UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported):

October 9, 2014

CYTOSORBENTS CORPORATION

(Exact name of registrant as specified in

its charter)

| Nevada |

000-51038 |

98-0373793 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

7 Deer Park Drive, Suite K,

Monmouth Junction, New Jersey |

08852 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (732) 329-8885

Not Applicable

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On October 14, 2014, the Company issued a press release

to provide an update regarding its progress toward up-listing to a national exchange, preliminary guidance on

product revenues for the quarter ended September 30, 2014, and other information related to its operating performance. A copy

of the press release is furnished herewith as Exhibit 99.1.

The information in Item 2.02 of this Form 8-K shall not be

deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”)

or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under

the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 5.03 Amendments to the Articles of Incorporation or

Bylaws; Change in Fiscal Year.

Certificate of Designation of Series A 10% Cumulative Convertible

Preferred Stock

On October 9, 2014, CytoSorbents Corporation

(the “Company”) filed with the Nevada Secretary of State an Amendment (the “Series

A Amendment”) to the Certificate of Designation, as amended (the “Series A Certificate

of Designation”) of the Series A 10% Cumulative Convertible Preferred Stock, $0.001 par value per share

(the “Series A Preferred Stock”). The Series A Amendment, which became effective on October 9, 2014, (i)

amends the Series A Certificate of Designation to allow the stockholders representing eighty percent (80%) of the issued

and outstanding shares of Series A Preferred Stock to elect to convert all issued and outstanding shares of Series A

Preferred Stock into Common Stock of the Company, $0.001 par value per share (the “Common Stock”), at the

then-effective “Conversion Price,” as defined in the Series A Certificate of Designation, and (ii)

in consideration for such amendment, amends the Conversion Price from $1.25 per share to $0.77 per share, except with respect

to the shares of Series A Preferred Stock covered by that certain Agreement and Consent dated as of June 25, 2008 by and

among the Company and certain holders of Series A Preferred Stock. Immediately following effectiveness of the Series A

Amendment, the stockholders representing over 88 percent (88%) of the then-issued and outstanding Series A Preferred Stock

elected to convert all issued and outstanding Series A Preferred Stock into Common Stock at the Conversion Price, as amended.

As a result of the election, 1,894,969 shares of Series A Preferred Stock have been converted into 2,583,289 shares of Common

Stock.

The Series A Amendment was approved by the Board of Directors

of the Company (the “Board”), as well as by over 88 percent (88%) of the Series A Preferred Stock.

The foregoing description of the amendment to the rights of

the Series A Preferred Stock is qualified in its entirety by the provisions of the Series A Amendment, filed as Exhibit 3.1 hereto.

Certificate of Designation of Series B 10% Cumulative Convertible

Preferred Stock

On October 9, 2014, the Company also filed with the

Nevada Secretary of State an Amendment (the “Series B Amendment”) to the Certificate of Designation (the

“Series B Certificate of Designation”) of the Series B 10% Cumulative Convertible Preferred Stock, $0.001

par value per share (the “Series B Preferred Stock”). The Series B Amendment, which became effective on

October 9, 2014, amends the Series B Certificate of Designation to allow the holders of a majority of the Series B Preferred

Stock, including NJTC Investment Fund, LP, to elect to convert all issued and outstanding shares of Series B Preferred Stock

into Common Stock. Immediately following effectiveness of the Series B Amendment, the stockholders representing over 93

percent (93%) of the then-issued and outstanding Series B Preferred Stock elected to convert all issued and outstanding

Series B Preferred Stock into Common Stock. Each share of Series B Preferred Stock has a stated value of $100.00 (the

“Series B Stated Value”), and is convertible into that number of shares of Common Stock equal to the

Series B Stated Value at a conversion price of $0.036 (which remained conversion price unchanged in this process). As more

fully described below, as consideration for the Series B Amendment the holders of Series B Preferred Stock received a

one-time dividend equal to ten percent (10%) of the shares of Series B Preferred Stock then held. As a result of the election

by the holders of Series B Preferred Stock and the one-time dividend, 84,283.99 shares of Series B Preferred Stock have been

converted into 256,111,243 shares of Common Stock.

The Series B Amendment was approved by the Board, as well as

by over 93 percent (93%) of the Series B Preferred Stock.

The foregoing description of the amendment to the rights of

the Series B Preferred Stock is qualified in its entirety by the provisions of the Series B Amendment, filed as Exhibit 3.2 hereto.

After giving effect to the conversions of the Series A

Preferred Stock and Series B Preferred Stock described above, there are no shares of Preferred Stock of the Company issued

and outstanding.

Item 5.07 Submission of Matters to a Vote of Security Holders.

The information set forth in Item 5.03 regarding the

approval of the Series A Amendment and Series B Amendment by written consent of the stockholders holding Series A Preferred

Stock and Series B Preferred Stock is incorporated by reference into this Item 5.07.

Item 8.01 Other Events.

As consideration for the Series B Amendment, on

September 30, 2014, the Board approved the payment of a one-time dividend to holders of Series B Preferred Stock (the

“Series B Dividend”), at a rate equal to ten percent (10%) of the shares of Series B Preferred Stock then

held by each holder of Series B Preferred Stock. The Series B Dividend was subsequently approved by stockholders representing

over 93 percent (93%) of Series B Preferred Stock. The Series B Dividend resulted in the issuance of 8,428.28 shares of

Series B Preferred Stock. On October 9, 2014, immediately following effectiveness of the Series B Amendment and following

payment of the Series B Dividend, the stockholders representing over 93 percent (93%) of Series B Preferred Stock elected to

convert all issued and outstanding shares of Series B Preferred Stock into Common Stock.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. |

Description |

| |

|

| 3.1 |

Certificate of Amendment to the Certificate of Designation of Series A 10% Cumulative Convertible Preferred Stock, as amended. |

| |

|

| 3.2 |

Certificate of Amendment to the Certificate of Designation of Series B 10% Cumulative Convertible Preferred Stock. |

| |

|

| 99.1 |

CytoSorbents Corporation Press Release, dated October 14, 2014. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: October 14, 2014 |

CYTOSORBENTS CORPORATION |

| |

|

|

| |

By: |

/s/ Dr. Phillip P. Chan |

| |

Name: |

Dr. Phillip P. Chan |

| |

Title: |

President and

Chief Executive Officer |

Exhibit 3.1

CERTIFICATE OF AMENDMENT

TO THE CERTIFICATE OF DESIGNATION OF

SERIES A 10% CUMULATIVE CONVERTIBLE PREFERRED STOCK, $0.001 PAR VALUE PER SHARE

OF CYTOSORBENTS CORPORATION

CytoSorbents Corporation,

a corporation organized and existing under the laws of the State of Nevada (the “Corporation”), hereby

certifies as follows:

1. The amendment to the Certificate

of Designation of Series A 10% Cumulative Convertible Preferred Stock, $0.001 Par Value Per Share of the Company, as amended, set

forth in the following resolutions has been approved by the Corporation’s Board of Directors, was duly adopted by the required

stockholders of the Corporation and was duly adopted in accordance with the provisions of Section 78.390 of the Nevada Revised

Statutes.

