UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15 (d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): October 22, 2014

Emerson Electric Co.

-------------------------------------------------

(Exact Name of Registrant as Specified in Charter)

|

| | |

Missouri --------------------------------- (State or Other Jurisdiction of Incorporation) | 1-278 ------------------- (Commission File Number) | 43-0259330 --------------------------- (I.R.S. Employer Identification Number) |

|

| | |

8000 West Florissant Avenue St. Louis, Missouri ------------------------------------------------ (Address of Principal Executive Offices) | | 63136 ------------------ (Zip Code) |

Registrant’s telephone number, including area code:

(314) 553-2000

------------------------------------------

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01 Regulation FD Disclosure

The following information is furnished pursuant to Regulation FD.

Emerson 3-Month Orders Growth

(Percentage change versus prior year; trailing 3-month averages, excluding acquisitions and divestitures, including currency translation)

|

| | | | | | |

| | July '14 | | August '14 | | September '14 |

Process Management | | +10 to 15 | | +10 | | 0 to +5 |

Industrial Automation | | +5 to 10 | | 0 to +5 | | 0 |

Network Power | | +5 to 10 | | 0 to +5 | | 0 |

Climate Technologies | | +5 to 10 | | +10 to 15 | | +20 |

Commercial & Residential Solutions | | +5 | | +5 to 10 | | +5 to 10 |

Total Emerson | | +5 to 10 | | +5 to 10 | | +5 |

September 2014 Orders Comments

Trailing three-month orders grew moderately, as mixed trends across markets and heightened currency volatility continued. Underlying orders, which exclude a 4 percentage point deduction from currency translation, increased 9 percent, led by robust growth in Process Management and Climate Technologies. Strength in North America continued, supported by favorable energy market conditions and inventory growth in the HVAC industry ahead of upcoming regulatory changes. Demand was varied in other regions, as economic uncertainty increased. Appreciation in the U.S. dollar drove the substantial impact from currency translation, which will reduce reported sales growth by 2 percentage points in 2015 if exchange rates remain unchanged. Excluding this impact, underlying sales growth next year is expected to slightly exceed the rate of growth in 2014, supported by recent strength in orders and elevated backlog.

Process Management orders growth moderated, as currency translation deducted 9 percentage points, including backlog revaluation. Underlying orders growth remained robust, led by continued momentum in North America oil and gas markets. Demand was also strong in Europe, driven by North Sea projects, and growth improved in the Middle East/Africa, although mixed across the region. Asia and Latin America increased modestly, led by strength in India and Mexico.

Industrial Automation order trends slowed, as weakness in Europe offset better market conditions in North America and Asia. Orders in the electrical distribution, power generating alternators, and materials joining businesses increased, while demand for motors and drives and in renewable energy markets was down. Currency translation deducted 1 percentage point.

Network Power orders were unchanged overall, with varied market conditions across geographies and businesses. Excluding currency translation, which deducted 2 percentage points, underlying order trends improved modestly, as growth in the data center business benefited from improvement in Europe and North America. Demand in telecommunications infrastructure markets was weak globally.

Climate Technologies orders grew at a robust rate, led by U.S. residential air conditioning markets that benefited from demand acceleration related to regulatory changes effective January 1, 2015. Strength in China drove improvement in Asia, while market conditions remained slow in Europe. Strong growth in the refrigeration business was driven by transportation markets. Currency translation deducted 1 percentage point.

Commercial & Residential Solutions orders growth was solid, as favorable momentum continued in North America. Growth was strongest in the professional tools and wet/dry vacuums businesses.

Upcoming Investor Events

On Tuesday, November 4, 2014, Emerson will report fourth quarter and fiscal year 2014 results. Management will discuss the results during a conference call at 2:00 p.m. ET the same day. Interested parties may listen to the live

conference call via the Internet by visiting Emerson's website at www.emerson.com/financial and completing a brief registration form. A replay of the conference call will remain available for approximately three months.

On Tuesday, November 11, 2014, Emerson Chairman and Chief Executive Officer David N. Farr will present at the R. W. Baird Industrial Conference in Chicago, Illinois.

Forward-Looking and Cautionary Statements

Statements in this Current Report on Form 8-K that are not strictly historical may be “forward-looking” statements, which involve risks and uncertainties, and Emerson undertakes no obligation to update any such statements to reflect later developments. These risks and uncertainties include economic and currency conditions, market demand, pricing, protection of intellectual property, and competitive and technological factors, among others, as set forth in the Company's most recent Annual Report on Form 10-K and subsequent reports filed with the SEC.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | EMERSON ELECTRIC CO. (Registrant) |

| | |

Date: | October 22, 2014 | By: | /s/ John G. Shively |

| | | John G. Shively Assistant General Counsel and Assistant Secretary |

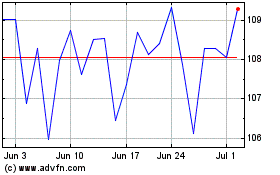

Emerson Electric (NYSE:EMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

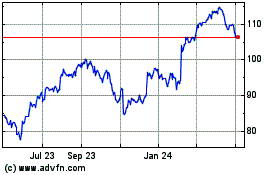

Emerson Electric (NYSE:EMR)

Historical Stock Chart

From Apr 2023 to Apr 2024