UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 10)*

Gilat Satellite Networks Ltd.

-------------------------------------

(Name of Issuer)

Ordinary Shares, NIS 0.20 par value per

share

----------------------------------------------------------

(Title of Class of Securities)

M51474118

-------------------

(CUSIP Number)

Richard P. Swanson, Esq.

York Capital Management Global Advisors, LLC

767 Fifth Avenue, 17th Floor

New York, New York 10153

Telephone: (212) 300-1300

With copies to:

Robert E. Holton, Esq.

Stephanie G. Nygard, Esq.

Arnold & Porter LLP

399 Park Avenue

New York, New York 10022

-----------------------------------------------------

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

September 17, 2014

-----------------------------------------------------

(Date of Event Which Requires Filing of

this Statement)

If the filing person

has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing

this schedule because of §240.13d-1(e), §240.13d-1(f) or §240.13d-1(g), check the following box o.

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

* The remainder of this

cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities,

and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

| |

|

|

|

|

|

|

| 1. |

|

Name of Reporting Persons

York Capital Management Global Advisors, LLC

|

| 2. |

|

Check the Appropriate Box if a Member of a Group (see instructions)

(a) ¨

(b) x |

| 3. |

|

SEC USE ONLY |

| 4. |

|

Source of Funds (see instructions)

AF

|

| 5. |

|

Check if Disclosure of Legal Proceedings Is Required Pursuant

to Item 2(d) or 2(e)

¨ |

| 6. |

|

Citizenship or Place of Organization

New York

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

7. |

|

Sole Voting Power

5,166,348

|

| |

8. |

|

Shared Voting Power

-0-

|

| |

9. |

|

Sole Dispositive Power

5,166,348

|

| |

10. |

|

Shared Dispositive Power

-0-

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

5,166,348

|

| 12. |

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

(see instructions)

¨ |

| 13. |

|

Percent of Class Represented by Amount in Row 11

Approximately 12.2%

|

| 14. |

|

Type of Reporting Person (see instructions)

IA

|

This Amendment No. 10 to Schedule 13D (this “Amendment”)

supplements and amends, but is not a complete restatement of, the Amendment No. 3 to Schedule 13D (the “Amendment No. 3”)

filed by JGD Management Corp., a Delaware corporation (“JGD”) with the U.S. Securities and Exchange Commission (the

“SEC”) on January 2, 2007, as amended by the Amendment No. 4 to Schedule 13D filed by JGD with the SEC on April 10,

2008 (the “Amendment No. 4”), the Amendment No. 5 to Schedule 13D filed by JGD with the SEC on June 3, 2009 (the “Amendment

No. 5”), the Amendment No. 6 to Schedule 13D filed by JGD with the SEC on June 10, 2009 (the “Amendment No. 6”),

the Amendment No. 7 to Schedule 13D filed jointly by JGD and York Capital Management Global Advisors, LLC, a New York limited liability

company (“YGA”), with the SEC on April 12, 2010 (the “Amendment No. 7”), the Amendment No. 8 to Schedule

13D filed by YGA with the SEC on September 20, 2011 (the “Amendment No. 8”) and the Amendment No. 9 to Schedule 13D

filed by YGA with the SEC on February 5, 2014 (the “Amendment No. 9” and, together with the Amendment No. 3, Amendment

No. 4, Amendment No. 5, Amendment No. 6, Amendment No. 7, Amendment No. 8, and Amendment No. 9, the “Prior Amendments”),

in each case, relating to the ordinary shares, par value NIS 0.20 per share (the “Shares”), of Gilat Satellite Networks

Ltd. (the “Company”). This Amendment should be read in conjunction with, and is qualified in its entirety by reference

to, the Prior Amendments. Capitalized terms used in this Amendment but not otherwise defined have the meaning ascribed to them

in the Prior Amendments. The Prior Amendments are supplemented and amended as follows:

Item 2. Identity and Background

Item 2 of the Amendment No. 9 is hereby amended and restated

in its entirety as follows:

(a) This Statement is being filed by York Capital Management

Global Advisors, LLC, a New York limited liability company (“YGA” or, the “Reporting Person”), with respect

to:

(i) 364,222 Shares directly owned by York

Capital Management, L.P., a Delaware limited partnership (“York Capital”);

(ii) 3,534,621 Shares directly owned by York

Multi-Strategy Master Fund, L.P., a Cayman Islands exempted limited partnership (“York Multi-Strategy”);

(iii) 191,523 Shares directly owned by York

Credit Opportunities Fund, L.P., a Delaware limited partnership (“York Credit Opportunities”);

(iv) 410,749 Shares directly owned by York

Credit Opportunities Master Fund, L.P., a Cayman Islands exempted limited partnership (“York Credit Opportunities Master”);

(v) 355,343 Shares directly owned by Jorvik

Multi-Strategy Master Fund, L.P., a Cayman Islands exempted limited partnership (“Jorvik”); and

(vi) 309,890 Shares directly owned by an account

managed by York Managed Holdings, LLC (“York Managed Holdings”) (such account, the “Managed Account”).

YGA, the sole managing member of the general

partner of each of York Capital, York Multi-Strategy, York Credit Opportunities, York Credit Opportunities Master and Jorvik and

the sole managing member of York Managed Holdings, exercises investment discretion over such investment funds and the Managed Account

and accordingly may be deemed to have beneficial ownership over the Shares directly owned by such investment funds and the Managed

Account.

James G. Dinan is the chairman and one of

two senior managers of YGA. Daniel A. Schwartz is also a senior manager of YGA.

Dinan Management, L.L.C., a New York limited

liability company (“Dinan Management”), is the general partner of York Capital, York Multi-Strategy and Jorvik. YGA

is the sole managing member of Dinan Management.

York Credit Opportunities Domestic Holdings,

LLC, a New York limited liability company (“York Credit Opportunities Domestic Holdings”), is the general partner of

York Credit Opportunities and York Credit Opportunities Master. YGA is the sole managing member of York Credit Opportunities Domestic

Holdings.

The name of each director and each executive

officer of YGA is set forth on Exhibit 1 to this Statement, and incorporated herein by reference.

(b) The principal business office address of each of YGA,

York Capital, York Multi-Strategy, York Credit Opportunities, York Credit Opportunities Master, Jorvik, Dinan Management, York

Credit Opportunities Domestic Holdings, York Managed Holdings, James G. Dinan and Daniel A. Schwartz is:

c/o York Capital Management

767 Fifth Avenue, 17th Floor

New York, New York 10153

The business address of each other person named in Item 2(a)

above is set forth on Exhibit 1 to this Statement, and incorporated herein by reference.

(c) YGA is a privately owned company having discretionary

investment authority over certain investment funds and accounts for which affiliates (including those identified below in this

Item 2(c)) act as general partner or manager.

Each of York Capital, York Multi-Strategy,

York Credit Opportunities, York Credit Opportunities Master and Jorvik is a privately owned investment limited partnership in the

principal business of purchasing for investment trading purposes securities and other financial instruments.

Dinan Management is a privately owned limited

liability company in the principal business of acting as the general partner of York Capital, York Multi-Strategy and Jorvik and

the general partner or investment manager of five other private investment funds.

York Credit Opportunities Domestic Holdings

is a privately owned limited liability company in the principal business of acting as the general partner of York Credit Opportunities

and York Credit Opportunities Master and the investment manager of one other private investment fund.

York Managed Holdings is a privately owned

limited liability company in the principal business of acting as manager of certain separately managed client investment accounts.

The present principal occupation or employment

of each other person named in Item 2(a) above is set forth on Exhibit 1 to this Statement, and incorporated herein by reference.

(d)-(e) Neither the Reporting Person nor, to the knowledge

of the Reporting Person, any other person named in Item 2(a) above has during the last five years been convicted in a criminal

proceeding (excluding traffic violations or similar misdemeanors) or been a party to a civil proceeding of a judicial or administrative

body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining

future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation

with respect to such laws.