2. Paragraph

4 of the Corporation’s Certificate of Designation is hereby amended and restated to read in its entirety as follows:

4. Conversion into

Common Stock. Holders of shares of Series A Preferred Stock shall have the following conversion rights and obligations:

(a) Subject to the further provisions

of this paragraph 4 each Holder of shares of Series A Preferred Stock shall have the right at any time commencing after the issuance

to the Holder of Series A Preferred Stock, to convert such shares (including any accrued and unpaid dividends on such shares whether

or not declared), and any other sum owed by the Corporation arising from the Series A Preferred Stock or pursuant to a Subscription

Agreement entered into by the Corporation and the Holder or Holder’s predecessor in connection with the issuance of Series

A Preferred Stock (each a “Subscription Agreement”) (collectively “Obligation Amount”) into fully paid

and non-assessable shares of Common Stock of the Corporation determined in accordance with the applicable “Conversion Price”

provided in paragraph 4(c) below (the “Conversion Price”). All issued or accrued but unpaid dividends may be converted

at the election of the Holder simultaneously with the conversion of principal amount of Series A Stated Value being converted.

(b) Subject to the further provisions

of this paragraph 4, upon the vote or written consent of the holders of at least eighty percent (80%) of the then outstanding shares

of Series A Preferred Stock, then all issued and outstanding shares of Series A Preferred Stock shall automatically be converted

into fully paid and non-assessable shares of Common Stock of the Corporation determined in accordance with the applicable “Conversion

Price” provided in paragraph 4(c) below. All issued or accrued but unpaid dividends shall be converted simultaneously with

the conversion of principal amount of Series A Stated Value being converted.

(c) The number of shares of Common

Stock issuable upon conversion of the Obligation Amount shall equal (i) the sum of (A) the Series A Stated Value per share being

converted, and (B) at the Holder’s election, accrued and unpaid dividends on such share, divided by (ii) the Conversion Price.

The Conversion Price of the Series A Preferred Stock shall be $0.77 (x) except with respect to the shares of Series A Preferred

Stock covered by that certain Agreement and Consent dated as of June 25, 2008 by and among the Company and certain holders of Series

A Preferred Stock, and (y) subject to adjustment only as described herein.

(d) (i) Holder will give notice of

its decision to exercise its right to convert the Series A Preferred Stock or part thereof in accordance with paragraph 4(a) above

by telecopying an executed and completed Notice of Conversion (a form of which is annexed as Exhibit A to this Certificate of Designation)

to the Corporation via confirmed telecopier transmission. The Holder will not be required to surrender the Series A Preferred Stock

certificate until in each case the Series A Preferred Stock has been fully converted. Each date on which a Notice of Conversion

is telecopied to the Corporation in accordance with the provisions hereof shall be deemed a Conversion Date. The Corporation will

itself or cause the Corporation’s transfer agent to transmit the Corporation’s Common Stock certificates representing

the Common Stock issuable upon conversion of the Series A Preferred Stock to the Holder via express courier for receipt by such

Holder within three (3) business days after receipt by the Corporation of the Notice of Conversion (the “Delivery Date”).

In the event the Common Stock is electronically transferable, then delivery of the Common Stock must be made by electronic transfer

provided request for such electronic transfer has been made by the Holder. A Series A Preferred Stock certificate representing

the balance of the Series A Preferred Stock not so converted will be provided by the Corporation to the Holder if requested by

Holder, provided the Holder has delivered the original Series A Preferred Stock certificate to the Corporation. To the extent that

a Holder elects not to surrender Series A Preferred Stock for reissuance upon partial payment or conversion, the Holder hereby

indemnifies the Corporation against any and all loss or damage attributable to a third-party claim in an amount in excess of the

actual amount of the Series A Stated Value then owned by the Holder.

(ii) If the vote or written consent

of the holders of at least eighty percent (80%) of the then outstanding shares of Series A Preferred Stock is received with respect

to the conversion of all issued and outstanding shares of Series A Preferred Stock, then the date on which the vote or written

consent is received in accordance with the provisions hereof shall be deemed a Conversion Date. The Corporation will cause the

Corporation’s transfer agent to transmit the Corporation’s Common Stock certificates representing the Common Stock

issuable upon conversion of the Series A Preferred Stock to the holders by electronic transfer.

In the case of the exercise of the

conversion rights set forth in Paragraph 4(a), the conversion privilege shall be deemed to have been exercised and the shares of

Common Stock issuable upon such conversion shall be deemed to have been issued upon the date of receipt by the Corporation of the

Notice of Conversion. The person or entity entitled to receive Common Stock issuable upon such conversion shall, on the date such

conversion privilege is deemed to have been exercised and thereafter, be treated for all purposes as the recordholder of such Common

Stock and shall on the same date cease to be treated for any purpose as the record Holder of such shares of Series A Preferred

Stock so converted.

Upon the conversion of any shares of

Series A Preferred Stock no adjustment or payment shall be made with respect to such converted shares on account of any dividend

on the Common Stock, except that the Holder of such converted shares shall be entitled to be paid any dividends declared on shares

of Common Stock after conversion thereof.

The Corporation shall not be required,

in connection with any conversion of Series A Preferred Stock, and payment of dividends on Series A Preferred Stock to issue a

fraction of a share of its Series A Preferred Stock or Common Stock and may instead deliver a stock certificate representing the

next whole number.

