UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 20, 2014

INTERNATIONAL GAME TECHNOLOGY

(Exact name of registrant as specified in its charter)

|

Nevada |

|

001-10684 |

|

88-0173041 |

|

(State or other jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

|

of incorporation) |

|

File Number) |

|

Identification No.) |

6355 South Buffalo Drive, Las Vegas, Nevada 89113

(Address of principal executive offices) (Zip Code)

(702) 669-7777

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

As previously reported, International Game Technology (the “Company”) had commenced a consent solicitation (the “Consent Solicitation”) of consents to amend the indentures pursuant to which its 7.50% Notes due 2019 (the “2019 Notes”), 5.50% Notes due 2020 (the “2020 Notes”) and 5.35% Notes due 2023 (the “2023 Notes” and, together with the 2019 Notes and the 2020 Notes, the “Notes”) were issued.

On October 20, 2014, after receiving the required majority consent from holders of the 2019 Notes, the Company entered into a supplemental indenture to amend the indenture dated as of June 15, 2009, as supplemented by a supplemental indenture dated as of June 15, 2009, between the Company and Wells Fargo Bank, National Association, as trustee, pursuant to which the 2019 Notes were issued (the “Amendment”). The Amendment is being undertaken in connection with the proposed business combination (the “Merger”) pursuant to the previously announced Agreement and Plan of Merger, dated as of July 15, 2014, among the Company, GTECH S.p.A. (“GTECH”), Georgia Worldwide PLC (“Holdco”), and the other parties thereto, as amended.

Among other things, the Amendment modifies the definition of “Change of Control” in the indenture governing the 2019 Notes so that (i) the consummation of the Merger would not be considered a Change of Control and (ii) following the Merger, the definition of Change of Control would apply to Holdco, as the post-Merger parent of the Company. The Amendment also permits Holdco to furnish the financial reports that are currently required to be furnished by the Company. Following the Merger, the 2019 Notes that remain outstanding will be unconditionally guaranteed by Holdco and certain subsidiary guarantors of Holdco’s debt securities on a pari passu basis.

The preceding description of the Amendment is qualified in its entirety by reference to full text of the Amendment, a copy of which is attached as Exhibit 4.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 3.03. Material Modification to Rights of Security Holders.

The information contained in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 8.01. Other Events.

On October 21, 2014, the Company announced that it had received the required majority consent of holders of the 2019 Notes to approve the Amendment. The consent solicitation with respect to the 2019 Notes expired at 5:00 p.m. New York City time, on October 20, 2014 (the “Expiration Time”). The Company has waived the condition to receive the required consents from the 2020 Notes and the 2023 Notes prior to the payment of the consent fee to holders of the 2019 Notes (the “Waiver”). Subject to the terms and conditions set forth in the Consent Solicitation as modified by the Waiver, the Company will make an aggregate cash payment equal to $2.50 per $1,000 principal amount of the 2019 Notes for which consents to the Amendment are validly delivered and unrevoked to the solicitation agents on behalf of the holders who delivered such valid and unrevoked consents to the Amendments on or prior to the Expiration Time.

On October 21, 2014, the Company also announced that it will amend the terms of the Consent Solicitation to (i) extend the Expiration Time of the Consent Solicitation with respect to the 2020 Notes to 5:00 p.m., New York City time, on October 22, 2014, unless further extended or terminated by the Company, and (ii) increase the consent fee applicable to the 2020 Notes. Additionally, IGT has waived the condition to receive the required consents from the 2023 Notes. All other terms and conditions of the consent solicitation with respect to the 2020 Notes remain as set forth in the Consent Solicitation.

On October 21, 2014, the Company also announced that it did not receive the required majority consent from holders of the 2023 Notes. However, IGT is not extending the expiration date for the Consent Solicitation for the 2023 Notes.

A copy of the press release announcing the results of the Consent Solicitation is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

2

Cautionary Statement Regarding Forward Looking Statements

This communication contains forward-looking statements (including within the meaning of the Private Securities Litigation Reform Act of 1995) concerning the Company, GTECH, Holdco, the proposed transactions and other matters. These statements may discuss goals, intentions and expectations as to future plans, trends, events, results of operations or financial condition, or otherwise, based on current beliefs of the management of the Company and GTECH as well as assumptions made by, and information currently available to, such management, including statements regarding the timing of the completion of the transactions. Forward-looking statements may be accompanied by words such as “aim,” “anticipate,” “believe,” “plan,” “could,” “would,” “should,” “estimate,” “expect,” “forecast,” “future,” “guidance,” “intend,” “may,” “will,” “possible,” “potential,” “predict,” “project” or similar words, phrases or expressions. These forward-looking statements are subject to various risks and uncertainties, many of which are outside the parties’ control. Therefore, you should not place undue reliance on such statements. Factors that could cause actual results to differ materially from those in the forward-looking statements include failure to obtain applicable regulatory or securityholder approvals in a timely manner or otherwise; the possibility that the transaction will not close, including by any failure to satisfy other closing conditions to the proposed transactions or a termination of the merger agreement; risks that the new businesses will not be integrated successfully or that the combined companies will not realize estimated cost savings, value of certain tax assets, synergies and growth or that such benefits may take longer to realize than expected; failure to realize anticipated benefits of the combined operations; risks relating to unanticipated costs of integration; reductions in customer spending, a slowdown in customer payments and changes in customer demand for products and services; unanticipated changes relating to competitive factors in the industries in which the companies operate; ability to hire and retain key personnel; the potential impact of announcement or consummation of the proposed transactions on relationships with third parties, including customers, employees and competitors; ability to attract new customers and retain existing customers in the manner anticipated; reliance on and integration of information technology systems; changes in legislation or governmental regulations affecting the companies; international, national or local economic, social or political conditions that could adversely affect the companies or their customers; conditions in the credit markets; risks associated with assumptions the parties make in connection with the parties’ critical accounting estimates and legal proceedings; and the parties’ international operations, which are subject to the risks of currency fluctuations and foreign exchange controls. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that affect the parties’ businesses, including those described in the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other documents filed by the Company, GTECH and Holdco from time to time with the SEC and those described in GTECH’s annual reports, registration documents and other documents filed from time to time with the Italian financial market regulator (CONSOB). Except as required under applicable law, the parties do not assume any obligation to update these forward-looking statements.

