Filed Pursuant to Rule 424(B)(3)

Registration No. 333-199184

Prospectus

SPRINT CORPORATION

|

|

|

|

|

| Offer to Exchange up to

$2,250,000,000 Aggregate

Principal Amount of Newly Issued

7.250% Notes due 2021

For

a Like Principal Amount of

Outstanding Restricted

7.250% Notes due 2021 Issued on September 11, 2013 |

|

Offer to Exchange up to

$4,250,000,000 Aggregate

Principal Amount of Newly Issued

7.875% Notes due 2023

For

a Like Principal Amount of

Outstanding

Restricted 7.875% Notes due 2023

Issued on September 11, 2013 |

|

Offer to Exchange up to

$2,500,000,000 Aggregate

Principal Amount of Newly Issued

7.125% Notes due 2024

For

a Like Principal Amount of

Outstanding

Restricted 7.125% Notes due 2024

Issued on December 12, 2013 |

On

September 11, 2013, Sprint Corporation issued $2,250,000,000 aggregate principal amount of restricted 7.250% Notes due 2021 and $4,250,000,000 aggregate principal amount of restricted 7.875% Notes due 2023 and on December 12, 2013, Sprint

Corporation issued $2,500,000,000 aggregate principal amount of restricted 7.125% Notes due 2024 in private placements. We refer to these notes collectively as the “Original Notes.” The Original Notes are fully and unconditionally

guaranteed by Sprint Corporation’s wholly owned subsidiary, Sprint Communications, Inc.

We are offering to exchange up to

$2,250,000,000 aggregate principal amount of new 7.250% Notes due 2021, $4,250,000,000 aggregate principal amount of new 7.875% Notes due 2023 and $2,500,000,000 aggregate principal amount of new 7.125% Notes due 2024, which we refer to collectively

as the “Exchange Notes,” for our outstanding restricted 7.250% Notes due 2021, restricted 7.875% Notes due 2023 and restricted 7.125% Notes due 2024, respectively. We refer to these offers to exchange collectively as the “Exchange

Offer.” The terms of the Exchange Notes are substantially identical to the terms of the Original Notes, except that the Exchange Notes will be registered under the Securities Act of 1933, or the “Securities Act,” and the transfer

restrictions and registration rights and related special interest provisions applicable to the Original Notes will not apply to the Exchange Notes. Each series of Exchange Notes will be part of the same series of corresponding Original Notes and

issued under the same base indenture and applicable supplemental indenture. The Exchange Notes will be exchanged for Original Notes of the corresponding series in minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof. We

will not receive any proceeds from the issuance of Exchange Notes in the Exchange Offer.

You may withdraw tenders of Original Notes at

any time prior to the expiration of the Exchange Offer.

The Exchange

Offer expires at 9:00 a.m. New York City time on November 14, 2014 (which is the 21st business day after the commencement of the Exchange Offer), unless extended, which we refer to as the

“Expiration Date.”

We do not intend to list the Exchange Notes on any securities exchange or to seek approval through any

automated quotation system, and no active public market for the Exchange Notes is anticipated.

You should consider carefully the risk

factors beginning on page 10 of this prospectus before deciding whether to participate in the Exchange Offer.

Neither the

Securities and Exchange Commission, or SEC, nor any state securities commission has approved or disapproved of these Exchange Notes or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is October 16, 2014.

TABLE OF CONTENTS

- i -

This prospectus may only be used where it is legal to make the Exchange Offer and by a

broker-dealer for resales of Exchange Notes acquired in the Exchange Offer where it is legal to do so.

Rather than repeat certain

information in this prospectus that we have already included in reports filed with the SEC, this prospectus incorporates important business and financial information about us that is not included in or delivered with this prospectus. We will provide

this information to you at no charge upon written or oral request directed to: Sprint Corporation, 6200 Sprint Parkway, Overland Park, Kansas 66251, Attention: Investor Relations, telephone: (800) 259-3755. In order to receive timely delivery

of any requested documents in advance of the Expiration Date, you should make your request no later than November 6, 2014, which is five full business days before you must make a decision regarding the Exchange Offer.

In making a decision regarding the Exchange Offer, you should rely only on the information contained in or incorporated by reference into this

prospectus. We have not authorized anyone to provide you with any other information. If you receive any other information, you should not rely on it.

You should not assume that the information contained in this prospectus is accurate as of any date other than the date of the front cover of

this prospectus or that the information incorporated by reference into this prospectus is accurate as of any date other than the date of the incorporated document. Neither the delivery of this prospectus nor any exchange made hereunder shall under

any circumstances imply that the information herein is correct as of any date subsequent to the date on the cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

In this prospectus, unless otherwise indicated (including, without limitation, as set forth under the heading “Description of the

Notes”), the terms “Company,” “issuer,” “Sprint,” “us,” “we” and “our” refer to Sprint Corporation and its consolidated subsidiaries. In this prospectus, unless otherwise indicated,

including as set forth under the heading “Description of the Notes,” the term “Sprint Communications” refers to Sprint Communications, Inc. but not its subsidiaries.

Each broker-dealer that receives Exchange Notes for its own account pursuant to the Exchange Offer must acknowledge that it will deliver a

prospectus in connection with any resale of Exchange Notes. The letter of transmittal accompanying this prospectus states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an

“underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of Exchange Notes received in exchange for Original

Notes where the Original Notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period ending on the earlier of (i) 180 days from the date on which the

registration statement of which this prospectus forms a part is declared effective and (ii) the date on which a broker-dealer is no longer required to deliver a prospectus in connection with market-making or other trading activities, we will

make this prospectus available to any broker-dealer for use in connection with these resales. See “Plan of Distribution.”

TRADEMARKS, SERVICE MARKS AND COPYRIGHTS

We own or have rights to trademarks, service marks or trade names that we use in connection with the operation of our business. In addition,

our names, logos and website names and addresses are our service marks or trademarks. Other trademarks, service marks and trade names appearing in this prospectus are the property of their respective owners. Some of the trademarks we own or have the

right to use include the Sprint name. We also own or have the rights to copyrights that protect the content of our products. Solely for convenience, the trademarks, service marks, tradenames and copyrights referred to in this prospectus are listed

without the ©,® and TM symbols, but we will assert, to the fullest extent under applicable law, our rights or the rights of the

applicable licensors to these trademarks, service marks, tradenames and copyrights.

