UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 16, 2014

SANTO MINING CORP.

(Exact name of registrant as specified in its charter)

|

Nevada |

|

333-169503 |

|

27-0518586 |

|

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

Ave. Sarasota #20, Torre Empresarial, Suite 1103

Santo Domingo, Dominican Republic |

|

(Address of principal executive offices) (Zip Code) |

|

|

|

Registrant’s telephone number, including area code: 809-535-9443 |

|

|

|

N/A |

|

(Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On September 15, 2014, Santo Mining Corp, (the “Company”) signed a new mining contract (the “Mexico Agreement”) in Mexico with Compania Minera Angeles Del Desierto SA de CV. The contract provides the Company with exclusive rights to extract, process, ship and refine an unlimited amount of mineral ore from three concessions totaling 7.468 square Kilometers. Term is 15 years with provision for a 10 year extension.

During the last two years the Company has conducted surface exploration focused on a mineralized hill. Samples collected at the crown and around the base of the hill were pretreated and sent to Inspectorate labs in Tucson. The average grades of all the samples were Gold 3.17 g/t and Silver 57.3 g/t. Other laboratory testing has repeatedly verified these results.

In 2011 samples were analyzed for Platinum at the University of Nueva Leon, Monterrey. Early results from this non-commercial lab using a hydrofluoric acid digestion were positive. Following the recommendation by a senior geologist, the Company decided to suspend platinum group metal metals exploration and focus on the gold and silver components. According to the seasoned geologist, it was unusual to find Platinum and gold mineralization sharing the same geological setting. Considering this and to preserve our credibility we decided to focus on Gold and Silver and postpone platinum testing.

However, in 2014 the Company resumed platinum testing following a positive result by a certified assayer in Arizona. The assayer used a propriety procedure using nickel instead of lead in the fire assay process. The first sample batch assayed for Platinum at 0.379 ounces per ton. This was verified using a fresh sample batch with an impressive 0.449 ounces per ton result. At current Platinum prices this represents an in the ground value of $511 to $606 per ton of the mineral ore, from which must be deducted extraction, transport, refining, costs etc.

All surface rights, entitlements, extractive permits and environmental license are in force except for a forestry permit which costs approximately $100,000 and is typically issued in 60-90 days. The concession has good truck access, is very remote with no social or community issues, good experienced labor pool and open-pit operation with no overburden.

Operationally the Company is responsible for the cost of permitting, extraction, trucking and loading the ore on board railcars at nearby Monclova. From there it will shipped to various toll refineries / smelters for processing. The cost of shipping beyond Monclova will be advanced by the Company and later reimbursed from proceeds. Net profits from operations will be split 50/50 with the concessionaire. Meanwhile, consultants will evaluate the cost effectiveness of concentrating the mineral ore either at the mine or in Monclova.

As a result of these positive “bonus” Platinum assays, the Company is planning to move its entire operations from the Dominican Republic to Mexico and focus 100% on financing and this near-term production opportunity.

Reference is made to the disclosure set forth under Items 2.01 of this this Current Report on Form 8-K (this “Report”), which disclosure is incorporated herein by reference.

Item 2.01 Completion of Acquisition or Disposition of Assets.

On July 16, 2014, the Company closed on an agreement (the “Purchase and Sale Agreement”) with Precipitate Gold Corp. (“Precipitate”) and Gexplo S.R.L. (“Gexplo,” and, together with the Company, the “Vendor”), dated June 30, 2014, whereby Precipitate acquired a 100% interest in two concession applications in the Dominican Republic known as “Richard” and “David,” which cover an area of 220 and 1,400 hectares respectively. The David concession is located on the north central border of Precipitate’s Juan de Herrera concession within the Tireo Gold Camp and greatly increases Precipitate’s prospective Tireo landholdings. In exchange, Precipitate granted the Vendor (1) a 2% net smelter royalty (“NSR”) on each of the concessions. The NSR can be purchased by Precipitate for the price of US$500,000 per 0.5% for a total purchase price of US$2,000,000; and (2) 100,000 share purchase warrants (“Warrants”) allowing the Vendor to purchase up to 100,000 shares of Precipitate’s common stock at an exercise price of $0.30 per share for up to 3 months from the date of grant. Should the Vendor exercise any of the Warrants and thereafter seek to sell some or all of the shares, it must notify Precipitate and allow Precipitate at least 10 calendar days to arrange buyers of the shares. Any warrant shares purchased by the Vendor will be subject to a four month hold period.

