UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1 /A

(Amendment No. 1)

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

GROWBLOX SCIENCES, INC.

(Exact name of registrant as specified in its charter)

DELAWARE

(State or other jurisdiction of incorporation or organization)

2834

(Primary Standard Industrial Classification Code)

7251 West Lake Mead Blvd, Suite 300

Las Vegas, Nevada 89128

Phone: (844) 843-2569

Fax: (866) 929-5122

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

A Registered Agent, Inc.

1521 Concord Pike #303

Wilmington, DE

Telephone: (302) 288-0670

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of Communications to:

Gary R. Henrie, Esq.

486 W. 1360 N.

American Fork, Utah 84003

Tel: (801) 310-1419

Email: grhlaw@hotmail.com

Approximate date of commencement of proposed sale to public:

From time to time after the effective date of this registration statement.

If any securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. [ ]

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities To Be Registered

|

|

Amount to

be

Registered

|

|

Proposed Maximum

Offering Price

Per Share

|

|

Proposed Maximum

Aggregate

Offering Price

|

|

Amount of

Registration Fee

|

|

Common stock, par value $.001 per share

|

|

29,700,000 shares(1)

|

|

$1.12 (2)

|

|

$33,264,000

|

|

$4,284.40

|

|

(1)

|

Of this amount, 9,000,000 common shares being registered are shares to be offered by Selling Stockholders, 18,000,000 common shares underlie warrants that are held by the Selling Stockholders and 2,700,000 common shares underlie warrants that are held by an entity who acted as a placement agent for the Registrant in a private offering.

|

|

(2)

|

The closing price of the common shares on July 23, 2014.

|

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and the selling stockholders are not soliciting offers to buy these securities in any state where such offers are not permitted.

Subject to completion,

October _____, 2014

PROSPECTUS

29,700,000 Shares

GROWBLOX SCIENCES, INC.

Common Stock

We are registering 9,000,000 shares of common stock of Growblox Sciences, Inc., a Delaware corporation (“Growblox” or the “Company”), held by the selling stockholders. We are also registering 18,000,000 common shares that underlie warrants held by the Selling Stockholders and 2,700,000 common shares that underlie warrants held by an entity who acted as a placement agent for the Registrant in a private offering. The selling stockholders will receive all of the proceeds from the sale of the shares. We will pay all expenses incident to the registration of the shares under the Securities Act of 1933, as amended.

At the present time our common stock is listed on the OTCQB under the symbol GBLX. The Selling Stockholders will sell the shares at prevailing market prices or at privately negotiated prices.

Investing in our common stock involves risks, which are described in the “Risk Factors” section beginning on page 9 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is October _____, 2014.

You should rely only on the information contained in this prospectus. We have not authorized any person to provide you with any information or represent anything not contained in this prospectus, and, if given or made, any such other information or representation should not be relied upon as having been authorized by us. The selling stockholders are not offering to sell, or seeking offers to buy, our common stock in any jurisdiction where the offer or sale is not permitted. You should not assume that the information provided in this prospectus is accurate as of any date other than the date on the front cover of this prospectus.

| |

|

Page

|

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

|

5 |

|

PROSPECTUS SUMMARY

|

|

6 |

|

RISK FACTORS

|

|

9 |

|

USE OF PROCEEDS

|

|

12 |

|

MARKET FOR OUR COMMON STOCK AND RELATED STOCKHOLDER MATTERS

|

|

12 |

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

|

13 |

|

BUSINESS

|

|

19 |

|

MANAGEMENT

|

|

23 |

| EXECUTIVE COMPENSATION |

|

25 |

|

VOTING SECURITIES AND PRINCIPAL HOLDERS

|

|

26 |

|

SELLING STOCKHOLDERS

|

|

27 |

|

PLAN OF DISTRIBUTION

|

|

29 |

|

DESCRIPTION OF CAPITAL STOCK

|

|

31 |

|

LEGAL MATTERS

|

|

31 |

|

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

|

|

31 |

|

EXPERTS

|

|

32 |

|

WHERE YOU CAN FIND MORE INFORMATION

|

|

32 |

|

INDEX TO FINANCIAL STATEMENTS

|

|

33 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

In addition to historical information, this prospectus contains forward-looking statements. The words “forecast”, “eliminate”, “project”, “intend”, “expect”, “should”, “believe” and similar expressions are intended to identify forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors, including those discussed in “Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of Operations,” which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, the following:

|

·

|

Our ability to achieve our business of producing and selling products;

|

|

·

|

The legalization of cannabis production and use in states where it is not currently legal;

|

|

·

|

Our ability to obtain licensing for cannabis production and distribution in the various states;

|

|

·

|

Our ability to produce medical grade cannabis products;

|

|

·

|

Our ability to attract, retain and motivate qualified employees and management.

|

|

·

|

The impact of federal, state or local government regulations;

|

|

·

|

Competition in the cannabis industry;

|

|

·

|

Availability and cost of additional capital;

|

|

·

|

Litigation in connection with our business;

|

|

·

|

Our ability to protect our trademarks, patents and other proprietary rights;

|

|

·

|

Other risks described from time to time in our periodic reports filed with the Securities and Exchange Commission

|

This list of factors that may affect future performance and the accuracy of forward-looking statements are illustrative but not exhaustive. Accordingly, all forward-looking statements should be evaluated with an understanding of their inherent uncertainty.

Except as required by law, we assume no obligation to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

The following summary highlights information contained elsewhere in this prospectus. It is not complete and does not contain all of the information that you should consider before investing in our common stock. You should read the entire prospectus carefully, especially the risks of investing in our common stock discussed under “Risk Factors” and our consolidated financial statements and accompanying notes. Any references to “Growblox”, “we”, “us” or “our” refer to Growblox Sciences, Inc., a Delaware corporation.

Our Business

Growblox’s business pursuit is to pioneer the medical marijuana industry by combining agriculture with biotechnology. The Company’s cultivation technology allows for exact and consistent growth of medical-grade cannabis for direct dispensary sale of the cannabis plant, marijuana. Moreover, their cannabinoid research and extraction process adds a biotech element to manufacture and acquire strains of medical cannabis and cannabis oils to treat patients with specific medical conditions. The Company's proprietary technology will allow for consistent, medical grade cannabis and cannabis products. The Company will also employ state of the art extration techniques and engage in peer reviewed research and development to further enhance its product offerings.

Our mission is to create the trusted brand of technology that empowers patients with access to the benefits of medicinal-grade cannabis, and to become the trusted producer of consistent and efficacious medicinal cannabis strains and product lines. Our focus is to bring to market, cutting-edge technologies to commercially cultivate and produce medical-grade cannabis and cannabis concentrates. These medical-grade products will provide patients with valuable medicines that make a real difference to their quality of life. Please note however that our beliefs in the medical viability of cannabis related products are contrary to the position taken by the United States federal government and various of its agencies that cannabis has no medical benefit.

