UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

|

| |

Date of Report (Date of earliest event reported): | October 21, 2014 |

Fulton Financial Corporation

(Exact name of Registrant as specified in its Charter)

|

| | |

Pennsylvania | 0-10587 | 23-2195389 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification Number) |

One Penn Square Lancaster, Pennsylvania | | 17604 |

(Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: 717-291-2411

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

£ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

£ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

£ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

£ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 - Results of Operations and Financial Condition

On October 21, 2014 Fulton Financial Corporation announced its results of operations for the third quarter ended September 30, 2014. A copy of the earnings release is attached as Exhibit 99.1 to this Form 8-K and incorporated herein by reference. Supplemental financial information included with the earnings release is attached as Exhibit 99.2 to this report and incorporated herein by reference.

Item 9.01 Financial Statements And Exhibits

(d) Exhibits.

|

| |

Exhibit No. | Description |

99.1 | Earnings Release dated October 21, 2014. |

99.2 | Supplemental financial information for the quarter ended September 30, 2014. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

Date: October 21, 2014 | FULTON FINANCIAL CORPORATION

|

| By: /s/ Patrick S. Barrett |

| Patrick S. Barrett

|

| Senior Executive Vice President and

|

| Chief Financial Officer |

Exhibit 99.1

FULTON FINANCIAL

CORPORATION

FOR IMMEDIATE RELEASE

Media Contact: Laura J. Wakeley (717) 291-2616

Investor Contact: David C. Hostetter (717) 291-2456

Fulton Financial reports third quarter earnings of $0.21 per share

| |

• | Diluted earnings per share for the third quarter of 2014 was 21 cents, unchanged from the second quarter of 2014 and the third quarter of 2013. |

| |

• | Net interest income for the third quarter of 2014 increased $1.5 million, or 1.1 percent, compared to the second quarter of 2014. The net interest margin for the third quarter of 2014 decreased two basis points, to 3.39 percent, compared to the second quarter of 2014. |

| |

• | Average loans for the third quarter of 2014 increased $127.1 million, or 1.0 percent, compared to the second quarter of 2014. Average non-interest-bearing and interest-bearing demand and savings deposits for the third quarter of 2014 increased $437.2 million, or 4.6 percent, compared to the second quarter of 2014. |

| |

• | The provision for credit losses was $3.5 million for the third quarter of 2014, unchanged from the second quarter of 2014 and a $6.0 million, or 63.2 percent, decrease from the third quarter of 2013. Non-performing loans decreased $5.5 million, or 3.7 percent, in comparison to June 30, 2014 and decreased $24.4 million, or 14.5 percent, in comparison to September 30, 2013. |

| |

• | Non-interest income, excluding investment securities gains, decreased $1.9 million, or 4.4 percent, in comparison to the second quarter of 2014, while non-interest expense decreased $376,000, or 0.3 percent. |

| |

• | In May 2014, the Corporation announced that its Board of Directors approved the repurchase of up to four million shares of the Corporation’s common stock, or approximately 2.1% of outstanding shares, through December 31, 2014. All four million shares were repurchased during the third quarter of 2014. |

(October 21, 2014) - Lancaster, PA - Fulton Financial Corporation (NASDAQ: FULT) reported net income of $38.6 million, or 21 cents per diluted share, for the third quarter of 2014, compared to $39.6 million, or 21 cents per diluted share, for the second quarter of 2014.

“Good loan growth, further improvement in asset quality and higher net interest income all contributed to our solid financial performance in the third quarter,” said E. Philip Wenger, Chairman, CEO and President. “We continue to execute on our strategic priorities. They include

positioning the company for profitable future growth, deploying capital to enhance long term shareholder value, ensuring a superior customer experience by investing in systems and technology, and building out our risk management and compliance processes.”

Net Interest Income and Margin

Net interest income for the third quarter of 2014 increased $1.5 million, or 1.1 percent, from the second quarter of 2014. The net interest margin decreased two basis points to 3.39 percent in the third quarter of 2014 from 3.41 percent in the second quarter of 2014. Average yields on interest-earning assets decreased two basis points, while the average cost of interest-bearing liabilities increased two basis points.

Average Balance Sheet

Total average assets for the third quarter of 2014 were $17.0 billion, an increase of $170.3 million, or 1.0 percent, from the second quarter of 2014. Average loans, net of unearned income, increased $127.1 million, or 1.0 percent, in comparison to the second quarter of 2014.

|

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Increase (decrease) |

| September 30, 2014 | | June 30, 2014 | | in Balance |

| Balance | | Yield (1) | | Balance | | Yield (1) | | $ | | % |

| (dollars in thousands) |

Average Loans, net of unearned income, by type: | | | | | | | | | | | |

Real estate - commercial mortgage | $ | 5,114,221 |

| | 4.35 | % | | $ | 5,138,537 |

| | 4.36 | % | | $ | (24,316 | ) | | (0.5 | )% |

Commercial - industrial, financial, and agricultural | 3,657,047 |

| | 3.97 | % | | 3,617,977 |

| | 3.95 | % | | 39,070 |

| | 1.1 | % |

Real estate - home equity | 1,727,253 |

| | 4.18 | % | | 1,735,767 |

| | 4.18 | % | | (8,514 | ) | | (0.5 | )% |

Real estate - residential mortgage | 1,369,087 |

| | 3.93 | % | | 1,339,034 |

| | 3.97 | % | | 30,053 |

| | 2.2 | % |

Real estate - construction | 663,922 |

| | 3.98 | % | | 588,176 |

| | 4.17 | % | | 75,746 |

| | 12.9 | % |

Consumer | 284,630 |

| | 5.39 | % | | 276,444 |

| | 4.56 | % | | 8,186 |

| | 3.0 | % |

Leasing and other | 106,661 |

| | 7.16 | % | | 99,812 |

| | 8.83 | % | | 6,849 |

| | 6.9 | % |

Total Average Loans, net of unearned income | $ | 12,922,821 |

| | 4.20 | % | | $ | 12,795,747 |

| | 4.21 | % | | $ | 127,074 |

| | 1.0 | % |

| | | | | | | | | | | |

(1) Presented on a tax-equivalent basis using a 35% Federal tax rate and statutory interest expense disallowances. |

Total average liabilities increased $162.7 million, or 1.1 percent, from the second quarter of 2014, due mainly to a $434.3 million, or 3.4 percent, increase in average deposits and a $101.0 million, or 11.3 percent, increase in FHLB Advances and long-term debt, partially offset by a $380.3 million, or 36.3 percent, decrease in average short-term borrowings.

|

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Increase (decrease) |

| September 30, 2014 | | June 30, 2014 | | in Balance |

| Balance | | Rate | | Balance | | Rate | | $ | | % |

| (dollars in thousands) |

Average Deposits, by type: | | | | | | | | | | | |

Noninterest-bearing demand | $ | 3,514,033 |

| | — | % | | $ | 3,322,195 |

| | — | % | | $ | 191,838 |

| | 5.8 | % |

Interest-bearing demand | 3,047,191 |

| | 0.12 | % | | 2,914,887 |

| | 0.12 | % | | 132,304 |

| | 4.5 | % |

Savings deposits | 3,468,958 |

| | 0.12 | % | | 3,355,929 |

| | 0.12 | % | | 113,029 |

| | 3.4 | % |

Total average demand and savings | 10,030,182 |

| | 0.08 | % | | 9,593,011 |

| | 0.08 | % | | 437,171 |

| | 4.6 | % |

Time deposits | 3,009,225 |

| | 0.92 | % | | 3,012,061 |

| | 0.90 | % | | (2,836 | ) | | (0.1 | )% |

Total Average Deposits | $ | 13,039,407 |

| | 0.27 | % | | $ | 12,605,072 |

| | 0.28 | % | | $ | 434,335 |

| | 3.4 | % |

Asset Quality

Non-performing assets were $157.3 million, or 0.91 percent of total assets, at September 30, 2014, compared to $162.8 million, or 0.96 percent of total assets, at June 30, 2014 and $186.5 million, or 1.09 percent of total assets, at September 30, 2013. The $5.5 million, or 3.4 percent, decrease in non-performing assets in comparison to the second quarter of 2014 was primarily due to decreases in non-performing commercial loans, and non-performing consumer and home equity loans.

