UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

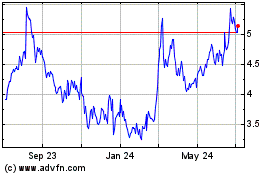

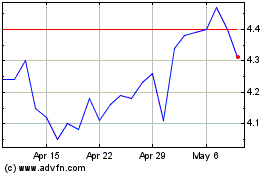

Date of Report (Date of earliest event reported): September 23, 2014

MannKind Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

000-50865 |

|

13-3607736 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

| 28903 North Avenue Paine

Valencia, California |

|

91355 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (661) 775-5300

N/A

(Former name or

former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CRF 240.13e-4(c)) |

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On September 23, 2014, MannKind Corporation (the

“Company”) entered into a Senior Secured Revolving Promissory Note (the “Note”) and a Guaranty and Security Agreement (the “Security Agreement”) with Aventisub LLC, a Delaware limited liability company (the

“noteholder”), an affiliate of Sanofi-Aventis Deutschland GmbH (“Sanofi”), to provide the Company with a secured loan facility of up to $175.0 million (the “Loan Facility”) to fund the Company’s share of net losses

under the previously announced license and collaboration agreement with Sanofi dated August 11, 2014 (the “License Agreement”).

The

obligations of the Company under the Loan Facility are guaranteed by the Company’s wholly-owned subsidiary, MannKind LLC, and are secured by a first priority security interest in certain insulin inventory located in the United States and any

contractual rights and obligations pursuant to which the Company purchases or has purchased such insulin, and a second priority security interest in the Company’s assets that secure the Company’s obligations under the July 1, 2013

facility agreement with Deerfield Private Design Fund II, L.P. and Deerfield Private Design International II, L.P. In addition, the Company has agreed to grant to the noteholder, as additional security for the obligations under the Loan Facility, a

first priority mortgage on the Company’s facility in Valencia, California, by December 22, 2014.

Advances under the Loan Facility will

bear interest at a rate of 8.5% per annum and will be payable in-kind and compounded quarterly and added to the outstanding principal balance under the Loan Facility. The Company is required to make mandatory prepayments on the outstanding

loans under the Loan Facility from its share of any Profits (as defined in the License Agreement) under the License Agreement within 30 days of receipt of its share of any such Profits.

The outstanding principal of all loans under the Loan Facility, if not prepaid, will become due and payable on September 23, 2024 unless accelerated

pursuant to the terms of the Loan Facility. Additionally, if the Company sells its Valencia facility, the Company is required to prepay the loans under the Loan Facility in an amount equal to 100% of the net cash proceeds of the sale within

five business days of receipt.

The Loan Facility includes customary representations, warranties and covenants by the Company, including restrictions on

its ability to incur additional indebtedness, grant certain liens and make certain changes to its organizational documents. Events of default under the Loan Facility include: the Company’s failure to timely make payments due under the Loan

Facility; inaccuracies in the Company’s representations and warranties to the noteholder; the Company’s failure to comply with any of its covenants under any of the Loan Facility or certain other related security agreements and documents

entered into in connection with the Loan Facility, subject to a cure period with respect to most covenants; the Company’s insolvency or the occurrence of certain bankruptcy-related events; termination by Sanofi of the License Agreement as a

result of the Company’s breach of the License Agreement; and the failure of any material provision under any of the Loan Facility or certain other related security agreements and documents entered into in connection with the Loan Facility to

remain in full force and effect. If one or more events of default occurs and is continuing, the noteholder may terminate its obligation to make advances under the Loan Facility, and, if certain specified events of default (including the

Company’s failure to timely make payments due under the Loan Facility; the Company’s failure to comply with the negative covenants under the Loan Facility limiting the Company’s ability to incur additional indebtedness or grant

certain liens; the Company’s insolvency or the occurrence of certain bankruptcy-related events; termination by Sanofi of the License Agreement as a result of the Company’s breach of the non-compete provisions of the License Agreement; or

the failure of any material provision under any of the Loan Facility or certain other related security agreements and documents entered into in connection with the Loan Facility to remain in full force and effect) occur and are continuing, the

noteholder may accelerate all of the Company’s repayment obligations under the Loan Facility and otherwise exercise any of its remedies as a secured creditor.

The foregoing description of the Note and the Security Agreement is only a summary and is qualified in its entirety by reference to the Note and the Security

Agreement, copies of which are attached as exhibits to this report.

| Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information in Item 1.01 above is incorporated by reference into this Item 2.03.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

|

|

|

| Number |

|

Description |

|

|

| 99.1 |

|

Senior Secured Revolving Promissory Note, dated as of September 23, 2014, by and between MannKind Corporation and Aventisub LLC. |

|

|

| 99.2 |

|

Guaranty and Security Agreement dated as of September 23, 2014 among MannKind Corporation, MannKind LLC, and Aventisub LLC. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

MANNKIND CORPORATION |

|

|

|

|

| Dated: September 29, 2014 |

|

|

|

By: |

|

/s/ Matthew J. Pfeffer |

|

|

|

|

|

|

Name: Matthew J. Pfeffer |

|

|

|

|

|

|

Title: Corporate Vice President and Chief Financial Officer |

EXHIBITS

|

|

|

| Number |

|

Description |

|

|

| 99.1 |

|

Senior Secured Revolving Promissory Note, dated as of September 23, 2014, by and between MannKind Corporation and Aventisub LLC. |

|

|

| 99.2 |

|

Guaranty and Security Agreement dated as of September 23, 2014 among MannKind Corporation, MannKind LLC, and Aventisub LLC. |

Exhibit 99.1

Execution Version

SENIOR

SECURED REVOLVING PROMISSORY NOTE

FOR VALUE RECEIVED, and subject to the terms and conditions set forth herein, MannKind Corporation,

a Delaware corporation (the “Borrower”), hereby unconditionally promises to pay to Aventisub LLC, a Delaware limited liability company (the “Original Noteholder”), or its registered assigns (collectively, the

“Noteholder”, and together with the Borrower, the “Parties”), the principal amount of $175.0 million or, if less, the aggregate unpaid amount of all Advances (as defined below) the Noteholder has disbursed to the

Borrower pursuant to Section 2.2, in each case, together with all accrued interest thereon (including any such interest added to the principal amount), as provided in this Promissory Note (the “Note”).

1. Definitions. Capitalized terms used herein shall have the meanings set forth in this Section 1.

“Advance” means each disbursement made by the Noteholder to the Borrower pursuant to Section 2.2.

“Applicable Rate” means the rate equal to 8.5% per annum (or 2.0605% per quarter for purposes of calculating

the amount of accrued interest to be added to principal pursuant to Section 5.2).

“Borrower” has the

meaning set forth in the introductory paragraph.

“Borrowing Notice” has the meaning set forth in

Section 2.2.

“Business Day” means a day other than a Saturday, Sunday or other day on which commercial

banks in New York City and any country where a permitted assignee of the Noteholder is located, are authorized or required by law to close.

“Code” means the Internal Revenue Code of 1986, as amended.

“Collateral” has the meaning specified in the Security Agreement.

“Collateral Documents” means, collectively, the Security Agreement, each of the mortgages, security agreements, pledge

agreements or other similar agreements delivered pursuant to Sections 8.5 and 8.7 and each of the other agreements, instruments or documents that creates or purports to create a Lien or guarantee in favor of the Noteholder.

“Commitment Letter” means that certain Commitment Letter dated as of August 11, 2014 by and among the Borrower and

Hoechst GmbH.

“Commitment Period” means the period from the date hereof to the Maturity Date.

