Current Report Filing (8-k)

September 25 2014 - 5:12PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

September 19, 2014

(Date of earliest event reported)

Legend Oil and Gas, Ltd.

(Exact Name of Registrant as Specified in Charter)

|

Colorado

(State or Other Jurisdiction of Incorporation)

|

000-49752

(Commission File Number)

|

84-1570556

(IRS Employer Identification No.)

|

|

555 Northpoint Center East, Suite 400

Alpharetta, GA

(Address of Principal Executive Offices)

|

30022

Zip Code

|

|

(678) 595-6243

(Registrant’s telephone number, including area code)

(Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.03 Bankruptcy or Receivership

On September 19, 2014, the Company’s wholly-owned Canadian subsidiary, Legend Energy Canada, Ltd., filed an Assignment for the General Benefit of Creditors in the Court of Queen’s Bench in Bankruptcy and Insolvency, Province of Alberta, Canada, for relief under the Bankruptcy and Insolvency Act of Canada. KPMG Inc. is the Trustee.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Legend Oil and Gas, Ltd.

|

|

| |

|

|

|

| |

|

|

|

|

Date: September 25, 2014

|

By:

|

/s/ Warren S. Binderman

|

|

| |

Warren S. Binderman

|

|

| |

Chief Financial Officer

|

|

Exhibit 2.1

Division No.

Court No.

Estate No.

ASSIGNMENT FOR THE GENAL BENEFIT OF CREDITORS

This indenture made this 17th day of September , 2014

Between

Legend Energy Canada Ltd.

hereinafter called “the debtor”

and

KPMG Inc.

hereinafter called “the trustee”.

WHEREAS the debtor is insolvent and desires to assign and to abandon all its property for distribution among its creditors in pursuance of the Bankruptcy and Insolvency Act (the “Act”),

THIS INDENTURE WITNESSETH that the debtor does hereby assign to the trustee, all the debtor’s property, for the uses, intents and purposes provided by the Act.

SIGNED at the City of Valley City, in the State of California, in the presence of

Niky Lovejoy

(Print name of witness) Notary Stamp

DATED: September 17, 2014

LEGEND ENERGY CANADA LTD.

Per: /s/

(Marshall Diamond-Goldberg)

/s/

Signature of witness

| |

Registry No.:

ALBERTA

COURT OF QUEEN’S BENCH

IN BANKRUPTCY AND INSOLVENCY

IN THE MATTER OF THE BANKRUPTCY

OF LEGEND ENERGY CANADA LTD., OF

THE ______________ OF

_____________, IN THE PROVINCE OF

ALBERTA

ASSIGNMENT FOR THE GENERAL

BENEFIT OF CREDITORS

KPMG INC.

TRUSTEE

Bow Valley Square II

205-5th Avenue SW

Suite 2700

Calgary AB, T2P 4B9

|

Exhibit 99.1

LEGEND OIL AND GAS LTD. (LOGL) Announces its Assignment of Legend Energy Canada, Ltd. (Its Wholly Owned Subsidiary) into Canadian Bankruptcy Courts

Alpharetta, Georgia. – September 25, 2014 - Legend Oil and Gas Ltd. (OTC Markets: LOGL) (“Legend”, the “Company”) announced that on September 19, 2014, Legend Oil and Gas, Ltd. (the "Company" or "Legend") has placed its wholly owned subsidiary, Legend Energy Canada, Ltd. (a Canadian company, "LEC"), into an Assignment for the General Benefit of Creditors in the Court of Queen’s Bench in Bankruptcy and Insolvency, Province of Alberta, Canada, for relief under the Bankruptcy and Insolvency Act of Canada. It has named KPMG, Inc. of Canada as the Trustee.

"We have proceeded in a strategic manner to place LEC into bankruptcy. LEC’s assets historically did not produce the operating or financial results that Legend’s prior management team had anticipated, which significantly encumbered both LEC and Legend, as LEC’s parent company. Further, the majority of the assets were taken into receivership by the National Bank of Canada in April of 2014, leaving the balance sheet at LEC with essentially nothing but liabilities." stated Chief Financial Officer, Warren Binderman. "The process we followed to place LEC into bankruptcy commenced , with Legend negotiating and obtaining a full release earlier this quarter, of all Legend’s obligations under certain bank debt LEC incurred with the National Bank of Canada (“NBC”). This full release gives Legend the flexibility and ability to move forward, unencumbered by these obligations which had been hanging over our heads, and limiting our ability to obtain further funding to enhance operations."