Item 9.01. Financial Statements and Other Exhibits.

(d) Exhibits

|

Exhibit

Number |

|

Description |

|

|

|

|

|

4.1 |

|

Amendment No. 1, dated as of October 20, 2014, between International Game Technology and Wells Fargo Bank, National Association, as trustee, to the Indenture dated as of June 15, 2009, as supplemented by the First Supplemental Indenture dated as of June 15, 2009 |

|

|

|

|

|

99.1 |

|

Press Release dated October 21, 2014 |

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

INTERNATIONAL GAME TECHNOLOGY |

|

|

|

|

|

Date: October 22, 2014 |

By: |

/s/ Peter A. Christou |

|

|

|

Peter A. Christou |

|

|

|

Assistant Secretary |

4

Exhibit Index

|

Exhibit

Number |

|

Description |

|

|

|

|

|

4.1 |

|

Amendment No. 1, dated as of October 20, 2014, between International Game Technology and Wells Fargo Bank, National Association, as trustee, to the Indenture dated as of June 15, 2009, as supplemented by the First Supplemental Indenture dated as of June 15, 2009 |

|

|

|

|

|

99.1 |

|

Press Release dated October 21, 2014 |

5

Exhibit 4.1

INTERNATIONAL GAME TECHNOLOGY

as Issuer

and

WELLS FARGO BANK, NATIONAL ASSOCIATION

as Trustee

AMENDMENT NO. 1

Dated as of October 20, 2014

TO FIRST SUPPLEMENTAL INDENTURE

Dated as of June 15, 2009

SUPPLEMENTAL TO INDENTURE

Dated as of June 15, 2009

7.50% NOTES DUE 2019

AMENDMENT NO. 1 TO FIRST SUPPLEMENTAL INDENTURE, dated as of October 20, 2014 (this “Amendment No. 1”), between INTERNATIONAL GAME TECHNOLOGY, a Nevada corporation (the “Company”), and WELLS FARGO BANK, NATIONAL ASSOCIATION, a national banking association (the “Trustee”).

WHEREAS, the Company and the Trustee have executed and delivered an Indenture, dated as of June 15, 2009 (the “Base Indenture” and, together with the First Supplemental Indenture, dated as of June 15, 2009 (the “First Supplemental Indenture”), each as amended by this Amendment No. 1 and as further amended or supplemented from time to time, the “Indenture”)), which provides for the issuance of debt securities in an unlimited aggregate principal amount from time to time in one or more series;

WHEREAS, pursuant to the terms of the Base Indenture and the First Supplemental Indenture, the Company established and issued a series of its Securities designated as its 7.50% Notes due 2019 (the “2019 Notes”);

WHEREAS, Section 9.2 of the Base Indenture provides that the Company and the Trustee, may from time to time and at any time enter into a supplemental indenture with the consent of the Holders of not less than a majority in aggregate principal amount of the Securities of each series affected by such supplemental indenture at the time Outstanding;

WHEREAS, Section 9.1(d) of the Base Indenture provides that the Company and the Trustee, may from time to time and at any time enter into a supplemental indenture without the consent of the Holders to provide any security for or guarantees of the Securities of any series;

WHEREAS, the Company entered into (1) an Agreement and Plan of Merger, dated as of July 15, 2014 (the “Merger Agreement”), with GTECH S.p.A., a joint stock company organized under the laws of Italy (“GTECH”), Georgia Worldwide PLC, a public limited company organized under the laws of England and Wales (“Holdco”), which, prior to its re-registration, was a private limited company organized under the laws of England and Wales under the name Georgia Worldwide Limited, Georgia Worldwide Corporation, a Nevada corporation and a wholly-owned subsidiary of Holdco (“Sub”), and, solely with respect to Section 5.02 and Article VIII of the Merger Agreement, GTECH Corporation, a Delaware corporation and a wholly-owned subsidiary of GTECH, (2) a Support Agreement, dated as of July 15, 2014, with the individuals and the other parties listed on Schedule A attached thereto, and (3) a Voting Agreement, dated as of July 15, 2014, with Holdco and the individuals and other parties listed on Schedule A attached thereto;

WHEREAS, pursuant to the Merger Agreement, GTECH will merge with and into Holdco and Sub will merge with and into the Company (the “Mergers”); the Mergers are subject to certain regulatory approvals and satisfaction or occurrence of other conditions;

WHEREAS, Section 4.3 of the First Supplemental Indenture provides that if a Change of Control Repurchase Event occurs, then at the option of the Holder of 2019 Notes, subject to certain provisions, the Company must repurchase the 2019 Notes;

WHEREAS, this Amendment No. 1 effects the following changes to the Base Indenture and the First Supplemental Indenture, which have been consented to by the Holders of not less

than a majority in aggregate principal amount of the 2019 Notes outstanding in accordance with Section 9.2 of the Base Indenture: (1) to amend the definition of “Change of Control” in the First Supplemental Indenture to exclude the Merger Transactions, make the Change of Control definition apply to Holdco instead of the Company after the consummation of the Merger Transactions, and include the concept of a Permitted Holder, (2) to amend Section 5.3 of the Base Indenture with respect to the 2019 Notes to permit reporting by Holdco in lieu of the Company under certain circumstances and (3) to amend or add relevant definitions to the Base Indenture and the First Supplemental Indenture with respect to the 2019 Notes relating to the foregoing, in each case as described in the Consent Solicitation Statement distributed to Holders of 2019 Notes on October 8, 2014 (the “Consent Solicitation Statement”);

WHEREAS, this Amendment No. 1 also amends Article V of the First Supplemental Indenture to include an additional covenant related to future guarantors, and such amendment is permitted to be effected without the consent of the Holders in accordance with Section 9.1(d) of the Base Indenture; and

WHEREAS, all requirements necessary to make this Amendment No. 1 a valid, binding and enforceable instrument in accordance with its terms have been satisfied and performed, and the execution and delivery of this Amendment No. 1 has been duly authorized in all respects.

