UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16

OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2014

Commission File Number: 000-55232

Sphere 3D Corp.

(Translation of registrant's name into English)

240 Matheson Blvd. East

Mississauga, Ontario L4Z 1X1

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

[ ] Form 20-F [ x ] Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

SUBMITTED HEREWITH

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

SPHERE 3D CORP. |

| |

(Registrant) |

| |

|

|

| Date: October 16, 2014 |

By: |

/s/ T. Scott Worthington |

| |

|

|

| |

|

T. Scott Worthington |

| |

Title: |

Chief Financial Officer |

GUARANTEE AGREEMENT

THIS AGREEMENT made as of the 13th day of

October, 2014.

B E T W E E N:

FBC HOLDINGS S.á.r.l., a private limited liability

company (société à responsabilité limitée) incorporated under the laws of

the Grand Duchy of Luxembourg, with its registered office located at 46 A,

Avenue John F. Kennedy, L-1855 Luxembourg, having a share capital of 12,500

shares with a nominal value of EUR 1, and registered with the Luxembourg

Register of Commerce and Companies (R.C.S. Luxembourg) under number B 142.133

(herein called the “Lender”)

- and -

SPHERE 3D CORPORATION, a

corporation incorporated under the laws of the Province of Ontario

(herein

called the “Guarantor”)

WHEREAS the Guarantor has agreed to guarantee payment of

the Obligations of Overland Storage, Inc., a California corporation (the

“Borrower”) on the terms and subject to the conditions set forth herein;

AND WHEREAS, it is in the best interests of the Guarantor to execute and

deliver this agreement, inasmuch as the Guarantor will derive substantial direct

and indirect benefits from the provision of credit and other financial

accommodations by the Lender to the Borrower;

AND WHEREAS, in

consideration of the financial and other support that the Borrower has provided

and may in the future provide to the Guarantor, and in order to induce the

Lender to extend credit and make other financial accommodations to the Borrower,

the Guarantor is willing to guarantee payment of the Obligations of the Borrower

on the terms and subject to the conditions set forth herein;

NOW

THEREFORE, in consideration of the premises and other good and valuable

consideration, the Guarantor hereby covenants with the Lender as follows:

ARTICLE 1

INTERPRETATION

1.1 Defined Terms. All capitalized terms

used herein which are not otherwise defined herein shall have the respective

meaning ascribed thereto in the Loan Agreement; otherwise, in this agreement or any amendment to this

agreement, unless the context clearly indicates to the contrary:

- 2 -

“Designated Currency” shall have the meaning ascribed

thereto in Section 2.1 herein.

“Loan Agreement” means the Loan and Security Agreement

made as of October 13, 2014 by and among the Borrower and the Lender, as the

same may be amended, modified, supplemented or replaced from time to time.

“Material Adverse Effect” means a material adverse

effect on (i) the assets, liabilities, results of operations, condition

(financial or otherwise), or business of the Guarantor and its Subsidiaries

taken as a whole, (ii) the legality, validity, enforceability or binding effect

of this agreement, or (iii) the ability of the Guarantor to perform its

obligations hereunder.

“Obligations” shall have the meaning ascribed thereto in

the Loan Agreement.

“Other Taxes” shall have the meaning ascribed thereto in

Section 2.11(b) herein.

“Subordination Agreement” means the subordination

agreement entered into as of October 13, 2014 by and between Silicon Valley

Bank, the Lender and the Borrower, as the same may be amended, modified,

supplemented or replaced from time to time.

“Taxes” shall have the meaning ascribed thereto in

Section 2.11(a) herein.

1.2 Other Usages. References to “this

agreement”, “the agreement”, “hereof”, “herein”,

“hereto” and like references refer to this Guarantee Agreement, as

amended, modified, supplemented or replaced from time to time, and not to any

particular Article, Section or other subdivision of this agreement. Any

references herein to any other agreements or documents shall mean such

agreements or documents as amended, modified, supplemented, restated or replaced

from time to time.

1.3 Plural and Singular. Where the context

so requires, words importing the singular number shall include the plural and

vice versa.

1.4 Headings. The division of this

agreement into Articles and Sections and the insertion of headings in this

agreement are for convenience of reference only and shall not affect the

construction or interpretation of this agreement.