The foregoing descriptions of the Purchase and Sale Agreement is qualified in its entirety by reference to the provisions of the Purchase and Sale Agreement filed as exhibit 10.1 to this Report, respectively, which are incorporated herein by reference.

2

|

Item 9.01 |

Financial Statements and Exhibits |

|

(d) |

Exhibits

|

|

10.1 |

Property Purchase and Sale Agreement, dated June 30, 2014, by and among Santo Mining Corp., Gexplo S.R.L., and Corporacion Minera San Juan, S.R.L. |

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: September 18, 2014

|

|

SANTO MINING CORP. |

|

|

|

|

|

|

By: |

/s/ ALAIN FRENCH |

|

|

|

Alain French

President and Chief Executive Officer |

4

Exhibit 10.1

PROPERTY PURCHASE AND SALE AGREEMENT

DAVID & RICHARD PROPERTIES – DOMINICAN REPUBLIC

THIS AGREEMENT is dated the 30 day of June, 2014.

BETWEEN: CORPORACION MINERA SAN JUAN, S.R.L.,

Calle Manuel de Jesus Troncoso #38, apto. A21, Edificio El Escorial, Piantini.

Santo Domingo 1000 Dominican Republic

(“CMSJ”)

AND: Each of GEXPLO S.R.L. (“Gexplo”) and SANTO MINING CORP. (“SANP”)

Ave. Sarasota #20, Torre Empresarial, Suite 1103, Santo Dominigo,

Dominican Republic

(Gexplo and SANP together the “Vendor”)

WHEREAS Gexplo and SANP together hold a 100% interest in those two mineral exploration concession applications for the mineral properties known as the David and Richard properties (the “Properties”), as more particularly described in Schedule “A” hereto;

AND WHEREAS CMSJ has agreed to purchase and the Vendor has agreed to sell all of the Vendor’s interest

in the Properties in accordance with the terms of this Agreement;

AND WHEREAS CMSJ is the wholly owned subsidiary of Precipitate Gold Corp. (“PRG”), a public company listed on the TSX Venture Exchange;

NOW THEREFORE THIS AGREEMENT WITNESSES that in consideration of the mutual covenants and agreements herein contained, and for purposes of documenting the mutual understanding among the parties, each jointly and severally agrees as follows,

1. DEFINITIONS

1.1 In this Agreement and in the Schedules and the recitals hereto:

“Applications” mean the applications made by the Vendor for two exploration concessions with respect to the Properties, as made to the Ministry of Industry and Commerce of the Dominican Republic, or such other rights and interests the Vendor may have with respect to the Properties.

“Encumbrance” means any encumbrance, lien, charge, pledge, mortgage, title retention agreement, security interest of any nature, adverse claim, exception, restriction, reservation, option, pre-emptive right or privilege of any nature or kind whatsoever or any contract to create any of the foregoing.

“Environmental Laws” means any statute, bylaw or regulation relating to protection of the environment, or any lawful order under any of them and any common law rule giving rise to liability in connection with pollution.

“Exchange” means the TSX Venture Exchange.

2

“Hazardous Materials” means any contaminant, pollutant, waste, hazardous material, toxic substance, radioactive substance, petroleum and its derivatives and by products and other hydrocarbons, dangerous substances and dangerous goods, all as identified or defined in any Environmental Laws.

“Properties” means those two mineral claim blocks known as David (comprising 1,400 hectares more or less) and Richard (comprising 220 hectares more or less), (each of the Properties being a “Property”), which are to form the basis of two exploration concessions to which the Applications pertain; all as more particularly described in Schedule “A” hereto, together with all prospecting, research, exploration, exploitation, operating and mining permits, licences and leases associated therewith, mineral, surface, water and ancillary or appurtenant rights attached or accruing thereto, and any mining licence or other form of substitute or successor mineral title or interest granted, obtained or issued in connection with or in place of or in substitution for any such Properties (including, without limitation, any Properties issued to cover any internal gaps or fractions in respect of such ground).