“Debt” means all (a) indebtedness for borrowed money;

(b) obligations for the deferred purchase price of property or services (other than trade payables, obligations in respect of benefit plans and employment and severance arrangements, and other deferred compensation obligations to employees and

directors arising in the ordinary course of business and not related to any financing) which in accordance with GAAP would be shown as a liability (or on the liability side of the balance sheet); (c) obligations evidenced by notes, bonds,

debentures or other similar instruments; (d) obligations as lessee under capital leases; (e) obligations in respect of any interest rate swaps, currency exchange agreements, commodity swaps, caps, collar agreements or similar arrangements

entered into by the Borrower providing for protection against fluctuations in interest rates, currency exchange rates or commodity prices or the exchange of nominal interest obligations, either generally or under specific contingencies;

(f) obligations under acceptance facilities and letters of credit (other than letters of credit supporting other Debt of the Borrower or any Guarantor which is otherwise permitted hereunder); (g) guaranties, endorsements (other than for

collection or deposit in the ordinary course of business), and other contingent obligations to purchase, to provide funds for payment, to supply funds to invest in any Person, or otherwise to assure a creditor against loss, in each case, in respect

of indebtedness set out in clauses (a) through (f) of a Person other than the Borrower; and (h) indebtedness set out in clauses (a) through (g) of any Person other than Borrower secured by any Lien on any asset of the

Borrower, whether or not such indebtedness has been assumed by the Borrower.

“Deerfield Facility” means that certain

Facility Agreement dated as of July 1, 2013 as amended February 28, 2014 and August 11, 2014, by and among MannKind and the purchasers party thereto (as may be further amended, restated, supplemented or otherwise modified from time to

time).

“Default” means any of the events specified in Section 10 which constitutes an Event of Default

or which, upon the giving of notice, the lapse of time, or both pursuant to Section 10 would, unless cured or waived, become an Event of Default.

“Default Rate” means, at any time, the Applicable Rate plus 2% per annum.

“Disbursement Date” has the meaning set forth in Section 2.1.

“Dollar” and “$” mean lawful money of the United States.

“Event of Default” has the meaning set forth in Section 10.

“Excluded Taxes” shall mean, with respect to any payment made by or on account of any obligation of any Borrower under this

Note or any of the Collateral Documents any of the following Taxes imposed on or with respect to any Person: (a) Taxes imposed on or measured by net income (however denominated), franchise Taxes, and branch profit Taxes, in each case imposed on

any Person as a result of a present or former connection between such Person and the jurisdiction of the Governmental Authority imposing such Tax or any political subdivision or taxing authority thereof or therein (other than connections arising

from such Person having

2

executed, delivered, performed its obligations under, received payments under, or enforced this Agreement or any of the Collateral Documents); (b) U.S. federal withholding Taxes to the

extent that the obligation to withhold amounts existed on the date that such Person became a party to this Agreement in the capacity under which such Person makes a claim for additional amounts under Section 6.1 in respect of Tax Deductions or

Section 6.7 or designates a new lending office (except to the extent the transferor to such Person (if any) was entitled, at the time the transfer to such Person became effective, to receive additional amounts under Section 6.1

or Section 6.7); (c) Taxes that are attributable to a failure to deliver the documentation required to be delivered pursuant to Section 6.6; and (d) any Tax imposed pursuant to FATCA.

“FATCA” means Sections 1471 through 1474 of the Code, as of the date of this Note (or any amended or successor version that

is substantively comparable and not materially more onerous to comply with), any current or future regulations or official interpretations thereof, any agreement entered into pursuant to Section 1471(b)(1) of the Code and any intergovernmental

agreement entered into with a Governmental Authority (or any regulatory legislation, rules or practices adopted pursuant to such agreement).

“GAAP” means generally accepted accounting principles in the United States of America as in effect from time to time.

“Governmental Authority” means the government of any nation or any political subdivision thereof, whether at the

national, state, territorial, provincial, municipal or any other level, and any agency, authority, instrumentality, regulatory body, court, central bank or other entity exercising executive, legislative, judicial, taxing, regulatory or

administrative powers or functions of, or pertaining to, government (including any supranational bodies such as the European Union or the European Central Bank).

“Guarantors” has the meaning specified in the Security Agreement.

“Interest Payment Date” means the last Business Day of each March, June, September and December commencing on the first

such date to occur after the execution of this Note.

“Law” as to any Person, means any law (including common law),

statute, ordinance, treaty, rule, regulation, policy or requirement of any Governmental Authority and authoritative interpretations thereon, whether now or hereafter in effect, in each case, applicable to or binding on such Person or any of its

properties or to which such Person or any of its properties is subject.

“License Agreement” means the License and

Collaboration Agreement dated as of August 11, 2014 by and among MannKind, Technosphere International C.V., a Dutch limited partnership, MannKind Netherlands B.V., a Dutch limited liability company, and Sanofi.

“Lien” means any mortgage, pledge, hypothecation, encumbrance, lien (statutory or other), charge or other security

interest.

3

“Loans” means the Advances and other extensions of credit hereunder,

including without limitation, pursuant to Section 5.2.

“Loss Amount” means MannKind’s Sharing

Percentage of any Losses (each as defined in Exhibit B of the License Agreement).

“MannKind” means MannKind Corporation,

a Delaware corporation.

“Material Adverse Effect” means a material adverse effect on (a) the business, assets,

properties, liabilities, operations or financial condition of the Borrower and its subsidiaries; (b) the validity or enforceability of the Note or the Collateral Documents; (c) the perfection or priority of any Lien purported to be created

under the Collateral Documents to the extent required under the Collateral Documents (except with respect to the perfection or priority of any Lien created pursuant to the Noteholder’s “control” thereof); (d) the rights or

remedies of the Noteholder hereunder or under the Collateral Documents; or (e) the Borrower’s ability to timely perform any of its obligations hereunder or under the Collateral Documents; provided, however, that none of the

following shall be deemed either alone or in combination to constitute, and none of the following shall be taken into account in determining whether there has been or would be a Material Adverse Effect: (A) any adverse effect that results

directly from general economic, business, financial or market conditions unrelated to the Borrower; and (B) any adverse effect arising directly from the industries or industry sectors in which the Borrower operates.

“Maturity Date” means the earlier of (a) September 23, 2024 and (b) the date on which all amounts under

this Note shall become due and payable pursuant to Section 11.

“Maximum Amount” means $175.0 million.

“Note” has the meaning set forth in the introductory paragraph.

“Noteholder” has the meaning set forth in the introductory paragraph.

“Order” as to any Person, means any order, decree, judgment, writ, injunction, settlement agreement, requirement or

determination of an arbitrator or a court or other Governmental Authority, in each case, applicable to or binding on such Person or any of its properties or to which such Person or any of its properties is subject.

“Original Noteholder” has the meaning set forth in the introductory paragraph.

“Parties” has the meaning set forth in the introductory paragraph.

“Person” means any individual, corporation, limited liability company, trust, joint venture, association, company,

limited or general partnership, unincorporated organization, Governmental Authority or other entity.

4

“Profit Amount” means MannKind’s Sharing Percentage of any Profits (each as

defined in Exhibit B of the License Agreement).

“Register” has the meaning set forth in Section12.8.

“Sanofi” means Sanofi-Aventis Deutschland GmbH, a company organized and existing under the laws of Germany.

“Security Agreement” means the Guaranty and Security Agreement, dated as of the date hereof, by and between the

Borrower, the Guarantors and Noteholder, as the same may be amended, restated, supplemented or otherwise modified from time to time in accordance with its terms.

“Specified Event of Default” means any Event of Default pursuant to Sections 10.1, 10.3(a) (with respect to

Sections 9.1 and 9.2 only), 10.4 (with respect to a breach by any Licensor or any MannKind Affiliate (each as defined in the License Agreement) of the non-compete obligations in Section 2.8(a) of the License Agreement only),

10.5 or 10.6.

“Tax Deduction” means a deduction or withholding for or on account of any Tax that is not an Excluded

Tax from a payment under the Note or the Collateral Documents.

