UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) September 19, 2014

LIGHTING SCIENCE GROUP CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

000-20354 |

|

23-2596710 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

Building 2A, 1227 South Patrick Drive, Satellite Beach, Florida 32937

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (321) 779-5520

Not Applicable

(Former

name or former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 1 – Registrant’s Business and Operations

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On September 19, 2014, Lighting Science Group

Corporation (the “Company”) and its domestic material wholly-owned subsidiary, BioLogical Illumination (“BioLogical”; and collectively with the Company, the “Borrowers”) entered

into a letter agreement (the “Amendment”) amending that certain Loan and Security Agreement (the “FCC Loan Agreement”) by and among the Borrowers, the financial institutions from time to time party

thereto as lenders (the “Lenders”), and FCC, LLC, d/b/a First Capital, as administrative agent for the Lenders (“FCC”). The Amendment amended the FCC Loan Agreement to provide that the entry of a

judgment in connection with the previously disclosed lawsuit styled Geveran Investments Limited v. Lighting Science Group Corp., et al., Case No. 12-17738 (07) (the “Geveran Suit”) would not constitute a

default under the FCC Loan Agreement unless it gives rise to the entry or filing of a judgment, order or award for the payment of $250,000 or more (which amount is not covered by insurance) against a Borrower and (a) within forty-five

(45) days after the entry of such judgment, order or award (1) such judgment, order or award is not discharged, satisfied, vacated or bonded pending appeal, or (2) a stay of enforcement thereof is not in effect; (b) enforcement

proceedings with respect to such judgment have been commenced, or (c) any person becomes a lien creditor (as defined in the Uniform Commercial Code) of the Company in connection with the Geveran Suit.

The foregoing summary of the Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of such Amendment, which

is filed as Exhibit 10.1 to this Current Report on Form 8-K (this “Current Report”) and is incorporated herein by reference.

Section 5 – Corporate Governance and Management

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Appointment of Wayne Nesbit as Chief Operations Officer

Effective September 23, 2014, the Board of Directors of the Company (the “Board”) appointed Wayne Nesbit as Chief Operations

Officer of the Company.

Mr. Nesbit, 53, previously served as Vice President Operations, of Cree Inc., a manufacturer and seller of LED lighting

products and applications, from 2008 to 2013. From 2001 to 2008, Mr. Nesbit served as Senior Vice President, Operations, of Mindspeed Technologies, a designer, developer and seller of semiconductor solutions for communications applications in

wireless and wireline network infrastructure markets and as Vice President in various roles, for Motorola, SPS, a leading producer of semiconductors, from 1984 to 2001. Mr. Nesbit has served as a Trustee of the University of Virginia from 1997

to 2007 and as Founding Member of the Board of Trustees, Engineering Foundation, of Virginia Commonwealth University since 1996. Mr. Nesbit holds a Bachelor of Science degree in Electrical Engineering from Texas A&M University.

The terms of Mr. Nesbit’s employment are governed by an Employment Agreement, dated as of September 23, 2014, between the Company and

Mr. Nesbit (the “Employment Agreement”), which was approved by the Board as of that date. The Employment Agreement has a five-year term (the “Employment Period”) and provides that, during the

Employment Period, Mr. Nesbit is entitled to (a) an annual base salary of $300,000 (the “Base Salary”) and benefits generally available to other senior executives of the Company and (b) reimbursement for up to

$15,000 of reasonable and documented

relocation expenses in connection with his relocation and temporary living expenses. Mr. Nesbit is also eligible to receive a performance bonus with respect to each calendar year (or partial

calendar year) during the Employment Period based upon a bonus plan to be determined annually by the Board (or the compensation committee of the Board) and criteria that will be presented by the Board (or the compensation committee of the Board) to

Mr. Nesbit promptly following the first meeting of the Board during each fiscal year (such criteria, with respect to any calendar year, the “Applicable Plan” ). The level of such performance bonus will be the sum of