NOW, THEREFORE, in consideration of the premises hereof, the parties have executed and delivered this Amendment No. 1, and the Company and the Trustee agree for the benefit of each other and for the equal and ratable benefit of the Holders of 2019 Notes, as follows:

Section 1. Capitalized Terms. Any capitalized term used herein and not otherwise defined herein shall have the meaning assigned to such term in the Indenture.

Section 2. Effectiveness; Conditions Precedent. The Company represents and warrants to the Trustee that the conditions precedent to the amendments of the Indenture, including such conditions pursuant to Sections 9.1 and 9.2 of the Base Indenture, have been satisfied in all respects. Pursuant to Section 9.2 of the Base Indenture, the Company has been authorized by a Board Resolution to enter into this Amendment No. 1 and the Holders of not less than a majority in aggregate principal amount of the Outstanding 2019 Notes have consented to the amendments herein and have authorized and directed the Trustee to execute and deliver this Amendment No. 1. The Company and the Trustee are on this date executing this Amendment No. 1.

This Amendment No. 1 shall become effective and binding upon the Company, the Trustee and the Holders of 2019 Notes immediately upon its execution and delivery by the parties hereto on the date hereof. Notwithstanding the foregoing, the amendments set forth in Section 3 and Section 4 shall become inoperative if the Merger Agreement is terminated in accordance with its terms. In addition, the amendments set forth in Section 3 shall become inoperative if the Company or one or more of its Affiliates fails to pay, and GTECH or GTECH Corporation fails to pay, on behalf of the Company, the applicable Consent Payment (as defined in the Consent Solicitation Statement) in respect of the 2019 Notes.

2

Section 3. Indenture Amendments with the Consent of the Holders. Pursuant to Section 9.2 of the Base Indenture and subject to Section 2 hereof, the Indenture is hereby amended as follows:

(a) The definition of “Change of Control” in Section 1.1 of the First Supplemental Indenture is hereby amended to add the following paragraph as the last sentence:

“Notwithstanding the foregoing, (i) the consummation of any of the Merger Transactions shall be deemed not to constitute or result in a Change of Control and (ii) following the Merger Consummation Date, “Change of Control” means the occurrence of any of the following (and only the following):

(i) the direct or indirect sale, lease, transfer, conveyance or other disposition (other than by way of merger or consolidation) in one or a series of related transactions, of all or substantially all of Holdco’s assets and the assets of Holdco’s Subsidiaries, taken as a whole, to any Person (including any “person” (as that term is used in Section 13(d)(3) of the Exchange Act)) other than to Holdco, a Permitted Holder or any Subsidiary of Holdco or a Permitted Holder;

(ii) the consummation of any transaction (including without limitation, any merger or consolidation) the result of which is that any Person (including any “person” (as that term is used in Section 13(d)(3) of the Exchange Act)) other than a Permitted Holder becomes the “beneficial owner” as defined in Rules 13d-3 and 13d-5 under the Exchange Act of more than 50% of Holdco’s outstanding Voting Stock, measured by voting power rather than number of shares;

(iii) Holdco consolidates with, or merges with or into, any Person (other than a Permitted Holder) or any Person (other than a Permitted Holder) consolidates with, or merges with or into, Holdco, in any such event pursuant to a transaction in which any of Holdco’s outstanding Voting Stock or the Voting Stock of such other Person is converted into or exchanged for cash, securities or other property, other than any such transaction where the shares of Holdco’s Voting Stock outstanding immediately prior to such transaction constitute, or are converted into or exchanged for, a majority of the Voting Stock of the surviving Person immediately after giving effect to such transaction;

(iv) the first day on which the majority of the members of Holdco’s Board of Directors ceases to be Continuing Directors; or

(v) the adoption of a plan relating to the Holdco’s liquidation or dissolution.”

(b) The definition of “Continuing Director” in Section 1.1 of the First Supplemental Indenture is hereby amended to add the following paragraph as the last sentence:

“Notwithstanding the foregoing, following the Merger Consummation Date, references in this definition to the original Issue Date of the 2019 Notes shall refer instead to the Merger Consummation Date and not to such Issue Date, and references to the members of the Board of Directors as of the Merger Consummation Date shall refer to the persons who are directors of Holdco on the Merger Consummation Date.”

3

(c) The following definitions are hereby added to Section 1.1 of the First Supplemental Indenture in their relevant alphabetical locations:

“Merger Transactions” means the transactions contemplated by (i) the Merger Agreement, (ii) the Support Agreement, dated as of July 15, 2014, by and among the Company and the individuals and the other parties listed on Schedule A attached thereto, and (iii) the Voting Agreement, dated as of July 15, 2014, by and among the Company, Holdco and the individuals and other parties listed on Schedule A attached thereto.

“Permitted Holder” means DeAgostini S.p.A., its Subsidiaries or B&D Holding di Marco Drago e C.S.a.p.a. (“B&D Holding”) or any entity controlled by one or more of the same beneficial holders that directly or indirectly control B&D Holding on the Merger Consummation Date; provided, that for the purposes of this definition, an entity or B&D Holding shall be treated as being controlled, directly or indirectly, by any such holder(s) if the latter (whether by way of ownership of shares, proxy, contract, agency or otherwise) have or has, as applicable, the power to (i) appoint or remove all, or the majority, of its directors or other equivalent officers or (ii) direct its operating and financial policies.

