UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) September 18, 2014

| ROADSHIPS HOLDINGS, INC. |

| (Exact name of registrant as specified in its charter) |

|

Delaware

|

|

333-141907

|

|

20-5034780

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

134 Vintage Park Blvd., Suite A-183, Houston TX

|

|

77070

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.01 Entry into a Material Definitive Agreement

On September 18, 2014, the Registrant’s wholly-owned subsidiary, Roadships Acquisitions Australia Pty Ltd. (the “Subsidiary”), entered into a written agreement with Luke Kestle, as trustee for Luke Kestle Family Trust (the “Vendor”), to acquire from the Vendor a self-contained software program by the name of PEOBI that is designed for download to mobile devices and is intended to expedite the paperless exchange of business contacts (the “Asset Acquisition”).

Under the terms of the Asset Acquisition, the Vendor agrees to accept 120,000,000 shares of the common stock of the Registrant at a deemed price of $0.0002 per share as the only consideration payable for PEOBI (the “Shares”). On September 29, 2014, the Shares were transferred to Vendor on behalf of the Registrant by Tamara Nugent, as trustee for Twenty Second Trust, an affiliate of the Registrant.

On September 29, 2014, the Registrant issued Twenty Second Trust an unsecured promissory note for $24,000 in consideration of the transfer of the Shares (the “Note”). The Note is payable on demand and does not accrue interest.

Tamara Nugent is the wife of Micheal Nugent, President, CEO, CFO and a director of the Registrant. Micheal Nugent was the trustee of Twenty Second Trust until January 15, 2014. Except as otherwise provided in this paragraph, there was no material relationship between the Vendor, Tamara Nugent, Twenty Second Trust, the Registrant and its subsidiaries, or any of the directors or officers of the Registrant or its subsidiaries, or associates of any such directors or officers prior to the Asset Acquisition.

The Registrant’s board of directors approved the Asset Acquisition and the Note after determining each was fair to and in the best interests of the Registrant.

The description of the terms of the Asset Acquisition set forth herein does not purport to be complete and is qualified in its entirety by reference to the terms of the Technology Assignment Agreement, which is filed as Exhibit 10.1 to this Current Report.

The description of the terms of the Note set forth herein does not purport to be complete and is qualified in its entirety by reference to the terms of the Technology Assignment Agreement, which is filed as Exhibit 10.2 to this Current Report.

This document is not intended to provide any other factual information about the Registrant. Such information can be found in other public filings the Registrant makes with the Securities and Exchange Commission (the “SEC”), which are available without charge at www.sec.gov.

Item 2.01 Completion of Acquisition or Disposition of Assets

On September 18, 2014, the Subsidiary acquired a self-contained software program by the name of PEOBI that is designed for download to mobile devices and is intended to expedite the paperless exchange of business contacts. Reference is made to the disclosure set forth under Item 1.01 of this Report, which disclosure is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure

On September 29, 2014, the Registrant issued a press release advising that it acquired software and architecture for a mobile app that is intended to expedite the paperless exchange of business information. A copy of the press release is attached as Exhibit 99.1 and is incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information in the press release attached as Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

|

10.1

|

Technology Assignment Agreement dated September 18, 2014, between Luke Kestle as Trustee for Luke Kestle Family Trust, and Roadships Acquistions Australia Pty Ltd.

|

| |

|

|

10.2

|

Promissory Note dated September 29, 2014.

|

| |

|

|

99.1

|

Press release of Roadships Holdings Inc., dated September 29, 2014.

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ROADSHIPS HOLDINGS INC. |

|

| |

|

|

|

|

Date: September 29, 2014

|

By:

|

/s/ Micheal P. Nugent |

|

| |

|

Micheal P. Nugent

|

|

| |

|

President & CEO |

|

4

EXHIBIT 10.1

Technology Assignment Agreement

THIS AGREEMENT made the 18th day of September, 2014, between LUKE KESTLE as trustee for LUKE KESTLE FAMILY TRUST, a Trust organized in the state of Queensland, Australia (the “Vendor”) and ROADSHIPS ACQUISTIONS AUSTRALIA PTY LTD, a corporation incorporated under the laws of the State New South Wales, Australia (the “Purchaser”).

WHEREAS:

A. the Vendor is the owner and creator of PEOBI, a self-contained software program that is designed for download to mobile devices and is intended to expedite the paperless exchange of business contacts (“PEOBI”);

B. the Vendor has agreed to sell to the Purchaser and the Purchaser has agreed to purchase from the Vendor substantially all the assets, property and undertakings of and pertaining to the software program, upon and subject to the terms and conditions of this Agreement; and

C. the Payee, as the major shareholder in Roadships Holdings Inc., the parent Purchaser of the Purchaser, has agreed to transfer common shares in Roadships Holdings Inc., (the “consideration shares”) to the Purchaser and the Purchaser has agreed to accept common shares in Roadships Holdings Inc. from the Payee for all the assets, property and undertakings of and pertaining to the software program, upon and subject to the terms and conditions of this Agreement.

