______________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

October 2, 2014

__________

The Walt Disney Company

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

|

| | |

1-11605 | | 95-4545390 |

(Commission File Number) | | (IRS Employer Identification No.) |

| | |

500 South Buena Vista Street | | |

Burbank, California | | 91521 |

(Address of principal executive offices) | | (Zip Code) |

(818) 560-1000

(Registrant's telephone number, including area code)

Not applicable

(Former name or address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

p | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

p | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

p | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

p | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

______________________________________________________________________

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

(e) On October 2, 2014, the Company amended the Amended and Restated Employment Agreement with Robert A. Iger dated as of October 6, 2011, as previously amended (the “Agreement”), to extend the period during which Mr. Iger would remain employed with the Company and serve as Chairman and Chief Executive Officer from June 30, 2016 to June 30, 2018. The amendment acknowledges that Mr. Iger will have the right to retire after June 30, 2016 and prior to the end of the Agreement’s extended term upon six months advance written notice to the Company. Except as described below, the remaining terms of the Agreement remain unchanged.

The amendment provides that Mr. Iger’s annual compensation for the extended employment period will be determined on the same basis as his annual compensation for fiscal 2016. Specifically, in addition to his annual salary, which remains unchanged, the amendment states that the target annual incentive under the Company’s Management Incentive Bonus Program and the target equity award value for fiscal year 2017 and 2018 will be the same as those that apply for fiscal year 2016. The Agreement provides that the terms of any equity grants made for fiscal 2017 or 2018 will be on the same terms and conditions as would apply to the grants to be made in fiscal 2016.

In consideration for agreeing to extend the term of the Agreement, Mr. Iger will receive the opportunity to receive an additional cash retention bonus, subject to the Company’s cumulative adjusted operating income over the five-year period ending at the end of fiscal year 2018 (“COI”) exceeding a threshold amount of $76.01 billion (the “Growth Incentive Retention Bonus”). The amount of the Growth Incentive Retention Bonus will increase to the extent that the aggregate adjusted operating income exceeds this threshold, in accordance with the following table:

|

| | | | | | | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) |

COI (billions) | <$76.010 | $76.389 | $76.771 | $77.154 | $77.539 | $77.925 | >$78.314 |

Earned Award (millions) | $0 | $10 | $20 | $30 | $40 | $50 | $60 |

Between stated levels of cumulative adjusting operating income, the amount payable will be determined by linear interpolation.

To receive any Growth Incentive Retention Payment earned, Mr. Iger must generally remain employed by the Company through June 30, 2018. If Mr. Iger dies or terminates employment prior to that date due to disability, he will receive payment of the amount that would have been payable based on the Company’s actual performance through the end of fiscal year 2018, but pro-rated to reflect the period of his actual employment after fiscal year 2014. Similar treatment will apply in the event the Company exercises its termination rights under the Agreement other than for Cause or Mr. Iger quits for Good Reason, as specified and defined, respectively, under the previously established terms of the Agreement, except that the bonus amount that will be payable to Mr. Iger will not be pro-rated if his employment is terminated in these circumstances after fiscal year 2017.

There are special provisions to address the amount that is payable in respect of the Growth Incentive Retention Bonus upon a change in control of the Company, which is defined incorporating the definition of that term from the Company’s Amended and Restated 2011 Stock Incentive Plan. If a change in control occurs on or prior to the end of fiscal year 2016, the amount payable in respect of the Growth Incentive Retention Bonus will be zero. If a change in control occurs after fiscal year 2016, the amount of the Growth Incentive Retention Bonus payable, if any, will be determined based on the actual cumulative adjusted operating income for each fiscal quarter in the performance period completed on or prior to the date the change of control occurs, plus a projected measure of adjusted operating income for the remainder of the performance period, assuming that adjusted operating income grows at an annualized rate equal to the compounded aggregate growth rate achieved from the beginning of the performance period to such last quarter ended coincident with or prior to the change of control. To receive the amount, if any, payable in respect of the Growth Incentive Bonus upon a change in control, Mr. Iger must generally remain employed until June 30, 2018. However, payment of such amount will be made earlier in the event that his employment terminates due to his death, disability, a termination by the exercise of the Company’s termination rights without Cause or a termination by Mr. Iger for Good Reason.

The amendment of Mr. Iger’s agreement is attached as Exhibit 10.1 to this Report and is incorporated herein by reference.

