UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 6)*

Shanda Games

Limited

(Name of Issuer)

Class A Ordinary Shares, par value US$0.01 per share

(Title of Class of Securities)

81941U105**

(CUSIP

Number)

Jie Lian

Lawrence Wang

Primavera

Capital (Cayman) Fund I L.P.

28th Floor, 28 Hennessy Road, Wanchai

Hong Kong

+852 3767-5000

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

with a copy to:

Timothy

M. Gardner

Latham & Watkins

18th Floor, One Exchange Square

8 Connaught Place, Central

Hong Kong

+852 2912-2500

September 23, 2014

(Date of Event Which Requires Filing of This Statement)

If the filing

person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box. ¨

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for

other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter disclosures provided in a prior cover page. |

| ** |

This CUSIP applies to the American Depositary Shares, evidenced by American Depositary Receipts, each representing two Class A ordinary shares. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of

the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

[Continued on following pages]

Page 1 of 15

|

|

|

| CUSIP No. 81941U105 |

|

Page

2

of 15 |

|

|

|

|

|

|

|

| 1 |

|

Name of

reporting person Mage Capital Limited |

| 2 |

|

Check the appropriate box if a member

of a group (a) ¨ (b) x |

| 3 |

|

SEC use only

|

| 4 |

|

Source of funds

OO |

| 5 |

|

Check box if disclosure of legal

proceedings is required pursuant to Item 2(d) or 2(e): ¨ |

| 6 |

|

Citizenship or place of

organization British Virgin Islands |

| Number of

shares beneficially

owned by each

reporting person

with |

|

7 |

|

Sole voting power

0 |

| |

8 |

|

Shared voting power

0 |

| |

9 |

|

Sole dispositive power

0 |

| |

10 |

|

Shared dispositive power

0 |

| 11 |

|

Aggregate amount beneficially owned by each reporting person

0 |

| 12 |

|

Check box if the aggregate amount in

Row (11) excludes certain shares ¨ |

| 13 |

|

Percent of class represented by amount

in Row (11)

0.0% |

| 14 |

|

Type of reporting person

CO |

|

|

|

| CUSIP No. 81941U105 |

|

Page

3

of 15 |

|

|

|

|

|

|

|

| 1 |

|

Name of

reporting person Mage SPV Limited |

| 2 |

|

Check the appropriate box if a member

of a group (a) ¨ (b) x |

| 3 |

|

SEC use only

|

| 4 |

|

Source of funds

OO |

| 5 |

|

Check box if disclosure of legal

proceedings is required pursuant to Item 2(d) or 2(e): ¨ |

| 6 |

|

Citizenship or place of

organization British Virgin Islands |

| Number of

shares beneficially

owned by each

reporting person

with |

|

7 |

|

Sole voting power

0 |

| |

8 |

|

Shared voting power

0 |

| |

9 |

|

Sole dispositive power

0 |

| |

10 |

|

Shared dispositive power

0 |

| 11 |

|

Aggregate amount beneficially owned by each reporting person

0 |

| 12 |

|

Check box if the aggregate amount in

Row (11) excludes certain shares ¨ |

| 13 |

|

Percent of class represented by amount

in Row (11)

0.0% |

| 14 |

|

Type of reporting person

CO |

|

|

|

| CUSIP No. 81941U105 |

|

Page

4

of 15 |

|

|

|

|

|

|

|

| 1 |

|

Name of

reporting person Primavera Capital (Cayman) Fund I L.P. |

| 2 |

|

Check the appropriate box if a member

of a group (a) ¨ (b) x |

| 3 |

|

SEC use only

|

| 4 |

|

Source of funds

OO |

| 5 |

|

Check box if disclosure of legal

proceedings is required pursuant to Item 2(d) or 2(e): ¨ |

| 6 |

|

Citizenship or place of

organization Cayman Islands |

| Number of

shares beneficially

owned by each

reporting person

with |

|

7 |

|

Sole voting power

0 |

| |

8 |

|

Shared voting power

0 |

| |

9 |

|

Sole dispositive power

0 |

| |

10 |

|

Shared dispositive power

0 |

| 11 |

|

Aggregate amount beneficially owned by each reporting person

0 |

| 12 |

|

Check box if the aggregate amount in

Row (11) excludes certain shares ¨ |

| 13 |

|

Percent of class represented by amount

in Row (11)

