UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

September 26, 2014

Date of Report

(Date of earliest

event reported)

LABOR SMART INC.

(Exact name of Registrant as specified in its

Charter)

| Nevada | |

000-54654 | |

45-2433287 |

| (State or Other Jurisdiction of Incorporation) | |

(Commission File Number) | |

(I.R.S. Employer Identification No.) |

5604 Wendy Bagwell Parkway, Suite 223,

Hiram, Georgia 30141

(Address of Principal Executive

Offices)

(770) 222-5888

(Registrant’s Telephone Number, including

area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant

under any of the following provisions (see general instruction A.2. below):

[

] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[

] Soliciting material pursuant to Rule 14-a-12 under the Exchange Act (17 CFR 240.14a-12)

[

] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[

] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.01 Entry into Definitive

Material Agreement

On

September 26, 2014, Labor Smart Inc. (the “Company”) entered into an Asset Purchase Agreement (the “Asset Purchase

Agreement”) with Kwik Jobs, Inc. (“Kwik Jobs”). Under the terms of the Asset Purchase Agreement, the Company

shall acquire all the operating assets of Kwik Jobs (the “Assets”). In exchange for the Assets, the Company shall

pay Kwik Jobs a down payment of fifty thousand dollars ($50,000) plus, for an aggregate of eighteen (18) months, the Company shall

pay Kwik Jobs five percent (5%) of the monthly accounts receivable collected from the operating locations in Birmingham, Alabama

and Decatur, Georgia. The foregoing description of the Agreement and the terms thereof are qualified in their entirety by the

full text of the Agreement, which is filed as Exhibit 99.1 to, and incorporated by reference in this report.

Item 2.01

Completion of Acquisition or Disposition of Assets.

On

September 29, 2014 the Company completed the acquisition of the Assets described in Item 1.01 above.

Item 9.01

Financial Statements and Exhibits.

(d) Exhibits

Signatures

Pursuant to

the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this Current Report to be signed on

its behalf by the undersigned hereunto duly authorized.

LABOR SMART,

INC.

| Date: |

September 30, 2014 |

|

By: |

/s/ Ryan Schadel |

| |

|

|

|

Ryan Schadel |

| |

|

|

|

Chief Executive Officer |

Asset Purchase Agreement

(this “Agreement”) dated as of September 26, 2014, between Labor Smart, Inc. (“Buyer”) and Kwik Jobs, Inc.

(“Seller”).

WITNESSETH:

Whereas,

Seller desires to sell, assign, transfer and convey to Buyer, and Buyer desires to purchase, acquire and accept from Seller, substantially

all of the operating assets (the Assets) of the Seller, excluding cash, security deposits, and accounts receivable, pursuant to

and in accordance with the terms and conditions of this Agreement and as itemized in Schedule B.

Therefore, in consideration of the mutual representations, warranties, covenants and agreements herein contained, the parties hereto

agree as follows:

ARTICLE 1. DEFINITIONS

1.1

Definitions.

Capitalized

terms used in this Agreement have the meanings set forth below:

“Business Day” means any day other than a Saturday or a Sunday or other day on which banking institutions in the State

of New York are authorized or required by applicable law or other governmental action to close.

“Closing Date” means the date on which the transactions contemplated by this Agreement are consummated.

“Governmental Authority” shall mean any federal, state or local governmental entity, authority or agency, court, tribunal,

board, regulatory commission or other body of any federal, state, county, district, municipality, city, foreign or other government

unit.

ARTICLE 2. PURCHASE, SALE AND DELIVERY OF ASSETS

2.1 Transfer of Assets.

At the

Closing, and upon the terms and subject to the conditions set forth in this Agreement, Seller shall sell, assign, transfer and

convey to Buyer, and Buyer shall purchase, acquire and accept from Seller, all right, title and interest in and to the Assets.

2.2 Price.

The purchase

price for the sale, assignment, transfer and conveyance of the Assets shall be calculated as follows: Buyer shall pay a down payment

of $50,000 (Fifty Thousand Dollars). The down payment shall be paid in full no later than one day prior to the delivery of the

Assets by Seller as provided herein, subject to Buyer’s right of inspection as set forth in Section 2.4 of this Agreement.

On the 3rd day of each month thereafter and for an aggregate period of 18 calendar months, Buyer shall pay to Seller

an amount equal to 5% of monthly accounts receivable collected from the operating locations in Birmingham, AL and Decatur, GA which

are included in the Assets.

2.3 Delivery

Seller

shall cause the Assets to be delivered to Buyer’s agents and/or employees and Seller shall assist with the integration of

the Assets to the Buyer’s business for a reasonable amount of time, which may include visits to clients’ of the Assets

or properties included in the Assets. Buyer will reimburse Seller for reasonable expenses incurred while traveling at Buyer’s

request. Buyer and Seller together will coordinate operations to insure a smooth but timely and effective delivery without disruption

to the operation of the Assets.

2.4 Right of Inspection.

Buyer has

waived Right to Inspection.