“Property Information” means all maps, drill hole logs, assay results, reports, data and other information compiled or prepared by or on behalf of the Vendor with respect to work on or with respect to the Properties, and all core, samples and sample pulps and rejects.

2. ACQUISITION AND DISPOSITION OF THE PROPERTY

2.1 The Vendor hereby agrees to sell, transfer and assign to CMSJ all of the Vendor’s right, title and interest in and to the Applications and the Properties for and in consideration of CMSJ:

(a) assuming all of the Vendor’s obligations under its Applications;

(b) granting to the Vendor a 2.0% net smelter return royalty in any future production from the

Properties calculated in accordance with Schedule “B” hereto (the “Royalty”); and

(c) delivering to the Vendor a total of 100,000 common share purchase warrants in the capital of PRG

(“Warrants”);

(collectively the “Purchase Price”); to be assumed, granted, issued and delivered within five business days following completion of all conditions precedent set out in section 4.1 hereto.

2.2 As to CMSJ’s assumption of the Vendor’s obligations under its Applications, CMSJ agrees to assume the Vendor’s exploration budget obligations included in the Vendor’s current Applications or amend the same to include a exploration budget that will be acceptable to the Ministry of Industry and Commerce of the Dominican Republic.

2.3 As to the Royalty, (i) it will apply to all base and precious metals, rare earth minerals and gems produced from the Properties, (ii) at any time, CMSJ may purchase some or all of the Royalty for the price of US$500,000for each one-quarter of the Royalty (0.5% NSR) acquired (total purchase price of US$2,000,000); and (ii) the Vendor will advise CMSJ as to the allocation between Gexplo and SANC of payments to be made by CMSJ under the Royalty.

2.4 The Vendor will advise CMSJ as to the allocation between Gexplo and SANC of the Warrants to be issued pursuant to section 2.1(c). Each Warrant will entitle the holder to acquire one common share in the capital of PRG (“Warrant Shares”) at the exercise price of C$0.30 per share for a period of three months from the date of issue. The certificates representing the Warrants will, among other things, include provisions for the appropriate adjustment in the class, number and price of the shares issued on exercise of the Warrants upon the occurrence of certain events, including any subsequent subdivision, consolidation or reclassification of PRG’s common shares, the payment of stock dividends or any business reorganization of PRG.

3

2.5 Should the Vendor exercise any of the Warrants and thereafter seek to sell some or all of the Warrant Shares, it will first notify PRG of the same and allow PRG at least 10 calendar days to arrange for buyers of the Warrant Shares. The purpose of this section to allow PRG to manage the market for its common shares; and PRG will not be obliged to arrange buyers for the Warrant Shares and the Vendor will not be obliged to accept any offer to buy the same.

3. REPRESENTATIONS AND COVENANTS OF THE PARTIES

3.1 The Vendor hereby represents and covenants to CMSJ that:

(a) Gexplo is a company duly incorporated under the laws of the Dominican Republic, and is a valid and subsisting company in good standing with all applicable governmental authorities.

(b) SANC is a company duly incorporated under the laws of Nevada, USA, and is a valid and subsisting company in good standing with all applicable governmental authorities.

(b) It has the full power, capacity and authority to enter into and perform its obligations under this

Agreement and any agreement or instrument referred to or contemplated herein.

(c) Neither the execution and delivery of this Agreement nor any of the agreements referred to herein or contemplated hereby, nor the consummation of the transactions hereby contemplated conflict with, result in the breach of or accelerate the performance required by, any agreement to which either Gexplo or SANC is a party.

(d) The Vendor is the sole holder of all right, title and interest in and to the Applications; and there are no adverse claims or challenges against or to the ownership or title to either the Applications or rights to the Property areas, nor to the best of the Vendor’s knowledge is there any basis therefor.

(e) There are no Encumbrances affecting either of the Applications or the Properties (other than surface rights held by third parties, and royalties, duties, assessments and amounts paid to governmental authorities in the normal course).

(f) To the Vendor’s knowledge, the Applications have been duly and properly prepared and submitted in accordance with applicable mining law in the Dominican Republic.