0.0% |

| 14 |

|

Type of reporting person

PN |

|

|

|

| CUSIP No. 81941U105 |

|

Page

5

of 15 |

|

|

|

|

|

|

|

| 1 |

|

Name of

reporting person Primavera Capital (Cayman) GP1 L.P. |

| 2 |

|

Check the appropriate box if a member

of a group (a) ¨ (b) x |

| 3 |

|

SEC use only

|

| 4 |

|

Source of funds

OO |

| 5 |

|

Check box if disclosure of legal

proceedings is required pursuant to Item 2(d) or 2(e): ¨ |

| 6 |

|

Citizenship or place of

organization Cayman Islands |

| Number of

shares beneficially

owned by each

reporting person

with |

|

7 |

|

Sole voting power

0 |

| |

8 |

|

Shared voting power

0 |

| |

9 |

|

Sole dispositive power

0 |

| |

10 |

|

Shared dispositive power

0 |

| 11 |

|

Aggregate amount beneficially owned by each reporting person

0 |

| 12 |

|

Check box if the aggregate amount in

Row (11) excludes certain shares ¨ |

| 13 |

|

Percent of class represented by amount

in Row (11)

0.0% |

| 14 |

|

Type of reporting person

PN |

|

|

|

| CUSIP No. 81941U105 |

|

Page

6

of 15 |

|

|

|

|

|

|

|

| 1 |

|

Name of

reporting person Primavera (Cayman) GP1 Ltd |

| 2 |

|

Check the appropriate box if a member

of a group (a) ¨ (b) x |

| 3 |

|

SEC use only

|

| 4 |

|

Source of funds

OO |

| 5 |

|

Check box if disclosure of legal

proceedings is required pursuant to Item 2(d) or 2(e): ¨ |

| 6 |

|

Citizenship or place of

organization Cayman Islands |

| Number of

shares beneficially

owned by each

reporting person

with |

|

7 |

|

Sole voting power

0 |

| |

8 |

|

Shared voting power

0 |

| |

9 |

|

Sole dispositive power

0 |

| |

10 |

|

Shared dispositive power

0 |

| 11 |

|

Aggregate amount beneficially owned by each reporting person

0 |

| 12 |

|

Check box if the aggregate amount in

Row (11) excludes certain shares ¨ |

| 13 |

|

Percent of class represented by amount

in Row (11)

0.0% |

| 14 |

|

Type of reporting person

CO |

INTRODUCTION

This statement on Schedule 13D/A (this “Statement”) amends the previous Schedule 13D filed by Primavera Capital (Cayman) Fund I L.P.,

Primavera Capital (Cayman) GP1 L.P. and Primavera (Cayman) GP1 Ltd with the Securities and Exchange Commission on February 5, 2014, as amended and supplemented by Amendment No. 1 filed by the Reporting Persons (as defined below) under

Schedule 13D/A on February 20, 2014, Amendment No. 2 filed by the Reporting Persons under Schedule 13D/A on April 22, 2014, Amendment No. 3 filed by the Reporting Persons under Schedule 13D/A on April 28, 2014, Amendment No. 4 filed by the

Reporting Persons under Schedule 13D/A on May 19, 2014 and Amendment No. 5 filed by the Reporting Persons under Schedule 13D/A on September 3, 2014 (the “Original 13D”) with respect to Shanda Games Limited (the “Issuer”). Except

as amended and supplemented herein, the information set forth in the Original 13D remains unchanged. Capitalized terms used herein without definition have meanings assigned thereto in the Original 13D.

Page 7 of 15

| ITEM 4. |

PURPOSE OF TRANSACTION: |

Item 4 is hereby amended and restated as follows:

On January 27, 2014, Shanda Interactive Entertainment Limited (“Shanda Interactive”) and Primavera Capital (Cayman) Fund I L.P.

(“Fund I”) (together with Shanda Interactive, the “Consortium” and each member in the Consortium, a “Consortium Member”) entered into a consortium agreement (the “Consortium Agreement”). Under the Consortium

Agreement, the Consortium Members agreed, among other things, (i) to jointly deliver a preliminary non-binding proposal (the “Proposal”) to the board of directors of the Issuer (the “Board”) to acquire the Issuer in a going

private transaction (the “Transaction”), (ii) to deal exclusively with each other with respect to the Transaction until the earlier of (x) 9 months after the date thereof, and (y) termination of the Consortium Agreement by

all Consortium Members, (iii) to use their reasonable efforts and cooperate in good faith to arrange debt financing to support the Transaction, and (iv) to cooperate and proceed in good faith to negotiate and consummate the Transaction.