“Taxes” means all present or future taxes, levies,

imposts, duties, deductions, withholdings (including backup withholding), assessments, fees or other charges imposed by any Governmental Authority, including any interest, additions to tax or penalties applicable thereto.

2. Loan Disbursement Mechanics.

2.1 Commitment. Subject to Section 2.2, the Noteholder shall make available to the Borrower one Advance (or, in the case of

a dispute relating to the amount of the Loss, multiple Advances) with respect to each Calendar Quarter (as defined in the License Agreement) in an aggregate amount not to exceed the Loss Amount for such Calendar Quarter and each such Advance shall

be made within 15 days of receipt by the Borrower of the Profit/Loss Statement (as defined in the License Agreement) for such Calendar Quarter in accordance with Exhibit B to the License Agreement (or, in the case of a dispute relating to the amount

of the Loss, within 15 days after resolution thereof) (each such date of an Advance, a “Disbursement Date”); provided that, (a) after giving effect to any such Advance, the aggregate outstanding amount of Loans shall not

exceed the Maximum Amount and (b) no Advances may be made after the occurrence or during the continuance of (x) an Event of Default hereunder, (y) a “Change of Control” under the License Agreement or (z) any “Event

of Default” under the Deerfield Facility that has resulted in the lenders thereunder commencing enforcement proceedings with respect to their rights thereunder.

2.2 Advances. As a condition to the disbursement of any Advance, the Borrower shall, at least three Business Days prior to the

requested Disbursement Date, deliver to the Noteholder a written notice (the “Borrowing Notice”) setting out (a) that no Event of Default has occurred and

5

is continuing; (b) the amount of the Advance; (c) the Disbursement Date; and (d) that no “Event of Default” under the Deerfield Facility that has resulted in the lenders

thereunder commencing enforcement proceedings with respect to their rights thereunder has occurred and is continuing. Each Borrowing Notice shall be deemed to repeat the Borrower’s representations and warranties in Section 7 as of

the date of such Borrowing Notice. Upon receipt of the Borrowing Notice, the Noteholder shall make available to the Borrower on the Disbursement Date the amount set out in the notice in immediately available funds. Subject to the terms and

conditions set forth herein, the Borrower may borrow, prepay and reborrow the Loans.

3. Final Payment Date; Optional Prepayments;

Mandatory Prepayments.

3.1 Final Payment Date. The aggregate unpaid principal amount of the Loans, all accrued and unpaid

interest and all other amounts payable under this Note shall be due and payable on the Maturity Date.

3.2 Optional Prepayment. The

Borrower may prepay the Loans in whole or in part at any time or from time to time without penalty or premium upon five Business Days’ prior written notice, by paying the principal amount to be prepaid together with accrued interest thereon to

the date of prepayment.

3.3 Mandatory Prepayment. In the event (x) and on each occasion that any Profit Amount is received by

the Borrower, the Borrower shall, within 30 days after such Profit Amount is received, prepay the Loans in an aggregate amount equal to 100% of such Profit Amount; provided that, the amount payable pursuant to this Section 3.3

shall be reduced by the aggregate amount of any optional prepayments made pursuant to Section 3.2 during the fiscal quarter of the Borrower most recently ended and (y) that any transaction contemplated by Section 5.9(d) of the

Security Agreement is consummated, the Borrower shall, with 5 Business Days after such transaction, prepay the Loans or reduce the commitments of the Noteholder to make Advances hereunder in an aggregate amount equal to 100% of the net cash proceeds

thereof.

4. Collateral Documents.

The Borrower’s performance of its obligations hereunder is secured by a security interest having the applicable priority as specified in

the Collateral Documents in the collateral specified therein.

5. Interest.

5.1 Interest Rate. Except as otherwise provided herein, the outstanding principal amount of all Loans made hereunder shall bear

interest at the Applicable Rate from the date such Loans were made (including when interest is added to the principal amount of the Loans pursuant to Section 5.2) until the Loans are paid in full, whether at maturity, upon acceleration,

by prepayment or otherwise.

6

5.2 Interest Payment Dates. On each Interest Payment Date, interest shall be paid-in-kind

by increasing the principal amount of the outstanding Loans on such date by an amount equal to the amount of interest for the applicable interest period (rounded to the nearest whole cent). Following an increase in the principal amount of the

outstanding Loans as a result of an interest payment, the Loans will bear interest on such increased principal amount from and after the date of such interest payment.

5.3 Default Interest. Upon the occurrence and during the continuance of any Event of Default pursuant to Sections 10.1 and 10.5,

interest will accrue at the Default Rate on any amount then outstanding from the date of such non-payment until such amount is paid in full and will be payable on demand.

5.4 Computation of Interest. All computations of interest shall be made on the basis of a year of 360 days (or a quarter of 90 days),

as the case may be, and the actual number of days elapsed (which shall not exceed 90 days for any period between Interest Payment Dates). Interest shall accrue on each Loan on the day on which such Loan is made (or deemed made pursuant to

Section 5.2), and shall not accrue on any Loan for the day on which it is paid.

5.5 Interest Rate Limitation. If at

any time and for any reason whatsoever, the interest rate payable on any Loan shall exceed the maximum rate of interest permitted to be charged by the Noteholder to the Borrower under applicable Law, such interest rate shall be reduced automatically

to the maximum rate of interest permitted to be charged under applicable Law.

6. Payment Mechanics.

6.1 Manner of Payments. All payments of interest and principal shall be made in lawful money of the United States of America no later

than 11:00 AM New York City time on the date on which such payment is due by wire transfer of immediately available funds to the Noteholder’s account at a bank specified by the Noteholder in writing to the Borrower from time to time. All

payments to be made by the Borrower hereunder and under the Collateral Documents shall be made (x) without condition or deduction for any counterclaim, defense, recoupment or setoff and (y) without deduction or withholding for any Taxes,

except as required by applicable Law; provided that if any applicable Law requires the deduction or withholding of any Tax for any such payment then Borrower shall be entitled to make such deduction or withholding, and if such Tax is not an Excluded

Tax, then the amount of the payment due from the Borrower shall be increased by an amount which (after making any Tax Deduction) leaves an amount equal to the payment which would have been due if no Tax Deduction had been required.

6.2 Application of Payments. All payments made hereunder shall be applied first to the payment of any fees or charges outstanding

hereunder, second to accrued interest, and third to the payment of the principal amount outstanding under the Note.

6.3 Business Day

Convention. Whenever any payment to be made hereunder shall be due on a day that is not a Business Day, such payment shall be made on the next succeeding Business

7

Day and such extension will not be taken into account in calculating the amount of interest payable under this Note; provided that, if such next succeeding Business Day would fall after

the Maturity Date, payment shall be made on the immediately preceding Business Day.

6.4 Evidence of Debt. The Noteholder is

authorized to record on the grid attached hereto as Exhibit A each Loan made to the Borrower and each payment or prepayment thereof. The entries made by the Noteholder shall, to the extent permitted by applicable Law, be prima facie evidence of the

existence and amounts of the obligations of the Borrower therein recorded; provided, however, that the failure of the Noteholder to record such payments or prepayments, or any inaccuracy therein, shall not in any manner affect the obligation

of the Borrower to repay (with applicable interest) the Loans in accordance with the terms of this Note.

6.5 Rescission of

Payments. If at any time any payment made by the Borrower under this Note is rescinded or must otherwise be restored or returned upon the insolvency, bankruptcy or reorganization of the Borrower or otherwise, the Borrower’s obligation to

make such payment shall be reinstated as though such payment had not been made.