(g) There is no litigation, claim or proceeding, including appeals or applications for review, in progress or (to the best of the Vendor’s knowledge) pending or threatened against or relating to either Gexplo or SANC, or affecting the Applications or the Vendor’s interests in the Properties before any domestic court, governmental department, commission, board, bureau or agency, or arbitration panel, and there is not presently outstanding against Gexplo, SANC or the Properties any judgment, decree, injunction, rule or order of any court, governmental department, commission, agency or arbitrator which materially adversely affects the Applications or the Properties.

(h) To the best of the Vendor’s knowledge, it is not in breach of any law, ordinance, statute, regulation, bylaw, order, decree, or permit to which it is subject or which applies to it.

(i) Each of the Applications (i) was duly and validly applied for and registered with the applicable mining authorities pursuant to all applicable laws and regulations; (ii) is accurately described in Schedule “A” hereto; and (iii) is free and clear of all liens, charges, royalties and encumbrances.

(j) There are no outstanding agreements or options to acquire or purchase any interest in any of the Properties, or to explore, develop or exploit any part of the Properties, and no person has any royalty or other interest whatsoever in the Properties or any production therefrom.

4

(k) There are no pending or threatened actions, suits, claims or proceedings regarding the Properties or any portion thereof.

(l) The Vendor has (i) paid all applicable taxes due and payable in the Dominican Republic, and (ii) paid all assessments and reassessments due and payable in respect of such taxes.

(m) There is not pending or, to the best of the knowledge of the Vendors, threatened or contemplated, any suit, action, legal proceeding, litigation or governmental investigation of any sort which would:

(i) in any manner restrain or prevent the Vendor from effectually or legally indirectly selling its interests in the Applications or rights in and to the Properties to CMSJ in accordance with this Agreement;

(ii) cause any Encumbrance to be attached to the Applications or the Properties; or

(iii) make CMSJ liable for damages to any third party.

(n) To the best of its knowledge after reasonable inquiry, (i) no Hazardous Substance has been placed, held, located, used or disposed of, on, under or at any of the lands comprising the Properties by any person, and (ii) no claim has ever been asserted and there are no present circumstances which could reasonably form the basis for the assertion of any claim for losses of any kind as a direct or indirect result of the presence on or under or the escape, seepage, leakage, spillage, discharge, emission or release from any of the Properties of any Hazardous Substance.

(o) There are no outstanding work orders or actions required or reasonably anticipated to be required to be taken in respect of the rehabilitation or restoration of any of the Properties or relating to environmental matters in respect thereof or any operations thereon, nor has the Vendor received notice of same.

(p) To the best of its knowledge, all previous exploration on the Properties has been carried out in accordance with applicable law in a sound and workmanlike manner and in compliance with sound geological and geophysical exploration and mining, engineering and metallurgical practices.

(q) There is no adverse claim or challenge against the Applications or to the ownership of or title to the Properties, nor to its knowledge is there any basis therefore.

(r) There has been no notice from any governmental agency of any intention of expropriating the Properties for the purpose of converting any or all of it into any protected area such as a park.

(s) To the best of their knowledge, there has been no notice from any person or group of any claim for possession or occupation of the Properties.

(t) To the best of its knowledge, there are no restrictions to access to the Properties along existing roadways.

(u) The Vendor does not have any information or knowledge of any facts pertaining to the Applications, the Properties, the title thereto, or substances thereon or therefrom, not disclosed in writing to CMSJ, which if known to CMSJ might reasonably be expected to deter CMSJ from completing the transactions contemplated hereby.

3.2 CMSJ hereby represents and covenants to the Vendor that:

(a) it has the full power, capacity and authority to enter into and perform its obligations under this Agreement and any agreement or instrument referred to or contemplated herein;

(b) neither the execution and delivery of this Agreement nor any of the agreements referred to herein or contemplated hereby, nor the consummation of the transactions hereby contemplated conflict with, result in the breach of or accelerate the performance required by, any agreement to which it is a party;

5

(c) it is a wholly owned subsidiary of PRG; and PRG’s common shares are listed and posted for trading on the Exchange, and it is in good standing with each of the British Columbia, Alberta, Ontario and Yukon Securities Commissions and the Exchange.

