As filed with the Securities and Exchange Commission on September 25, 2014

Registration No. 333-198758

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment

No. 1

to

FORM F-3

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SEQUANS

COMMUNICATIONS S.A.

(Exact name of registrant as specified in its charter)

|

|

|

| French Republic |

|

Not Applicable |

| (State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification Number) |

15-55 boulevard Charles de Gaulle

92700 Colombes, France

Telephone: +33 1 70 72 16 00

(Address and telephone number of Registrant’s principal executive offices)

GKL Corporate/Search, Inc.

One Capitol Mall, Suite 660

Sacramento, California 95814

Telephone: +1 916 442 7652

(Name, address, and telephone number of agent for service)

Copies to:

John V.

Bautista, Esq.

Brett Cooper, Esq.

Orrick, Herrington & Sutcliffe LLP

The Orrick Building

405

Howard Street

San Francisco, California 94105

Telephone: +1 415 773-5700

Approximate date of

commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being

registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933,

check the following box. x

If this Form is filed to register additional securities for an

offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with

the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the

following box. ¨

The registrant hereby amends this

registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in

accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Amendment No. 1 to the Registration Statement on Form F-3 (File No. 333-198758) is being filed for the purpose of filing

Exhibit 5.2 as indicated in Item 9 of Part II of the Registration Statement. No change is made to the prospectus constituting Part I of the Registration Statement.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

| Item 8. |

Indemnification of Directors and Officers |

We maintain liability insurance for our

directors and officers, including insurance against liabilities under the Securities Act.

|

|

|

| Exhibit

Number |

|

Description of Exhibit |

|

|

| 1.1* |

|

Form of Underwriting Agreement |

|

|

| 3.1# |

|

By-laws (statuts) of Sequans Communications S.A. (English translation), as amended on June 26, 2014 |

|

|

| 4.1 |

|

Shareholders’ Agreement, by and between Sequans Communications S.A. and certain shareholders signatory thereto, dated January 31, 2008 (incorporated by reference to Exhibit 4.1 Registration No. 333-173001) |

|

|

| 4.2 |

|

Form of Deposit Agreement among Sequans Communications S.A., The Bank of New York Mellon and owners and holders of American Depositary Shares (incorporated by reference to Exhibit 4.2 to Registration No. 333-173001) |

|

|

| 4.3 |

|

Form of American Depositary Receipt (included in Exhibit 4.2) |

|

|

| 4.4* |

|

Form of Warrant Agreement (including form of Warrant) |

|

|

| 5.1# |

|

Opinion of Orrick, Herrington & Sutcliffe LLP |

|

|

| 5.2 |

|

Opinion of Orrick Rambaud Martel |

|

|

| 8.1# |

|

Tax Opinion of Orrick, Herrington & Sutcliffe LLP |

|

|

| 23.1# |

|

Consent of Ernst & Young Audit, independent registered public accounting firm |

|

|

| 23.2 |

|

Consent of Orrick, Herrington & Sutcliffe LLP (included in Exhibit 5.1) |

|

|

| 23.3 |

|

Consent of Orrick Rambaud Martel (included in Exhibits 5.2) |

|

|

| 24.1 |

|

Power of Attorney (included within signature page) |

| * |

To be filed as an exhibit to a post-effective amendment to this registration statement or as an exhibit to a report filed on Form 6-K under the Exchange Act, and incorporated herein by reference. |

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by section 10(a)(3) of the Securities;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities

offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of

II-1

the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent

no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement;

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or

any material change to such information in the registration statement;

Provided, however, that paragraphs (a)(1)(i), (a)(1)(ii)

and (a)(1)(iii) of this section do not apply if the information otherwise required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to

section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be

a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(4) To file a post-effective amendment to the registration statement to include any financial statements

required by Item 8.A of Form 20-F at the start of any delayed offering or throughout a continuous offering; provided, however, that a post-effective amendment need not be filed to include financial statements and information otherwise required

by Section 10(a)(3) of the Act or §210.3-19 if such financial statements and information are contained in periodic reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the

Securities Exchange Act of 1934 that are incorporated by reference in this registration statement.