6.6 Status of Noteholders. If any Noteholder is

entitled to an exemption from or reduction of withholding Tax with respect to payments made under this Note, it shall deliver to the Borrower and the Original Noteholder, at the time or times prescribed by applicable law and at any times reasonably

requested by the Borrower or the Original Noteholder, such properly completed and executed documentation prescribed by applicable Law or reasonably requested by the Borrower or the Original Noteholder as will permit such payments to be made without

withholding or at a reduced rate of withholding. In addition, the Noteholders, if reasonably requested by the Borrower or the Original Noteholder, shall deliver such other documentation prescribed by applicable Law or reasonably requested by the

Borrower or the Original Noteholder as will enable the Borrower or the Original Noteholder to determine whether or not the Noteholder is subject to backup withholding or information reporting requirements. Notwithstanding anything to the contrary in

the preceding two sentences, the completion, execution and submission of such documentation (other than a Form W-9 or Form W-8, as applicable, and documentation prescribed by FATCA) shall not be required if in the Noteholder’s reasonable

judgment such completion, execution or submission would subject the Noteholder to any material unreimbursed cost or expense or would materially prejudice the legal or commercial position of the Noteholder. In furtherance of the foregoing, on the

date hereof the Original Noteholder shall deliver to the Borrower duly completed and executed copies of IRS Form W-9 certifying that the Original Noteholder is a U.S. person exempt from U.S. federal backup withholding tax.

6.7 Tax Indemnity. The Borrower shall indemnify each Noteholder, within 10 days after demand therefor, for the full amount any Taxes,

other than Excluded Taxes (including any such non-Excluded Taxes imposed or asserted on or attributable to amounts payable under this Section), imposed on or with respect to any payment made by or on account of the Borrower under this Note or any

Collateral Document (including any payment made by the Guarantor) that are payable or paid by such Noteholder or required to be withheld or deducted from a payment to

8

such Noteholder and any reasonable expenses arising therefrom or with respect thereto (whether or not such non-Excluded Taxes were correctly or legally imposed or asserted by the relevant

Governmental Authority).

7. Representations and Warranties. The Borrower hereby represents and warrants to the Noteholder on

behalf of itself and the Guarantors on the date hereof and on the date of each Borrowing Notice as follows:

7.1 Existence; Compliance

With Laws. The Borrower and each Guarantor is (a) a corporation, limited liability company or limited partnership duly incorporated or formed, validly existing and in good standing under the laws of the state of its jurisdiction of

organization and has the requisite power and authority, and the legal right, to own, lease and operate its properties and assets and to conduct its business as it is now being conducted and (b) in compliance with all Laws and Orders, except as

would not reasonably be expected to result in a Material Adverse Effect.

7.2 Power and Authority. The Borrower and each Guarantor

has the power and authority, and the legal right, to execute and deliver this Note and each of the Collateral Documents and to perform its obligations hereunder and thereunder.

7.3 Authorization; Execution and Delivery. The execution and delivery of this Note and each of the Collateral Documents by the Borrower

and each Guarantor and the performance of their respective obligations hereunder and thereunder have been duly authorized by all necessary corporate, limited liability or limited partnership action in accordance with all applicable Laws. The

Borrower and each Guarantor has duly executed and delivered this Note and each of the Collateral Documents, as applicable.

7.4 No

Approvals. No consent or authorization of, filing with, notice to or other act by, or in respect of, any Governmental Authority or any other Person is required in order for the Borrower and each Guarantor to execute, deliver, or perform any of

its obligations under this Note or each of the Collateral Documents, except (x) such as have been obtained or made and are in full force and effect or (y) for filings, recordings or registrations contemplated by the Collateral Documents.

7.5 No Violations. The execution and delivery of this Note and each of the Collateral Documents and the consummation by the

Borrower and each Guarantor of the transactions contemplated hereby and thereby do not and will not (a) violate any provision of the Borrower’s organizational documents; or (b) constitute a default under any material agreement or

contract listed on the Borrower’s annual report on Form 10-K for the year ended December 31, 2013 or any subsequent quarterly reports on Form 10-Q filed prior to the date hereof, except in the case of clause (b) as would not

reasonably be expected to result in a Material Adverse Effect.

7.6 Enforceability. The Note and each of the Collateral Documents

is a valid, legal and binding obligation of the Borrower and each Guarantor, enforceable against the Borrower and

9

each Guarantor in accordance with its terms except as enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium or similar laws affecting the enforcement of

creditors’ rights generally and by general equitable principles (whether enforcement is sought by proceedings in equity or at law).

7.7 No Litigation. No action, suit, litigation, investigation or proceeding of, or before, any arbitrator or Governmental Authority is

pending or, to the knowledge of the Borrower, threatened by or against the Borrower, any Guarantor or any of their property or assets with respect to the Note, the Collateral Documents or any of the transactions contemplated hereby or thereby, which

litigation would reasonably be expected to have a Material Adverse Effect.

7.8 Payment of Taxes. The Borrower and each Guarantor

has filed all federal income and material state and local tax returns which were required to be filed by it prior to and as of the date of the Note. The Borrower and each Guarantor has paid all material taxes and assessments payable by the Borrower

and each Guarantor, to the extent that the same have become due and payable and before they became delinquent, except for any such taxes or assessments that are being contested in good faith by appropriate proceedings properly instituted and

diligently conducted. The Borrower and each Guarantor has not been informed in writing of any proposed material tax assessment against it or any of its properties for which adequate provision has not been made on its books.

7.9 No Defaults. There exists no default under the provisions of any instrument or agreement evidencing, governing or otherwise

relating to any material indebtedness that would reasonably be expected to have a Material Adverse Effect.

7.10 Collateral

Documents. Each of the Collateral Documents is effective to create in favor of the Noteholder for its benefit a legal, valid, and enforceable Lien on the Collateral as security for the Loan having the applicable priority as specified therein.

7.11 Solvency. (a) The fair value of the property of the Borrower and the Guarantors on a consolidated basis is greater than

the total amount of liabilities, including contingent liabilities, of the Borrower and the Guarantors on a consolidated basis, (b) the present fair saleable value of the Borrower and the Guarantors on a consolidated basis is not less than the

amount that will be required to pay their probable liability on their debts as they become absolute and matured, (c) the Borrower and the Guarantors on a consolidated basis does not intend to, and does not believe that it will, incur debts or

liabilities beyond their ability to pay such debts and liabilities as they mature and (d) the Borrower and the Guarantors on a consolidated basis is not engaged in a business or a transaction, and is not about to engage in a business or a

transaction, for which their property would constitute an unreasonably small capital.

10

8. Affirmative Covenants. Until all amounts outstanding in this Note have been paid in

full, the Borrower shall and shall cause each Guarantor to:

8.1 Maintenance of Existence. (a) Preserve, renew and maintain in

full force and effect its corporate or organizational existence and (b) take all reasonable action to maintain all rights, privileges and franchises necessary or desirable in the normal conduct of its business, except, in each case, where the

failure to do so would not reasonably be expected to have a Material Adverse Effect.

8.2 Compliance. Comply with (a) all of

the terms and provisions of its organizational documents; and (b) all Laws and Orders applicable to it and its business, except where the failure to do so would not reasonably be expected to have a Material Adverse Effect.

8.3 Payment Obligations. Pay, discharge or otherwise satisfy at or before maturity or before they become delinquent, as the case may

be, all its material obligations of whatever nature, except where the amount or validity thereof is currently being contested in good faith by appropriate proceedings, and reserves in conformity with GAAP with respect thereto have been provided on

its books or where the failure to so pay would not reasonably be expected to result in a Material Adverse Effect.

8.4 Notice of Events

of Default. As soon as possible and in any event within two Business Days after it becomes aware that (a) an “Event of Default” under the Deerfield Facility that has resulted in the lenders thereunder commencing enforcement

proceedings with respect to their rights thereunder has occurred, notify the Noteholder in writing of the nature and extent of such “Event of Default” and (b) a Default or an Event of Default has occurred, notify the Noteholder in

writing of the nature and extent of such Default or Event of Default and the action, if any, it has taken or proposes to take with respect to such Default or Event of Default.