3.3 The representations and warranties set out herein are conditions on which the parties have relied in entering into this Agreement and will survive the closing hereof, and each of the parties will indemnify and save the other harmless from all loss, damage, costs, actions and suits arising out of or in connection with any breach of any representation, warranty, covenant, agreement or condition made by it and contained in this Agreement.

3.4 The Vendor covenants and agrees with CMSJ that up to and including the closing:

(a) the Vendor will provide or make available to CMSJ and its authorized representatives all Property

Information relating to the Applications and the Properties, and

(b) the Vendor will permit CMSJ, and its authorized representatives, to make such investigation of the Properties and the Applications as CMSJ deems necessary or advisable to familiarize itself with such matters and to have reasonable access to all records, documents and other information related thereto.

4. CONDITIONS PRECEDENT

4.1 This Agreement, and the obligations of the parties, are subject to:

(a) completion of CMSJ’s due diligence review, to CMSJ’s satisfaction, to be completed within 30 days following receipt of all Property Information from the Vendor. CMSJ will advise the Vendor of its decision to accept or reject the purchase of the Properties on or before the end of the said 30 day period; and

(b) receipt of Exchange approval. CMSJ agrees to cause PRG to make application for Exchange approval forthwith following execution of this Agreement; and to advise the Vendor of all correspondence with the Exchange.

5. CLOSING

5.1 Upon payment of the Purchase Price in full, the Vendor will:

(a) do all things necessary to transfer title of the Applications and the Properties to CMSJ, and to have the same registered in the name of CMSJ or its nominee; and

(b) transfer and deliver to CMSJ all Property Information, either in its possession or which it can reasonably obtain.

6. SHARING OF AND CONFIDENTIAL NATURE OF INFORMATION

6.1 Each party agrees that all information obtained hereunder will be the exclusive property of the parties and not publicly disclosed or used other than for the activities contemplated hereunder except as required by law or by the rules and regulations of any regulatory authority or stock exchange having jurisdiction or with the written consent of the other party, such consent not to be unreasonably withheld. Should CMSJ elect not to complete the purchase of the Applications and the Properties following its due diligence review, it will return all Property Information provided to it by the Vendor; and all information reviewed by CMSJ during its due diligence review will be and remain confidential and the sole property of the Vendor.

6

7. ASSIGNMENT

7.1 Either party may at any time assign or transfer any or all of its interest herein, provided such assignee agrees to abide by and be bound by the terms of this Agreement in the same manner and to the same effect as if an original signatory hereto.

8. NOTICES

8.1 Any notice, direction or other instrument required or permitted to be given under this Agreement will be in writing and may be given by the delivery of the same or by mailing the same by prepaid registered or certified mail or by sending the same by facsimile, e-mail or other similar form of communication, in each case addressed to the address first listed above or the following facsimile numbers or e-mail addresses:

(a) If to CMSJ at fax: 604-558-1590; or email: jwilson@precipitategold.com

(b) If to the Vendor at fax: ●; or email: afrench@santominingcorp.com

8.2 Any notice, direction or other instrument will:

(a) if delivered, be deemed to have been given and received on the day it was delivered;

(b) if mailed, be deemed to have been given and received on the fifth (5th) business day following the day of mailing, except in the event of disruption of the postal service in which event notice will be deemed to be received only when actually received; and

(c) if sent by facsimile, email or other similar form of communication, be deemed to have been received by that party upon the sending party receiving electronic confirmation of delivery.

8.3 Any party may at any time give to the others notice in writing of any change of address of the party giving such notice and from and after the giving of such notice the address or addresses therein specified will be deemed to be the address of such party for the purposes of giving notice hereunder.

9. GENERAL

9.1 The parties will execute such further and other documents and do such further and other things as may be necessary or convenient to carry out and give effect to the intent of this Agreement.

9.2 This Agreement will enure to the benefit of and be binding upon the parties hereto and their respective successors and assigns.

9.3 This Agreement shall constitute the entire agreement between the parties and, except as hereafter set out, replaces and supersedes all prior agreements, memoranda, correspondence, communications, negotiations and representations, whether oral or written, express or implied, statutory or otherwise between the parties with respect to the subject matter herein.

9.4 This Agreement will be governed by and construed according to the laws of British Columbia and the laws of Canada applicable therein. All actions arising from this Agreement will be commenced and maintained in the Supreme Court of British Columbia.

