Current Report Filing (8-k)

October 01 2014 - 8:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant To Section 13 or 15 (d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) — October 1, 2014

ENVESTNET, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

001-34835 |

|

20-1409613 |

|

(State or other jurisdiction) |

|

(State or other jurisdiction) |

|

(I.R.S. Employer of Incorporation

Identification No.) |

|

35 East Wacker Drive, Suite 2400

Chicago, Illinois |

|

60601 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (312) 827-2800

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.01. Completion of Acquisition or Disposition of Assets.

On October 1, 2014, pursuant to the Amended and Restated Acquisition and Agreement of Merger (the “Agreement”) dated as of August 11, 2014 with Placemark Holdings, Inc., a Delaware corporation (“Placemark”), the Selling Securityholders and Fortis Advisors, LLC, as Securityholder Representative, Envestnet completed the merger of its wholly owned subsidiary with and into Placemark (the “Merger”). Following the merger, Placemark will continue as a wholly owned subsidiary of Envestnet.

Under the terms of the Agreement, Envestnet paid total merger consideration of $66 million in cash, subject to certain post-closing adjustments. Envestnet funded the merger consideration with available cash and borrowings under its revolving credit facility. The foregoing summary of the Agreement and the Merger does not purport to be a complete description and is subject to, and qualified in its entirety by, the full text of the Agreement, a copy of which was filed as Exhibit 10.1 to Envestnet’s Quarterly Report on Form 10-Q for the period ending June 30, 2014, and is incorporated herein by reference.

Item 8.01. Other Events.

On October 1, 2014, Envestnet issued a press release announcing the completion of the Placemark merger referred to in Item 2.01 above. A copy of the press release is attached as Exhibit 99.4 hereto.

Item 9.01. Financial Statements and Exhibits.

(a) Financial Statements of Businesses Acquired.

As permitted by 9.01(a)(4) of Form 8-K, the financial statements required by this item will be filed by amendment to this Current Report on Form 8-K within 71 calendar days after the date on which this Report must be filed.

(b) Pro Forma Financial Information.

As permitted by 9.01(a)(4) of Form 8-K, the pro forma financial statements required by this item will be filed by amendment to this Current Report on Form 8-K within 71 calendar days after the date on which this Report must be filed.

(d) Exhibits.

99.4 Press release, dated October 1, 2014, regarding completion of the acquisition of Placemark.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ENVESTNET, INC. |

|

|

|

|

|

|

|

|

By: |

/s/ Peter H. D’Arrigo |

|

|

|

Name: |

Peter H. D’Arrigo |

|

|

|

Title: |

Chief Financial Officer |

|

|

|

Date: October 1, 2014 |

3

Exhibit 99.4

ENVESTNET COMPLETES ACQUISITION OF PLACEMARK INVESTMENTS

Acquisition Puts Envestnet Among Top 5 Providers of UMA Programs

CHICAGO, IL — October 1, 2014 — Envestnet, Inc. (NYSE: ENV), a leading provider of unified wealth management technology and services to investment advisors and wealth managers, announced today that it has completed the acquisition of Placemark Holdings, Inc., a leading developer of Unified Managed Accounts (UMA) programs for banks, full-service broker-dealers and RIA firms.

“Placemark’s portfolio overlay and tax optimization technologies will be designed into Envestnet | PMC’s product offerings as we integrate our two companies,” said Jud Bergman, Chairman and Chief Executive Officer, Envestnet. “As advisors increasingly adopt UMA implementations for their clients’ portfolio strategies, Envestnet will be there to support them with the industry’s leading UMA technology and platform.”

The acquisition will give Placemark’s clients immediate access to Envestnet’s full suite of wealth management services including advisor-driven portfolio management, rebalancing and aggregated reporting solutions.

“With the acquisition completed, our focus will now be on serving the current and future wealth management needs of Placemark’s customers — full-service broker-dealers, banks and individual RIAs,” said Bill Crager, President, Envestnet.

Envestnet acquired Placemark Holdings, Inc. for $66 million in cash upon closing. Placemark had $15.6 billion in UMA assets under management as of June 30, 2014. Lee Chertavian, CEO of Placemark, is joining Envestnet as Group President of Envestnet | Placemark.

