SCHEDULE 14C

INFORMATION

Information Statement

Pursuant to Section 14 (c)

of the Securities

Exchange Act of 1934

(Amendment No.

____)

Check the appropriate box:

| o |

|

Preliminary Information Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5 (d)(2)) |

| |

|

|

|

|

|

| x |

|

Definitive Information Statement |

|

|

|

Car Charging

Group, Inc.

(Name of Registrant

as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate

box):

| x |

No fee required. |

| |

|

|

| o |

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11. |

| |

|

|

| |

1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

2) |

Aggregate number of securities to which transaction applies: |

| |

|

|

| |

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

| |

4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

5) |

Total fee paid: |

| |

|

|

| o |

Fee paid previously with preliminary materials. |

| |

|

| o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

1) |

Amount Previously Paid: |

| |

|

|

| |

2) |

Form, Schedule or Registration Statement No: |

| |

|

|

| |

3) |

Filing Party: |

| |

|

|

| |

4) |

Date Filed: |

CAR CHARGING GROUP, INC.

1691 Michigan Avenue, Sixth

Floor

Miami Beach, FL 33139

_________________

NOTICE OF 2014 ANNUAL MEETING

OF THE SHAREHOLDERS

TO BE HELD ON OCTOBER 21, 2014

__________________

Dear Shareholder,

This Information

Statement is being made available to the holders of record of the outstanding common stock, $0.001 per value per share (the “Common

Stock”) and the Series A Convertible Preferred Stock, $0.001 par value per share (the “Series A Preferred Stock”),

of Car Charging Group, Inc., a Nevada corporation (the “Company”), as of the close of business on October 3, 2014,

pursuant to Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). This

Information Statement relates to the Annual Meeting of Shareholders of the Company (the “Annual Meeting”). The

Annual Meeting will be held at the Fountainbleau Hotel, 4441 Collins Avenue, Miami Beach, FL 33140 on Tuesday, October 21, 2014,

at 10:00 a.m. Eastern Time for the following purposes:

| 1. |

To elect 6 director(s) to hold office until the 2017 Annual Meeting of Shareholders; |

| |

|

| 2. |

To ratify the selection of Marcum LLP. as independent auditors for the 2014 fiscal year; and |

| |

|

The Annual Meeting

will include a presentation by management.

This Information

Statement is being furnished to you solely for the purpose of informing you of the matters described herein pursuant to Section

14(c) of the Exchange Act and the regulations promulgated thereunder, including Regulation 14C, and accordance

with Section 78.320 of the Nevada Revised Statutes and the Company’s governing documents.

| |

By Order of the Board of Directors, |

| |

|

| |

|

| |

/s/ MICHAEL D. FARKAS |

| |

|

| |

Michael D. Farkas |

| |

Chief Executive Officer |

October

6, 2014

IMPORTANT NOTICE

REGARDING THE AVAILABILITY OF MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON OCTOBER 21, 2014

This Notice and

Information Statement and our 2014 Annual Report on Form 10-K are available online at www.sec.gov and through our website

http://ir.stockpr.com/carcharging/sec-filings

CAR CHARGING GROUP, INC.

1691 Michigan Avenue, Sixth Floor

Miami Beach, FL 33139

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON OCTOBER 21, 2014

OUTSTANDING SHARES AND VOTING RIGHTS

The Board has

fixed the close of business on October 3, 2014 as the record date (the “Record Date”) for the determination of the

holders of our Common Stock and Series A Preferred Stock entitled to notice of, and to vote at, the Annual Meeting.

At the close of

business on the Record Date, there will be approximately 77,697,633 and 10,000,000 shares of our Common Stock and Series A

Preferred Stock outstanding, respectively.

As of the Record Date, there are 10,000,000

shares of Series A Preferred Stock issued and outstanding. The Series A has five (5) times the number of votes on all matters to

which common shareholders are entitled. The total aggregate number of votes for the outstanding Series A Preferred Stock is 50

million. Michael Farkas, our Chief Executive Officer and Director, is the holder of the 10,000,000 shares of Series A Preferred

Stock, represents a majority of the outstanding voting shares and the number of votes entitled to be cast on the matters to be

considered at the Annual Meeting. Mr. Farkas has advised the Company that he intend to vote “FOR” each of the nominees

for election to the Board and “FOR” the ratification of the appointment of Marcum. Therefore, the Company expects that

each matter to be considered at the Annual Meeting will be approved.

For the transaction

of business at the Annual Meeting a quorum must be present. A quorum consists of a majority of the shares entitled to vote at the

meeting. In the event there are not sufficient votes for a quorum or to approve any proposals at the time of the Annual Meeting,

the meeting may be adjourned to a future time and date. As a result of his holdings, Mr. Farkas constitutes a quorum for the conduct

of the meeting.

GENERAL INFORMATION

This Information

Statement is being posted on our website, http://ir.stockpr.com/carcharging/sec-filings

by our Board to provide our shareholders with material information regarding corporate actions that we have proposed to be approved

at the Annual Meeting.

The Annual Meeting will be held at the

Fountainbleau Hotel, 4441 Collins Avenue, Miami Beach, FL 33140. We intend to mail this Information Statement to shareholders on

or before October 11, 2014.

Our principal executive offices are located

at 1691 Michigan Avenue, Sixth Floor, Miami Beach, FL 33139, and our telephone number is (305) 521-0200.

PLEASE NOTE

THAT THIS IS NOT A REQUEST FOR YOUR VOTE OR A PROXY STATEMENT, BUT RATHER AN INFORMATION STATEMENT DESIGNED TO INFORM YOU OF CORPORATE

ACTIONS TAKEN BY THE MAJORITY SHAREHOLDER.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS, DIRECTORS AND EXECUTIVE OFFICERS

Shown below is certain information as of

October 1, 2014 with respect to beneficial ownership, as that term is defined in Rule 13d-3 under the Exchange Act, of shares of

the Company’s common stock by: (a) the only persons or entities known to us to be beneficial owners of more than five (5%)

percent of the outstanding share of the Company’s common stock, (b) each of our directors and director nominees, (c) our

Named Executive Officers, as identified in the Summary Compensation Table, and (d) all of our directors and our Named Executive

Officers as a group.

