Report of Foreign Issuer (6-k)

October 21 2014 - 7:56AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 AND 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For 21 October 2014

InterContinental Hotels Group PLC

Broadwater Park, Denham, Buckinghamshire, UB9 5HJ, United Kingdom

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F Form 40-F

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes No

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable

EXHIBIT INDEX

Exhibit No: 99.1

21 October 2014

InterContinental Hotels Group PLC

Third Quarter Interim Management Statement

Strong third quarter performance

|

· Global Q3 comparable RevPAR growth of 7.0%; 6.3% in the first nine months

|

|

· 8k rooms opened in Q3; net system size up 2.7% year on year to 697k rooms

|

|

· 16k rooms signed in Q3; over 90% of year to date signings located in our priority markets

|

|

· High quality pipeline of 190k rooms at quarter end; over 45% under construction

|

|

· Key growth milestones reached for Staybridge Suites and Hotel Indigo; record signings for InterContinental Hotels & Resorts

|

|

Richard Solomons, Chief Executive of InterContinental Hotels Group PLC, said:

|

|

"We delivered our best quarterly RevPAR performance in over two years with growth in each of our four regions. Performance in the US was particularly strong where RevPAR was up 8.7%, demonstrating the excellent momentum in the business and the success of our winning strategy.

We continue to focus on enhancing our scale position and developing our high quality pipeline, opening 8k rooms in the period, signing 16k rooms into the system, and delivering solid net system size growth of 2.7%.

Our preferred brands reached several important milestones in the quarter. Staybridge Suites became the fastest growing brand in its segment to reach 200 open hotels, and Hotel Indigo opened its 60th hotel. InterContinental Hotels and Resorts reinforced its position as the largest global luxury hotel brand with record quarterly signings.

Whilst some of our markets face heightened uncertainty and risks, we continue to see strong momentum in the business and remain encouraged by current trading and positive booking trends."

|

|

Third Quarter RevPAR performance

|

| |

|

Americas

RevPAR was up 8.4% in the third quarter and 7.5% in the first 9 months. In the US, RevPAR was up 8.7% in the third quarter and 7.5% in the first 9 months, the strongest quarterly US RevPAR growth in 8 years.

Q3 RevPAR growth in the US continued to be driven by record levels of demand, with comparable occupancy rates 1.7% points above the previous third quarter peak, and 4.5% growth in average daily rate. Trading in the quarter was led by higher leisure demand and increased groups business, particularly at our Holiday Inn and Crowne Plaza hotels, where we outperformed the industry on a total RevPAR basis.

|

| |

|

Europe

RevPAR was up 6.1% in the third quarter and 5.3% in the first 9 months. There were particularly strong performances from the UK and Germany, two of our priority markets. The UK delivered double digit RevPAR growth reflecting strong performance in both London and the regions; and Germany drove high single digit RevPAR growth due to a favourable trade fair calendar.

InterContinental Paris - Le Grand reported Q3 RevPAR up 7.3% following the completion in the second quarter of the renovation of the Salon Opera ballroom.

|

| |

|

Asia, Middle East & Africa

RevPAR was up 4.4% in the third quarter and 4.1% in the first 9 months. Our priority markets of Middle East, Indonesia and India performed strongly, with the latter benefiting from improved business confidence following the recent election. Japan and Australia performed solidly both delivering low single digit RevPAR growth. Trading in Thailand has shown signs of returning to relative stability.

|

| |

|

Greater China

RevPAR was up 0.8% in the third quarter and 3.0% in the first 9 months. Trading was strongest in tier one cities, especially Shanghai, Guangzhou and Shenzhen with good levels of transient and corporate business. Performance in certain tier two and three cities was impacted by new supply as these markets develop, and trading in Northern China remains challenging where there is higher contribution from government business.

RevPAR at InterContinental Hong Kong was up 5.4% in the quarter with increased group business and corporate events, despite the disruption from the on-going redevelopment adjacent to this hotel. We have seen minimal impact so far from recent protests.

|

|

Substantial scale drives high quality growth

|

|

Group system size

Net rooms were up 2.7% year on year to 697k rooms (4,760 hotels). 8k rooms (59 hotels) opened in the quarter, over 90% of which were in our priority markets where we are building on our established scale presence.

4k rooms (31 hotels) were removed from the system, mainly in the Americas, reflecting our continued focus on driving high quality growth.

Group pipeline

IHG's high quality pipeline now stands at 190k rooms (1,198 hotels), with more than 45% under construction and 90% situated in our priority markets.

