UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 13, 2014

| | | | |

XSUNX, INC.

|

(Exact name of registrant as specified in its charter)

|

| | | | |

Colorado

| | 000-29621

| | 84-1384159

|

(State or other jurisdiction of incorporation)

| | (Commission File Number)

| | (IRS Employer Identification No.)

|

| | | | |

65 Enterprise, Aliso Viejo, CA 92656

|

(Address of principal executive Offices) (Zip Code)

|

| | | | |

| | | | |

Registrant’s telephone number, including area code: (949) 330-8060

|

| | | | |

| | | | |

(Former name or former address, if changed since last report.)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|_| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|_| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|_| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|_| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

1

SECTION 2 – FINANCIAL INFORMATION

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

Amendment of Existing Promissory Note

As previously disclosed by XsunX, Inc. (the “Company”) in its Annual Report on Form 10-K/A for the year ended September 30, 2013, filed on January 14, 2014, the Company, in exchange for a promissory note (the “Note”) that had matured on September 30, 2013, issued a new unsecured 12% convertible promissory exchange note (the “Exchange Note”) for the remaining accrued principal and interest totaling $293,496. The Exchange Note had a maturity date of September 30, 2014. Effective October 1, 2014, the Company and the Holder entered into a Second Extension and Amendment Agreement (“Second Amendment Agreement”), under which the maturity date was extended to September 30, 2015 for the remaining principal, interest, and costs totaling $252,335 at the time of the amendment.

SECTION 3 – SECURITIES AND TRADING MARKETS

Item 3.02 Unregistered Sales of Equity Securities.

Final Conversion of Notes

Between September 11 and 30, 2014 the Company issued the aggregate of 12,143,600 shares of common stock to holders of two convertible promissory notes upon the conversion of the remaining $39,000 of principal and accrued interest to the holder of an 8% convertible note, and the conversion of the remaining balance of $12,222 of principal and accrued interest to the holder of a 10% convertible note. Upon conversion no further liabilities or notes remain outstanding with the holders.

The securities above were offered and sold pursuant to an exemption from the registration requirements under Section 4(a)2 of the Securities Act since, among other things, the transactions did not involve a public offering.

SECTION 5 - CORPORATE GOVERNANCE AND MANAGEMENT

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Effective October 10, 2014, Joseph Grimes resigned as a director.

SECTION 7 – REGULATION FD

Item 7.01 Regulation FD Disclosure.

Press Release and Company Newsletter

The information in this Item 7.01 of this Current Report is furnished pursuant to Item 7.01 and shall not be deemed "filed" for any purpose, including for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that Section. The information in this Current Report on Form 8-K shall not be deemed incorporated by reference into any filing under the Securities Act or the Exchange Act regardless of any general incorporation language in such filing.

On October 14, 2014, the Company issued a Press Release (the “Press Release”) announcing the intent to bundle power management technologies with its commercial solar power systems. The Company’s new product offering is focused at providing clients with increased energy savings, and faster payback times for solar energy investments thereby increasing the investment value potential clients’ consider when deciding to purchase an XsunX commercial power system.

2

On October 16, 2014, the Company issued a Newsletter (the “Newsletter”) providing information related to success the Company has been achieving with satisfied customers who have provided letters of satisfaction and intent to recommend XsunX. The Newsletter also provided additional insight to the Company’s decision to begin bundling commercial power management technology with its solar power systems, which was the topic of the Company’s press release issued October 14, 2014 and noted above.

A copy of the Press Release is attached hereto as Exhibit 99.1

A copy of the Newsletter is attached hereto as Exhibit 99.2

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are filed herewith.

| | |

Exhibit No.

| | Description

|

| | |

10.1

| | Form of Second Extension and Amendment Agreement of 12% Promissory Note

|

| | |

10.2

| | Form of and 12% Amended and Restated Promissory Note (1)

|

| | |

99.1

| | Press Release by XsunX, Inc., dated October 14, 2014.

|

| | |

99.2

| | XsunX Investor Newsletter, dated October 16, 2014

|

| |

(1)

| Incorporated by reference to exhibits included with the Company’s Report on Form 10-K filed with the Securities and Exchange Commission dated January 11, 2013.