The Corporation and Holder may not

convert that amount of the Obligation Amount on a Conversion Date in amounts that would result in the Holder having a beneficial

ownership of Common Stock which would be in excess of the sum of (i) the number of shares of Common Stock beneficially owned by

the Holder and its affiliates on such Conversion Date, and (ii) the number of shares of Common Stock issuable upon the conversion

of the Obligation Amount with respect to which the determination of this proviso is being made on such Conversion Date, which would

result in beneficial ownership by the Holder and its affiliates of more than 4.99% of the outstanding shares of Common Stock of

the Corporation. For the purposes of the proviso to the immediately preceding sentence, beneficial ownership shall be determined

in accordance with Section 13(d) of the Securities Exchange Act of 1934, as amended, and Regulation 13d-3 thereunder. Subject to

the foregoing, the Holder shall not be limited to successive exercises which would result in the aggregate issuance of more than

4.99%. The Holder may revoke the conversion limitation described in this Paragraph, in whole or in part, upon 61 days prior notice

to the Corporation. The Holder may allocate which of the equity of the Corporation deemed beneficially owned by the Holder shall

be included in the 4.99% amount described above and which shall be allocated to the excess above 4.99%. The Holder may waive the

conversion limitation described in this Section in whole or in part, upon and effective after 61 days prior written notice to the

Company to increase such percentage to up to 9.99%.

(e) The Conversion Price determined

pursuant to Paragraph 4(c) shall be subject to adjustment from time to time as follows:

(i) In case the Corporation

shall at any time (A) declare any dividend or distribution on its Common Stock or other securities of the Corporation other than

on the Series A Preferred Stock or Series B Preferred Stock, (B) split or subdivide the outstanding Common Stock, (C) combine the

outstanding Common Stock into a smaller number of shares, or (D) issue by reclassification of its Common Stock any shares or other

securities of the Corporation, then in each such event the Conversion Price shall be adjusted proportionately so that the Holders

of Series A Preferred Stock shall be entitled to receive the kind and number of shares or other securities of the Corporation which

such Holders would have owned or have been entitled to receive after the happening of any of the events described above had such

shares of Series A Preferred Stock been converted immediately prior to the happening of such event (or any record date with respect

thereto). Such adjustment shall be made whenever any of the events listed above shall occur. An adjustment made to the Conversion

Price pursuant to this paragraph 4(e)(i) shall become effective immediately after the effective date of the event.

(f) (1) In case of any merger of the

Corporation with or into any other corporation (other than a merger in which the Corporation is the surviving or continuing corporation

and which does not result in any reclassification, conversion, or change of the outstanding shares of Common Stock) then unless

the right to convert shares of Series A Preferred Stock shall have terminated as part of such merger, lawful provision shall be

made so that Holders of Series A Preferred Stock shall thereafter have the right to convert each share of Series A Preferred Stock

into the kind and amount of shares of stock and/or other securities or property receivable upon such merger by a Holder of the

number of shares of Common Stock into which such shares of Series A Preferred Stock might have been converted immediately prior

to such consolidation or merger. Such provision shall also provide for adjustments which shall be as nearly equivalent as may be

practicable to the adjustments provided for in sub-paragraph (e) of this paragraph 4. The foregoing provisions of this paragraph

4(f) shall similarly apply to successive mergers.

(i) In case of any sale or

conveyance to another person or entity of the property of the Corporation as an entirety, or substantially as an entirety, in connection

with which shares or other securities or cash or other property shall be issuable, distributable, payable, or deliverable for outstanding

shares of Common Stock, then, unless the right to convert such shares shall have terminated, lawful provision shall be made so

that the Holders of Series A Preferred Stock shall thereafter have the right to convert each share of the Series A Preferred Stock

into the kind and amount of shares of stock or other securities or property that shall be issuable, distributable, payable, or

deliverable upon such sale or conveyance with respect to each share of Common Stock immediately prior to such conveyance.

(g) Whenever the number of shares to

be issued upon conversion of the Series A Preferred Stock is required to be adjusted as provided in this paragraph 4, the Corporation

shall forthwith compute the adjusted number of shares to be so issued and prepare a certificate setting forth such adjusted conversion

amount and the facts upon which such adjustment is based, and such certificate shall forthwith be filed with the Transfer Agent

for the Series A Preferred Stock and the Common Stock; and the Corporation shall mail to each Holder of record of Series A Preferred

Stock notice of such adjusted conversion price not later than the first business day after the event, giving rise to the adjustment.

(h) In case at any time the Corporation

shall propose:

(i) to pay any dividend or

distribution payable in shares upon its Common Stock or make any distribution (other than cash dividends) to the Holders of its

Common Stock; or

(ii) to offer for subscription

to the Holders of its Common Stock any additional shares of any class or any other rights; or

(iii) any capital reorganization

or reclassification of its shares or the merger of the Corporation with another corporation (other than a merger in which the Corporation

is the surviving or continuing corporation and which does not result in any reclassification, conversion, or change of the outstanding

shares of Common Stock); or

(iv) the voluntary dissolution,

liquidation or winding-up of the Corporation;

then, and in any one or more of said

cases, the Corporation shall cause at least fifteen (15) days prior notice of the date on which (A) the books of the Corporation

shall close or a record be taken for such stock dividend, distribution, or subscription rights, or (B) such capital reorganization,

reclassification, merger, dissolution, liquidation or winding-up shall take place, as the case may be, to be mailed to the Holders

of record of the Series A Preferred Stock.

(i) Following the effectiveness of

the reverse stock split and/or increase in authorized capital required by Section 9(f) of the Subscription Agreement entered into

by the Corporation with the purchasers of the Series B Preferred Stock, and in no event later than 180 days following the Initial

Closing Date, so long as any shares of Series A Preferred Stock or any Obligation Amount shall remain outstanding and the Holders

thereof shall have the right to convert the same in accordance with provisions of this paragraph 4 the Corporation shall at all

times reserve from the authorized and unissued shares of its Common Stock 175% of the number of shares of Common Stock that would

be necessary to allow the conversion of the entire Obligation Amount.