The Company’s current and short term business plan involves research and development in the growing and processing of cannabis products for medicinal purposes and in obtaining state licenses for the production and sale of cannabis products. These activities are not in violation of Federal Law. The Company’s long term business plan is to operate within the parameters of any state licenses obtained, which activities we believe will violate federal laws as presently constituted. If the Company is successful in obtaining state licenses and operating pursuant to those licenses and if federal law does not change, we believe the Company will be in violation of federal law which will likely have material adverse consequences to our business.

Our Offices

Growblox Sciences, Inc. is a Delaware corporation organized on April 1, 2001. Our principal executive offices are located at 7251 West Lake Mead Blvd., Suite 309, Las Vegas, NV 89128. Our telephone number is (884) 843-2569.

Our Website

Our Internet address is www.growbloxsciences.com. Information contained on our website is not part of this prospectus.

The Offering

Shares of common stock offered by us: None.

Shares of common stock that may be sold by the selling stockholders: 29,700,000.

At the present time our common stock is listed on the OTCQB under the symbol GBLX. The Selling Shareholders will sell the shares at prevailing market prices or at privately negotiated prices.

Use of proceeds:

We will not receive any proceeds from the resale of the shares offered hereby, all of which proceeds will be paid to the selling stockholders.

Risk factors:

The purchase of our common stock involves a high degree of risk. You should carefully review and consider “Risk Factors” beginning on page 8.

We will pay all expenses incident to the registration of the shares under the Securities Act.

Summary Financial Information

The tables and information below are derived from Growblox’s audited financial statements for the years ended March 31, 2014, and March 31, 2013.

|

Balance Sheet Summary

|

|

March 31, 2014

|

|

|

March 31, 2013

|

|

| |

|

(Audited)

|

|

|

(Audited)

|

|

| |

|

|

|

|

|

|

|

Cash

|

|

$ |

339,327 |

|

|

$ |

2,427 |

|

|

Subscription receivable

|

|

|

150,000 |

|

|

|

- |

|

|

Property and equipment, net

|

|

|

44,922 |

|

|

|

128 |

|

|

Total assets

|

|

|

537,984 |

|

|

|

6,618 |

|

|

Total liabilities

|

|

|

1,551,354 |

|

|

|

1,196,307 |

|

|

Total stockholders’ deficiency

|

|

|

(1,013,370 |

) |

|

|

(1,189,689 |

) |

|

Statement of Operations Summary

|

|

Year Ended March 31, 2014

|

|

|

Year Ended March 31, 2013

|

|

| |

|

(Audited)

|

|

|

(Audited)

|

|

| |

|

|

|

|

|

|

|

Revenues

|

|

$ |

0 |

|

|

$ |

0 |

|

|

Gross profit

|

|

|

0 |

|

|

|

0 |

|

|

General and administrative expenses

|

|

|

187,760 |

|

|

|

75,718 |

|

|

Net income/(loss)

|

|

|

(655,955 |

) |

|

|

36,150 |

|

The tables and information below are derived from Growblox’s unaudited financial statements at June 30, 2014 and for the quarters ended June 30, 2014, and June 30, 2013.

|

Balance Sheet Summary

|

|

June 30, 2014

|

|

| |

|

(Unaudited)

|

|

| |

|

|

|

|

Cash

|

|

$ |

3,213,358 |

|

|

Other current assets

|

|

|

20,664 |

|

|

Property and equipment, net

|

|

|

77,696 |

|

|

Total assets

|

|

|

3,311,718 |

|

|

Total liabilities

|

|

|

553,318 |

|

|

Total stockholders’ deficiency

|

|

|

2,695,705 |

|

|

Statement of Operations Summary

|

|

Quarter Ended June 30, 2014

|

|

|

Quarter Ended June 30, 2013

|

|

| |

|

(Unaudited)

|

|

|

(Unaudited)

|

|

| |

|

|

|

|

|

|

|

Revenues

|

|

$ |

- |

|

|

$ |

- |

|

|

Gross profit

|

|

|

- |

|

|

|

- |

|

|

General and administrative expenses

|

|

|

561,900 |

|

|

|

29,487 |

|

|

Net income/(loss)

|

|

|

(1,445,218 |

) |

|

|

(42,204 |

) |

RISK FACTORS

This offering involves a high degree of risk. You should carefully consider the risks and uncertainties described below in addition to the other information contained in this prospectus before deciding whether to invest in shares of our common stock. If any of the following risks actually occur, our business, financial condition or operating results could be harmed. In that case, the trading price of our common stock could decline and you may lose part or all of your investment. In the opinion of management, the risks discussed below represent the material risks known to the company. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also impair our business operations and adversely affect the market price of our common stock.

The success of the Company is dependent upon the services of key personnel.

The current business prospects of the Company are dependent upon the business and technological acumen and services of Mr. Craig Ellins. In the event the Company should lose the services of Mr. Ellins for any reason, it is doubtful the Company could be successful in commercializing its current business plan. The services of Mr. Steven Weldon and Mrs. Andrea Small-Howard are also important to the ongoing success of the Company without whom the business prospects of the Company will suffer.

Federal law prohibits the use of cannabis for the purposes in which the Company expects to engage.

As of the date of this prospectus, the policy and regulations of the Federal government and its agencies are that cannabis has no medical benefit and a range of activities including cultivation and use of cannabis for personal use is prohibited on the basis of federal law and may or may not be permitted on the basis of state law. Active enforcement of the current federal regulatory position on cannabis on a regional or national basis may directly and adversely affect the ability of the Company to develop its business plan even though it is allowed by state regulation in the various states in which the Company intends to operate. The Company’s current and short term business plan involves research and development in the growing and processing of cannabis products for medicinal purposes and in obtaining state licenses for the production and sale of cannabis products. These activities are not in violation of Federal Law. The Company’s long term business plan is to operate within the parameters of any state licenses obtained, which activities we believe will violate federal laws as presently constituted. If the Company is successful in obtaining state licenses and operating pursuant to those licenses and if federal law does not change, we believe the Company will at that time be in violation of federal law. If at that time the federal laws are enforced, it is likely the business will be significantly, adversly affected, as will hundreds of other businesses around the country and investors in this offering will lose their investments.

Our intellectual property may be compromised.

Part of the value of the Company going forward is vested in the intellectual property that the Company is acquiring the rights to at the present time. There may have been many persons involved in the development of the intellectual property, some of which the Company is not successful in obtaining the rights from. It is possible that in the future, claimants to the property rights may come forward that the Company is not aware of at the present time. It is also possible that the Company may not be successful in protecting its property rights. In either event, it is possible that the Company could lose the value of its intellectual property and if so the business prospects of the Company may suffer.