(5) That, for the purpose of

determining liability under the Securities Act to any purchaser:

(i) If the registrant is relying on Rule 430B:

(A) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date

the filed prospectus was deemed part of and included in the registration statement; and

(B) Each prospectus required to be filed

pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by

section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of

securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration

statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that

no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the

registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or

made in any such document immediately prior to such effective date; or

(ii) If the registrant is subject to Rule 430C, each prospectus

filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other

II-2

than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness. Provided,

however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is

part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration

statement or made in any such document immediately prior to such date of first use.

(6) That, for the purpose of determining liability of

the registrant under the Securities Act to any purchaser in the initial distribution of the securities:

The undersigned registrant

undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to

such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant; (iii) The portion of any other free writing prospectus relating to the

offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and (iv) Any other communication that is an offer in the offering made by the undersigned

registrant to the purchaser.

(b) The undersigned registrant hereby undertakes that, for purposes of determining any liability under the

Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report

pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of

such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for

liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities

and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of

expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being

registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question of whether such indemnification by it is against public policy as

expressed in the Act and will be governed by the final adjudication of such issue.

(d) The undersigned registrant hereby further

undertakes that:

(1) For purposes of determining any liability under the Securities Act, the information omitted from the form of

prospectus filed as part of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the registrant pursuant to Rule 424(b)(1) or (4), or 497(h) under the Securities Act shall be deemed to be part of this

registration statement as of the time it was declared effective.

(2) For the purpose of determining any liability under the Securities

Act, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof.

II-3

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets

all of the requirements for filing on Form F-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the Republic of France, on the 25th day of September, 2014.

|

|

|

| SEQUANS COMMUNICATIONS S.A. |

|

|

| By: |

|

/s/ Dr. Georges Karam |

|

|

Name: Dr. Georges Karam

Title: Chief Executive Officer and Chairman |

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has

been signed by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

| Name |

|

Title |

|

Date |

|

|

|

| /s/ Dr. Georges Karam

Dr. Georges Karam |

|

Chairman of the Board, President and Chief Executive Officer (Principal Executive Officer) |

|

September 25, 2014 |

|

|

|

| /s/ Deborah Choate

Deborah Choate |

|

Chief Financial Officer (Principal Financial Officer and Accounting Officer) |

|

September 25, 2014 |

|

|

|

| *

Gilles Delfassy |

|

Director |

|

September 25, 2014 |

|

|

|

| *

Yves Maitre |

|

Director |

|

September 25, 2014 |

|

|

|

| *

James Patterson |

|

Director |

|

September 25, 2014 |

|

|

|

| *

Hubert de Pesquidoux |

|

Director |

|

September 25, 2014 |

|

|

|

| *

Dominique Pitteloud |

|

Director |

|

September 25, 2014 |

|

|

|

| *

Dr. Alok Sharma |

|

Director |

|

September 25, 2014 |

|

|

|

| *

Zvi Slonimsky |

|

Director |

|

September 25, 2014 |

|

|

|

|

|

| *By: |

|

/s/ Dr. Georges Karam |

|

|

Dr. Georges Karam

Attorney-in-fact |

II-4

SIGNATURE OF AUTHORIZED U.S. REPRESENTATIVE OF THE REGISTRANT

Pursuant to the Securities Act of 1933, the undersigned, the duly authorized representative in the United States of Sequans Communications

S.A. has signed this registration statement or amendment thereto in the City of San Diego, State of California, on September 25, 2014.