8.5 Further Assurances. Maintain the security interest created by the Collateral Documents as a perfected security interest having at

least the priority described in the Security Agreement. Promptly execute and deliver such further instruments and do or cause to be done such further acts as may be reasonably necessary or advisable to carry out the intent and purposes of this Note

and each of the Collateral Documents.

8.6 Use of Proceeds. Use the proceeds of the Advances solely to fund MannKind’s Loss

Amount for the fiscal quarter most recently ended.

8.7 Post-Closing Obligations. On or prior to the date that is 90 days after the

date hereof, (x) use commercially reasonable efforts to obtain account control agreements with its depository banks in form and substance reasonably satisfactory to the Noteholder; provided that, a failure to obtain such account control

agreements shall not result in a Default provided the Borrower has used commercially reasonable efforts and (y) obtain a first priority mortgage on the real property and improvements thereon located at 28903 North Avenue Paine, Valencia,

California 91355, to be based on the mortgage on such property entered into in connection with the Deerfield Facility, with modifications as are necessary to reflect comments from counsel to the Noteholder; provided that, with respect to this

clause (y) only, such 90 day period may be extended to a later date as may be agreed by the Noteholder in its reasonable discretion.

11

9. Negative Covenants. Until all amounts outstanding under this Note have been paid in

full, the Borrower shall not and shall not permit each Guarantor to:

9.1 Indebtedness. Incur, create or assume any Debt, other

than (a) Debt existing or arising under this Note and any refinancing thereof; (b) the Deerfield Facility, Debt issued in exchange for, or the net proceeds of which are used to refinance, replace, defease or refund, the Deerfield Facility,

and Debt issued in replacement of any such Debt to the extent such Debt is converted into equity of the Borrower immediately upon such replacement being outstanding; provided that, the principal amount of such indebtedness does not exceed

$160.0 million; and (c) Debt defined as “Permitted Indebtedness” under the Deerfield Facility on the date hereof.

9.2

Liens. Incur, create, assume or suffer to exist any Lien on any of its property or assets, whether now owned or hereinafter acquired except for (a) Liens defined as “Permitted Liens” under the Deerfield Facility on the date

hereof; and (b) Liens created pursuant to the Collateral Documents.

9.3 Amendment of Organizational Documents. The Borrower

will not amend modify or waive its organizational documents in any manner materially adverse to the interest of the Noteholder.

10.

Events of Default. The occurrence and continuance of any of the following shall constitute an Event of Default hereunder:

10.1

Failure to Pay. The Borrower or any Guarantor fails to pay (a) any principal amount of the Loan when due or (b) interest or any other amount when due to the Noteholder hereunder and such failure continues for two days.

10.2 Breach of Representations and Warranties. Any representation or warranty made or deemed made by the Borrower or any Guarantor to

the Noteholder herein or in any of the Collateral Documents is incorrect in any material respect on the date as of which such representation or warranty was made or deemed made.

10.3 Breach of Covenants. The Borrower or any Guarantor fails to observe or perform (a) any covenant, condition or agreement

contained in Sections 8.1(a), 8.4, 8.6, 9.1 or 9.2 or (b) any other material covenant, obligation, condition or agreement contained in this Note or any of the Collateral Documents other than those specified in clause (a) and

Section 10.1 and such failure continues for 30 days following receipt of notice thereof from the Noteholder.

10.4 License

Agreement. Sanofi terminates the License Agreement as a result of a breach thereof by MannKind in accordance with Section 12.2 thereof.

10.5 Bankruptcy.

(a)

the Borrower or any Guarantor commences any case, proceeding or other action (i) under any existing or future Law relating to bankruptcy, insolvency, reorganization, or other

12

relief of debtors, seeking to have an order for relief entered with respect to it, or seeking to adjudicate it as bankrupt or insolvent, or seeking reorganization, arrangement, adjustment,

winding-up, liquidation, dissolution, composition or other relief with respect to it or its debts or (ii) seeking appointment of a receiver, trustee, custodian, conservator or other similar official for it or for all or any substantial part of

its assets, or the Borrower or any Guarantor makes a general assignment for the benefit of its creditors;

(b) there is commenced against

the Borrower or any Guarantor any case, proceeding or other action of a nature referred to in Section 10.5(a) above which (i) results in the entry of an order for relief or any such adjudication or appointment or (ii) remains

undismissed, undischarged or unbonded for a period of 60 days;

(c) there is commenced against the Borrower or any Guarantor any case,

proceeding or other action seeking issuance of a warrant of attachment, execution or similar process against all or any substantial part of its assets which results in the entry of an order for any such relief which has not been vacated, discharged,

or stayed or bonded pending appeal within 60 days from the entry thereof;

(d) the Borrower or any Guarantor takes any action in

furtherance of, or indicating its consent to, approval of, or acquiescence in, any of the acts set forth in Section 10.5(b) or 10.5(c) above; or

(e) the Borrower or any Guarantor is generally not, or shall be unable to, or admits in writing its inability to, pay its debts as they become

due.

10.6 Note; Collateral Documents. Any material provision of this Note or any Collateral Document shall for any reason cease to

be in full force and effect except as expressly permitted hereunder or thereunder, or the Borrower or any Guarantor shall so state in writing.

11. Remedies. Upon the occurrence of any (x) Specified Event of Default and at any time thereafter during the continuance of such

Specified Event of Default, the Noteholder may at its option, by written notice to the Borrower (a) terminate its commitment to make any Advances hereunder; (b) declare the entire principal amount of this Note, together with all accrued

interest thereon and all other amounts payable hereunder, immediately due and payable; and/or (c) exercise any or all of its rights, powers or remedies under the Collateral Documents or applicable Law; provided, however that, if an Event

of Default described in Section 10.5 shall occur, the principal of and accrued interest on the Loan shall become immediately due and payable without any notice, declaration or other act on the part of the Noteholder or (y) other

Event of Default, and at any time thereafter during the continuance of such Event of Default, the Noteholder may at its option, by written notice to the Borrower terminate its commitment to make any Advances hereunder.

13

12. Miscellaneous.

12.1 Notices.

(a) All

notices, requests or other communications required or permitted to be delivered hereunder shall be delivered in writing, in each case to the address specified below or to such other address as such Party may from time to time specify in writing in

compliance with this provision:

28903 North Avenue Paine

Valencia, California 91355

Attn: Matt Pfeffer

Telephone:

(661) 775-3300, Facsimile: (661) 775-2099

E-mail: mpfeffer@mannkindcorp.com

| |

(ii) |

If to the Noteholder: |

Aventisub LLC

3711 Kennett Pike, Suite 200

Greenville, DE 19807

Attn:

Joseph M. Palladino

Telephone: (302) 777-6340, Facsimile: (302) 777-7222

E-mail: joseph.palladino@sanof.com

(b) Notices if (i) mailed by certified or registered mail or sent by hand or overnight courier service shall be deemed to have been given

when received; (ii) sent by facsimile during the recipient’s normal business hours shall be deemed to have been given when sent (and if sent after normal business hours shall be deemed to have been given at the opening of the

recipient’s business on the next business day); and (iii) sent by e-mail shall be deemed received upon the sender’s receipt of an acknowledgment from the intended recipient (such as by the “return receipt requested”

function, as available, return e-mail or other written acknowledgment).