Page 8 of 15

On January 27, 2014, Shanda SDG Investment Limited (“SDG”) and Fund I entered into

a share purchase agreement (the “Fund I Share Purchase Agreement”) pursuant to which SDG agreed to sell, and Fund I agreed to purchase, 28,959,276 Class A Ordinary Shares (the “Fund I Purchase Shares”) at US$2.7625 per

Class A Ordinary Share (the “Fund I Purchase Price”) subject to the terms and conditions thereof. Pursuant to the Fund I Share Purchase Agreement, if (i) a going-private transaction occurs within one year of the closing date of

the sale of the Fund I Purchase Shares where Fund I is part of the buyer consortium and the price per share in the going-private transaction (“Going-private Price”) is higher than the Fund I Purchase Price, or (ii) a going-private

transaction occurs within one year of the closing date of the sale of the Fund I Purchase Shares where Fund I is not part of the buyer consortium due to its own decision or election without SDG’s written consent and the Going-private Price is

higher than the Fund I Purchase Price, Fund I shall pay SDG the shortfall between the Fund I Purchase Price and the Going-private Price with respect to all the Fund I Purchase Shares. Pursuant to the Fund I Share Purchase Agreement, if a

going-private transaction is not consummated within one year of the closing date of the sale of the Fund I Purchase Shares solely due to SDG’s failure to vote in favor of such going-private transaction, SDG shall repurchase the Fund I Purchase

Shares at a per share price equal to the Fund I Purchase Price. The purchase and sale of the Fund I Purchase Shares was completed on February 17, 2014.

On April 18, 2014, SDG and Perfect World Co., Ltd. (“Perfect World”) entered into a share purchase agreement (the “PW

Share Purchase Agreement”) pursuant to which SDG agreed to sell, and Perfect World agreed to purchase, 30,326,005 Class A Ordinary Shares (the “PW Purchase Shares”) at US$3.2975 per Class A Ordinary Share (the “PW

Purchase Price”) subject to the terms and conditions thereof. Pursuant to the PW Share Purchase Agreement, if (i) a going-private transaction occurs within one year of the closing date of the sale of the PW Purchase Shares where Perfect

World is part of the buyer consortium and the Going-private Price is higher than the PW Purchase Price, or (ii) a going-private transaction occurs within one year of the closing date of the sale of the PW Purchase Shares where Perfect World is

not part of the buyer consortium due to its own decision or election without SDG’s written consent and the Going-private Price is higher than the PW Purchase Price, Perfect World shall pay SDG the shortfall between the PW Purchase Price and the

Going-private Price with respect to all PW Purchase Shares. Pursuant to the PW Share Purchase Agreement, if a going-private transaction is not consummated within one year of the closing date of the sale of the PW Purchase Shares solely due to

SDG’s failure to vote in favor of such going-private transaction, SDG shall repurchase the PW Purchase Shares at a per share price equal to the PW Purchase Price. The purchase and sale of the PW Purchase Shares was completed on May 16, 2014.

Page 9 of 15

Concurrently with the execution of the PW Share Purchase Agreement, Shanda Interactive, Fund I

and Perfect World entered into an adherence agreement (the “PW Adherence Agreement”), pursuant to which Perfect World became a party to the Consortium Agreement and joined the Consortium.

On April 25, 2014, FV Investment Holdings (“FV Investment”), which is an affiliate of FountainVest Partners, Shanda Interactive,

Fund I and Perfect World entered into an adherence agreement (the “FV Adherence Agreement”), pursuant to which FV Investment became a party to the Consortium Agreement and joined the Consortium.

On May 19, 2014, CAP IV Engagement Limited (“Carlyle”), which is an affiliate of Carlyle Asia Partners IV, L.P., Shanda Interactive,

Fund I, Perfect World and FV Investment entered into an adherence agreement (the “Carlyle Adherence Agreement”), pursuant to which Carlyle became a party to the Consortium Agreement and joined the Consortium.