16k rooms (107 hotels) were signed into the pipeline in the third quarter taking total signings in the first nine months to 45k rooms (315 hotels), our strongest Q3 year-to-date underlying performance since 2008. Development activity in the Americas continues to benefit from favourable financing conditions, particularly for refinancing existing hotels with stable cash flow, and strong industry RevPAR performance.

|

| |

|

Building preferred brands

|

|

InterContinental Hotels & Resorts enhanced its position as the largest global luxury hotel brand with the signing of landmark hotels in Jakarta, Singapore and Los Angeles, where a 900-room new build InterContinental hotel will be our largest for the brand in the US. In September, InterContinental New York Barclay closed for a major refurbishment, which will substantially reposition it as a flagship hotel when it reopens in approximately 18 months.

IHG enhanced its position in Mexico, one of our priority markets where we are the largest hotel company with over 20k open rooms, by strengthening our 20-year relationship with Grupo Presidente to expand the footprint and diversity of our brands in key cities and resort destinations.

Hotel Indigo Paris Opera opened in the quarter, our first for the brand in France and 60th worldwide. This took the brand to 119 hotels in the system and pipeline combined, with 5 hotels opened and 14 hotels signed so far in this its 10th anniversary year.

Staybridge Suites celebrated its 200th open hotel in the quarter; a milestone met faster than any other brand in its segment, with the opening of Staybridge Suites Denver Stapleton.

|

| |

|

Capital allocation

|

|

Our strategic review of opportunities for further asset sales continues to progress well. We received a binding offer for InterContinental Paris - Le Grand for €330 million in the quarter.

We also continued our track record of returning surplus funds to shareholders with the payment of a $2.93 per share special dividend and 25¢ interim dividend in the quarter, taking total returns to shareholders so far this year to $1bn.

|

| |

|

Financial position

|

|

The financial position of the group remains robust, with an on-going commitment to an efficient balance sheet and an investment grade credit rating.

|

| |

|

Appendix 1: RevPAR Movement Summary

|

| |

Q3 2014

|

|

YTD 2014

|

|

|

|

RevPAR

|

Rate

|

Occ.

|

RevPAR

|

Rate

|

Occ.

|

|

|

Group

|

7.0%

|

3.6%

|

2.3%pts

|

6.3%

|

2.8%

|

2.3%pts

|

|

|

Americas

|

8.4%

|

4.6%

|

2.6%pts

|

7.5%

|

3.7%

|

2.5%pts

|

|

|

Europe

|

6.1%

|

3.8%

|

1.7%pts

|

5.3%

|

2.2%

|

2.1%pts

|

|

|

AMEA

|

4.4%

|

2.3%

|

1.4%pts

|

4.1%

|

2.8%

|

0.9%pts

|

|

|

G. China

|

0.8%

|

(2.6)%

|

2.3%pts

|

3.0%

|

(1.8)%

|

2.9%pts

|

|

|

Appendix 2: Q3 System & Pipeline Summary (rooms)

|

| |

System

|

Pipeline

|

|

Openings

|

Removals

|

Net

|

Total

|

YoY%

|

Signings

|

Total

|

|

Group

|

8,381

|

(4,405)

|

3,976

|

697,048

|

2.7%

|

15,608

|

189,860

|

|

Americas

|

4,047

|

(3,488)

|

559

|

454,008

|

0.7%

|

8,617

|

85,223

|

|

Europe

|

537

|

(555)

|

(18)

|

102,415

|

2.0%

|

1,993

|

17,267

|

|

AMEA

|

624

|

(439)

|

185

|

66,237

|

5.6%

|

1,288

|

33,057

|

|

G. China

|

3,173

|

77

|

3,250

|

74,388

|

14.0%

|

3,710

|

54,313

|

|

Appendix 3: Q3 YTD System & Pipeline Summary (rooms)

|

| |

System

|

Pipeline

|

|

Openings

|

Removals

|

Net

|

Total

|

|

Signings

|

Total

|

|

Group

|

25,679

|

(15,504)

|

10,175

|

697,048

|

|

45,452

|

189,860

|

|

Americas

|

12,891

|

(10,307)

|

2,584

|

454,008

|

|

27,406

|

85,223

|

|

Europe

|

3,302

|

(2,953)

|

349

|

102,415

|

|

4,083

|

17,267

|

|

AMEA

|

2,356

|

(957)

|

1,399

|

66,237

|

|

3,254

|

33,057

|

|

G. China

|

7,130

|

(1,287)

|

5,843

|

74,388

|

|

10,709

|

54,313

|

|

Appendix 4: Definitions

|

|

RevPAR: Revenue per available room.