1.5 Applicable Law. This agreement shall

be governed by and construed in accordance with the laws of the Province of

Ontario and the federal laws of Canada applicable therein. The parties hereby

attorn to the courts of the Province of Ontario and agree that those courts

shall have non-exclusive jurisdiction to determine all disputes relating to this

agreement. 1.6 Time of the Essence. Time shall in all

respects be of the essence of this agreement and no extension or variation of

this agreement or any obligation hereunder shall operate as a waiver of this

provision.

- 3 -

1.7 Currency. Unless otherwise specified

herein, all statements of or references to dollar amounts in this agreement

shall mean lawful money of the United States of America.

ARTICLE 2

GUARANTEE

2.1 Guarantee. Subject to Section 2.12,

the Guarantor hereby unconditionally, absolutely, irrevocably and guarantees the

full and punctual payment by the Borrower to the Lender as and when due, whether

at stated maturity, by required prepayment, declaration, acceleration, demand or

otherwise, of all of the Obligations in the same currency (the “Designated

Currency”) as the currency of the Obligations, whether for principal,

interest, fees, expenses, indemnities or otherwise. For greater certainty, the

Guarantor shall be required to pay the Obligations, subject to Section 2.12, if

the Sphere 3D Merger Closing does not occur within 90 days after the Funding

Date.

2.2 Nature of Guarantee. Subject to

Section 2.12, this agreement shall in all respects be a continuing, absolute,

unconditional and irrevocable guarantee of payment when due and not of

collection, and shall remain in full force and effect until the Obligations have

been fully satisfied. Subject to Section 2.12, the Guarantor guarantees that the

Obligations will be paid by the Borrower strictly in accordance with their

respective terms, regardless of any law, regulation or order now or hereafter in

effect in any jurisdiction affecting any of such terms or the rights of the

Lender with respect thereto (provided the Guarantor shall not be in breach of

any such law, regulation or order by doing so).

2.3 Liability Not Lessened or Limited.

Subject to the provisions hereof and Section 2.12 in particular, the

liability of the Guarantor under this agreement shall be absolute, unconditional

and irrevocable irrespective of, and without being lessened or limited by:

| |

(a) |

any lack of validity, effectiveness or enforceability of

any of the agreements or instruments evidencing any of the

Obligations; |

| |

|

|

|

| |

(b) |

the failure of the Lender: |

| |

|

|

|

| |

|

(i) |

to assert any claim or demand or to enforce any right or

remedy against the Borrower or any other Person (including any other

guarantor) under the provisions of any of the agreements or instruments

evidencing any of the Obligations, or otherwise, or |

| |

|

|

|

| |

|

(ii) |

to exercise any right or remedy against any other

guarantor of, or collateral securing, any of the Obligations; |

| |

|

|

|

| |

(c) |

any change in the time, manner or place of payment of, or

in any other term of, all or any of the Obligations, or any other

extension, compromise, indulgence or renewal of any Obligations; |

| |

|

|

|

| |

(d) |

any reduction, limitation, variation, impairment,

discontinuance or termination of the Obligations for any reason (other

than by reason of any payment which is not required to be rescinded),

including any claim of waiver, release,

discharge, surrender, alteration or compromise, and shall not be

subject to (and the Guarantor hereby waives any right to or claim of) any

defence or setoff, counterclaim, recoupment or termination whatsoever by

reason of the invalidity, illegality, nongenuineness, irregularity,

compromise, unenforceability of, or any other event or occurrence

affecting, the Obligations or otherwise (other than by reason of any

payment which is not required to be rescinded); |

- 4 -

| |

(e) |

any amendment to, rescission, waiver or other

modification of, or any consent to any departure from, any of the terms of

any of the agreements or instruments evidencing any of the Obligations or

any other guarantees or security; |

| |

|

|

| |

(f) |

any addition, exchange, release, discharge, renewal,

realization or non-perfection of any collateral security for the

Obligations or any amendment to, or waiver or release or addition of, or

consent to departure from, any other guarantee held by the Lender as

security for any of the Obligations; |

| |

|

|

| |

(g) |

the loss of or in respect of or the unenforceability of

any other guarantee or other security which the Lender may now or

hereafter hold in respect of the Obligations, whether occasioned by the

fault of the Lender or otherwise; |

| |

|

|

| |

(h) |

any change in the name of the Borrower, constating

documents, capital structure, capacity or constitution of the Borrower,

the bankruptcy or insolvency of the Borrower, the sale of any or all of

the business or assets of the Borrower or the Borrower being consolidated,

merged or amalgamated with any other Person; |

| |

|

|

| |

(i) |

any payment received on account of the Obligations by the

Lender that it is obliged to repay pursuant to any applicable law or for

any other reason; or |

| |

|

|

| |

(j) |

any other circumstance which might otherwise constitute a

defence available to, or a legal or equitable discharge of, the Borrower,

any surety or any guarantor. |

2.4 Lender not Bound to Exhaust Recourse.

The Lender shall not be bound to pursue or exhaust its recourse against the

Borrower or others or any security or other guarantees it may at any time hold

before being entitled to payment hereunder from the Guarantor or to enforce its

rights against the Guarantor hereunder.

2.5 Enforcement. Upon any of the

Obligations becoming due and payable by the Borrower (and, for greater

certainty, if the Sphere 3D Merger Closing does not occur within 90 days after

the Funding Date), the Guarantor shall forthwith pay to the Lender in

immediately available funds at the address of the Lender set forth in Section

4.1 the total amount of such Obligations as provided for in Section 2.12 and the

Lender may forthwith enforce its rights against the Guarantor hereunder. A

written statement of the Lender as to the amount of the Obligations remaining

unpaid to the Lender at any time shall be prima facie evidence against

the Guarantor, absent manifest error, as to the amount of the Obligations

remaining unpaid to the Lender at such time.

- 5 -

2.6 Guarantee in Addition to Other Security.

The guarantee contained herein shall be in addition to and not in

substitution for any other guarantee or other security which the Lender may now

or hereafter hold in respect of the Obligations, and the Lender shall be under

no obligation to marshal in favour of the Guarantor any other guarantee or other

security or any moneys or other assets which the Lender may be entitled to

receive or may have a claim upon. 2.7 Reinstatement. The

guarantee contained herein and all other terms of this agreement shall continue

to be effective or shall be reinstated, as the case may be, if at any time any

payment (in whole or in part) of any of the Obligations is rescinded or must

otherwise be returned or restored by the Lender by reason of the insolvency,

bankruptcy or reorganization of the Borrower or for any other reason not

involving the wilful misconduct of the Lender, all as though such payment had

not been made.

2.8 Waiver of Notice, etc. The Guarantor

hereby waives promptness, diligence, notice of acceptance and any other notice

with respect to any of the Obligations and this agreement.

2.9 Subrogation Rights. Until all of the

Obligations have been fully satisfied, all dividends, compositions, proceeds of

security or payments received by the Lender from the Borrower or others in

respect of the Obligations shall be regarded for all purposes as payments in

gross without any right on the part of the Guarantor to claim the benefit

thereof in reduction of their liability under this agreement. Except to the

extent necessary to preserve its rights, the Guarantor will not exercise any

rights which it may acquire by way of subrogation under this agreement, by any

payment made hereunder or otherwise, until the prior satisfaction in full of all

of the Obligations. Any amount paid to the Guarantor on account of any such

subrogation rights prior to the satisfaction in full of all Obligations shall be

held in trust for the benefit of the Lender and shall immediately be paid to the

Lender and credited and applied against the Obligations, whether matured or

unmatured; provided, however, that if

| |

(a) |

the Guarantor has made payment to the Lender of all or

any part of the Obligations, and |

| |

|

|

| |

(b) |

all Obligations have been paid in full and all

commitments of the Lender to the Borrower have been permanently

terminated, |

the Lender agrees that, at the Guarantor’s request, the Lender

will execute and deliver to the Guarantor appropriate documents (without

recourse and without representation or warranty) necessary to evidence the

transfer by subrogation to the Guarantor of an interest in the Obligations

resulting from such payment by the Guarantor. Additionally, without limiting the

foregoing, the Guarantor hereby acknowledges and agrees that any and all

subrogation rights the Guarantor may acquire under this agreement constitute

“Junior Debt” as such term is defined in the Subordination Agreement. In the

event that the Guarantor acquires any such subrogation rights, it will execute a

joinder to the Subordination Agreement or other agreement requested by Silicon

Valley Bank to give effect to the foregoing.