(f) The citizenship of each natural person named in Item

2(a) above is set forth on Exhibit 1 to this Statement, and incorporated herein by reference.

Item 4. Purpose of Transaction

Item 4 of the Amendment No. 9 is hereby amended and restated

in its entirety as follows:

The Reporting Person acquired the securities of the Company

described in Item 5 of this Statement for investment purposes.

On September 17, 2014, the Reporting Person, on behalf of York

Capital, York Multi-Strategy, York Credit Opportunities, York Credit Opportunities Master, Jorvik and the Managed Account (collectively,

the “Seller Entities”), entered into an Agreement (the “Sale Agreement”) with Dov Baharav (the “Buyer”)

pursuant to which the Seller Entities will sell to the Buyer in the aggregate 849,182 Shares (the “Purchased Shares”)

for an aggregate purchase price of US$4,203,451 (the “Purchase Price”) on the Effective Date (as defined below). The

“Effective Date” is the business day, in New York and Israel, immediately following the day on which the Seller Entities

notify the Buyer that they are ready to consummate the sale of the Purchased Shares for the Purchase Price, but in no event before

September 21, 2014 or after October 21, 2014.

The preceding description of the Sale Agreement is a summary

only and is qualified in its entirety by reference to a copy of the Sale Agreement included as an exhibit to this Amendment and

incorporated herein by reference.

A Managing Director of YGA currently serves as a director on

the board of directors of the Company and will resign from such position as of September 30, 2014.

Except as described above and below in Item 6, the Reporting

Person does not have any plans or proposals which relate to or would result in:

(a) the acquisition by any person of additional securities

of the Company, or the disposition of securities of the Company;

(b) an extraordinary corporate transaction, such as

a merger, reorganization or liquidation, involving the Company or any of its subsidiaries;

(c) a sale or transfer of a material amount of assets

of the Company or any of its subsidiaries;

(d) any change in the board of directors or management

of the Company, including any plans or proposals to change the number or term of directors or to fill any existing vacancies on

the board;

(e) any material change in the present capitalization

or dividend policy of the Company;

(f) any other material change in the Company’s

business or corporate structure;

(g) changes in the Company’s charter, bylaws

or instruments corresponding thereto or other actions which may impede the acquisition of control of the Company by any person;

(h) causing a class of securities of the Company to

be delisted from a national securities exchange or cease to be authorized to be quoted in an inter-dealer quotation system of registered

national securities association;

(i) a class of equity securities of the Company becoming

eligible for termination of registration pursuant to Section 12(g)(4) of the Securities Exchange Act of 1934, as amended;

or

(j) any action similar to those enumerated in clauses

(a)-(i) above.

The Reporting Person reserves the right to consider, either

separately or together with other persons, plans or proposals relating to or resulting in the occurrence of one or more of the

transactions described in clauses (a)-(j) above in the future depending upon then existing factors, including without limitation

the market for the Shares, the Company’s then prospects, alternative investment opportunities, general economic and money-market

investment conditions and other factors deemed relevant from time to time.

Item 5. Interest in Securities of the Issuer

Item 5 of the Amendment No. 9 is hereby amended and restated

in its entirety as follows:

(a) (i) YGA may, pursuant to Rule 13d-3 of the Exchange Act,

be deemed to be the beneficial owner of 5,166,348 Shares, which constitute approximately 12.2% of the issued and outstanding Shares.

(ii) York Capital may, pursuant to Rule 13d-3

of the Exchange Act, be deemed to be the beneficial owner of 364,222 Shares, which constitute approximately 0.9% of the issued

and outstanding Shares. As the general partner of York Capital, Dinan Management may be deemed to be the beneficial owner of the

Shares beneficially owned by York Capital.