For purposes of this table, a person

or group of persons is deemed to have “beneficial ownership” of any shares of common stock that such person has the

right to acquire within 60 days of October 1, 2014. For purposes of computing the percentage of outstanding shares of our common

stock held by each person or group of persons named above, any shares that such person or persons has the right to acquire within

60 days of October 1, 2014 is deemed to be outstanding, but is not deemed to be outstanding for the purpose of computing the percentage

ownership of any other person. The inclusion herein of any shares listed as beneficially owned does not constitute an admission

of beneficial ownership.

| Name and Address of Beneficial Owner | |

Amount and Nature of Beneficial Ownership of Common Stock | | |

Percent

Common Stock (1) | | |

Amount and Nature of Beneficial Ownership of Series A Preferred Stock | | |

Percent of Series A Preferred Stock (2) | |

| 5% Shareholders | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| |

Eventide Gilead Fund

Institutional Trust Custody

7 Easton Oval, EA4E62

Columbus, OH 43219 | |

| 14,285,714 | (3) | |

| 16.838 | % | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

Platinum Partners Value Arbitrage Fund LP (4)

152 West 57th Street

New York, N.Y. 10019 | |

| 5,951,985 | | |

| 7.660 | % | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

Platinum Partners Liquid Opportunity Master Fund, LP (4)

152 West 57th Street, 4th Floor

New York, NY 10019 | |

| 4,063,215 | (5) | |

| 5.100 | % | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

Nathan Low

600 Lexington Avenue, 23rd Floor

New York, NY 10022 | |

| 8,740,552 | (6) | |

| 11.042 | % | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

Wolverine Flagship Fund Trading Limited

Wolverine Asset Management, LLC

175 West Jackson Blvd

Chicago, IL 60604 | |

| 7,000,000 | (7) | |

| 8.728 | % | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

Regal Funds

152 West 57th Street, 9th Floor

New York, NY 10019 | |

| 6,872,708 | (8) | |

| 8.464 | % | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

Allston Limited

Blake Building, Suite 302

Corner of Hutson & Eyre Street

Belize City, Belize | |

| 5,600,000 | (9) | |

| 7.152 | % | |

| - | | |

| - | |

| Name and Address of Beneficial Owner | |

Amount and Nature of Beneficial Ownership of Common Stock | | |

Percent

Common Stock (1) | | |

Amount and Nature of Beneficial Ownership of Series A Preferred Stock | | |

Percent of Series A Preferred Stock (2) | |

| Directors and Executive Officers | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| |

Michael D. Farkas

1691 Michigan Avenue, Suite 601

Miami Beach, FL 33139 | |

| 48,196,829 | (10) | |

| 44.447 | % | |

| 10,000,000 | | |

| 100 | % |

| | |

| | | |

| | | |

| | | |

| | |

Bill Richardson

1691 Michigan Avenue

Suite 601

Miami Beach, FL 33139 | |

| 200,000 | | |

| * | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

Jack Zwick

20950 Civic Center Drive, Suite 418

Southfield, MI 48076 | |

| 75,000 | | |

| * | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

Andy Kinard

1691 Michigan Avenue, Suite 601

Miami Beach, FL 33139 | |

| 10,000 | (11) | |

| * | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

Andrew Shapiro

1691 Michigan Avenue, Suite 601

Miami Beach, FL 33139 | |

| 12,658 | | |

| * | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

Donald Engel

1691 Michigan Avenue, Suite 601

Miami Beach, FL 33139 | |

| 300,000 | (12) | |

| * | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| All directors and officers as a group (5 people) | |

| 48,794,487 | | |

| 44.87 | % | |

| 10,000,000 | | |

| 100 | % |

| (1) |

Based on 77,697,633 shares of common stock issued and outstanding as of October 1, 2014. Shares of common stock subject to options or warrants currently exercisable or exercisable within 60 days are deemed outstanding for purposes of computing the percentage of the person holding such options or warrants, but are not deemed outstanding for purposes of computing the percentage of any other person. |

| |

|

| (2) |

Based on 10,000,000 shares of Series A Preferred Stock issued and outstanding as of October 1, 2014. Each share of Series A Preferred Stock has voting rights five (5) times the number of shares of common stock into which the Series A Preferred Stock are convertible, as designated in the Certificate of Designation for the Series A Convertible Preferred Stock. The total aggregate number of votes for the Series A Preferred Stock is 125 million. |

| |

|

| (3) |

Includes 7,142,857 warrants which are currently exercisable. |

| |

|

| (4) |

The two funds are affiliated and vote their shares in tandem. |

| |

|

| (5) |

Includes 2,000,000 warrants which are currently exercisable. |

| |

|

| (6) |

Includes 3,368,702 shares held by Sunrise Securities Corp., which is 100% owned by Nathan Low; 1,750,000 shares held by NLBDIT Portfolio LLC, a trust held in the name of Nathan Low’s children, of which he is a guardian; 1,200,000 shares held by the Sunrise Charitable Foundation of which Mr. Low has voting authority, 766,000 warrants, which are currently exercisable, held by Sunrise Financial Group, which is 100% owned by Nathan Low; 100,000 warrants, which are currently exercisable, held by Nathan Low and 591,850 warrants in Mr. Low’s Individual Retirement Account. |

| |

|

| (7) |

Includes 2,500,000 warrants which are currently exercisable. |

| |

|

| (8) |

Includes 3,500,000 warrants which are currently exercisable. |

| |

|

| (9) |

Includes 600,000 warrants which are currently exercisable. |

| |

|

| (10) |

Includes 10,000,000 Series A Convertible Preferred shares as if converted into 25,000,000 shares of common stock; 2,598,000 shares of common stock and 5,000 warrants all owned by Mr. Farkas. Additionally included are 250,000 common shares owned by each of Mr. Farkas’ three minor children of which Mr. Farkas has voting authority and serves as custodian; 4,000 shares owned by the Farkas Family Irrevocable Trust of which Mr. Farkas is a beneficiary and 250,000 common shares owned by The Farkas Family Foundation of which Mr. Farkas has voting authority as trustee, and 12,742,494 common shares and 5,733,335 warrants, which are currently exercisable, held by The Farkas Group, Inc. which is wholly-owned by Michael D. Farkas and 1,114,000 common shares, which is owned by the Ze’evi Group Inc.of which Mr. Farkas is a controlling party. |

| |

|

| (11) |

Includes 10,000 warrants, which are currently exercisable, held by Andy Kinard. |

| |

|

| (12) |

Includes an option to purchase 300,000 shares of common stock, which is currently exercisable. |

