UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the quarterly period ended |

July 31, 2014 |

| ¨ | TRANSITION REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from |

|

to |

|

| Commission File Number |

000-54323 |

| INDEPENDENCE ENERGY CORP. |

| (Exact name of registrant as specified in its charter) |

| Nevada |

|

20-3866475 |

| (State or other jurisdiction of incorporation or organization) |

|

(IRS Employer Identification No.) |

| 3020 Old Ranch Parkway, Suite 300, Seal Beach, CA |

90740 |

| (Address of principal executive offices) |

(Zip Code) |

| (562) 799-5588 |

| (Registrant’s telephone number, including area code) |

| |

| N/A |

| (Former name, former address and former fiscal year, if changed since last report) |

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

x YES ¨ NO

Indicate by check mark whether the registrant

has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted

and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter

period that the registrant was required to submit and post such files).

x YES ¨ NO

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See the definitions

of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2

of the Exchange Act.

| Large accelerated filer |

¨ |

Accelerated filer ¨ |

|

| Non-accelerated filer |

¨ |

(Do not check if a smaller reporting company) |

Smaller reporting company ☒ |

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act)

¨ YES x NO

Independence Energy Corp. had

345,188,164 shares of its common stock issued and outstanding as of September 12, 2014.

Independence Energy Corp.

July 31, 2014

Index

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

Independence Energy Corp.

Condensed Balance

Sheets

| | |

July 31,

2014 | | |

January 31,

2014 | |

| | |

(unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| Current Assets | |

| | | |

| | |

| | |

| | | |

| | |

| Cash | |

$ | 2,161 | | |

$ | 7,292 | |

| Prepaid expenses and deposits | |

| – | | |

| 3,100 | |

| Deferred financing charge | |

| – | | |

| 1,264 | |

| Held for sale - oil and gas properties | |

| 56,645 | | |

| – | |

| | |

| | | |

| | |

| Total Current Assets | |

| 58,806 | | |

| 11,656 | |

| | |

| | | |

| | |

| Oil and gas properties | |

| – | | |

| 208,678 | |

| Intangible assets | |

| 320,431 | | |

| – | |

| | |

| | | |

| | |

| Total Assets | |

$ | 379,237 | | |

$ | 220,334 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | |

| | | |

| | |

| | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 30,355 | | |

$ | 11,488 | |

| Convertible debenture, net of unamortized discount of $0 and $41,666, respectively | |

| – | | |

| 35,834 | |

| Loan payable | |

| 156,697 | | |

| 156,697 | |

| Derivative liability | |

| – | | |

| 97,237 | |

| Due to related party | |

| 44,451 | | |

| – | |

| Liabilities of oil and gas properties | |

| 56,645 | | |

| 61,469 | |

| | |

| | | |

| | |

| Total Liabilities | |

| 288,148 | | |

| 362,725 | |

| | |

| | | |

| | |

| Commitments and Contingencies | |

| – | | |

| – | |

| | |

| | | |

| | |

| Stockholders’ Equity (Deficit) | |

| | | |

| | |

| | |

| | | |

| | |

| Common Stock | |

| | | |

| | |

Authorized: 375,000,000 common shares, with a par value of $0.001 per share

Issued and outstanding: 345,188,164 and 129,304,155 common shares, respectively | |

| 345,188 | | |

| 129,304 | |

| | |

| | | |

| | |

| Additional paid-in capital | |

| 892,832 | | |

| 541,497 | |

| | |

| | | |

| | |

| Deficit accumulated | |

| (1,146,931 | ) | |

| (813,192 | ) |

| | |

| | | |

| | |

| Total Stockholders’ Equity (Deficit) | |

| 91,089 | | |

| (142,391 | ) |

| | |

| | | |

| | |

| Total Liabilities and Stockholders’ Equity (Deficit) | |

$ | 379,237 | | |

$ | 220,334 | |

(The accompanying notes are an integral

part of these condensed financial statements)

Independence Energy Corp.

Condensed Statements of Operations and Comprehensive

Loss

(unaudited)

| | |

Three Months

Ended July 31, | | |

Six Months

Ended July 31, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

$ | – | | |

$ | – | | |

$ | – | | |

$ | – | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Expenses | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

| 70,699 | | |

| 25,681 | | |

| 107,768 | | |

| 62,853 | |

| Professional fees | |

| 1,750 | | |

| 13,741 | | |

| 26,715 | | |

| 32,526 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total Operating Expenses | |

| 72,449 | | |

| 39,422 | | |

| 134,483 | | |

| 95,379 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Operating Loss | |

| (72,449 | ) | |

| (39,422 | ) | |

| (134,483 | ) | |

| (95,379 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other Income (Expense) | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Amortization of debt discount | |

| – | | |

| (1,283 | ) | |

| (74,166 | ) | |

| (496 | ) |

| Amortization of deferred financing charges | |

| – | | |

| – | | |

| (1,264 | ) | |

| – | |

| Gain on change in fair value of derivative liability | |

| – | | |

| – | | |

| 24,029 | | |

| – | |

| Interest expense | |

| – | | |

| – | | |

| (116 | ) | |

| (1,092 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Total Other Expense, net | |

| – | | |

| (1,283 | ) | |

| (51,517 | ) | |

| (1,588 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from Continuing Operations | |

| (72,449 | ) | |

| (40,705 | ) | |

| (186,000 | ) | |

| (96,967 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Discontinued Operations (Note 7) | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from discontinued operations | |

| (147,739 | ) | |

| – | | |

| (147,739 | ) | |

| – | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss on Discontinued Operations | |

| (147,739 | ) | |

| – | | |

| (147,739 | ) | |

| – | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss and Comprehensive Loss | |

$ | (220,188 | ) | |

$ | (40,705 | ) | |

$ | (333,739 | ) | |

$ | (96,967 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss Per Share, Basic and Diluted | |

$ | – | | |

$ | – | | |

$ | – | | |

$ | – | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted Average Shares Outstanding, Basic and Diluted | |

| 345,188,164 | | |

| 121,804,155 | | |

| 255,907,955 | | |

| 121,804,155 | |

(The accompanying notes are an integral

part of these condensed financial statements)

Independence Energy

Corp.