The fact that we have generated operating losses in the past raises doubt about our ability to continue as a going concern.

The Company has a history of generating operating losses. We have in the past covered any shortfall in operating capital from sales of equity and debt securities, but there can be no assurance that we will continue to be able to do so. The unpredictable economy in the United States and the volatile public equity markets may make it more difficult for us to raise capital as and when we need it, and it is difficult for us to assess the impact this might have on our operations or liquidity. If we cannot raise the funds that we require to continue our business operations, there is a substantial risk that our business will fail.

Our common shares are penny stock. Trading of our common shares may be restricted by the SEC’s penny stock regulations and the FINRA’s sales practice requirements, which may limit a shareholder’s ability to buy and sell our common shares.

Our common shares are deemed to be penny stock. The Securities and Exchange Commission has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the common shares that are subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in, and limit the marketability of, our common shares.

In addition to the “penny stock” rules promulgated by the Securities and Exchange Commission, the Financial Industry Regulatory Authority has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, the Financial Industry Regulatory Authority believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. The Financial Industry Regulatory Authority requirements make it more difficult for broker-dealers to recommend that their customers buy our common shares, which may limit your ability to buy and sell our shares.

Clearing Brokers may Decline to Deposit the Shares in the Subscriber’s Account.

Clearing brokers may decline to deposit into Subscriber's account a stock certificate for a security that (1) is a penny stock or (2) has stale or incomplete filings with the U.S. Securities and Exchange Commission (SEC). In addition to these conditions and limitations, the clearing broker may subject The Company's securities to additional review before accepting such securities for deposit. This review process may (1) take up to two weeks or longer, and (2) may include research into the Company or Subscriber. The characteristics that may trigger additional review include (1) low price of the security or securities under review; (2) large number of shares being deposited with clearing broker into Subscriber's account; (3) the securities in question are non-exchange traded; (4) the stock certificates are recently issued; (5) recent merger activity of the underlying company; and/or (6) change of name of the underlying company issuing these stock certificates. Finally, all of the aforementioned conditions, limitations, and characteristics triggering review may apply to Subscriber's Deposit/Withdrawal At Custodian (DWAC) requests, Automated Customer Account Transfer Account Service (ACATS) requests, and Depository Trust Company (DTC) receipts for deposit requests.

We may be unable to attract and retain qualified, experienced, highly skilled personnel, which could adversely affect the implementation of our business plan.

Our success depends to a significant degree upon our ability to attract, retain and motivate skilled and qualified personnel. As we become a more mature company in the future, we may find recruiting and retention efforts more challenging. If we do not succeed in attracting, hiring and integrating excellent personnel, or retaining and motivating existing personnel, we may be unable to grow effectively. The loss of any key employee, including members of our senior management team, and our inability to attract highly skilled personnel with sufficient experience in our industries could harm our business.

Our common stock is quoted on the OTCQB which may have an unfavorable impact on our stock price and liquidity.

Our common stock is quoted on the OTCQB, which is a significantly more limited trading market than the New York Stock Exchange or The NASDAQ Stock Market. The quotation of the Company’s shares on the OTCQB may result in a less liquid market available for existing and potential stockholders to trade shares of our common stock, could depress the trading price of our common stock and could have a long-term adverse impact on our ability to raise capital in the future.

There is limited liquidity on the OTCQB which may result in stock price volatility and inaccurate quote information.

When fewer shares of a security are being traded on the OTCQB, volatility of prices may increase and price movement may outpace the ability to deliver accurate quote information. Due to lower trading volumes in shares of our common stock, there may be a lower likelihood of one’s orders for shares of our common stock being executed, and current prices may differ significantly from the price one was quoted at the time of one’s order entry.

Our common stock is thinly traded, so you may be unable to sell at or near asking prices or at all if you need to sell your shares to raise money or otherwise desire to liquidate your shares.

Currently, the Company’s common stock is quoted in the OTCQB and future trading volume may be limited by the fact that many major institutional investment funds, including mutual funds, as well as individual investors follow a policy of not investing in OTCQB stocks and certain major brokerage firms restrict their brokers from recommending OTCQB stocks because they are considered speculative, volatile and thinly traded. The OTCQB market is an inter-dealer market much less regulated than the major exchanges and our common stock is subject to abuses, volatility and shorting. Thus, there is currently no broadly followed and established trading market for the Company’s common stock. An established trading market may never develop or be maintained. Active trading markets generally result in lower price volatility and more efficient execution of buy and sell orders. Absence of an active trading market reduces the liquidity of the shares traded there.

Our common stock is subject to price volatility unrelated to our operations.

The market price of our common stock could fluctuate substantially due to a variety of factors, including market perception of our ability to achieve our planned growth, quarterly operating results of other companies in the same industry, trading volume in our common stock, changes in general conditions in the economy and the financial markets or other developments affecting the Company’s competitors or the Company itself. In addition, the OTCBB is subject to extreme price and volume fluctuations in general. This volatility has had a significant effect on the market price of securities issued by many companies for reasons unrelated to their operating performance and could have the same effect on our common stock.

The success of our business plan is dependent upon obtaining state licenses to operate in the cannabis industry which we may or may not be successful in obtaining.

We are in the process of directly or indirectly through subsidiaries, applying for state licenses to operate in the cannabis industry. The application process is extremely competitive and we may or may not be successful in obtaining one or more licenses. In the event we are not successful in obtaining the licenses applied for or if the approval of the licenses is significantly delayed, we may not be successful in implementing our business plan.

The Company has warrants outstanding for the purchase of shares of common stock of the Company, the exercise of which may dilute the value of shares held by Company shareholders.

The Company has warrants outstanding that if exercised would lead to the issuance of 20,700,000 shares of common stock of the company. In the event the warrants or any of them are exercised, the stock of the existing stockholders will be diluted.

USE OF PROCEEDS

Shares totaling 29,700,000 offered by this prospectus are being offered solely for the account of the selling stockholders. We will not receive any proceeds from the sale of the shares by the selling stockholders.

MARKET FOR OUR COMMON STOCK AND RELATED STOCKHOLDER MATTERS

Our common stock is quoted on the OTCQB under the symbol "GBLX".

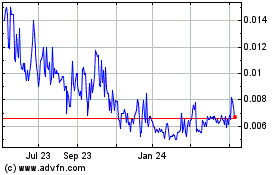

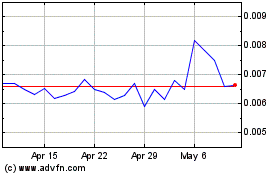

For the periods indicated, the following table sets forth the high and low per share intra-day sales prices per share of common stock. These prices represent inter-dealer quotations without retail markup, markdown, or commission and may not necessarily represent actual transactions.