(j) The term “Common Stock”

as used in this Certificate of Designation shall mean the $.001 par value Common Stock of the Corporation as such stock is constituted

at the date of issuance thereof or as it may from time to time be changed, or shares of stock of any class or other securities

and/or property into which the shares of the Series A Preferred Stock shall at any time become convertible pursuant to the provisions

of this paragraph 4.

(k) The Corporation shall pay the amount

of any and all issue taxes (but not income taxes) which may be imposed in respect of any issue or delivery of stock upon the conversion

of any shares of Series A Preferred Stock, but all transfer taxes and income taxes that may be payable in respect of any change

of ownership of Series A Preferred Stock or any rights represented thereby or of stock receivable upon conversion thereof shall

be paid by the person or persons surrendering such stock for conversion.

(l) In the event a Holder shall elect

to convert any shares of Series A Preferred Stock as provided herein, the Corporation may not refuse conversion based on any claim

that such Holder or anyone associated or affiliated with such Holder has been engaged in any violation of law, or for any other

reason unless, an injunction from a court, on notice, restraining and or enjoining conversion of all or part of said shares of

Series A Preferred Stock shall have been sought and obtained by the Corporation or at the Corporation’s request or with the

Corporation’s assistance and the Corporation posts a surety bond for the benefit of such Holder equal to 120% of the Obligation

Amount sought to be converted, which is subject to the injunction, which bond shall remain in effect until the completion of arbitration/litigation

of the dispute and the proceeds of which shall be payable to such Holder in the event it obtains judgment.

(m) In addition to any other rights

available to the Holder, if the Corporation fails to deliver to the Holder such certificate or certificates pursuant to Section

4(d) by the Delivery Date and if within seven (7) business days after the Delivery Date the Holder purchases (in an open market

transaction or otherwise) shares of Common Stock to deliver in satisfaction of a sale by such Holder of the Common Stock which

the Holder anticipated receiving upon such conversion (a “Buy-In”), then the Corporation shall pay in cash to the Holder

(in addition to any remedies available to or elected by the Holder) within five (5) business days after written notice from the

Holder, the amount by which (A) the Holder’s total purchase price (including brokerage commissions, if any) for the shares

of Common Stock so purchased exceeds (B) the aggregate Stated Value of the shares of Series A Preferred Stock for which such conversion

was not timely honored, together with interest thereon at a rate of 15% per annum, accruing until such amount and any accrued interest

thereon is paid in full (which amount shall be paid as liquidated damages and not as a penalty). The Holder shall provide the Corporation

written notice indicating the amounts payable to the Holder in respect of the Buy-In.

(n) The Corporation understands that

a delay in the delivery of Common Stock upon conversion of Series A Preferred Stock in the form required pursuant to this Certificate

of Designation and the applicable Subscription Agreement after the Delivery Date could result in economic loss to the Holder. As

compensation to the Holder for such loss, the Corporation agrees to pay (as liquidated damages and not as a penalty) to the Holder

for such late issuance of Common Stock upon Conversion of the Series A Preferred Stock in the amount of $100 per business day after

the Delivery Date for each $10,000 of Obligation Amount being converted of the corresponding Common stock which is not timely delivered.

The Corporation shall pay any payments incurred under this Section in immediately available funds upon demand. Furthermore, in

addition to any other remedies which may be available to the Holder, in the event that the Corporation fails for any reason to

effect delivery of the Common Stock by the Delivery Date, the Holder will be entitled to revoke all or part of the relevant Notice

of Conversion or rescind all by delivery of a notice to such effect to the Corporation whereupon the Corporation and the Holder

shall each be restored to their respective positions immediately prior to the delivery of such notice, except that the liquidated

damages described above shall be payable through the date notice of revocation is given to the Corporation.

3. That

in lieu of a meeting and vote of stockholders, the stockholders have given consent to said amendment in accordance with the provisions

of Section 78.320 of the Nevada Revised Statutes.

[Signature Page Follows]

IN WITNESS WHEREOF,

CytoSorbents Corporation has caused this Certificate of Amendment to be signed and attested by its duly authorized officer on this

9th day of October, 2014.

| |

CYTOSORBENTS CORPORATION |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Dr. Phillip Chan |

|

| |

|

Dr. Phillip

Chan |

|

| |

|

President

and Chief Executive Officer |

|

| [Signature

Page of Certificate of Amendment to Certificate of Designation of Series A 10% Cumulative

Convertible Preferred Stock] |

Exhibit 3.2

CERTIFICATE OF AMENDMENT

TO THE CERTIFICATE OF DESIGNATION OF

SERIES B 10% CUMULATIVE CONVERTIBLE PREFERRED STOCK, $0.001 PAR VALUE PER SHARE

OF CYTOSORBENTS CORPORATION

CytoSorbents Corporation,

a corporation organized and existing under the laws of the State of Nevada (the “Corporation”), hereby

certifies as follows:

1. The amendment to the Certificate

of Designation of Series B 10% Cumulative Convertible Preferred Stock, $0.001 Par Value Per Share of the Company set forth in the

following resolutions has been approved by the Corporation’s Board of Directors, was duly adopted by the required stockholders

of the Corporation and was duly adopted in accordance with the provisions of Section 78.390 of the Nevada Revised Statutes.

2. Paragraph

4 of the Corporation’s Certificate of Designation is hereby amended and restated to read in its entirety as follows:

4. Conversion into

Common Stock. Holders of shares of Series B Preferred Stock shall have the following conversion rights and obligations:

(a) Subject to the further provisions of this paragraph 4:

(i) At any time commencing after the issuance of Series B Preferred Stock

to the Holder, each Holder of Series B Preferred Stock shall have the right to convert such shares (including any accrued and unpaid

dividends on such shares whether or not declared if such conversion occurs prior to the third (3rd) anniversary of the Initial

Closing Date), and any other sum owed by the Corporation arising from the Series B Preferred Stock or pursuant to the Subscription

Agreement entered into by the Corporation and the Holder or Holder’s predecessor in connection with the issuance of Series

B Preferred Stock (each a “Subscription Agreement”) (collectively “Obligation Amount”) into fully paid

and non-assessable shares of Common Stock of the Corporation determined in accordance with the applicable “Conversion Price”

provided in paragraph 4(b) below (the “Conversion Price”). All issued or accrued but unpaid dividends may be converted

at the election of the Holder simultaneously with the conversion of principal amount of Series B Stated Value, as the case may

be, being converted. Following the third (3rd) anniversary of the Initial Closing Date, and with the written consent of NJTC (if

it is then a Holder of at least 25% of the shares of Series B Preferred Stock purchased by it on the Initial Closing Date), Holders,

at their election, may receive payment of such dividends in cash upon conversion under this Paragraph 4(a).