12.2 Expenses and Indemnification. The Borrower shall

reimburse the Noteholder on demand for all reasonable and documented out-of-pocket costs, expenses and fees (including reasonable expenses and fees of its external counsel) incurred by the Noteholder in connection with the enforcement of the

Noteholder’s rights hereunder and under the Collateral Documents or in any bankruptcy case or insolvency proceeding. The Borrower shall indemnify the Noteholder and each of Noteholder’s affiliates, partners, trustees, shareholders,

directors, officers, employees, advisors, representatives, agents, attorneys and controlling persons (each such person being called an “Indemnitee”) against, and hold each Indemnitee harmless from, any and all actions, suits,

proceedings (including any investigations or inquiries), claims, losses, damages, liabilities and

14

expenses, including the reasonable and documented fees, charges and disbursements of any counsel for any Indemnitee, brought or threatened by the Borrower, the Guarantors, any of their respective

affiliates or any other person or entity and which may be incurred by, asserted against or involve any Indemnitee arising out of, in connection with, or as a result of, (i) the execution or delivery of this Note and the Collateral Documents,

the performance by the parties hereto of their respective obligations under this Note or the Collateral Documents, the consummation of the transactions or any other transactions contemplated by this Note or the Collateral Documents or the use or

intended use of the proceeds of this Note or (ii) any actual or prospective claim, litigation, investigation or proceeding relating to any of the foregoing, whether based on contract, tort or any other theory and regardless of whether any

Indemnitee is a party thereto; provided that, such indemnity shall not, as to any Indemnitee, be available to the extent that such actions, suits, proceedings (including any investigations or inquiries), claims, losses, damages, liabilities

or expenses are determined by a court of competent jurisdiction by final and nonappealable judgment to have resulted directly and primarily from the gross negligence or willful misconduct of such Indemnitee. The obligations of Borrower under this

paragraph shall survive the payment in full of the Note.

12.3 Governing Law. This Note, the Collateral Documents and any claim,

controversy, dispute or cause of action (whether in contract or tort or otherwise) based upon, arising out of or relating to this Note, the Collateral Documents and the transactions contemplated hereby and thereby shall be governed by the laws of

the State of New York.

12.4 Submission to Jurisdiction.

(a) The Borrower hereby irrevocably and unconditionally (i) agrees that any legal action, suit or proceeding arising out of or relating

to this Note or the Collateral Documents shall be brought in the courts of the State of New York located in the Borough of Manhattan or of the United States of America for the Southern District of New York and (ii) submits to the exclusive

jurisdiction of any such court in any such action, suit or proceeding. Final judgment against the Borrower in any action, suit or proceeding shall be conclusive and may be enforced in any other jurisdiction by suit on the judgment.

(b) Nothing in this Section 12.4 shall affect the right of the Noteholder to (i) commence legal proceedings or otherwise sue

the Borrower in any other court having jurisdiction over the Borrower or (ii) serve process upon the Borrower in any manner authorized by the laws of any such jurisdiction.

12.5 Venue. The Borrower irrevocably and unconditionally waives, to the fullest extent permitted by applicable law, any objection that

it may now or hereafter have to the laying of venue of any action or proceeding arising out of or relating to this Note or the Collateral Documents in any court referred to in Section 12.4 and the defense of an inconvenient forum to the

maintenance of such action or proceeding in any such court.

15

12.6 Waiver of Jury Trial. EACH OF THE BORROWER AND THE NOTEHOLDER HEREBY IRREVOCABLY

WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN ANY LEGAL PROCEEDING DIRECTLY OR INDIRECTLY RELATING TO THIS NOTE, THE COLLATERAL DOCUMENTS OR THE TRANSACTIONS CONTEMPLATED HEREBY OR THEREBY

WHETHER BASED ON CONTRACT, TORT OR ANY OTHER THEORY.

12.7 Counterparts; Integration; Effectiveness. This Note, the Collateral

Documents and any amendments, waivers, consents or supplements hereto and thereto may be executed in counterparts, each of which shall constitute an original, but all taken together shall constitute a single contract. This Note and the Collateral

Documents constitutes the entire contract between the Parties and their respective affiliates with respect to the subject matter hereof and supersede all previous agreements and understandings, oral or written, with respect thereto, including,

without limitation, the Commitment Letter. Hoechst GmbH is fully released and discharged by the Borrower from any and all obligations under the Commitment Letter and all claims, demands, actions and causes of action arising out of or in relation to

the termination of the Commitment Letter. Delivery of an executed counterpart of a signature page to this Note or the Collateral Documents by facsimile or in electronic (i.e., “pdf” or “tif”) format shall be effective as delivery

of a manually executed counterpart of this Note or the Collateral Documents, as applicable.

12.8 Successors and Assigns.

(a) This Note may not be assigned or transferred by the Noteholder to any Person without the prior written consent of the Borrower;

provided that, the Noteholder may assign or transfer this Note to an Affiliate (as defined in the License Agreement) upon written notice to the Borrower so long as such Affiliate has the financial capability to fulfill the obligations of the

Noteholder contained herein (including the obligation to make the Loans under Sections 2 and 5); provided, further that, such assignment does not result in an increased cost to the Borrower under Section 6.7

or the last sentence of Section 6.1.

(b) The Original Noteholder, acting solely for this purpose as an agent of the Borrower,

shall maintain at its office in Delaware a register for the recordation of the names and addresses of the Noteholders, and the commitments of, and principal amounts (and stated interest) of the Loans owing to, the Noteholders pursuant to the terms

hereof from time to time (the “Register”). The entries in the Register shall be conclusive absent manifest error, and the Borrower and the Noteholders shall treat each Person whose name is recorded in the Register pursuant to the

terms hereof as a lender hereunder for all purposes of this Note. The Register shall be available for inspection by the Borrower and the Noteholder, at any reasonable time and from time to time upon reasonable prior notice. The obligations of

Borrower under this Agreement and the Collateral Documents are registered obligations and the right, title and interest of the Original Noteholder and its assignees in and to such obligations shall be transferable only upon notation of such transfer

in the Register. This Section 12.8 shall be construed so that such obligations are at all times maintained in “registered from” within the meaning of Sections 163(f), 871(h)(2) and 881(c)(2) of the Code and any related

regulations (and any other relevant or successor provisions of the Code or such regulations).

16

(c) The Borrower may not assign or transfer this Note or any of its rights hereunder without the

prior written consent of the Noteholder.

(d) This Note shall inure to the benefit of, and be binding upon, the Parties and their

permitted assigns.

12.9 Waiver of Notice. The Borrower hereby waives demand for payment, presentment for payment, protest, notice

of payment, notice of dishonor, notice of nonpayment, notice of acceleration of maturity and diligence in taking any action to collect sums owing hereunder.

12.10 Interpretation. For purposes of this Note (a) the words “include,” “includes” and “including”

shall be deemed to be followed by the words “without limitation”; (b) the word “or” is not exclusive; and (c) the words “herein,” “hereof,” “hereby,” “hereto” and

“hereunder” refer to this Note as a whole. The definitions given for any defined terms in this Note shall apply equally to both the singular and plural forms of the terms defined. Whenever the context may require, any pronoun shall include

the corresponding masculine, feminine and neuter forms. Unless the context otherwise requires, references herein: (x) to Schedules, Exhibits and Sections mean the Schedules, Exhibits and Sections of this Note; (y) to an agreement,

instrument or other document means such agreement, instrument or other document as amended, supplemented and modified from time to time to the extent permitted by the provisions thereof; and (z) to a statute means such statute as amended from

time to time and includes any successor legislation thereto and any regulations promulgated thereunder. This Note shall be construed without regard to any presumption or rule requiring construction or interpretation against the party drafting an

instrument or causing any instrument to be drafted.

12.11 Amendments and Waivers. No term of this Note may be waived, modified or

amended except by an instrument in writing signed by both of the parties hereto. Any waiver of the terms hereof shall be effective only in the specific instance and for the specific purpose given.

12.12 Headings. The headings of the various Sections and subsections herein are for reference only and shall not define, modify, expand

or limit any of the terms or provisions hereof.

12.13 No Waiver; Cumulative Remedies. No failure to exercise and no delay in

exercising on the part of the Noteholder, of any right, remedy, power or privilege hereunder shall operate as a waiver thereof; nor shall any single or partial exercise of any right, remedy, power or privilege hereunder preclude any other or further

exercise thereof or the exercise of any other right, remedy, power or privilege. The rights, remedies, powers and privileges herein provided are cumulative and not exclusive of any rights, remedies, powers and privileges provided by law.