PROPOSAL ONE

ELECTION OF DIRECTORS

Our Articles of Incorporation provide for

a board of director of not less than one (1) and not more than nine (9) directors, the exact number being determined by our Board.

The number of members of our Board is currently six (6). The directors are elected for a term of three years.

Nominees

Six director(s) are to be elected at the

Annual Meeting for the term ending in 2017. The Board has recommended the nomination of Bill Richardson, Andy Kinard, Michael Farkas,

Jack Zwick, Andrew Shapiro, and Donald Engel as director for the term that will expire at our Annual Meeting of Shareholders to

be held in 2015. The Board has approved this recommendation and nominated Andy Bill Richardson, Andy Kinard, Michael Farkas, Jack

Zwick, Andrew Shapiro, and Donald Engel, who have indicated their willingness to serve.

Vote Required; Recommendation of Board

The candidates receiving the highest number

of affirmative votes cast will be elected as directors. Votes against the directors and votes withheld will have no legal effect.

| Name |

|

Age |

|

Principal Positions With Us |

| Bill Richardson |

|

66 |

|

Chairman of Board of Directors |

| Andy Kinard |

|

49 |

|

President, Director |

| Michael D. Farkas |

|

42 |

|

Chief Executive Officer, Director |

| Jack Zwick |

|

78 |

|

Chief Financial Officer, Director |

| Andrew Shapiro |

|

45 |

|

Director |

| Donald Engel |

|

82 |

|

Director |

Bill Richardson, Chairman of the

Board of Directors

Governor Richardson

has served as Chairman of our Board of Directors since December 14, 2012. Governor Richardson currently serves as Senior

Fellow for Latin America at Rice University’s James A. Baker III Institute for Public Policy, and participates on several

non-profit and for-profit boards including Abengoa’s International Advisory Board, the fifth largest biofuels producer in

the United States, WRI World Resources Institute, and the National Council for Science and the Environment. From January 2003 through

January 2011, he was the Governor of New Mexico. Prior to his governorship, Governor Richardson was the U.S. Secretary of Energy

(1998-2001), U.S. Ambassador to the United Nations (1997-1998) and a member of the U.S House of Representatives for New Mexico

(1983-1997). Governor Richardson has a BA from Tufts University and an MA from Tufts University Fletcher School of Law and Diplomacy.

Based on his experience

in the energy sector, work experience and education, the Company has deemed Governor Richardson fit to serve on the Board.

Andy Kinard,

President, Director

Mr. Kinard has

served as our President and as a Member of our Board of Directors since 2009. Prior to his joining the Company

Mr. Kinard sold electric vehicles in Florida for Foreign Affairs Auto from 2007 to 2009. From 2004 through 2005, he marketed

renewable energy in Florida and was a Guest Speaker at the World Energy Congress. His first employer was Florida Power

& Light (“FPL”) where he worked for 15 years. In his early years, his focus was on engineering. During his tenure,

he performed energy analysis for large commercial accounts, and ultimately became a Certified Energy Manager. Simultaneously,

Mr. Kinard was assigned to FPL’s electric vehicle program. FPL had their own fleet of electric vehicles that they

used to promote the technology. He also served on the Board of Directors of the South Florida Manufacturing Association for 4 years.

He has City, County, and State contacts throughout Florida, and has attended every car show, and green fair in the State. Mr.

Kinard graduated from the Auburn University in 1987 with a degree in Engineering.

Based on his work

experience and education, the Company has deemed Mr. Kinard fit to serve on the Board.

Jack Zwick,

Chief Financial Officer, Director

Mr. Zwick has

served as our Chief Financial Officer and as a Member of our Board of Directors since 2012. Mr. Zwick is a certified public accountant,

and he is a founding member of Zwick & Banyai, PLLC, certified public accountants, where he has worked since its inception

in 1994. He began his career in public accounting in 1958 in Detroit; he worked with local firms in New York and Detroit until

1969 when he joined Laventhol & Horwath. He was promoted to partner at Laventhol & Horwath in 1973 and became the managing

partner of the Detroit office in 1982. He was also an executive director with Grant Thornton (an International CPA firm).

Mr. Zwick holds

a Bachelor of Arts degree in Accountancy and a Masters of Science in Taxation from Wayne State University. He is a member of the

American Institute of Certified Public Accountants; the Michigan Association of Certified Public Accountants; and past Chair of

the City of Southfield Zoning Board of Appeal. He was a member of Wayne State University's Accounting Department Advisory Board.

He was a member of the Board of Directors of Health-Chem Corporation, (a public company). He has served on the Executive Committee

of senior citizens housing projects and their food committees and served on the board of a private school.

Mr. Zwick currently

serves as, and has served in the past five years as a Life Member of the Board of Trustees of the senior citizens housing projects,

the Senior Vice President of finance of Sunrise Sports & Entertainment, LLC the Florida Panthers of the National Hockey League

and was the CFO of American Bio Care, Inc. (a public company). He currently serves as a member of the board of directors and chairman

of the audit committee for First China Pharmaceutical Group, Inc., a public company.

Based on his work

experience, previous directorships and education, the Company has deemed Mr. Zwick fit to serve on the Board.

Michael D.