|

|

|

| By: |

|

/s/ T. Craig Miller |

|

|

Name: T. Craig Miller |

|

|

Title: Authorized Representative in the United States |

II-5

EXHIBITS

|

|

|

| Exhibit

Number |

|

Description of Exhibit |

|

|

| 1.1* |

|

Form of Underwriting Agreement |

|

|

| 3.1# |

|

By-laws (statuts) of Sequans Communications S.A. (English translation), as amended on June 26, 2014 |

|

|

| 4.1 |

|

Shareholders’ Agreement, by and between Sequans Communications S.A. and certain shareholders signatory thereto, dated January 31, 2008 (incorporated by reference to Exhibit 4.1 Registration No. 333-173001) |

|

|

| 4.2 |

|

Form of Deposit Agreement among Sequans Communications S.A., The Bank of New York Mellon and owners and holders of American Depositary Shares (incorporated by reference to Exhibit 4.2 to Registration No. 333-173001) |

|

|

| 4.3 |

|

Form of American Depositary Receipt (included in Exhibit 4.2) |

|

|

| 4.4* |

|

Form of Warrant Agreement (including form of Warrant) |

|

|

| 5.1# |

|

Opinion of Orrick, Herrington & Sutcliffe LLP |

|

|

| 5.2 |

|

Opinion of Orrick Rambaud Martel |

|

|

| 8.1# |

|

Tax Opinion of Orrick, Herrington & Sutcliffe LLP |

|

|

| 23.1# |

|

Consent of Ernst & Young Audit, independent registered public accounting firm |

|

|

| 23.2 |

|

Consent of Orrick, Herrington & Sutcliffe LLP (included in Exhibit 5.1) |

|

|

| 23.3 |

|

Consent of Orrick Rambaud Martel (included in Exhibits 5.2) |

|

|

| 24.1 |

|

Power of Attorney (included within signature page) |

| * |

To be filed as an exhibit to a post-effective amendment to this registration statement or as an exhibit to a report filed on Form 6-K under the Exchange Act, and incorporated herein by reference. |

Exhibit 5.2

|

|

|

|

|

|

|

|

|

|

|

|

|

RAMBAUD MARTEL |

| |

|

|

SOCIETE D’AVOCATS |

| |

|

|

31, AVENUE PIERRE IER DE SERBIE |

| |

|

|

75782 PARIS CEDEX 16 |

| |

|

|

FRANCE |

| |

|

|

tel +33 (0) 1 53 53 75 00 |

| |

|

|

fax +33 (0) 1 53 53 75 01 |

| |

|

|

WWW.ORRICK.COM |

September 25, 2014

Sequans Communications S.A.

15-55 boulevard Charles de Gaulle

92700 Colombes, France

|

|

|

| Re: |

|

Sequans Communications S.A |

|

|

Registration Statement on Form F-3 |

Ladies and Gentlemen:

We have acted as special French counsel to Sequans Communications S.A., a société anonyme incorporated in the French

Republic (the “Company”) and have examined the Registration Statement on Form F-3 (the “Registration Statement”), filed with the Securities and Exchange Commission (the “Commission”) relating to the

offering from time to time, pursuant to Rule 415 of the General Rules and Regulations of the Commission promulgated under the Securities Act of 1933, as amended (the “Securities Act”), by the Company of one or more of the following

securities with an aggregate offering price of up to U.S.$50,000,000 or the equivalent thereof in one or more foreign currencies: (a) ordinary shares of the Company, par value €0.02 per share, including in the form of American

Depositary Shares (the “Ordinary Shares”), including Ordinary Shares that may be issued upon exercise of the Warrants (as defined below); (b) warrants to be exercised for the subscription to Ordinary Shares (the

“Warrants”) and (c) a combination of such Ordinary Shares and Warrants as units (the “Units”).

The

offering of the Ordinary Shares, the Warrants and the Units (collectively, the “Securities”) will be as set forth in the prospectus contained in the Registration Statement (the “Prospectus”), as supplemented by one

or more supplements to the Prospectus.

We have examined the instruments, documents and records which we deemed relevant and necessary for

the basis of our opinions hereinafter expressed. In such examination, we have assumed the following: (a) the authenticity of original documents and the genuineness of all signatures; (b) the conformity to the originals of all documents

submitted to us as copies; and (c) the truth, accuracy, and completeness of the information, representations, and warranties contained in the records, documents, instruments, and certificates we have reviewed.

Sequans Communications S.A.