(iii) York Multi-Strategy may, pursuant to

Rule 13d-3 of the Exchange Act, be deemed to be the beneficial owner of 3,534,621 Shares, which constitute approximately 8.3% of

the issued and outstanding Shares. As the general partner of York Multi-Strategy, Dinan Management may be deemed to be the beneficial

owner of the Shares beneficially owned by York Multi-Strategy.

(iv) York Credit Opportunities may, pursuant

to Rule 13d-3 of the Exchange Act, be deemed to be the beneficial owner of 191,523 Shares, which constitute approximately 0.5%

of the issued and outstanding Shares. As the general partner of York Credit Opportunities, York Credit Opportunities Domestic Holdings

may be deemed to be the beneficial owner of the Shares beneficially owned by York Credit Opportunities.

(v) York Credit Opportunities Master may,

pursuant to Rule 13d-3 of the Exchange Act, be deemed to be the beneficial owner of 410,749 Shares, which constitute approximately

1.0% of the issued and outstanding Shares. As the general partner of York Credit Opportunities Master, York Credit Opportunities

Domestic Holdings may be deemed to be the beneficial owner of the Shares beneficially owned by York Credit Opportunities Master.

(vi) Jorvik may, pursuant to Rule 13d-3 of

the Exchange Act, be deemed to be the beneficial owner of 355,343 Shares, which constitute approximately 0.8% of the issued and

outstanding Shares. As the general partner of Jorvik, Dinan Management may be deemed to be the beneficial owner of the Shares beneficially

owned by Jorvik.

(vii) York Managed Holdings may, pursuant

to Rule 13d-3 of the Exchange Act, be deemed to be the beneficial owner of 309,890 Shares, which constitute approximately 0.7%

of the issued and outstanding Shares.

(viii) To the knowledge of the Reporting Person,

except as described above, no Shares are beneficially owned, or may be deemed to be beneficially owned, by any of the persons named

in Item 2(a) above.

The number of Shares beneficially owned and

the percentage of outstanding Shares represented thereby, for each person named above, have been computed in accordance with Rule

13d-3 under the Exchange Act. The percentages of ownership described above for YGA, York Capital, York Multi-Strategy, York Credit

Opportunities, York Credit Opportunities Master, Jorvik and York Managed Holdings are based on 42,459,061 Shares issued and outstanding

as of May 28, 2014 as reported in the Company’s Report on Form 6-K furnished to the SEC on May 29, 2014.

(b) (i) YGA may be deemed to have the sole power to dispose

of, direct the disposition of, vote or direct the vote of 5,166,348 Shares.

(ii) York Capital may be deemed to have the

sole power to dispose of, direct the disposition of, vote or direct the vote of 364,222 Shares. As the general partner of York

Capital, Dinan Management may be deemed to have the sole power to dispose of, direct the disposition of, vote or direct the vote

of 364,222 Shares.

(iii) York Multi-Strategy may be deemed to

have the sole power to dispose of, direct the disposition of, vote or direct the vote of 3,534,621 Shares. As the general partner

of York Multi-Strategy, Dinan Management may be deemed to have the sole power to dispose of, direct the disposition of, vote or

direct the vote of 3,534,621 Shares.

(iv) York Credit Opportunities may be deemed

to have the sole power to dispose of, direct the disposition of, vote or direct the vote of 191,523 Shares. As the general partner

of York Credit Opportunities, York Credit Opportunities Domestic Holdings may be deemed to have the sole power to dispose of, direct

the disposition of, vote or direct the vote of 191,523 Shares.

(v) York Credit Opportunities Master may be

deemed to have the sole power to dispose of, direct the disposition of, vote or direct the vote of 410,749 Shares. As the general

partner of York Credit Opportunities Master, York Credit Opportunities Domestic Holdings may be deemed to have the sole power to

dispose of, direct the disposition of, vote or direct the vote of 410,749 Shares.

(vi) Jorvik may be deemed to have the sole

power to dispose of, direct the disposition of, vote or direct the vote of 355,343 Shares. As the general partner of Jorvik, Dinan

Management may be deemed to have the sole power to dispose of, direct the disposition of, vote or direct the vote of 355,343 Shares.