2.10 Advances After Certain Events. All

advances, renewals and credits made or granted by the Lender to or for the

Borrower under the Loan Agreement after the bankruptcy or insolvency of the Borrower, but before the Lender has received

notice thereof, shall be deemed to form part of the Obligations, and all

advances, renewals and credits obtained from the Lender by or on behalf of the

Borrower under the Loan Agreement shall be deemed to form part of the

Obligations, notwithstanding any lack or limitation of power, incapacity or

disability of the Borrower or of the directors or agents thereof and

notwithstanding that the Borrower may not be a legal entity and notwithstanding

any irregularity, defect or informality in the obtaining of such advances,

renewals or credits, whether or not the Lender has knowledge thereof. The

Guarantor will indemnify the Lender for any such advance, renewal or credit that

is not repaid to the Lender.

- 6 -

2.11 Payments Free and Clear of Taxes, etc.

The Guarantor hereby agrees that:

| |

(a) |

Any and all payments made by the Guarantor hereunder

shall be made free and clear of, and without deduction for, any and all

present or future taxes, levies, imposts, deductions, charges or

withholdings, and all liabilities with respect thereto, excluding, in the

case of the Lender, taxes imposed on its net income (all such non-excluded

taxes, levies, imposts, deductions, charges, withholdings and liabilities

being hereinafter referred to as “Taxes”). If the Guarantor shall

be required by law to deduct any Taxes from or in respect of any sum

payable hereunder to the Lender: |

| |

|

|

|

| |

|

(i) |

the sum payable shall be increased as may be necessary so

that after making all required deductions (including deductions applicable

to additional sums payable under this Section 2.11) the Lender receives an

amount equal to the sum it would have received had no such deductions been

made, |

| |

|

|

|

| |

|

(ii) |

the Guarantor shall make such deductions, and |

| |

|

|

|

| |

|

(iii) |

the Guarantor shall pay the full amount deducted to the

relevant taxation authority or other authority in accordance with

applicable law. |

| |

|

|

|

| |

(b) |

The Guarantor shall pay any present or future stamp or

documentary taxes or any other excise or property taxes, charges or

similar levies which arise from any payment made hereunder or from the

execution, delivery or registration of, or otherwise with respect to, this

agreement (hereinafter referred to as “Other Taxes”). |

| |

|

|

|

| |

(c) |

The Guarantor hereby indemnifies and holds harmless the

Lender for the full amount of Taxes or Other Taxes (including, without

limitation, any Taxes or Other Taxes imposed by any jurisdiction on

amounts payable under this Section 2.11) paid by the Lender and any

liability (including penalties, interest and expenses) arising therefrom

or with respect thereto, whether or not such Taxes or Other Taxes were

correctly or legally assessed. |

| |

|

|

|

| |

(d) |

Within 30 days after the date of any payment of Taxes or

Other Taxes, the Guarantor will furnish to the Lender the original or a

certified copy of a receipt evidencing payment thereof. If no Taxes or Other Taxes

are payable in respect of any payment hereunder to the Lender, the

Guarantor will furnish to the Lender a certificate from each appropriate

taxing authority, or an opinion of counsel acceptable to the Lender, in

either case stating that such payment is exempt from or not subject to

Taxes or Other Taxes. |

- 7 -

| |

(e) |

Without prejudice to the survival of any other agreement

of the Guarantor hereunder, the agreements and obligations of the

Guarantor contained in this Section 2.11 shall survive the payment in full

of the Obligations. |

2.12 Limited Liability; Method of Payment.

Notwithstanding any other provision hereof, (a) the liability of the Guarantor

hereunder shall be limited in amount to the lesser of (i) $2,500,000 plus all

accrued and unpaid interest thereon and all cost and expenses incurred by the

Lender in enforcing this agreement and (ii) the amount of the Obligations, (b)

such liability shall only arise if (i) the Sphere 3D Merger Closing does not

occur within 90 days after the Funding Date or (ii) Guarantor shall fail to

comply with or other breach shall occur under any covenant or term hereof or any

representation made by Guarantor hereunder shall be untrue when made or deemed

made and (c) the Guarantor shall have the option of satisfying its liability

pursuant to clause (b)(i) of this Section 2.12 by cash or by the issuance of

Sphere Stock or by a combination thereof. The number of shares of Sphere Stock

issued pursuant to this Section 2.12 to the Lender in satisfaction of the

Guarantor’s obligations hereunder shall be determined on the basis set forth in

section 2.3(iii) of the Loan Agreement. For the avoidance of doubt, in the event

that Guarantor shall fail to comply with or any breach shall occur under any

covenant or term hereof or any representation made by Guarantor hereunder shall

be untrue when made or deemed made, the full amount of the obligations of the

Guarantor hereunder (subject to the limitation set forth in clause (a) of the

first sentence of this Section 2.12) shall immediately be due and payable in

cash by Guarantor whether or not the Obligations are then due and payable by

Borrower.