On August 31, 2014, SDG and Orient Finance Holdings (Hong Kong) Limited, a company limited by shares incorporated and existing under the laws

of Hong Kong (“Orient Finance”) entered into a share purchase agreement (the “Orient Share Purchase Agreement”) pursuant to which SDG agreed to sell, and Orient Finance agreed to purchase, 123,552,669 Class A Ordinary Shares (the

“Orient Purchase Shares”) at US$3.45 per Class A Ordinary Share (the “Orient Purchase Price”) subject to the terms and conditions thereof. Pursuant to the Orient Share Purchase Agreement, if (i) a going-private transaction occurs

within one year of the closing date of the sale of the Orient Purchase Shares where Orient Finance is part of the buyer consortium and the Going-private Price is higher than the Orient Purchase Price, or (ii) a going-private transaction occurs

within one year of the closing date of the sale of the Orient Purchase Shares where Orient Finance is not part of the buyer consortium due to its own decision or election without SDG’s written consent and the Going-private Price is higher than

the Orient Purchase Price, Orient shall pay SDG the shortfall between the Orient Purchase Price and the Going-private Price with respect to all the Orient Purchase Shares. Pursuant to the Orient Share Purchase Agreement, if a going-private

transaction is not consummated within one year of the closing date of the sale of the Orient Purchase Shares solely due to SDG’s failure to vote in favor of such going-private transaction, SDG shall repurchase the Orient Purchase Shares at a

per share price equal to the Orient Purchase Price.

On September 1, 2014, Perfect World, FV Investment and Carlyle withdrew from the

Consortium pursuant to a withdrawal notice (the “Withdrawal Notice”). References to “Consortium” or “Consortium Members” after September 1, 2014 shall not include Perfect World, FV Investment and Carlyle.

On September 1, 2014, Shanda Interactive, Fund I and Orient Finance entered into an adherence agreement (the “Orient Adherence

Agreement”), pursuant to which Orient Finance became a party to the Consortium Agreement and joined the Consortium. References to “Consortium” or “Consortium Members” after September 1, 2014 shall include Orient Finance.

On September 1, 2014, SDG and Shanghai Buyout Fund L.P., a limited partnership formed under the laws of the People’s Republic of

China (“Haitong”) entered into a share purchase agreement (the “Haitong Share Purchase Agreement”) pursuant to which SDG agreed to sell, and Haitong agreed to purchase, 48,152,848 Class A Ordinary Shares (the “Haitong

Purchase Shares”) at US$3.45 per Class A Ordinary Share (the “Haitong Purchase Price”) subject to the terms and conditions thereof. Pursuant to the Haitong Share Purchase Agreement, if (i) a going-private transaction occurs within one

year of the closing date of the sale of the Haitong Purchase Shares where Haitong is part of the buyer consortium and the Going-private Price is higher than the Haitong Purchase Price, or (ii) a going-private transaction occurs within one year of

the closing date of the sale of the Haitong Purchase Shares where Haitong is not part of the buyer consortium due to its own decision or election without SDG’s written consent and the Going-private Price is higher than the Haitong Purchase

Price, Haitong shall pay SDG the shortfall between the Haitong Purchase Price and the Going-private Price with respect to all the Haitong Purchase Shares. Pursuant to the Haitong Share Purchase Agreement, if a going-private transaction is not

consummated within one year of the closing date of the sale of the Haitong Purchase Shares solely due to SDG’s failure to vote in favor of such going-private transaction, SDG shall repurchase the Haitong Purchase Shares at a per share price

equal to the Haitong Purchase Price.

Page 10 of 15

Concurrently with the execution of the Haitong Share Purchase Agreement, Fund I, Perfect World

and Haitong entered into a share purchase agreement, pursuant to which Haitong agreed to purchase 28,959,276 and 30,326,005 Class A Ordinary Shares from Fund I and Perfect World, respectively. The transaction was completed on September 24, 2014. In

connection with the transaction, SDG, Fund I and Perfect World entered into a consent and release dated as of September 1, 2014 (the “Consent and Release”), pursuant to which all remaining obligations of Fund I and its affiliates and SDG

and its affiliates under the Fund I Share Purchase Agreement, and all remaining obligations of Perfect World and its affiliates and SDG and its affiliates under the PW Share Purchase Agreement, as applicable, automatically terminated effective upon

consummation of the transaction.

On the same day, Shanda Interactive, Fund I and Haitong entered into an adherence agreement (the

“Haitong Adherence Agreement”), pursuant to which Haitong became a party to the Consortium Agreement and joined the Consortium. References to “Consortium” or “Consortium Members” after September 1, 2014 shall include

Haitong.