- ii -

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein may contain forward-looking statements. They can be identified by the use

of forward-looking words, such as “may,” “could,” “estimate,” “project,” “forecast,” “intend,” “expect,” “believe,” “target,” “providing guidance” or

other comparable words, or by discussions of strategy that may involve risks and uncertainties. We caution you that these forward-looking statements are only predictions, which are subject to risks and uncertainties that could cause actual results

to differ materially from those in the forward-looking statements. Some factors that could cause actual results to differ include, among other things, the following:

| |

• |

|

our ability to retain and attract subscribers and to manage credit risks associated with our subscribers; |

| |

• |

|

the ability of our competitors to offer products and services at lower prices due to lower cost structures; |

| |

• |

|

our ability to operationalize the anticipated benefits from the SoftBank Corp. (“SoftBank”), Clearwire (as defined below) and United States Cellular Corporation (“U.S. Cellular”) transactions;

|

| |

• |

|

our ability to comply with the restrictions imposed by the U.S. Government as a precondition to our merger with SoftBank; |

| |

• |

|

our ability to fully integrate the operations of Clearwire Corporation and its consolidated subsidiary Clearwire Communications LLC (together “Clearwire”) and access and utilize its spectrum;

|

| |

• |

|

the effects of vigorous competition on a highly penetrated market, including the impact of competition on the price we are able to charge subscribers for services and equipment we provide and on the geographic areas

served by Sprint’s wireless networks; |

| |

• |

|

the impact of equipment net subsidy costs; the impact of increased purchase commitments; the overall demand for our service offerings, including the impact of decisions of new or existing subscribers between our

postpaid and prepaid service offerings; and the impact of new, emerging and competing technologies on our business; |

| |

• |

|

our ability to provide the desired mix of integrated services to our subscribers; |

| |

• |

|

the ability to generate sufficient cash flow to fully implement our network modernization and integration plans to improve and enhance our networks and service offerings, improve our operating margins, implement our

business strategies and provide competitive new technologies; |

| |

• |

|

the effective implementation of our network modernization plans, including timing, execution, technologies, costs, and performance of our network; |

| |

• |

|

our ability to retain subscribers acquired during transactions and mitigate related increases in churn; |

| |

• |

|

our ability to continue to access our spectrum and additional spectrum capacity; |

| |

• |

|

changes in available technology and the effects of such changes, including product substitutions and deployment costs; |

| |

• |

|

our ability to obtain additional financing on terms acceptable to us, or at all; |

| |

• |

|

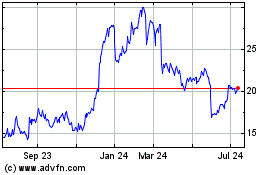

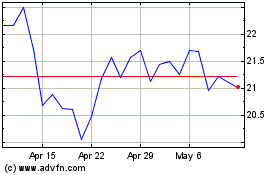

volatility in the trading price of our common stock, current economic conditions and our ability to access capital; |

| |

• |

|

the impact of various parties not meeting our business requirements, including a significant adverse change in the ability or willingness of such parties to provide devices or infrastructure equipment for our networks;

|

| |

• |

|

the costs and business risks associated with providing new services and entering new geographic markets; |

- iii -

| |

• |

|

potential increase in subscriber churn, bad debt expense and write-offs related to our service plans; |

| |

• |

|

the effects of any material impairment of our goodwill or indefinite-lived intangible assets; |

| |

• |

|

the effects of any future merger or acquisition involving us, as well as the effect of mergers, acquisitions and consolidations, and new entrants in the communications industry, and unexpected announcements or

developments from others in the communications industry; |

| |

• |

|

unexpected results of litigation filed against us or our suppliers or vendors; |

| |

• |

|

the costs or potential customer impact of compliance with regulatory mandates including, but not limited to, compliance with the Federal Communications Commission’s Report and Order to reconfigure the 800 MHz band

and government regulation regarding “net neutrality”; |

| |

• |

|

equipment failure, natural disasters, terrorist acts or breaches of network or information technology security; |

| |

• |

|

one or more of the markets in which we compete being impacted by changes in political, economic or other factors such as monetary policy, legal and regulatory changes, or other external factors over which we have no

control; |

| |

• |

|

the impact of being a “controlled company” exempt from many corporate governance requirements of the NYSE; and |

| |

• |

|

other risks referenced from time to time in our filings with the SEC, including in Part I, Item 1A “Risk Factors” of our Transition Report on Form 10-K for the three-month transition period ended

March 31, 2014. |

We specifically disclaim any obligation to update any factors or publicly announce the results of

revisions to any of the forward-looking statements included in this prospectus, including the information incorporated by reference, to reflect future events or developments.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy materials filed with

the SEC at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at (800) SEC-0330 for further information on the public reference room. The SEC also maintains an Internet website that contains

reports, proxy statements and other information regarding issuers, including us, who file electronically with the SEC. The address of that site is www.sec.gov. The information contained on the SEC’s website is expressly not incorporated by

reference into this prospectus, other than documents that we file with the SEC that are incorporated by reference in this prospectus.

This prospectus contains summaries of provisions contained in some of the documents discussed in this prospectus, but reference is made to the

actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to in this prospectus have been filed or will be filed or incorporated by reference as

exhibits to the registration statement of which this prospectus is a part. If any contract, agreement or other document is filed or incorporated by reference as an exhibit to the registration statement, you should read the exhibit for a more

complete understanding of the document or matter involved. Do not rely on or assume the accuracy of any representation or warranty in any agreement that we have filed or incorporated by reference as an exhibit to the registration statement because

such representation or warranty may be subject to exceptions and qualifications contained in separate disclosure schedules, may have been included in such agreement for the purpose of allocating risk between the parties to the particular

transaction, and may no longer continue to be true as of any subsequent date.

- iv -

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

We have incorporated by reference information into this prospectus. We will make those documents available to you without charge upon your

oral or written request. Requests for those documents should be directed to Sprint Corporation, 6200 Sprint Parkway, Overland Park, Kansas 66251, Attention: Investor Relations, telephone: (800) 259-3755.

This prospectus incorporates by reference the following documents that we have filed with the SEC but have not included or delivered with this

prospectus:

| |

• |

|

Transition Report on Form 10-K for the three-month transition period ended March 31, 2014, filed on May 27, 2014 (the financial statements included in Item 8 of our Transition Report on Form 10-K for the

three-month transition period ended March 31, 2014 have been superseded by the financial statements in our Current Report on Form 8-K filed with the SEC on June 18, 2014); |

| |

• |

|

Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2014, filed on August 8, 2014; and |

| |

• |

|

Current Reports on Form 8-K filed on June 18, 2014, August 4, 2014, August 6, 2014, August 8, 2014, October 3, 2014 and October 6, 2014 and on Form 8-K/A filed on August 6,

2013 (but only with respect to Exhibit 99.4) and April 23, 2014; |

We are also incorporating by reference additional

documents we may file pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, after the date of this prospectus until the Exchange Offer has been completed, other than any portion of the respective filings furnished, rather than filed,

under the applicable SEC rules. This additional information is a part of this prospectus from the date of filing of those documents.

Any

statements made in this prospectus or in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded to the extent that a statement contained in this prospectus or in any other

subsequently filed document which is also incorporated or deemed to be incorporated into this prospectus modifies or supersedes the statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to

constitute a part of this prospectus or the accompanying prospectus.

The information relating to us contained in this prospectus should

be read together with the information in the documents incorporated by reference.

- v -

SUMMARY

This summary highlights information contained elsewhere in or incorporated by reference into this prospectus. This summary does not contain

all of the information that you should consider in making your investment decision. You should read the following summary together with the entire prospectus, including the more detailed information regarding our Company, the Exchange Notes (as

defined below) and the consolidated financial statements and the related notes incorporated by reference into this prospectus. You should also carefully consider, among other things, the matters discussed in the section entitled “Risk

Factors” in this prospectus before making an investment decision. Some of the statements in this prospectus constitute forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements.”