(d) Section 5.3 of the Base Indenture is hereby amended with respect to the 2019 Notes by adding the following paragraph after clause (c):

“Notwithstanding the foregoing, following the Merger Consummation Date and if and for so long as the 2019 Notes are fully and unconditionally guaranteed by Holdco, the Company is permitted to elect to satisfy its obligations under clauses (a) and (b) of this Section 5.3 by delivering the corresponding reports, information and documents of Holdco within the timeframes set forth under such clauses (a) and (b).”

Section 4. Indenture Amendments without the Consent of Holders. Pursuant to Section 9.1(d) of the Base Indenture and subject to Section 2 hereof, Article V of the First Supplemental Indenture is hereby amended as follows:

(a) The following Section 5.7 is hereby added to the First Supplemental Indenture:

“Section 5.7 Future Guarantors; Releases.

(a) Following the Merger Consummation Date and if and for so long as the 2019 Notes are fully and unconditionally guaranteed by Holdco, each of Holdco and the Company will cause each Holdco Subsidiary that guarantees, as of the Merger Consummation Date or any time thereafter, any Holdco Debt Securities and is not, or is no longer, a Non-Guarantor Holdco Subsidiary to execute and deliver to the Trustee a supplemental indenture pursuant to which such Holdco Subsidiary will irrevocably and unconditionally guarantee, on a joint and several basis, the full and prompt payment of the principal of, and premium, if any, and interest in respect of the 2019 Notes on a senior basis and all other obligations of the Company under the Indenture.

4

(b) A guarantee of the 2019 Notes by a Holdco Subsidiary will be automatically and unconditionally released and discharged, and no further action by such Holdco Subsidiary, Holdco, the Company or the Trustee shall be required for the release of such Holdco Subsidiary’s guarantee of the 2019 Notes, upon:

(1) any sale, assignment, transfer, conveyance, exchange or other disposition (by merger, consolidation or otherwise) of the Capital Stock of such Holdco Subsidiary after which the applicable Holdco Subsidiary is no longer a Holdco Subsidiary of Holdco or one or more other Holdco Subsidiaries or all or substantially all of the assets of such Holdco Subsidiary, which sale, assignment, transfer, conveyance, exchange or other disposition is made in compliance with the provisions of the Indenture, including Article VI of this First Supplemental Indenture; provided that each guarantee of such Holdco Subsidiary of any Holdco Debt Securities terminates upon consummation of such transaction;

(2) the release or discharge of such Holdco Subsidiary from its guarantee of all Holdco Debt Securities, including each guarantee that resulted in the obligation of such Holdco Subsidiary to guarantee the 2019 Notes, if such Holdco Subsidiary would not then otherwise be required to guarantee the 2019 Notes pursuant to the Indenture, except a discharge or release by or as a result of payment under such guarantee; or

(3) the Company’s exercise of its Defeasance option or Covenant Defeasance option in accordance with Article XI of the Base Indenture, as modified and amended by Section 3.7 of this First Supplemental Indenture, or the discharge of the Company’s obligations under the Indenture in accordance with the terms of the Indenture.

At the written request of the Company, the Trustee shall execute and deliver any documents reasonably required in order to evidence such release, discharge and termination in respect of the applicable guarantee of the 2019 Notes.”

(b) The following definitions are hereby added to Section 1.1 of the First Supplemental Indenture in their relevant alphabetical location:

“GTECH” means GTECH S.p.A., a joint stock company organized under the laws of Italy.

“Holdco” means Georgia Worldwide Limited, a private limited liability company organized under the laws of England and Wales, together with its successors.

“Holdco Debt Securities” means any issued and outstanding debt securities of Holdco, including debentures, notes or bonds, and for the avoidance of doubt, excluding credit facilities, term loans, lines of credit, advances or similar credit arrangements.

“Holdco Subsidiary” means a Person more than 50% of the outstanding Voting Stock of which is owned, directly or indirectly, by Holdco or by one or more other Holdco Subsidiaries, or by Holdco and one or more other Holdco Subsidiaries.

5

“Merger Agreement” means that certain Agreement and Plan of Merger, dated as of July 15, 2014, among GTECH, GTECH Corporation, a Delaware corporation and a wholly-owned subsidiary of GTECH solely with respect to Section 5.02 and Article VIII, Holdco, Merger Subsidiary and the Company.

“Merger Consummation Date” means the first date on which both of the Mergers have become effective, notice of which shall be promptly given to the Trustee in writing by the Company.

“Merger Subsidiary” means Georgia Worldwide Corporation, a Nevada corporation and a wholly-owned subsidiary of Holdco.

“Mergers” means the merger of GTECH with and into Holdco pursuant to the Merger Agreement and the merger of Merger Subsidiary with and into the Company pursuant to the Merger Agreement.

“Non-Guarantor Holdco Subsidiary” means any Holdco Subsidiary (i) that constitutes a “controlled foreign corporation,” as defined in Section 957 of the Internal Revenue Code of 1986, as amended, or (ii) if its guarantee of 2019 Notes pursuant to Section 5.7 of this Supplemental Indenture would violate any statute or any order, rule or regulation of a court or governmental agency or body having jurisdiction over such Holdco Subsidiary, Holdco, any other Holdco Subsidiary or the Company.

Section 5. Form of Additional Guarantees. Each of the entities to be added as a guarantors of the 2019 Notes pursuant to Section 5.7 of the First Supplemental Indenture (which section is being added to the First Supplemental Indenture in accordance with Section 4 of this Amendment No. 1), shall execute a supplemental indenture amendment substantially in the form attached hereto as Annex A promptly after first being required to do so pursuant to Section 5.7 of the First Supplemental Indenture.