(ii) At any time commencing after the issuance to the Holder Series B Preferred

Stock, upon the election of the Holders of a majority of the then-outstanding shares of Series B Preferred Stock, including NJTC,

each issued and outstanding share of Series B Preferred Stock and any other Obligation Amount (including all accrued but unpaid

dividends) shall automatically convert into fully paid and non-assessable shares of Common Stock of the Corporation determined

in accordance with the applicable Conversion Price.

(b) The number of shares of Common Stock issuable upon conversion of the

Obligation Amount shall equal (i) the sum of (A) the Series B Stated Value per share being converted, and (B) at the Holder’s

election, accrued and unpaid dividends on such share, divided by (ii) the Conversion Price. The Conversion Price of the Series

B Preferred Stock shall initially be $.035 and shall be increased to $.0375 in the event that within the 60-day period following

the Initial Closing Date, the Corporation, at one or more additional closings, issues additional shares of Series B Preferred Stock

so that the aggregate gross proceeds raised by the Corporation on the Initial Closing Date and at such additional closings (including

the principal amount of outstanding debt of the Corporation converted into Series B Preferred Stock) is $4,685,000 or more. The

Conversion Price shall also be subject to adjustment as described below.

(c) (i) In the event Holder elects to convert the Series B Preferred Stock

in accordance with Paragraph 4(a)(i) hereof, Holder will give notice of its decision to exercise its right to convert the Series

B Preferred Stock, or part thereof by telecopying an executed and completed Notice of Conversion (a form of which is annexed as

Exhibit A to this Certificate of Designation) to the Corporation via confirmed telecopier transmission. The Holder will not be

required to surrender the Series B Preferred Stock certificate until in each case the Series B Preferred Stock has been fully converted.

Each date on which a Notice of Conversion is telecopied to the Corporation in accordance with the provisions hereof shall be deemed

a Conversion Date. The Corporation will itself or cause the Corporation’s transfer agent to transmit the Corporation’s

Common Stock certificates representing the Common Stock issuable upon conversion of the Series B Preferred Stock to the Holder

via express courier for receipt by such Holder within three (3) business days after receipt by the Corporation of the Notice of

Conversion (the “Delivery Date”). In the event the Common Stock is electronically transferable, then delivery of the

Common Stock must be made by electronic transfer provided request for such electronic transfer has been made by the Holder. A Series

B Preferred Stock certificate representing the balance of the Series B Preferred Stock not so converted will be provided by the

Corporation to the Holder if requested by Holder, provided the Holder has delivered the original Series B Preferred Stock certificate

to the Corporation. To the extent that a Holder elects not to surrender Series B Preferred Stock for reissuance upon partial payment

or conversion, the Holder hereby indemnifies the Corporation against any and all loss or damage attributable to a third-party claim

in an amount in excess of the actual amount of the Series B Stated Value then owned by the Holder.

(ii) In the event the Series B Preferred Stock held by the Holder is automatically

converted in accordance with Paragraph 4(a)(ii) hereof, then the date on which the vote or written consent is received in accordance

with the provisions hereof shall be deemed a Conversion Date. The Corporation will cause the Corporation’s transfer agent

to transmit the Corporation’s Common Stock certificates representing the Common Stock issuable upon conversion of the Series

B Preferred Stock to the holders by electronic transfer.

In

the case of the exercise of the conversion rights set forth in paragraph 4(a) the conversion privilege shall be deemed to have

been exercised and the shares of Common Stock issuable upon such conversion shall be deemed to have been issued upon the date of

receipt by the Corporation of the Notice of Conversion. The person or entity entitled to receive Common Stock issuable upon such

conversion shall, on the date such conversion privilege is deemed to have been exercised and thereafter, be treated for all purposes

as the recordholder of such Common Stock and shall on the same date cease to be treated for any purpose as the record Holder of

such shares of Series B Preferred Stock so converted.

Upon

the conversion of any shares of Series B Preferred Stock no adjustment or payment shall be made with respect to such converted

shares on account of any dividend on the Common Stock, except that the Holder of such converted shares shall be entitled to be

paid any dividends declared on shares of Common Stock after conversion thereof.

The

Corporation shall not be required, in connection with any conversion of Series B Preferred Stock, and payment of dividends on Series

B Preferred Stock to issue a fraction of a share of its Series B Preferred Stock or Common Stock and may instead deliver a stock

certificate representing the next whole number.

The

Corporation and Holder may not convert that amount of the Obligation Amount on a Conversion Date in amounts that would result in

the Holder having a beneficial ownership of Common Stock which would be in excess of the sum of (i) the number of shares of Common

Stock beneficially owned by the Holder and its affiliates on such Conversion Date, and (ii) the number of shares of Common Stock

issuable upon the conversion of the Obligation Amount with respect to which the determination of this proviso is being made on

such Conversion Date, which would result in beneficial ownership by the Holder and its affiliates of more than 4.99% of the outstanding

shares of Common Stock of the Corporation. For the purposes of the proviso to the immediately preceding sentence, beneficial ownership

shall be determined in accordance with Section 13(d) of the Securities Exchange Act of 1934, as amended, and Regulation 13d-3 thereunder.

Subject to the foregoing, the Holder shall not be limited to successive exercises which would result in the aggregate issuance

of more than 4.99%. The Holder may revoke the conversion limitation described in this Paragraph, in whole or in part, upon 61 days

prior notice to the Corporation. The Holder may allocate which of the equity of the Corporation deemed beneficially owned by the

Holder shall be included in the 4.99% amount described above and which shall be allocated to the excess above 4.99%. The Holder

may waive the conversion limitation described in this Section in whole or in part, upon and effective after 61 days prior written

notice to the Company to increase such percentage to up to 9.99%.