NOW THEREFORE, in consideration of the premises and mutual agreements contained in this Agreement and of other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by each Party, the Parties agree with one another as follows:

1. Assignment. Developer hereby assigns to the Purchaser exclusively throughout the world all right, title and interest (choate or inchoate) in the following:

(a) all past, present and future versions of PEOBI (regardless of the form in which it exists or the media upon which it resides), including but not limited to the source code version thereof and all patent rights, copyrights, trade secret rights and other proprietary rights in and thereto, all precursors, portions and work in progress with respect thereto and all inventions, works of authorship, mask works, technology, information, know-how, materials and tools relating thereto or to the development, support or maintenance thereof ("Technology"); and

(b) all copyrights, patent rights, trade secret rights, trademark rights, mask works rights and all other intellectual property rights of any sort and all business, contract rights, causes of action and goodwill in, incorporated or embodied in, used to develop, or related to any of the foregoing (the "Intellectual Property”).

2. Consideration. Vendor shall accept 120,000,000 shares of the common capital stock of Roadships Holdings, Inc., a Nevada corporation, at the deemed price of $0.0002 per share, on the date of this Agreement as the only consideration required or payable with respect to the Intellectual Property, including without limitation the Technology.

3. Further Assurances; Moral Rights; Competition; Marketing

(1) Developer shall assist the Purchaser in every legal way to evidence, record and perfect the assignment in Section 1 of this Agreement and to apply for and obtain recordation of and from time to time enforce, maintain and defend all rights, titles and interests assigned under this Agreement. If the Purchaser is unable for any reason whatsoever to secure the Developer's signature to any document it is entitled to under this Section 3(1), Developer irrevocably designates and appoints the Purchaser and its duly authorized officers and agents, as his agents and attorneys-in-fact with full power of substitution to act for and on his behalf and instead of Developer, to execute and file any such document or documents and to do all other lawfully permitted acts to further the purposes of the foregoing with the same legal force and effect as if executed by Developer.

(2) To the extent allowed by law, the Intellectual Property includes all rights of paternity, integrity, disclosure and withdrawal and any other rights that may be known as or referred to as "moral rights", "artist's rights", "droit moral" or the like (collectively "Moral Rights"). To the extent Developer retains any such Moral Rights under applicable law, Developer ratifies and consents to, and provides all necessary ratifications and consents to, any action that may be taken with respect to such Moral Rights by or authorized by Purchaser; Developer shall not assert any Moral Rights with respect thereto. Developer will confirm any such ratifications, consents and agreements from time to time as requested by Purchaser.

4. Confidential Information. Developer will not use or disclose anything assigned to the Purchaser under this Agreement or any other technical or business information or plans of the Purchaser, except to the extent Developer can document that it is generally available (through no fault of Developer) for use and disclosure by the public without any charge, licence or restriction. Developer recognizes and agrees that there is no adequate remedy at law for a breach of this Section 4, that such a breach would irreparably harm the Purchaser and that the Purchaser is entitled to equitable relief (including, without limitations, injunctions) with respect to any such breach or potential breach in addition to any other remedies.

5. Warranty. Developer represents and warrants to the Purchaser that the Developer: (a) was the sole owner (other than the Purchaser) of all rights, title and interest in the Intellectual Property and the Technology, (b) has not assigned, transferred, licensed, pledged or otherwise encumbered any Intellectual Property or the Technology or agreed to do so, (c) has full power and authority to enter into this Agreement and to make the assignment in Section 1 of this Agreement, (d) is not aware of any violation, infringement or misappropriation of any third party's rights (or any claim thereof) by the Intellectual Property or the Technology, (e) was not acting within the scope of employment by any third party when conceiving, creating or otherwise performing any activity with respect to anything purportedly assigned in Section 1 of this Agreement; and (f) is not aware of any questions or challenges with respect to the patentability or validity of any claims of any existing patents or patent applications relating to the Intellectual Property.

6. Miscellaneous.

(1) This Agreement is not assignable or transferable by Developer without the prior written consent of the Purchaser; any attempt to do so shall be void.

(2) Any notice, report, approval or consent required or permitted under this Agreement shall be in writing and will be deemed to have been duly given if delivered personally or mailed by first-class, registered or certified mail, postage prepaid to the respective addresses of the parties as set out below (or such other address as a party may designate by ten days’ notice):

If to Vendor:

Luke Kestle

92 Mortensen Road, Nerang, Queensland, Australia 4211

If to Purchaser:

Roadships Acquistions Australia Pty Ltd

Att; Ashley Nugent

2/5 Glenelg Avenue, Mermaid Beach, Queensland Australia 4218

(3) No failure to exercise, and no delay in exercising, on the part of either party, any privilege, any power or any rights under this Agreement will operate as a waiver thereof, nor will any single or partial exercise of any right or power preclude further exercise of any other right under this Agreement.

(4) If any provision of this Agreement shall be adjudged by any court of competent jurisdiction to be unenforceable or invalid, that provision shall be limited or eliminated to the minimum extent necessary so that this Agreement shall otherwise remain in full force and effect and enforceable.