Annualized net charge-offs for the third quarter ended September 30, 2014 were 0.18 percent of average total loans, compared to 0.28 percent for the second quarter of 2014 and 0.45 percent for the third quarter ended September 30, 2013. The allowance for credit losses as a percentage of non-performing loans was 132.9 percent at September 30, 2014, as compared to 129.6 percent at June 30, 2014 and 126.5 percent at September 30, 2013.

Non-interest Income

Non-interest income, excluding investment securities gains, decreased $1.9 million, or 4.4 percent, in comparison to the second quarter of 2014. Mortgage banking income decreased $1.7 million, or 29.7 percent, as amortization of mortgage servicing rights increased and sales volumes decreased in the third quarter. Other service charges and fees decreased $572,000, or 5.4 percent, including a $456,000 decrease in commercial swap fees. Service charges on deposit accounts increased $249,000, or 2.0 percent, due to a $264,000 increase in overdraft fees.

Non-interest Expense

Non-interest expense decreased $376,000, or 0.3 percent, in the third quarter of 2014 compared to the second quarter of 2014. Salaries and employee benefits decreased $1.2 million, or 1.9 percent, in comparison to the second quarter of 2014, due primarily to a decrease in self-insured healthcare costs. Marketing expenses decreased $539,000, or 23.1 percent. Other non-interest expense decreased $1.6 million, or 13.0 percent, including a reduction in the reserve for

debit card reward points. Partially offsetting these decreases in non-interest expense was a $1.4 million, or 19.2 percent, increase in other outside services largely attributable to continuing risk management and compliance efforts, including the enhancement of the Corporation’s Bank Secrecy Act and anti-money laundering compliance program (the “BSA/AML Compliance Program”). These enhanced risk management and compliance efforts continue the Corporation’s ongoing efforts to improve its BSA/AML Compliance Program and to remediate deficiencies specified in the previously disclosed regulatory enforcement orders received by the Corporation and four of its banking subsidiaries during the third quarter of 2014. In addition, other real estate owned and repossession expense and operating risk loss increased $555,000 and $526,000, respectively, in comparison to the second quarter of 2014.

About Fulton Financial

Fulton Financial Corporation is a Lancaster, Pennsylvania-based financial holding company that has banking offices in Pennsylvania, Maryland, Delaware, New Jersey and Virginia through the following affiliates, headquartered as indicated: Fulton Bank, N.A., Lancaster, PA; Swineford National Bank, Middleburg, PA; Lafayette Ambassador Bank, Easton, PA; FNB Bank, N.A., Danville, PA; Fulton Bank of New Jersey, Mt. Laurel, NJ; and The Columbia Bank, Columbia, MD.

The Corporation’s investment management and trust services are offered at all banks through Fulton Financial Advisors, a division of Fulton Bank, N.A. Residential mortgage lending is offered by all banks under the Fulton Mortgage Company brand.

Additional information on Fulton Financial Corporation is available on the Internet at www.fult.com.

Safe Harbor Statement

This news release may contain forward-looking statements with respect to the Corporation’s financial condition, results of operations and business. Do not unduly rely on forward-looking statements. Forward-looking statements can be identified by the use of words such as "may," "should," "will," "could," "estimates," "predicts," "potential," "continue," "anticipates," "believes," "plans," "expects," "future," "intends" and similar expressions which are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties, some of which are beyond the Corporation's control and ability to predict, that could cause actual results to differ materially from those expressed in the forward-looking statements.

A discussion of certain risks and uncertainties affecting the Corporation, and some of the factors that could cause the Corporation's actual results to differ materially from those described in the forward-looking statements, can be found in the sections entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in the

Corporation’s Annual Report on Form 10-K for the year ended December 31, 2013, and the Quarterly Reports on Form 10-Q for the quarters ended March 31, 2014 and June 30, 2014, which have been filed with the Securities and Exchange Commission and are available in the Investor Relations section of the Corporation's website (www.fult.com) and on the Securities and Exchange Commission's website (www.sec.gov). The Corporation undertakes no obligation, other than as required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Non-GAAP Financial Measures

The Corporation uses certain non-GAAP financial measures in this earnings release. These non-GAAP financial measures are reconciled to the most comparable GAAP measures in tables at the end of this release.

|

| | | | | | | | | | | | | | | | | | |

Exhibit 99.2 | | |

| | | | | | | | | | |

FULTON FINANCIAL CORPORATION | | |

CONDENSED CONSOLIDATED ENDING BALANCE SHEETS (UNAUDITED) | | |

dollars in thousands | | |

| | | | | | | | % Change from |

| | September 30 | | September 30 | | June 30 | | September 30 | | June 30 |

| | 2014 | | 2013 | | 2014 | | 2013 | | 2014 |

ASSETS | | | | | | | | |

| Cash and due from banks | $ | 220,946 |

| | $ | 262,938 |

| | $ | 258,837 |

| | (16.0 | )% | | (14.6 | )% |

| Other interest-earning assets | 377,579 |

| | 308,924 |

| | 305,518 |

| | 22.2 | % | | 23.6 | % |

| Loans held for sale | 25,212 |

| | 39,273 |

| | 36,079 |

| | (35.8 | )% | | (30.1 | )% |

| Investment securities | 2,470,609 |

| | 2,597,435 |

| | 2,497,776 |

| | (4.9 | )% | | (1.1 | )% |

| Loans, net of unearned income | 13,030,405 |

| | 12,780,899 |

| | 12,839,511 |

| | 2.0 | % | | 1.5 | % |

| Allowance for loan losses | (189,477 | ) | | (210,486 | ) | | (191,685 | ) | | (10.0 | )% | | (1.2 | )% |

