW, ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY LEGAL PROCEEDING ARISING OUT OF OR RELATING TO THIS

INDENTURE, THE NOTES, THE NOTE GUARANTEES OR THE TRANSACTIONS CONTEMPLATED HEREBY.

Section 5.8

Counterparts. The parties may sign any number of copies of this Supplemental Indenture (including by electronic transmission).

Each signed copy shall be an original, but all of them together represent the same agreement. The exchange of copies of this Supplemental

Indenture and of signature pages by facsimile or PDF transmission shall constitute effective execution and delivery of this

Supplemental Indenture as to the parties hereto and may be used in lieu of the original Supplemental Indenture for all purposes.

Signatures of the parties hereto transmitted by facsimile or PDF shall be deemed to be their original signatures for all purposes.

Section 5.9

Effect of Headings. The Section headings herein are for convenience only and shall not affect the construction hereof.

Section 5.10

Trustee. The Trustee shall not be responsible in any manner whatsoever for or in respect of the validity or sufficiency

of this Supplemental Indenture or for or in respect of the recitals contained herein, all of which recitals are made solely by

the Guarantors and the Company.

[Signature

pages follow]

IN WITNESS WHEREOF, the parties hereto have

caused this Supplemental Indenture to be duly executed as of the day and year first above written.

| |

Consolidated Communications, Inc.,

as the Successor |

| |

By: |

/s/ Steven L. Childers |

| |

|

Name: |

Steven L. Childers |

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

| |

Consolidated Communications

Holdings, Inc., as a Guarantor |

| |

By: |

/s/ Steven L. Childers |

| |

|

Name: |

Steven L. Childers |

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

| |

Consolidated Communications

Enterprise services, inc., as a Guarantor |

| |

By: |

/s/ Steven L. Childers |

| |

|

Name: |

Steven L. Childers |

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

| |

Consolidated Communications

services company, as a Guarantor |

| |

By: |

/s/ Steven L. Childers |

| |

|

Name: |

Steven L. Childers |

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

[Signature Page to Supplemental Indenture]

| |

Consolidated Communications

of fort bend company, as a Guarantor |

| |

By: |

/s/ Steven L. Childers |

| |

|

Name: |

Steven L. Childers |

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

| |

Consolidated Communications

of texas company, as a Guarantor |

| |

By: |

/s/ Steven L. Childers |

| |

|

Name: |

Steven L. Childers |

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

| |

Consolidated Communications

of PENNSYLVANIA company, llc,

as a Guarantor |

| |

By: |

/s/ Steven L. Childers |

| |

|

Name: |

Steven L. Childers |

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

| |

SuREWEST COMMUNICATIONS, as a Guarantor |

| |

By: |

/s/ Steven L. Childers |

| |

|

Name: |

Steven L. Childers |

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

| |

SUREWEST TELEPHONE, as a Guarantor |

| |

By: |

/s/ Steven L. Childers |

| |

|

Name: |

Steven L. Childers |

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

[Signature Page to Supplemental Indenture]

| |

SUREWEST LONG DISTANCE, as a Guarantor |

| |

By: |

/s/ Steven L. Childers |

| |

|

Name: |

Steven L. Childers |

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

| |

SUREWEST TELEVIDEO, as a Guarantor |

| |

By: |

/s/ Steven L. Childers |

| |

|

Name: |

Steven L. Childers |

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

| |

SUREWEST FIBER VENTURES, LLC, as a Guarantor |

| |

By: |

/s/ Steven L. Childers |

| |

|

Name: |

Steven L. Childers |

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

| |

SUREWEST KANSAS, INC., as a Guarantor |

| |

By: |

/s/ Steven L. Childers |

| |

|

Name: |

Steven L. Childers |

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

| |

Wells fargo bank, national association, as Trustee |

| |

By: |

/s/ Julius R. Zamora |

| |

|

Name: |

Julius R. Zamora |

| |

|

Title: |

Vice President |

[Signature Page to Supplemental Indenture]

Exhibit 4.3

$200,000,000

CONSOLIDATED COMMUNICATIONS FINANCE II CO.