Section 6. Ancillary Consents. The Holders of the 2019 Notes, by delivery of their Consents (as defined in the Consent Solicitation Statement) (i) expressly authorize and direct the Trustee, without the further consent of such Holders, to amend and waive any and all other provisions of the Indenture (with respect to the 2019 Notes) and the 2019 Notes that would prohibit the consummation of any of the transactions contemplated by the amendments set forth in Section 3 hereof and expressly authorize such amendments notwithstanding any other provision of the Indenture and (ii) expressly authorize and direct the Trustee to enter into any and all amendments to the Indenture (with respect to the 2019 Notes) to permit and facilitate the amendments set forth in Section 3 hereof, in each case, to the extent such amendment is necessary or advisable to give effect to and/or reflect the amendments set forth in Section 3 hereof (including with respect to supplementing, modifying and amending the terms of the 2019 Notes in such a manner as necessary to make the 2019 Notes consistent with the Indenture). The Holders of the 2019 Notes, by delivery of their Consents, authorize the making of any and all changes to the Indenture (with respect to the 2019 Notes) and the 2019 Notes necessary to give effect to the amendments set forth in Section 3 hereof.

6

Section 7. Conforming Changes. In accordance with Section 9.2 of the Base Indenture, the Holders of the 2019 Notes by delivery of their Consents, permit and approve any and all conforming changes (as determined in good faith by the Company and evidenced by an Officers’ Certificate), including conforming amendments and/or waivers, to the 2019 Notes and any related documents and any documents appended thereto that may be required by, or as a result of, this Amendment No. 1.

Section 8. Global Securities. Each Global Security representing 2019 Notes, with effect on and from the date hereof and subject to becoming operative, pursuant to Section 2 hereof shall be deemed supplemented, modified and amended in such manner as necessary to make the terms of such Global Security consistent with the terms of the Indenture and giving effect to the amendments set forth in Sections 3 and 4 hereof.

Section 9. Ratification and Effect. Except as hereby expressly amended, the Indenture is in all respects ratified and confirmed and all the terms, provisions and conditions thereof shall be and remain in full force and effect.

Upon and after the execution of this Amendment No. 1, each reference to the Indenture in the Indenture shall mean and be a reference to the Indenture as modified and supplemented hereby.

Section 10. Governing Law. THIS AMENDMENT NO. 1 SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK BUT WITHOUT GIVING EFFECT TO APPLICABLE PRINCIPLES OF CONFLICTS OF LAW TO THE EXTENT THAT THE APPLICATION OF THE LAWS OF ANOTHER JURISDICTION WOULD BE REQUIRED THEREBY.

Section 11. Effect of Headings. The section headings are for convenience only and shall not affect the construction hereof.

Section 12. Conflicts. To the extent of any inconsistency between the terms of the Indenture or any Global Security representing 2019 Notes and this Amendment No. 1, the terms of this Amendment No. 1 shall control.

Section 13. Entire Agreement. This Amendment No. 1 constitutes the entire agreement of the parties hereto with respect to the amendments to the Indenture set forth herein.

Section 14. Successors. All covenants and agreements in this Amendment No. 1 given by the parties hereto shall bind their successors. The exchange of copies of this Amendment No. 1 and of signature pages by facsimile or PDF transmission shall constitute effective execution and delivery of this Amendment No. 1 to the parties hereto and may be used in lieu of the original for all purposes. Signatures of the parties hereto transmitted by facsimile or PDF shall be deemed to be their original signatures for all purposes.

7

Section 15. Miscellaneous.

(a) In case any provision in this Amendment No. 1 shall be invalid, illegal or unenforceable, the validity, legality and enforceability of the remaining provisions hereof or of the Indenture shall not in any way be affected or impaired thereby.

(b) The parties may sign any number of copies of this Amendment No. 1. Each signed copy shall be an original, but all of them together represent the same agreement, binding on the parties hereto.

(c) The Trustee shall not be responsible in any manner whatsoever for or in respect of the validity or sufficiency of this Amendment No. 1 or for or in respect of the recitals contained herein, all of which recitals are made solely by the Company.

[Signatures on following pages]

8

IN WITNESS WHEREOF, the parties hereto have caused this Amendment No. 1 to be duly executed as of the date first written above.

|

Dated as of October 20, 2014 |

|

|

|

|

|

|

INTERNATIONAL GAME TECHNOLOGY |

|

|

|

|

|

|

|

|

By: |

/s/ John Vandemore |

|

|

|

Name: |

John Vandemore |

|

|

|

Title: |

CFO |

|

|

|

|

|

|

|

|

WELLS FARGO BANK, NATIONAL ASSOCIATION, as Trustee |

|

|

|

|

|

|

|

|

By: |

/s/ Michael Tu |

|

|

|

Name: |

Michael Tu |

|

|

|

Title: |

Assistant Vice President |

Annex A

INTERNATIONAL GAME TECHNOLOGY

as Issuer

[GUARANTORS]

as Guarantors

and

WELLS FARGO BANK, NATIONAL ASSOCIATION

as Trustee

AMENDMENT NO. [ ]

Dated as of [ ]

TO FIRST SUPPLEMENTAL INDENTURE

Dated as of September 19, 2013

SUPPLEMENTAL TO INDENTURE

Dated as of June 15, 2009

7.50% NOTES DUE 2019

AMENDMENT NO. [ ] TO FIRST SUPPLEMENTAL INDENTURE, dated as of [ ] (this “Amendment No. [ ]”), among INTERNATIONAL GAME TECHNOLOGY, a Nevada corporation (the “Company”), the [GUARANTORS] (collectively, the “Guarantors”) and WELLS FARGO BANK, NATIONAL ASSOCIATION, a national banking association (the “Trustee”).