| Net loans | 12,840,928 |

| | 12,570,413 |

| | 12,647,826 |

| | 2.2 | % | | 1.5 | % |

| Premises and equipment | 224,441 |

| | 227,299 |

| | 225,168 |

| | (1.3 | )% | | (0.3 | )% |

| Accrued interest receivable | 43,544 |

| | 44,715 |

| | 42,116 |

| | (2.6 | )% | | 3.4 | % |

| Goodwill and intangible assets | 532,117 |

| | 533,918 |

| | 532,432 |

| | (0.3 | )% | | (0.1 | )% |

| Other assets | 502,798 |

| | 465,856 |

| | 487,887 |

| | 7.9 | % | | 3.1 | % |

| Total Assets | $ | 17,238,174 |

| | $ | 17,050,771 |

| | $ | 17,033,639 |

| | 1.1 | % | | 1.2 | % |

LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | |

| Deposits | $ | 13,333,627 |

| | $ | 12,721,121 |

| | $ | 12,693,659 |

| | 4.8 | % | | 5.0 | % |

| Short-term borrowings | 564,952 |

| | 1,198,577 |

| | 1,008,307 |

| | (52.9 | )% | | (44.0 | )% |

| Other liabilities | 243,300 |

| | 212,987 |

| | 263,478 |

| | 14.2 | % | | (7.7 | )% |

| FHLB advances and long-term debt | 1,018,289 |

| | 889,122 |

| | 968,395 |

| | 14.5 | % | | 5.2 | % |

| Total Liabilities | 15,160,168 |

| | 15,021,807 |

| | 14,933,839 |

| | 0.9 | % | | 1.5 | % |

| Shareholders' equity | 2,078,006 |

| | 2,028,964 |

| | 2,099,800 |

| | 2.4 | % | | (1.0 | )% |

| Total Liabilities and Shareholders' Equity | $ | 17,238,174 |

| | $ | 17,050,771 |

| | $ | 17,033,639 |

| | 1.1 | % | | 1.2 | % |

| | | | | | | | | | |

LOANS, DEPOSITS AND SHORT-TERM BORROWINGS DETAIL: | | | | | | | | |

Loans, by type: | | | | | | | | |

| Real estate - commercial mortgage | $ | 5,156,979 |

| | $ | 5,063,372 |

| | $ | 5,128,734 |

| | 1.8 | % | | 0.6 | % |

| Commercial - industrial, financial and agricultural | 3,691,262 |

| | 3,645,270 |

| | 3,601,721 |

| | 1.3 | % | | 2.5 | % |

| Real estate - home equity | 1,733,036 |

| | 1,773,554 |

| | 1,730,497 |

| | (2.3 | )% | | 0.1 | % |

| Real estate - residential mortgage | 1,372,033 |

| | 1,327,469 |

| | 1,361,976 |

| | 3.4 | % | | 0.7 | % |

| Real estate - construction | 687,728 |

| | 577,342 |

| | 634,018 |

| | 19.1 | % | | 8.5 | % |

| Consumer | 278,219 |

| | 296,142 |

| | 280,557 |

| | (6.1 | )% | | (0.8 | )% |

| Leasing and other | 111,148 |

| | 97,749 |

| | 102,008 |

| | 13.7 | % | | 9.0 | % |

| Total Loans, net of unearned income | $ | 13,030,405 |

| | $ | 12,780,898 |

| | $ | 12,839,511 |

| | 2.0 | % | | 1.5 | % |

Deposits, by type: | | | | | | | | |

| Noninterest-bearing demand | $ | 3,556,810 |

| | $ | 3,338,075 |

| | $ | 3,484,125 |

| | 6.6 | % | | 2.1 | % |

| Interest-bearing demand | 3,164,514 |

| | 2,986,549 |

| | 2,855,511 |

| | 6.0 | % | | 10.8 | % |

| Savings deposits | 3,620,919 |

| | 3,371,923 |

| | 3,338,018 |

| | 7.4 | % | | 8.5 | % |

| Time deposits | 2,991,384 |

| | 3,024,574 |

| | 3,016,005 |

| | (1.1 | )% | | (0.8 | )% |

| Total Deposits | $ | 13,333,627 |

| | $ | 12,721,121 |

| | $ | 12,693,659 |

| | 4.8 | % | | 5.0 | % |

Short-term borrowings, by type: | | | | | | | | |

| Customer repurchase agreements | $ | 195,121 |

| | $ | 209,800 |

| | $ | 212,930 |

| | (7.0 | )% | | (8.4 | )% |

| Customer short-term promissory notes | 78,225 |

| | 95,503 |

| | 86,366 |

| | (18.1 | )% | | (9.4 | )% |

| Federal funds purchased | 6,606 |

| | 493,274 |

| | 384,011 |

| | (98.7 | )% | | (98.3 | )% |

| Short-term FHLB advances | 285,000 |

| | 400,000 |

| | 325,000 |

| | (28.8 | )% | | (12.3 | )% |

| Total Short-term Borrowings | $ | 564,952 |

| | $ | 1,198,577 |

| | $ | 1,008,307 |

| | (52.9 | )% | | (44.0 | )% |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

FULTON FINANCIAL CORPORATION | | | | | | | |

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) | | | | | | | |

in thousands, except per-share data and percentages | | | | | | | |

| | | | Three Months Ended | | % Change from | | Nine Months Ended | | | |

| | | | September 30 | | September 30 | | June 30 | | Sep 30 | | Jun 30 | | September 30 | | | |

| | | | 2014 | | 2013 | | 2014 | | 2013 | | 2014 | | 2014 | | 2013 | | % Change | |