6.50% SENIOR NOTES DUE 2022

JOINDER TO REGISTRATION RIGHTS AGREEMENT

October 16, 2014

Morgan Stanley & Co. LLC

As Representative of the Initial Purchasers

| c/o | | Morgan Stanley & Co. LLC

1585 Broadway

New York, New York 10036 |

Ladies and Gentlemen:

Reference is made to the Registration Rights Agreement

dated as of September 18, 2014, among Consolidated Communications Finance II Co. (the “Issuer”) and Morgan Stanley &

Co. LLC, as representative of the Initial Purchasers. Capitalized terms used in this Joinder Agreement without definition have

the respective meanings given to them in the Registration Rights Agreement.

The undersigned Consolidated Communications,

Inc. (the “Company”), hereby agrees to accede to the terms of, and assume all of the obligations of the Issuer

set forth in, the Registration Rights Agreement, as though the Company had entered into the Registration Rights Agreement on the

Closing Date and been named as the “Issuer” therein. The Company agrees that such obligations include, without limitation,

(a) all of the obligations of the Issuer to perform and comply with all of the agreements thereof contained in the Registration

Rights Agreement, including the obligation to pay Additional Interest, and (b) the Issuer’s indemnification and other

obligations contained in Section 6 of the Registration Rights Agreement. The Company acknowledges and agrees that all references

to the Issuer in the Registration Rights Agreement shall include the Company and that the Company shall be bound by all provisions

of the Registration Rights Agreement containing such references.

The undersigned Guarantors hereby agree, on

a joint and several basis, to accede to the terms of the Registration Rights Agreement and to undertake and perform all of the

obligations of the “Guarantors” set forth therein as though the undersigned Guarantors had entered into the Registration

Rights Agreement on the Closing Date and been named as “Guarantors” therein. The undersigned Guarantors agree that

such obligations include, without limitation, (a) all of the obligations of the Guarantors to perform and comply with all

of the agreements thereof contained in the Registration Rights Agreement, including the obligation to pay Additional Interest,

and (b) the Guarantors’ indemnification and other obligations contained in Section 6 of the Registration Rights

Agreement. Each of the undersigned Guarantors acknowledges and agrees that all references to the Guarantors in the Registration

Rights Agreement shall include the undersigned Guarantors and that the undersigned Guarantors shall be bound by all provisions

of the Registration Rights Agreement containing such references.

THIS JOINDER AGREEMENT SHALL BE GOVERNED

BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK.

This Joinder Agreement may be executed in any

number of counterparts (including by electronic transmission) and by the parties hereto in separate counterparts, each of which

when so executed shall be deemed to be an original and all of which taken together shall constitute one and the same agreement.

Delivery of an executed counterpart of a signature page by facsimile, e-mail or other electronic means shall be effective

as delivery of a manually executed counterpart.

[Signature Pages Follow]

IN WITNESS WHEREOF, the parties hereto have

executed this Joinder Agreement as of the date first written above.

| |

Consolidated Communications, Inc. |

| |

By: |

/s/ Steven L. Childers |

| |

|

Name: |

Steven L. Childers |

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

| |

Consolidated

Communications

Holdings, Inc., as a Guarantor |

| |

By: |

/s/ Steven L. Childers |

| |

|

Name: |

Steven L. Childers |

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

| |

Consolidated Communications

Enterprise services, inc., as a Guarantor |

| |

By: |

/s/ Steven L. Childers |

| |

|

Name: |

Steven L. Childers |

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

| |

Consolidated Communications

services company, as a Guarantor |

| |

By: |

/s/ Steven L. Childers |

| |

|

Name: |

Steven L. Childers |

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

| |

Consolidated Communications

of fort bend company, as a Guarantor |

| |

By: |

/s/ Steven L. Childers |

| |

|

Name: |

Steven L. Childers |

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

[Signature Page to Form of Joinder

to Registration Rights Agreement]