12.14 Electronic Execution. The words “execution,” “signed,” “signature,” and words of similar import in

the Note shall be deemed to include electronic or digital signatures or the

17

keeping of records in electronic form, each of which shall be of the same effect, validity and enforceability as manually executed signatures or a paper-based recordkeeping system, as the case

may be, to the extent and as provided for under applicable law, including the Electronic Signatures in Global and National Commerce Act of 2000 (15 USC § 7001 et seq.), the Electronic Signatures and Records Act of 1999 (N.Y. State Tech. Law

§§ 301-309), or any other similar state laws based on the Uniform Electronic Transactions Act.

12.15 Severability. If

any term or provision of this Note or the Collateral Documents is invalid, illegal or unenforceable in any jurisdiction, such invalidity, illegality or unenforceability shall not affect any other term or provision of this Note or the Collateral

Documents or invalidate or render unenforceable such term or provision in any other jurisdiction. Upon such determination that any term or other provision is invalid, illegal or unenforceable, the parties hereto shall negotiate in good faith to

modify this Note so as to effect the original intent of the parties as closely as possible in a mutually acceptable manner in order that the transactions contemplated hereby be consummated as originally contemplated to the greatest extent possible.

THIS NOTE IS ISSUED WITH ORIGINAL ISSUE DISCOUNT (“OID”) FOR U.S. FEDERAL INCOME TAX PURPOSES. THE ISSUE PRICE, AMOUNT OF OID, ISSUE DATE AND

YIELD TO MATURITY WITH RESPECT TO THIS NOTE MAY BE OBTAINED BY WRITING TO THE BORROWER AT THE FOLLOWING ADDRESS: 28903 NORTH AVENUE PAINE, VALENCIA, CALIFORNIA 91355, ATTENTION: MATT PFEFFER, FAX NUMBER: (661) 775-2099.

[SIGNATURE PAGE FOLLOWS]

18

IN WITNESS WHEREOF, the Borrower has executed this Note as of September 23, 2014.

|

|

|

|

|

|

|

|

|

| MANNKIND CORPORATION |

|

|

| By |

|

/s/ Matthew J.

Pfeffer |

| Name: Matthew J. Pfeffer |

| Title: Chief Financial Officer |

|

|

|

| By its acceptance of this Note, the Noteholder acknowledges and agrees to be bound by the provisions of this Note. |

|

| AVENTISUB LLC |

|

|

| By |

|

/s/ Joseph M.

Palladino |

| Name: Joseph M. Palladino Title:

President |

[Signature Page to Promissory Note]

EXHIBIT A

LOANS AND PAYMENTS ON THE LOANS

|

|

|

|

|

|

|

|

|

| Date of Loan |

|

Amount of Loan |

|

Amount of Principal Paid |

|

Unpaid Principal

Amount of Note |

|

Name of Person Making the

Notation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit 99.2

EXECUTION VERSION

GUARANTY AND SECURITY AGREEMENT

among

MANNKIND

CORPORATION

and

THE OTHER PARTIES HERETO,

as Grantors and Guarantors,

and

AVENTISUB LLC,

as Secured Creditor

September 23, 2014

GUARANTY AND SECURITY AGREEMENT

THIS GUARANTY AND SECURITY AGREEMENT dated as of September 23, 2014 (this “Agreement”) is entered into among MANNKIND

CORPORATION, a Delaware corporation (“Borrower”), MANNKIND LLC, a Delaware limited liability company (“MLLC”), and each other Person signatory hereto as a Grantor (together with Borrower and MLLC and any other

Person that becomes a party hereto as provided herein, the “Grantors” and each, a “Grantor”) in favor of AVENTISUB LLC (“Secured Creditor”).

RECITALS

A.

Secured Creditor has agreed to extend credit to Borrower in the aggregate principal amount of up to $175,000,000 subject to the terms and conditions set forth in the Promissory Note (defined below). Borrower is affiliated with each other Grantor.

B. The Borrower and the Grantors are engaged in interrelated businesses, and each Grantor will derive substantial direct and indirect

benefit from extensions of credit under the Promissory Note.

D. It is a condition precedent to Secured Creditor’s obligation to

extend credit under the Promissory Note that the Grantors shall have executed and delivered this Agreement to Secured Creditor.

In

consideration of the premises and to induce Secured Creditor to enter into the Promissory Note and to induce Secured Creditor to extend credit thereunder, each Grantor hereby agrees with Secured Creditor as follows:

SECTION 1 DEFINITIONS.

1.1 Unless

otherwise defined herein, terms defined in the Promissory Note and used herein shall have the meanings given to them in the Promissory Note, and the following terms are used herein as defined in the UCC: Accounts, Certificated Security, Chattel

Paper, Commercial Tort Claims, Deposit Accounts, Documents, Electronic Chattel Paper, Equipment, Farm Products, General Intangibles, Goods, Health Care Insurance Receivables, Instruments, Inventory, Leases, Letter-of-Credit Rights, Money, Payment

Intangibles, Supporting Obligations, Tangible Chattel Paper.

1.2 When used herein the following terms shall have the following meanings:

“Agreement” has the meaning set forth in the preamble of this Agreement.

“Borrower Obligations” means all Obligations of the Borrower under the Promissory Note.

“Closing Date” means the date of this Agreement.

“Collateral” means any and all property or other assets, now existing or hereafter acquired or created, real or personal,

tangible or intangible, wherever located, and whether owned by, consigned to, or held by, or under the care, custody or control of Grantors (or any of them), including:

(a) money, cash, and cash equivalents;

(b) Accounts and all of each Grantor’s rights and benefits under the Accounts, including, but not limited to, each Grantor’s right

to receive payment in full of the obligations owing to such Grantor thereunder, whether now or hereafter existing, together with any and all guarantees, other Supporting Obligations and/or security therefore, as well as all of Grantors’ Books

and Records relating thereto;

- 2 -

(c) Deposit Accounts, other bank and deposit accounts (including any bank accounts maintained by

Grantors (or any of them)), and all sums on deposit in any of them, and any items in such accounts;

(d) Investment Property;

(e) Inventory (including the US Insulin Inventory), Equipment, Fixtures, and other Goods;

(f) Chattel Paper, Documents, and Instruments;

(g) letters of credit and Letter of Credit Rights;

(h) Supporting Obligations;

(i) Commercial Tort Claims and all other Identified Claims;

(j) books and records;

(k)

General Intangibles (including all Intellectual Property, claims, Payment Intangibles, contract rights, choses in action, and software);

(l) all of each Grantor’s other interests in property of every kind and description, and the products, profits, rents of, dividends or

distributions on, or accessions to such property; and

(m) all Proceeds (including insurance claims and insurance proceeds) of any of the

foregoing, regardless of whether the Collateral, or any of it, is property as to which the UCC provides the perfection of a security interest, and all rights and remedies applicable to such property.

Where the context requires, terms relating to the Collateral or any part thereof, when used in relation to a Grantor, shall refer to such Grantor’s

Collateral or the relevant part thereof. Notwithstanding the foregoing, “Collateral” shall not include Excluded Property.

“Control Agreement” means an agreement among a Grantor or any of its Subsidiaries, Secured Creditor and (i) a securities

intermediary with respect to securities, whether certificated or uncertificated, securities entitlements and other financial assets held in a securities account in the name of such Grantor, (ii) a futures commission merchant or clearing house,

as applicable, with respect to commodity accounts and commodity contracts held by such Grantor, or (iii) a bank with respect to a Deposit Account, whereby, among other things, the issuer, securities intermediary or futures commission merchant,

or bank limits any Lien that it may have in the applicable financial assets or Deposit Account in a manner reasonably satisfactory to Secured Creditor, acknowledges the Lien of Secured Creditor on such financial assets or Deposit Account, and agrees

to follow the instructions or entitlement orders of Secured Creditor without further consent by such Grantor.