On September 1, 2014, SDG and Ningxia Zhongyincashmere International Group Co., Ltd., a company formed under the laws of the

People’s Republic of China (“Ningxia”) entered into a share purchase agreement (the “Ningxia Share Purchase Agreement”) pursuant to which SDG agreed to sell, and Ningxia agreed to purchase, 80,577,828 Class A Ordinary Shares

(the “Ningxia Purchase Shares”) at US$3.45 per Class A Ordinary Share (the “Ningxia Purchase Price”) subject to the terms and conditions thereof. Pursuant to the Ningxia Share Purchase Agreement, if (i) a going-private

transaction occurs within one year of the closing date of the sale of the Ningxia Purchase Shares where Ningxia is part of the buyer consortium and the Going-private Price is higher than the Ningxia Purchase Price, or (ii) a going-private

transaction occurs within one year of the closing date of the sale of the Ningxia Purchase Shares where Ningxia is not part of the buyer consortium due to its own decision or election without SDG’s written consent and the Going-private Price is

higher than the Ningxia Purchase Price, Ningxia shall pay SDG the shortfall between the Ningxia Purchase Price and the Going-private Price with respect to all the Ningxia Purchase Shares. Pursuant to the Ningxia Share Purchase Agreement, if a

going-private transaction is not consummated within one year of the closing date of the sale of the Ningxia Purchase Shares solely due to SDG’s failure to vote in favor of such going-private transaction, SDG shall repurchase the Ningxia

Purchase Shares at a per share price equal to the Ningxia Purchase Price.

On the same day, Shanda Interactive, Fund I and Ningxia entered

into an adherence agreement (the “Ningxia Adherence Agreement”), pursuant to which Ningxia became a party to the Consortium Agreement and joined the Consortium. References to “Consortium” or “Consortium Members” after

September 1, 2014 shall include Ningxia.

On September 1, 2014, Fund I withdrew from the Consortium pursuant to a withdrawal notice (the

“Fund I Withdrawal Notice”). References to “Consortium” or “Consortium Members” after September 1, 2014 shall not include Fund I.

If the Transaction is completed, the ADSs would be delisted from the NASDAQ Global Select Market and the Issuer’s obligations to file

periodic reports under the Act would be terminated.

Descriptions of the Consortium Agreement, the Fund I Share Purchase Agreement, the PW

Share Purchase Agreement, the PW Adherence Agreement, the FV Adherence Agreement, the Carlyle Adherence Agreement, the Orient Share Purchase Agreement, the Haitong Share Purchase Agreement, the Ningxia Share Purchase Agreement, the Orient Adherence

Agreement, the Haitong Adherence Agreement, the Ningxia Adherence Agreement, the Withdrawal Notice, the Fund I Withdrawal Notice, the share purchase agreement among Haitong, Fund I and Perfect World, and the Consent and Release in this Schedule

13D/A are qualified in their entirety by reference to the Consortium Agreement, the Fund I Share Purchase Agreement, the PW Share Purchase Agreement, the PW Adherence Agreement, the FV Adherence Agreement, the Carlyle Adherence Agreement, the Orient

Share Purchase Agreement, the Haitong Share Purchase Agreement, the Ningxia Share Purchase Agreement, the Orient Adherence Agreement, the Haitong Adherence Agreement, the Ningxia Adherence Agreement, the Withdrawal Notice, the Fund I Withdrawal

Notice, the share purchase agreement among Haitong, Fund I and Perfect World, and the Consent and Release, copies of which are filed as Exhibits 7.03, 7.04, 7.05, 7.06, 7.07,7.08, 7.09, 7.10, 7.11, 7.12, 7.13, 7.14, 7.15, 7.16, 7.17 and 7.18 hereto

and incorporated herein by reference in their entirety.

Page 11 of 15

| ITEM 5. |

INTEREST IN SECURITIES OF THE ISSUER: |

Item 5(a) – (b) is hereby amended and restated as

follows:

(a) – (b) The following disclosure assumes that there were a total of 187,395,237 Class A Ordinary Shares and 349,801,719

Class B Ordinary Shares outstanding as of August 31, 2014. Each Class A Ordinary Share is entitled to one vote per share and is not convertible into Class B Ordinary Shares. Each Class B Ordinary Share is entitled to 10 votes per share and is

convertible at any time into one Class A Ordinary Share at the election of its holder.

