The recent rumble on Wall Street coupled with looming fears over

rising interest rates has prompted many investors to re-examine

their portfolios. More specifically, investors who rely on the

current income stream from their portfolios have likely been

thinking of prudent ways to more favorably re-position their

holdings over the coming months. We recently had an opportunity to

talk with David Fabian, a managing partner at FMD Capital

Management, whose firm specializes in actively managed ETF

portfolios.

David offers his insights below on how investors can utilize

ETFs to build an income portfolio [see our List of ETF

Friendly Advisors]:

ETF Database (ETFdb): What are the key components of

a successful income portfolio?

David Fabian (DF): A successful income portfolio is made up

of multiple asset classes that include: dividend paying equities,

fixed-income, and alternative income strategies.

Most ETF income portfolios for retired or conservative investors

are centered on core holdings in bonds because of the dependable

dividends and reduced price swings. I tend to favor

actively-managed funds such as the PIMCO Total Return ETF (BOND)

which carries a wide array of treasury, mortgage, and corporate

debt of both developed and foreign nations. I like that active

managers have the ability to control their sector allocations,

duration, and credit profile to seek alpha. You can then

subsequently overweight your fixed-income exposure in tactical

sectors such as the iShares J.P. Morgan USD Emerging Markets Bond

ETF (EMB) or iShares iBoxx $ Investment Grade Corporate Bond ETF

(LQD) to enhance your returns [see also 101 High Yielding ETFs for

Every Dividend Investor].

The dividend paying equity side of the

portfolio is designed to provide market correlation along with

inflation fighting effects over time. The Vanguard High Yield

Dividend ETF (VYM) is a favorite core holding that includes a broad

array of nearly 400 stocks with strong dividend histories. One of

the reasons I like this ETF is that it has an overweight allocation

to technology stocks such as Apple Inc (AAPL), which has become a

heavy weight in the dividend world and still offers excellent

growth potential.

The dividend paying equity side of the

portfolio is designed to provide market correlation along with

inflation fighting effects over time. The Vanguard High Yield

Dividend ETF (VYM) is a favorite core holding that includes a broad

array of nearly 400 stocks with strong dividend histories. One of

the reasons I like this ETF is that it has an overweight allocation

to technology stocks such as Apple Inc (AAPL), which has become a

heavy weight in the dividend world and still offers excellent

growth potential.

Lastly, the alternative sleeve of a successful ETF income

portfolio provides exposure to REITs, MLPs, and preferred stocks.

The Vanguard REIT ETF (VNQ) and iShares U.S. Preferred Stock ETF

(PFF) are two examples of alternative strategies that offer

above-average yields and access to non-traditional asset classes.

These are often overlooked by investors that are focused solely on

common stocks and bonds.

ETFdb: Why does diversification play such a key role in

this strategy?

DF: A diversified approach helps to minimize the risk of

being overly concentrated in one asset class, increase the overall

yield of the portfolio, and generally offers lower volatility.

By focusing exclusively on just one aspect of the

income-generating world, you put all your eggs in one basket, which

can lead to inconsistent returns. Conversely, spreading your money

among a variety of sectors and strategies allows your portfolio to

reap the benefits of non-correlated returns and steadier price

action.

Alternative assets in particular are one area that can offer

much higher yields and price trends that don’t directly correlate

with stocks or interest rates. This provides a counterweight to

your core equity and bond exposure, while still offering consistent

income streams.

ETFdb: With so many income-oriented ETFs available, how do

you decipher the best funds in each category?

DF: Dissecting the numerous ETFs available to income

investors can be a tedious task. However, it is made much simpler

with free tools from websites such as ETFdb.com to sort through the

various options [see Complete List of Dividend-focused

ETFs].

Below are some of the previously mentioned ETFs, and a few

others as well, along with their respective yield and year-to-date

returns (data as of 10/15/2014):

Ticker Name Yield YTD Return

|

| BOND |

PIMCO Total Return ETF |

2.89% |

5.98% |

| EMB |

iShares USD Emerging Markets Bond ETF |

4.51% |

8.20% |

| LQD |

iShares Invest Grade Corporate Bond ETF |

3.10% |

8.20% |

| VYM |

Vanguard High Yield Dividend ETF |

2.98% |

3.55% |

| HDV |

iShares High Dividend ETF |

3.45% |

5.38% |

| VNQ |

Vanguard REIT ETF |

3.93% |

18.23% |

| PFF |

iShares U.S. Preferred Stock |

5.75% |

11.56% |

| AMLP |

Alerian MLP ETF |

6.37% |

5.01% |

The number one factor when selecting an ETF that will have the

biggest impact on total return is the index construction

methodology. This includes examining the underlying securities,

sectors, and asset allocation to determine if they meet your

overarching criteria. Each ETF will offer a unique opportunity

based on its investment mandate.