Company Overview

Sprint

Corporation, including its subsidiaries, is a communications company offering a comprehensive range of wireless and wireline communications products and services that are designed to meet the needs of individual consumers, businesses, government

subscribers, and resellers.

As of June 30, 2014, we are the third largest wireless communications company in the United States based

on wireless revenue, one of the largest providers of wireline long distance services, and one of the largest internet carriers in the nation. Our services are provided through our ownership of extensive wireless networks, an all-digital global long

distance network and a Tier 1 Internet backbone. We offer wireless and wireline voice and data transmission services to subscribers in all 50 states, Puerto Rico, and the U.S. Virgin Islands under the Sprint corporate brand, which includes our

retail brands of Sprint®, Boost Mobile®, Virgin Mobile®, and Assurance

Wireless® on networks that utilize third generation code division multiple access or Internet protocol technologies. We also offer fourth generation services utilizing Long Term Evolution as

well as Worldwide Interoperability for Microwave Access technologies (which we expect to shut-down by the end of calendar year 2015). We utilize these networks to offer our wireless and wireline subscribers differentiated products and services

whether through the use of a single network or a combination of these networks. We offer wireless services on a postpaid and prepaid payment basis to retail subscribers and also on a wholesale and affiliate basis, which includes the sale of wireless

services that utilize the Sprint network but are sold under the wholesaler’s brand.

We maintain our principal executive

offices at 6200 Sprint Parkway, Overland Park, Kansas 66251. Our telephone number there is (800) 829-0965. The address of our website is www.sprint.com. Information on, or accessible through, our website is expressly not incorporated by

reference into, and does not constitute a part of, this prospectus.

- 1 -

The Exchange Offer

| The Exchange Offer |

We are offering to exchange up to (i) $2,250,000,000 aggregate principal amount of Sprint Corporation’s registered 7.250% Notes due 2021, which we refer to as the “New 2021 Notes,” for an equal principal amount of Sprint

Corporation’s outstanding restricted 7.250% Notes due 2021, which we refer to as the “Original 2021 Notes,” that were issued on September 11, 2013, (ii) $4,250,000,000 aggregate principal amount of Sprint Corporation’s

registered 7.875% Notes due 2023, which we refer to as the “New 2023 Notes,” for an equal principal amount of Sprint Corporation’s outstanding restricted 7.875% Notes due 2023, which we refer to as the “Original 2023 Notes,”

that were issued on September 11, 2013 and (iii) $2,500,000,000 aggregate principal amount of Sprint Corporation’s registered 7.125% Notes due 2024, which we refer to as the “New 2024 Notes,” for an equal principal amount of

Sprint Corporation’s outstanding restricted 7.125% Notes due 2024, which we refer to as the “Original 2024 Notes,” that were issued on December 12, 2013. We refer to the Original 2021 Notes, the Original 2023 Notes and the

Original 2024 Notes collectively as the “Original Notes.” We refer to the New 2021 Notes, the New 2023 Notes and the New 2024 Notes collectively as the “Exchange Notes.” The terms of each series of Exchange Notes are identical in

all material respects to those of the corresponding series of Original Notes, except for transfer restrictions and registration rights and related special interest provisions relating to the Original Notes. Each series of Exchange Notes will be of

the same class as the corresponding series of outstanding Original Notes. Holders of Original Notes do not have any appraisal or dissenters’ rights in connection with the Exchange Offer. |

| Purpose of the Exchange Offer |

The Exchange Notes are being offered to satisfy our obligations under the respective registration rights agreements entered into at the time we issued and sold the Original 2021 Notes, the Original 2023 Notes and the Original 2024 Notes.

|

| Expiration Date; withdrawal of tenders; return of Original Notes not accepted for exchange |

The Exchange Offer will expire at 9:00 a.m., New York City time, on November 14, 2014, or on a later date and time to which we extend it. We refer to such time and date as the “Expiration Date.” Tenders of Original Notes in the

Exchange Offer may be withdrawn at any time prior to the Expiration Date. We will exchange the Exchange Notes for validly tendered Original Notes promptly following the Expiration Date. Any Original Notes that are not accepted for exchange for any

reason will be returned by us, at our expense, to the tendering holder promptly after the expiration or termination of the Exchange Offer. |

- 2 -

| Procedures for tendering Original Notes |

Each holder of Original Notes wishing to participate in the Exchange Offer must follow procedures of DTC’s Automated Tender Offer Program, or “ATOP,” subject to the terms and procedures of that program. The ATOP procedures require

that the exchange agent receive, prior to the Expiration Date, a computer-generated message known as an “agent’s message” that is transmitted through ATOP and that DTC confirm that: |

| |

• |

|

DTC has received instructions to exchange your Original Notes; and |

| |

• |

|

you agree to be bound by the terms of the letter of transmittal. |

| |

See “The Exchange Offer—Procedures for tendering Original Notes.” |

| Consequences of failure to exchange the Original Notes |

You will continue to hold Original Notes, which will remain subject to their existing transfer restrictions if you do not validly tender your Original Notes or you tender your Original Notes and they are not accepted for exchange. With some

limited exceptions, we will have no obligation to register the Original Notes after we consummate the Exchange Offer. See “The Exchange Offer—Terms of the Exchange Offer” and “The Exchange Offer—Consequences of failure to

exchange.” |

| Conditions to the Exchange Offer |

The Exchange Offer is not conditioned upon any minimum aggregate principal amount of Original Notes of any series being tendered or accepted for exchange. The Exchange Offer is subject to customary conditions, which may be waived by us in our

discretion. We currently expect that all of the conditions will be satisfied and that no waivers will be necessary. |

| Exchange agent |

The Bank of New York Mellon Trust Company, N.A. |

| United States federal income tax considerations |

Your exchange of an Original Note for an Exchange Note of the corresponding series will not constitute a taxable exchange. The exchange will not result in taxable income, gain or loss being recognized by you. Immediately after the exchange, you

will have the same adjusted tax basis and holding period in each Exchange Note received as you had immediately prior to the exchange in the corresponding Original Note surrendered. See “United States Federal Income Tax Considerations.”

|

| Risk factors |

You should consider carefully the risk factors beginning on page 10 of this prospectus before deciding whether to participate in the Exchange Offer. |

- 3 -

The Exchange Notes

The following is a brief summary of the principal terms of the Exchange Notes. The terms of each series of Exchange Notes are identical in

all material respects to those of the corresponding series of Original Notes, except that the transfer restrictions and registration rights and related special interest provisions relating to the Original Notes will not apply to the Exchange Notes.

Certain of the terms and conditions described below are subject to important limitations and exceptions. For a more complete description of the terms of the Exchange Notes, see “Description of the Notes.”