Underlying: Year to date underlying hotel signings exclude hotels signed on US Army bases (2014: 2k signed, 2013: 4k signed)

|

| |

|

For further information, please contact:

|

|

Investor Relations (David Kellett; Isabel Green):

|

+44 (0)1895 512176

|

+44 (0) 7808 098724

|

|

Media Relations (Yasmin Diamond, Zoe Bird):

|

+44 (0)1895 512008

|

+44 (0) 7736 746167

|

|

High resolution images to accompany this announcement are available for the media to download free of charge from www.vismedia.co.uk. This includes profile shots of the key executives.

|

|

Conference call for Analysts and Shareholders:

A conference call with Paul Edgecliffe-Johnson (Chief Financial Officer) will commence at 8.00am UK time on 21 October and can be accessed on www.ihgplc.com/Q3. There will be an opportunity to ask questions.

|

|

UK Toll

UK Toll Free

US Toll

|

+44 (0) 20 3003 2666

0808 109 0700

+1 212 999 6659

|

|

Passcode:

|

IHG

|

|

A replay of the 8.00am conference call will be available following the event - details are below:

|

|

UK Toll

|

+44 (0) 20 8196 1480

|

|

Replay pin

|

1315474

|

|

US conference call and Q&A:

There will also be a conference call, primarily for US investors and analysts, at 9.00am Eastern Standard Time on 21 October with Paul Edgecliffe-Johnson (Chief Financial Officer). There will be an opportunity to ask questions.

|

|

UK Toll

US Toll

US Toll Free

|

+44 (0) 20 3003 2666

+1 212 999 6659

+1 866 966 5335

|

|

Passcode:

|

IHG

|

|

A replay of the 9.00am US conference call will be available following the event - details are below:

|

|

UK Toll

US Toll Free

|

+44 (0) 20 8196 1480

+1 866 583 1035

|

|

Replay pin

|

9243508

|

|

Website:

The full release and supplementary data will be available on our website from 7.00am (London time) on 21 October. The web address is www.ihgplc.com/Q3.

|

|

Notes to Editors:

IHG (InterContinental Hotels Group) [LON:IHG, NYSE:IHG (ADRs)] is a global organisation with a broad portfolio of nine hotel brands, including InterContinental® Hotels & Resorts, Hotel Indigo®, Crowne Plaza® Hotels & Resorts, Holiday Inn® Hotels & Resorts, Holiday Inn Express®, Staybridge Suites®, Candlewood Suites®, EVEN™ Hotels and HUALUXE® Hotels and Resorts.

IHG manages IHG® Rewards Club, the world's first and largest hotel loyalty programme with over 82 million members worldwide. The programme was relaunched in July 2013, offering enhanced benefits for members including free internet across all hotels, globally.

IHG franchises, leases, manages or owns over 4,700 hotels and 697,000 guest rooms in nearly 100 countries, with almost 1,200 hotels in its development pipeline.

InterContinental Hotels Group PLC is the Group's holding company and is incorporated in Great Britain and registered in England and Wales.

Visit www.ihg.com for hotel information and reservations and www.ihgrewardsclub.com for more on IHG Rewards Club. For our latest news, visit: www.ihg.com/media, www.twitter.com/ihg, www.facebook.com/ihg or www.youtube.com/ihgplc.

|

|

Cautionary note regarding forward-looking statements:

This announcement contains certain forward-looking statements as defined under US law (Section 21E of the Securities Exchange Act of 1934). These forward-looking statements can be identified by the fact that they do not relate to historical or current facts. Forward-looking statements often use words such as 'anticipate', 'target', 'expect', 'estimate', 'intend', 'plan', 'goal', 'believe' or other words of similar meaning. By their nature, forward-looking statements are inherently predictive, speculative and involve risk and uncertainty. There are a number of factors that could cause actual results and developments to differ materially from those expressed in or implied by, such forward-looking statements. Factors that could affect the business and the financial results are described in 'Risk Factors' in the InterContinental Hotels Group PLC Annual report on Form 20-F filed with the United States Securities and Exchange Commission.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

InterContinental Hotels Group PLC

|

| |

|

(Registrant)

|

| |

|

|

| |

By:

|

/s/ H. Patel

|

| |

Name:

|

H. PATEL

|

| |

Title:

|

COMPANY SECRETARIAL OFFICER

|

| |

|

|

| |

Date:

|

21 October 2014

|

| |

|

|

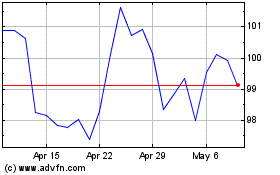

InterContinental Hotels (NYSE:IHG)

Historical Stock Chart

From Mar 2024 to Apr 2024

InterContinental Hotels (NYSE:IHG)

Historical Stock Chart

From Apr 2023 to Apr 2024