I also encourage investors to pay close attention to fees – both

underlying expenses and transaction fees at their broker. Many

comparable ETFs offer widely varying fee structures, which can

significantly impact your long-term performance. One example of

this disparity is the 0.10% expense ratio charged by the Vanguard

REIT ETF (VNQ) and 0.45% expense ratio of the iShares U.S. Real

Estate ETF (IYR). Both indexes offer comparable exposure to a

diversified index of U.S.-listed REITs.

Volume and size are additional attributes to consider when

analyzing comparable funds. Small funds or those with insignificant

trading volume should be viewed with caution. I typically recommend

that investors select 2 – 4 funds in each of the three categories

to diversify their exposure [see also Dividend ETFs: 3 Things to

Consider].

ETFdb: In the current environment, what is

your advice for income investors who are looking to achieve

above-average yield?

ETFdb: In the current environment, what is

your advice for income investors who are looking to achieve

above-average yield?

DF: The stretch for yield has been a theme on Wall Street

over the last several years as the Federal Reserve has fought to

keep interest rates low. However, many investors are still

languishing in areas that are offering yields below 3%.

To combat the low yield environment, investors can get creative

with their portfolio exposure and positioning. If they have a

higher tolerance for risk, this may include greater allocations to

the alternative asset sleeve of the portfolio or selecting bond

holdings that include high yield and emerging market coverage.

The one word of caution I have is that, in general, high yield =

high risk. Investors should assume that each incremental jump

higher in income will come with a commensurate higher level of risk

that includes price volatility. With the eventual tightening of

interest rates on the horizon, this will become an important theme

to manage moving forward.

ETFdb: How can active management play a role in an income

portfolio?

DF: In my opinion, active management continues to be a

significant driver of total return in the income investing world.

This is particularly true when you have to factor in credit cycles,

interest rate risk, and stock market returns. This will entail

casting a wide net in the search for suitable investment

opportunities with just the right mix of yield and risk to maintain

purchasing power and an eye towards capital preservation [see also

Monthly Dividend ETFdb Portfolio].

Sizing your allocations to each sleeve of the income portfolio

is also an important consideration. An interest rate tightening

cycle may call for lowering your allocation to bonds and increasing

exposure to stocks, alternatives, or cash to capitalize on more

advantageous prices in fixed-income down the road. Conversely, a

volatile stock market may increase the need for quality

fixed-income as a deflationary hedge.

The one commonality in this process is the use of low-cost,

diversified, and liquid ETFs to generate sustainable income with

consistent returns.

The Bottom Line

When it comes to generating a meaningful source of income,

especially in the current environment, dividend-focused ETFs may

offer creative solutions to yield-starved investors. With that

being said, simply going after the highest-yielding securities is a

surefire way to take on too much risk and leave your portfolio

quite vulnerable. Consider the advice featured above and be sure to

also do your own homework on any one fund before making an

allocation; it’s always better to take your time and uncover any

nuances before you’ve pulled the buy trigger.

Follow me on Twitter @SBojinov

[For more ETF analysis, make sure to sign up for our free ETF

newsletter]

Disclosure: No positions at time of writing.

Click here to read the original article on ETFdb.com.

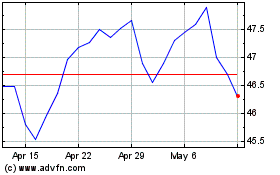

Alerian MLP (AMEX:AMLP)

Historical Stock Chart

From Mar 2024 to Apr 2024

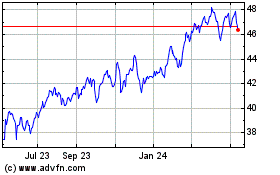

Alerian MLP (AMEX:AMLP)

Historical Stock Chart

From Apr 2023 to Apr 2024