(d) The Conversion Price determined pursuant to Paragraph 4(b) shall be subject

to adjustment from time to time as follows:

(i) In case the Corporation shall at any time (A) declare any dividend or

distribution on its Common Stock or other securities of the Corporation other than the Series A Preferred Stock and Series B Preferred

Stock, (B) split or subdivide the outstanding Common Stock, (C) combine the outstanding Common Stock into a smaller number of shares,

or (D) issue by reclassification of its Common Stock any shares or other securities of the Corporation, then in each such event

the Conversion Price shall be adjusted proportionately so that the Holders of Series B Preferred Stock shall be entitled to receive

the kind and number of shares or other securities of the Corporation which such Holders would have owned or have been entitled

to receive after the happening of any of the events described above had such shares of Series B Preferred Stock been converted

immediately prior to the happening of such event (or any record date with respect thereto). Such adjustment shall be made whenever

any of the events listed above shall occur. An adjustment made to the Conversion Price pursuant to this paragraph 4(d)(i) shall

become effective immediately after the effective date of the event.

(ii) For so long as the Series B Preferred Stock is outstanding, other than

in the case of an “Excepted Issuance” (as defined below), if the Corporation issues shares of Common Stock (or securities

convertible into or exchangeable or exercisable for Common Stock) (“New Issuance”), for a consideration at a price

per share (or having a conversion, exchange or exercise price per share) less than the Conversion Price of the Series B Preferred

Stock immediately in effect prior to such sale or issuance, then immediately prior to such sale or issuance the Conversion Price

of the Series B Preferred Stock shall be reduced to a price (calculated to the nearest hundredth of a cent) determined by multiplying

such prior Conversion Price by a fraction, the numerator of which shall be the number of shares of “Calculated Securities”

(as defined below) outstanding immediately prior to such sale or issuance plus the number of additional securities in respect of

the New Issuance which the aggregate consideration received by the Corporation for the total number of such additional securities

so issued or sold would purchase at such prior Conversion Price, and the denominator of which shall be the number of shares Calculated

Securities outstanding immediately prior to such issue or sale plus the number of such additional securities so issued or sold.

“Calculated Securities” means (i) all shares of Common Stock then outstanding, (ii) all shares of Common Stock issuable

upon conversion of the then outstanding Series A Preferred Stock and Series B Preferred Stock (without giving effect to any adjustments

to the conversion price of any Series of Preferred Stock as a result of such issuance) and (iii) and all shares of Common Stock

issuable upon exercise and/or conversion of outstanding options, warrants or other rights for the purchase of shares of Common

Stock. “Excepted Issuances” shall include the Corporation’s issuance of (i) options to purchase Common Stock

pursuant to stock option plans and employee stock purchase plans, (ii) Common Stock upon exercise of the options referred to in

clause (i), (iii) Common Stock upon the exercise of warrants or other convertible securities outstanding prior to the date hereof,

(iv) securities which results in an adjustment to the Conversion Price under Section 4(d)(i) above, (v) Series A Preferred Stock

or Series B Preferred Stock or any shares of Common Stock on conversion thereof, and (vi) securities as payment of dividends or

liquidated damages in respect of the Series A Preferred Stock or Series B Preferred Stock.

(e) (1) In case of any merger of the Corporation with or into any other corporation

(other than a merger in which the Corporation is the surviving or continuing corporation and which does not result in any reclassification,

conversion, or change of the outstanding shares of Common Stock) then unless the right to convert shares of Series B Preferred

Stock shall have terminated as part of such merger, lawful provision shall be made so that Holders of Series B Preferred Stock

shall thereafter have the right to convert each share of Series B Preferred Stock into the kind and amount of shares of stock and/or

other securities or property receivable upon such merger by a Holder of the number of shares of Common Stock into which such shares

of Series B Preferred Stock might have been converted immediately prior to such consolidation or merger. Such provision shall also

provide for adjustments which shall be as nearly equivalent as may be practicable to the adjustments provided for in sub-paragraph

(d) of this paragraph 4. The foregoing provisions of this paragraph 4(e) shall similarly apply to successive mergers.

(i) In case of any sale or conveyance to another person or entity of the

property of the Corporation as an entirety, or substantially as an entirety, in connection with which shares or other securities

or cash or other property shall be issuable, distributable, payable, or deliverable for outstanding shares of Common Stock, then,

unless the right to convert such shares shall have terminated, lawful provision shall be made so that the Holders of Series B Preferred

Stock shall thereafter have the right to convert each share of the Series B Preferred Stock into the kind and amount of shares

of stock or other securities or property that shall be issuable, distributable, payable, or deliverable upon such sale or conveyance

with respect to each share of Common Stock immediately prior to such conveyance.

(f) Whenever the number of shares to be issued upon conversion of the Series

B Preferred Stock is required to be adjusted as provided in this paragraph 4, the Corporation shall forthwith compute the adjusted

number of shares to be so issued and prepare a certificate setting forth such adjusted conversion amount and the facts upon which

such adjustment is based, and such certificate shall forthwith be filed with the Transfer Agent for the Series B Preferred Stock

and the Common Stock; and the Corporation shall mail to each Holder of record of Series B Preferred Stock notice of such adjusted

conversion price not later than the first business day after the event, giving rise to the adjustment.

(g) In case at any time the Corporation shall propose:

(i) to pay any dividend or distribution payable in shares upon its Common

Stock or make any distribution (other than cash dividends) to the Holders of its Common Stock; or

(ii) to offer for subscription to the Holders of its Common Stock any additional

shares of any class or any other rights; or

(iii) any capital reorganization or reclassification of its shares or the

merger of the Corporation with another corporation (other than a merger in which the Corporation is the surviving or continuing

corporation and which does not result in any reclassification, conversion, or change of the outstanding shares of Common Stock);

or

(iv) the voluntary dissolution, liquidation or winding-up of the Corporation;

then, and in any one or more of said cases, the Corporation shall cause at least fifteen (15) days prior notice of the date on

which (A) the books of the Corporation shall close or a record be taken for such stock dividend, distribution, or subscription

rights, or (B) such capital reorganization, reclassification, merger, dissolution, liquidation or winding-up shall take place,

as the case may be, to be mailed to the Holders of record of the Series B Preferred Stock.