Farkas, Chief Executive Officer, Director

Mr. Farkas has

served as our Chief Executive Officer and as a Member of our Board of Directors since 2010. Mr. Farkas is the founder

and manager of The Farkas Group, a privately held investment firm. Mr. Farkas also currently holds the position of Chairman and

Chief Executive Officer of the Atlas Group, where its subsidiary, Atlas Capital Services, a broker-dealer, has successfully raised

capital for a number of public and private clients until it withdrew its FINRA registration in 2007. Over the last 20 years, Mr.

Farkas has established a successful track record as a principal investor across a variety of industries, including telecommunications,

technology, aerospace and defense, agriculture, and automotive retail.

Based on his work

experience and education, the Company has deemed Mr. Farkas fit to serve on the Board.

Andrew Shapiro,

Director

Mr. Shapiro founded

and currently leads Broadscale Group, a new model of investment firm working with leading energy corporations to invest in and

commercialize the industry's most promising market-ready innovations. Prior to Broadscale, Mr. Shapiro founded GreenOrder, a strategic

advisory firm that worked with more than 100 enterprises to create energy and environmental innovation as a competitive advantage.

In this capacity, Mr. Shapiro and his team worked with General Electric’s leadership on the creation and execution of its

multi-billion dollar “ecomagination” initiative, provided strategic counsel to General Motors on the launch of the

Chevrolet Volt, and served as the green advisor for 7 World Trade Center, New York City’s first LEED-certified office tower.

GreenOrder’s client list included Alcan, Allianz, Bloomberg, BP, Bunge, Citi, Coca-Cola, Dell, Disney, Duke Energy, DuPont,

eBay, Hines, HP, JPMorganChase, KKR, McDonald’s, Morgan Stanley, NASDAQ OMX, National Grid, NBC Universal, NRG, Office Depot,

Pfizer, Polo Ralph Lauren, Simon Property Group, Staples, Target, Tishman Speyer, TXU, and Waste Management. Mr. Shapiro and GreenOrder

also co-founded the US Partnership for Renewable Energy Finance (US PREF), and created GO Ventures, a subsidiary to incubate and

invest in environmentally innovative businesses, which cofounded and financed California Bioenergy, Class Green Capital, and GreenYour.com. Mr.

Shapiro also led the sale of GreenYour.com to Recyclebank and joined Recyclebank’s Sustainability Advisory Council.

Donald Engel, Director

Mr. Engel served as Managing Director and

consultant at Drexel Burnham Lambert for 15 years. Mr. Engel managed developed new business relationships and represented clients

such as Warner Communications and KKR & Co., L.P. Mr. Engel also served as a consultant to Bear Stearns and as a Director of

such companies as Revlon, Uniroyal Chemical, Levitz, Banner Industries, Savannah Pulp & Paper, and APL Corp. In the last decade,

Mr. Engel consulted to Morgan Joseph TriArtisan.

THE BOARD UNANIMOUSLY RECOMMENDS THAT

THE SHAREHOLDERS VOTE “FOR” THE ELECTION OF BILL RICHARDSON, ANDY KINARD, MICHAEL FARKAS, JACK ZWICK, ANDREW SHAPIRO,

AND DONALD ENGEL

Director Independence

NASDAQ Listing

Rule 5605(a)(2) provides that an “independent director” is a person other than an officer or employee of the Company

or any other individual having a relationship which, in the opinion of the Company’s Board, would interfere with the exercise

of independent judgment in carrying out the responsibilities of a director. The NASDAQ listing rules provide that a director cannot

be considered independent if:

| ● |

the director is, or at any time during the past three years was, an employee of the company; |

| ● |

the director or a family member of the director accepted any compensation from the company in excess of $120,000 during any period of 12 consecutive months within the three years preceding the independence determination (subject to certain exclusions, including, among other things, compensation for board or board committee service); |

| ● |

a family member of the director is, or at any time during the past three years was, an executive officer of the company; |

| ● |

the director or a family member of the director is a partner in, controlling stockholder of, or an executive officer of an entity to which the company made, or from which the company received, payments in the current or any of the past three fiscal years that exceed 5% of the recipient’s consolidated gross revenue for that year or $200,000, whichever is greater (subject to certain exclusions); |

| ● |

the director or a family member of the director is employed as an executive officer of an entity where, at any time during the past three years, any of the executive officers of the company served on the compensation committee of such other entity; or the director or a family member of the director is a current partner of the company’s outside auditor, or at any time during the past three years was a partner or employee of the company’s outside auditor, and who worked on the company’s audit. |

As of October

1, 2014, our Board is composed of six members, of which three directors are independent directors. The three independent directors

are Bill Richardson, Andrew Shapiro, and Donald Engel. We believe that the number of independent directors that make up our

board benefits the Company, as well as our stockholders.

Board Meetings and Committees

The Board held 3 meetings during the fiscal

year ended December 31, 2013 and acted by unanimous written consent on 3 occasions. Each Board member attended at least 33% or

more, and a majority of the Board members attended 100% of the Board meetings held during the fiscal year ended December 31, 2013.

As of the date of this Information Statement, our Board of Directors has no separate committees and our Board of Directors acts

as the audit committee and the compensation committee. We do not have an audit committee financial expert serving on our Board

of Directors.

Communications with the Board

The Board has adopted the following procedure

for shareholders who wish to communicate any concern directly with the Board. Shareholders may mail or deliver their communication

to our principal executive offices, addressed as follows:

Addressee (*)

1691 Michigan Avenue, Suite 601

Miami Beach, Florid 33139

*Addressees: Board of Directors; name of

individual director.

Copies of written communications received

at such address will be forwarded to the addressee as soon as practicable.

Attendance at Annual Meetings

Members of the Board are encouraged to

attend our Annual Meeting; attendance is not mandatory.

Director Compensation

Directors are permitted to receive fixed

fees and other compensation for their services as directors. The Board has the authority to fix the compensation of directors.

Jack Zwick has received 75,000 shares as compensation for his services as a director and interim Chief Financial Officer.