Condensed Statements of Cash Flows

(unaudited)

| | |

Six Months

Ended July 31, | |

| | |

2014 | | |

2013 | |

| Operating Activities | |

| | | |

| | |

| | |

| | | |

| | |

| Net loss from continuing operations | |

$ | (186,000 | ) | |

$ | (96,967 | ) |

| | |

| | | |

| | |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Amortization of discount on convertible debenture | |

| 74,166 | | |

| 496 | |

| Amortization of deferred financing charges | |

| 1,264 | | |

| – | |

| Gain on change in fair value of derivative liability | |

| (24,029 | ) | |

| – | |

| | |

| | | |

| | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| | |

| | | |

| | |

| Prepaid expense and deposits | |

| 3,100 | | |

| 2,127 | |

| Accounts payable and accrued liabilities | |

| 22,460 | | |

| 822 | |

| Due to a related party | |

| 44,451 | | |

| – | |

| | |

| | | |

| | |

| Net Cash Used in Operating Activities | |

| (64,588 | ) | |

| (93,522 | ) |

| | |

| | | |

| | |

| Financing activities | |

| | | |

| | |

| | |

| | | |

| | |

| Proceeds from acquisition transaction | |

| 60,000 | | |

| – | |

| | |

| | | |

| | |

| Proceeds from issuance of convertible debenture | |

| – | | |

| 103,000 | |

| | |

| | | |

| | |

| Net Cash Provided by Financing Activities | |

| 60,000 | | |

| 103,000 | |

| | |

| | | |

| | |

| Discontinued operations: | |

| | | |

| | |

| | |

| | | |

| | |

| Operating activities | |

| (543 | ) | |

| – | |

| | |

| | | |

| | |

| Net Cash Used in Discontinued Operations | |

| (543 | ) | |

| – | |

| | |

| | | |

| | |

| Increase (Decrease) in Cash | |

| (5,131 | ) | |

| 9,478 | |

| | |

| | | |

| | |

| Cash, Beginning of Period | |

| 7,292 | | |

| 36,235 | |

| | |

| | | |

| | |

| Cash, End of Period | |

$ | 2,161 | | |

$ | 45,713 | |

| | |

| | | |

| | |

| Non-cash investing and financing activities: | |

| | | |

| | |

| Beneficial conversion feature of convertible debenture | |

$ | – | | |

$ | 4,600 | |

| Shares issued on conversion of convertible debt | |

$ | 147,212 | | |

$ | – | |

| Shares issued for acquisition of intangible assets | |

$ | 320,431 | | |

$ | – | |

| | |

| | | |

| | |

| Supplemental Disclosures | |

| | | |

| | |

| Interest paid | |

$ | – | | |

$ | – | |

| Income tax paid | |

$ | – | | |

$ | – | |

(The accompanying notes are an integral

part of these condensed financial statements)

Independence Energy Corp.

Notes to the Condensed Financial Statements

(unaudited)

| 1. | Nature of Operations and Continuance of Business |

Independence Energy Corp. (the

"Company") was incorporated in the State of Nevada on November 30, 2005. The Company was

organized to explore natural resource properties in the United States. On March 31, 2014, the Company acquired the exclusive right

to distribute certain medical products and has changed its focus to the medical products distribution business.

Going Concern

These financial statements

have been prepared on a going concern basis, which implies that the Company will be able to continue as a going concern

without further financing. Currently, the Company must continue to realize its assets to discharge its liabilities in the

normal course of business. The Company has generated no revenues to date and has never paid any dividends and is unlikely to

pay dividends or generate significant earnings in the immediate or foreseeable future. As of July 31, 2014, the Company

had a working capital deficit of $229,347 and an accumulated deficit of $1,146,931. The continuation of the Company as a

going concern is dependent upon the continued financial support from its shareholders, the ability to raise equity or debt

financing, and the attainment of profitable operations from the Company's future medical products distribution

business. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern. These

financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts

and classification of liabilities that might be necessary should the Company be unable to continue as a going

concern.

| 2. | Summary of Significant Accounting Policies |

These financial statements and

related notes are presented in accordance with accounting principles generally accepted in the United States (“GAAP”).

The Company’s fiscal year-end is January 31.