| |

Consolidated Communications

of texas company, as a Guarantor |

| |

By: |

/s/ Steven L. Childers |

| |

|

Name: |

Steven L. Childers |

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

| |

Consolidated Communications

of PENNSYLVANIA company, llc, as a Guarantor |

| |

By: |

/s/ Steven L. Childers |

| |

|

Name: |

Steven L. Childers |

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

| |

Surewest communications, as a Guarantor |

| |

By: |

/s/ Steven L. Childers |

| |

|

Name: |

Steven L. Childers |

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

| |

Surewest telephone, as a Guarantor |

| |

By: |

/s/ Steven L. Childers |

| |

|

Name: |

Steven L. Childers |

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

[Signature Page to Form of Joinder

to Registration Rights Agreement]

| |

Surewest long distance, as a Guarantor |

| |

By: |

/s/ Steven L. Childers |

| |

|

Name: |

Steven L. Childers |

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

| |

Surewest televideo, as a Guarantor |

| |

By: |

/s/ Steven L. Childers |

| |

|

Name: |

Steven L. Childers |

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

| |

Surewest fiber ventures, llc, as a Guarantor |

| |

By: |

/s/ Steven L. Childers |

| |

|

Name: |

Steven L. Childers |

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

| |

Surewest kansas, inc., as a Guarantor |

| |

By: |

/s/ Steven L. Childers |

| |

|

Name: |

Steven L. Childers |

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

[Signature Page to Form of Joinder

to Registration Rights Agreement]

Exhibit 4.4

FOURTH SUPPLEMENTAL INDENTURE (this “Supplemental

Indenture”), dated as of October 16, 2014, among Consolidated Communications Holdings, Inc., a Delaware corporation (“Holdings”),

Consolidated Communications, Inc., an Illinois corporation and a wholly owned subsidiary of Holdings (as successor to Consolidated

Communications Finance Co., the “Company”), and the guarantors listed on the signature page hereto (together

with Holdings, the “Guarantors”), and Wells Fargo Bank, National Association, a national banking association

(or its permitted successor), as trustee under the Indenture referred to below (the “Trustee”). Capitalized

terms used herein without definition shall have the meanings ascribed to them in the Indenture.

W I T N E S S E T H

WHEREAS, the Company and the Guarantors party

thereto have heretofore executed and delivered an Indenture, dated as of May 30, 2012, as amended by a First Supplemental Indenture,

dated as of July 2, 2012, a Second Supplemental Indenture, dated as of August 3, 2012, and a Third Supplemental Indenture, dated

as of April 1, 2014 (as amended, supplemented or otherwise modified from time to time, the “Indenture”), providing

for the issuance by the Company of its 10.875% Senior Notes due 2020 (the “Notes”);

WHEREAS, pursuant to Indenture, dated as of

September 18, 2014, between Consolidated Communications Finance II Co., a Delaware corporation and subsidiary of the Company (“Finance

II”), and Wells Fargo Bank, National Association, a national banking association, as Trustee, on the date hereof Finance

II is merging with and into the Company (the “Merger”);

WHEREAS, Section 5.01 of the Indenture provides,

among other things, that the Company may merge with or into another Person; provided that, among other things, that each

Guarantor under the Indenture shall have by amendment to its Note Guarantee confirmed that its Note Guarantee shall apply to the

obligations of the Company in accordance with the Notes and the Indenture (the “Note Guarantee Confirmation”);

WHEREAS, Section 9.01(a)(iii) of the Indenture

provides, among other things, that the Indenture and Notes Guarantees may be amended or supplemented without the consent of any

Holder to provide for the assumption of the Guarantor’s obligations to Holders in the case of a merger consummated pursuant

to Article 5 of the Indenture;

WHEREAS, Section 9.01(a)(iv) of the Indenture

provides, among other things, that the Indenture and Notes Guarantees may be amended or supplemented without the consent of any

Holder to provide for any change that would provide any additional rights or benefits to the Holders of Notes or that does not

materially adversely affect the legal rights under this Indenture of any such Holder;

WHEREAS, the Company and the Guarantors named

herein desire to execute this Supplemental Indenture in order to confirm the Guarantors’ Note Guarantees under Article 10

of the Indenture and to comply with Article 5 of the Indenture;

WHEREAS, the execution and delivery of this

Supplemental Indenture has been authorized by resolutions of the boards of directors or equivalent managing bodies of the Company

and the Guarantors; and

WHEREAS, all conditions precedent and requirements

necessary to make this Supplemental Indenture a valid and legally binding instrument in accordance with its terms have been complied

with, performed and fulfilled, and the execution and delivery hereof has been in all respects duly authorized.