The Company entered into a director agreement

(the “Richardson Agreement”) with Governor Richardson. Pursuant to the Richardson Agreement, Governor Richardson will

fulfill general duties associated with being Chairman of the Board. For every board meeting he attends, Governor Richardson will

receive five-year options to purchase 5,000 shares at an exercise price equal to the then-current market price, which will vest

two years following the grant date, and $1,500, which can be paid in shares at a value of $3,000 at the Company’s discretion.

Additionally, Governor Richardson will receive $100,000 annually for being Chairman of the Board. Upon the execution of the Richardson

Agreement, Governor Richardson received 200,000 shares and five-year options to purchase 10,000 shares at an exercise price of

$1.00, which will vest two years following the grant date.

The Company entered into a director agreement

(the “Fields Agreement”) with Mr. Fields. Every year that he is a member of the Board, Mr. Fields will receive five-year

options to purchase 12,000 shares at an exercise price equal to $0.01 above the closing price on the date of grant, which will

vest two years following the grant date. For every board meeting he attends, Mr. Fields will receive five-year options to purchase

5,000 shares at an exercise price equal to $0.01 above the closing price on the date of grant, which will vest two years following

the grant date, and $1,500, which can be paid in shares at a value of $3,000 at the Company’s discretion. Additionally, should

Mr. Fields become chairman of any Board committee, he will receive $1,500 for every committee meeting attended, which can be paid

in shares at a value of $3,000 at the Company’s discretion. Upon the execution of the Fields Agreement, Mr. Fields received

50,000 shares. On April 17, 2014, the Company’s Board of Directors accepted the resignation letter of Mr. Fields of January

3, 2014 from the Company’s Board of Directors. Upon Mr. Fields’ accepted resignation from the Board, the

Fields Agreement was terminated.

The Company entered into a director agreement

(the “Beck Agreement”) with Mr. Beck. Every year that he is a member of the Board, Mr. Beck will receive five-year

options to purchase 12,000 shares at an exercise price equal to $0.01 above the closing price on the date of grant, which will

vest two years following the grant date. For every board meeting he attends, Mr. Beck will receive five-year options to purchase

5,000 shares at an exercise price equal to $0.01 above the closing price on the date of grant, which will vest two years following

the grant date, and $1,500, which can be paid in shares at a value of $3,000 at the Company’s discretion. Additionally, should

Mr. Beck become chairman of any Board committee, he will receive $1,500 for every committee meeting attended, which can be paid

in shares at a value of $3,000 at the Company’s discretion. Upon the execution of the Beck Agreement, Mr. Beck received 50,000

shares. Upon Mr. Beck’s resignation from the Board on October 10, 2013, the Beck Agreement was terminated.

The Company entered into a director agreement

(the “Shapiro Agreement”) with Mr. Shapiro on April 28, 2014. The Shapiro Agreement has a term of three years, and

Mr. Shapiro shall attend no fewer than four meetings per year. As compensation for his services, Mr. Shapiro shall receive: (i)

annual compensation of $100,000; (ii) an option to purchase 400,000 shares of Common Stock, upon execution of the director agreement

at an exercise price $0.01 above the closing price on the date of execution (the “Membership Option Award”); (iii)

an option to purchase up to 5,000 shares of Common Stock for each Board meeting attended by Mr. Shapiro, at an exercise price $0.01

above the closing price on the date of such a meeting; (iv) $1,500 for each Board meeting attended for Mr. Shapiro; and (v) $1,500

for each committee meeting of the Board of Directors, should Mr. Shapiro become Chairman of such committee. The Membership Option

Award shall vest immediately and expire seven years from the date of issue; all other options issued pursuant to the director agreement

shall have a one year vesting period and expire five years from the date of issue. Pursuant to the director agreement, Mr. Shapiro

has agreed to a six month lock-up period for the disposition of any shares acquired, and, following the expiration of such lock-up

period, shall have the right to sell up to five percent of the total daily trading volume of the Common Stock. The Shapiro Agreement

may be terminated upon 30 days written notice by either party.

The Company and Mr. Engel entered into

a director agreement (the “Engel Agreement”) with Mr. Engel whereby the Company agreed to issue Mr. Engel an option

to purchase 300,000 shares of common stock at an exercise price of $1.00 per share. Additionally, for each Board meeting that Mr.

Engel attends he will receive compensation of: (i) an option to purchase 5,000 shares of common stock at an exercise price of $1.00

per share; and (ii) at the Company’s option, either (a) $1,500 cash or such number of shares of common stock that equal $3,000

as of the date of such Board meeting.

The following table provides information

for 2013 regarding all compensation awarded to, earned by or paid to each person who served as a non-employee director for some

portion or all of 2013. Other than as set forth in the table, to date we have not paid any fees to or, except for reasonable expenses

for attending Board and committee meetings, reimbursed any expenses of our directors, made any equity or non-equity awards to directors,

or paid any other compensation to directors.

| Name | |

Fees Earned or Paid in Cash ($) | | |

Stock

Awards

($) | | |

Option

Awards

($) | | |

Non-Equity

Incentive Plan

Compensation

($) | | |

Nonqualified

Deferred

Compensation

Earnings

($) | | |

All Other

Compensation

($) | | |

Total

($) | |

| (1) Governor Richardson | |

$ | 3,000 | | |

$ | 0 | | |

$ | 11,137 | | |

$ | - | | |

$ | - | | |

$ | 100,000 | | |

$ | 114,137 | |

| (2) William Fields | |

$ | 9,000 | | |

$ | 74,500 | | |

$ | 33,477 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 116,977 | |

| (3) Eckhardt Beck | |

$ | 12,000 | | |

$ | 71,000 | | |

$ | 35,117 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 118,117 | |

| (4) Andrew Shapiro | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | |

| (1) Governor Richardson was appointed as a Director on December 14, 2012. |

|

| (2) Mr. Fields was appointed as a Director on January 11, 2013 and the Board of Directors accepted Mr. Fields’ resignation letter of January 3, 2014 on April 17, 2014. |

|

| (3) Mr. Beck was appointed as a Director on April 3, 2013 and resigned his directorship on October 10, 2013. |

|

| (4) Mr. Shapiro was appointed as a Director on April 17, 2014. |

|

EXECUTIVE OFFICERS

The following table sets forth our executive

officers as of October 6, 2014. Executive officers are appointed by the Board and serve at the discretion of the Board, subject

to their respective employment agreements.