The financial statements

and related notes are prepared in conformity with GAAP which requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of

the financial statements and the reported amounts of revenues and expenses during the reporting period. The Company

regularly evaluates estimates and assumptions related to valuation and impairment of long-lived assets, asset retirement

obligations, fair value of share-based payments, and deferred income tax asset valuation allowances. The Company bases its

estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable

under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and

liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results

experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are

material differences between the estimates and the actual results, future results of operations will be affected.

| c) | Interim Financial Statements |

These interim unaudited financial

statements have been prepared on the same basis as the annual financial statements and in the opinion of management, reflect all

adjustments, which include only normal recurring adjustments, necessary to present fairly the Company’s financial position,

results of operations and cash flows for the periods shown. The results of operations for such periods are not necessarily indicative

of the results expected for a full year or for any future period.

| d) | Basic and Diluted Net Loss Per Share |

The Company computes net loss

per share in accordance with ASC 260, Earnings Per Share, which requires presentation of both basic and diluted earnings

per share (EPS) on the face of the income statement. Basic EPS is computed by dividing net loss available to common shareholders

(numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted EPS gives effect to all

dilutive potential common shares outstanding during the period using the treasury stock method and convertible preferred stock

using the if-converted method. In computing Diluted EPS, the average stock price for the period is used in determining the number

of shares assumed to be purchased from the exercise of stock options or warrants. Diluted EPS excludes all dilutive potential shares

if their effect is anti-dilutive. As of July 31, 2014 and 2013, the Company had no potentially

dilutive shares.

Independence Energy Corp.

Notes to the Condensed Financial Statements

(unaudited)

| 2. | Summary of Significant Accounting Policies (continued) |

| e) | Oil and Gas Property Costs |

The Company utilizes the full-cost

method of accounting for oil and natural gas properties. Under this method, the Company capitalizes all costs associated with acquisition,

exploration, and development of oil and natural gas reserves, including leasehold acquisition costs, geological and geophysical

expenditures, lease rentals on undeveloped properties and costs of drilling of productive and non-productive wells into the full

cost pool on a country-by-country basis. If the Company obtains proven oil and natural gas reserves, capitalized costs, including

estimated future costs to develop the reserves proved and estimated abandonment costs, net of salvage, will be depleted on the

units-of-production method using estimates of proved reserves. The costs of unproved properties and exploratory wells in progress

are not amortized until it is determined whether or not proved reserves could be assigned to the properties. Until such determination

is made, the Company assesses annually whether impairment has occurred, and includes in the amortization base drilling exploratory

dry holes associated with unproved properties.

The Company applies

a ceiling test to the capitalized cost in the full cost pool. The ceiling test limits such cost to the estimated present

value, using a ten percent discount rate, of the future net revenue from proved reserves based on current economic and

operating conditions. Specifically, the Company computes the ceiling test so that capitalized cost, less accumulated

depletion and related deferred income tax, do not exceed an amount (the ceiling) equal to the sum of: The present value of

estimated future net revenue computed by applying current prices of oil and gas reserves (with consideration of price changes

only to the extent provided by contractual arrangements) to estimated future production of proved oil and natural gas

reserves as of the date of the latest balance sheet presented, less estimated future expenditures (based on current cost) to

be incurred in developing and producing the proved reserves computed using a discount factor of ten percent and assuming

continuation of existing economic conditions; plus the cost of property not being amortized; plus the lower of cost or

estimated fair value of unproven properties included in the costs being amortized; less income tax effects related to

differences between the book and tax basis of the property. For unproven properties, the Company excludes from capitalized

costs subject to depletion, all costs directly associated with the acquisition and evaluation of the unproved property until

it is determined whether or not proved reserves could be assigned to the property. Until such a determination is made, the

Company assesses the property at least annually to ascertain whether impairment has occurred. In assessing impairment the

Company considers factors such as historical experience and other data such as primary lease terms of the property, average

holding periods of unproved property, and geographic and geologic data. The Company adds the amount of impairment assessed to

the cost to be amortized subject to the ceiling test. During the period ended July 31, 2014, the Company decided that it

does not intend to continue its oil and gas business and the relevant assets have been impaired.

| f) | Asset Retirement Obligations |

The Company accounts for asset

retirement obligations in accordance with standards which require the Company to record the fair value of liabilities related to

future asset retirement obligations in the period the obligation is incurred. Generally, the amount of the asset retirement

obligation and the costs capitalized will be equal to the estimated future cost to satisfy the abandonment obligation using current

prices that are escalated by an assumed inflation factor after discounting the future cost back to the date that the abandonment

obligation was incurred using an assumed cost of funds rate for the Company. After initially recording such amounts, these asset

retirement obligations are accreted to their future estimated value using the same assumed cost of funds and the capitalized costs

are depleted using the future gross revenue method over the productive lives of the Company’s oil and gas properties.

This is accounted for as a reduction of assets held for sale as these are directly related to the assets to be disposed.

| g) | Beneficial Conversion Features |

From time to time, the Company

may issue convertible notes that may contain an imbedded beneficial conversion feature. A beneficial conversion feature exists

on the date a convertible note is issued when the fair value of the underlying common stock to which the note is convertible into

is in excess of the remaining unallocated proceeds of the note after first considering the allocation of a portion of the note

proceeds to the fair value of the warrants, if related warrants have been granted. The intrinsic value of the beneficial conversion

feature is recorded as a debt discount with a corresponding amount to additional paid in capital. The debt discount is amortized

to interest expense over the life of the note using the effective interest method.

From time to time, the Company

may issue equity instruments that may contain an embedded derivative instrument which may result in a derivative liability. A derivative

liability exists on the date the equity instrument is issued when there is a contingent exercise provision. The derivative liability

is recorded at its fair value calculated by using an option pricing model such as a multi-nominal lattice model. The fair value

of the derivative liability is then calculated on each balance sheet date with the corresponding changes in the asset or liability

recorded as derivative gains and losses in the consolidated statement of operations.

Potential benefits of income

tax losses are not recognized in the accounts until realization is more likely than not. The Company has adopted ASC 740, Income

Taxes, as of its inception. Pursuant to ASC 740, the Company is required to compute tax asset benefits for net operating losses

carried forward. The potential benefits of net operating losses have not been recognized in these financial statements because

the Company cannot be assured it is more likely than not it will utilize the net operating losses carried forward in future years.