For the periods indicated, the following table sets forth the high and low per share intra-day sales prices per share of common stock. These prices represent inter-dealer quotations without retail markup, markdown, or commission and may not necessarily represent actual transactions.

|

Fiscal Year 2014

|

High ($)

|

Low ($)

|

| |

|

|

|

Fourth Quarter

|

$8.90

|

$0.40

|

|

Third Quarter

|

$1.00

|

$0.30

|

|

Second Quarter

|

$0.70

|

$0.30

|

|

First Quarter

|

$0.70

|

$0.70

|

| |

|

|

|

Fiscal Year 2013

|

|

|

| |

|

|

|

Fourth Quarter

|

$0.80

|

$0.30

|

|

Third Quarter

|

$2.00

|

$0.03

|

|

Second Quarter

|

$0.70

|

$0.70

|

|

First Quarter

|

$1.80

|

$1.80

|

Dividends and Dividend Policy

We have never declared or paid cash dividends on our common stock and do not anticipate paying any cash dividends on our common stock in the foreseeable future. We currently intend to retain future earnings, if any, to finance the expansion of our business and for general corporate purposes. We cannot assure you that we will pay dividends in the future. Our future dividend policy is within the discretion of our Board of Directors and will depend upon various factors, including our results of operations, financial condition, capital requirements and investment opportunities.

Equity Compensation Plan Information

The 2007 Amended Stock Option Plan was adopted by the Board of Directors on February 6, 2008. Under this plan, a maximum of 8,000,000 shares of our common stock, par value $0.0001, were authorized for issue. The vesting and terms of all of the options are determined by the Board of Directors and may vary by optionee; however, the term may be no longer than 10 years from the date of grant.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

The following discussion of our plan of operation, financial condition and results of operations should be read in conjunction with the Company’s financial statements, and notes thereto, included elsewhere herein. This discussion contains forward-looking statements that involve risks and uncertainties. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of various factors including, but not limited to, those discussed in this prospectus.

Overview

Our company was incorporated in the State of Delaware on April 4, 2001, under the name “Flagstick Venture, Inc.” On March 28, 2008, a majority of our stockholders approved changing our name to Signature Exploration and Production Corp. as our business model had changed to become an independent energy company engaged in the acquisition and development of crude oil and natural gas leases in the United States.

On March 18, 2014, we purchased assets from Craig Ellins, which included the innovative and proprietary GrowBLOX™ cultivation technology. We plan to utilize this technology to commercially cultivate and produce medical grade cannabis for sale in the U.S. states and territories in which it is legal. We also plan to research the medical treatment potential of cannabis and develop treatments from those findings. On April 4, 2014, we officially changed our name to GrowBLOX™ Sciences, Inc. to reflect this new corporate direction

Plan of Operation

Our goal is to be an industry leader in the cultivation of and the research and development of cannabis for medical drugs and treatments. To achieve our goal, we plan on developing methods and products that will improve the cultivation of cannabis and provide consistent medical-grade yields for biopharmaceutical and nutraceutical products.

We estimate that we will require an additional $4,750,000 to fund our currently anticipated requirements for ongoing operations and grow and dispensary facilities for our existing business for the next twelve-month period.

Based upon our cash position, we will need to raise additional capital prior by the end of fiscal 2015 in order to fund current operations. These factors raise substantial doubt about our ability to continue as a going concern. We are pursuing several alternatives to address this situation, including the raising of additional funding through equity or debt financings. We are in discussions with our existing stockholders to provide additional funding in exchange for notes or equity. However, there can be no assurance that the requisite financing will be consummated in the necessary time frame or on terms acceptable to us. Should we be unable to raise sufficient funds, we may be required to curtail our operating plans or possibly cease operations. No assurance can be given that we will be able to operate profitably on a consistent basis, or at all, in the future.

We have created a majority owned limited liability company (55%), GB Sciences Nevada, LLC to obtain licensing for cultivation and distribution of cannabis in the state of Nevada. We have been granted a special use permit by Clark County, NV for a cultivation and dispensary location. Upon state approval, we will set up a cultivation facility and a dispensary in Clark County, Nevada. We are also seeking approval to set up a dispensary in the city of Las Vegas, Nevada. Our co-owner in GB Sciences Nevada, LLC is a Nevada limited liability company named GBS Nevada Partners LLC that owns the other 45%. The Company made an initial contribution of $137,500 for its 55% of GB Sciences Nevada, LLC and GBS Nevada Partners LLC made an initial contribution of $112,500 for its 45%. The Company has agreed to loan GB Sciences Nevada LLC up to $3,750,000 to fund its initial business operations. We plan to use our Nevada operations as a model for establishing business in other U.S. states and territories. At this time, we have created subsidiary companies in New York , Puerto Rico, Florida and New Jersey.

We are finalizing the production and testing of the GrowBLOX™ system. We received the first prototype growing chamber in September , 2014. After testing and revisions are made, an initial round of production will provide containers for the first cultivation facility in Clark County, Nevada in January 2015.

We also plan to set up biopharmaceutical research and development of products using our harvested cannabis. Our initial phase will be the accelerated “virtual pharma” and will include obtaining license patents on promising projects, testing and FDA approval, and co-developing the resulting product for marketing and sale. The next phase will involve setting up a traditional biopharmaceutical research method to allow our company to begin the R&D process in-house and fully own resulting patents and products.

Results of Operations

Comparison of the fiscal year ended March 31, 2014 and March 31, 2013.

FINANCIAL INFORMATION

| |

|

2014

|

|

|

2013

|

|

|

Loss on oil and gas properties

|

|

$ |

- |

|

|

$ |

36,000 |

|

|

General and administrative

|

|

|

166,000 |

|

|

|

76,000 |

|

|

Other income/(expense)

|

|

|

(468,000 |

) |

|

|

148,000 |

|

|

Net income/(loss)

|

|

$ |

( 634,000 |

) |

|

$ |

36,000 |

|

Loss on oil and gas properties. Loss on oil and gas properties increased by $36,000 due to a lease cancelation during 2013.

General and Administrative. General and administrative expenses increased in 2014 due to an increase in professional and consulting fees for obtaining licenses in Nevada.

Other Income/(Expense). Other expenses increased by $616,000 in 2014 due to the change in the fair value of convertible notes and warrants by 57,000 and a loss on loan modifications of $559,000.

Liquidity and Capital Resources relative to year end of March 31, 2014

We had cash balances totaling approximately $339,000 as of March 31, 2014. Historically, our principal source of funds has been cash generated from financing activities. We raised have $5 million in capital in the past three months.

Cash flow from operations. We have been unable to generate either significant liquidity or cash flow to fund our current operations. We anticipate that cash flows from operations will be insufficient to fund our business operations for the next twelve-month period.

Cash flows from investing activities. There was $15,200 and $0.00 cash used in investing activities for the years ended March 31, 2014 and 2013.