Interest Income: | | | | | | | | | | | | | | | | | | |

| Interest income | | | $ | 149,790 |

| | $ | 152,832 |

| | $ | 147,902 |

| | (2.0 | )% | | 1.3 | % | | $ | 446,484 |

| | $ | 457,232 |

| | (2.4 | )% | |

| Interest expense | | | 20,424 |

| | 20,299 |

| | 20,004 |

| | 0.6 | % | | 2.1 | % | | 59,655 |

| | 62,990 |

| | (5.3 | )% | |

| Net Interest Income | | | 129,366 |

| | 132,533 |

| | 127,898 |

| | (2.4 | )% | | 1.1 | % | | 386,829 |

| | 394,242 |

| | (1.9 | )% | |

| Provision for credit losses | | | 3,500 |

| | 9,500 |

| | 3,500 |

| | (63.2 | )% | | — | % | | 9,500 |

| | 38,000 |

| | (75.0 | )% | |

| Net Interest Income after Provision | | | 125,866 |

| | 123,033 |

| | 124,398 |

| | 2.3 | % | | 1.2 | % | | 377,329 |

| | 356,242 |

| | 5.9 | % | |

Non-Interest Income: | | | | | | | | | | | | | | | | | | |

| Service charges on deposit accounts | | | 12,801 |

| | 13,938 |

| | 12,552 |

| | (8.2 | )% | | 2.0 | % | | 37,064 |

| | 42,700 |

| | (13.2 | )% | |

| Investment management and trust services | | | 11,120 |

| | 10,420 |

| | 11,339 |

| | 6.7 | % | | (1.9 | )% | | 33,417 |

| | 31,117 |

| | 7.4 | % | |

| Other service charges and fees | | | 9,954 |

| | 9,518 |

| | 10,526 |

| | 4.6 | % | | (5.4 | )% | | 29,407 |

| | 27,536 |

| | 6.8 | % | |

| Mortgage banking income | | | 4,038 |

| | 7,123 |

| | 5,741 |

| | (43.3 | )% | | (29.7 | )% | | 13,384 |

| | 26,293 |

| | (49.1 | )% | |

| Investment securities gains | | | 81 |

| | 2,633 |

| | 1,112 |

| | (96.9 | )% | | (92.7 | )% | | 1,193 |

| | 7,971 |

| | (85.0 | )% | |

| Other | | | 3,906 |

| | 3,725 |

| | 3,602 |

| | 4.9 | % | | 8.4 | % | | 10,813 |

| | 11,315 |

| | (4.4 | )% | |

| Total Non-Interest Income | | | 41,900 |

| | 47,357 |

| | 44,872 |

| | (11.5 | )% | | (6.6 | )% | | 125,278 |

| | 146,932 |

| | (14.7 | )% | |

Non-Interest Expense: | | | | | | | | | | | | | | | | | | |

| Salaries and employee benefits | | | 62,434 |

| | 63,344 |

| | 63,623 |

| | (1.4 | )% | | (1.9 | )% | | 185,623 |

| | 188,046 |

| | (1.3 | )% | |

| Net occupancy expense | | | 11,582 |

| | 11,519 |

| | 11,464 |

| | 0.5 | % | | 1.0 | % | | 36,649 |

| | 34,810 |

| | 5.3 | % | |

| Other outside services | | | 8,632 |

| | 5,048 |

| | 7,240 |

| | 71.0 | % | | 19.2 | % | | 19,684 |

| | 13,223 |

| | 48.9 | % | |

| Data processing | | | 4,689 |

| | 4,757 |

| | 4,331 |

| | (1.4 | )% | | 8.3 | % | | 12,816 |

| | 13,169 |

| | (2.7 | )% | |

| Software | | | 3,353 |

| | 3,268 |

| | 3,209 |

| | 2.6 | % | | 4.5 | % | | 9,487 |

| | 9,110 |

| | 4.1 | % | |

| Equipment expense | | | 3,307 |

| | 3,646 |

| | 3,360 |

| | (9.3 | )% | | (1.6 | )% | | 10,269 |

| | 11,447 |

| | (10.3 | )% | |

| Professional fees | | | 3,252 |

| | 3,329 |

| | 3,559 |

| | (2.3 | )% | | (8.6 | )% | | 9,715 |

| | 9,771 |

| | (0.6 | )% | |

| FDIC insurance expense | | | 2,882 |

| | 2,918 |

| | 2,615 |

| | (1.2 | )% | | 10.2 | % | | 8,186 |

| | 8,766 |

| | (6.6 | )% | |

| Marketing | | | 1,798 |

| | 2,251 |

| | 2,337 |

| | (20.1 | )% | | (23.1 | )% | | 5,719 |

| | 6,045 |

| | (5.4 | )% | |

| Other real estate owned and repossession expense | | | 1,303 |

| | 1,453 |

| | 748 |

| | (10.3 | )% | | 74.2 | % | | 3,034 |

| | 6,248 |

| | (51.4 | )% | |

| Operating risk loss | | | 1,242 |

| | 3,297 |

| | 716 |

| | (62.3 | )% | | 73.5 | % | | 3,786 |

| | 6,923 |

| | (45.3 | )% | |

| Intangible amortization | | | 314 |

| | 534 |

| | 315 |

| | (41.2 | )% | | (0.3 | )% | | 944 |

| | 1,603 |

| | (41.1 | )% | |

| Other | | | 11,010 |

| | 11,241 |

| | 12,657 |

| | (2.1 | )% | | (13.0 | )% | | 35,614 |

| | 35,510 |

| | 0.3 | % | |

| Total Non-Interest Expense | | | 115,798 |

| | 116,605 |

| | 116,174 |

| | (0.7 | )% | | (0.3 | )% | | 341,526 |

| | 344,671 |

| | (0.9 | )% | |

| Income Before Income Taxes | | | 51,968 |

| | 53,785 |

| | 53,096 |

| | (3.4 | )% | | (2.1 | )% | | 161,081 |

| | 158,503 |

| | 1.6 | % | |

| Income tax expense | | | 13,402 |

| | 13,837 |

| | 13,500 |

| | (3.1 | )% | | (0.7 | )% | | 41,136 |

| | 38,746 |

| | 6.2 | % | |

| Net Income | | | $ | 38,566 |

| | $ | 39,948 |

| | $ | 39,596 |

| | (3.5 | )% | | (2.6 | )% | | $ | 119,945 |

| | $ | 119,757 |

| | 0.2 | % | |

| | | | | | | | | | | | | | | | | | | |

PER SHARE: | | | | | | | | | | | | | | | | | | |

| Net income: | | | | | | | | | | | | | | | | | | |

| Basic | | | $ | 0.21 |

| | $ | 0.21 |

| | $ | 0.21 |

| | — | % | | — | % | | $ | 0.64 |

| | $ | 0.62 |

| | 3.2 | % | |

| Diluted | | | 0.21 |

| | 0.21 |

| | 0.21 |

| | — | % | | — | % | | 0.64 |

| | 0.61 |

| | 4.9 | % | |

| | | | | | | | | | | | | | | | | | | |

| Cash dividends | | | $ | 0.08 |

| | $ | 0.08 |

| | $ | 0.08 |

| | — | % | | — | % | | $ | 0.24 |

| | $ | 0.24 |

| | — | % | |

| Shareholders' equity | | | 11.22 |

| | 10.55 |

| | 11.11 |

| | 6.4 | % | | 1.0 | % | | 11.22 |

| | 10.55 |

| | 6.4 | % | |

| Shareholders' equity (tangible) | | | 8.35 |

| | 7.77 |

| | 8.29 |

| | 7.5 | % | | 0.7 | % | | 8.35 |

| | 7.77 |

| | 7.5 | % | |

| | | | | | | | | | | | | | | | | | | |

| Weighted average shares (basic) | | | 186,109 |

| | 192,251 |

| | 188,139 |

| | (3.2 | )% | | (1.1 | )% | | 187,893 |

| | 193,926 |

| | (3.1 | )% | |

| Weighted average shares (diluted) | | | 186,955 |

| | 193,259 |

| | 189,182 |

| | (3.3 | )% | | (1.2 | )% | | 188,863 |

| | 194,926 |

| | (3.1 | )% | |

| Shares outstanding, end of period | | | 185,158 |

| | 192,332 |

| | 189,033 |

| | (3.7 | )% | | (2.0 | )% | | 185,158 |

| | 192,332 |

| | (3.7 | )% | |

| | | | | | | | | | | | | | | | | | | |

SELECTED FINANCIAL RATIOS: | | | | | | | | | | | | | | | | | | |

| Return on average assets | | | 0.90 | % | | 0.93 | % | | 0.94 | % | | | | | | 0.95 | % | | 0.95 | % | | | |

| Return on average shareholders' equity | | | 7.32 | % | | 7.81 | % | | 7.63 | % | | | | | | 7.72 | % | | 7.79 | % | | | |

| Return on average shareholders' equity (tangible) | | | 9.88 | % | | 10.69 | % | | 10.30 | % | | | | | | 10.43 | % | | 10.62 | % | | | |

| Net interest margin | | | 3.39 | % | | 3.45 | % | | 3.41 | % | | | | | | 3.42 | % | | 3.51 | % | | | |

| Efficiency ratio | | | 65.80 | % | | 63.92 | % | | 65.85 | % | | | | | | 65.02 | % | | 62.81 | % | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

FULTON FINANCIAL CORPORATION | | | | | | |

CONDENSED CONSOLIDATED AVERAGE BALANCE SHEET ANALYSIS (UNAUDITED) | | | | | |

dollars in thousands | | | | | | |

| | Three Months Ended |

| | September 30, 2014 | | September 30, 2013 | | June 30, 2014 |

| | Average | | | | Yield/ | | Average | | | | Yield/ | | Average | | | | Yield/ |

| | Balance | | Interest (1) | | Rate | | Balance | | Interest (1) | | Rate | | Balance | | Interest (1) | | Rate |

ASSETS | | | | | | | | | | | | | | | | | |

Interest-earning assets: | | | | | | | | | | | | | | | | |

| Loans, net of unearned income | $ | 12,922,821 |

| | $ | 136,773 |

| | 4.20% | | $ | 12,728,162 |

| | $ | 139,141 |

| | 4.34% | | $ | 12,795,747 |

| | $ | 134,387 |

| | 4.21% |

| Taxable investment securities | 2,181,099 |

| | 12,278 |

| | 2.25% | | 2,446,583 |

| | 12,977 |

| | 2.12% | | 2,211,004 |

| | 12,418 |

| | 2.25% |

| Tax-exempt investment securities | 256,303 |

| | 3,414 |

| | 5.33% | | 284,372 |

| | 3,581 |

| | 5.04% | | 270,482 |

| | 3,534 |

| | 5.23% |

| Equity securities | 34,002 |

| | 438 |

| | 5.12% | | 35,999 |

| | 435 |

| | 4.82% | | 33,922 |

| | 419 |

| | 4.95% |

| Total Investment Securities | 2,471,404 |

| | 16,130 |

| | 2.61% | | 2,766,954 |

| | 16,993 |

| | 2.46% | | 2,515,408 |

| | 16,371 |

| | 2.60% |

| Loans held for sale | 23,699 |

| | 237 |

| | 4.01% | | 36,450 |

| | 382 |

| | 4.19% | | 17,540 |

| | 214 |

| | 4.87% |

| Other interest-earning assets | 293,286 |

| | 976 |

| | 1.33% | | 236,185 |

| | 659 |

| | 1.12% | | 238,921 |

| | 1,207 |

| | 2.02% |

| Total Interest-earning Assets | 15,711,210 |

| | 154,116 |

| | 3.90% | | 15,767,751 |

| | 157,175 |

| | 3.96% | | 15,567,616 |

| | 152,179 |

| | 3.92% |

Noninterest-earning assets: | | | | | | | | | | | | | | | | |

| Cash and due from banks | 203,134 |

| | | | | | 210,525 |

| | | | | | 198,291 |

| | | | |

| Premises and equipment | 224,241 |

| | | | | | 224,837 |

| | | | | | 224,586 |

| | | | |

| Other assets | 1,055,521 |

| | | | | | 1,009,162 |

| | | | | | 1,037,654 |

| | | | |

| Less: allowance for loan losses | (192,163 | ) | | | | | | (220,342 | ) | | | | | | (196,462 | ) | | | | |