“Deerfield

Lenders” means, collectively, Deerfield Private Design Fund II, L.P., Deerfield Private Design International II, L.P., and Horizon Santé FLML SÀRL.

“Deerfield Security Agreement” means that certain Guaranty and Security Agreement, dated as of July 1, 2013, by and

among Borrower, the Grantors and Guarantors party thereto, the purchasers party thereto and the milestone creditor party thereto, as amended, supplemented, restated or otherwise modified from time to time.

- 3 -

“Disclosure Letter” means that certain Disclosure Letter dated as of the date

hereof made by Borrower in favor of Secured Creditor.

“Excluded Accounts” shall mean (a) any Deposit Account of a

Grantor that is used by such Grantor solely as a payroll account for the employees of Borrower or its Subsidiaries or the funds in which consist solely of funds held by any Grantor in trust for any director, officer or employee of any Grantor or any

employee benefit plan maintained by any Grantor or funds representing deferred compensation for the directors and employees of any Grantor, (b) escrow accounts, Deposit Accounts and trust accounts, in each case either securing Permitted Liens

or otherwise entered into in the ordinary course of business and consistent with prudent business practice conduct where the applicable Grantor holds the funds exclusively for the benefit of an unaffiliated third party, (c) accounts that are

swept to a zero balance on a daily basis to a Deposit Account that is subject to a Control Agreement, and (d) Deposit Accounts and securities accounts held in jurisdictions outside the United States.

“Excluded Property” means, collectively, (a) any permit, license or agreement entered into by any Grantor (i) to

the extent that any such permit, license or agreement or any requirement of law applicable thereto prohibits the creation of a Lien thereon, but only to the extent, and for as long as, such prohibition is not terminated or rendered unenforceable or

otherwise deemed ineffective by the UCC or any other requirement of law, (ii) which would be abandoned, invalidated or unenforceable as a result of the creation of a Lien in favor of Secured Creditor or (iii) to the extent that the

creation of a Lien in favor of Secured Creditor would result in a breach or termination pursuant to the terms of or a default under any such permit, license or agreement (other than to the extent that any such term would be rendered ineffective

pursuant to the Sections 9-406, 9-407, 9-408 or 9-409 of the UCC or any other applicable law (including the Bankruptcy Code) or principles of equity), (b) property owned by any Grantor that is subject to a purchase money Lien or a capital lease

permitted under the Promissory Note if the agreement pursuant to which such Lien is granted (or in the document providing for such capital lease) prohibits or requires the consent of any Person other than a Grantor and its Affiliates which has not

been obtained as a condition to the creation of any other Lien on such property, (c) any “intent to use” trademark applications for which a statement of use has not been filed (but only until such statement is filed), (d) Insulin

Inventory (other than the US Insulin Inventory), (e) the Oncology Assets and any equity interests in any Oncology Subsidiary, (f) equity interests in joint ventures or any non-Wholly Owned Subsidiaries to the extent not permitted by the

terms of such entity’s Organization Documents or joint venture documents, (g) voting equity interests in a Foreign Subsidiary or Foreign Subsidiary Holding Company (each as defined in the Deerfield Facility) that is not a Grantor, in

excess of 65% of the total voting equity interests in such Subsidiary, to the extent the pledge thereof would result in material adverse Tax consequences to Borrower and its Subsidiaries as determined in good faith by Borrower, (h) any assets

(including intangibles) not located in the United States to the extent the grant of a security interest therein is restricted or prohibited by applicable law or contract (after giving effect to applicable anti-assignment provisions of the UCC or

other applicable law), (i) any property and assets subject to Permitted Liens (as defined in the Deerfield Facility on the date hereof) securing debt permitted by clause (xiv) of the definition of Permitted Indebtedness (as defined in the

Deerfield Facility on the date hereof), and (j) motor vehicles and other assets subject to certificates of title; provided, however, “Excluded Property” shall not include any proceeds, products, substitutions or

replacements of Excluded Property (unless such proceeds, products, substitutions or replacements would otherwise constitute Excluded Property).

“Grantor” has the meaning set forth in the preamble of this Agreement.

- 4 -

“Guarantor Obligations” means, collectively, with respect to each Guarantor, all

obligations and liabilities of such Guarantor to Secured Creditor under this Agreement.

“Guarantors” means the

collective reference to each Grantor (other than Borrower) and “Guarantor” means any of them.

“Identified

Claims” means the Commercial Tort Claims described on Schedule G of the Disclosure Letter as such schedule shall be supplemented from time to time in accordance with the terms and conditions of this Agreement.

“Insulin Inventory” means any insulin owned by Borrower and its Subsidiaries from time to time and any contractual rights and

obligations pursuant to which Borrower purchases or has purchased insulin from time to time, including without limitation, the agreements set forth on Schedule H of the Disclosure Letter.

“Intellectual Property” means (i) all patents, patent applications, patent disclosures and inventions (whether

patentable or unpatentable and whether or not reduced to practice, (ii) all trademarks, service marks, trade dress, trade names, slogans, logos, and corporate names and Internet domain names, together with all of the goodwill associated with

each of the foregoing, (iii) copyrights, copyrightable works, and licenses, (iv) registrations and applications for registration for any of the foregoing, (v) computer software (including but not limited to source code and object

code), data, databases, and documentation thereof, (vi) trade secrets and other confidential information, (vii) other intellectual property, and (viii) copies and tangible embodiments of the foregoing (in whatever form and medium).

“Intercreditor Agreement” means that certain Intercreditor Agreement, dated as of the Closing Date, by and among Secured

Creditor and the Deerfield Lenders, as amended, supplemented, restated or otherwise modified from time to time.

“Investment

Property” means the collective reference to (a) all “investment property” as such term is defined in Section 9-102(a)(49) of the UCC, (b) all “financial assets” as such term is defined in

Section 8-102(a)(9) of the UCC, and (b) whether or not constituting “investment property” as so defined, all Pledged Notes and all Pledged Equity.

“Issuers” means the collective reference to each issuer of any Investment Property.

“Lien” means any mortgage, deed of trust, pledge, hypothecation, assignment, charge, deposit arrangement, encumbrance,

easement, lien (statutory or otherwise), security interest or other security arrangement and any other preference, priority or preferential arrangement of any kind or nature whatsoever, including any conditional sale contract or other title

retention agreement.

“Loan Documents” mean the Promissory Note and the Collateral Documents.

“Obligations” means all advances to, and debts, liabilities, obligations, covenants and duties of, the Borrower arising under

any Loan Document or otherwise with respect to the Loan, whether direct or indirect (including those acquired by assumption), absolute or contingent, due or to become due, now existing or hereafter arising and including interest and fees that accrue

after the commencement by or against the Borrower of any case, proceeding or other action relating to bankruptcy, insolvency, reorganization, or other relief of debtors, naming the Borrower as the debtor in such proceeding, regardless of whether

such interest and fees are allowed claims in such proceeding. Without limiting the foregoing, the Obligations include (a) the obligation to pay principal, interest, charges, expenses, fees, indemnities and other amounts payable by the Borrower

under any Loan Document and (b) the obligation of the Borrower to reimburse any amount in respect of any of the foregoing that the Noteholder, in its sole discretion, may elect to pay or advance on behalf of the Borrower.

- 5 -

“Oncology Assets” means any Intellectual Property and other assets related to

Borrower’s oncology programs, including without limitation, the patents and trademarks set forth on Schedule I of the Disclosure Letter and any licenses relating to the foregoing.

“Paid in Full” means with respect to Secured Creditor (a) all Secured Obligations to Secured Creditor (other than