NOW THEREFORE, in consideration of the foregoing

and for other good and valuable consideration, the receipt and adequacy of which is hereby acknowledged, the Company, the Guarantors

and the Trustee mutually covenant and agree for the benefit of each other and for the equal and ratable benefit of the Holders

as follows:

ARTICLE 1

DEFINITIONS

Section 1.1 Defined Terms. As used in

this Supplemental Indenture, terms defined in the Indenture or in the preamble or recitals hereto are used herein as therein defined.

The words “herein,” “hereof” and “hereby” and other words of similar import used in this Supplemental

Indenture refer to this Supplemental Indenture as a whole and not to any particular section hereof.

ARTICLE 2

CONFIRMATION OF NOTE GUARANTEES

As of the effective time of the Merger, the

Guarantors named herein hereby confirm, agree, jointly and severally with all other Guarantors, to fully, unconditionally and irrevocably

Guarantee to each Holder and the Trustee, the Company’s obligations under the Indenture and the Notes on the terms and subject

to the conditions set forth in Article 10 of the Indenture and to be bound by all other applicable provisions of the Indenture

applicable to “Guarantors.”

ARTICLE 3

MISCELLANEOUS

Section 3.1 Execution and Delivery. This

Supplemental Indenture shall be effective upon execution by the parties hereto. The Company hereby represents, warrants, and certifies

to the Trustee that the execution of this Supplemental Indenture is authorized and permitted by the Indenture, and constitutes

the legal, valid and binding obligation of the Company and the Guarantors enforceable in accordance with its terms, subject to

bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium and other similar laws relating to or affecting creditors'

rights generally, general equitable principles (whether considered in a proceeding in equity or at law) and an implied covenant

of good faith and fair dealing.

Section 3.2 Ratification of Indenture; Supplemental

Indenture Part of Indenture. Except as expressly amended hereby, the Indenture is in all respects ratified and confirmed and

all the terms, conditions and provisions thereof shall remain in full force and effect. This Supplemental Indenture shall form

a part of the Indenture for all purposes, and every Holder of Notes heretofore or hereafter authenticated and delivered shall be

bound hereby.

Section 3.3 Severability. In case any

provision in this Supplemental Indenture shall be invalid, illegal or unenforceable, the validity, legality and enforceability

of the remaining provisions shall not in any way be affected or impaired thereby and such provision shall be ineffective only to

the extent of such invalidity, illegality or unenforceability.

Section 3.4 Governing Law. THE LAWS OF

THE STATE OF NEW YORK SHALL GOVERN AND BE USED TO CONSTRUE THIS SUPPLEMENTAL INDENTURE.

Section 3.5 Waiver of Jury Trial. EACH

OF THE COMPANY AND EACH GUARANTOR HEREBY IRREVOCABLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY AND ALL RIGHT

TO TRIAL BY JURY IN ANY LEGAL PROCEEDING ARISING OUT OF OR RELATING TO THIS SUPPLEMENTAL INDENTURE, THE INDENTURE, THE NOTES, THE

NOTE GUARANTEES OR THE TRANSACTIONS CONTEMPLATED HEREBY.

Section 3.6 Counterparts. The parties

may sign any number of copies of this Supplemental Indenture (including by electronic transmission). Each signed copy shall be

an original, but all of them together represent the same agreement. The exchange of copies of this Supplemental Indenture and of

signature pages by facsimile or PDF transmission shall constitute effective execution and delivery of this Supplemental Indenture

as to the parties hereto and may be used in lieu of the original Supplemental Indenture for all purposes. Signatures of the parties

hereto transmitted by facsimile or PDF shall be deemed to be their original signatures for all purposes.

Section 3.7 Effect of Headings. The Section

headings herein are for convenience only and shall not affect the construction hereof.