ARTICLE 3

COVENANTS, REPRESENTATIONS, WARRANTIES

AND INDEMNITIES

3.1 Affirmative Covenants. The Guarantor

hereby covenants and agrees that, until the Obligations have been paid in full,

or unless the Lender otherwise expressly consents in writing to amend or waive

any covenant, it will comply with, perform, fulfil and satisfy the covenants in

this Section 3.1.

| |

(a) |

Corporate Existence. The Guarantor shall maintain

its corporate existence in good standing and shall, qualify and remain

duly qualified to carry on business and own property in each jurisdiction

in which such qualification is necessary to the extent that a failure to

so qualify could reasonably be expected to have a Material Adverse

Effect. |

| |

|

|

| |

(b) |

Conduct of Business. The Guarantor shall conduct

its business in such a manner so as to comply in all respects with all

applicable laws, so as to observe and perform all its obligations under

leases, licences and agreements necessary for the proper conduct of its

business and so as to preserve and protect its property and assets and the

earnings, income and profits therefrom to the extent that such

non-compliance, non-observance or non-performance would

reasonably be expected to have a Material Adverse Effect. The Guarantor

shall obtain and maintain all material licenses, certificates of approval,

consents, registrations, permits, government approvals, franchises,

authorizations and other rights necessary for the operation of its

business to the extent that a failure to do so would reasonably be

expected to have a Material Adverse Effect. The Guarantor shall perform

all obligations incidental to any trust imposed upon it by statute and

shall ensure that any breaches of the said obligations and the

consequences of any such breach shall be promptly remedied except where

failure to do so would not reasonably be expected to have a Material

Adverse Effect. |

- 8 -

| |

(c) |

Taxes. The Guarantor shall file all tax returns

and tax reports required by law to be filed by them and pay all material

taxes, rates, government fees and dues levied, assessed or imposed upon

them and upon their property or assets or any part thereof, as and when

the same become due and payable (except any such taxes or charges which

are being diligently contested in good faith by appropriate proceedings

and for which adequate reserves in accordance with generally accepted

accounting principles shall have been set aside on its books), and the

Guarantor shall deliver to the Lender, when requested, written evidence of

such payments. |

| |

|

|

| |

(d) |

Adequate Allotment of Sphere Stock. The Guarantor

shall at all times ensure that a sufficient number of shares of Sphere

Stock have been duly allotted for issuance to the Lender so that the

Guarantor may fully satisfy its obligations hereunder by the issuance of

shares of Sphere Stock, free and clear of all encumbrances and

restrictions, as provided herein. Any such shares of Sphere Stock used to

pay the Guarantor’s obligations hereunder shall be validly issued, fully

paid and non-assessable and will be free and clear of all encumbrances and

restrictions. |

| |

|

|

| |

(e) |

Regulatory Compliance. The Guarantor shall, within

30 days following the date hereof, obtain all necessary consents and

approvals from all relevant stock exchanges and securities regulatory

authorities in order to fully satisfy its obligations hereunder by the

issuance of shares of Sphere Stock as provided herein. Nothing herein

shall require the Guarantor to register any securities of the Guarantor,

whether on a demand basis or in connection with the registration of

securities of the Guarantor for its own account under the United States

Securities and Exchange Act. |

3.2 Representations and Warranties. The

Guarantor hereby represents and warrants that each of the representations and

warranties contained in this Section 3.2 are true and correct each time they are

made.

| |

(a) |

Status and Power. The Guarantor is a corporation

duly incorporated and validly existing under the laws of the Province of

Ontario. The Guarantor is duly qualified, registered or licensed in all

jurisdictions where such qualification, registration or licensing is

required for the Guarantor to carry on its business.