(h) Following the effectiveness of the reverse stock split and/or increase

in authorized capital required by Section 9(F) of the Subscription Agreement, and in no event later than 180 days following the

Initial Closing Date, so long as any shares of Series B Preferred Stock or any Obligation Amount shall remain outstanding and the

Holders thereof shall have the right to convert the same in accordance with provisions of this paragraph 4, the Corporation shall

at all times, reserve from the authorized and unissued shares of its Common Stock 175% of the number of shares of Common Stock

that would be necessary to allow the conversion of the entire Obligation Amount.

(i) The term “Common Stock” as used in this Certificate of Designation

shall mean the $.001 par value Common Stock of the Corporation as such stock is constituted at the date of issuance thereof or

as it may from time to time be changed, or shares of stock of any class or other securities and/or property into which the shares

of the Series B Preferred Stock shall at any time become convertible pursuant to the provisions of this paragraph 4.

(j) The Corporation shall pay the amount of any and all issue taxes (but

not income taxes) which may be imposed in respect of any issue or delivery of stock upon the conversion of any shares of Series

B Preferred Stock, but all transfer taxes and income taxes that may be payable in respect of any change of ownership of Series

B Preferred Stock or any rights represented thereby or of stock receivable upon conversion thereof shall be paid by the person

or persons surrendering such stock for conversion.

(k) In the event a Holder shall elect to convert any shares of Series B Preferred

Stock as provided herein, the Corporation may not refuse conversion based on any claim that such Holder or anyone associated or

affiliated with such Holder has been engaged in any violation of law, or for any other reason unless, an injunction from a court,

on notice, restraining and or enjoining conversion of all or part of said shares of Series B Preferred Stock shall have been sought

and obtained by the Corporation or at the Corporation’s request or with the Corporation’s assistance and the Corporation

posts a surety bond for the benefit of such Holder equal to 120% of the Obligation Amount sought to be converted, which is subject

to the injunction, which bond shall remain in effect until the completion of arbitration/litigation of the dispute and the proceeds

of which shall be payable to such Holder in the event it obtains judgment.

(l) In addition to any other rights available to the Holder, if the Corporation

fails to deliver to the Holder such certificate or certificates pursuant to Section 4(c) by the Delivery Date and if within seven

(7) business days after the Delivery Date the Holder purchases (in an open market transaction or otherwise) shares of Common Stock

to deliver in satisfaction of a sale by such Holder of the Common Stock which the Holder anticipated receiving upon such conversion

(a “Buy-In”), then the Corporation shall pay in cash to the Holder (in addition to any remedies available to or elected

by the Holder) within five (5) business days after written notice from the Holder, the amount by which (A) the Holder’s total

purchase price (including brokerage commissions, if any) for the shares of Common Stock so purchased exceeds (B) the aggregate

Stated Value of the shares of Series B Preferred Stock for which such conversion was not timely honored, together with interest

thereon at a rate of 15% per annum, accruing until such amount and any accrued interest thereon is paid in full (which amount shall

be paid as liquidated damages and not as a penalty). The Holder shall provide the Corporation written notice indicating the amounts

payable to the Holder in respect of the Buy-In.

(m)

The Corporation understands that a delay in the delivery of Common Stock upon conversion of Series B Preferred Stock in the form

required pursuant to this Certificate of Designation and the applicable Subscription Agreement after the Delivery Date could result

in economic loss to the Holder. As compensation to the Holder for such loss, the Corporation agrees to pay (as liquidated damages

and not as a penalty) to the Holder for such late issuance of Common Stock upon Conversion of the Series B Preferred Stock in the

amount of $100 per business day after the Delivery Date for each $10,000 of Obligation Amount being converted of the corresponding

Common stock which is not timely delivered. The Corporation shall pay any payments incurred under this Section in immediately available

funds upon demand. Furthermore, in addition to any other remedies which may be available to the Holder, in the event that the Corporation

fails for any reason to effect delivery of the Common Stock by the Delivery Date, the Holder will be entitled to revoke all or

part of the relevant Notice of Conversion or rescind all by delivery of a notice to such effect to the Corporation whereupon the

Corporation and the Holder shall each be restored to their respective positions immediately prior to the delivery of such notice,

except that the liquidated damages described above shall be payable through the date notice of revocation is given to the Corporation.

3.

That in lieu of a meeting and vote of stockholders, the stockholders have given consent to said amendment in accordance with

the provisions of Section 78.320 of the Nevada Revised Statutes.

[Signature Page Follows]

IN WITNESS WHEREOF,

CytoSorbents Corporation has caused this Certificate of Amendment to be signed and attested by its duly authorized officer on this

9th day of October, 2014.

| |

CYTOSORBENTS CORPORATION |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Dr. Phillip Chan

|

|

| |

|

Dr. Phillip Chan |

|

| |

|

President and Chief Executive Officer |

|

| [Signature

Page of Certificate of Amendment to Certificate of Designation of Series B 10% Cumulative

Convertible Preferred Stock] |

Exhibit 99.1

Preliminary Q3 2014 Report: CytoSorbents

Achieves Its First Quarter of Approximately $1M in CytoSorb® Sales and Provides Up-listing Update

MONMOUTH

JUNCTION, N.J., October 14, 2014 – CytoSorbents Corporation (OTCQB: CTSO), a critical care immunotherapy company commercializing

its European Union approved CytoSorb® blood purification therapy to prevent or treat life-threatening illnesses in the intensive

care unit and in cardiac surgery, provides a preliminary update on Q3 2014 operating and business progress as well as an update

on its planned up-listing efforts.