Section 3.8 Trustee. The Trustee shall

not be responsible in any manner whatsoever for or in respect of the validity or sufficiency of this Supplemental Indenture or

for or in respect of the recitals contained herein, all of which recitals are made solely by the Guarantors and the Company. In

entering into this Supplemental Indenture, the Trustee shall be entitled to the benefit of every provision of the Indenture relating

to the conduct or affecting the liability of or affording protection to the Trustee, including its right to be compensated, reimbursed

and indemnified, whether or not elsewhere herein so provided. The Trustee makes no representations as to the validity or sufficiency

of this Supplemental Indenture or with respect to the consents of the Holders or any documents used in the solicitations of such

consents, all of which recitals are made solely by the Company and the Guarantors. The Company hereby confirms to the Trustee that

this Supplemental Indenture has not resulted in a material modification of the Notes for Foreign Accounting Tax Compliance Act

(“FATCA”) purposes. The Company shall give the Trustee prompt written notice of any material modification of the Notes

deemed to occur for FATCA purposes. The Trustee shall assume that no material modification for FATCA purposes has occurred regarding

the Notes, unless the Trustee receives written notice of such modification from the Company.

[SIGNATURE PAGE FOLLOW]

IN WITNESS WHEREOF, the parties hereto have

caused this Supplemental Indenture to be duly executed and attested, all as of the date first above written.

| |

CONSOLIDATED COMMUNICATIONS, INC.

CONSOLIDATED COMMUNICATIONS

HOLDINGS, INC., as a Guarantor

CONSOLIDATED COMMUNICATIONS

OF TEXAS COMPANY, as a Guarantor

CONSOLIDATED COMMUNICATIONS

OF FORT BEND COMPANY, as a Guarantor

CONSOLIDATED COMMUNICATIONS

SERVICES COMPANY, as a Guarantor

CONSOLIDATED COMMUNICATIONS

ENTERPRISE SERVICES, INC., as a Guarantor

CONSOLIDATED COMMUNICATIONS

OF PENNSYLVANIA COMPANY, LLC, as a Guarantor |

| |

SUREWEST COMMUNICATIONS, as a Guarantor |

| |

SUREWEST TELEPHONE, as a Guarantor |

| |

SUREWEST LONG DISTANCE, as a Guarantor |

| |

SUREWEST TELEVIDEO, as a Guarantor |

| |

SUREWEST FIBER VENTURES LLC, as a Guarantor

SUREWEST KANSAS, INC., as a Guarantor |

| |

By: |

/s/ Steven L. Childers |

|

| |

|

Name: |

Steven L. Childers |

|

| |

|

Title: |

Senior Vice President and Chief Financial Officer |

|

| |

WELLS FARGO BANK, NATIONAL ASSOCIATION, as Trustee |

| |

By: |

/s/ Julius R. Zamora |

| |

|

Name: |

Julius R. Zamora |

| |

|

Title: |

Vice President |

[Signature Page to Fourth Supplemental Indenture]

EXHIBIT 99.1

Consolidated Communications Completes Acquisition of Enventis Corporation

MATTOON, Ill., Oct. 16, 2014 (GLOBE NEWSWIRE) -- Consolidated Communications Holdings, Inc. ("Consolidated") (Nasdaq:CNSL) announced today that it has completed the previously announced acquisition of Enventis Corporation ("Enventis") (Nasdaq:ENVE).

"We are excited to finalize the acquisition and are looking forward to the opportunities that lie ahead," said Bob Currey, Consolidated's Chairman and Chief Executive Officer. "This transaction with Enventis brings together two companies with similar strategies and consistent cash flows. The combined company will utilize its extensive fiber network to deliver a diverse set of revenues across multiple markets resulting in a stronger, more competitive company."

At the effective time of the merger, shares of Enventis common stock will be converted into the right to receive 0.7402 shares of common stock of the Company.

No fractional shares of Company common stock will be issued to any Enventis shareholder in the Merger. Each Enventis shareholder who would otherwise have been entitled to receive a fraction of a share of Company common stock in the Merger will receive an amount in cash (without interest), rounded to the nearest whole cent, equal to the product obtained by multiplying (i) the fractional share of Company common stock to which such holder would otherwise be entitled by (ii) $25.40 (which represents the last reported sale price of Company common stock on the Nasdaq Stock Market on the last complete trading day prior to the date of the effective time of the Merger).