Independence Energy Corp.

Notes to the Condensed Financial Statements

(unaudited)

| 2. | Summary of Significant Accounting Policies (continued) |

ASC 220, Comprehensive Income,

establishes standards for the reporting and display of comprehensive loss and its components in the financial statements. As of

July 31, 2014, the Company had no items that represented comprehensive loss and, therefore, did not include a schedule

of comprehensive loss in the financial statements.

Pursuant to ASC 820, Fair

Value Measurements and Disclosures, an entity is required to maximize the use of observable inputs and minimize the use of

unobservable inputs when measuring fair value. ASC 820 establishes a fair value hierarchy based on the level of independent, objective

evidence surrounding the inputs used to measure fair value. A financial instrument’s categorization within the fair value

hierarchy is based upon the lowest level of input that is significant to the fair value measurement. ASC 820 prioritizes the inputs

into three levels that may be used to measure fair value:

Level

1

Level 1 applies to assets or

liabilities for which there are quoted prices in active markets for identical assets or liabilities.

Level

2

Level 2 applies to assets or

liabilities for which there are inputs other than quoted prices that are observable for the asset or liability such as quoted prices

for similar assets or liabilities in active markets; quoted prices for identical assets or liabilities in markets with insufficient

volume or infrequent transactions (less active markets); or model-derived valuations in which significant inputs are observable

or can be derived principally from, or corroborated by, observable market data.

Level

3

Level 3 applies to assets or

liabilities for which there are unobservable inputs to the valuation methodology that are significant to the measurement of the

fair value of the assets or liabilities.

The Company’s financial

instruments consist principally of cash, accounts payable and accrued liabilities, and amounts due to related parties. Pursuant

to ASC 820 and 825, the fair value of our cash is determined based on “Level 1” inputs, which consist of quoted prices

in active markets for identical assets. We believe that the recorded values of all of our other financial instruments approximate

their current fair values because of their nature and respective maturity dates or durations.

Certain financial statement items

have been reclassified to conform to current period financial reporting requirements.

| m) | Recent Accounting Pronouncements |

The Company has limited operations

and is considered to be in the development stage. In the period ended July 31, 2014, the Company has elected to early adopt Accounting

Standards Update No. 2014-10, Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting Requirements.

The adoption of this ASU allows the Company to remove the inception to date information and all references to development stage.

The Company does not believe that

there are any other new accounting pronouncements that have been issued that might have a material impact on its consolidated financial

statements.

Independence Energy Corp.

Notes to the Condensed Financial Statements

(unaudited)

| a) | On December 15, 2011, the Company acquired a 2.5% interest in four wells in the Quinlan Lease (the

“Quinlan Lease”) from Wise Oil and Gas LLC (“Wise”) for $39,040, with the option to increase the interest

to 10%. The Quinlan Lease is located in Pottawatomie County, Oklahoma. |

On December 23, 2011, the Company

acquired an additional 2.5% interest in the Quinlan Lease for $39,040. On March 1, 2012, the Company acquired an additional

5% interest in the Quinlan Lease for $78,080, which brought the Company’s total interest in the Quinlan Lease to 10%.

During the period ended July 31,

2014, the Company decided to discontinue their interest in the Quinlan Lease. As a result, the Company recognized an impairment

of $147,739 to reflect the net liabilities owed on oil and gas production.

| b) | On March 29, 2012, the Company acquired a 5% interest in a 70% net revenue interest in certain

properties located in Coleman County, Texas for $115,000. On June 28, 2012, the Company amended the original agreement so that

the Company has a 7% interest in a 75% net revenue interest in such properties for an additional payment of $47,000, which replaced

the terms of the original agreement. |

On May 29, 2012, the Company acquired

a 2.5% interest in a 70% net revenue interest in two oil and gas wells and approximately 20 acres of land surrounding such properties

in Coleman County, Texas for $82,500. On June 8, 2012, the Company acquired a 12.5% interest in such wells, with an option to acquire

an additional 12.5% interest, for $90,785. Collectively, these properties in Coleman County, Texas comprised an area of 2,421 acres.

On February 28, 2013, the Company

entered into a Compromise, Settlement and Property Exchange Agreement with MontCrest Energy, Inc. and Black Strata, LLC. Pursuant

to the terms of such agreement, the Company transferred its working interests in the properties in Coleman County, Texas for a

100% interest in approximately 1,400 acres of the Coleman County South Lease held by Black Strata, LLC.

During the year ended January 31,

2014, the Company elected not to renew the working interest in the Coleman County South Lease and recognized an impairment of $335,285

to reflect the book value of such lease.

On

March 31, 2014, the Company entered into an asset purchase agreement (the “Agreement”) with American

Medical Distributors, LLC (“AMD”) where the Company acquired the intangible assets of AMD in exchange for the

issuance of 152,172,287 shares of the Company’s common stock with a fair value of $320,431 based on the fair value of

such shares on the date of issuance. As a part of this asset acquisition, the Company received $60,000

of financing.

| a) | On July 15, 2013, the Company issued an unsecured convertible note in a principal amount of $57,000

bearing interest at 8% per annum and due on April 17, 2014 (the “April 2014 Note”). The April 2014 Note was convertible

into shares of common stock 180 days after the date of issuance (or January 11, 2014) at a conversion rate of 58% of the average

of the three lowest closing bid prices of the shares of the Company’s common stock for the ten trading days ending one trading

day prior to the date the conversion notice was sent by the holder to the Company. During the year ended January 31, 2014, the

Company issued 7,500,000 shares of its common stock upon the conversion of $12,000 of the principal amount of the April 2014 Note.