As of August 31, 2014, Shanda Interactive, through

its wholly owned subsidiary SDG, beneficially owned 349,801,719 Class B Ordinary Shares, representing 100% of the Class B Ordinary Shares of the Issuer outstanding as of August 31, 2014, or approximately 65.1% of the combined total outstanding

shares (including Class A Ordinary Shares and Class B Ordinary Shares) of the Issuer, and representing approximately 94.9% of the total voting rights in the Issuer as of August 31, 2014.

As of August 31, 2014, Perfect World owned 30,326,005 Class A Ordinary Shares, representing approximately 16.2% of the Class A Ordinary Shares

of the Issuer outstanding as of August 31, 2014, or approximately 5.6% of the combined total outstanding shares (including Class A Ordinary Shares and Class B Ordinary Shares) of the Issuer as of August 31, 2014.

As of August 31, 2014, Fund I, through its indirect wholly owned subsidiary Mage Capital Limited, beneficially owned 28,959,276 Class A

Ordinary Shares, representing approximately 15.5% of the Class A Ordinary Shares of the Issuer outstanding as of August 31, 2014, or approximately 5.4% of the combined total outstanding shares (including Class A Ordinary Shares and Class B Ordinary

Shares) of the Issuer as of August 31, 2014.

(c) Except as set forth Item 4, to the best knowledge of each of the Reporting Persons

with respect to the persons named in response to Item 5(a), none of the persons named in response to Item 5(a) has effected any transactions in the shares of the Issuer during the past 60 days.

(e) On September 24, 2014, the Reporting Persons ceased to be the beneficial owners of more than five percent of the Class A Ordinary Shares of

the Issuer as a result of the consummation of the transaction under the share purchase agreement among Fund I, Perfect World and Haitong.

| ITEM 6. |

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO THE ISSUER. |

The description of the Consortium Agreement, the Fund I Share Purchase Agreement, the PW Share Purchase Agreement, the PW Adherence Agreement,

the FV Adherence Agreement, the Carlyle Adherence Agreement, the Orient Share Purchase Agreement, the Haitong Share Purchase Agreement, the Ningxia Share Purchase Agreement, the Orient Adherence Agreement, the Haitong Adherence Agreement, the

Ningxia Adherence Agreement, the Withdrawal Notice, the Fund I Withdrawal Notice, the share purchase agreement among Haitong, Fund I and Perfect World, and the Consent and Release under Item 4 are incorproated herein by reference in their entirety.

Page 12 of 15

| ITEM 7. |

MATERIAL TO BE FILED AS EXHIBITS: |

|

|

|

| Exhibit 7.01: |

|

Joint Filing Agreement by and among the Reporting Persons dated February 20, 2014 (incorporated by reference to Exhibit 7.01 to Schedule 13D filed by the Reporting Persons on February 20, 2014). |

|

|

| Exhibit 7.02: |

|

Preliminary Proposal between Shanda Interactive Entertainment Limited and Primavera Capital (Cayman) Fund I L.P. dated January 27, 2014 (incorporated herein by reference to Exhibit 7.02 to Schedule 13D filed by Shanda Interactive

Entertainment Limited with the Securities and Exchange Commission on January 30, 2014). |

|

|

| Exhibit 7.03: |

|

Consortium Agreement between Shanda Interactive Entertainment Limited and Primavera Capital (Cayman) Fund I L.P. dated January 27, 2014 (incorporated herein by reference to Exhibit 7.03 to Schedule 13D filed by Shanda Interactive

Entertainment Limited with the Securities and Exchange Commission on January 30, 2014). |

|

|

| Exhibit 7.04: |

|

Fund I Share Purchase Agreement between Shanda SDG Investment Limited and Primavera Capital (Cayman) Fund I L.P. dated January 27, 2014 (incorporated herein by reference to Exhibit 7.04 to Schedule 13D filed by Shanda Interactive

Entertainment Limited with the Securities and Exchange Commission on January 30, 2014). |

|

|

| Exhibit 7.05 |

|

PW Share Purchase Agreement dated April 18, 2014 (incorporated herein by reference to Exhibit 7.05 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on April 21,

2014). |

|

|

| Exhibit 7.06 |

|

PW Adherence Agreement dated April 18, 2014 (incorporated herein by reference to Exhibit 7.06 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on April 21,

2014). |

|

|

| Exhibit 7.07 |

|

FV Adherence Agreement dated April 25, 2014 (incorporated herein by reference to Exhibit 7.07 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on April 28,