| Name |

|

Age |

|

Principal Positions With Us |

| Andy Kinard |

|

49 |

|

President, Director |

| Michael D. Farkas |

|

42 |

|

Chief Executive Officer, Director |

| Jack Zwick |

|

78 |

|

Chief Financial Officer, Director |

Andy Kinard, President, Director

Mr. Kinard has served as our President

and as a Member of our Board of Directors since 2009. Prior to his joining the Company Mr. Kinard sold electric

vehicles in Florida for Foreign Affairs Auto from 2007 to 2009. From 2004 through 2005, he marketed renewable energy in Florida

and was a Guest Speaker at the World Energy Congress. His first employer was Florida Power & Light (“FPL”)

where he worked for 15 years. In his early years, his focus was on engineering. During his tenure, he performed energy analysis

for large commercial accounts, and ultimately became a Certified Energy Manager. Simultaneously, Mr. Kinard was assigned

to FPL’s electric vehicle program. FPL had their own fleet of electric vehicles that they used to promote the

technology. He also served on the Board of Directors of the South Florida Manufacturing Association for 4 years. He has City, County,

and State contacts throughout Florida, and has attended every car show, and green fair in the State. Mr. Kinard graduated

from the Auburn University in 1987 with a degree in Engineering.

Based on his work experience and education,

the Company has deemed Mr. Kinard fit to serve on the Board.

Michael D. Farkas, Chief Executive

Officer, Director

Mr. Farkas has served as our Chief

Executive Officer and as a Member of our Board of Directors since 2010. Mr. Farkas is the founder and manager of The

Farkas Group, a privately held investment firm. Mr. Farkas also currently holds the position of Chairman and Chief Executive Officer

of the Atlas Group, where its subsidiary, Atlas Capital Services, a broker-dealer, has successfully raised capital for a number

of public and private clients until it withdrew its FINRA registration in 2007. Over the last 20 years, Mr. Farkas has established

a successful track record as a principal investor across a variety of industries, including telecommunications, technology, aerospace

and defense, agriculture, and automotive retail.

Based on his work experience and education,

the Company has deemed Mr. Farkas fit to serve on the Board.

Jack Zwick, Chief Financial Officer,

Director

Mr. Zwick has served as our Chief Financial

Officer and as a Member of our Board of Directors since 2012. Mr. Zwick is a certified public accountant, and he is a founding

member of Zwick & Banyai, PLLC, certified public accountants, where he has worked since its inception in 1994. He began his

career in public accounting in 1958 in Detroit; he worked with local firms in New York and Detroit until 1969 when he joined Laventhol

& Horwath. He was promoted to partner at Laventhol & Horwath in 1973 and became the managing partner of the Detroit office

in 1982. He was also an executive director with Grant Thornton (an International CPA firm).

Mr. Zwick holds a Bachelor of Arts

degree in Accountancy and a Masters of Science in Taxation from Wayne State University. He is a member of the American Institute

of Certified Public Accountants; the Michigan Association of Certified Public Accountants; and past Chair of the City of Southfield

Zoning Board of Appeal. He was a member of Wayne State University's Accounting Department Advisory Board. He was a member of the

Board of Directors of Health-Chem Corporation, (a public company). He has served on the Executive Committee of senior citizens

housing projects and their food committees and served on the board of a private school.

Mr. Zwick currently serves as, and

has served in the past five years as a Life Member of the Board of Trustees of the senior citizens housing projects, the Senior

Vice President of finance of Sunrise Sports & Entertainment, LLC the Florida Panthers of the National Hockey League and was

the CFO of American Bio Care, Inc. (a public company). He currently serves as a member of the board of directors and chairman of

the audit committee for First China Pharmaceutical Group, Inc., a public company.

Based on his work experience, previous

directorships and education, the Company has deemed Mr. Zwick fit to serve on the Board.

Compensation of Executive Officers and Other Matters

Summary Compensation Table

The following summary compensation table sets forth all compensation

awarded to, earned by, or paid to the named executive officer during the years ended December 31, 2013 and 2012 in all capacities

for the accounts of our executive, including the Chief Executive Officer (CEO) and Chief Financial Officer (CFO).

SUMMARY COMPENSATION TABLE

| Name and Principal

Position | |

Year | |

Salary

($) | | |

Bonus

($) | | |

Stock

Awards ($) | | |

Option

Awards ($) | | |

Non-Equity

Incentive Plan Compensation ($) | | |

Non-Qualified

Deferred Compensation Earnings ($) | | |

All

Other Compensation ($) | | |

Totals

($) | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Andy Kinard, | |

2012 | |

$ | 80,740 | | |

$ | 0 | | |

$ | 0 | | |

$ | 431,846 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 512,586 | |

| President | |

2013 | |

$ | 87,250 | | |

$ | 0 | | |

$ | 0 | | |

$ | 9,859 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 97,109 | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Michael D. Farkas, | |

2012 | |

$ | 335,190 | | |

$ | 30,000 | | |

$ | 0 | | |

$ | 1,078,847 | | |

$ | 0 | | |

$ | 0 | | |

$ | 24,800 | | |

$ | 1,468,837 | |

| Chief Executive Officer | |

2013 | |

$ | 435,000 | | |

$ | 15,000 | | |

$ | 0 | | |

$ | 5,634,045 | | |

$ | 0 | | |

$ | 0 | | |

$ | 24,130 | | |

$ | 6,108,175 | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Jack Zwick, | |