WHEREAS, the Company and the Trustee have executed and delivered an Indenture, dated as of June 15, 2009 (the “Base Indenture” and, together with the First Supplemental Indenture, dated as of June 15, 2009 (the “First Supplemental Indenture”), each as amended by Amendment No. 1, dated as of [ ] (“Amendment No. 1”), and as further amended or supplemented from time to time, the “Indenture”)), which provides for the issuance of debt securities in an unlimited aggregate principal amount from time to time in one or more series;

WHEREAS, pursuant to the terms of the Base Indenture and the First Supplemental Indenture, the Company established and issued a series of its Securities designated as its 7.50% Notes due 2019 (the “2019 Notes”);

WHEREAS, the Indenture provides that under certain circumstances a Holdco Subsidiary shall execute and deliver to the Trustee a supplemental indenture pursuant to which the Holdco Subsidiary shall unconditionally guarantee all of the Company’s obligations under the 2019 Notes and the Indenture on the terms and conditions set forth herein and under the Indenture; and

WHEREAS, Section 9.1(d) of the Base Indenture provides that the Company and the Trustee, may from time to time and at any time enter into a supplemental indenture without the consent of the Holders to provide any security for or guarantees of the 2019 Notes.

NOW, THEREFORE, the Company, the Guarantors and the Trustee hereby agree that the following Sections of this Amendment No. [ ] supplement the Indenture with respect to the 2019 Notes issued thereunder, as follows:

Section 1. Capitalized Terms. Any capitalized term used herein and not otherwise defined herein shall have the meaning assigned to such term in the Indenture.

Section 2. Guarantees.

(a) Each Guarantor hereby absolutely, unconditionally and irrevocably guarantees (each, a “Guarantee”), on a joint and several basis, to each Holder of 2019 Notes (including each Holder of 2019 Notes issued under the Indenture after the date of this Amendment No. [ ]) and to the Trustee and its successors and assigns on a senior basis, irrespective of the validity and enforceability of this Indenture, the 2019 Notes or the obligations of the Company hereunder or thereunder (i) the full and punctual payment of all monetary obligations of the Company under the Indenture (including obligations to the Trustee) and (ii) the full and punctual performance within applicable grace periods of all other obligations of the Company under the Indenture. Each Guarantor further agrees that its obligations hereunder shall be unconditional irrespective of the absence or existence of any action to enforce the same, the recovery of any judgment against the Company (except to the extent such judgment is paid) or any waiver or amendment of the provisions of the Indenture or the 2019 Notes to the extent that any such action or any similar action would otherwise constitute a legal or equitable discharge or defence of such Guarantor (except that such waiver or amendment shall be effective in accordance with its terms).

Annex A

1

(b) Failing payment when due of any amount so guaranteed or any performance so guaranteed for whatever reason, the Guarantors will be jointly and severally obligated to pay the same immediately. Each Guarantor further agrees that its Guarantee constitutes a guarantee of payment, performance and compliance and not merely of collection.

(c) Subject to this Section 2 and Section 5 hereof, the Guarantors hereby agree that their obligations hereunder are unconditional, irrespective of the validity, regularity or enforceability of the 2019 Notes or this Indenture, the absence of any action to enforce the same, any waiver or consent by any Holder of the 2019 Notes with respect to any provisions hereof or thereof, the recovery of any judgment against the Company, any action to enforce the same or any other circumstance which might otherwise constitute a legal or equitable discharge or defense of a Guarantor. Without limiting the generality of the foregoing, each Guarantor’s liability under this Guarantee shall extend to all obligations under the 2019 Notes and the Indenture (including, without limitation, interest, fees, costs and expenses) that would be owed but for the fact that they are unenforceable or not allowable due to any proceeding under bankruptcy law involving the Company or any Guarantor. Each Guarantor further agrees to waive presentment to, demand of payment from and protest to the Company of its Guarantee, and also waives diligence, notice of acceptance of its Guarantee, presentment, demand for payment, notice of protest for non-payment, the filing of claims with a court in the event of merger or bankruptcy of the Company and any right to require a proceeding first against the Company or any other Person. The obligations of a Guarantor shall not be affected by any failure or policy on the part of the Trustee to exercise any right or remedy under the Indenture or the 2019 Notes of any series. Subject to Section 5 hereof, each Guarantor covenants that this Guarantee will not be discharged except by complete performance of the obligations contained in the 2019 Notes and this Indenture.

(d) The obligation of a Guarantor to make any payment hereunder may be satisfied by causing the Company or any other Guarantor to make such payment. If any Holder of any 2019 Notes or the Trustee is required by any court or otherwise to return to the Company or any Guarantor or any custodian, trustee, liquidator or other similar official acting in relation to any of the Company or any such Guarantor any amount paid by any of them to the Trustee or such Holder, any applicable Guarantee, to the extent theretofore discharged, shall be reinstated in full force and effect.

(e) Each Guarantor also agrees to pay any and all costs and expenses (including reasonable attorneys’ fees) incurred by the Trustee or any Holder of 2019 Notes in enforcing any of their respective rights under its Guarantee.

(f) Each Guarantor agrees that it will not be entitled to any right of subrogation in relation to the Holders of the 2019 Notes in respect of any obligations guaranteed hereby until payment and performance in full of all obligations guaranteed hereby. Each Guarantor further agrees that, as between the Guarantors, on the one hand, and the Holders of the 2019 Notes and the Trustee, on the other hand, (1) the maturity of the obligations guaranteed hereby may be accelerated as provided in Article VII of the First Supplemental Indenture for the purposes of

Annex A

2

this Guarantee, notwithstanding any stay, injunction or other prohibition preventing such acceleration in respect of the obligations guaranteed hereby, and (2) in the event of any declaration of acceleration of such obligations as provided in Article VII of the First Supplemental Indenture, such obligations (whether or not due and payable) will forthwith become due and payable by the Guarantors for the purpose of this Guarantee. The Guarantors will have the right to seek contribution from any non-paying Guarantor so long as the exercise of such right does not impair the rights of the Holders of the 2019 Notes under the Guarantee.

