IHS Inc. Announces Offering of Senior Notes

October 21 2014 - 8:33AM

Business Wire

IHS Inc. (NYSE: IHS) today announced that it intends to offer,

subject to market and other conditions, $500 million in aggregate

principal amount of senior notes due 2022 (the “notes”) in a

private placement transaction pursuant to Rule 144A and Regulation

S under the Securities Act of 1933, as amended.

IHS intends to use the net proceeds from the offering of the

notes to repay all amounts outstanding under its existing $250

million unsecured term loan and to repay a portion of the $850

million of outstanding borrowings under its new $1.3 billion senior

unsecured revolving facility (the “2014 revolving facility”).

As previously disclosed, on October 17, 2014, IHS borrowed

approximately $850 million under the 2014 revolving facility and,

together with cash on hand, repaid all amounts outstanding and

cancelled all commitments under its 2011 credit facility. Following

consummation of the offering of the notes and use of proceeds

therefrom, IHS expects to have approximately $1.8 billion of

indebtedness outstanding.

The combination of the offering and the 2014 revolving facility

diversifies IHS capital sources, increases liquidity and extends

debt maturities.

This news release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of,

these securities in any state or other jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or

other jurisdiction.

The notes are being offered and sold to qualified institutional

buyers in the United States in reliance on Rule 144A under the U.S.

Securities Act of 1933, as amended and to non-U.S. persons in

offshore transactions outside the United States in accordance with

Regulation S under the Securities Act. The notes have not been

registered under the Securities Act or any state securities laws,

and may not be offered or sold in the United States or to U.S.

persons absent registration or an applicable exemption from the

registration requirements.

Forward-Looking Statements

This release contains “forward-looking statements” within the

meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking

statements can be identified by words such as: “anticipate,”

“intend,” “plan,” “goal,” “seek,” “aim,” “strive,” “believe,”

“project,” “predict,” “estimate,” “expect,” “continue,” “strategy,”

“future,” “likely,” “may,” “might,” “should,” “will,” the negative

of these terms, and similar references to future periods.

Forward-looking statements are neither historical facts nor

assurances of future performance. Instead, they are based only on

our current beliefs, expectations and assumptions regarding the

future of our business, future plans and strategies, projections,

anticipated events and trends, the economy and other future

conditions. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks and

changes in circumstances that are difficult to predict and many of

which are outside of our control. A detailed discussion of some of

the risks and uncertainties that could cause our actual results and

financial condition to differ materially from the forward-looking

statements is described under the caption “Risk Factors” in our

most recent annual report on Form 10-K, along with our other

filings with the SEC.

Any forward-looking statement made by us in this release speaks

only as of the date on which it is made. We undertake no obligation

to publicly update any forward-looking statement, whether written

or oral, that may be made from time to time, whether as a result of

new information, future developments or otherwise.

About IHS

IHS (NYSE: IHS) is the leading source of information, insight

and analytics in critical areas that shape today’s business

landscape. Businesses and governments in more than 165 countries

around the globe rely on the comprehensive content, expert

independent analysis and flexible delivery methods of IHS to make

high-impact decisions and develop strategies with speed and

confidence. IHS has been in business since 1959 and became a

publicly traded company on the New York Stock Exchange in 2005.

Headquartered in Englewood, Colorado, USA, IHS is committed to

sustainable, profitable growth and employs more than 8,000 people

in 31 countries around the world.

IHS is a registered trademark of IHS Inc. All other company and

product names may be trademarks of their respective owners. © 2014

IHS Inc. All rights reserved.

News Media Contact:IHS Inc.Ed Mattix, +1 303 397

2467ed.mattix@ihs.comorInvestor Relations Contact:IHS

Inc.Eric Boyer, +1 303 397 2969eric.boyer@ihs.com

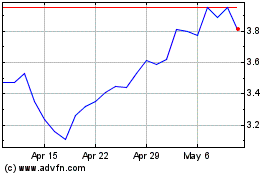

IHS (NYSE:IHS)

Historical Stock Chart

From Mar 2024 to Apr 2024

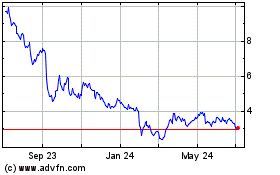

IHS (NYSE:IHS)

Historical Stock Chart

From Apr 2023 to Apr 2024