During the period ended July 31, 2014, the Company issued an additional 35,545,055 shares of its common stock upon the conversion

of the remaining $45,000 of the principal amount of the April 2014 Note plus $2,280 of accrued interest. |

In accordance with ASC 470-20, “Debt

with Conversion and Other Options”, the Company recognized the intrinsic value of the embedded beneficial conversion feature

of the April 2014 Note equal to the principal amount of $57,000 and an equivalent discount which was charged to operations over

the term of the April 2014 Note. During the six month period ended July 31, 2014, the Company had amortized the [remaining] $41,666

of the debt discount to interest expense. As of July 31, 2014, the April 2014 Note was no longer outstanding and the Company did

not have a carrying value for such note.

| b) | On September 17, 2013, the Company issued an unsecured convertible note in a principal amount of

$32,500 bearing interest at 8% per annum and due on June 19, 2014 (the “June 2014 Note”). The Company received $30,000,

net of issuance fee of $2,500. The June 2014 Note was convertible into shares of common stock 180 days after the date of issuance

(or March 16, 2014) at a conversion rate of 58% of the average of the three lowest closing bid prices of the shares of the Company’s

common stock for the ten trading days ending one trading day prior to the date the conversion notice was sent by the holder to

the Company. During the three month period ended July 31, 2014, the Company issued 28,166,667 shares of its common stock upon the

conversion of the full $32,500 of the principal of the June 2014 Note plus $1,300 of accrued interest. |

In accordance with ASC 470-20, “Debt

with Conversion and Other Options”, the Company recognized the intrinsic value of the embedded beneficial conversion feature

of the June 2014 Note equal to the principal amount of $32,500 and an equivalent discount which was charged to operations over

the term of the June 2014 Note. During the six month period ended July 31, 2014, the Company had amortized the full $32,500 of

the debt discount to interest expense. As of July 31, 2014, the June 2014 Note was no longer outstanding and the Company did not

have a carrying value for such note.

Independence Energy Corp.

Notes to the Condensed Financial Statements

(unaudited)

In December 2011, the

Company received a loan in the amount of $156,697 from an unrelated third party. The loan is non-interest

bearing, unsecured and due on demand.

| 7. | Related Party Transactions |

| a) | During the three month period ended July 31, 2014, the Company incurred $22,500 to a director

for management and consulting services. |

| b) | During the three month period ended July 31, 2014, the Company incurred $30,000 to its

Chief Executive Officer for consulting

services. |

| 8. | Discontinued operations |

On June 23, 2014,

the Company impaired its remaining oil and natural gas properties and changed its focus to the medical products distribution

business. The Company’s oil and gas properties have been classified as held for sale and are reflected at the estimated

fair value expected to be realized by the Company. As a result, the Company’s impairment of its oil and

gas properties and change in direction for the Company’s business, all expenses related to the oil and natural

gas operations have been classified as discontinued operations.

The results of discontinued

operations are summarized as follows:

| | |

For the Three Months

Ended July 31, | | |

For the Six Months

Ended July 31, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| | |

| | |

| | |

| | |

| |

| Operating Expenses | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Impairment of oil and natural gas property | |

$ | 147,739 | | |

$ | – | | |

$ | 147,739 | | |

$ | – | |

| | |

| | | |

| | | |

| | | |

| | |

| Total Operating Expenses | |

| 147,739 | | |

| – | | |

| 147,739 | | |

| – | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss From Discontinued Operations | |

$ | (147,739 | ) | |

$ | – | | |

$ | (147,739 | ) | |

$ | – | |

Subsequent to July 31,

2014, we borrowed $15,100 from two stockholders pursuant to a promissory note. The promissory note accrues interest at 7%

per annum and is due upon demand.

Item 2. Management's

Discussion and Analysis or Plan of Operation

This Management's Discussion and Analysis

of Financial Condition and Results of Operations contains forward-looking statements. Forward-looking statements are all statements

other than statements of historical facts. The words “may,” “can,” “will” “should,”

“plans,” “believes,” “estimates,” “expects,” “projects,” “targets,”

“intends,” “potential,” “proposed,” and any similar expressions are intended to identify those

assertions as forward-looking statements. Investors are cautioned that forward-looking statements are inherently uncertain. Actual

performance and results may differ materially from that projected or suggested herein due to certain risks and uncertainties. In

evaluating these statements, you should consider the various factors which may cause actual results to differ materially from any

forward-looking statements. Although we believe that the exceptions reflected in the forward-looking statements are reasonable,

we cannot guarantee future results, levels of activity, performance or achievements. We undertake no obligation to revise or update

any forward-looking statements.

Working Capital

| | |

July 31, | | |

January 31, | |

| | |

2014 | | |

2014 | |

| Current Assets | |

$ | 58,806 | | |

$ | 11,656 | |

| Current Liabilities | |

$ | 288,148 | | |

$ | 362,725 | |

| Working Capital (Deficit) | |

$ | (229,342 | ) | |

$ | (351,069 | ) |

Cash Flows

| | |

Six months ended

July 31, | |

| | |

2014 | | |

2013 | |

| Cash Flows used in Operating Activities | |

$ | (64,588 | ) | |

$ | (93,522 | ) |

| Cash Flows from Financing Activities | |

$ | 60,000 | | |

$ | 103,000 | |

| Net Increase (decrease) in Cash During Period | |

$ | (5,131 | ) | |

$ | 9,478 | |

Operating Revenues

For the period from

November 30, 2005 (date of inception) to July 31, 2014, our company did not earn any operating revenues.