(5) This Agreement shall be deemed to have been made in, and shall be construed pursuant to the laws of the State of Queensland, Australia without regard to conflicts of law provisions thereof.

(6) The prevailing party in any action to enforce this Agreement shall be entitled to recover costs and expenses including, without limitation, attorneys' fees.

(7) The terms of this Agreement are confidential to the Purchaser and no press release or other written or oral disclosure of any nature regarding the compensation terms of this Agreement shall be made by Developer without the Purchaser's prior written approval; however, approval for such disclosure shall be deemed given to the extent such disclosure is required to comply with governmental rules.

(8) Any waivers or amendments shall be effective only if made in writing and signed by a representative of the respective parties authorized to bind the parties.

(9) Both parties agree that this Agreement is the complete and exclusive statement of the mutual understanding of the parties and supersedes and cancels all previous written and oral agreements and communications relating to the subject-matter of this Agreement.

IN WITNESS WHEREOF, the parties have executed this Agreement on the day and year first indicated above.

|

|

By:

|

/s/ Luke Kestle |

|

| |

|

Luke Kestle |

|

| |

|

as Trustee for Luke Kestle Family Trust |

|

| |

|

|

|

| |

|

|

| |

ROADSHIPS ACQUISTIONS AUSTRALIA PTY LTD. |

|

| |

|

|

|

| |

By: |

/s/ Ashley Nugent |

|

| |

|

Ashely Nugent |

|

| |

|

Director |

|

3

EXHIBIT 10.2

Promissory Note

| USD $24,000.00 |

Due: ON DEMAND |

FOR VALUE RECEIVED, the undersigned corporation, Roadships Holdings Inc., a company existing under the laws of the State of Delaware (the “Borrower”), hereby acknowledges itself indebted to Tamara Nugent, as trustee for Twenty Second Trust (the “Lender”) and promises to pay to or to the order of the Lender at 38012 80th Avenue East, Eatonville, Washington 98328, or as otherwise directed in writing by the Lender, the principal sum of $24,000 in lawful money of the United States of America with no interest thereon.

The entire principal sum and all interest accrued thereon shall be paid on demand by the Lender.

The Borrower may pay the principal sum at any time without penalty.

The Lender may assign all of its right, title and interest in, to and under this promissory note. All payments required to be made hereunder shall be made by the Borrower without any right of set-off or counterclaim.

DATED: September 29, 2014

|

|

|

|

| |

|

Micheal Nugent |

|

| |

|

President |

|

PAID IN FULL on _____________________________20__.

per: ___________________________________________

EXHIBIT 99.1

ROADSHIPS HOLDINGS ACQUIRES PEOBI

TO ADD COMMUNICATIONS EFFICIENCY

Roadships Holdings, Inc. (OTC-PINK: RDSH) today announced that it has acquired the software and architecture for a mobile app that expedites the paperless exchange of business information (“PEOBI”). Created by Luke Kestle, PEOBI is in the final stages of development and has not yet been commercially distributed.

Roadships has established a dedicated IT department office at Mermaid Beach, Gold Coast, Australia and has recruited a number of Bond University graduating students to work with Mr. Kestle to complete development of PEOBI.

The transport industry is heavily reliant on the efficient flow of paperwork and communications, with a number of companies having already either adopted the use of apps or developed their own. Roadships intends to utilize PEOBI specifically for the transport industry to more efficiently facilitate the exchange of its business information.

“We have been following other local and international transport operations and seen how they have aggressively positioned IT as part of their core business operations,” said Micheal Nugent, CEO of Roadships. “The acquisition of PEOBI is a first step for us to address this in our business.”

# # #

About Roadships Holdings Inc.

Roadships Holdings, Inc. (OTC-PINK: RDSH) is an emerging growth company in the short-sea and ground freight industry sectors operating through its wholly owned subsidiaries in the United States and Australia.

Safe Harbor Statement

Statements made in this press release are forward-looking and are made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995. Risk factors that could cause actual results to differ materially from those projected in forward-looking statements include, but are not limited to, general business conditions, managing growth, and political and other business risks. All forward-looking statements are expressly qualified in their entirety by this paragraph and the risks and other factors detailed in Roadships’s reports filed with the Securities and Exchange Commission. Roadships undertakes no duty to update these forward-looking statements.

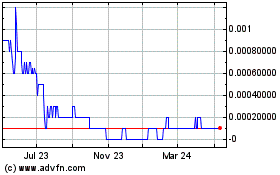

Tautachrome (CE) (USOTC:TTCM)

Historical Stock Chart

From Mar 2024 to Apr 2024

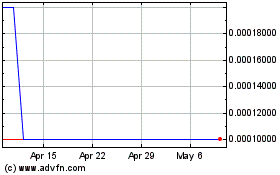

Tautachrome (CE) (USOTC:TTCM)

Historical Stock Chart

From Apr 2023 to Apr 2024