Gold Reserve Awarded $740.3 Million by ICSID for the Expropriation of the Brisas Project by Venezuela

September 22 2014 - 7:48PM

Business Wire

Gold Reserve Inc. (TSX.V:GRZ) (OTCQB:GDRZF) is pleased to

announce that the three-member Tribunal at the World Bank’s

International Center for the Settlement of Investment Disputes

(“ICSID”) has awarded the Company $740.3 million in accordance with

the provisions of the Canada–Venezuela Bilateral Investment Treaty

(“BIT”).

The Award represents $713 million for the fair market value of

the Brisas Project, $22.3 million for interest on the Award since

April 2008 based on the US Treasury Bill rate compounded annually

and $5 million for reimbursement of legal and technical costs

expended by the Company. Payment of the Award is due and payable

immediately with any unpaid amounts accruing interest at Libor plus

2% per annum.

Gold Reserve and its legal counsel are evaluating the

substantial text of the Award and expect to have further comments

on the Tribunal’s decision in the near future. A copy of the full

text of the Award will be posted on the Company’s website in the

next few days.

Gold Reserve has commenced steps to ensure the recognition and

collection of the Award which is immediately enforceable in any of

the 150-plus member states party to the New York Convention. The

Company is well financed and has the strong support of its

stakeholders to pursue the collection of the Award in full.

Gold Reserve expects that Venezuela will honor its international

obligations and will effect prompt payment of the tribunal’s

unanimous Award. While the Company is pleased with the Award it is

less than the value of the Brisas project at today’s gold and

copper prices and Venezuela will substantially benefit from the

development of the mine. As previously reported, the Company

expended approximately US$300 million developing the Brisas project

to the construction stage prior to its termination by Venezuela.

The acquisition of the Company’s valuable engineering work product

by the Venezuelan government would both expedite and reduce the

cost of the project’s development. If requested, Gold Reserve would

also be prepared to assist in the fast-track development of the

Brisas Project.

The Company plans to distribute a substantial majority of any

proceeds received to its shareholders in the most efficient manner

possible, subject to the need to retain funds for operating and

arbitration related expenses, corporate income taxes and other

obligations, such as repayment of convertible notes (if not

otherwise converted).

As of the date of this notice the Company has 76.1 million Class

A common shares issued and outstanding and holds approximately $8.8

million in cash. On a fully diluted basis, assuming all warrants,

options and convertible notes are converted to common shares, the

Company would have approximately 93.5 million Class A common shares

issued and outstanding and would hold approximately $18.8 million

in cash. This amount excludes any potential sale of the Brisas

project technical and engineering work product and approximately

$19 million of related equipment held for sale.

Gold Reserve President Doug Belanger stated, “The board of

directors, management and employees of the Company are pleased that

the Tribunal was unanimous in deciding all phases of the Award in

favor of the Company. We feel vindicated by the Tribunal’s clear

conclusion that the Venezuelan government acted unlawfully in

terminating the Brisas Project in direct violation of the BIT. We

are gratified to know that all of our hard work prior to the

unlawful termination of the project and subsequently in the

execution of our claim against the Venezuelan government has been

rewarded.

“On behalf of the Board, we thank our legal team at White &

Case, led by Abby Cohen Smutny and Darryl Lew and supported by a

host of talented and dedicated professionals. We also acknowledge

our employees, consultants and legal and technical experts for

their tremendous contribution and dedication. Lastly, we commend

our shareholders for their continued support throughout this

difficult, very costly and time consuming process.

“As our counsel studies the Award, the Company plans to reach

out to the government of Venezuela to explore ways to facilitate

Venezuela’s ability to honor its obligations promptly. We are

hopeful that Venezuela will satisfy its obligations to the Company

without delay and without any further legal proceeding. Should they

fail to do so, we are prepared to pursue all available means to

ensure that the amount awarded to the Company is recovered in full.

There are well documented procedures in place for identifying and

attaching sovereign commercial assets located in States that are

party to the New York Convention. The Company is already well

advanced in this effort.”

Please see our website at www.goldreserveinc.com for further

information including: International Arbitration, Brisas Project,

Corporate Obligations, Investor Information – pro forma diluted

Common Shares outstanding.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This release contains “forward-looking statements” or

“forward-looking information” as such terms are defined under

applicable U.S. and Canadian securities laws (collectively referred

to herein as “forward-looking statements”) with respect to the

ICSID Award related to the expropriation of the Company’s Brisas

Project by the Venezuela government. Forward-looking statements are

necessarily based upon a number of estimates and assumptions that,

while considered reasonable by management at this time, are

inherently subject to significant business, economic and

competitive uncertainties and contingencies such as, among other

things, the Company’s ability to collect such Award.

We caution that such forward-looking statements involve known

and unknown risks, uncertainties and other risks that may cause the

actual outcomes, financial results, performance, or achievements of

Gold Reserve to be materially different from our estimated

outcomes, future results, performance, or achievements expressed or

implied by those forward-looking statements.

Factors that could cause actual results to differ materially

from those in the forward-looking statements include the timing of

and amount of collection of the Award, if at all.

This list is not exhaustive of the factors that may affect any

of Gold Reserve's forward-looking statements. Investors are

cautioned not to put undue reliance on forward-looking statements.

All subsequent written and oral forward-looking statements

attributable to Gold Reserve or persons acting on its behalf are

expressly qualified in their entirety by this notice. Gold Reserve

disclaims any intent or obligation to update publicly or otherwise

revise any forward-looking statements or the foregoing list of

assumptions or factors, whether as a result of new information,

future events or otherwise, subject to its disclosure obligations

under applicable U.S. or Canadian securities laws.

“Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.”

Gold Reserve Inc.A. Douglas Belanger, President,

509-623-1500Fax: 509-623-1634

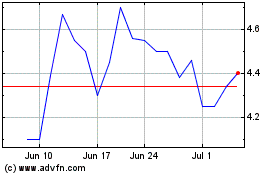

Gold Reserve (QX) (USOTC:GDRZF)

Historical Stock Chart

From Mar 2024 to Apr 2024

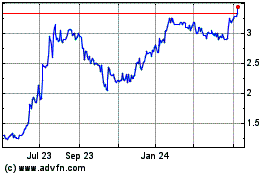

Gold Reserve (QX) (USOTC:GDRZF)

Historical Stock Chart

From Apr 2023 to Apr 2024