Operating Expenses and Loss from

Continuing Operations

Operating expenses

for the three months ended July 31, 2014 was $72,449 compared with $39,422 for the three months ended July 31, 2013. The increase

of $33,027 was due principally to the management fees of $30,000 for the Company’s Chief Executive Officer.

Operating expenses

for the six months ended July 31, 2014 was $134,483 compared with $95,379 for the six months ended July 31, 2013. The increase

of $39,104 was due principally to the management fees of $40,000 for the Company’s Chief Executive Officer.

For the three

months ended July 31, 2014, we incurred a $72,449 loss from continuing operations or $0.00 per share compared with a loss

from continuing operations of $40,705 or $nil per share for the three months ended July 31, 2013. In addition to operating

expenses, we incurred $1,283 of expense during the three months ended July 31, 2013 relating to the amortization of the

discount on the convertible notes, all of which were converted during the three month period ended July 31, 2014.

As of July 31, 2014, we had no outstanding convertible notes.

For the six

months ended July 31, 2014, we incurred a $186,000 loss from continuing operations or $0.00 per share compared with a loss

from continuing operations of $96,967 or $nil per share for the six months ended July 31, 2013. In addition to operating

expenses, we incurred $74,282 of expense relating to the amortization of the discount on the convertible notes during the six

month period ended July 31, 2014. The amortization of the debt discount was offset by a $24,029 gain resulting from the

change in fair value of the derivative liability due to the change in the fair value of the conversion feature on the

convertible notes. During the same six month period during 2013, accretion and interest expense totaled only $1,588.

Discontinued Operations and Net Loss

This was due

primarily to our decision to sell our interest in the Quinlan properties during the three month period ended July 31, 2014. As a

result, the Company recognized an impairment of $147,739 reflecting the estimated fair value of the assets held. For the

three month period ended July 31, 2014, we reported a net loss of $220,188, or $nil per share. This compares to a net loss

of $40,705, or $nil per share, for the same three month period ended in 2013.

Due to

the impairment charge of $147,739 resulting from our decision to sell interest in the Quinlan properties, we reported a net

loss of $333,739, or $0.00 per share, for the six month period ended July 31, 2014. This compares to a net loss of $96,967,

or $0.00 per share, for the six month period ended July 31, 2013.

Liquidity and Capital Resources

As of July

31, 2014, we had cash of $2,161 compared with $7,292 at January 31, 2014. During the six month period ended July 31, 2014 we

obtained additional financing of $60,000 in connection with the acquisition of intangible assets from AMD. Approximately $15,000 of this amount was paid to our Chief Executive Officer and $22,750 paid to our President as

management fees during the six month period ended July 31, 2014.

We had total

assets at July, 2014 of $379,237 compared with $220,334 at January 31, 2014. Overall, intangible assets increased by $320,431 offset

by a decrease in oil and gas properties of $152,033 and prepaid expenses and deposits of $3,100.

At July 31, 2014,

we had total liabilities of $288,148 compared with $362,275 at January 31, 2014. The decrease in total liabilities was due to

the conversion of $35,834 in convertible notes during the period, which also included the elimination of $97,237 of

derivative liability relating to the convertible notes. The decrease was offset by an $18,867 increase in accounts

payable and accrued liabilities due to the timing of payments relating to day-to-day operations, and an increase of $44,451

in amounts due to related parties.

During the six

month period ended July 31, 2014, we issued 63,711,722 shares of our common stock upon the conversion of all of

the outstanding convertible notes and issued 152,172,287 shares of our common stock upon the acquisition of the intangible

assets of AMD and received $60,000 of financing.

Cash flow from Operating

Activities

During the six months

ended July 31, 2014, we used cash of $64,588 for operating activities compared with $93,522 during the six months ended

July 31, 2013. The decrease in cash used for operating activities was attributed to increases in our payables and amounts due to a related party which more than offset higher day-to-day general and administrative

expenses for our Company.

Cash Flow from Financing

Activities

During the

six months ended July 31, 2014, we received $60,000 as part of the financing in connection with the acquisition of the

intangible assets from AMD.

During the six months

ended July 31, 2013, we received proceeds of $103,000 in connection with the issuance of

both series of 8% convertible notes.

Going Concern

We have not attained

profitable operations and are dependent upon obtaining financing to pursue any extensive acquisitions and activities. For these

reasons, our auditors stated in their report on our audited financial statements that they have substantial doubt that we will

be able to continue as a going concern without further financing.

Off-Balance Sheet Arrangements

We have no significant

off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition,

changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources

that are material to stockholders.

Future Financings

We will continue

to rely on financial support from our stockholders and our ability to raise equity capital or debt financing in

order to continue to fund our business operations. Issuances of additional shares will result in dilution to existing

stockholders. There is no assurance that we will achieve any additional sales of the equity securities or arrange for debt or

other financing to fund our operations and other activities.

Critical Accounting Policies

Our financial statements

and accompanying notes have been prepared in accordance with GAAP applied on

a consistent basis. The preparation of financial statements in conformity with GAAP requires

management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent

assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting

periods.

We regularly evaluate

the accounting policies and estimates that we use to prepare our financial statements. A complete summary of these policies is

included in the notes to our financial statements. In general, management's estimates are based on historical experience, on information

from third party professionals, and on various other assumptions that are believed to be reasonable under the facts and circumstances.

Actual results could differ from those estimates made by management.