2.5. Transfer of Title.

Transfer

of title and full ownership rights in the Assets shall not pass to Buyer until Buyer has paid in full the down payment to Seller

as described in Section 2.2. Seller agrees to assist Buyer with executing new lease agreements for the locations, as listed in

Schedule B, included in the Assets.

2.6

Default

Buyer will

be in Default under the terms of this agreement if monthly payments as described in Section 2.2 are not received by the 15th

of the month due. If Buyer is unable to cure the Default by the 25th of the month when due, Buyer agrees to return the

Assets to the Seller without delay.

ARTICLE 3. REPRESENTATIONS AND WARRANTIES OF SELLER

3.1 Warranty.

Except

as set forth herein, Seller makes no warranty to Buyer with respect to the Assets, and Buyer disclaims all other warranties, express

or implied, including, without limitation, any implied warranty of merchantability or fitness for a particular purpose. Seller

agrees to hold Buyer harmless for any and all liabilities of the Seller, both present and future. Buyer agrees to allow access

to Seller any and all documents relating to customers and employees as needed for Seller’s success in collecting outstanding

receivables as of the date of execution and reporting and record keeping requirements under state and federal employment law.

3.2

Condition.

Not Applicable.

ARTICLE 4. REPRESENTATIONS AND WARRANTIES OF BUYER

4.1 Taxes.

In no event

shall Buyer be responsible for any tax imposed upon Seller based upon Seller’s income or for the privilege of doing business.

4.2 Organization.

Buyer is

a corporation company duly organized, validly existing and in good standing under the laws of the State of Nevada, and has all

requisite power and authority to own, lease and operate all of its properties and assets, and to carry on its business as now conducted,

to enter into this Agreement and to carry out the obligations thereunder.

4.3 No Violation.

Neither

the execution and delivery of this Agreement nor the consummation of the transaction contemplated hereby will (i) result in the

acceleration of, or the creation in any party of any right to accelerate, terminate, modify or cancel any material indenture, contract,

lease, sublease, loan agreement, note or other obligation or liability to which Buyer is a party or by which it is bound, or to

which any of its assets is subject or (ii) conflict with or result in a breach of or constitute a default under any provision of

the Articles of Association (or other charter documents) of Buyer, or a default under or violation of any material restriction,

lien, bond, guarantee, license, permit, agreement, understanding, arrangement, commitment, indenture, contract, lease, sublease,

loan agreement, note or other obligation or liability, whether oral or written, to which it is a party or by which it is bound

or to which any of its assets is subject or result in the creation of any lien or encumbrance upon any of said assets.

4.4 No Consents.

No consent

of, or notice to, any federal, state or local authority, or any third party or entity, is required to be obtained or given by Buyer

in connection with the execution, delivery or performance of this Agreement.

ARTICLE 5. TERMINATION

5.1 Termination.

This Agreement

may be terminated and the transactions contemplated hereby abandoned at any time prior to the Closing by (a) mutual written consent

of Seller and Buyer; (b) Seller in the event of any breach by Buyer of any of its representations or warranties contained herein,

and the failure of Buyer to cure such breach within 1 Business Day after receipt of written notice from Seller requesting such

breach to be cured; or (c) Buyer in the event of any breach by Seller of any of its representations or warranties contained herein,

and the failure of Seller to

cure such breach within 1 Business Days after receipt of written notice from the Buyer requesting such breach to be cured.

ARTICLE 6. MISCELLANEOUS

6.1 No Waiver.

The waiver

or failure of either party to exercise in any respect any right provided in this Agreement shall not be deemed a waiver of any

other right or remedy to which the party may be entitled.

6.2 Entirety of Agreement.

The terms

and conditions set forth in this Agreement constitute the entire agreement between the parties and supersede any communications

or previous agreements with respect to the subject matter of this Agreement. There are no written or oral understandings, directly

or indirectly, related to this Agreement that are not set forth herein. No change can be made to this Agreement other than in writing

and signed by both parties.

6.3 Governing Law.

This Agreement

shall be construed and enforced according to the laws of the State of Nevada. Any claim or dispute related to this Agreement, including

the validity of this arbitration clause, shall be resolved by binding arbitration by the American Arbitration Association, under

the arbitration rules then in effect, by a

panel of

three arbitrators (one to be chosen by Buyer, one to be chosen by Seller, and the third to be chosen by the two arbitrators chosen

by Buyer and Seller).

6.4

Severability.

If any

term of this Agreement is held found to be invalid or unenforceable, then this Agreement, including all of the remaining terms,

will remain in full force and effect as if such invalid or unenforceable term had never been included.

In Witness whereof, the parties have executed this Agreement as of the date first written above.

Labor

SMART, Inc Kwik Jobs, Inc.

Buyer

Seller

By: _____________________________

By:____________________________

Its: President

& CEO Its: ____________________________

_____________________

_____________________

Date

Date

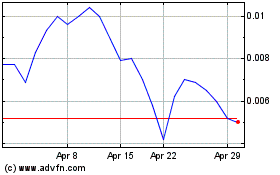

Labor Smart (PK) (USOTC:LTNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Labor Smart (PK) (USOTC:LTNC)

Historical Stock Chart

From Apr 2023 to Apr 2024