| Total Assets | $ | 17,001,943 |

| | | | | | $ | 16,991,933 |

| | | | | | $ | 16,831,685 |

| | | | |

LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | | | |

| Demand deposits | $ | 3,047,191 |

| | $ | 953 |

| | 0.12% | | $ | 2,895,156 |

| | $ | 938 |

| | 0.13% | | $ | 2,914,887 |

| | $ | 904 |

| | 0.12% |

| Savings deposits | 3,468,958 |

| | 1,061 |

| | 0.12% | | 3,359,795 |

| | 1,015 |

| | 0.12% | | 3,355,929 |

| | 1,031 |

| | 0.12% |

| Time deposits | 3,009,225 |

| | 6,984 |

| | 0.92% | | 3,065,210 |

| | 6,790 |

| | 0.88% | | 3,012,061 |

| | 6,750 |

| | 0.90% |

| Total Interest-bearing Deposits | 9,525,374 |

| | 8,998 |

| | 0.37% | | 9,320,161 |

| | 8,743 |

| | 0.37% | | 9,282,877 |

| | 8,685 |

| | 0.38% |

| Short-term borrowings | 667,397 |

| | 297 |

| | 0.18% | | 1,337,742 |

| | 691 |

| | 0.20% | | 1,047,684 |

| | 540 |

| | 0.21% |

| FHLB advances and long-term debt | 995,486 |

| | 11,129 |

| | 4.45% | | 889,141 |

| | 10,865 |

| | 4.87% | | 894,511 |

| | 10,779 |

| | 4.83% |

| Total Interest-bearing Liabilities | 11,188,257 |

| | 20,424 |

| | 0.73% | | 11,547,044 |

| | 20,299 |

| | 0.70% | | 11,225,072 |

| | 20,004 |

| | 0.71% |

Noninterest-bearing liabilities: | | | | | | | | | | | | | | | | |

| Demand deposits | 3,514,033 |

| | | | | | 3,221,648 |

| | | | | | 3,322,195 |

| | | | |

| Other | 210,194 |

| | | | | | 194,163 |

| | | | | | 202,520 |

| | | | |

| Total Liabilities | 14,912,484 |

| | | | | | 14,962,855 |

| | | | | | 14,749,787 |

| | | | |

| Shareholders' equity | 2,089,459 |

| | | | | | 2,029,078 |

| | | | | | 2,081,898 |

| | | | |

| Total Liabilities and Shareholders' Equity | $ | 17,001,943 |

| | | | | | $ | 16,991,933 |

| | | | | | $ | 16,831,685 |

| | | | |

| Net interest income/net interest margin (fully taxable equivalent) | | | 133,692 |

| | 3.39% | | | | 136,876 |

| | 3.45% | | | | 132,175 |

| | 3.41% |

| Tax equivalent adjustment | | | (4,326 | ) | | | | | | (4,343 | ) | | | | | | (4,277 | ) | | |

| Net interest income | | | $ | 129,366 |

| | | | | | $ | 132,533 |

| | | | | | $ | 127,898 |

| | |

| | | | | | | | | | | | | | | | | | |

| (1) Presented on a tax-equivalent basis using a 35% Federal tax rate and statutory interest expense disallowances. | | | | | | |

| | | | | | | | | | | | | | | | | | |

AVERAGE LOANS, DEPOSITS AND SHORT-TERM BORROWINGS DETAIL: | | | | | | | | | | | | |

| | Three Months Ended | | % Change from | | | | | | | | |

| | September 30 | | September 30 | | June 30 | | September 30 | | June 30 | | | | | | | | |

| | 2014 | | 2013 | | 2014 | | 2013 | | 2014 | | | | | | | | |

Loans, by type: | | | | | | | | | | | | | | | | |

| Real estate - commercial mortgage | $ | 5,114,221 |

| | $ | 4,961,871 |

| | $ | 5,138,537 |

| | 3.1 | % | | (0.5 | )% | | | | | | | | |

| Commercial - industrial, financial and agricultural | 3,657,047 |

| | 3,706,113 |

| | 3,617,977 |

| | (1.3 | )% | | 1.1 | % | | | | | | | | |

| Real estate - home equity | 1,727,253 |

| | 1,767,095 |

| | 1,735,767 |

| | (2.3 | )% | | (0.5 | )% | | | | | | | | |

| Real estate - residential mortgage | 1,369,087 |

| | 1,323,972 |

| | 1,339,034 |

| | 3.4 | % | | 2.2 | % | | | | | | | | |

| Real estate - construction | 663,922 |

| | 576,222 |

| | 588,176 |

| | 15.2 | % | | 12.9 | % | | | | | | | | |

| Consumer | 284,630 |

| | 299,057 |

| | 276,444 |

| | (4.8 | )% | | 3.0 | % | | | | | | | | |

| Leasing and other | 106,661 |

| | 93,832 |

| | 99,812 |

| | 13.7 | % | | 6.9 | % | | | | | | | | |

| Total Loans, net of unearned income | $ | 12,922,821 |

| | $ | 12,728,162 |

| | $ | 12,795,747 |

| | 1.5 | % | | 1.0 | % | | | | | | | | |

Deposits, by type: | | | | | | | | | | | | | | | | |

| Noninterest-bearing demand | $ | 3,514,033 |

| | $ | 3,221,648 |

| | $ | 3,322,195 |

| | 9.1 | % | | 5.8 | % | | | | | | | | |

| Interest-bearing demand | 3,047,191 |

| | 2,895,156 |

| | 2,914,887 |

| | 5.3 | % | | 4.5 | % | | | | | | | | |

| Savings deposits | 3,468,958 |

| | 3,359,795 |

| | 3,355,929 |

| | 3.2 | % | | 3.4 | % | | | | | | | | |

| Time deposits | 3,009,225 |

| | 3,065,210 |

| | 3,012,061 |

| | (1.8 | )% | | (0.1 | )% | | | | | | | | |

| Total Deposits | $ | 13,039,407 |

| | $ | 12,541,809 |

| | $ | 12,605,072 |

| | 4.0 | % | | 3.4 | % | | | | | | | | |

Short-term borrowings, by type: | | | | | | | | | | | | | | | | |

| Customer repurchase agreements | $ | 202,809 |

| | $ | 196,503 |

| | $ | 216,212 |

| | 3.2 | % | | (6.2 | )% | | | | | | | | |

| Customer short-term promissory notes | 83,734 |

| | 91,573 |

| | 81,823 |

| | (8.6 | )% | | 2.3 | % | | | | | | | | |

| Federal funds purchased | 224,930 |

| | 559,992 |

| | 444,429 |

| | (59.8 | )% | | (49.4 | )% | | | | | | | | |

| Short-term FHLB advances and other borrowings | 155,924 |

| | 489,674 |

| | 305,220 |

| | (68.2 | )% | | (48.9 | )% | | | | | | | | |

| Total Short-term Borrowings | $ | 667,397 |

| | $ | 1,337,742 |

| | $ | 1,047,684 |

| | (50.1 | )% | | (36.3 | )% | | | | | | | | |

| | | | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | |

FULTON FINANCIAL CORPORATION | | | | | | |

CONDENSED CONSOLIDATED AVERAGE BALANCE SHEET ANALYSIS (UNAUDITED) | | | | | | |

dollars in thousands | | | | | | |

| | | Nine Months Ended September 30 |

| | | 2014 | | 2013 |

| | | Average | | | | | | Average | | | | |

| | | Balance | | Interest (1) | | Yield/Rate | | Balance | | Interest (1) | | Yield/Rate |