Item 9.01 Exhibits

| |

Exhibit 10.1 | Amendment dated October 2, 2014 to the Amended and Restated Employment Agreement, dated as of October 6, 2011, between the Company and Robert A. Iger. |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | | |

| | The Walt Disney Company | |

| | |

By: | | /s/ Roger J. Patterson | |

| | Roger J. Patterson | |

| | Associate General Counsel and Assistant Secretary | |

| | Registered In-House Counsel | |

Dated: October 3, 2014

Exhibit 10.1

October 2, 2014

Mr. Robert Iger

Chief Executive Officer and Chairman

The Walt Disney Company

500 S. Buena Vista Avenue

Burbank, CA

Amendment to Amended and Restated Employment Agreement

Dated as of October 6, 2011, as amended July 1, 2013

This letter amends the above captioned employment agreement (the “Agreement”) to provide that the Employment Period thereof shall be extended so as to end on June 30, 2018. Except as expressly provided herein, all references in the Agreement to June 30, 2016 shall be changed to June 30, 2018. Notwithstanding the immediately preceding sentence or anything else in the Agreement, you may elect to voluntarily retire from employment with the Company at any date after June 30, 2016 so long as you shall have provided the Board at least six months’ advance written notice of termination of your employment.

Your base salary, target annual incentive and target award value under Section 3(b) and 3(c) of the Agreement for fiscal years 2017 and 2018 shall be the same as those that currently apply for fiscal year 2016 and the awards for such years shall be subject to the same terms and conditions as awards to be granted in 2016. In determining any annual incentive payable under Section 3(b) for fiscal year 2016 or fiscal year 2018, you shall be eligible to receive such incentive if, in either case, you remain employed at least through June 30 of the applicable year. If you retire in fiscal year 2016, any vesting and, if applicable, exercise periods that would have applied under Section 3(c)(i)(E) or 3(c)(ii)(D) under the original terms of the Agreement to any award granted prior to June 30, 2016 had you remained employed through June 30, 2016 (i.e., the originally scheduled end of the Employment Period) shall continue to apply if you remain employed through June 30, 2016. With respect to any awards made after June 30, 2016, any vesting and, if applicable, exercise period applicable under Section 3(c)(i)(E) or 3(c)(ii)(D) shall only apply if you remain employed through June 30, 2018. The vesting and, if applicable, exercise periods that would have applied in respect of any outstanding equity awards under either Section 5(d) and 5(e) in connection with a Termination Date occurring on or after the date the Chairman Period would have commenced (i.e., April 1, 2015) shall also apply in respect of awards granted after June 30, 2016.

As consideration for the extension of the term of the Agreement, you shall be eligible to receive an additional bonus payment (the “Growth Incentive Retention Bonus”) if you are continuously employed with the Company through June 30, 2018 (or your employment terminates under any of the circumstances described in paragraph 4 below), and during the periods specified herein, the Company achieves at least the lowest level of cumulative operating income (“COI”) set forth in the table below (or as the same may be adjusted in accordance with the terms hereof). Any amount of the Growth Incentive Retention Bonus that you earn (the “Earned Award”), including pursuant to paragraph 5 below, shall be paid to you in cash, less required tax withholding, on the later to occur of (i) December 1, 2018 and (ii) your separation from service with the Company; provided, however, that any amount payable on account of your separation

from service will be payable on the date that is six months after such separation. If pursuant to the terms of this letter, payment of the Growth Incentive Retention Bonus is deferred to a date that is more than 90 days after the time at which the Earned Award is determined, the Earned Amount shall be deemed invested in a deferred compensation account that shall offer you deemed investment opportunities which are at least the same (except as may be required to comply with Company policies related to insider trading in the Company’s common stock) as the most diverse investment choices available under any other non-qualified deferred compensation arrangement or qualified individual account plan maintained by the Company or any of its affiliates. The terms of the Growth Incentive Retention Bonus are as follows:

1. “COI” equals aggregate segment operating income as reported in the Company’s financial statements for each of the Company’s five consecutive fiscal years ending with September 29, 2018, which five years are the “Performance Period;” provided, however, that, if the Company's accounting policies or practices change for any reason such that the manner in which aggregate segment operating income is determined for any period subsequent to fiscal year 2014 differs from that applicable in respect of fiscal year 2014 then, for purposes of this Agreement, COI shall be adjusted such that such measure is determined with respect to all relevant periods in the same manner as applied in respect of fiscal year 2014.

2. The Earned Award shall be determined based on the following performance schedule:

|

| | | | | | | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) |

COI (billions) | <$76.010 | $76.389 | $76.771 | $77.154 | $77.539 | $77.925 | >$78.314 |

Earned Award (millions) | $0 | $10 | $20 | $30 | $40 | $50 | $60 |

The numbers in the row marked “COI (billions”) shall be referred to herein as the COI Targets.

3. The Earned Award with respect to COI at levels between the amounts stated in the above table shall be determined by linear interpolation. For example, COI of $76.9625 billion would result in an Earned Award of $25 million.

4. If your employment terminates before June 30, 2018 on account of death or Termination due to a Disability, you shall be entitled to a prorated portion of the Earned Award, if any, that would otherwise be payable had you remained employed through June 30, 2018. If your employment terminates before June 30, 2018 due to the Company’s exercise of its Termination Right, or a Termination for Good Reason, you shall be entitled to (i) a prorated portion of the Earned Award, if your termination occurs on or prior to the last day of fiscal year 2017, or (ii) the full Earned Award, if your termination occurs after fiscal year 2017, that would otherwise be payable had you remained employed through June 30, 2018. Any pro-rated portion payable shall be determined based on the ratio of (a) the number of days you were employed during the last four fiscal years in the Performance Period to (b) the total number of days in the last four years of the Performance Period through June 30, 2018, which is 1,372. Payment of any amount in respect of the Growth Incentive Retention Bonus shall not be accelerated due to your termination of employment.

