IDT Corporation Completes Sale of Fabrix Systems

October 08 2014 - 8:30AM

Business Wire

IDT Corporation (NYSE:IDT), a global provider of

telecommunications and payment services, announced today that it

has completed the sale of Fabrix Systems (Fabrix) to Ericsson. The

final sale price for 100% of the shares in Fabrix was $95 million

in cash, excluding transaction costs and working-capital and other

adjustments. IDT owned approximately 78% of Fabrix on a fully

diluted basis.

IDT’s share of the sale price, net of transaction costs, is

expected to be approximately $73 million in cash. IDT and other

shareholders have placed $13.0 million of their proceeds in escrow

to resolve any post-closing claims that may arise. Any unclaimed

escrow balance will be released in two tranches over a period of 18

months.

IDT was advised on the deal by Stifel.

The description of the transaction contained herein is only a

summary and is qualified in its entirety by reference to the

definitive agreement relating to the transaction, a copy of which

has been filed with the SEC as an exhibit to a Current Report on

Form 8-K.

Forward Looking

Statements:

All statements above that are not purely about historical facts,

including, but not limited to, those in which we use the words

“believe,” “anticipate,” “expect,” “plan,” “intend,” “estimate,

“target” and similar expressions, are forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. While these forward-looking statements represent our

current judgment of what may happen in the future, actual results

may differ materially from the results expressed or implied by

these statements due to numerous important factors. Our filings

with the SEC provide detailed information on such statements and

risks, and should be consulted along with this release. To the

extent permitted under applicable law, IDT assumes no obligation to

update any forward-looking statements.

About IDT Corporation:

IDT Corporation (NYSE:IDT), through its IDT Telecom division,

provides retail telecommunications and payment services to help

immigrants and the under-banked to conveniently and inexpensively

communicate and share resources around the world. IDT Telecom’s

wholesale business is a leading global carrier of international

long distance voice calls. IDT also holds a majority interest in

Zedge (www.zedge.net), a mobile content discovery and acquisition

platform, with one of the most popular Apps for Android and iOS.

For more information, visit www.idt.net.

Investor RelationsIDT CorporationBill Ulrey,

973-438-3838invest@idt.net

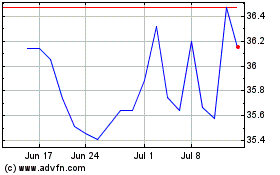

IDT (NYSE:IDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

IDT (NYSE:IDT)

Historical Stock Chart

From Apr 2023 to Apr 2024