ASSETS | | | | | | |

| | | | | | | | | | | | | |

Interest-earning assets: | | | | | | |

| Loans, net of unearned income | | $ | 12,827,563 |

| | $ | 405,904 |

| | 4.23 | % | | $ | 12,506,393 |

| | $ | 414,091 |

| | 4.43 | % |

| Taxable investment securities | | 2,216,344 |

| | 37,962 |

| | 2.28 | % | | 2,426,015 |

| | 40,890 |

| | 2.25 | % |

| Tax-exempt investment securities | | 268,604 |

| | 10,561 |

| | 5.24 | % | | 285,638 |

| | 11,003 |

| | 5.14 | % |

| Equity securities | | 33,949 |

| | 1,286 |

| | 5.06 | % | | 40,352 |

| | 1,416 |

| | 4.69 | % |

| Total Investment Securities | | 2,518,897 |

| | 49,809 |

| | 2.64 | % | | 2,752,005 |

| | 53,309 |

| | 2.58 | % |

| Loans held for sale | | 18,259 |

| | 585 |

| | 4.27 | % | | 42,122 |

| | 1,261 |

| | 3.99 | % |

| Other interest-earning assets | | 263,797 |

| | 3,065 |

| | 1.55 | % | | 217,975 |

| | 1,527 |

| | 0.93 | % |

| Total Interest-earning Assets | | 15,628,516 |

| | 459,363 |

| | 3.93 | % | | 15,518,495 |

| | 470,188 |

| | 4.05 | % |

| | | | | | | | | | | | | |

Noninterest-earning assets: | | | | | | |

| Cash and due from banks | | 200,368 |

| | | | | | 206,403 |

| | | | |

| Premises and equipment | | 225,033 |

| | | | | | 225,733 |

| | | | |

| Other assets | | 1,041,834 |

| | | | | | 1,047,122 |

| | | | |

| Less: allowance for loan losses | | (197,235 | ) | | | | | | (223,220 | ) | | | | |

| Total Assets | | $ | 16,898,516 |

| | | | | | $ | 16,774,533 |

| | | | |

| | | | | | | | | | | | | |

LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | |

| | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | |

| Demand deposits | | $ | 2,969,470 |

| | $ | 2,766 |

| | 0.12 | % | | $ | 2,773,917 |

| | $ | 2,687 |

| | 0.13 | % |

| Savings deposits | | 3,392,681 |

| | 3,127 |

| | 0.12 | % | | 3,348,413 |

| | 3,054 |

| | 0.12 | % |

| Time deposits | | 2,984,861 |

| | 19,686 |

| | 0.88 | % | | 3,184,281 |

| | 22,901 |

| | 0.96 | % |

| Total Interest-bearing Deposits | | 9,347,012 |

| | 25,579 |

| | 0.37 | % | | 9,306,611 |

| | 28,642 |

| | 0.41 | % |

| | | | | | | | | | | | | |

| Short-term borrowings | | 972,694 |

| | 1,470 |

| | 0.20 | % | | 1,228,882 |

| | 1,900 |

| | 0.20 | % |

| FHLB advances and long-term debt | | 924,920 |

| | 32,606 |

| | 4.71 | % | | 889,826 |

| | 32,448 |

| | 4.87 | % |

| Total Interest-bearing Liabilities | | 11,244,626 |

| | 59,655 |

| | 0.71 | % | | 11,425,319 |

| | 62,990 |

| | 0.74 | % |

| | | | | | | | | | | | | |

Noninterest-bearing liabilities: | | | | | | |

| Demand deposits | | 3,360,876 |

| | | | | | 3,103,381 |

| | | | |

| Other | | 214,826 |

| | | | | | 190,976 |

| | | | |

| Total Liabilities | | 14,820,328 |

| | | | | | 14,719,676 |

| | | | |

| Shareholders' equity | | 2,078,188 |

| | | | | | 2,054,857 |

| | | | |

| | | | | | | | | | | | | |

| Total Liabilities and Shareholders' Equity | | $ | 16,898,516 |

| | | | | | $ | 16,774,533 |

| | | | |

| | | | | | | | | | | | | |

| Net interest income/net interest margin (fully taxable equivalent) | | | | 399,708 |

| | 3.42 | % | | | | 407,198 |

| | 3.51 | % |

| Tax equivalent adjustment | | | | (12,879 | ) | | | | | | (12,956 | ) | | |

| | | | | | | | | | | | | |

| Net interest income | | | | $ | 386,829 |

| | | | | | $ | 394,242 |

| | |

| | | | | | | | | | | | | |

(1) Presented on a tax-equivalent basis using a 35% Federal tax rate and statutory interest expense disallowances. | | | | | | |

| | | | | | | | | | | | | |

AVERAGE LOANS, DEPOSITS AND SHORT-TERM BORROWINGS DETAIL: | | | | | | |

| | | | | | | | | | | | | |

| | | Nine Months Ended | | | | | | | | |

| | | September 30 | | | | | | | | |

| | | 2014 | | 2013 | | % Change | | | | | | |

Loans, by type: | | | | | | |

| Real estate - commercial mortgage | | $ | 5,112,735 |

| | $ | 4,796,557 |

| | 6.6 | % | | | | | | |

| Commercial - industrial, financial and agricultural | | 3,637,440 |

| | 3,694,612 |

| | (1.5 | )% | | | | | | |

| Real estate - home equity | | 1,739,352 |

| | 1,721,041 |

| | 1.1 | % | | | | | | |

| Real estate - residential mortgage | | 1,348,269 |

| | 1,305,434 |

| | 3.3 | % | | | | | | |

| Real estate - construction | | 609,803 |

| | 594,991 |

| | 2.5 | % | | | | | | |

| Consumer | | 278,697 |

| | 303,127 |

| | (8.1 | )% | | | | | | |

| Leasing and other | | 101,267 |

| | 90,631 |

| | 11.7 | % | | | | | | |

| Total Loans, net of unearned income | | $ | 12,827,563 |

| | $ | 12,506,393 |

| | 2.6 | % | | | | | | |

| | | | | | | | | | | | | |

Deposits, by type: | | | | | | |

| Noninterest-bearing demand | | $ | 3,360,876 |

| | $ | 3,103,381 |

| | 8.3 | % | | | | | | |

| Interest-bearing demand | | 2,969,470 |

| | 2,773,917 |

| | 7.0 | % | | | | | | |

| Savings deposits | | 3,392,681 |

| | 3,348,413 |

| | 1.3 | % | | | | | | |

| Time deposits | | 2,984,861 |

| | 3,184,281 |

| | (6.3 | )% | | | | | | |

| | | | | | | | | | | | | |

| Total Deposits | | $ | 12,707,888 |

| | $ | 12,409,992 |

| | 2.4 | % | | | | | | |

| | | | | | | | | | | | | |

Short-term borrowings, by type: | | | | | | |

| Customer repurchase agreements | | $ | 202,184 |

| | $ | 183,432 |

| | 10.2 | % | | | | | | |

| Customer short-term promissory notes | | 89,119 |

| | 100,532 |

| | (11.4 | )% | | | | | | |

| Federal funds purchased | | 361,162 |

| | 681,576 |

| | (47.0 | )% | | | | | | |

| Short-term FHLB advances and other borrowings | | 320,229 |

| | 263,342 |

| | 21.6 | % | | | | | | |

| Total Short-term Borrowings | | $ | 972,694 |

| | $ | 1,228,882 |

| | (20.8 | )% | | | | | | |

| | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

FULTON FINANCIAL CORPORATION | | | | | | | | | | | |

ASSET QUALITY INFORMATION (UNAUDITED) | | | | | | | | | | | |

dollars in thousands | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended | | | | | | | | |

| | Sep 30 | | Sep 30 | | Jun 30 | | Sep 30 | | Sep 30 | | | | | | | | |

| | 2014 | | 2013 | | 2014 | | 2014 | | 2013 | | | | | | | | |

ALLOWANCE FOR CREDIT LOSSES: | | | | | | | | | | | | | | | | |

Balance at beginning of period | $ | 193,442 |

| | $ | 217,626 |

| | $ | 199,006 |

| | $ | 204,917 |

| | $ | 225,439 |

| | | | | | | | |

| Loans charged off: | | | | | | | | | | | | | | | | | |

| Commercial - industrial, financial and agricultural | (5,167 | ) | | (9,394 | ) | | (5,512 | ) | | (15,804 | ) | | (24,856 | ) | | | | | | | | |

| Consumer and home equity | (2,030 | ) | | (2,838 | ) | | (1,683 | ) | | (6,115 | ) | | (8,191 | ) | | | | | | | | |

| Real estate - commercial mortgage | (1,557 | ) | | (3,724 | ) | | (2,141 | ) | | (5,084 | ) | | (13,050 | ) | | | | | | | | |

| Real estate - construction | (313 | ) | | (598 | ) | | (218 | ) | | (745 | ) | | (5,181 | ) | | | | | | | | |

| Leasing and other | (306 | ) | | (787 | ) | | (833 | ) | | (1,434 | ) | | (2,037 | ) | | | | | | | | |

| Real estate - residential mortgage | (231 | ) | | (767 | ) | | (1,089 | ) | | (2,166 | ) | | (8,282 | ) | | | | | | | | |

| Total loans charged off | (9,604 | ) | | (18,108 | ) | | (11,476 | ) | | (31,348 | ) | | (61,597 | ) | | | | | | | | |

Recoveries of loans previously charged off: | | | | | | | | | | | | | | | | | |

| Commercial - industrial, financial and agricultural | 1,013 |

| | 2,295 |

| | 775 |

| | 2,532 |

| | 3,430 |

| | | | | | | | |

| Consumer and home equity | 784 |

| | 492 |

| | 579 |

| | 1,928 |

| | 1,927 |

| | | | | | | | |

| Real estate - commercial mortgage | 1,167 |

| | 185 |

| | 430 |

| | 1,641 |

| | 2,754 |

| | | | | | | | |

| Real estate - construction | 470 |

| | 379 |

| | 158 |

| | 852 |

| | 1,794 |

| | | | | | | | |

| Leasing and other | 241 |

| | 224 |

| | 362 |

| | 767 |

| | 649 |

| | | | | | | | |

| Real estate - residential mortgage | 95 |

| | 245 |

| | 108 |

| | 319 |

| | 442 |

| | | | | | | | |

| Recoveries of loans previously charged off | 3,770 |

| | 3,820 |

| | 2.412 |

| | 8,039 |

| | 10,996 |

| | | | | | | | |

Net loans charged off | (5,834 | ) | | (14,288 | ) | | (9.064 | ) | | (23,309 | ) | | (50,601 | ) | | | | | | | | |

Provision for credit losses | 3,500 |

| | 9,500 |

| | 3,500 |

| | 9,500 |

| | 38,000 |

| | | | | | | | |

Balance at end of period | $ | 191,108 |

| | $ | 212,838 |

| | $ | 193,442 |

| | $ | 191,108 |

| | $ | 212,838 |

| | | | | | | | |

Net charge-offs to average loans (annualized) | 0.18 | % | | 0.45 | % | | 0.28 | % | | 0.24 | % | | 0.54 | % | | | | | | | | |

NON-PERFORMING ASSETS: | | | | | | | | | | | | | | | | |

| Non-accrual loans | $ | 126,420 |

| | $ | 143,012 |

| | $ | 129,934 |

| | | | | | | | | | | | |

| Loans 90 days past due and accruing | 17,428 |

| | 25,271 |

| | 19,378 |

| | | | | | | | | | | | |

| Total non-performing loans | 143,848 |

| | 168,283 |

| | 149,312 |

| | | | | | | | | | | | |

| Other real estate owned | 13,489 |

| | 18,173 |

| | 13,482 |

| | | | | | | | | | | | |

| Total non-performing assets | $ | 157,337 |

| | $ | 186,456 |

| | $ | 162,794 |

| | | | | | | | | | | | |

NON-PERFORMING LOANS, BY TYPE: | | | | | | | | | | | | | | | | |

| Real estate - commercial mortgage | $ | 44,602 |

| | $ | 42,623 |

| | $ | 44,015 |

| | | | | | | | | | | | |

| Commercial - industrial, financial and agricultural | 33,277 |

| | 45,184 |

| | 38,163 |

| | | | | | | | | | | | |

| Real estate - residential mortgage | 28,135 |

| | 34,309 |

| | 27,887 |

| | | | | | | | | | | | |

| Real estate - construction | 19,860 |

| | 24,396 |

| | 20,268 |

| | | | | | | | | | | | |

| Consumer and home equity | 17,586 |

| | 21,704 |

| | 18,919 |

| | | | | | | | | | | | |

| Leasing | 388 |

| | 67 |

| | 60 |

| | | | | | | | | | | | |

| Total non-performing loans | $ | 143,848 |

| | $ | 168,283 |

| | $ | 149,312 |

| | | | | | | | | | | | |

TROUBLED DEBT RESTRUCTURINGS (TDRs), BY TYPE: | | | | | | | | | | | | | | | | |

| Real-estate - residential mortgage | $ | 30,850 |

| | $ | 27,820 |

| | $ | 31,184 |

| | | | | | | | | | | | |

| Real-estate - commercial mortgage | 18,869 |

| | 22,644 |

| | 19,398 |

| | | | | | | | | | | | |

| Real estate - construction | 9,251 |

| | 9,841 |

| | 8,561 |

| | | | | | | | | | | | |

| Commercial - industrial, financial and agricultural | 5,115 |

| | 8,184 |

| | 6,953 |

| | | | | | | | | | | | |

| Consumer and home equity | 2,927 |

| | 1,678 |

| | 2,838 |

| | | | | | | | | | | | |

| Total accruing TDRs | $ | 67,012 |

| | $ | 70,167 |

| | $ | 68,934 |

| | | | | | | | | | | | |

| Non-accrual TDRs (1) | 27,724 |

| | 30,501 |

| | 25,526 |

| | | | | | | | | | | | |

| Total TDRs | $ | 94,736 |

| | $ | 100,668 |

| | $ | 94,460 |

| | | | | | | | | | | | |

(1) Included within non-accrual loans above. | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

DELINQUENCY RATES, BY TYPE: | | | | | | | | | | | | | | | | |

| | September 30, 2014 | | September 30, 2013 | | June 30, 2014 |

| | 31-89 Days | | ≥90 Days (2) | | Total | | 31-89 Days | | ≥90 Days (2) | | Total | | 31-89 Days | | ≥90 Days (2) | | Total |

| | | | | | | | | | | | | | | | | | |

| Real estate - commercial mortgage | 0.48 | % | | 0.86 | % | | 1.34 | % | | 0.40 | % | | 0.84 | % | | 1.24 | % | | 0.30 | % | | 0.86 | % | | 1.16 | % |

| Commercial - industrial, financial and agricultural | 0.28 | % | | 0.91 | % | | 1.19 | % | | 0.32 | % | | 1.24 | % | | 1.56 | % | | 0.47 | % | | 1.05 | % | | 1.52 | % |

| Real estate - construction | 0.03 | % | | 2.89 | % | | 2.92 | % | | 0.40 | % | | 4.22 | % | | 4.62 | % | | 0.10 | % | | 3.20 | % | | 3.30 | % |

| Real estate - residential mortgage | 1.81 | % | | 2.06 | % | | 3.87 | % | | 1.82 | % | | 2.58 | % | | 4.40 | % | | 1.78 | % | | 2.05 | % | | 3.83 | % |

| Consumer, home equity, leasing and other | 0.74 | % | | 0.85 | % | | 1.59 | % | | 1.19 | % | | 1.00 | % | | 2.19 | % | | 0.84 | % | | 0.90 | % | | 1.74 | % |

| Total | 0.58 | % | | 1.11 | % | | 1.69 | % | | 0.66 | % | | 1.31 | % | | 1.97 | % | | 0.58 | % | | 1.17 | % | | 1.75 | % |