September 25, 2014

Page

2

Based on the foregoing, and subject to the further limitations, qualifications and

assumptions set forth herein, we are of the opinion that:

| |

1. |

The Ordinary Shares, including Ordinary Shares that may be issued upon exercise of the Warrants, when (a) the extraordinary shareholders’ meeting of the Company and, as the case may be, the Board of Directors

of the Company (the “Board”), and/or the meeting of any holders of a specific category of securities of the Company, have taken all necessary corporate action to approve the issuance of, and establish the terms of, the offering of the

Ordinary Shares and related matters, and (b) issued, sold and delivered in the manner and for the consideration stated in the applicable definitive purchase, underwriting, placement or similar agreement approved by the Board, as the case may

be, upon payment of the consideration provided therein to the Company, will be validly issued, fully paid up, non-assessable and may be freely traded (librement négociables). |

| |

2. |

The Warrants, when (a) the extraordinary shareholders’ meeting of the Company and, as the case may be, the Board and/or the meeting of any holders of a specific category of securities of the Company, has taken

all necessary corporate action to approve the issuance of and establish the terms of such Warrants, the terms of the offering of the Warrants and related matters, and (b) issued, sold and delivered in the manner and for the consideration stated

in the applicable definitive purchase, underwriting, placement or similar agreement approved by the Board as the case may be, and upon payment of the consideration approved by the Board, the Warrants will be validly issued. |

In rendering the foregoing opinion, we have assumed that (i) the Registration Statement, and any amendments thereto, will have become

effective under the Securities Act (and will remain effective at the time of issuance of any Securities thereunder); (ii) a prospectus supplement describing each class and/or series of Securities offered pursuant to the Registration Statement,

to the extent required by applicable law and the relevant rules and regulations of the Commission will be timely filed with the Commission (iii) the resolutions authorizing the Company to issue and offer the Securities as adopted by the

extraordinary shareholders’ meeting and/or the Board, as applicable, will be in full force and effect at all times at which the Securities are issued and offered by the Company, (iv) the definitive terms of the Securities will have been

established in accordance with the authorizing resolutions adopted by the extraordinary shareholders’ meeting and/or the Board, as applicable, the Company’s by-laws and applicable law; (v) the Company will issue and deliver the

Securities in the manner contemplated in the Registration Statement and the amount of Securities issued will remain within the limits of the then authorized but unissued amounts of such Securities; (vi) all Securities will be issued in

compliance with applicable securities and corporate law; and (vii) any deposit agreement, warrant agreement, subscription contract agreement will constitute a valid and binding obligation of each party thereto other than the Company.

Sequans Communications S.A.

September 25, 2014

Page

3

As to facts material to the opinions and assumptions expressed herein, we have relied upon

written statements and representations of officers and other representatives of the Company. We are members of the Paris bar and this opinion is limited to the laws of the French Republic. This opinion is subject to the sovereign power of the French

courts to interpret the facts and circumstances of any adjudication. This opinion is given on the basis that it is to be governed by, and construed in accordance with, the laws of the French Republic. We consent to the reference to us under the

heading “Legal Matters” in the Prospectus and to the filing of this opinion as Exhibit 5.2 to the Registration Statement. By giving this consent, we do not thereby admit that we are within the category of persons whose consent is

required under Section 7 of the Securities Act, or the rules and regulations promulgated thereunder, nor do we thereby admit that we are “experts” within the meaning of such term as used in the Securities Act with respect to any part

of the Registration Statement, including this opinion letter as an exhibit or otherwise.

Very truly yours,

/s/ Orrick Rambaud Martel

ORRICK RAMBAUD MARTEL

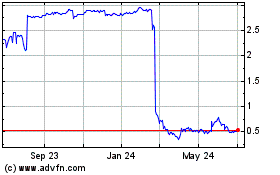

Sequans Communications (NYSE:SQNS)

Historical Stock Chart

From Mar 2024 to Apr 2024

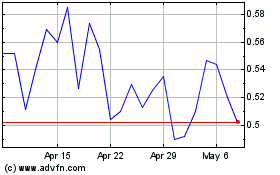

Sequans Communications (NYSE:SQNS)

Historical Stock Chart

From Apr 2023 to Apr 2024