|

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | |

|

|

|

| XSUNX, INC.

|

|

|

|

Date: October 16, 2014

| By:

| /s/ Tom M. Djokovich

|

| Tom M. Djokovich

|

| Title: CEO/Secretary

|

4

SECOND EXTENSION AND AMENDMENT AGREEMENT

This Second Extension and Amendment Agreement (“Agreement”), effective as of October 1, 2014 is entered into by and between XSUNX, INC., a Colorado corporation having its principal address at 65 Enterprise, Aliso Viejo, CA 92656 (the “Company”), and ___________ having an address at ___________ (the “Holder”).

W I T N E S S E T H:

WHEREAS, the Holder is the holder of that certain Promissory Note (“Original Note”) issued by the Company to Viasystems Corporation, formerly known as Merix Corporation (“Original Holder”), on or about August 27, 2009 in the original principal amount of $456,920.66;

WHEREAS, pursuant to that certain Securities Purchase Agreement dated as of March 30, 2011 between the Holder and the Original Holder, the Original Holder sold, assigned and conveyed all of its right, title and interest in and to the Original Note to the Holder;

WHEREAS, pursuant to that certain Exchange Agreement dated as of November 3, 2011 between the Company and the Holder (“2011 Exchange Agreement”), the Company and the Holder exchanged the Original Note solely for securities consisting of (i) a 10% Promissory Note due on September 30, 2012 (“10% Note”), and (ii) 7,000,000 shares of common stock of the Company, no par value (“Common Stock”); and

WHEREAS, the Company and the Holder exchanged the 10% Note solely for securities consisting of (i) a 12% Promissory Note (“Exchange Note”) and (ii) 500,000 shares (“Shares”) of Common Stock;

WHEREAS, on September 30, 2013 the Company and the Holder subsequently exchanged the Exchange Note solely for securities consisting of an Amended and Restated 12% Promissory Note (the “A&R Note”);

WHEREAS, the Borrower is unable to repay the balance of the A&R Note on the date hereof and has requested a forbearance from the Holder from enforcing the A&R Note by extending the Maturity Date under the A&R Note; and the parties hereto wish to so extend the maturity date of the A&R Note in accordance with the terms hereof;

NOW, THEREFORE, in consideration of the premises and the mutual covenants contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

1.

Amendments.

a.

Extension of Maturity Date. Subject to the terms hereof, the Maturity Date under the A&R Note is hereby extended until September 30, 2015, and all amounts due under the A&R Note shall be paid on or prior to such date.

b.

Conversion. The A&R Note shall remain convertible into shares of common stock of the Company on the terms and conditions contained in the A&R Note.

2.

Capitalization.

a.

Capitalization. The accrued and unpaid interest and expenses incurred to date under the A&R Note as of the date hereof shall be capitalized as of the date hereof, such that the outstanding principal amount of the A&R Note as of the date hereof is hereby amended to equal $252,335.

3.

Representations and Warranties. The Company hereby makes the following representations and warranties to the Holder:

a.

Authorization; Enforcement. The Company has the requisite corporate power and authority to enter into and to consummate the transactions contemplated by this Agreement and otherwise to carry out its obligations hereunder and thereunder. The execution and delivery of this Agreement by the Company and the consummation by it of the transactions contemplated hereby and thereby have been duly authorized by all necessary action on the part of the Company and no further action is required by the Company, its board of directors or its stockholders in connection therewith. This Agreement has been duly executed by the Company and, when delivered in accordance with the terms hereof will constitute the valid and binding obligations of the Company enforceable against the Company in accordance with their terms.

b.

No Conflicts. The execution, delivery and performance of this Agreement by the Company and the consummation by the Company of the transactions contemplated hereby do not and will not: (i) conflict with or violate any provision of the Company’s certificate of incorporation, bylaws or other organizational or charter documents, or (ii) conflict with, or constitute a default (or an event that with notice or lapse of time or both would become a default) under, result in the creation of any lien or encumbrance upon any of the properties or assets of the Company, or give to others any rights of termination, amendment, acceleration or cancellation (with or without notice, lapse of time or both) of, any material agreement, credit facility, debt or other material instrument or other material understanding to which the Company is a party or by which any property or asset of the Company is bound or affected, or (iii) conflict with or result in a violation of any law, rule, regulation, order, judgment, injunction, decree or other restriction of any court or governmental authority to which the Company is subject or by which any property or asset of the Company is bound or affected, except, in the case of clauses (ii) and (iii) above, such as could not have or reasonably be expected to result in a material adverse effect.

c.