(2) Includes non-accrual loans | | | | | | | | | | | | | | | | | |

ASSET QUALITY RATIOS: | | | | | | | | | | | | | | | | |

| | Sep 30 | | Sep 30 | | Jun 30 | | | | | | | | | | | | |

| | 2014 | | 2013 | | 2014 | | | | | | | | | | | | |

| Non-accrual loans to total loans | 0.97 | % | | 1.12 | % | | 1.01 | % | | | | | | | | | | | | |

| Non-performing assets to total loans and OREO | 1.21 | % | | 1.46 | % | | 1.27 | % | | | | | | | | | | | | |

| Non-performing assets to total assets | 0.91 | % | | 1.09 | % | | 0.96 | % | | | | | | | | | | | | |

| Allowance for credit losses to loans outstanding | 1.47 | % | | 1.67 | % | | 1.51 | % | | | | | | | | | | | | |

| Allowance for credit losses to non-performing loans | 132.85 | % | | 126.48 | % | | 129.56 | % | | | | | | | | | | | | |

| Non-performing assets to tangible common shareholders' equity and allowance for credit losses | 9.06 | % | | 10.92 | % | | 9.25 | % | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

FULTON FINANCIAL CORPORATION | | | | | | |

RECONCILIATION OF GAAP TO NON-GAAP MEASURES (UNAUDITED) | | | | | | |

in thousands, except per share data and percentages | | | | | | |

| | | | | | | | | | | | | | | |

Explanatory note: | This press release contains certain financial information, as detailed below, which has been derived by methods other than Generally Accepted Accounting Principles ("GAAP"). The Corporation has presented these non-GAAP financial measures because it believes that these measures provide useful and comparative information to assess trends in the Corporation's quarterly results of operations. Presentation of these non-GAAP financial measures is consistent with how the Corporation evaluates its performance internally and these non-GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Corporation's industry. Management believes that these non-GAAP financial measures, in addition to GAAP measures, are also useful to investors to evaluate the Corporation's results. Investors should recognize that the Corporation's presentation of these non-GAAP financial measures might not be comparable to similarly-titled measures of other companies. These non-GAAP financial measures should not be considered a substitute for GAAP basis measures and the Corporation strongly encourages a review of its condensed consolidated financial statements in their entirety. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measure follow: |

| | | | | | | | | | | | | | | |

| | | | | | | Three Months Ended | | Nine Months Ended |

| | | | | | | Sep 30 | | Sep 30 | | Jun 30 | | Sep 30 | | Sep 30 |

| | | | | | | 2014 | | 2013 | | 2014 | | 2014 | | 2013 |

Shareholders' equity (tangible), per share | | | | | | | | | | | |

Shareholders' equity | | | $ | 2,078,006 |

| | $ | 2,028,964 |

| | $ | 2,099,800 |

| | | | |

Less: Goodwill and intangible assets | | | (532,117 | ) | | (533,918 | ) | | (532,432 | ) | | | | |

Tangible shareholders' equity (numerator) | | | $ | 1,545,889 |

| | $ | 1,495,046 |

| | $ | 1,567,368 |

| | | | |

Shares outstanding, end of period (denominator) | | | 185,158 |

| | 192,332 |

| | 189,033 |

| | | | |

Shareholders' equity (tangible), per share | | | $ | 8.35 |

| | $ | 7.77 |

| | $ | 8.29 |

| | | | |

| | | | | | | | | | | | | | | |

Return on average common shareholders' equity (tangible) | | | | | | | | | | |

Net income | | | $ | 38,566 |

| | $ | 39,948 |

| | $ | 39,596 |

| | $ | 119,945 |

| | $ | 119,757 |

|

Plus: Intangible amortization, net of tax | | | 203 |

| | 347 |

| | 204 |

| | 614 |

| | 1,042 |

|

Numerator | | $ | 38,769 |

| | $ | 40,295 |

| | $ | 39,800 |

| | $ | 120,559 |

| | $ | 120,799 |

|

Average shareholders' equity | | | $ | 2,089,459 |

| | $ | 2,029,078 |

| | $ | 2,081,898 |

| | $ | 2,078,188 |

| | $ | 2,054,857 |

|

Less: Average goodwill and intangible assets | | | (532,271 | ) | | (534,179 | ) | | (532,585 | ) | | (532,584 | ) | | (534,712 | ) |

Average tangible shareholders' equity (denominator) | | $ | 1,557,188 |

| | $ | 1,494,899 |

| | $ | 1,549,313 |

| | $ | 1,545,604 |

| | $ | 1,520,145 |

|

Return on average common shareholders' equity (tangible), annualized | | 9.88 | % | | 10.69 | % | | 10.30 | % | | 10.43 | % | | 10.62 | % |

| | | | | | | | | | | | | | | |

Efficiency ratio | | | | | | | | | | | | | |

Non-interest expense | | | $ | 115,798 |

| | $ | 116,605 |

| | $ | 116,174 |

| | $ | 341,526 |

| | $ | 344,671 |

|

Less: Intangible amortization | | | (314 | ) | | (534 | ) | | (315 | ) | | (944 | ) | | (1,603 | ) |

Numerator | | | $ | 115,484 |

| | $ | 116,071 |

| | $ | 115,859 |

| | $ | 340,582 |

| | $ | 343,068 |

|

Net interest income (fully taxable equivalent) | | | $ | 133,692 |

| | $ | 136,876 |

| | $ | 132,175 |

| | $ | 399,708 |

| | $ | 407,198 |

|

Plus: Total Non-interest income | | | 41,900 |

| | 47,357 |

| | 44,872 |

| | 125,278 |

| | 146,932 |

|

Less: Investment securities gains | | | (81 | ) | | (2,633 | ) | | (1,112 | ) | | (1,193 | ) | | (7,971 | ) |

Denominator | | | $ | 175,511 |

| | $ | 181,600 |

| | $ | 175,935 |

| | $ | 523,793 |

| | $ | 546,159 |

|

Efficiency ratio | | | 65.80 | % | | 63.92 | % | | 65.85 | % | | 65.02 | % | | 62.81 | % |

| | | | | | | | | | | | | | | |

Non-performing assets to tangible common shareholders' equity and allowance for credit losses | | | | | | |

Non-performing assets (numerator) | | | $ | 157,337 |

| | $ | 186,456 |

| | $ | 162,794 |

| | | | |

Tangible shareholders' equity | | | $ | 1,545,889 |

| | $ | 1,495,046 |

| | $ | 1,567,368 |

| | | | |

Plus: Allowance for credit losses | | | 191,108 |

| | 212,838 |

| | 193,442 |

| | | | |

Tangible shareholders' equity and allowance for credit losses (denominator) | $ | 1,736,997 |

| | $ | 1,707,884 |

| | $ | 1,760,810 |

| | | | |

Non-performing assets to tangible common shareholders' equity and allowance for credit losses | 9.06 | % | | 10.92 | % | | 9.25 | % | | | | |

| | | | | | | | | | | | | | | |

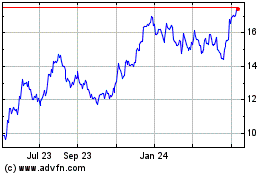

Fulton Financial (NASDAQ:FULT)

Historical Stock Chart

From Mar 2024 to Apr 2024

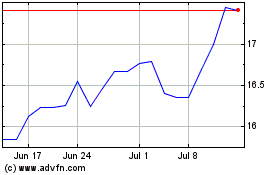

Fulton Financial (NASDAQ:FULT)

Historical Stock Chart

From Apr 2023 to Apr 2024