2012 | |

$ | 0 | | |

$ | 0 | | |

$ | 146,250 | | |

$ | 431,846 | | |

$ | 0 | | |

$ | 0 | | |

$ | 8,000 | | |

$ | 586,096 | |

| Chief Financial Officer | |

2013 | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 15,000 | | |

$ | 15,000 | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Ted Fagenson, | |

2012 | |

$ | 107,500 | | |

$ | 0 | | |

$ | 0 | | |

$ | 1,688,130 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 1,795,630 | |

| Chief Operating Officer** | |

2013 | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Richard Adeline, | |

2012 | |

$ | 7,599 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 7,599 | |

| Chief Financial Officer, Treasurer* | |

2013 | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Jack Zwick, President | |

2010 | |

$ | 0 | | |

$ | 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

$ | 0 | |

| (2) | |

2011 | |

$ | 0 | | |

$ | 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

$ | 0 | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

Richard Adeline,

Chief

Financial Officer, | |

2010 | |

$ | 61,500 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

$ | 61,500 | |

| Treasurer(3) | |

2011 | |

$ | 71,155.63 | | |

$ | 10,000 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

$ | 81,155.63 | |

* Mr. Adeline is no longer an employee

of the Company as of February 27, 2012.

** Mr. Fagenson is no longer an employee of the

Company as of October 3, 2012.

Compensation

Mr. Farkas received $75,000 in 2013 that was earned in 2012.

Stock Grants

Mr. Zwick was issued 75,000 shares of the Company’s common

stock valued at $146,250 on the date of issuance, in connection with his hiring as the Company’s interim Chief Financial

Officer and Director in 2012.

Option Grants

Messrs. Kinard, Zwick and Farkas were awarded

300,000, 300,000 and 750,000 options respectively under the Company’s 2012 Omnibus Plan and valued on the date of grant at

$431,486, $431,846 and $1,078,847 in accordance with FASB ASC Topic 718 in 2012. In 2013, Mr. Kinard was issued 10,000 options

under the Company’s 2013 Omnibus Plan valued at $9,859 to replace options which had expired in accordance with FASB ASC Topic

718.

No options were exercised during the year ended December 31,

2012 or 2013.

Warrant Grants

Mr. Fagenson was awarded warrants to purchase 1,000,000 shares

of the Company’s common stock, which vested ratably over three years and valued on the date of grant at $1,688,130 in accordance

with FASB ASC Topic 718 in 2012. No warrants were exercised during 2013 and 2012. Mr. Fagensons’s warrants were

forfeited upon his departure from the Company. The Farkas Group, Inc., a company which is owned by our CEO and is a shareholder

of our Company, was awarded warrants to purchase 5,633,335 shares of the Company’s common stock which vest immediately and

valued at $5,634,045 in accordance with FASB ASC Topic 718. The warrants were issued to replace warrants which had expired.

Long-Term Incentive Plan (“LTIP”) Awards Table.

No awards made during the years ended December 2013 or

2012 under any LTIP.

Other Compensation

Mr. Farkas received an auto allowance of $1,500 per month and

health insurance reimbursement of $7,630 and $6,800 for the years ended December 31, 2013 and 2012, respectively.

Mr. Zwick received a monthly stipend of $1,000 per month for

the years ended December 31, 2013 and 2012.

Employment Agreements

The Company entered into an employment

agreement with Michael Farkas, its CEO, on October 15, 2010. The agreement is for three years and stipulates a base salary

of $120,000 in year one, $240,000 in year two and $360,000 in year three. The agreement also included a signing bonus

of $60,000 upon commencement of the agreement. At the Board of Directors meeting of April 17, 2014, the Board resolved to enter

into three year contract with Mr. Farkas, whereby Mr. Farkas will receive a monthly salary of $40,000 with an increase to $50,000

per month in the event the Company becomes listed on NASDAQ or NYSE. All other aspects of his 2010 contract shall remain

the same.

Section 16(a) Beneficial Ownership Reporting

Compliance

The Company does not have a class of securities registered under

the Exchange Act and therefore its directors, executive officers, and any persons holding more than ten percent of the Company’s

common stock are not required to comply with Section 16 of the Exchange Act.

Certain Relationships and Related Transactions

The Company paid commissions to a company

owned by its Chief Executive Officer totaling $38,500 and $77,500 during the years ended December 31, 2013 and 2012 for business

development related to installations of EV charging stations by the Company in accordance with the support services contract.

In February 2013, the Company had borrowed

$2,000 from a shareholder on an unsecured basis with interest at 12% due on demand. The loan was paid in full in eight days with

accrued interest thereon of $5.

On April 29, 2013, the Company issued 2,200,000

warrants to a company that is owned by the Chief Executive Officer of the Company and is a shareholder of the Company to replace

a grant of 2,200,000 warrants which had recently expired. The warrants vest immediately, expire three years from date of issuance

and have an exercise price of $1.31. The fair value of the warrants issued on the date of the grant was estimated at $2,253,119,

which was recognized when issued, using the Black-Scholes valuation model and the following assumptions: (1) expected volatility

of 144% based on historical volatility; (2) a discount rate of 0.32%; (3) expected life of 3 years and (4) zero dividend yield.

The fair value of the warrants was determined based on the closing price on the date of the grant.

On August 26, 2013 the Company issued 3,433,335

warrants to a company that is owned by the Chief Executive Officer of the Company and is a shareholder of the Company to replace

a grant of 3,433,335 warrants which had recently expired. The warrants vest immediately, expire three years from date of issuance

and have an exercise price of $1.29. The fair value of the warrants issued on the date of the grant was estimated at $3,380,926,

which was recognized when issued, using the Black-Scholes valuation model and the following assumptions: (1) expected volatility

of 138% based on historical volatility; (2) an interest rate of 0.79%; (3) expected life of 3 years and (4) zero dividend yield.

The stock price was determined based on the closing price on the date of the grant.

For the year ended December 31, 2013, the

Company issued nine notes to a company which was controlled and now owned by the CEO of the Company that is also a shareholder

totaling $440,000 with interest at 12% per annum and payable on demand for working capital purposes. As of December 31, 2013, the

Company had repaid the shareholder all notes inclusive of accrued interest of $10,117 thereon.