(x) up to 50% of the Base Salary, based on Mr. Nesbit’s satisfaction of the criteria specified in the Applicable Plan, which bonus will be paid 50% in cash and 50% in restricted stock units (“Restricted Stock

Units”) of the Company’s common stock, par value $0.001 per share (the “Common Stock”), with such Restricted Stock Units vesting over a two-year period, in two equal increments on the first two anniversaries

of the award, and (y) up to 100% of the Base Salary, based on the Board’s evaluation, in its sole discretion, of the Company’s operating results during such year as measured against criteria specified in the Applicable Plan, which

bonus will be paid 100% in Restricted Stock Units, with such Restricted Stock Units vesting over a two-year period, in two equal increments on the first two anniversaries of the award. The Employment Agreement provides that, at

Mr. Nesbit’s option, on each Restricted Stock Unit vesting date he may sell up to one-third of the Restricted Stock Units vesting on such date back to the Company, and the Company will purchase such stock at a price equal to the published

closing price of the Common Stock on such date.

Pursuant to the Employment Agreement, Mr. Nesbit is also entitled to a grant of an employee stock

option to purchase 12,300,000 of shares of Common Stock (the “Option”). Unless vested or accelerated sooner in accordance with the terms of the Company’s 2012 Amended and Restated Equity-Based Compensation Plan (the

“Plan”) , the Option will vest and become exercisable in four equal tranches over a four-year period, with the first tranche vesting on September 23, 2015, and the remaining tranches vesting annually thereafter. The

Option will be subject to the terms and conditions of the Plan and a stock option award agreement. Furthermore, to the extent that the foregoing Option grant exceeds the maximum number of options to purchase Common Stock permitted to be granted

under the Plan to any individual during a single year (the “Maximum Number”), the Company agreed to present to its stockholders, for their approval at the Company’s first Annual Meeting of Stockholders following

Mr. Nesbit’s start date, a proposal to amend the Plan so as to raise the Maximum Number to at least 12,300,000, and to the extent that the Option grant to Mr. Nesbit exceeds the number of shares of Common Stock underlying options

registered pursuant to the Company’s Registration Statements on Form S-8 currently on file with the SEC, the Company will file an additional Registration Statement on Form S-8 to register the shares of Common Stock underlying the Option.

The Employment Agreement contains customary confidentiality and non-competition provisions. If Mr. Nesbit’s employment is terminated by the Company

without “cause,” or if he resigns for “good reason,” the Company would be required to continue to pay him the Base Salary for a period of one (1) year following the date of termination, subject to Mr. Nesbit’s

execution of a general release. If Mr. Nesbit’s employment is terminated for “cause,” (a) any shares of Common Stock underlying the Restricted Stock Units that are not then vested will be forfeited on the date of such

termination and (b) no portion of the Option will continue to be exercisable as of the date of such termination.

Section 7 – Regulation

FD

| Item 7.01 |

Regulation FD Disclosure. |

On September 24, 2014, the Company issued a press release announcing the

appointment of Edward Nesbit as Chief Operations Officer of the Company, effective as of September 23, 2014. A copy of the press release announcing the appointment of Mr. Nesbit is attached as Exhibit 99.1 to this Current Report on Form

8-K and is incorporated by reference herein.

Section 9 – Financial Statements and Exhibits

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

The information in the Exhibit Index of this Current Report is incorporated into this Item 9.01(d) by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

| |

|

LIGHTING SCIENCE GROUP CORPORATION |

|

|

|

| Date: September 24, 2014 |

|

By: |

|

/s/ Zvi Raskin |

|

|

Name: |

|

Zvi Raskin |

|

|

Title: |

|

General Counsel and Secretary |

Signature Page to Form 8-K

EXHIBIT INDEX

|

|

|

| Number |

|

Description of Exhibit |

|

|

| 10.1 |

|

Letter Amendment to Loan and Security Agreement, dated September 19, 2014, by and between Lighting Science Group Corporation, Biological Illumination, LLC, FCC, LLC, d/b/a First Capital, in its capacity as agent, and various

financial institutions. |

|

|

| 99.1 |

|

Press Release. |

Exhibit 10.1

September 19, 2014

Lighting Science Group

Corporation

BioLogical Illumination, LLC

1227 South Patrick

Drive, Building 2A

Satellite Beach, FL 32937-3969

Attn.:

Chief Financial Officer

Facsimile No.: (321) 779-5521

Ladies and Gentlemen:

Reference is hereby made

to that certain Loan and Security Agreement dated as of April 25, 2014 (as at any time amended, restated, supplemented or otherwise modified, the “Loan Agreement”), among LIGHTING SCIENCE GROUP CORPORATION, a Delaware

corporation (“LSG”), BIOLOGICAL ILLUMINATION, LLC, a Delaware limited liability company (“BioLogical”; LSG and BioLogical are hereinafter referred to collectively as “Borrowers” and each

individually as a “Borrower”), the various financial institutions from time to time party thereto as lenders (collectively, “Lenders”) and FCC, LLC, d/b/a FIRST CAPITAL, a Florida limited liability company

(“First Capital”), in its capacity as agent for Lenders (together with its successors and assigns in such capacity, “Agent”). Each capitalized term used herein, unless otherwise defined herein, shall have the

meaning ascribed to such term in the Loan Agreement.

Borrowers, Agent and Lenders desire to amend the Loan Agreement, on the terms and

subject to the conditions hereinafter set forth.

NOW, THEREFORE, for TEN DOLLARS ($10.00) in hand paid and other good and valuable

consideration, the receipt and sufficiency of which are hereby severally acknowledged, the parties hereto, intending to be legally bound hereby, agree as follows:

The Loan Agreement is hereby amended as follows:

(a) By adding the following new definition of “Geveran Case” to Section 1 of the Loan Agreement in appropriate

alphabetical order:

“Geveran Case” means Case Number 2012-CA-020121-O in the Circuit Court of the Ninth

Judicial Circuit, in and for Orange County, Florida, by Geveran Investments Limited, as plaintiff, against LSG and the other parties thereto as defendants.

(b) By adding the phrase “(other than a judgment in the Geveran Case)” immediately after the phrase “entry of any one or more

judgments” in clause (viii) of Section 13(a) of the Loan Agreement.

(c) By deleting the word “or” immediately prior to clause (xvii) of

Section 13(a) of the Loan Agreement, deleting the period immediately following clause (xvii) of Section 13(a) of the Loan Agreement, and adding the following immediately after clause (xvii) of

Section 13(a) of the Loan Agreement:

; or (xviii) entry or filing of any judgment, order, or award for the payment of

money with respect to the Geveran Case involving an aggregate amount of $250,000 or more (except to the extent covered (other than to the extent of customary deductibles) by insurance pursuant to which the insurer has not denied coverage) against a

Borrower or any of its subsidiaries, or with respect to any of their respective assets, if either (a) there is a period of forty-five (45) consecutive days at any time after the entry of any such judgment, order, or award during which

(1) the same is not discharged, satisfied, vacated, or bonded pending appeal, or (2) a stay of enforcement thereof is not in effect, (b) enforcement proceedings are commenced upon such judgment, order, or award, or (c) any Person

becomes a lien creditor (as defined in the Uniform Commercial Code as in effect from time to time in any applicable jurisdiction) in connection with the Geveran Case.

The effectiveness of the amendments contained herein is subject to Agent’s receipt of (a) evidence in form and substance

satisfactory to Agent that LSG has concurrently agreed to enter into an amendment to the Term Loan Agreement to contain substantially the same event of default as set forth in clause (c) above, and (b) a duly executed secretary’s or

manager’s certificate of resolutions with respect to each Borrower, in each case in form and substance satisfactory to Agent.