(vii) York Managed Holdings may be deemed

to have the sole power to dispose of, vote or direct the disposition or vote of 309,890 Shares.

(viii) To the knowledge of the Reporting Person,

except as described above, none of the persons named on Exhibit 1 to this Statement, and incorporated herein by reference, has,

or may be deemed to have, any power to dispose of, direct the disposition of, vote or direct the vote of any Share.

(c) Except as described in Item 4 above, during the past

sixty (60) days preceding the date of this Statement, the Reporting Person did not effect any transactions in the Shares.

(d) The right to receive dividends from, or the proceeds

from the sale of, all Shares reported in this Statement as beneficially owned by the Reporting Person is held by York Capital,

York Multi-Strategy, York Credit Opportunities, York Credit Opportunities Master, Jorvik or the Managed Account, as the case may

be, as the advisory clients of the Reporting Person. In accordance with Rule 13d-4 under the Exchange Act, the filing of this Statement

shall not be construed as an admission that the Reporting Person or any other person named in this Statement is, for the purposes

of Section 13(d) or 13(g) of the Exchange Act, the beneficial owner of any of the Shares reported in this Statement.

Except as set forth in this Item 5(d), to

the knowledge of the Reporting Person, no other person has the right to receive or the power to direct the receipt of dividends

from, or the proceeds from the sale of, any other Shares deemed to be beneficially owned by the Reporting Person.

(e) Not applicable.

Item 6. Contracts, Arrangements,

Understandings or Relationships with Respect to Securities of the Issuer

Item 6 of the Amendment No. 9 is

hereby amended and restated in its entirety as follows:

The information provided in response to Item 2(a) and Item 4

above is incorporated herein by reference.

On September 17, 2014, the Reporting Person, on behalf of York

Capital, York Multi-Strategy, York Credit Opportunities, York Credit Opportunities Master, Jorvik and the Managed Account (collectively,

“York”), entered into an Agreement (the “Offer Agreement”) with FIMI Opportunity Fund IV, L.P., FIMI Israel

Opportunity Fund IV, Limited Partnership, FIMI Opportunity V, L.P. and FIMI Israel Opportunity V, Limited Partnership (collectively,

“FIMI”), pursuant to which (i) FIMI undertook to make (by itself or together with any of its designees), a public “special

tender offer” (as defined in Part 8, Chapter 2 of the Israeli Companies Law, 1999) on or prior to October 24, 2014, to acquire

5,166,348 Shares of the Company in consideration for a cash price of US$4.95 per share (the “Offer”), and (ii) York

undertook to accept the Offer in respect of the 5,166,348 Shares held by it and not to offer or sell the Shares held by it to any

other person until the expiration of the Offer.

York may terminate the Offer Agreement in the event that certain

conditions related to the Offer are not satisfied, as described in the Offer Agreement.

The preceding description of the Offer Agreement is a summary

only and is qualified in its entirety by reference to a copy of the Offer Agreement included as an exhibit to this Amendment and

incorporated herein by reference.

Item 7. Material to Be Filed as Exhibits

Item 7 of the Amendment No. 9 is hereby amended and restated

in its entirety as follows:

The exhibits listed on the Index of Exhibits

of this Statement are filed herewith or incorporated by reference to a previously filed document.

SIGNATURE

After reasonable inquiry

and to the best of the knowledge and belief of the undersigned Reporting Person, the undersigned Reporting Person certifies that

the information set forth in this statement with respect to it is true, complete and correct.