The New 2021 Notes

| Issuer |

Sprint Corporation |

| Securities offered |

$2,250,000,000 aggregate principal amount of 7.250% Notes due 2021. The New 2021 Notes offered hereby will be of the same class as the Original 2021 Notes. |

| Maturity date |

The New 2021 Notes will mature on September 15, 2021. |

| Interest payment dates |

March 15 and September 15, commencing March 15, 2014. |

| Optional redemption |

The New 2021 Notes will be redeemable, from time to time, as a whole or in part, at our option, at a redemption price equal to the greater of 100% of the principal amount of the New 2021 Notes to be redeemed, and the sum of the present values of

the remaining scheduled payments of principal and interest that would be due but for the redemption, discounted to the redemption date, on a semi-annual basis, assuming a 360-day year consisting of twelve 30-day months, at the Treasury Rate (as

defined in “Description of the Notes—Make whole optional redemption”), plus 50 basis points; plus, in each case, accrued interest to the date of redemption that has not been paid. See “Description of the Notes—Make whole

optional redemption.” |

| Repurchase of New 2021 Notes upon a change of control triggering event. |

The occurrence of a change of control, together with a ratings decline, will be a triggering event requiring us to offer to purchase from you all or a portion of your New 2021 Notes at a price equal to 101% of their aggregate principal amount,

together with accrued and unpaid interest, if any, up to but excluding the date of repurchase. |

| Guarantee |

The New 2021 Notes will be fully and unconditionally guaranteed on a senior unsecured basis by Sprint Communications (the “2021 Notes Sprint Communications Guarantee”). |

| Ranking |

The New 2021 Notes will be our general unsecured senior obligations and will: |

| |

• |

|

rank equally with our other senior unsecured indebtedness; |

- 4 -

| |

• |

|

be structurally subordinated to all existing and future indebtedness and other liabilities (including trade payables) of our subsidiaries, other than Sprint Communications; |

| |

• |

|

be effectively subordinated to all existing and future secured indebtedness to the extent of the value of the assets securing such debt; and |

| |

• |

|

be senior in right of payment to all debt obligations that are, by their terms, expressly subordinated in right of payment to the notes. |

| |

See “Description of the Notes—Ranking.” |

| Absence of public market for the New 2021 Notes |

The New 2021 Notes are a new issue of securities for which there is currently no established trading market. We do not intend to apply for a listing of the New 2021 Notes on any securities exchange or an automated dealer quotation system.

Accordingly, there can be no assurance as to the development or liquidity of any market for the New 2021 Notes. |

| Use of proceeds |

We will not receive any cash proceeds from the issuance of the New 2021 Notes. See “Use of Proceeds.” |

| Trustee |

The Bank of New York Mellon Trust Company, N.A. |

The New 2023 Notes

| Issuer |

Sprint Corporation |

| Securities offered |

$4,250,000,000 aggregate principal amount of 7.875% Notes due 2023. The New 2023 Notes offered hereby will be of the same class as the Original 2023 Notes. |

| Maturity date |

The New 2023 Notes will mature on September 15, 2023. |

| Interest payment dates |

March 15 and September 15, commencing March 15, 2014. |

| Optional redemption |

The New 2023 Notes will be redeemable, from time to time, as a whole or in part, at our option, at a redemption price equal to the greater of 100% of the principal amount of the New 2023 Notes to be redeemed, and the sum of the present values of

the remaining scheduled payments of principal and interest that would be due but for the redemption, discounted to the redemption date, on a semi-annual basis, assuming a 360-day year consisting of twelve 30-day months, at the Treasury Rate (as

defined in “Description of the Notes—Make whole optional redemption”), plus 50 basis points; plus, in each case, accrued interest to the date of redemption that has not been paid. See “Description of the Notes—Make whole

optional redemption.” |

- 5 -

| Repurchase of New 2023 Notes upon a change of control triggering event. |

The occurrence of a change of control, together with a ratings decline, will be a triggering event requiring us to offer to purchase from you all or a portion of your New 2023 Notes at a price equal to 101% of their aggregate principal amount,

together with accrued and unpaid interest, if any, up to but excluding the date of repurchase. |

| Guarantee |

The New 2023 Notes will be fully and unconditionally guaranteed on a senior unsecured basis by Sprint Communications (the “2023 Notes Sprint Communications Guarantee”). |

| Ranking |

The New 2023 Notes will be our general unsecured senior obligations and will: |

| |

• |

|

rank equally with our other senior unsecured indebtedness; |

| |

• |

|

be structurally subordinated to all existing and future indebtedness and other liabilities (including trade payables) of our subsidiaries, other than Sprint Communications; |

| |

• |

|

be effectively subordinated to all existing and future secured indebtedness to the extent of the value of the assets securing such debt; and |

| |

• |

|

be senior in right of payment to all debt obligations that are, by their terms, expressly subordinated in right of payment to the notes. |

| |

See “Description of the Notes—Ranking.” |

| Absence of public market for the New 2023 Notes |

The New 2023 Notes are a new issue of securities for which there is currently no established trading market. We do not intend to apply for a listing of the New 2023 Notes on any securities exchange or an automated dealer quotation system.

Accordingly, there can be no assurance as to the development or liquidity of any market for the New 2023 Notes. |

| Use of proceeds |

We will not receive any cash proceeds from the issuance of the New 2023 Notes. See “Use of Proceeds.” |

| Trustee |

The Bank of New York Mellon Trust Company, N.A. |

The New 2024 Notes

| Issuer |

Sprint Corporation |

| Securities offered |

$2,500,000,000 aggregate principal amount of 7.125% Notes due 2024. The New 2024 Notes offered hereby will be of the same class as the Original 2024 Notes. |

| Maturity date |

The New 2024 Notes will mature on June 15, 2024. |

- 6 -

| Interest payment dates |

June 15 and December 15, commencing June 15, 2014. |

| Optional redemption |

The New 2024 Notes will be redeemable, from time to time, as a whole or in part, at our option, at a redemption price equal to the greater of 100% of the principal amount of the New 2024 Notes to be redeemed, and the sum of the present values of

the remaining scheduled payments of principal and interest that would be due but for the redemption, discounted to the redemption date, on a semi-annual basis, assuming a 360-day year consisting of twelve 30-day months, at the Treasury Rate (as

defined in “Description of the Notes—Make whole optional redemption”), plus 50 basis points; plus, in each case, accrued interest to the date of redemption that has not been paid. See “Description of the Notes—Make whole

optional redemption.” |

| Repurchase of New 2024 Notes upon a change of control triggering event |

The occurrence of a change of control, together with a ratings decline, will be a triggering event requiring us to offer to purchase from you all or a portion of your New 2024 Notes at a price equal to 101% of their aggregate principal amount,

together with accrued and unpaid interest, if any, up to but excluding the date of repurchase. |

| Guarantee |

The New 2024 Notes will be fully and unconditionally guaranteed on a senior unsecured basis by Sprint Communications (together with the 2021 Notes Sprint Communications Guarantee and the 2023 Notes Sprint Communications Guarantee, the

“Sprint Communications Guarantee”). |

| Ranking |

The New 2024 Notes will be our general unsecured senior obligations and will: |

| |

• |

|

rank equally with our other senior unsecured indebtedness; |

| |

• |

|

be structurally subordinated to all existing and future indebtedness and other liabilities (including trade payables) of our subsidiaries, other than Sprint Communications; |

| |

• |

|

be effectively subordinated to all existing and future secured indebtedness to the extent of the value of the assets securing such debt; and |

| |

• |

|

be senior in right of payment to all debt obligations that are, by their terms, expressly subordinated in right of payment to the notes. |

| |

See “Description of the Notes—Ranking.” |

| Absence of public market for the New 2024 Notes |

The New 2024 Notes are a new issue of securities for which there is currently no established trading market. We do not intend to apply for a listing of the New 2024 Notes on any securities exchange or an automated dealer quotation system.