By its

signature hereto, each Borrower hereby (a) ratifies and reaffirms the Obligations, each of the Loan Documents and all of such Borrower’s covenants, duties, indebtedness and liabilities under the Loan Documents; (b) acknowledges and

stipulates that the Loan Agreement and the other Loan Documents executed by such Borrower are legal, valid and binding obligations of such Borrower that are enforceable against such Borrower in accordance with the terms thereof; all of the

Obligations are owing and payable without defense, offset or counterclaim (and to the extent there exists any such defense, offset or counterclaim on the date hereof, the same is hereby waived by each Borrower); and the security interests and liens

granted by such Borrower in favor of Agent are duly perfected, first priority security interests and liens; and (c) represents and warrants to Agent and Lenders, to induce Agent and Lenders to enter into this agreement, that (i) no Default

exists on the date hereof or would result from the effectiveness of this agreement or the consummation of the actions described in that certain Joint Stipulation for Dismissal of Claims and Defenses with Right to Reinstate Claims and Defenses

Pending Outcome of Appeal and for Stay of Judgment filed with respect to the Geveran Case on September 16, 2014 in the Circuit Court of the Ninth Judicial Circuit, in and for Orange County, Florida, (ii) the execution, delivery and

performance of this agreement have been duly authorized by all requisite company action on the part of such Borrower and this agreement has been duly executed and delivered by such Borrower, and (iii) all of the representations and warranties

made by such Borrower in the Loan Agreement are true and correct on and as of the date hereof.

In consideration of Agent’s and

Lenders’ willingness to enter into this agreement, Borrowers jointly and severally agree to pay to Agent and Lenders, on demand, all costs and expenses (including taxes and legal fees and expenses) incurred by Agent and Lenders in

connection with the preparation, negotiation and execution of this agreement and any other Loan Documents executed pursuant hereto and any and all amendments, modifications, and supplements thereto. Except as otherwise expressly provided in this

agreement, nothing herein shall be deemed to amend or modify any provision of the Loan Agreement or any of the other Loan Documents, each of which shall remain in full force and effect. This agreement is not intended to be, nor shall it be construed

to create, a novation or accord and satisfaction, and the Loan Agreement as herein modified shall continue in full force and effect. This agreement shall be governed by and construed in accordance with the internal laws of the State of Georgia and

shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns. This agreement may be executed in any number of counterparts and by different parties to this agreement on separate counterparts, each

of which, when so executed, shall be deemed an original, but all such

- 2 -

counterparts shall constitute one and the same agreement. Any manually executed signature page hereto that is delivered by facsimile or other electronic transmission shall be deemed to be an

original signature hereto. To the fullest extent permitted by applicable law, the parties hereto each hereby waives the right to trial by jury in any action, suit, counterclaim or proceeding arising out of or related to this agreement.

To induce Agent and Lenders to enter into this Amendment, each Borrower hereby RELEASES, ACQUITS AND FOREVER DISCHARGES Agent and each

Lender, and all officers, directors, agents, employees, successors and assigns of Agent or any Lender, from any and all liabilities, claims, demands, actions or causes of action of any kind or nature (if there be any), whether absolute or

contingent, disputed or undisputed, at law or in equity, or known or unknown, that any Borrower now has or ever had against Agent or any Lender arising under or in connection with any of the Loan Documents or otherwise. Each Borrower represents and

warrants to Agent and Lenders that such Borrower has not transferred or assigned to any Person any claim that such Borrower ever had or claimed to have against Agent or any Lender.