About Consolidated

Consolidated Communications Holdings, Inc. is a leading communications provider within its six state operations of California, Illinois, Kansas, Missouri, Pennsylvania and Texas. Headquartered in Mattoon, IL, Consolidated has been providing services in many of its markets for over a century. With one of the highest quality networks in the industry, Consolidated offers a wide range of communications services, including IP-based digital and high definition television, high speed internet, Voice over IP, carrier access, directory publishing and local and long distance service.

Safe Harbor

The Securities and Exchange Commission ("SEC") encourages companies to disclose forward-looking information so that investors can better understand a company's future prospects and make informed investment decisions. Certain statements in this press release are forward-looking statements and are made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995. These forward-looking statements reflect, among other things, our current expectations, plans, strategies, and anticipated financial results. There are a number of risks, uncertainties, and conditions that may cause our actual results to differ materially from those expressed or implied by these forward-looking statements. These risks and uncertainties include our ability to complete the acquisition of Enventis and successfully integrate Enventis' operations and realize the synergies from the acquisition, as well as a number of factors related to our business and that of Enventis, including economic and financial market conditions generally and economic conditions in Consolidated's and Enventis' service areas; various risks to shareholders of not receiving dividends and risks to Consolidated's ability to pursue growth opportunities if Consolidated continues to pay dividends according to the current dividend policy; various risks to the price and volatility of Consolidated's common stock; changes in the valuation of pension plan assets; the substantial amount of debt and Consolidated's ability to repay or refinance it or incur additional debt in the future; Consolidated's need for a significant amount of cash to service and repay the debt and to pay dividends on the common stock; restrictions contained in the debt agreements that limit the discretion of management in operating the business; regulatory changes, including changes to subsidies, rapid development and introduction of new technologies and intense competition in the telecommunications industry; risks associated with Consolidated's possible pursuit of acquisitions; system failures; losses of large customers or government contracts; risks associated with the rights-of-way for the network; disruptions in the relationship with third party vendors; losses of key management personnel and the inability to attract and retain highly qualified management and personnel in the future; changes in the extensive governmental legislation and regulations governing telecommunications providers and the provision of telecommunications services; telecommunications carriers disputing and/or avoiding their obligations to pay network access charges for use of Consolidated's and Enventis' network; high costs of regulatory compliance; the competitive impact of legislation and regulatory changes in the telecommunications industry; and liability and compliance costs regarding environmental regulations. A detailed discussion of these and other risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements are discussed in more detail in Consolidated's and Enventis' filings with the Securities and Exchange Commission, including their reports on Form 10-K and Form 10-Q. Many of these circumstances are beyond our ability to control or predict. Moreover, forward-looking statements necessarily involve assumptions on our part. These forward-looking statements generally are identified by the words "believe", "expect", "anticipate", "estimate", "project", "intend", "plan", "should", "may", "will", "would", "will be", \"will continue" or similar expressions. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements of Consolidated Communications Holdings, Inc. and its subsidiaries to be different from those expressed or implied in the forward-looking statements. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements that appear throughout this press release. Furthermore, forward-looking statements speak only as of the date they are made. Except as required under the federal securities laws or the rules and regulations of the Securities and Exchange Commission, we disclaim any intention or obligation to update or revise publicly any forward-looking statements. You should not place undue reliance on forward-looking statements.

CONTACT: Matt Smith

VP of Finance & Treasurer

217-258-2959

matthew.smith@consolidated.com

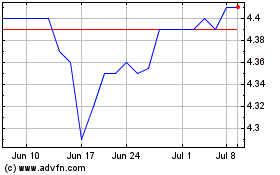

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

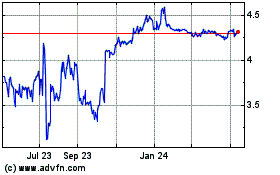

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Apr 2023 to Apr 2024