Cash flows from financing activities. Net cash provided by financing activities was generated from promissory notes and sale of common stock that total $715,750 and $37,700 for the years ended March 31, 2014 and 2013.

Comparison of the fiscal quarters ended June 30, 2014 and June 30, 2013.

FINANCIAL INFORMATION

| |

|

June 30, 2014

|

|

|

June 30, 2013

|

|

|

Stock Compensation

|

|

$ |

537,300 |

|

|

$ |

- |

|

|

Investor relations

|

|

|

396,000 |

|

|

|

- |

|

|

General and administrative

|

|

|

561,900 |

|

|

|

29,000 |

|

|

Other income/(expense)

|

|

|

200 |

|

|

|

(13,000 |

) |

|

Net income/(loss)

|

|

$ |

1,495,218 |

|

|

$ |

(42,900 |

) |

Stock Compensation. Stock compensation increase due to the issues of shares to employees in accordance with employee contracts.

Investor Relation. The company hire a professional firm to manage it investor and public relations in the May 2014.

General and Administrative. General and administrative expenses increased by 532,900 in 2014 due to an increase in professional and consulting fees relating to our licensing process, the addition of six employees. Travel expenses have also increased due to the licensing process in multiple states.

Other Income/(Expense). Other expenses decreased by $12,800 in 2013 due to a decrease in interest expense.

Liquidity and Capital Resources relative to quarter end of June 30, 2014

We had cash balances totaling approximately $3,200,000 as of June 30, 2013. Historically, our principal source of funds has been cash generated from financing activities.

Cash flow from operations. We have been unable to generate either significant liquidity or cash flow to fund our current operations. We anticipate that cash flows from operations will be insufficient to fund our business operations for the next twelve-month period.

Cash flows from investing activities. There was $29,000 and $0 cash used in investing activities for the three months ended June 30, 2014 and 2013.

Cash flows from financing activities. Net cash provided by financing activities was generated from the sale of equity that total approximately $3,800,000 and $26,000 for the three months ended June 30, 2014 and 2013.

Variables and Trends

We have no operating history with respect to our current business plan. In the event we are able to obtain the necessary financing to move forward with our business plan, we expect our expenses to increase significantly as we grow our business. Accordingly, the comparison of the financial data for the periods presented may not be a meaningful indicator of our future performance and must be considered in light these circumstances.

Critical Accounting Policies

General

The preparation of financial statements requires management to utilize estimates and make judgments that affect the reported amounts of assets, liabilities, revenues and expenses and related disclosure of contingent assets and liabilities. These estimates are based on historical experience and on various other assumptions that management believes to be reasonable under the circumstances. The estimates are evaluated by management on an ongoing basis, and the results of these evaluations form a basis for making decisions about the carrying value of assets and liabilities that are not readily apparent from other sources. Although actual results may differ from these estimates under different assumptions or conditions, management believes that the estimates used in the preparation of our financial statements are reasonable. Policies involving the most significant judgments and estimates are summarized below.

Fair Value of Financial Instruments

The Company holds certain financial liabilities which are measured at fair value on a recurring basis in accordance with ASC Topic 825-10-15. ASC Topic 820-10 establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). ASC Topic 820-10 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. A fair value measurement assumes that the transaction to sell the asset or transfer the liability occurs in the principal market for the asset or liability.

Convertible notes issued with detachable warrants were measured at fair value, in accordance with ASC Topic 825-10-15, as one instrument, and that fair value was allocated to each component. The Company made the fair value election due to this methodology providing a fairer representation of the economic substance of the transaction within the fair value hierarchy. Due to the lack of relevant and market reflective Level 1 and Level 2 inputs, the Company valued the instruments using Level 3 inputs, which require significant judgment and estimates on behalf of management in developing model assumptions. The factors considered in developing those assumptions included; the Company’s inability to attract investment at terms more favorable to the Company, the lack of success in developing oil properties thus far, the continuing reduction in the net assets of the Company and the Company’s history of default on currently outstanding debt.

Based on management’s evaluation of the assumptions discussed above, the liabilities were initially recorded in an amount equal to the transaction price, which represented the fair value of the total liability at initial recognition. The model used by the Company is calibrated so that the model value at initial recognition equals the transaction price. On an ongoing basis the fair value model used in valuing the convertible notes and derivative liability utilizes the following inputs; exercise price per warrant, conversion price per share, contract term, volatility, current stock prices and risk free rates. The following assumptions were made in the model: (1) risk free interest rate of 0.19% to 0.51%, (2) remaining contractual life of 1 to 4.98 years, (3) expected stock price volatility of 697% and (4) expected dividend yield of zero.

Equity-Based Compensation

The computation of the expense associated with stock-based compensation requires the use of a valuation model. The FASB issued accounting guidance requires significant judgment and the use of estimates, particularly surrounding Black-Scholes assumptions such as stock price volatility, expected option lives, and expected option forfeiture rates, to value equity-based compensation. We currently use a Black-Scholes option pricing model to calculate the fair value of our stock options. We primarily use historical data to determine the assumptions to be used in the Black-Scholes model and have no reason to believe that future data is likely to differ materially from historical data. However, changes in the assumptions to reflect future stock price volatility and future stock award exercise experience could result in a change in the assumptions used to value awards in the future and may result in a material change to the fair value calculation of stock-based awards. This accounting guidance requires the recognition of the fair value of stock compensation in net income. Although every effort is made to ensure the accuracy of our estimates and assumptions, significant unanticipated changes in those estimates, interpretations and assumptions may result in recording stock option expense that may materially impact our financial statements for each respective reporting period.

Property and Equipment

Property and equipment are stated at cost less accumulated depreciation. Depreciation is calculated using the straight-line method over the estimated useful lives of the assets: 3-8 years for machinery and equipment, leasehold improvements are amortized over the shorter of the estimated useful lives or the underlying lease term. Repairs and maintenance expenditures which do not extend the useful lives of related assets are expensed as incurred.

Intangibles

Intangible assets with definite lives are amortized, but are tested for impairment annually and when an event occurs or circumstances change such that it is more likely than not that an impairment may exist. Our annual testing date is March 31. We test intangibles for impairment by first comparing the carrying value of net assets to the fair value of the related operations. If the fair value is determined to be less than carrying value, a second step is performed to compute the amount of the impairment. In this process, a fair value for intangibles is estimated, based in part on the fair value of the operations, and is compared to its carrying value. The shortfall of the fair value below carrying value represents the amount of intangible impairment. We test these intangibles for impairment by comparing their carrying value to current projections of discounted cash flows attributable to the customer list. Any excess carrying value over the amount of discounted cash flows represents the amount of the impairment.

Off Balance Sheet Arrangements

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

Stock-Based Compensation

Please see page F-6, Note 3 of the audited financial statements.