(g) Any term or provision of this Amendment No. [ ] to the contrary notwithstanding, the maximum aggregate amount of a Guarantor’s Guarantee shall not exceed the maximum amount that will, after giving effect to such maximum amount and all other contingent and fixed liabilities of such Guarantor that are relevant under such laws, and after giving effect to any collections from, rights to receive contribution from or payments made by or on behalf of any other Guarantor in respect of the obligations of such other Guarantor under this Section 2, result in the obligations of such Guarantor under its Guarantee not constituting either a fraudulent transfer or conveyance or voidable preference, financial assistance or improper corporate benefit, or violating the corporate purpose of the relevant Guarantor or any applicable capital maintenance or similar laws or regulations affecting the rights of creditors generally under any applicable law or regulation.

Section 3. Execution and Delivery of Guarantee. Neither the Company nor any Guarantor shall be required to make a notation on the 2019 Notes to reflect any Guarantee or any release, termination or discharge thereof. Each Guarantor agrees that its Guarantee set forth in Section 2 hereof will remain in full force and effect notwithstanding any failure to endorse on each Note a notation of such Guarantee.

Section 4. Successor Guarantor Substituted. In case of any consolidation, merger, sale or conveyance in compliance with the Indenture and upon, to the extent required by the Indenture, the assumption by the successor Person, by supplemental indenture, executed and delivered to the Trustee and satisfactory in form to the Trustee, of the Guarantee endorsed upon the 2019 Notes and the due and punctual performance of all of the covenants and conditions of this Indenture to be performed by the Guarantor, such successor Person will succeed to and be substituted for the Guarantor with the same effect as if it had been named herein as a Guarantor. Such successor Person thereupon may cause to be signed any or all of the Guarantees to be endorsed upon all of the 2019 Notes issuable hereunder which theretofore shall not have been signed by the Company and delivered to the Trustee. All the Guarantees so issued will in all respects have the same legal rank and benefit under the Indenture as the Guarantees theretofore and thereafter issued in accordance with the terms of the Indenture as though all of such Guarantees had been issued at the date of the execution hereof.

Section 5. Release and Termination of Guarantee. A guarantee of the 2019 Notes by a Guarantor will be automatically and unconditionally released and discharged in accordance with the terms set forth in Section 5.7 of the First Supplemental Indenture.

Section 6. This Amendment No. [ ]. This Amendment No. [ ] shall be construed as supplemental to the Indenture and shall form a part of it, and the Indenture is hereby incorporated by reference herein and each is hereby ratified, approved and confirmed.

Annex A

3

Section 7. Governing Law. THIS AMENDMENT NO. [ ] SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK BUT WITHOUT GIVING EFFECT TO APPLICABLE PRINCIPLES OF CONFLICTS OF LAW TO THE EXTENT THAT THE APPLICATION OF THE LAWS OF ANOTHER JURISDICTION WOULD BE REQUIRED THEREBY.

Section 8. Effect of Headings. The section headings are for convenience only and shall not affect the construction hereof.

Section 9. Conflicts. To the extent of any inconsistency between the terms of the Indenture or any Global Security representing 2019 Notes and this Amendment No. [ ], the terms of this Amendment No. [ ] will control.

Section 10. Entire Agreement. This Amendment No. [ ] constitutes the entire agreement of the parties hereto with respect to the amendments to the Indenture set forth herein.

Section 11. Successors. All covenants and agreements in this Amendment No. [ ] given by the parties hereto shall bind their successors.

Section 12. Miscellaneous.

(a) In case any provision in this Amendment No. [ ] shall be invalid, illegal or unenforceable, the validity, legality and enforceability of the remaining provisions hereof or of the Indenture shall not in any way be affected or impaired thereby.

(b) The parties may sign any number of copies of this Amendment No. [ ]. Each signed copy shall be an original, but all of them together represent the same agreement, binding on the parties hereto.

[Signatures on following pages]

Annex A

4

IN WITNESS WHEREOF, the parties hereto have caused this Amendment No. [ ] to be duly executed as of the date first written above.

|

Dated as of |

|

|

|

|

|

|

|

|

INTERNATIONAL GAME TECHNOLOGY |

|

|

|

|

|

|

|

|

By: |

|

|

|

|

Name: |

|

|

|

Title: |

|

|

|

|

|

|

|

|

WELLS FARGO BANK, NATIONAL ASSOCIATION |

|

|

|

|

|

|

|

|

By: |

|

|

|

|

Name: |

|

|

|

Title: |

|

|

|

|

|

|

|

|

[GUARANTORS] |

|

|

|

|

|

|

|

|

By: |

|

|

|

|

Name: |

|

|

|

Title: |

[Signature Page to Guarantee]

Exhibit 99.1

News Release

IGT Announces Receipt of Requisite Consents

for Its $500 Million 7.50% Notes Due 2019 and Extension of Its

Consent Solicitation for Its $300 Million 5.50% Notes Due 2020

(LAS VEGAS — October 21, 2014) — International Game Technology (“IGT”) today announced the results of its consent solicitation from holders of the three series of Notes described in the table below (together, the “Notes”) with respect to proposed amendments relating to each series of the Notes. Pursuant to the terms of the Consent Solicitation Statement dated October 8, 2014, (the “Solicitation Statement”) the consent solicitation was originally scheduled to expire at 5:00 p.m., New York City time, on October 20, 2014 (the “Original Expiration Date”).