Recently Issued Accounting Pronouncements

We have

implemented all new accounting pronouncements that are in effect. These pronouncements did not have any material impact on

the financial statements unless otherwise disclosed, and we do not believe that there are any other new accounting

pronouncements that have been issued that might have a material impact on its financial position or results of

operations.

| Item 3. | Quantitative and Qualitative Disclosures About Market

Risk |

As a smaller reporting

company we are not required to provide the information under this item.

| Item 4. | Controls and Procedures |

Management's Report on Disclosure

Controls and Procedures

The

Company maintains disclosure controls and procedures that are designed to ensure that information required to be disclosed in

the Company’s reports filed under the Securities Exchange Act of 1934, as amended, is recorded, processed, summarized

and reported within the time periods specified in the Securities and Exchange Commission's rules and forms, and that

such information is accumulated and communicated to the Company’s management, including its chief executive officer

and chief financial officer to allow for timely decisions regarding required disclosure.

As of the end

of the quarter covered by this report, we carried out an evaluation of the effectiveness of the design and operation of the

Company’s disclosure controls and procedures. Based on the foregoing, the chief executive officer and chief financial

officer concluded that the Company’s disclosure controls and procedures were not effective as of the end of the period

covered by this quarterly report.

Changes in Internal Control Over

Financial Reporting

During the period

covered by this report there were no changes in the Company’s internal control over financial reporting that materially

affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

PART

II - OTHER INFORMATION

We know of no material,

existing or pending legal proceedings against us, nor are we involved as a plaintiff in any material proceeding or pending

litigation. There are no proceedings in which our director, officer or any affiliates, or any registered or beneficial shareholder,

is an adverse party or has a material interest adverse to our interest.

Exhibit

Number |

|

Description of Exhibit |

| (3) |

|

Articles of Incorporation and Bylaws |

| |

|

|

| 3.01 |

|

Articles of Incorporation (incorporated by reference to our Registration Statement on Form SB-2 filed on March 7, 2006) |

| |

|

|

| 3.02 |

|

Bylaws (incorporated by reference to our Registration Statement on Form SB-2 filed on March 7, 2006) |

| |

|

|

| 3.03 |

|

Certificate of Amendment filed on July 23, 2008 (incorporated by reference to our Current Report on Form 8-K filed on August 14, 2008) |

| |

|

|

| 3.04 |

|

Certificate of Change filed on July 23, 2008 (incorporated by reference to our Current Report on Form 8-K filed on August 14, 2008) |

| |

|

|

| 3.05 |

|

Certificate of Change filed on June 14, 2012 (incorporated by reference to our Current Report on Form 8-K filed on June 16, 2012) |

| |

|

|

Exhibit

Number |

|

Description of Exhibit |

| (31) |

|

Rule 13a-14(a) / 15d-14(a) Certifications |

| |

|

|

| 31.1* |

|

Certification pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 of the Principal Executive Officer |

| |

|

|

| 31.2* |

|

Certification pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 of the Principal Financial Officer and Principal Accounting Officer. |

| |

|

|

| (32) |

|

Section 1350 Certifications |

| |

|

|

| 32.1* |

|

Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 of the Principal Executive Officer |

| |

|

|

| 32.2* |

|

Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 of the Principal Financial Officer and Principal Accounting Officer. |

| |

|

|

| 101 |

|

Interactive Data File |

| |

|

|

| 101** |

|

Interactive Data File (Form 10-Q for the quarter ended July 31, 2014 furnished in XBRL). |

| |

|

|

| 101.INS |

|

XBRL Instance Document |

| 101.SCH |

|

XBRL Taxonomy Extension Schema Document |

| 101.CAL |

|

XBRL Taxonomy Extension Calculation Linkbase Document |

| 101.DEF |

|

XBRL Taxonomy Extension Definition Linkbase Document |

| 101.LAB |

|

XBRL Taxonomy Extension Label Linkbase Document |

| 101.PRE |

|

XBRL Taxonomy Extension Presentation Linkbase Document |

| ** | Furnished herewith. Pursuant to Rule 406T of Regulation S-T, the Interactive Data Files on Exhibit

101 hereto are deemed not filed or part of a registration statement or prospectus for purposes of Sections 11 or 12 of the Securities

Act of 1933, are deemed not filed for purposes of Section 18 of the Securities and Exchange Act of 1934, and otherwise are not

subject to liability under these sections. |

SIGNATURES

In accordance with

Section 13 or 15(d) of the Securities and Exchange Act of 1934, the Registrant caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

INDEPENDENCE ENERGY CORP. |

| |

(Registrant) |

| |

|

| Dated: September 15, 2014 |

/s/ Howard J. Taylor |

| |

Howard J. Taylor |

| |

Chief Executive Officer and Director |

| |

(Principal Executive Officer) |

| |

|

| Dated: September 15, 2014 |

/s/ Gregory Rotelli |

| |

Gregory Rotelli |

| |

President, Chief Financial Officer, Secretary, Treasurer and Director |

| |

(Principal Financial Officer and Principal Accounting Officer) |

EXHIBIT 31.1

CERTIFICATION PURSUANT TO

18 U.S.C. ss 1350, AS ADOPTED PURSUANT TO

SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

I, Howard J. Taylor, certify that:

| 1. | I have reviewed this quarterly report on Form 10-Q of

Independence Energy Corp.; |

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or

omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements

were made, not misleading with respect to the period covered by this report; |

| 3. | Based on my knowledge, the financial statements, and other financial information included in this

report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant

as of, and for, the periods presented in this report; |

| 4. | The registrant's other certifying officer(s) and I are responsible for establishing and maintaining

disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial

reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

| (a) | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures

to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated

subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being

prepared; |

| (b) | Designed such internal control over financial reporting, or caused such internal control over financial

reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting

and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| (c) | Evaluated the effectiveness of the registrant's disclosure controls and procedures and presented

in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered

by this report based on such evaluation; and |

| (d) | Disclosed in this report any change in the registrant's internal control over financial reporting

that occurred during the registrant's most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual

report) that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial

reporting; and |

| 5. | The registrant's other certifying officer(s) and I have disclosed, based on our most recent evaluation

of internal control over financial reporting, to the registrant's auditors and the audit committee of the registrant's board of

directors (or persons performing the equivalent functions): |

| (a) | All significant deficiencies and material weaknesses in the design or operation of internal control

over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize

and report financial information; and |

| (b) | Any fraud, whether or not material, that involves management or other employees who have a significant

role in the registrant's internal control over financial reporting. |

Date: September 15, 2014

| /s/ Howard J. Taylor |

|

| Howard J. Taylor |

|

Chief Executive Officer and Director

(Principal Executive Officer) |

|

EXHIBIT 31.2

CERTIFICATION PURSUANT TO

18 U.S.C. ss 1350, AS ADOPTED PURSUANT TO

SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

I, Gregory Rotelli, certify that:

| 1. | I have reviewed this quarterly report on Form 10-Q of

Independence Energy Corp.; |

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or

omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements

were made, not misleading with respect to the period covered by this report; |

| 3. | Based on my knowledge, the financial statements, and other financial information included in this

report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant

as of, and for, the periods presented in this report; |

| 4. | The registrant's other certifying officer(s) and I are responsible for establishing and maintaining

disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial

reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

| (a) | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures

to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated

subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being

prepared; |

| (b) | Designed such internal control over financial reporting, or caused such internal control over financial

reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting

and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| (c) | Evaluated the effectiveness of the registrant's disclosure controls and procedures and presented

in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered

by this report based on such evaluation; and |

| (d) | Disclosed in this report any change in the registrant's internal control over financial reporting

that occurred during the registrant's most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual

report) that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial

reporting; and |

| 5. | The registrant's other certifying officer(s) and I have disclosed, based on our most recent evaluation

of internal control over financial reporting, to the registrant's auditors and the audit committee of the registrant's board of

directors (or persons performing the equivalent functions): |

| (a) | All significant deficiencies and material weaknesses in the design or operation of internal control

over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize

and report financial information; and |

| (b) | Any fraud, whether or not material, that involves management or other employees who have a significant

role in the registrant's internal control over financial reporting. |

Date: September 15, 2014

| /s/ Gregory Rotelli |

|

| Gregory Rotelli |

|

| President, Chief Financial Officer, Secretary, Treasurer and Director |

|

| (Principal Financial Officer and Principal Accounting Officer) |

|

EXHIBIT 32.1

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350, AS ADOPTED PURSUANT

TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF

2002

I, Howard J. Taylor, hereby certify, pursuant

to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that:

| (1) | the Quarterly Report on Form 10-Q of Independence Energy Corp. for the period ended July 31, 2014

(the "Report") fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934;

and |

| (2) | the information contained in the Report fairly presents, in all material respects, the financial

condition and results of operations of Independence Energy Corp. |

| Dated: September 15, 2014 |

|

|

| |

|

|

| |

|

/s/ Howard J. Taylor |

| |

|

Howard J. Taylor |

| |

|

Chief Executive Officer and Director

(Principal Executive Officer) |

| |

|

Independence Energy Corp. |

A signed original of this written statement

required by Section 906, or other document authenticating, acknowledging, or otherwise adopting the signature that appears in typed

form within the electronic version of this written statement required by Section 906, has been provided to Independence Energy

Corp. and will be retained by Independence Energy Corp. and furnished to the Securities and Exchange Commission or its staff upon

request.

EXHIBIT 32.2

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350, AS ADOPTED PURSUANT

TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF

2002

I, Gregory Rotelli, hereby certify,

pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that:

| (1) | the Quarterly Report on Form 10-Q of Independence Energy Corp. for the period ended July 31, 2014

(the "Report") fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934;

and |

| (2) | the information contained in the Report fairly presents, in all material respects, the financial

condition and results of operations of Independence Energy Corp. |

| Dated: September 15, 2014 |

|

|

| |

|

|

| |

|

/s/ Gregory Rotelli |

| |

|

Gregory Rotelli |

| |

|

President, Chief Financial Officer, Secretary, Treasurer and Director

(Principal Financial Officer and Principal Accounting Officer) |

| |

|

Independence Energy Corp. |

A signed original of this written statement

required by Section 906, or other document authenticating, acknowledging, or otherwise adopting the signature that appears in typed

form within the electronic version of this written statement required by Section 906, has been provided to Independence Energy

Corp. and will be retained by Independence Energy Corp. and furnished to the Securities and Exchange Commission or its staff upon

request.

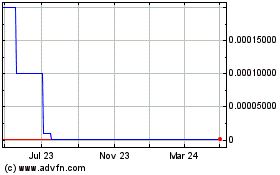

RedHawk (CE) (USOTC:SNDD)

Historical Stock Chart

From Mar 2024 to Apr 2024

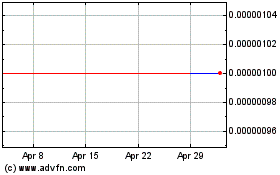

RedHawk (CE) (USOTC:SNDD)

Historical Stock Chart

From Apr 2023 to Apr 2024