5. Notwithstanding paragraphs 2, 3 and 4, in the event that, prior to September 29, 2018, the Company undergoes a “Change in Control,” as defined in the Amended and Restated 2011 Stock Incentive Plan, (i) on or before the last day of fiscal year 2016, the Earned Award shall be zero or (ii) after fiscal year 2016, the Earned Award shall be determined as of the date of the Change in Control, by measuring against the COI Targets the sum of (i) the aggregate adjusted operating income earned during the Performance Period through the fiscal quarter ending coincident with or immediately prior to the Change in Control (the “Last Ended Fiscal Quarter”) and (ii) the adjusted operating income that would have been earned during the remaining fiscal quarters during the Performance Period (the “Remaining Quarters”), determined as provided below. First, the compound annual growth rate in adjusted operating income achieved from the beginning of the Performance Period to the Last Ended Fiscal Quarter (the “Annual Growth Rate”) shall be calculated. The Annual Growth Rate shall then be used to calculate a quarterly growth rate )the “Quarterly Growth Rate”) and the amount of adjusted operating income deemed earned for the first quarter ending following the Change in Control (the “Initial Quarterly AOI”), such that by applying the Quarterly Growth Rate over a period of four quarters and starting with the Initial Quarterly AOI, the deemed adjusted operating income would achieve the same aggregate result as by applying the Annual Growth Rate over the same period (the “Quarterly Growth Rate”) to the actual adjusted operating income accrued for the four quarters ending with the Last Ended Fiscal Quarter. The deemed adjusted operating income for each other Remaining Quarter after the first such Remaining Quarter shall be determined assuming that, in each such Remaining Quarter, the Initial Quarterly AOI, as adjusted to reflect the assumed growth at the Quarterly Growth Rate in each Remaining Quarter that would have previously preceded in chronological order, grew at the Quarterly Growth Rate. In order to receive any Earned Award payable in the event of a Change in Control, you must remain employed through June 30, 2018 or, if your employment terminates as of an earlier date, it must terminate due to one of the circumstances described in paragraph 4. Payment of any Earned Award shall be made at the time specified above

6. If the Company or one of its affiliates whose income is consolidated with the

Company for financial accounting purposes (a “Consolidated Entity”) shall (i) divest or otherwise transfer any subsidiary or other business unit or division to any person other than a Consolidated Entity (including any distribution of assets to the Company’s shareholders) or (ii) purchase or otherwise acquire any subsidiary or other business unit or division, and the Board or the appropriate Committee thereof determines in good faith that an adjustment to the COI Targets is necessary or appropriate to prevent either (A) an enhancement of, or diminution in, the opportunity provided by the Growth Incentive Retention Bonus or (B) an unintended incentive or disincentive in regard to the operations of the Company or a specified segment thereof, such COI Targets shall be adjusted in such manner and to such extent the Board or the applicable Committee considers fair, reasonable and equitable under the circumstances. Notwithstanding the immediately preceding sentence, no adjustment shall made in respect of any such divestiture or acquisition if the aggregate amount being received or paid by a Consolidated Entity for such assets is less than $250 million, unless you shall request that the Board or the applicable Committee consider, and the Board or such Committee determines to make, an appropriate adjustment to the COI Targets in respect of such divestiture or acquisition.

Except as specified above, the Agreement shall otherwise continue in accordance with its terms. Defined terms used, but not defined, in this letter have the meanings ascribed thereto in the Agreement. If you agree that the foregoing sets forth our full understanding regarding the amendment of the Agreement, please evidence your agreement and acceptance by counter-signing two copies of this letter where indicated below, returning one executed copy to me.

|

| | | |

|

| | | |

THE WALT DISNEY COMPANY |

| | |

By: | | /s/ Alan N. Braverman | |

| | Alan N. Braverman | |

| | Senior Executive Vice President, | |

| | General Counsel and Secretary | |

|

| | | |

|

| | | |

AGREED AND ACCEPTED: |

| | |

/s/ Robert A. Iger | |

Robert A. Iger | |

Date: | | 10/2/2014 | |

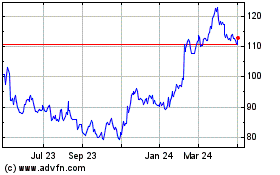

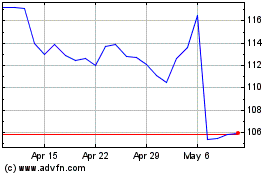

Walt Disney (NYSE:DIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Walt Disney (NYSE:DIS)

Historical Stock Chart

From Apr 2023 to Apr 2024