The Guarantor has all requisite capacity, power and authority

to own, hold under licence or lease its properties, to carry on its

business and to otherwise enter into, and carry out the transactions

contemplated hereby except to the extent the lack thereof would not

reasonably be expected to have a Material Adverse Effect. |

- 9 -

| |

(b) |

Authorization and Enforcement. All necessary

action, corporate or otherwise, has been taken to authorize the execution,

delivery and performance by the Guarantor of this agreement. The Guarantor

has duly executed and delivered this agreement. This agreement constitutes

legal, valid and binding obligations of the Guarantor enforceable against

the Guarantor by the Lender in accordance with its terms, except to the

extent that the enforceability thereof may be limited by (i) applicable

bankruptcy, insolvency, moratorium, reorganization and other laws of

general application limiting the enforcement of creditors’ rights

generally and (ii) the fact that the courts may deny the granting or

enforcement of equitable rights. |

| |

|

|

|

| |

(c) |

Compliance with Other Instruments. The execution,

delivery and performance by the Guarantor of this agreement, and the

consummation of the transactions contemplated hereby, do not and will not

conflict with, result in any breach or violation of, or constitute a

default under the terms, conditions or provisions of the articles of

incorporation or by-laws of the Guarantor, any applicable law or any

agreement, lease, licence, permit or other instrument to which the

Guarantor is a party or is otherwise bound or by which the Guarantor

benefits or to which its property is subject and do not require the

consent or approval of any stock exchange, securities regulatory or any

other person or governmental authority. |

| |

|

|

|

| |

(d) |

Compliance with Laws. The Guarantor has complied

with all applicable laws in respect of this agreement and the transactions

contemplated hereby except to the extent the failure to do so would not

reasonably be expected to have a Material Adverse Effect. The Guarantor is

not in violation of any agreement, employee benefit plan, pension plan,

mortgage, franchise, licence, judgment, decree, order, statute, treaty,

rule or regulation relating in any way to itself, to the operation of its

business or to its property or assets and which would reasonably be

expected to have a Material Adverse Effect. |

| |

|

|

|

| |

(e) |

Solvency Proceedings. The Guarantor has

not: |

| |

|

|

|

| |

|

(i) |

admitted its inability to pay its debts generally as they

become due or failed to pay its debts generally as they become

due; |

| |

|

|

|

| |

|

(ii) |

in respect of itself, filed an assignment or petition in

bankruptcy or a petition to take advantage of any insolvency

statute; |

| |

|

|

|

| |

|

(iii) |

made an assignment for the benefit of its

creditors; |

| |

|

|

|

| |

|

(iv) |

consented to the appointment of a receiver of the whole

or any substantial part of its assets; |

- 10 -

| |

(v) |

filed a petition or answer seeking a reorganization,

arrangement, adjustment or composition in respect of itself under

applicable bankruptcy laws or any other applicable law or statute of

Canada or any subdivision thereof; or |

| |

|

|

| |

(vi) |

been adjudged by a court having jurisdiction a bankrupt

or insolvent, nor has a decree or order of a court having jurisdiction

been entered for the appointment of a receiver, liquidator, trustee or

assignee in bankruptcy of the Guarantor with such decree or order having

remained in force and undischarged or unstayed for a period of thirty

days. |

3.3 Survival of Representations and

Warranties. All of the representations and warranties of the Guarantor

contained in Section 3.2 shall survive the execution and delivery of this

agreement notwithstanding any investigation made at any time by or on behalf of

the Lender. 3.4 Indemnities. The Guarantor hereby agrees to

indemnify and save the Lender harmless from and against all loss, cost, damage,

expense, claims and liability which it may at any time suffer or incur in

connection with:

| |

(a) |

any failure by the Borrower to duly and punctually pay or

perform the Obligations; and |

| |

|

|

| |

(b) |

any loss for any reason whatsoever, including by

operation of law or otherwise, of any right of the Lender against the

Borrower, other than losses that are caused by the Lender’s gross

negligence or wilful misconduct. |

ARTICLE 4

GENERAL CONTRACT PROVISIONS

4.1 Notices. All notices, requests,

demands, directions and other communications provided for herein shall be in

writing and shall be personally delivered or sent by telefacsimile, charges

prepaid, at or to the address or telefacsimile number of the party set opposite

its name below:

| In the case of the Guarantor: |

Sphere 3D Corporation |

| |

240 Matheson Blvd. East |

| |

Mississauga, Ontario |

| |

L4L 1X1 |

| |

|

| |

Attention: T. Scott Worthington, CFO |

| |

Telefax: (905) 282-9966 |

| |

|

| In the case of the Lender: |

FBC Holdings S.á.r.l. |

| |

c/o Cyrus Capital Partners, L.P. |

| |

399 Park Avenue, 39th Floor |

| |

New York, New York, 10022

|

- 11 -

| Attention: |

Daniel Bordessa |

| Telefax: |

(212) 380-5801 |

or to such other address or addresses or telefacsimile number

or numbers as any party hereto may from time to time designate to the other

parties in such manner. Any communication which is personally delivered as

aforesaid shall be deemed to have been validly and effectively given on the date

of such delivery if such date is a Business Day and such delivery was made

during normal business hours of the recipient; otherwise, it shall be deemed to

have been validly and effectively given on the Business Day next following such

date of delivery. Any communication which is transmitted by telefacsimile as

aforesaid shall be deemed to have been validly and effectively given on the date

of transmission if such date is a Business Day and such transmission was made

during normal business hours of the recipient; otherwise, it shall be deemed to

have been validly and effectively given on the Business Day next following such

date of transmission.

4.2 Further Assurances. The Guarantor

shall do, execute and deliver or shall cause to be done, executed and delivered

all such further acts, documents and things as the Lender may reasonably request

for the purpose of giving effect to this agreement.

4.3 Severability. Wherever possible, each

provision of this agreement shall be interpreted in such manner as to be

effective and valid under applicable law, but if any provision of this agreement

shall be prohibited by or invalid under such law, such provision shall be

ineffective to the extent of such prohibition or invalidity, without

invalidating the remainder of such provision or the remaining provisions of this

agreement.

4.4 Assignment. The Lender may only assign

or transfer this agreement, any of its rights hereunder or any part thereof to

any persons to whom any of the Obligations may be assigned in compliance with

the Loan Agreement. Neither this agreement nor the benefit hereof may be

assigned by the Guarantor.

4.5 Successors and Assigns. This agreement

shall enure to the benefit of and shall be binding upon the parties hereto and

their respective successors and permitted assigns.

4.6 Amendments and Waivers. No amendment

to or waiver of any provision of this agreement, nor consent to any departure by

the Guarantor herefrom, shall in any event be effective unless the same shall be

in writing and signed by the Lender, and then such waiver or consent shall be

effective only in the specific instance and for the specific purpose for which

given.

4.7 Entire Agreement. This agreement and

the agreements referred to herein constitute the entire agreement between the

parties hereto and supersede any prior agreements, undertakings, declarations,

representations and understandings, both written and verbal, in respect of the

subject matter hereof.