CytoSorbents Operating Progress:

| · | CytoSorbents expects to report CytoSorb®

product revenue of approximately $1 million for Q3 2014, a first in the Company’s history. This will represent a greater

than 50% increase in CytoSorb® sales over the prior quarter, and a more than 390% increase in sales compared to Q3 2013 |

| · | Trailing twelve month sales of CytoSorb®,

as of Q3 2014, is also expected to increase to approximately $2.6 million with continued momentum expected through the end of this

year |

| · | Preliminary results indicate that sales

of CytoSorb® benefitted from strong usage and re-order rates from most existing territories where CytoSorb® is currently

being sold |

Up-listing Progress/Business Update:

| · | As previously disclosed, CytoSorbents

plans to up-list to a national exchange by the end of this year and is in the process of completing the necessary governance, internal

controls and other documentation and applications needed to achieve this goal |

| · | In connection with the Company’s

planned up-listing, the Company has significantly simplified its capitalization structure with the conversion of all issued and

outstanding Series A Preferred Stock and Series B Preferred Stock into shares of the Company’s Common Stock, effective October

9, 2014 |

| · | CytoSorbents remains committed to achieving

many of the operational milestones discussed in the last earnings conference call, including continued momentum of product sales,

potential strategic partnerships, expansion of distribution, and improved visibility on clinical studies including the filing of

an IDE application for a U.S. cardiac surgery trial in the next several months |

| · | CytoSorbents is now covered by 4 institutional

analysts from Brean Capital, Zacks, Merriman Capital, and H.C. Wainwright |

Dr. Phillip Chan, MD, PhD, Chief Executive

Officer of CytoSorbents stated, “We are very pleased with our preliminary operating performance for Q3 2014. The increase

in sales was across a broad base of both direct customers and distributors. Importantly, we continue to hear positive treatment

successes in many different applications, led by sepsis and cardiac surgery, from many different sources, which we will share in

greater detail in the future. We continue to believe that our therapy may have applications beyond current uses, including the

treatment of Ebola infection, particularly in the terminal phase that is dominated by cytokine storm.”

“In terms of our up-listing plans,

we believe that the up-listing to a national exchange is in the best interest of our Company and shareholders. As we have discussed

before, we believe there are many advantages to up-listing. We believe the most compelling potential benefit is that larger institutional

investors, who collectively command billions of dollars in investment capital but are currently unable to own our stock (due to

restrictions in holding shares of OTCBB companies with shares trading under $1), will have the ability and appetite to purchase

our stock in the open market when we up-list. We expect that this may increase the liquidity and/or demand for our shares, when

coupled with positive news. Other potential advantages include greater credibility and visibility in the investor community and

access to lower cost sources of capital, for example. As we continue to move through this process, we will be reaching out to shareholders

to finalize our plans.”

“Finally, we continue to be committed

to strengthening the science behind our therapy with more vigorous clinical activity. In addition to launching our International

CytoSorb® Registry and announcing our Cardiac Surgery Advisory Board, we continue to add to our clinical development team,

with a European Medical Director who is an intensive care physician to help oversee the more than 40 investigator initiated studies

being planned or enrolling, an in-house Ph.D. statistician, and shortly a Head of Clinical Development in the U.S. We also continue

to be highly visible in the scientific community, currently with sponsorship of the Acute Dialysis

Quality Initiative (ADQI) Conference in Bogotá, Columbia on “Blood Purification in Sepsis”, and

our booth exhibition at the European Association for Cardio-Thoracic Surgery (EACTS) in

Milan, Italy. Importantly, we are very excited about our second annual CytoSorb® Users Meeting that will take place just prior

to the DIVI 2014 conference in Hamburg, Germany (December 3-5, 2014), where users will

again share their clinical treatment experiences with CytoSorb®. Later this month, at the American

Association of Blood Banks (AABB) conference in Philadelphia, Pennsylvania (October 25-28, 2014), we may also hear

results from the Red Cell Storage Duration Study (RECESS trial) administering old blood versus new blood to complex cardiac surgery

patients. If positive, we believe this could be a significant catalyst for our HemoDefend program. We will continue to keep shareholders

informed with important and relevant news as it develops.”

About CytoSorbents Corporation

CytoSorbents Corporation is a critical

care focused immunotherapy company using blood purification to modulate inflammation -- with the goal of preventing or treating

multiple organ failure in life-threatening illnesses. Organ failure is the cause of nearly half of all deaths in the intensive

care unit, with little to improve clinical outcome. CytoSorb®, the Company's flagship product, is approved in the European

Union as a safe and effective extracorporeal cytokine adsorber, designed to reduce the "cytokine storm" that could otherwise

cause massive inflammation, organ failure and death in common critical illnesses such as sepsis, burn injury, trauma, lung injury,

and pancreatitis. These are conditions where the risk of death is extremely high, yet no effective treatments exist. CytoSorb®

is also being used during and after cardiac surgery to try to remove inflammatory mediators, such as cytokines and free hemoglobin,

which can lead to post-operative complications, including multiple organ failure.

CytoSorbents' purification technologies

are based on biocompatible, highly porous polymer beads that can actively remove toxic substances from blood and other bodily

fluids by pore capture and surface adsorption. CytoSorbents has numerous products under development based upon this unique blood

purification technology, protected by 32 issued U.S. patents and multiple applications pending, including HemoDefend™, ContrastSorb,

DrugSorb, and others. Additional information is available for download on the Company's website: http://www.cytosorbents.com/

Forward-Looking

Statements

This

press release includes forward-looking statements intended to qualify for the safe harbor from liability established by the Private

Securities Litigation Reform Act of 1995. Forward-looking statements in this press release are not promises or guarantees and

are subject to risks and uncertainties that could cause our actual results to differ materially from those anticipated or disclosed.

You should be aware that our actual results and our future prospects could differ materially from those contained in the forward-looking

statements, which are based upon management’s current expectations and are subject to a number of risks and uncertainties,

including, but not limited to, our ability to successfully market and sell our CytoSorb product, our dependence upon partners

to successfully distribute our CytoSorb product, our ability to receive and maintain regulatory approval for our products, our

ability to obtain additional financing as needed, technological changes, government and agency regulation, changes in industry

practice, and one-time events, including those discussed herein and in our Annual Report on Form 10-K filed with the SEC on March

31, 2014, which is available at http://www.sec.gov.

We do not intend to update any of these factors or to publicly announce the results of any revisions to these forward-looking

statements.

Please Click to Follow us on Facebook

and Twitter

Company Contact:

CytoSorbents Corporation

Dr. Phillip Chan

Chief Executive Officer

(732) 329-8885 ext. *823

pchan@cytosorbents.com

Investor Contact:

CytoSorbents Corporation

Amy Vogel

(732) 329-8885 ext. *825

avogel@cytosorbents.com

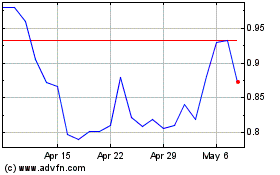

CytoSorbents (NASDAQ:CTSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

CytoSorbents (NASDAQ:CTSO)

Historical Stock Chart

From Apr 2023 to Apr 2024