Filings, Consents and Approvals. Except for the filing of Form 8-K with the Securities and Exchange Commission (“SEC”) as may be required, the Company is not required to obtain any approval, consent, waiver, authorization or order of, give any notice to, or make any filing, qualification or registration with, any court or other federal, state, local, foreign or other governmental authority or other person or entity in connection with the execution, delivery and performance by the Company of this Agreement. No further approval or authorization of any stockholder, the Board of Directors or others is required.

d.

No Inside Information. Neither the Company nor any person acting on its behalf has provided the Holder or its counsel with any information that constitutes or might constitute material, non-public information concerning the Company.

e.

No Additional Consideration. Except as otherwise set forth herein, no consideration has been offered or paid to any person to amend or consent to a waiver, modification, forbearance, exchange or otherwise of any provision of the the A&R Note.

f.

Survival. All of the Company’s warranties and representations contained in this Agreement shall survive the execution, delivery and acceptance of this Agreement by the parties hereto.

4.

Holding Period for A&R Note.

a.

Rule 144. Pursuant to Rule 144 promulgated under the Securities Act of 1933, as amended (“Securities Act”), the holding period of the A&R Note tacks back to August 27, 2009 (the original issue date of the Original Note). The Company agrees not to take a position contrary to this paragraph. The Company is not currently, and has never been, an issuer of the type described in Rule 144(i) under the Securities Act.

b.

Not Affiliate. The Company represents and warrants to the Holder that (i) the Holder is not, as of the date of this representation, and has not been for the last one hundred twenty (120) days, an employee, officer, director or, to the Company’s knowledge, a direct beneficial owner of more than ten percent (10%) of any class of equity security of the Company, or otherwise been an “affiliate” as that term is used in Rule 144 promulgated under the Securities Act, (ii) the Holder has not, directly or indirectly, controlled, been controlled by or been under common control with the Company.

5.

Public Information. So long as the A&R Note is outstanding, the Company shall timely file (or timely obtain extensions in respect thereof and file within the applicable grace period) all reports and definitive proxy or information statements required to be filed by the Company under the Securities Exchange Act of 1934, as amended (“Exchange Act”), and shall not terminate its status as an issuer required to file reports under the Exchange Act (even if the Exchange Act or the rules and regulations promulgated thereunder would otherwise permit such termination).

6.

Miscellaneous.

a.

This Agreement may be executed in two or more counterparts and by facsimile signature, delivery of PDF images of executed signature pages by email or otherwise, and each of such counterparts shall be deemed an original and all of such counterparts together shall constitute one and the same agreement.

b.

This Agreement shall be governed by and interpreted in accordance with laws of the State of New York, excluding its choice of law rules. The parties hereto hereby waive the right to a jury trial in any litigation resulting from or related to this Agreement. The parties hereto consent to exclusive jurisdiction and venue in the federal and state courts sitting in the County of New York, State of New York. Each party waives all defenses of lack of personal jurisdiction and forum non conveniens. Process may be served on any party hereto in the manner authorized by applicable law or court rule.

c.

Each of the Holder and the Company hereby agrees and provides further assurances that it will, in the future, execute and deliver any and all further agreements, certificates, instruments and documents and do and perform or cause to be done and performed, all acts and things as may be necessary or appropriate to carry out the intent and accomplish the purposes of this Agreement.

IN WITNESS WHEREOF, this Agreement is executed as of the date first set forth above.

| |

| COMPANY:

|

| XSUNX, INC.

|

By:

|

|

Name:

| Tom Djokovich

|

Title:

| CEO

|

|

|

| HOLDER:

|

By:

|

|

Name:

| |

Title:

| |

XsunX Adds Enterprise Power management to Its Commercial Solar Power Systems

The company’s expanded offering provides additional energy savings and faster paybacks for solar investments

Aliso Viejo, CA – October 14, 2014 – XsunX, Inc. (OTCBB: XSNX), a solar energy solutions provider, today announced that it has begun to bundle a commercial power management “CPM” technology with its solar power systems. The company’s new offering provides clients with access to increased energy savings and faster payback times for solar energy investments while only adding pennies to the per/watt costs of its systems.