|

Title of Security |

|

Principal Amount

Outstanding |

|

CUSIP No. |

|

ISIN No. |

|

|

7.50% Notes due 2019 (the “2019 Notes”) |

|

$ |

500,000,000 |

|

459902 AR3 |

|

US459902AR30 |

|

|

5.50% Notes due 2020 (the “2020 Notes”) |

|

$ |

300,000,000 |

|

459902 AS1 |

|

US459902AS13 |

|

|

5.35% Notes due 2023 (the “2023 Notes”) |

|

$ |

500,000,000 |

|

459902 AT9 |

|

US459902AT95 |

|

IGT received the requisite consents from holders of a majority in outstanding principal amount of the 2019 Notes. As a result, IGT executed an amendment to the supplemental indenture with respect to the 2019 Notes effecting the proposed amendments, which amended the terms of the Notes as follows:

· Excluding the merger of IGT and GTECH from the definition of “Change of Control”; and

· After the merger, applying the definition of “Change of Control” to the post-merger parent of IGT (“Holdco”) other than permitted holders, and permitting Holdco to furnish the financial reports that are currently required to be furnished by IGT.

The consent fee of $2.50 in cash per $1,000 principal amount of the 2019 Notes will be paid to the consenting holders of such 2019 Notes on or before October 23, 2014. IGT has waived the condition to receive the required consents from the 2020 Notes and the 2023 Notes prior to the payment of this consent fee.

© IGT. All rights reserved.

IGT is also amending the terms of the consent solicitation to extend the expiration date of the consent solicitation with respect to the 2020 Notes to 5:00 p.m., New York City time, on October 22, 2014 (the “New Expiration Date”), unless further extended or terminated by IGT and increasing the consent fee applicable to the 2020 Notes. Holders of 2020 Notes who validly deliver (and do not revoke) consents to the proposed amendment on or prior to the New Expiration Date will now be eligible to receive a consent fee equal to $10.00 in cash per $1,000 principal amount of 2020 Notes if the proposed amendment becomes effective. The higher consent fee will also be payable to holders of 2020 Notes who have previously delivered (and not revoked) consents if the proposed amendment becomes effective. Additionally, IGT has waived the condition to receive the required consents from the 2023 Notes prior to the payment of this consent fee. All other terms and conditions of the consent solicitation with respect to the 2020 Notes remain as set forth in the Solicitation Statement.

IGT did not receive the requisite consents from holders of a majority in outstanding principal amount of the 2023 Notes prior to the Original Expiration Date. However, IGT is not extending the expiration date for the consent solicitation for the 2023 Notes.

IGT has retained Citigroup Global Markets Limited, Deutsche Bank Securities Inc. and Credit Suisse Securities (USA) LLC to act as solicitation agents in connection with the consent solicitation and D.F. King & Co., Inc. to act as the information and tabulation agent for the consent solicitation. Questions regarding the terms and conditions of the consent solicitation may be directed to Deutsche Bank Securities Inc. at (866) 627-0391 (toll free within the U.S.) or (212) 250-2955 (collect) or Citigroup Global Markets Limited at (800) 558-3745 (toll free within the U.S.) or (212) 723-6106 (collect). Requests for documents and questions regarding the procedures for submission of consents may be directed to D.F. King & Co., Inc. at (800) 884-5882 (toll free) or (212) 269-5550 (collect).

This announcement is for information purposes only and is neither an offer to sell nor a solicitation of an offer to buy any security. This announcement is also not a solicitation of consents with respect to the proposed amendment or any securities. No recommendation is being made as to whether holders of Notes should consent to the proposed amendments.

2

The solicitation of consents is not being made in any jurisdiction in which, or to or from any person to or from whom, it is unlawful to make such solicitation under applicable state or foreign securities or “blue sky” laws.

Forward-Looking Statements

This press release may contain forward-looking information and statements regarding IGT and the consent solicitation. Any statements included in this press release that address activities, events or developments that will or may occur in the future are forward looking, and include among others, statements regarding: (i) the proposed amendments, (ii) the expected payment of the consent fee, and (iii) the consummation of the merger of IGT and GTECH. Actual results may differ materially due to a variety of factors including: changed market conditions, the conditions for completing the merger, the participation of and level of participation by the holders of Notes in the consent solicitation and other factors listed in the Solicitation Statement under “Cautionary Statement Regarding Forward-Looking Statements.” Except as required by law, IGT undertakes no obligation to update forward-looking information if circumstances or management’s estimates or opinions should change. Do not place undue reliance on forward-looking information.

IGT Resources:

· Like us on Facebook

· Play DoubleDown Casino Games

· Like DoubleDown Casino on Facebook

· Follow us on Twitter

· View IGT’s YouTube Channel

About IGT:

International Game Technology (NYSE: IGT) is a global leader in casino gaming entertainment and continues to transform the industry by translating casino player experiences to social, mobile and interactive environments for markets around the world. IGT’s acquisition of DoubleDown Interactive provides engaging social casino style entertainment to approximately 6 million players monthly. More information about IGT is available at IGT.com or connect with IGT at @IGTNews or facebook.com/IGT. Anyone can play at the DoubleDown Casino by visiting http://apps.facebook.com/doubledowncasino or doubledowncasino.com .

IGT Contact:

Kate Pearlman

Vice President, Investor Relations and Treasury

+1 702-669-6451

3

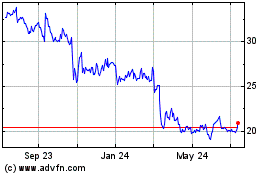

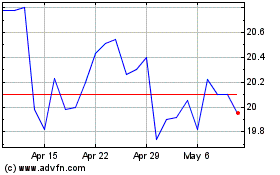

International Game Techn... (NYSE:IGT)

Historical Stock Chart

From Mar 2024 to Apr 2024

International Game Techn... (NYSE:IGT)

Historical Stock Chart

From Apr 2023 to Apr 2024