Further, Binderman states, "while it is unfortunate to place any entity into bankruptcy, we firmly believe this action is in the best interest of our shareholders and many stakeholders. We are now fully able to clean up our balance sheet by writing off LEC’s liabilities from the consolidated financial statements, which will result in a gain on debt forgiveness during the third quarter of 2014.”

Andrew Reckles, Chief Restructuring Officer notes "over the past several months we have seen the results of our drilling programs come to fruition. The LEC bankruptcy accomplishes many things for Legend, foremost among them is unencumbering the Company from an albatross that has been hanging around our necks for some time, limiting certain potential credit facilities and capital providers from working with us, and allowing us to seek and implement more traditional, lower cost financing solutions for our continuing growth plans in Kansas and other areas in the mid-continent. This step firmly allows us to move forward with our restructuring in an efficient and streamlined way to positively benefit the shareholders and stakeholders of Legend."

Reckles continued "Marshall Diamond-Goldberg, our current CEO, has been on the ground, in Kansas, ensuring our drilling program continues to produce the results needed, and we have seen the fruits of that labor. In June, at the beginning of the restructuring total combined production at Legend was approximately 8 BOPD, but as of the end of September Legend has combined total daily production of over five times that number, and growing. His contributions to this effort have been immeasurable."

Binderman stated "this puts closure to a matter that has been hindering our go-forward abilities, and the entire executive team are quite happy to have transitioned LEC out of the Company and into the capable hands of KPMG, Inc. as Trustee."

About Legend Oil and Gas Ltd.

Legend Oil and Gas Ltd. is a managed risk, oil and gas exploration/exploitation, development and production company with activities currently focused on leases in southeastern Kansas.

Investor Contact: Warren S. Binderman, 678-595-6243

Forward-looking Statements:

This press release contains forward-looking statements concerning future events and the Company’s growth and business strategy. Words such as “expects,” “will,” “intends,” “plans,” “believes,” “anticipates,” “hopes,” “estimates,” and variations on such words and similar expressions are intended to identify forward-looking statements. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. Forward looking statements in this press release include statements about our drilling development program. These statements involve known and unknown risks and are based upon a number of assumptions and estimates that are inherently subject to significant uncertainties and contingencies, many of which are beyond the control of the Company. Actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, the timing and results of our 2014 drilling and development plan. Additional factors include increased expenses or unanticipated difficulties in drilling wells, actual production being less than our development tests, changes in the Company’s business; competitive factors in the market(s) in which the Company operates; risks associated with oil and gas operations in the United States; and other factors listed from time to time in the Company’s filings with the Securities and Exchange Commission including the Company’s Annual Report on Form 10-K for the year ended December 31, 2013 and Form 10Q for the quarter ended March 31, 2014. The Company expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based.

Cautionary Note to U.S. Investors -- The United States Securities and Exchange Commission permits oil and gas companies, in their filings with the SEC, to disclose only proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. We use certain terms in this press release, such as "probable," "possible," "recoverable" or “potential” reserves among others, that the SEC's guidelines strictly prohibit us from including in filings with the SEC. Investors are urged to consider closely the disclosure in our filings with the SEC.

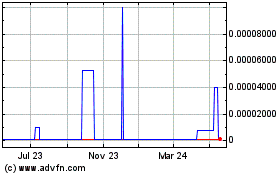

Legend Oil and Gas (CE) (USOTC:LOGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

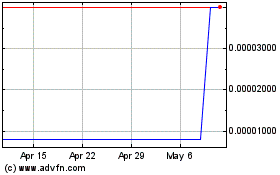

Legend Oil and Gas (CE) (USOTC:LOGL)

Historical Stock Chart

From Apr 2023 to Apr 2024