“There are potential savings left hidden in the way businesses use electricity,” stated Tom Djokovich, XsunX CEO. “The first step in finding these hidden savings is to reduce energy costs by adding one of our commercial solar power systems. Then, our new CPM bundle provides clients with a total energy efficiency management package which includes the tools to monitor, analyze, and control energy usage to further reduce operating costs.”

With the addition of CPM technology, the company’s goal is to offer clients a more comprehensive energy saving package to increase the cost savings and value potential clients’ consider when deciding to purchase an XsunX commercial power system. The company is also striving to create a distinct advantage over other solar companies in the market place.

The company’s decision to bundle CPM technology was also driven by the multiple ways businesses are charged by utilities for their electricity usage, and the average client’s inability to realize maximum savings from just the installation of solar by itself.

Typically, businesses pay for electricity in two ways – the total kilowatt hours used and the peak energy intensity of what they use. This peak intensity can account for as much as 10% to 50% of a business’s utility bill, and can occur anytime of day or night. By bundling real-time electrical energy use analysis technology with its solar systems, XsunX provides its clients with the tools to increase energy efficiencies throughout business operations 24 hours a day.

“After working with client after client to analyze utility bills, and usage profiles, it became evident that we had to expand the scope and impact of how our solar systems delivered savings,” continued Mr. Djokovich. “Now with an XsunX integrated Solar and CPM technology bundle our clients can squeeze efficiencies from their operations, further reduce utility bills, and realize more value by investing in an XsunX commercial solar power system.

About XsunX

XsunX provides solar energy solutions with the greatest bottom-line financial benefits for commercial and industrial users. Our background and experience spans virtually all aspects of solar, including technology assessment, design and development. The company has developed a highly skilled team of qualified engineering and specialty contractors with extensive commercial solar experience necessary to service the diverse conditions that can be encountered in commercial buildings. The company couples this superior design and delivery capability with factory direct pricing and zero down financing options to provide exceptional solar power plant investment opportunities for its clients.

For more information, please visit our website at www.xsunx.com.

Safe Harbor Statement

Matters discussed in this release contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical

facts included in this press release are forward-looking statements. These statements relate to future events or to the Company's future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Investors should not place any undue reliance on forward-looking statements since they involve known and unknown, uncertainties and other factors which are, in some cases, beyond the Company's control which could, and likely will, materially affect actual results, levels of activity, performance or achievements. Any forward-looking statement reflects the Company's current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to operations, results of operations, growth strategy and liquidity. Such risks, uncertainties and other factors, which could impact the Company and the forward-looking statements contained herein, are included in the Company's filings with the Securities and Exchange Commission. The Company assumes no obligation to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Company Contact:

Tom Djokovich, President and CEO

949-330-8060

info@xsunx.com

XsunX Investor Newsletter

Aliso Viejo, CA – October 16, 2014 – XsunX, Inc. (OTCBB: XSNX)

Good Morning,

Over the past months we have shared a number of milestones that XsunX has achieved including success in making commercial solar power system sales which is the best news of all.

There is more we want to share on our progress, but before we outline our recent developments we thought investors would like to see an example of the success we are achieving with satisfied customers.

We recently received the following message from a commercial printing business where we had installed a 35kW roof-top system earlier this summer:

“Hey Tom,

We were thinking about you today. We just found out from SCE why we hadn't received an invoice from them, as we usually would have by now, at this point in the month.

Turns out there is a zero balance owed, our little solar farm produced more than we used!

Last year our power bill for the same period was $3400, and we certainly had the AC’s going full blast most days these last weeks!

At this point it looks like you coached us into a very intelligent business decision by going solar on our roof.