2014). |

|

|

| Exhibit 7.08 |

|

Carlyle Adherence Agreement dated May 19, 2014 (incorporated herein by reference to Exhibit 7.08 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on May 19,

2014). |

|

|

| Exhibit 7.09: |

|

Orient Share Purchase Agreement dated August 31, 2014 (incorporated herein by reference to Exhibit 7.09 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on September 3,

2014). |

|

|

| Exhibit 7.10: |

|

Haitong Share Purchase Agreement dated September 1, 2014 (incorporated herein by reference to Exhibit 7.10 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on September 3,

2014). |

|

|

| Exhibit 7.11: |

|

Ningxia Share Purchase Agreement dated September 1, 2014 (incorporated herein by reference to Exhibit 7.11 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on September 3,

2014). |

|

|

| Exhibit 7.12: |

|

Orient Adherence Agreement dated September 1, 2014 (incorporated herein by reference to Exhibit 7.12 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on September 3,

2014). |

|

|

| Exhibit 7.13: |

|

Haitong Adherence Agreement dated September 1, 2014 (incorporated herein by reference to Exhibit 7.13 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on September 3,

2014). |

|

|

| Exhibit 7.14: |

|

Ningxia Adherence Agreement dated September 1, 2014 (incorporated herein by reference to Exhibit 7.14 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on September 3,

2014). |

|

|

| Exhibit 7.15: |

|

Withdrawal Notice dated September 1, 2014 (incorporated herein by reference to Exhibit 7.15 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on September 3,

2014). |

|

|

| Exhibit 7.16: |

|

Fund I Withdrawal Notice dated September 1, 2014 (incorporated herein by reference to Exhibit 7.16 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on September 3,

2014). |

|

|

| Exhibit 7.17: |

|

Share Purchase Agreement dated September 1, 2014 among Shanghai Buyout Fund L.P., Primavera Capital (Cayman) Fund I L.P. and Perfect World Co., Ltd. (incorporated herein by reference to Exhibit 7.05 to Schedule 13D filed by Perfect

World Co., Ltd. with the Securities and Exchange Commission on September 2, 2014). |

|

|

| Exhibit 7.18: |

|

Consent and Release dated September 1, 2014 (incorporated herein by reference to Exhibit 7.17 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on September 3,

2014) |

Page 13 of 15

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Statement is true,

complete and correct.

Dated: September 24, 2014

|

|

|

|

|

| MAGE CAPITAL LIMITED |

|

|

| By: |

|

/s/ Lawrence Wang |

|

|

Name: |

|

Lawrence Wang |

|

|

Title: |

|

Director |

|

| MAGE SPV LIMITED |

|

|

| By: |

|

/s/ Lawrence Wang |

|

|

Name: |

|

Lawrence Wang |

|

|

Title: |

|

Director |

|

| PRIMAVERA CAPITAL (CAYMAN) FUND I L.P. |

|

|

| By: |

|

PRIMAVERA CAPITAL (CAYMAN) GP1 L.P., its General Partner |

|

|

| By: |

|

PRIMAVERA (CAYMAN) GP1 LTD, its General Partner |

|

|

| By: |

|

/s/ Lawrence Wang |

|

|

Name: |

|

Lawrence Wang |

|

|

Title: |

|

Authorized Signatory |

|

| PRIMAVERA CAPITAL (CAYMAN) GP1 L.P. |

|

|

| By: |

|

PRIMAVERA (CAYMAN) GP1 LTD, its General Partner |

|

|

| By: |

|

/s/ Lawrence Wang |

|

|

Name: |

|

Lawrence Wang |

|

|

Title: |

|

Authorized Signatory |

|

| PRIMAVERA (CAYMAN) GP1 LTD |

|

|

| By: |

|

/s/ Lawrence Wang |

|

|

Name: |

|

Lawrence Wang |

|

|

Title: |

|

Authorized Signatory |

INDEX TO EXHIBITS

|

|

|

| Exhibit 7.01: |

|

Joint Filing Agreement by and among the Reporting Persons dated February 20, 2014 (incorporated by reference to Exhibit 7.01 to Schedule 13D filed by the Reporting Persons on February 20, 2014). |

|

|

| Exhibit 7.02: |

|

Preliminary Proposal between Shanda Interactive Entertainment Limited and Primavera Capital (Cayman) Fund I L.P. dated January 27, 2014 (incorporated herein by reference to Exhibit 7.02 to Schedule 13D filed by Shanda Interactive