The Company incurred accounting and tax

service fees totaling $61,393 and $68,913 for the years ended December 31, 2013 and 2012 provided by a company that is partially

owned by the Company’s Chief Financial Officer.

On March 29, 2012, the Company entered

into a patent license agreement with a stockholder of the Company and a related party under common ownership. Under terms of the

agreement, the Company has agreed to pay royalties to the licensors equal to 10% of the gross profits received by the Company from

bona fide commercial sales and/or use of the licensed products and licensed processes. As of December 31, 2013, the Company has

not incurred nor paid any royalty fees related to this agreement.

Notes Receivable – Affiliates

None.

PROPOSAL TWO

RATIFICATION OF THE APPOINTMENT OF MARCUM

LLP.

AS INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

The Board has selected, and recommends

the approval of the appointment of, Marcum LLP (“Marcum”) as our independent public accounting firm for the fiscal

year ending December 31, 2014. Representatives of Marcum may be present at the Annual Meeting and, if in attendance, will be given

the opportunity to make a statement, if they desire to do so, and to respond to appropriate questions.

Although the appointment of an independent

public accounting firm is not required to be submitted to a vote of shareholders, the Board recommended that the appointment be

submitted to our shareholders for approval. If our shareholders do not approve the appointment of Marcum, the Board will consider

the appointment of another independent public accounting firm.

Independent Registered Public Accounting

Firm’s Fees

On June 26, 2014, the Board engaged Marcum

LLP as its new independent registered public accounting firm.. Marcum billed us as set forth in the table below for professional

services rendered for the review of our quarterly financial statements included in our quarterly reports on Form 10-Q for the quarterly

period ended June 30, 2014, and for work on other SEC filings and tax service fees.

| Description | |

June 30, 2014 | |

| Audit Fees | |

$ | 125,900 | |

| Tax Service Fees | |

$ | 0 | |

Besides the Audit Fees and Tax Service

fees, there were no additional fees billed by Marcum pursuant to professional services rendered for the review of our financial

statements.

Our Audit Fees and Tax Fees for 2013 and

2012 were $402,500, $0, $114,700, and $0, respectively.

THE BOARD RECOMMENDS THAT SHAREHOLDERS

VOTE “FOR” THE RATIFICATION OF THE SELECTION OF MARCUM LLP. AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR

FISCAL YEAR 2014.

ADDITIONAL INFORMATION

The Company is

subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and in accordance therewith files reports, proxy statements and other information including annual and quarterly reports on Form

10-K and 10-Q (the “1934 Act Filings”) with the Securities and Exchange Commission (the “Commission”).

Reports and other information filed by the Company can be inspected and copied at the public reference facilities maintained at

the Commission at Room 1024, 450 Fifth Street, N.W., Washington, DC 20549. Copies of such material can be obtained upon written

request addressed to the Commission, Public Reference Section, 450 Fifth Street, N.W., Washington, D.C. 20549, at prescribed rates.

The Commission maintains a web site on the Internet (http://www.sec.gov) that contains reports, proxy and information statements

and other information regarding issuers that file electronically with the Commission through the Electronic Data Gathering, Analysis

and Retrieval System (“EDGAR”).

The following

documents as filed with the Commission by the Company are incorporated herein by reference:

| ● | Our Annual Report on Form

10-K for the fiscal year ended December 31, 2013, filed with the SEC on May 5, 2014; |

| ● | Our Quarterly Reports on

Form 10-Q for the fiscal quarters ended March 31, 2014, and June 30, 2014, filed with the SEC on June 6, 2014, and August 22,

2014; |

| ● | Our Current Reports on

Form 8-K filed with the SEC on July 3, 2014 and September 2, 2014. |

SHAREHOLDERS SHARING AN ADDRESS

If hard copies of the materials are requested,

we will send only one Information Statement and other corporate mailings to stockholders who share a single address unless we received

contrary instructions from any stockholder at that address. This practice, known as “householding,” is designed to

reduce our printing and postage costs. However, the Company will deliver promptly upon written or oral request a separate copy

of the Information Statement to a stockholder at a shared address to which a single copy of the Information Statement was delivered.

You may make such a written or oral request by (a) sending a written notification stating (i) your name, (ii) your shared address

and (iii) the address to which the Company should direct the additional copy of the Information Statement, to the Company at Car

Charging Group Inc., 1691 Michigan Avenue, Sixth Floor, Miami Beach, FL 33139, telephone (305)521-0200.

If multiple stockholders sharing an address have received one copy of this Information Statement or any

other corporate mailing and would prefer the Company to mail each stockholder a separate copy of future mailings, you may send

notification to or call the Company’s principal executive offices. Additionally, if current stockholders with a shared address

received multiple copies of this Information Statement or other corporate mailings and would prefer the Company to mail one copy

of future mailings to stockholders at the shared address, notification of such request may also be made by mail or telephone to

the Company’s principal executive offices.

OTHER MATTERS

The Board knows of no other matters that

will be prepared for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting,

the persons named in the accompanying proxy intend to vote on those matters in accordance with their best judgment.

| |

By Order of the Board of Directors, |

|

| |

|

|

| |

/s/ Michael D. Farkas |

|

| |

|

|

| |

MICHAEL D. FARKAS, Chief Executive Officer |

|

THANK YOU FOR YOUR ATTENTION TO THIS

MATTER.

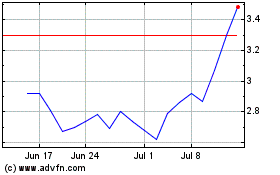

Blink Charging (NASDAQ:BLNK)

Historical Stock Chart

From Mar 2024 to Apr 2024

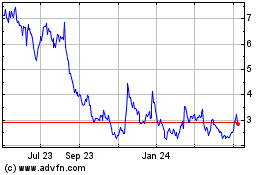

Blink Charging (NASDAQ:BLNK)

Historical Stock Chart

From Apr 2023 to Apr 2024