Accordingly, there can be no assurance as to the development or liquidity of any market for the New 2024 Notes. |

| Use of proceeds |

We will not receive any cash proceeds from the issuance of the New 2024 Notes. See “Use of Proceeds.” |

| Trustee |

The Bank of New York Mellon Trust Company, N.A. |

- 7 -

Summary Historical Financial Information

Set forth below is our summary historical financial information as of and for the periods indicated. The summary historical financial

information as of March 31, 2014 and December 31, 2013 and 2012 and for the three-month transition period ended March 31, 2014 and the years ended December 31, 2013, 2012 and 2011 has been derived from our audited consolidated

financial statements and related notes incorporated by reference into this prospectus. The summary historical financial information as of December 31, 2011 has been derived from our audited consolidated financial statements not included or

incorporated by reference into this prospectus. The summary historical financial information as of June 30, 2014, March 31, 2013 and for the three-month periods ended March 31, 2013 and June 30, 2014 and 2013 has been

derived from our unaudited interim consolidated financial statements and related notes incorporated by reference into this prospectus.

The summary historical financial information presented below is not comparable for all periods presented because of transactions consummated

in those periods. The Company’s financial statement presentations distinguish between the predecessor period (Predecessor) relating to Sprint Communications (formerly known as Sprint Nextel Corporation) for periods prior to our merger with

SoftBank (the “SoftBank Merger”) and the successor period (Successor) relating to Sprint Corporation, formerly known as Starburst II, Inc. (“Starburst II”), for periods subsequent to the incorporation of Starburst II on

October 5, 2012. The Successor financial information includes the activity and accounts of Sprint Corporation as of and for the three-month period ended June 30, 2014, the three-month transition period ended March 31, 2014 and the

year ended December 31, 2013, which includes the activity and accounts of Sprint Communications, inclusive of the consolidation of Clearwire, prospectively following completion of the SoftBank Merger, beginning on July 11, 2013. The

accounts and operating activity for the Successor periods from October 5, 2012 (date of inception) to December 31, 2012, the three-month period ended June 30, 2013, the three-month period ended March 31, 2013 and from

January 1, 2013 to July 10, 2013 consist solely of the activity of Starburst II prior to the close of the SoftBank Merger, which primarily related to merger expenses that were incurred in connection with the SoftBank Merger (recognized in

selling, general and administrative expense) and interest income related to the $3.1 billion bond issued to Starburst II by Sprint Nextel Corporation. The Predecessor financial information represents the historical basis of presentation for Sprint

Communications for all periods prior to the SoftBank Merger.

The selected financial data presented below is not comparable for all

periods presented primarily as a result of transactions such as the SoftBank Merger and acquisitions of Clearwire and certain assets of U.S. Cellular in 2013 and the acquisitions of Virgin Mobile USA, Inc. (Virgin Mobile) and third-party affiliates

in 2009. All acquired companies’ results of operations subsequent to their acquisition dates are included in our consolidated financial statements.

The summary historical financial information presented below does not contain all of the information you should consider before deciding

whether to participate in the Exchange Offer, and should be read in conjunction with the information under the heading “Risk Factors” included in this prospectus, as well as with the information under the headings “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors,” in our Transition Report on Form 10-K for the three-month transition period ended March 31, 2014, and with our audited and unaudited

consolidated financial statements and related notes and other information contained in our Current Report on Form 8-K filed with the SEC on June 18, 2014 and our subsequently filed Quarterly Report on Form 10-Q for the quarter ended

June 30, 2014, as well as information

- 8 -

contained in the other documents incorporated by reference into this prospectus. See “Where You Can Find More Information.”

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Successor |

|

|

Predecessor |

|

| |

|

Three Months

Ended

June 30, |

|

|

Three Months

Ended

March 31, |

|

|

Year

Ended

December 31, |

|

|

87 Days

Ended

December 31, |

|

|

191 Days

Ended

July 10, |

|

|

Three

Months

Ended

June 30, |

|

|

Three

Months

Ended

March 31, |

|

|

Years Ended

December 31, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

|

2013 |

|

|

2012 |

|

|

2013 |

|

|

2013 |

|

|

2013 |

|

|

2012 |

|

|

2011 |

|

| |

|

(in millions, except per share amounts) |

|

| Results of Operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net operating revenues |

|

$ |

8,789 |

|

|

|

— |

|

|

$ |

8,875 |

|

|

$ |

— |

|

|

$ |

16,891 |

|

|

$ |

— |

|

|

$ |

18,602 |

|

|

$ |

8,877 |

|

|

$ |

8,793 |

|

|

$ |

35,345 |

|

|

$ |

33,679 |

|

| Depreciation |

|

|

868 |

|

|

|

— |

|

|

|

868 |

|

|

|

— |

|

|

|

2,026 |

|

|

|

— |

|

|

|

3,098 |

|

|

|

1,563 |

|

|

|

1,422 |

|

|

|

6,240 |

|

|

|

4,455 |

|

| Amortization |

|

|

413 |

|

|

|

— |

|

|

|

429 |

|

|

|

— |

|

|

|

908 |

|

|

|

— |

|

|

|

147 |

|

|

|

69 |

|

|

|

70 |

|

|

|

303 |

|

|

|

403 |

|

| Operating income (loss) |

|

|

519 |

|

|

|

(22 |

) |

|

|

420 |

|

|

|

(14 |

) |

|

|

(970 |

) |

|

|

(33 |

) |

|

|

(885 |

) |

|

|

(874 |

) |

|

|

29 |

|

|

|

(1,820 |

) |

|

|

108 |

|

| Net income (loss) |

|

|

23 |

|

|

|

(114 |

) |

|

|

(151 |

) |

|

|

(9 |

) |

|

|

(1,860 |

) |

|

|

(27 |

) |

|

|

(1,158 |

) |

|

|

(1,597 |

) |

|

|

(643 |

) |

|

|

(4,326 |

) |

|

|

(2,890 |

) |

| Income (loss) per Share and Dividends(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted net income (loss) per common share |

|

$ |

0.01 |

|

|

|

|

|

|

$ |

(0.04 |

) |

|

|

|

|

|

$ |

(0.54 |

) |

|

|

|

|

|

$ |

(0.38 |

) |

|

$ |

(0.53 |

) |

|

$ |

(0.21 |

) |

|

$ |

(1.44 |

) |

|

$ |

(0.96 |

) |

| Cash Flow Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by (used in) operating activities |

|

$ |

679 |

|

|

$ |

8 |

|

|

$ |

522 |

|

|

$ |

(2 |

) |

|

$ |

(61 |

) |

|

$ |

— |

|

|

$ |

2,671 |

|

|

$ |

1,235 |

|

|

$ |

940 |

|

|

$ |

2,999 |

|

|

$ |

3,691 |

|

| Capital expenditures |

|

|

1,246 |

|

|

|

— |

|

|

|

1,488 |

|

|

|

— |

|

|

|

3,847 |

|

|

|

— |

|

|

|

3,140 |

|

|

|

1,571 |

|

|

|

1,381 |

|

|

|

4,261 |

|

|

|

3,130 |

|

| Ratio of Earnings to Fixed Charges(2) |

|

|

1.04 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1.6 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Successor |