Entertainment Limited with the Securities and Exchange Commission on January 30, 2014). |

|

|

| Exhibit 7.03: |

|

Consortium Agreement between Shanda Interactive Entertainment Limited and Primavera Capital (Cayman) Fund I L.P. dated January 27, 2014 (incorporated herein by reference to Exhibit 7.03 to Schedule 13D filed by Shanda Interactive

Entertainment Limited with the Securities and Exchange Commission on January 30, 2014). |

|

|

| Exhibit 7.04: |

|

Fund I Share Purchase Agreement between Shanda SDG Investment Limited and Primavera Capital (Cayman) Fund I L.P. dated January 27, 2014 (incorporated herein by reference to Exhibit 7.04 to Schedule 13D filed by Shanda Interactive

Entertainment Limited with the Securities and Exchange Commission on January 30, 2014). |

|

|

| Exhibit 7.05 |

|

PW Share Purchase Agreement dated April 18, 2014 (incorporated herein by reference to Exhibit 7.05 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on April 21,

2014). |

|

|

| Exhibit 7.06 |

|

PW Adherence Agreement dated April 18, 2014 (incorporated herein by reference to Exhibit 7.06 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on April 21,

2014). |

|

|

| Exhibit 7.07 |

|

FV Adherence Agreement dated April 25, 2014 (incorporated herein by reference to Exhibit 7.07 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on April 28,

2014). |

|

|

| Exhibit 7.08 |

|

Carlyle Adherence Agreement dated May 19, 2014 (incorporated herein by reference to Exhibit 7.08 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on May 19,

2014). |

|

|

| Exhibit 7.09: |

|

Orient Share Purchase Agreement dated August 31, 2014 (incorporated herein by reference to Exhibit 7.09 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on September 3,

2014). |

|

|

| Exhibit 7.10: |

|

Haitong Share Purchase Agreement dated September 1, 2014 (incorporated herein by reference to Exhibit 7.10 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on September 3,

2014). |

|

|

| Exhibit 7.11: |

|

Ningxia Share Purchase Agreement dated September 1, 2014 (incorporated herein by reference to Exhibit 7.11 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on September 3,

2014). |

|

|

| Exhibit 7.12: |

|

Orient Adherence Agreement dated September 1, 2014 (incorporated herein by reference to Exhibit 7.12 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on September 3,

2014). |

|

|

| Exhibit 7.13: |

|

Haitong Adherence Agreement dated September 1, 2014 (incorporated herein by reference to Exhibit 7.13 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on September 3,

2014). |

|

|

| Exhibit 7.14: |

|

Ningxia Adherence Agreement dated September 1, 2014 (incorporated herein by reference to Exhibit 7.14 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on September 3,

2014). |

|

|

| Exhibit 7.15: |

|

Withdrawal Notice dated September 1, 2014 (incorporated herein by reference to Exhibit 7.15 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on September 3,

2014). |

|

|

| Exhibit 7.16: |

|

Fund I Withdrawal Notice dated September 1, 2014 (incorporated herein by reference to Exhibit 7.16 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on September 3,

2014). |

|

|

| Exhibit 7.17: |

|

Share Purchase Agreement dated September 1, 2014 among Shanghai Buyout Fund L.P., Primavera Capital (Cayman) Fund I L.P. and Perfect World Co., Ltd. (incorporated herein by reference to Exhibit 7.05 to Schedule 13D filed by Perfect

World Co., Ltd. with the Securities and Exchange Commission on September 2, 2014). |

|

|

| Exhibit 7.18: |

|

Consent and Release dated September 1, 2014 (incorporated herein by reference to Exhibit 7.17 to Schedule 13D filed by Shanda Interactive Entertainment Limited with the Securities and Exchange Commission on September 3,

2014) |

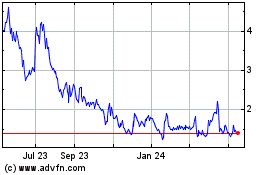

GameSquare (NASDAQ:GAME)

Historical Stock Chart

From Mar 2024 to Apr 2024

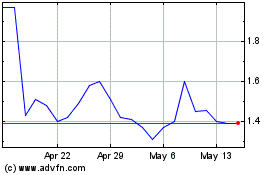

GameSquare (NASDAQ:GAME)

Historical Stock Chart

From Apr 2023 to Apr 2024