- 12 -

4.8 Judgment Currency.

| |

(a) |

If, for the purpose of obtaining or enforcing judgment

against the Guarantor in any court in any jurisdiction, it becomes

necessary to convert into any other currency (such other currency being

hereinafter in this Section 4.8 referred to as the “Judgment

Currency”) an amount due in a Designated Currency under this

agreement, the conversion shall be made at the rate of exchange prevailing

on the Business Day immediately preceding: |

| |

|

|

|

| |

|

(i) |

the date of actual payment of the amount due, in the case

of any proceeding in the courts of the Province of Ontario or in the

courts of any other jurisdiction that will give effect to such conversion

being made on such date; or |

| |

|

|

|

| |

|

(ii) |

the date on which the judgment is given, in the case of

any proceeding in the courts of any other jurisdiction (the date as of

which such conversion is made pursuant to this Section 4.8(a)(ii) being

hereinafter in this Section 4.8 referred to as the “Judgment Conversion

Date”). |

| |

|

|

|

| |

(b) |

If, in the case of any proceeding in the court of any

jurisdiction referred to in Section 4.8(a)(ii), there is a change in the

rate of exchange prevailing between the Judgment Conversion Date and the

date of actual payment of the amount due, the Guarantor shall pay such

additional amount (if any, but in any event not a lesser amount) as may be

necessary to ensure that the amount paid in the Judgment Currency, when

converted at the rate of exchange prevailing on the date of payment, will

produce the amount of the Designated Currency which could have been

purchased with the amount of Judgment Currency stipulated in the judgment

or judicial order at the rate of exchange prevailing on the Judgment

Conversion Date. |

| |

|

|

|

| |

(c) |

Any amount due from the Guarantor under the provisions of

Section 4.8(b) shall be due as a separate debt and shall not be affected

by judgment being obtained for any other amounts due under or in respect

of this agreement. |

| |

|

|

|

| |

(d) |

The term “rate of exchange” in this Section 4.8

means the noon rate of exchange of the Judgment Currency into the

Designated Currency published by the Bank of Canada for the day in

question for Canadian interbank transactions. |

4.9 Set-Off.

| |

(a) |

In addition to any rights now or hereafter granted under

applicable law, and not by way of limitation of any such rights, the

Lender is authorized upon any amounts being payable by the Guarantor to

the Lender hereunder, without notice to the Guarantor or to any other

person, any such notice being expressly waived by the Guarantor, to

setoff, appropriate and apply any indebtedness at any time held by or

owing by the Lender to or for the credit of or the account of

the Guarantor against and on account of the obligations and

liabilities of the Guarantor which are due and payable to the Lender under

this agreement. |

- 13 -

| |

(b) |

The right of set-off set out in clause (a) above may be

exercised by the Lender even if the offsetting obligations are in

different currencies, in which case obligations which are denominated in a

currency other than United States dollars shall be expressed as the United

States dollar equivalent thereof (using the noon rate of exchange

published by the Bank of Canada for the day in question for Canadian

interbank transactions) and set off against obligations denominated in

United States dollars. |

4.10 No Waiver; Remedies; No Duty. In

addition to, and not in limitation of, Section 2.3 and Section 2.8, no failure

on the part of the Lender to exercise, and no delay in exercising, any right

hereunder shall operate as a waiver thereof; nor shall any single or partial

exercise of any right hereunder preclude any other or further exercise thereof

or the exercise of any other right. The remedies herein provided are cumulative

and not exclusive of any remedies provided by law. The Lender has no duty or

responsibility to provide the Guarantor with any credit or other information

concerning the Borrower’s affairs, financial condition or business which may

come into the possession of the Lender.

4.11 Paramountcy. In the event of any

conflict or inconsistency between the provisions of this agreement and the

provisions of the Loan Agreement, the provisions of the Loan Agreement shall

prevail and be paramount to the extent of such conflict or inconsistency.

4.12 Counterparts. This agreement may be

executed in any number of counterparts, all of which shall be deemed to be an

original and such counterparts taken together shall constitute one agreement,

and any of the parties hereto may execute this agreement by signing any such

counterpart.

[REMAINDER OF THIS PAGE INTENTIONALLY LEFT BLANK]

- 14 -

IN WITNESS WHEREOF the

parties hereto have executed this agreement as of the date first above written.

| |

FBC HOLDINGS S.á.r.l. |

| |

|

|

|

| |

|

|

|

| |

|

“Natalie S.E. Chevalier,

Proxyholder” |

| |

By: |

“Fabrice Stephane Rota, Director” |

| |

|

Name: |

Manacor (Luxembourg) S.A. |

| |

|

Title: |

Manager A |

| |

|

|

|

| |

|

|

|

| |

By: |

“Thomas Stamatelos” |

| |

|

Name: |

Cyrus Capital Partners, L.P. |

| |

|

Title: |

Manager B |

| |

|

|

|

| |

|

|

|

| |

SPHERE 3D CORPORATION |

| |

|

|

|

| |

|

|

|

| |

By: |

“T. Scott Worthington” |

| |

|

Name: |

T. Scott Worthington |

| |

|

Title: |

Chief Financial Officer |

[Signature page to Guaranty]

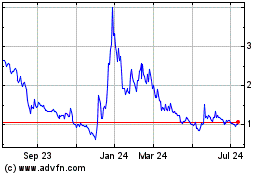

Sphere 3D (NASDAQ:ANY)

Historical Stock Chart

From Mar 2024 to Apr 2024

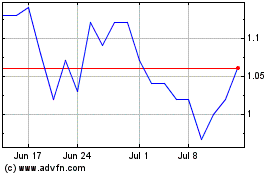

Sphere 3D (NASDAQ:ANY)

Historical Stock Chart

From Apr 2023 to Apr 2024