|

|

Predecessor |

|

| |

|

As of June 30, |

|

|

As of March 31, |

|

|

As of

December 31, |

|

|

As of

June 30, |

|

|

As of

March 31, |

|

|

As of December 31, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

|

2013 |

|

|

2012 |

|

|

2013 |

|

|

2013 |

|

|

2012 |

|

|

2011 |

|

| |

|

(in millions) |

|

| Financial Position |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

84,419 |

|

|

$ |

3,122 |

|

|

$ |

84,689 |

|

|

$ |

3,122 |

|

|

$ |

86,095 |

|

|

$ |

3,115 |

|

|

$ |

50,361 |

|

|

$ |

50,757 |

|

|

$ |

51,570 |

|

|

$ |

49,383 |

|

| Property, plant and equipment, net |

|

|

16,852 |

|

|

|

— |

|

|

|

16,299 |

|

|

|

— |

|

|

|

16,164 |

|

|

|

— |

|

|

|

14,403 |

|

|

|

14,025 |

|

|

|

13,607 |

|

|

|

14,009 |

|

| Intangible assets, net |

|

|

55,226 |

|

|

|

— |

|

|

|

55,919 |

|

|

|

— |

|

|

|

56,272 |

|

|

|

— |

|

|

|

22,979 |

|

|

|

22,352 |

|

|

|

22,371 |

|

|

|

22,428 |

|

| Total debt, capital lease and financing obligations (including equity unit notes) |

|

|

32,494 |

|

|

|

— |

|

|

|

32,778 |

|

|

|

— |

|

|

|

33,011 |

|

|

|

— |

|

|

|

24,208 |

|

|

|

24,500 |

|

|

|

24,341 |

|

|

|

20,274 |

|

| Stockholders’ equity |

|

|

25,364 |

|

|

|

3,108 |

|

|

|

25,312 |

|

|

|

3,111 |

|

|

|

25,584 |

|

|

|

3,110 |

|

|

|

4,980 |

|

|

|

6,474 |

|

|

|

7,087 |

|

|

|

11,427 |

|

| (1) |

We did not declare any dividends on our common shares in any of the periods reported. |

| (2) |

During the successor three-month periods ended June 30, 2013 and March 31, 2014 and 2013, the successor year ended December 31, 2013 and the 87 days ended December 31, 2012, the predecessor

three-month periods ended June 30, 2013 and March 31, 2013 and predecessor years ended December 31, 2012 and 2011, earnings (loss) as adjusted were inadequate to cover fixed charges by $175 million, $75 million, $8 million, $1.8

billion, $23 million, $1.3 billion, $385 million, $3.3 billion and $1.3 billion, respectively. |

- 9 -

RISK FACTORS

The terms of the Exchange Notes are identical in all material respects to those of the corresponding series of Original Notes, except for the

transfer restrictions and registration rights and related special interest provisions relating to the Original Notes that will not apply to the Exchange Notes. You should carefully consider the risks described below and all of the information

contained or incorporated by reference into this prospectus before making a decision regarding the Exchange Offer. If any of those risks actually occurs, our business, financial condition and results of operations could suffer. The risks discussed

below also include forward-looking statements, and our actual results may differ substantially from those discussed in these forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements” in this prospectus.

The Exchange Notes will be effectively subordinated to the debt and other liabilities (including trade payables) of our subsidiaries,

other than Sprint Communications, and to any of our secured debt to the extent of the value of the assets securing such debt. We and Sprint Communications are primarily holding companies and, as a result, rely on the receipt of funds from our

subsidiaries in order to meet cash needs and service indebtedness, including the notes.

Sprint Corporation and Sprint

Communications are primarily holding companies, which means substantially all of our respective business operations are conducted, and substantially all of our respective consolidated assets are held, by subsidiaries. These subsidiaries are separate

and distinct legal entities that do not guarantee the notes and therefore they have no obligation, contingent or otherwise, to pay any amounts due on the notes or to make any funds available for such purpose, whether by dividends, loans or other

payments. In the event of any liquidation, dissolution, reorganization, bankruptcy, insolvency or similar proceeding with respect to any of our subsidiaries, our right (and the consequent right of our creditors, including the holders of the notes,

other than with respect to Sprint Communications) to participate in the distribution of, or to realize the proceeds from, that subsidiary’s assets will be effectively subordinated to the claims of such subsidiary’s creditors (including

trade creditors). As a result, the Exchange Notes will be effectively subordinated to all existing and future debt and other liabilities of our subsidiaries other than Sprint Communications. In addition, because the notes are unsecured, if we were

to issue any secured debt, the notes would be effectively subordinated to that secured debt to the extent of the value of the assets securing such debt.

Sprint Communications has a $3.3 billion revolving credit facility and a $500.0 million unsecured Export Development Canada (“EDC”)

loan agreement. Certain subsidiaries of Sprint Communications have also guaranteed the revolving credit facility and EDC loan. Sprint Communications is a guarantor and certain of its subsidiaries are co-borrowers under a $1.0 billion secured

equipment credit facility. Certain subsidiaries of Sprint Corporation are party to a two-year committed facility to sell certain accounts receivable on a revolving basis, subject to a maximum funding limit of $1.3 billion (the “Receivables

Facility”). In addition, certain of our other long-term debt and capital lease obligations have been issued or guaranteed by our wholly owned subsidiaries, other than Sprint Communications, and will be structurally senior to the notes. As of

June 30, 2014, we had approximately $31.2 billion in principal amount of debt outstanding, including amounts drawn under the credit facilities but excluding outstanding letters of credit thereunder in the amount of $922 million. Of such amount

of debt outstanding, our wholly owned subsidiaries’ (excluding Sprint Communications) combined outstanding indebtedness (issued or guaranteed) totaled $12.9 billion in principal amount at June 30, 2014 and the total principal amount of our

secured debt was $1.5 billion.

Our cash flow and our ability to meet our payment obligations on our debt, including the Exchange Notes,

is dependent on the earnings of our subsidiaries and the distribution of those earnings to us in the form of dividends, loans, advances or other payments. Similarly, the cash flow and ability of Sprint Communications to meet its payment obligations

on its debt, including the Sprint Communications Guarantee, is dependent on the earnings of its subsidiaries and the distribution of those earnings to it in the form of dividends, loans, advances or other payments.

- 10 -

The indenture governing the Exchange Notes does not contain any covenants that restrict the

ability of our subsidiaries to agree to covenants or enter into other arrangements that would limit the ability of our subsidiaries to make distributions to us. The indentures and financing arrangements of certain of our subsidiaries contain

provisions that limit the ability of the subsidiaries to pay dividends on their common stock, and future debt agreements may contain more restrictive provisions which could adversely affect our ability to meet our payment obligations on our debt,

including the Exchange Notes.

The indenture that governs the Exchange Notes does not restrict our or our subsidiaries’ ability

to incur additional indebtedness, which could make our debt securities, including the Exchange Notes, more risky in the future.