Recent Accounting Pronouncements

Please see page F-6, Note 3 of the audited financial statements.

BUSINESS

Company Background

Our company was incorporated in the State of Delaware on April 4, 2001, under the name “Flagstick Venture, Inc.” On March 28, 2008, a majority of our stockholders approved changing our name to Signature Exploration and Production Corp. as our business model had changed to become an independent energy company engaged in the acquisition and development of crude oil and natural gas leases in the United States.

On March 18, 2014, we purchased assets from Craig Ellins, which included the revolutionary GrowBLOX™ technology. We plan to utilize this technology to commercially cultivate and produce medical grade cannabis for sale in the U.S. states and territories in which it is legal. We also plan to research the medical treatment potential of cannabis and develop treatments from those findings. On April 4, 2014, we officially changed our name to GrowBLOX™ Sciences, Inc. to reflect this new corporate direction.

Our common stock is quoted for trading on the OTC Market QB under the symbol GBLX.

Our principal executive offices are located at 7251 West Lake Mead Blvd., Suite 309, Las Vegas, NV 89128. Our telephone number is (884) 843-2569.

Business Strategy

GrowBLOX™ Sciences, Inc. maintains two research and development focuses: research in indoor agriculture technology for the medical cannabis industry and biopharmaceutical product development specializing including research, testing, and development of FDA-approved medical treatments and nutraceuticals using extracts from the Cannabis sativa plant.

To accomplish our biopharmaceutical strategy, the Company has designed the GrowBLOX™ system, a proprietary technology that allows for completely controlled growing conditions, ensuring the manufacture of a consistent, toxin-free, natural, medicinal-grade cannabis and cannabis concentrates. We will use this, and related cutting-edge technologies and methodologies, to commercially cultivate, produce, and market products which will provide patients with valuable medicines expected to make a difference in their quality of life. We expect to begin to generate revenue from the operations described in this paragraph in the second quarter of 2015.

For our biopharmaceutical product development, we will employ a two-phase strategy. Initially, we will use an accelerated near-term "virtual pharma" strategy to fast-track treatments to market. The method, in partnership with respected, independent contract research organizations, would include exploring existing cannabinoid patents with promising product prototypes, receiving licensing for selected product prototypes and testing through human trial phases for FDA approval, and co-developing the resulting drugs/treatments for marketing and sale. This accelerated phase would shorten the anticipated time from 15 years/$1 billion to an estimated 3.5 years/$7-20 million. We expect to begin to generate revenue from the operations described in this paragraph in approximately five years from now.

We will also utilize a longer-term traditional pipeline approach which will allow us to capture more of the value created from our cannabis-derived extracts using a vertically-integrated model that will allow for growth through addressing treatments for multiple illnesses and through expanding manufacturing and distribution to other companies. Additional near-term revenue may be generated through licensing opportunities. Through both our biotech and biopharmaceutical research strategies, our ultimate goal is to be an industry leader in the cultivation technology and research and development of medical cannabis drugs and treatments.

In order to further our ' virtual pharma" strategy, GB Sciences, Inc. is looking to partner with companies that have promising synthetic cannabinoid technology, or license their proprietary formulations, and then leverage our contacts with contract research organizations to get these therapies tested in human clinical trials for eventual approval by the US FDA. GB Sciences has undertaken a search for promising cannabinoid technologies and related therapies by attending research conventions (ie. the 24th International Cannabinoid Research Society Meeting sponsored by GW Pharma the leader in cannabinoid therapies) and through our network of contacts. Our business development and science team have been in multiple rounds of talks with two very promising partners. Our goal is to form a partnership or license their technologies. We will act as the accelerators of the product development through our financial resources, experience with triais, and the relationships that we have with Clinical Research Organizations.

In order to accomplish the establishment of a traditional pharmaceutical style pipeline of new products for eventual human clinical testing and submission to the US FDA, we are creating custom blends of extracted cannabinoids from our plants for testing at the pre-clinical level (cell culture and animal models) first. The initial blends will be screened in the future through a collaboration with an academic research lab and then the most promising candidates for cannabinoid therapies in each disease category (pain-management, anxiety, Parkinson's disease) will be tested through human clinical trial phase I (safety), phase II (efficacy over time-limited enrollment), and phase III (efficacy over time with full patient enrollment).

Markets

To accomplish the aforementioned strategy, we endeavor to secure a strong technological presence in all U.S. states and territories that have, or are seeking, to legally allow cultivation, production, and distribution of medical-grade cannabis. We are developing corporate partnerships in those locations in order to maximize the value of our technology and shareholder returns. Upon receiving the appropriate licenses in each location, we will establish our proprietary growing system to produce medical grade cannabis for that region. We will also partner with the local medical community to distribute the appropriate products needed to improve their patients’ quality of life.

We are beginning our strategy by seeking a license to cultivate and distribute medicinal cannabis in Nevada in partnership with local business persons. As of June 30, we have obtained permits for a medicinal cannabis dispensary and a cultivation facility from Clark County, Nevada, and are in the process of requesting the same permit for a dispensary permit from the City of Las Vegas, Nevada. These are the initial steps to our application to the State of Nevada, which will be submitted in August 2014. Preparations for cultivation and distribution would begin following granting of appropriate state licenses. The Nevada partnership and application procedures will be a template for establishing in other U.S. locations.

The company has also recently hired a new Chief Science Officer and two PhD-level scientists in order to engage in the research and development of biopharmaceutical and neutraceutical applications of our medical-grade marijuana and medical-grade cannabinoid extracts. The company is working on licensing its initial biopharmaceutical cannabinoid product prototype to begin clinical trials. In addition, we are looking for co-development partners to assist us with growing our own phytocannabinoid-based biopharmaceutical product pipeline.

Competition

Current competition in Nevada is specific to the application for licensure for the cultivation and/or dispensing of medicinal cannabis. Of 79 active applicants for land use permits for dispensaries in Clark County, GrowBLOX™ Sciences, Inc. was chosen to take one of the 18 state-allowed locations within the unincorporated county. As a result, Clark County has recommended our company for a license from the State of Nevada.

Upon commencement of cultivation and distribution, our competition in Nevada will be the other approved local cultivation facilities and dispensaries. However, we anticipate our approved dispensary will be the only dispensary located near one of the largest, rapidly growing suburban regions in Clark County.

We anticipate duplicating the competitive advantage of being located near rapidly growing suburban regions as we look forward to operations in other U.S. locations. In addition, due to the high publicity of medicinal cannabis legalization and anticipated need for the product, in conjunction with the limited number of operational licenses being offered, we expect ample demand for our cultivation and dispensary locations.

