Current Report Filing (8-k)

October 01 2014 - 4:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

____________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

October 1, 2014

ANNALY CAPITAL MANAGEMENT, INC.

(Exact name of registrant as specified in its charter)

| Maryland |

1-13447 |

22-3479661 |

| (State or Other Jurisdiction |

(Commission |

(IRS Employer |

| of Incorporation) |

File Number) |

Identification No.) |

| 1211 Avenue of the Americas |

|

|

Suite 2902

|

|

| New York, New York |

10036 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (212) 696-0100

No Change

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| o |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

On October 1, 2014, the Company issued a press release announcing an adjustment to the conversion rate of its 4% convertible senior notes due 2015. The Company’s press release is attached hereto as Exhibit 99.1.

| Item 9.01. |

Financial Statements and Exhibits. |

| |

|

| |

(a) Not applicable. |

| |

|

| |

(b) Not applicable. |

| |

|

| |

(c) Not applicable. |

| |

|

| |

(d) Exhibits: |

| |

99.1 |

Press Release, dated October 1, 2014, issued by the Company |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Annaly Capital Management, Inc. |

|

| |

|

|

|

| |

|

|

|

| |

By:

|

/s/ Glenn A. Votek |

|

| |

|

Name: Glenn A. Votek |

|

| |

|

Title: Chief Financial Officer |

|

| |

|

|

|

| Date: October 1, 2014 |

|

|

|

Exhibit 99.1

PRESS RELEASE

NYSE: NLY

ANNALY CAPITAL MANAGEMENT, INC.

1211 Avenue of the Americas

Suite 2902

New York, New York 10036

FOR IMMEDIATE RELEASE

Annaly Capital Management, Inc. Announces Conversion Rate Adjustment for 4.00% Convertible Senior Notes Due 2015

NEW YORK -- (BUSINESS WIRE) – October 1, 2014 -- Annaly Capital Management, Inc. (NYSE: NLY) (“Annaly” or the “Company”) today announced an adjustment to the conversion rate for 4.00% Convertible Senior Notes Due 2015 (the "Notes"). The adjustment to the conversion rate for the Notes is being made pursuant to the governing indenture for the Notes in light of the Company's previously announced third quarter 2014 common stock cash dividend of $0.30 per common share. The new conversion price for the Notes is $11.5772 per common share, effective September 29, 2014. The conversion price for the Notes was previously $11.8944 per common share. The new conversion rate for each $1,000 principal amount of Notes is 86.3764 of the Company’s common shares. The conversion rate for each $1,000 principal amount of Notes was previously 84.0728 of the Company’s common shares. Notice of the conversion rate adjustment was delivered to security holders and Wells Fargo Bank, National Association, the trustee, in accordance with the terms of the governing indenture for the Notes.

Annaly’s principal business objective is to generate net income for distribution to its shareholders from its investments. Annaly is a Maryland corporation that has elected to be taxed as a real estate investment trust (“REIT”). Annaly is managed and advised by Annaly Management Company LLC.

This news release and our public documents to which we refer contain or incorporate by reference certain forward-looking statements which are based on various assumptions (some of which are beyond our control) and may be identified by reference to a future period or periods or by the use of forward-looking terminology, such as "may," "will," "believe," "expect," "anticipate," "continue," or similar terms or variations on those terms or the negative of those terms. Actual results could differ materially from those set forth in forward-looking statements due to a variety of factors, including, but not limited to, changes in interest rates; changes in the yield curve; changes in prepayment rates; the availability of mortgage-backed securities and other securities for purchase; the availability of financing and, if available, the terms of any financings; changes in the market value of our assets; changes in business conditions and the general economy; our ability to grow the commercial mortgage business; credit risks related to our investments in commercial real estate assets and corporate debt; our ability to consummate any contemplated investment opportunities; changes in government regulations affecting our business; our ability to maintain our qualification as a REIT for federal income tax purposes; our ability to maintain our exemption from registration under the Investment Company Act of 1940, as amended; risks associated with the businesses of our subsidiaries, including the investment advisory business of a wholly-owned subsidiary and the broker-dealer business of a wholly-owned subsidiary. For a discussion of the risks and uncertainties which could cause actual results to differ from those contained in the forward-looking statements, see "Risk Factors" in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q. We do not undertake, and specifically disclaim any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements.

CONTACT: Annaly Capital Management, Inc.

Investor Relations, 888-8Annaly

www.annaly.com

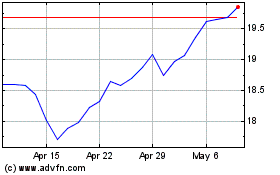

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

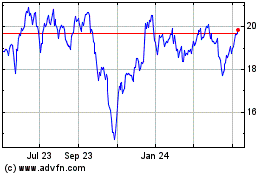

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Apr 2023 to Apr 2024