“With the benefit of Envestnet’s breadth of capabilities, we look forward to providing our customers with solutions they have been seeking on an accelerated schedule,” said Mr. Chertavian. “We are united with our Envestnet colleagues in our firm commitment to delivering the best solutions and service to our customers.”

ABOUT ENVESTNET (NYSE: ENV)

Envestnet, Inc. (NYSE: ENV) is a leading provider of unified wealth management technology and services to investment advisors. Our open-architecture platforms unify and fortify the wealth management process, delivering unparalleled flexibility, accuracy, performance and value. Envestnet solutions enable the transformation of wealth management into a transparent, independent, objective and fully-aligned standard of care, and empower advisors to deliver better results.

Envestnet’s Advisor Suite® software empowers financial advisors to better manage client outcomes and strengthen their practice. Envestnet provides institutional-quality research and advanced portfolio solutions through our Portfolio Management Consultants group, Envestnet | PMC®. Envestnet | Tamarac provides leading rebalancing, reporting and practice management software.

For more information on Envestnet, please visit www.envestnet.com and follow Envestnet at @ENVintel.

Cautionary Statement Regarding Forward-Looking Statements

The forward-looking statements made in this press release concerning, among other things, Envestnet, Inc.’s (the “Company”) expected financial performance and outlook, its strategic operational plans and growth strategy are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties and the Company’s actual results could differ materially from the results expressed or implied by such forward-looking statements.

Furthermore, reported results should not be considered as an indication of future performance. The potential risks, uncertainties and other factors that could cause actual results to differ from those expressed by the forward-looking statements in this press release. For example, the Company’s forward-looking statements related to Placemark could prove incorrect if Placemark were

to perform differently than currently expected by the Company or if anticipated benefits of the transaction are not realized. More generally, potential risks, uncertainties and other factors relating to the Company’s business include, but are not limited to, difficulty in sustaining rapid revenue growth, which may place significant demands on the Company’s administrative, operational and financial resources, fluctuations in the Company’s revenue, the concentration of nearly all of the Company’s revenues from the delivery of investment solutions and services to clients in the financial advisory industry, the Company’s reliance on a limited number of clients for a material portion of its revenue, the renegotiation of fee percentages or termination of the Company’s services by its clients, the impact of market and economic conditions on the Company’s revenues, compliance failures, regulatory actions against the Company, the failure to protect the Company’s intellectual property rights, the Company’s inability to successfully execute the conversion of its clients’ assets from their technology platform to the Company’s technology platform in a timely and accurate manner, general economic, political and regulatory conditions, as well as management’s response to these factors. More information regarding these and other risks, uncertainties and factors is contained in the Company’s filings with the Securities and Exchange Commission (“SEC”) which are available on the SEC’s website at www.sec.gov or the Company’s Investor Relations website at http://ir.envestnet.com/. You are cautioned not to unduly rely on these forward-looking statements, which speak only as of the date of this press release. All information in this press release is as of October 1, 2014 and, unless required by law, the Company undertakes no obligation to publicly revise any forward-looking statement to reflect circumstances or events after the date of this press release or to report the occurrence of unanticipated events.

Contacts

|

Investors: |

|

Media: |

|

Investor Relations |

|

Laura Simpson, JCPR |

|

investor.relations@envestnet.com |

|

lsimpson@jcprinc.com |

|

(312) 827-3940 |

|

(973) 850-7319 |

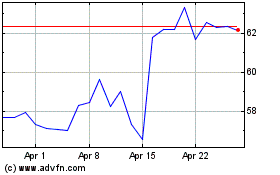

Envestnet (NYSE:ENV)

Historical Stock Chart

From Mar 2024 to Apr 2024

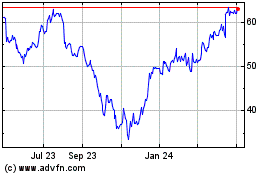

Envestnet (NYSE:ENV)

Historical Stock Chart

From Apr 2023 to Apr 2024