Intellectual Property

The company currently has one patent pending and opportunity for several potential patents. Our key technology is the patent-pending indoor agricultural growing chamber known as the GrowBLOX™. The GrowBLOX™ is a controlled-climate indoor agricultural growing chamber designed and engineered to cultivate medical-grade cannabis plants. The GrowBLOX™ chambers create the ideal growing environment for each plant by monitoring and adjusting the light, humidity, nutrition, temperature and aeration, while excluding outside stresses like, toxins, pathogens and pests. This customized environment ensure maximum harvest of the finest grade product which will provide patients with specific treatment options and consistently deliver the quality and efficacy expected from a medical-grade cannabis product.

The GrowBLOX™ system is very environmental and user friendly as it utilizes the following technologies:

|

·

|

GrowBLOX’s™ AeroVAPOR™ misting system delivers all of the moisture, nutrients and oxygen the cannabis plants need to grow through a misting system that recycles the water used. Absolutely, no gray water remains that would traditionally be released back into the environment.

|

|

·

|

Energy-efficient LED lighting system.

|

|

·

|

Integrated, intelligent control system that continuously monitors, manages, records, and analyzes the cultivation methodology for optimal growth.

|

|

·

|

Remote monitoring system sends alerts via text, email and telephone to our scientists, botanists and cultivators, recommending adjustments to the chambers cultivation levels.

|

Additional patents relating to the GrowBLOX™ technology are currently being sought and will be added to our portfolio of industry-leading technology.

We also anticipate patent applications in conjunction with our research, testing, and development of biopharmaceutical treatment options using the phytocannabinoids present in the cannabis plant. Cannabis sativa contains 70 naturally occurring cannabinoids. These cannabinoids, either in isolated form or in varying combinations within strains of cannabis plants, are either proven, or have the potential, for treatment of numerous conditions, including pain; nausea, seizure and inflammation reduction; tumor inhibition; psychotic and anxiety issue; and muscle spasms. This research will be facilitated by our GrowBLOX™ controlled indoor growing system which will provide scientists with the necessary consistent samples containing adequate cannabinoid levels from harvest to harvest, thus removing environmental variables.

Government Regulation

Currently, there are twenty states plus the District of Columbia that have laws and/or regulation that recognize in one form or another legitimate medical uses for cannabis and consumer use of cannabis in connection with medical treatment. Fifteen other states are considering legislation to similar effect. As of the date of this writing, the policy and regulations of the Federal government and its agencies is that cannabis has no medical benefit and a range of activities including cultivation and use of cannabis for personal use is prohibited on the basis of federal law and may or may not be permitted on the basis of state law.

Related Party Transaction

On March 13, 2014, the Company acquired from Craig Ellins assets to be used in the production and use of cannabis (the “Assets”). At that time there were approximately twenty-one states plus the District of Columbia that had laws and/or regulations that recognized in one form or another medical uses for cannabis and consumer use of cannabis in connection with medical treatment. The Assets equipped the Company to be among the first to provide methods of cannabis production for the uses that are being legislated in the various states. The Assets included:

|

·

|

a provisional patent application associated with the production or use of cannabis;

|

|

·

|

concepts associated with the production, use of, or in any way connected with cannabis conceived or developed by Mr. Ellins or his associates;

|

|

·

|

investor presentations and histories;

|

|

·

|

trade secrets including without limitation trade secrets involving nutrient mixes;

|

|

·

|

drawings and digital artwork;

|

|

·

|

research analysis and reports, including without limitation a report entitled “GrowOpp Hydroponic Agriculture;

|

|

·

|

raw materials associated with the production and use of cannabis;

|

|

·

|

production equipment and related assets including without limitation electrical equipment, plastic molds and internal parts;

|

|

·

|

proof-of-concept equipment; and

|

|

·

|

URL’s associated with or intended to be associated with the production, use of, or in any way connected with cannabis.

|

In exchange for the Assets, the Company has issued to Mr. Ellins 12,500,000 restricted shares of the Company’s common stock. On the date of the acquisition, the Company’s free trading stock had traded with extremely limited volume or with no volume for the prior 12 months making it difficult or impossible to assign a realistic value to the transaction.

Approval of Related Party Transactions

Related party transactions are reviewed and approved or denied by the board of directors of the Company. If the related party to a transactions is a member of the board of directors, the transaction must be approved by a majority of the board that does not include the related party.

Employees

We currently employ a Chief Executive Officer, Chief Financial Officer, Chief Science Officer, and a support staff of six employees and contractors.

Our executive offices are located at 7251 West Lake Mead Blvd, Suite 300, Las Vegas, NV 89128.

Legal Proceedings

On April 2, 2014, the Company commenced an action in the United States District Court for the Southern District of New York against GCM Administrative Services, LLC (“GCM”), Strategic Turnaround Equity Partners, L.P., Gary Herman, and Seth M. Lukash. The action was brought for the purpose of determining whether the defendants or any of them were entitled to receive stock in the Company pursuant to conversion rights held under promissory notes given by an affiliate of the Company to GCM. The defendants answered the compliant and brought five counterclaims back against the Company. The counterclaims were for declaratory judgment, damages for breach of fiduciary duty and unjust enrichment, a money award for quantum meruit, and for breach of contract for refusing to convert the notes into shares. No specific amount of money damages is identified in the counterclaims. The Company believes the court will rule that there are no conversion rights pursuant to which the Company will be required to issue stock and that the counterclaims are without merit.

Executive Officers and Directors

The names of our executive officers and directors, their ages as of September 16 , 2014, and the positions currently held by each are as follows:

|

Name

|

Age

|

Position

|

| |

|

|

|

Craig Ellins

|

62

|

Chief Executive Officer and Chairman of the Board

|

|

Steven Weldon

|

38

|

Chief Financial Officer and Director

|

|

Dr. Andrea Small-Howard

|

45

|

Chief Science Officer and Director

|

Craig Ellins, Chairman and Chief Executive Officer

Chairman and Chief Executive Officer, Craig Ellins has spent over 30 years discovering emerging trends and developing start-ups for various industries. He has served as Chief Executive Officer and on the Board of Directors of numerous organizations, both in the private and public sectors and has worked with a multitude of Fortune 500 organizations. Mr. Ellins has a proven and successful background in international and domestic product and business development, technological innovation, trade secrets, strategic planning, critical infrastructure and sustainable growth. Mr. Ellins continuously sets new standards for innovation and most recently set his sights on the cannabis industry. His work in medical marijuana has produced significant advancements in indoor growing technology, all of which have pending patents. Mr. Ellins has worked diligently over the years to produce state-of-the-art technology that has a substantial impact on cultivation and ingenuity. Finding treatments to serious medical conditions has become the benchmark to Mr. Ellins technological innovation, out of which has come the GrowBLOX™. Mr. Ellins’ rich history of new technology and financial expertise has created a framework for change in technological enterprises, especially in cultivation. Mr. Ellins served as a member of the board of directors of Phototron Holdings, Inc., now known as GrowLife, Inc., a company who has a class of stock registered pursuant to section 12 of the Securities Exchange Act of 1934, from March 9, 2011, to April 12, 2013. Mr. Ellins was appointed as our Chief Executive Officer and as chairman of our board of directors on March 13, 2014, and has served continuously in both positions since that time.