Kindest Regards,

Bill, October 2014”

Our process with every client has been to deliver accurate financial guidance, size systems to deliver the best results, and focus on details and satisfaction. Our goals are to carry a strong reputation for quality and exceptional pricing into commercial neighborhoods throughout California. With our results and reputation building, we are excited about our prospects.

In addition to a strong reputation, we have been working to build depth in the technology and savings our system designs deliver to customers. Earlier this week we issued press regarding our addition of commercial power management capabilities (“CPM”) with our PV systems. We wanted to outline a bit more of what this technology adds to our marketing efforts.

As our press release outlined, the first step in reducing utility costs is to install one of our commercial PV systems. That enables clients to offset as much as 100% of their monthly kilowatt hour charges. But, utilities also add charges for how and when commercial clients use power which can make it challenging for a businesses to understand or manage.

A major advantage for clients would be to allow them to see and manage how and when they use power. The difference in managing power use effectively can result in one company experiencing utility bills 50% higher, or lower, than another with the same number of kilowatt hour charges.

To deliver power management capabilities to clients, and create advantages for XsunX in the marketplace, we now bundle CPM capabilities with our PV systems giving clients the ability to

see and manage every detail of how and when they use power. With these tools we anticipate that most clients will be able to adjust their operations intelligently and add another 10% to 30% in savings above what solar alone offers.

Best of all, the CPM technology that we integrate only adds pennies per watt to the cost of a 30kW system, and even less with larger systems. We are excited about adding the CPM feature to our systems and allowing us to make the economics we present to clients that much better - and easier to sell.

We began this newsletter with comments from one of our satisfied clients and we would like to end with another. We received the following message from a motel operator in Anaheim, California where we had installed a 31kW roof-top system this past spring:

“Dear Mr. Djokovich,

Thank you for your assistance in helping us to realize a goal that we have had for some time – the addition of a solar energy systems to help power our motel properties.

In the past we had spoken to several solar contractors who only offered much smaller systems than the 50 module designs you provided for each of our buildings. This helped us to receive the maximum city cash incentives while also offsetting more of our power use from the local utility.

As I mentioned to you, I know many other owners of motels and I plan to recommend XsunX to anyone thinking of adding solar to their property.

Thank you again for your help and good work,

Jay, June 2014”

The bottom line is that every business relies on electricity, and virtually every business can benefit from the addition of solar power. Our goal at XsunX is to make that addition as easy and beneficial for our clients as possible.

Have a great rest of your week,

Tom Djokovich, CEO

About XsunX

XsunX focuses on providing solar energy solutions that provide the greatest bottom-line financial benefits. The Company’s background and experience spans virtually all aspects of solar including technology assessment, design, and development. We have a deep passion for solar and have worked to pioneer new technologies and solar business solutions focused at making solar an affordable energy option. For more information, please visit the Company’s website at www.xsunx.com, or to learn more about the benefits of solar energy for your business schedule a free PV project assessment.

Company Contact:

Tom Djokovich, President and CEO

949-330-8060

info@xsunx.com

Safe Harbor Statement

Matters discussed in this newsletter contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts included in this press release are forward-looking statements. These statements relate to future events or to the Company's future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Investors should not place any undue reliance on forward-looking statements since they involve known and unknown, uncertainties and other factors which are, in some cases, beyond the Company's control which could, and likely will, materially affect actual results, levels of activity, performance or achievements. Any forward-looking statement reflects the Company's current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to operations, results of operations, growth strategy and liquidity. Such risks, uncertainties and other factors, which could impact the Company and the forward-looking statements contained herein, are included in the Company's filings with the Securities and Exchange Commission. The Company assumes no obligation to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

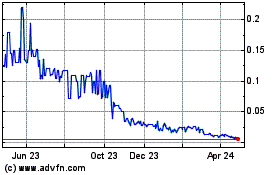

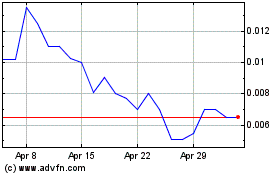

NovAccess Global (QB) (USOTC:XSNX)

Historical Stock Chart

From Mar 2024 to Apr 2024

NovAccess Global (QB) (USOTC:XSNX)

Historical Stock Chart

From Apr 2023 to Apr 2024