Our consolidated principal amount of indebtedness was $31.2 billion at June 30, 2014. As of June 30, 2014, we had $2.4 billion of

borrowing capacity under our $3.3 billion revolving credit facility, after accounting for $922 million of outstanding letters of credit and the amount available under the Receivables Facility was $1.2 billion. The indenture that governs the Exchange

Notes does not restrict our ability or our subsidiaries’ ability to incur additional indebtedness. The degree to which we incur additional debt could have important consequences to holders of the notes, including:

| |

• |

|

making it harder for us to satisfy our obligations under the notes; |

| |

• |

|

a loss in trading value; |

| |

• |

|

a risk that the credit ratings of the notes are lowered or withdrawn; |

| |

• |

|

limiting our ability to obtain any necessary financing in the future for working capital, capital expenditures, debt service requirements, acquisitions or other purposes; |

| |

• |

|

requiring us to dedicate a substantial portion of our cash flows from operations to the payment of indebtedness and not for other purposes, such as working capital and capital expenditures; |

| |

• |

|

limiting our flexibility to plan for, or react to, changes in our businesses; |

| |

• |

|

making compliance with financial covenants in certain of our other debt instruments more difficult; |

| |

• |

|

making us more indebted than some of our competitors, which may place us at a competitive disadvantage; and |

| |

• |

|

making us more vulnerable to a downturn in our businesses. |

Sprint Corporation has fully and unconditionally

guaranteed on a senior unsecured basis the outstanding securities issuances of its subsidiaries, Sprint Communications, Sprint Capital Corporation and the 8.25% exchangeable notes due 2040 of Clearwire Communications LLC and Clearwire Finance, Inc.,

which as of June 30, 2014, aggregated $20.1 billion. Sprint Corporation and Sprint Communications may in the future, subject to certain conditions, guarantee other outstanding security issuances of their subsidiary, Clearwire Communications,

LLC.

If an active trading market for the Exchange Notes does not develop or last, you may not be able to resell your Exchange Notes

when desired, at their fair market value or at all.

The Exchange Notes constitute new issues of securities with no established

trading market. We do not intend to list the Exchange Notes on any securities exchange or to include the Exchange Notes in any automated quotation system. Accordingly, no market for the Exchange Notes may develop, and any market that develops may

not last. If the Exchange Notes are traded, the market price of the Exchange Notes may decline depending on prevailing interest rates, the market for similar securities, our performance and other factors. To the extent that an active trading market

does not develop, you may not be able to resell your Exchange Notes when desired, at their fair market value or at all.

- 11 -

In certain instances, it is possible for the indenture governing the Exchange Notes to be

amended and for the compliance with certain covenants and for certain defaults thereunder to be waived with the consent of the holders of the Exchange Notes voting together with the holders of other of our debt securities, voting together as a

single class.

Subject to certain exceptions, the indenture governing the Exchange Notes may be amended by us and the trustee with

the consent of the holders of debt securities issued under the indenture, including the Exchange Notes. With respect to any such series of debt securities, the required consent can be obtained from either the holders of a majority in principal

amount of the debt securities of that series, or from the holders of a majority in principal amount of the debt securities of that series and all other series issued under the indenture affected by that amendment, voting as a single class. There are

currently outstanding three issuances of debt securities in an aggregate principal amount of $9.0 billion under the indenture, and it is likely we will issue additional series of debt securities thereunder in the future. In addition, subject to

certain exceptions, with respect to any series of debt securities issued under the indenture, our compliance with certain restrictive provisions of the indenture or any past default under the indenture may be waived by (i) the holders of a

majority in principal amount of that series of debt securities, or (ii) the holders of a majority in principal amount of that series of debt securities and all other series affected by the waiver, whether issued under the indenture or any of

our other indentures providing for such aggregated voting, all voting as a single class. As a result, it is possible in certain circumstances for the indenture governing the Exchange Notes to be amended and for compliance with certain covenants and

for certain defaults thereunder to be waived with the consent of holders of less than a majority of each series of notes outstanding.

We may not have sufficient funds to repurchase the Exchange Notes upon a Change of Control together with a Ratings Decline, and certain

strategic transactions may not constitute a Change of Control.

The occurrence of a change of control together with a ratings

decline, as provided in the indenture, will be a triggering event requiring us to offer to repurchase the Exchange Notes at a purchase price equal to 101% of the aggregate principal amount of Exchange Notes repurchased, plus accrued and unpaid

interest on the Exchange Notes up to but excluding the date of repurchase. It is possible that we will not have sufficient funds upon a change of control and ratings decline to make the required repurchase of Exchange Notes and any failure to do so

could result in cross defaults under certain of our other debt agreements. In addition, some of our debt agreements or other similar agreements to which we become a party may contain restrictions on our ability to purchase the Exchange Notes,

regardless of the occurrence of a Change of Control Triggering Event (as defined in “Description of the notes—Repurchase of the notes upon a Change of Control Triggering Event”).

We frequently evaluate and may in the future enter into strategic transactions. Any such transaction could happen at any time, could be

material to our business and could take any number of forms, including, for example, an acquisition, merger or sale of assets. As discussed below in “Description of the notes—Repurchase of the notes upon a Change of Control Triggering

Event,” the definition of change of control with respect to the Exchange Notes offered hereby specifically excludes transactions involving one or more “Permitted Holders,” which includes SoftBank and its affiliates, and could include

a subsequent controlling investor in SoftBank. In the future, we could enter into certain other transactions that, although material, would not result in a Change of Control Triggering Event and, therefore, would not require us to make an offer to

repurchase the Exchange Notes. Such transactions could significantly increase the amount of our indebtedness outstanding at such time or otherwise affect our capital structure or credit ratings.

Federal and state fraudulent transfer laws may permit a court to void the Sprint Communications Guarantee, and, if that occurs, you may

not receive any payments on the Exchange Notes.

Federal and state fraudulent transfer and conveyance statutes may apply to the

issuance of the Exchange Notes and the incurrence of the Sprint Communications Guarantee. Under federal bankruptcy law and comparable provisions of state fraudulent transfer or conveyance laws, which may vary from state to state, the

- 12 -

notes or the Sprint Communications Guarantee could be voided as a fraudulent transfer or conveyance if (1) Sprint Corporation or Sprint Communications, as applicable, issued the notes or

incurred the Sprint Communications Guarantee with the intent of hindering, delaying or defrauding creditors or (2) Sprint Corporation or Sprint Communications, as applicable, received less than reasonably equivalent value or fair consideration

in return for either issuing the notes or incurring the Sprint Communications Guarantee and, in the case of (2) only, one of the following is also true at the time thereof:

| |

• |

|

Sprint Corporation or Sprint Communications, as applicable, was insolvent or rendered insolvent by reason of the issuance of the notes or the incurrence of the Sprint Communications Guarantee; |

| |

• |

|

the issuance of the notes or the incurrence of the Sprint Communications Guarantee left Sprint Corporation or Sprint Communications, as applicable, with an unreasonably small amount of capital to carry on the business;

|

| |

• |

|

Sprint Corporation or Sprint Communications intended to, or believed that Sprint Corporation or Sprint Communications would, incur debts beyond our or Sprint Communications’ ability to pay as they mature; or

|

| |

• |

|

Sprint Corporation or Sprint Communications was a defendant in an action for money damages, or had a judgment for money damages docketed against Sprint Corporation or Sprint Communications if, in either case, after

final judgment, the judgment is unsatisfied. |

If a court were to find that the issuance of the notes or the incurrence of

the Sprint Communications Guarantee was a fraudulent transfer or conveyance, the court could void the payment obligations under the notes or the Sprint Communications Guarantee or subordinate the notes or the Sprint Communications Guarantee to

presently existing and future indebtedness of ours or of Sprint Communications, or require the holders of the notes to repay any amounts received with respect to the notes or the Sprint Communications Guarantee. In the event of a finding that a

fraudulent transfer or conveyance occurred, you may not receive any repayment on the notes. Further, the voidance of the notes could result in an event of default with respect to our and our subsidiaries’ other debt that could result in

acceleration of such debt.