Steven Weldon, MBA, CPA, Chief Financial Officer and Director

Chief Financial Officer, Steven Weldon, has over 15 years of financial and accounting experience. The majority of his vast career has been focused on tax planning, preparation, and CFO consulting. Mr. Weldon’s financial background includes experience in managerial, private accounting and planning. He has served on the board of several publicly traded companies as both, Chief Executive Officer and Chief Financial Officer. For several years, he taught accounting and tax courses to undergrad students at Florida Southern College. He received his Bachelor of Science degree and his Masters in Business Administration from Florida Southern College. Mr. Weldon was appointed as our Chief Financial Officer and as a member of our board of directors in September 2005, and has served continuously in both positions since that time. Mr. Weldon also served as our chief executive officer from December 29, 2009, through May 2, 2011, and from April 18, 2012, through March 13, 2014.

Dr. Andrea Small-Howard, PhD, MBA, Chief Science Officer and Board of Directors

Dr. Andrea Small-Howard, PhD, MBA, leverages broad industry knowledge and contacts with a focus on managing new product development that can be commercialized in the U.S. and selected international markets. She employs an integrated approach to product commercialization. Her core product development perspective is augmented with manufacturing, regulatory, supply chain and corporate alliance experience. Dr. Small-Howard originally received her AB from Occidental College in addition to receiving both an MBA and a PhD (USC All-University Merit Fellow) in Biological Sciences from the University of Southern California. As a post-doctoral fellow at the Queens Medical Center in Honolulu, Hawaii, Dr. Small-Howard lead a project group dedicated to the study of cannabinoids in the immune system and published two peer reviewed papers on the subject. She also screened synthetic cannabinoids at the in vitro and preclinical level. Dr. Small-Howard has previously screened licensing candidates in other biotech disciplines and developed biopharmaceutical products that are on the market. In addition, she has written and filed patents and global regulatory approvals. Dr. Small-Howard was appointed as our Chief Science Officer and as a member of our board of directors on June 10, 2014 and has served continuously in both positions since that time.

During the past five years none of our directors, executive officers, promoters or control persons was:

|

1)

|

the subject of any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time;

|

|

2)

|

convicted in a criminal proceeding or is subject to a pending criminal proceeding (excluding traffic violations and other minor offenses);

|

|

3)

|

subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; or

|

|

4)

|

found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law.

|

Director Independence

We do not have any independent directors serving on our Board of Directors. The definition the Company uses to determine whether a director is independent is NASDAQ Rule 4200(a)(15). See Exhibit 99 hereto.

The following summary compensation table reflects all compensation awarded to, earned by, or paid to our Chief Executive Officer and president and other employees for all services rendered to us in all capacities during each of the years ended March 31, 2014, 2013 and 2012.

Summary Compensation Table

|

Name and Position

|

Year

|

Salary($)

|

All Other Compensation

|

Total($)

|

| |

|

|

|

|

|

Craig Ellins, CEO and Chairman of the Board

|

2014

2013

2012

|

6,125

0

0

|

0

0

0

|

6,125

0

0

|

|

Steven Weldon, CFO and Director

|

2014

2013

2012

|

2,000

0

0

|

0

0

0

|

2,000

0

0

|

|

Dr. Andrea Small-Howard, Chief Science Officer and Director

|

2014

2013

2012

|

0

0

0

|

0

0

0

|

0

0

0

|

Employment Agreements

The Company has employment agreements with each of its three executive officers summarized as follows:

The term of the employment agreement with our CEO, Craig Ellins, commenced on March 17, 2014, and continues for three years. During the first year Mr. Ellins receives cash compensation of $147,000. During the second year he receives cash compensation of $180,000. During the third year he receives cash compensation of $240,000. The employment agreement also grants to Mr. Ellins 3,000,000 shares of common stock which vests over the three year term.

The term of the employment agreement with our CFO, Steven Weldon, commenced on March 17, 2014, and continues for three years. During the first year Mr. Weldon receives cash compensation of $108,000. During the second year he receives cash compensation of $132,000. During the third year he receives cash compensation of $180,000. The employment agreement also grants to Mr. Weldon 1,500,000 shares of common stock which vests over the three year term.

The term of the employment agreement with our Chief Science Officer, Andrea Small-Howard, commenced on June 10, 2014, and continues for three years. During the term of the agreement, Ms. Small-Howard receives cash compensation of $78,000 annually. The employment agreement also grants to her 450,000 shares of common stock which vests over the three year term.

Directors’ Compensation

Directors are not currently compensated, although each is entitled to be reimbursed for reasonable and necessary expenses incurred on our behalf. All directors hold office until the next annual meeting of stockholders and until their successors have been duly elected and qualified. There are no agreements with respect to the election of directors. Officers are appointed annually by the Board of Directors and each executive officer serves at the discretion of the Board of Directors. Our board of directors does not have an audit or any other committee.

VOTING SECURITIES AND PRINCIPAL HOLDERS

The following table presents information known to us, as of September 16 , 2014, relating to the beneficial ownership of common stock by:

|

·

|

each person who is known by us to be the beneficial holder of more than 5% of our outstanding common stock;

|

|

·

|

each of our named executive officers and directors; and

|

|

·

|

our directors and executive officers as a group.

|

We believe that all persons named in the table have sole voting and investment power with respect to all shares beneficially owned by them, except as noted.

Percentage ownership in the following table is based on 34,363,276 shares of common stock outstanding as of September 16 , 2014. A person is deemed to be the beneficial owner of securities that can be acquired by that person within 60 days from the date of this Annual Report upon the exercise of options, warrants or convertible securities. Each beneficial owner’s percentage ownership is determined by dividing the number of shares beneficially owned by that person by the base number of outstanding shares, increased to reflect the shares underlying options, warrants or other convertible securities included in that person’s holdings, but not those underlying shares held by any other person.

|

Beneficial Owner

|

|

Amount and Nature of

Beneficial Ownership

|

|

Percentage

|

| |

|

|

|

|

|

Craig Ellins

|

|

3,520,000 Direct

|

|

10.2%

|

|

Lazarus Investment Partners, LLLP

|

|

3,000,000 Direct

|

|

8.7%

|

|

Steven Weldon

|

|

374,521 Direct

|

|

1.1%

|

|

Andrea Small-Howard

|

|

50,000 Direct

|

|

0.1%

|

|

All directors and executive officers as a group (3 persons)

|

|

3,944,521 Direct