8

SCHEDULE “A”

PROPERTIES

The Properties consists of Applications for exploration concessions for two contiguous claim blocks; located in the Dominican Republic, as follows:

|

|

Registered |

Date of |

|

Claim Name

David |

Folio #

S9-119 |

Hectares

1,400 |

Applicant

Gexplo S.R.L. |

Application

June 28, 2012 |

|

Richard |

S9-093 |

220 |

Gexplo S.R.L. |

May 23, 2012 |

9

SCHEDULE “B”

NET SMELTER RETURN ROYALTY

1. Pursuant to the Property Purchase and Sale Agreement to which this Schedule is attached, the Vendor (the “Recipient”) may receive a Net Smelter Return royalty (the “NSR Royalty”) based on proceeds received by CMSJ (the “Producer”) from production from the Properties as described in Schedule “A” of the Agreement, free and clear of all costs of development and operations.

2. “Net Smelter Return” shall mean the actual proceeds received by the Producer from any mint, smelter, or other purchaser for the sale of ores, metals, minerals, gems or concentrated products (“Product”) from the Properties derived from commercial production (and not from bulk sampling or pilot plant operations) and sold after deducting from such proceeds the following charges to the extent that they were not deducted from such proceeds by the purchaser in computing payment: smelting and refining charges; penalties; cost of transportation of ores, metals or concentrates from the Properties to any mint, smelter or other purchaser; and any export and import taxes on said ores, metals or concentrates levied by the country into which such ore, metals or concentrates are imported, if such charges or costs are deducted from the proceeds received.

3. Payment of the NSR Royalty shall be made quarterly within 30 days after the end of each fiscal quarter of the Producer, on actual proceeds received by the Producer from the sale of Product from the Properties, and shall be accompanied by unaudited calculations and statements pertaining to the operations carried out on the Properties. Within 90 days after the end of each fiscal year of the Producer in which the NSR Royalty is payable, the records relating to the calculation of Net Smelter Return for such year shall be audited and any resulting adjustments in the payment of the NSR Royalty payable shall be made forthwith. A copy of the said audit shall be delivered to the Recipients within 30 days of the end of such 90-day period.

4. Each annual audit shall be final and not subject to adjustment unless the Recipients deliver to the Producer written exceptions in reasonable detail within three months after the Recipients receive the report. The Recipients, or their representatives duly authorized in writing, shall at their expense have the right to audit the books and records of the Producer related to the Net Smelter Return to determine the accuracy of the report, but shall not have access to any other books and records of the Producer. The audit shall be conducted by a chartered or certified public accountant of recognized standing (the “Auditor”). The Producer shall have the right to restrict access to its books and records until execution of a written agreement by the Auditor that all information will be held in confidence and used solely for purposes of audit and resolution of any disputes related to the report. A copy of the Auditor’s report shall be delivered to the Producer and the amount which should have been paid according to the Auditor’s report shall be paid forthwith, one party to the other. In the event that the said discrepancy is to the detriment of the Recipients and exceeds 5.0% of the amount actually paid by the Producer, then the Producer shall pay the entire cost of the audit.

5. In the event smelting or refining are carried out in facilities owned or controlled, in whole or in part, by the Producer, charges, costs and penalties with respect to such operations, excluding transportation, shall mean reasonable charges, costs and penalties for such operations but not in excess of the amounts that the Producer would have incurred if such operations were carried out at facilities not owned or controlled by the Producer then offering comparable custom services.

6. The Recipients shall at their election have the right to take their NSR Royalty in kind as it may pertain to precious metals defined as gold and platinum group elements, in whole or in part.

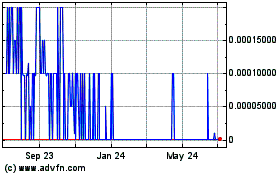

Santo Mining (CE) (USOTC:SANP)

Historical Stock Chart

From Mar 2024 to Apr 2024

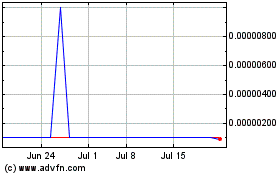

Santo Mining (CE) (USOTC:SANP)

Historical Stock Chart

From Apr 2023 to Apr 2024