As a general matter, value is given for a transfer or an obligation if, in exchange for the transfer or

obligation, property is transferred or an antecedent debt is secured or satisfied. A debtor will generally not be considered to have received value in connection with a debt offering if the debtor uses the proceeds of that offering to make a

dividend payment or otherwise retire or redeem equity securities issued by the debtor.

We cannot be certain as to the standards a court

would use to determine whether or not Sprint Corporation or Sprint Communications were solvent at the relevant time or, regardless of the standard that a court uses, that the incurrence of the Sprint Communications Guarantee would not be

subordinated to our or any of Sprint Communications’ other debt. Generally, however, an entity would be considered insolvent if, at the time it incurred indebtedness:

| |

• |

|

the sum of its debts, including contingent liabilities, was greater than the fair saleable value of all its assets; |

| |

• |

|

the present fair saleable value of its assets was less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they become absolute and mature; or

|

| |

• |

|

it could not pay its debts as they become due. |

Although the Sprint Communications Guarantee

will be subject to a provision intended to limit Sprint Communications’ liability to the maximum amount that it could incur without causing the incurrence of obligations under the Sprint Communications Guarantee to be a fraudulent transfer or

conveyance, this provision may not be effective to protect the Sprint Communications Guarantee from being voided under fraudulent transfer or conveyance law, or may reduce Sprint Communications’ obligation to an amount that effectively

- 13 -

makes the Sprint Communications Guarantee worthless. In a 2009 Florida bankruptcy court case, which was subsequently overturned on appeal and later reversed on different grounds, this type of

provision was found to be unenforceable. As a result, the subsidiary guarantees were found to be fraudulent conveyances. We cannot be certain whether this decision will be followed in the future; however, if it is, the risk that the Sprint

Communications Guarantee could be deemed a fraudulent transfer or conveyance would increase.

If you fail to exchange your Original

Notes, they will continue to be restricted securities and will likely become less liquid.

Original Notes that you do not tender,

or we do not accept, will, following the Exchange Offer, continue to be restricted securities, and you may not offer to sell them except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state

securities laws. We will issue Exchange Notes in exchange for Original Notes of the corresponding series pursuant to the Exchange Offer only following the satisfaction of the procedures and conditions set forth in “The Exchange

Offer—Procedures for tendering Original Notes” and “The Exchange Offer—Conditions to the Exchange Offer.” These procedures and conditions include timely receipt by the exchange agent of a confirmation of book-entry transfer

of the Original Notes being tendered and an agent’s message from DTC.

Because we anticipate that all or substantially all holders of

Original Notes will elect to exchange their Original Notes in this Exchange Offer, we expect that the market for any Original Notes remaining after the completion of the Exchange Offer will be substantially limited. Any Original Notes tendered and

exchanged in the Exchange Offer will reduce the aggregate principal amount of the Original Notes of the applicable series outstanding. If you do not tender your Original Notes following the Exchange Offer, you generally will not have any further

registration rights, and your Original Notes will continue to be subject to certain transfer restrictions. Accordingly, the liquidity of the market for the Original Notes of each series is likely to be adversely affected.

- 14 -

SELECTED HISTORICAL CONSOLIDATED FINANCIAL INFORMATION

Set forth below is our selected historical consolidated financial information as of and for the periods indicated. The selected historical

consolidated financial information as of March 31, 2014 and December 31, 2013 and 2012 and for the three-month transition period ended March 31, 2014 and the years ended December 31, 2013, 2012 and 2011 has been derived from our

audited consolidated financial statements and related notes incorporated by reference into this prospectus. The summary historical financial information as of December 31, 2011, 2010 and 2009 and for the years ended December 31, 2010 and

2009 has been derived from our audited consolidated financial statements not included or incorporated by reference into this prospectus. The selected historical consolidated financial information as of June 30, 2014, March 31, 2013

and for the three-month periods ended March 31, 2013 and June 30, 2014 and 2013 has been derived from our unaudited interim consolidated financial statements and related notes incorporated by reference into this prospectus.

The selected historical consolidated financial information presented below is not comparable for all periods presented because of transactions

consummated in those periods. The Company’s financial statement presentations distinguish between the predecessor period (Predecessor) relating to Sprint Communications (formerly known as Sprint Nextel Corporation) for periods prior to our

merger with SoftBank (the “SoftBank Merger”) and the successor period (Successor) relating to Sprint Corporation, formerly known as Starburst II, Inc. (“Starburst II”), for periods subsequent to the incorporation of Starburst II

on October 5, 2012. The Successor financial information includes the activity and accounts of Sprint Corporation as of and for the three-month period ended June 30, 2014, the three-month transition period ended March 31, 2014 and the

year ended December 31, 2013, which includes the activity and accounts of Sprint Communications, inclusive of the consolidation of Clearwire, prospectively following completion of the SoftBank Merger, beginning on July 11, 2013. The

accounts and operating activity for the Successor periods from October 5, 2012 (date of inception) to December 31, 2012, the three-month period ended June 30, 2013, the three-month period ended March 31, 2013 and from

January 1, 2013 to July 10, 2013 consist solely of the activity of Starburst II prior to the close of the SoftBank Merger, which primarily related to merger expenses that were incurred in connection with the SoftBank Merger (recognized in

selling, general and administrative expense) and interest income related to the $3.1 billion bond issued to Starburst II by Sprint Nextel Corporation. The Predecessor financial information represents the historical basis of presentation for Sprint

Communications for all periods prior to the SoftBank Merger.

The selected financial data presented below is not comparable for all

periods presented primarily as a result of transactions such as the SoftBank Merger and acquisitions of Clearwire and certain assets of U.S. Cellular in 2013 and the acquisitions of Virgin Mobile USA, Inc. (Virgin Mobile) and third-party affiliates

in 2009. All acquired companies’ results of operations subsequent to their acquisition dates are included in our consolidated financial statements.

The selected historical consolidated financial information presented below does not contain all of the information you should consider before

deciding whether to participate in the Exchange Offer, and should be read in conjunction with the information under the heading “Risk Factors” included in this prospectus, as well as with the information under the headings

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors,” in our Transition Report on Form 10-K for the three-month transition period ended March 31, 2014, and with our

audited and unaudited consolidated financial statements and related notes and other information contained in our Current Report on Form 8-K filed with the SEC on June 18, 2014 and our subsequently filed Quarterly Report on Form 10-Q for the

quarter ended June 30, 2014, as well as

- 15 -

information contained in the other documents incorporated by reference into this prospectus. See “Where You Can Find More Information.”

|

|

|