[Signatures appear on following page]

- 3 -

The parties hereto have caused this agreement to be duly executed under seal and delivered by

their respective duly authorized officers on the date first written above.

|

|

|

| AGENT AND SOLE LENDER: |

|

| FCC, LLC, d/b/a FIRST CAPITAL |

|

|

| By: |

|

/s/ Ralph J. Infante |

| Name: |

|

Ralph J. Infante |

| Title: |

|

Senior Vice President |

Accepted and agreed to:

BORROWERS:

|

|

|

|

|

| LIGHTING SCIENCE GROUP CORPORATION |

|

|

|

| By: |

|

/s/ Dennis McGill |

|

|

| Name: |

|

Dennis McGill |

|

|

| Title: |

|

Chief Financial Officer |

|

|

|

| BIOLOGICAL ILLUMINATION, LLC |

|

|

|

| By: |

|

/s/ Fred Maxik |

|

|

| Name: |

|

Fred Maxik |

|

|

| Title: |

|

Manager |

|

|

|

| Consented to by Guarantor: |

|

| LSGC, LLC |

|

|

|

| By: |

|

/s/ Zvi Raskin |

|

|

| Name: |

|

Zvi Raskin |

|

|

| Title: |

|

Corporate Secretary |

|

|

Letter Amendment to Loan and Security Agreement

Exhibit 99.1

WAYNE NESBIT APPOINTED AS CHIEF OPERATIONS OFFICER

AT LIGHTING SCIENCE

Top

LED Operations Executive To Lead Expansion of Domestic and International

Manufacturing Capabilities for Infrastructure, Commercial

and Residential LED Products

SATELLITE BEACH, FL—September 24, 2014—Intelligent lighting solutions company Lighting Science® announced today that Wayne Nesbit has been appointed Chief Operations Officer effective September 23, 2014. Mr. Nesbit will bring his proven global experience in manufacturing

operations to lead the company’s expansion of its domestic and international manufacturing capabilities for its innovative LED lighting.

“Through the course of his career, Wayne has demonstrated that he can lead and expand the manufacturing operations of large, multinational

technology-focused companies, and has specific experience in the LED space,” said Ed Bednarcik, Chief Executive Officer of Lighting Science. “Bringing Wayne to the Lighting Science team is one of my first actions as CEO, and we are looking

forward to his leadership as we build out and expand our domestic and international manufacturing capabilities in order to bring our LED lighting solutions to our residential, commercial and municipal consumers as efficiently as possible while

maintaining our strict quality standards.”

Mr. Nesbit joins Lighting Science from Cree, a multinational LED and semiconductor developer and

manufacturer, where he most recently served as Vice President, Global Operations, managing worldwide operations for the company’s LED and lighting divisions. Prior to Cree, Mr. Nesbit was the Senior Vice President, Operations from 2001

until 2008 at Mindspeed Technologies, a company focused on the design, development and sale of semiconductor solutions for communications applications in the wireline and wireless network infrastructure markets. From 1984 until 2001, Mr. Nesbit

was with Motorola in a variety of roles, most recently as Vice President and Director, Worldwide External Technology, where he was responsible for Motorola Semiconductor foundry and joint partnership activity worldwide.

“I am delighted for this opportunity to join Lighting Science at this exciting time in the company’s growth,” said Mr. Nesbit. “Now

that Lighting Science possesses domestic and international sourcing capabilities, we are well positioned to expand rapidly to meet the growing demand for advanced lighting technology, especially among commercial and municipal users.”

About Lighting Science

Lighting Science® (OTCQB:LSCG) is a global leader in lighting solutions that are environmentally friendlier and more energy-efficient than traditional lighting products. Lighting Science is committed to

UNLEASH THE SCIENCE OF LIGHT TO MAKE PEOPLE AND OUR PLANET LOOK, FEEL AND HEAL BETTER with award-winning,

innovative LED lamps and lighting fixtures. Find out more at www.lsgc.com or www.definitydigital.com and join us on Twitter, Facebook, LinkedIn and the Lighting Science Blog.

Contact

Bill Mendel

bill@mendelcommunications.com

212-397-1030

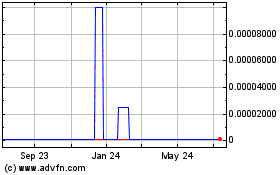

Lighting Science (CE) (USOTC:LSCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lighting Science (CE) (USOTC:LSCG)

Historical Stock Chart

From Apr 2023 to Apr 2024