Dated: September 18, 2014

YORK CAPITAL MANAGEMENT GLOBAL ADVISORS, LLC

By: /s/ Richard P. Swanson

Richard P. Swanson

General Counsel

INDEX OF EXHIBITS

| Exhibit No. |

Description |

| |

|

| 1 |

Directors and Executive Officers of York Capital Management Global Advisors, LLC (incorporated by reference to the Reporting Person’s Amendment No. 9 to Schedule 13D filed with the Securities and Exchange Commission on February 5, 2014). |

| |

|

| 2 |

Agreement, dated September 17, 2014, by and among (1) York Capital Management Fund, L.P., York Multi-Strategy Master Fund, L.P., York Credit Opportunities Fund, L.P., York Credit Opportunities Master Fund, L.P., Jorvik Multi-Strategy Master Fund, L.P. and Permal York Ltd., and (2) Dov Baharav. |

| |

|

| 3 |

Agreement, dated September 17, 2014, by and among (1) FIMI Opportunity Fund IV, L.P., FIMI Israel Opportunity Fund IV, Limited Partnership, FIMI Opportunity V, L.P. and FIMI Israel Opportunity V, Limited Partnership, and (2) York Capital Management, L.P., York Multi-Strategy Master Fund, L.P., York Credit Opportunities Fund, L.P., York Credit Opportunities Master Fund, L.P., Jorvik Multi-Strategy Master Fund, L.P. and Permal York Ltd. |

EXHIBIT

2

AGREEMENT

THIS AGREEMENT (this

“Agreement”) is entered into this September 17, 2014, by and between (1) Dov Baharav (the “Purchaser”),

and (2) York Capital Management, L.P., a Delaware limited partnership, York Multi-Strategy Master Fund, L.P., a Cayman Islands

exempted limited partnership, York Credit Opportunities Fund, L.P., a Delaware limited partnership, York Credit Opportunities Master

Fund, L.P., a Cayman Islands exempted limited partnership, Jorvik Multi-Strategy Master Fund, L.P., a Cayman Islands exempted limited

partnership and Permal York Ltd., a British Virgin Islands company (each, a "Seller Entity" and, collectively,

the “Seller”). Each of Purchaser and Seller may be referred to herein as a "Party" and collectively

as the "Parties".

WHEREAS,

Gilat Satellite Networks Ltd. (the “Company”) is a public Israeli company whose ordinary shares, par value NIS

0.2 per share (“Ordinary Shares”), are traded on the NASDAQ Global Select Market and on the Tel Aviv Stock Exchange;

and

WHEREAS,

Purchaser desires to purchase from Seller and Seller desires to sell to Purchaser a total of 849,182 Ordinary Shares of the Company

(the "Purchased Shares") in an off-market private transaction in accordance with the terms and conditions set

forth herein.

NOW,

THEREFORE, the Parties hereto agree as follows:

| 1. | Sale of the Purchased Shares. On the Effective Date, Seller shall sell and transfer to Purchaser

and Purchaser shall purchase from Seller the Purchased Shares, free and clear of any and all Encumbrances (as defined below), at

a price per Purchased Share of US$4.95 and an aggregate purchase price of US$4,203,451 (the “Purchase Price”).

The “Effective Date” shall be the business day in New York and Israel immediately following the day on which

Seller notifies Purchaser that it is ready to consummate the sale of the Purchased Shares for the Purchase Price, but in no event

before September 21, 2014 or after October 21, 2014. |

| | For purposes of this Agreement "Encumbrances" shall mean: liens, pledges, security

interests, easements, restrictive covenants, claims, charges, mortgages or other third party rights of any kind, provided however

that (i) the Purchased Shares certificates bear certain restrictive legends under U.S. securities law, (ii) the Seller is not obligated

to remove the legends prior to, during or following the Effective Date, and (iii) the Purchased Shares shall be transferred from

the Seller to the Purchaser with their legends and subject to the terms of the restrictions reflected by the legends. |

| 2. | The following transactions shall take place on the Effective Date, which transactions shall be

deemed to take place simultaneously and no transaction shall be deemed to have been completed or any document delivered until all

such transactions have been completed and all required documents have been delivered: |

| (1) | Seller Entities shall transfer to Purchaser the Purchased Shares, free and

clear of any and all Encumbrances, as follows: |

| Name of Seller Entity |

Number of Purchased Shares |

| York Capital Management, L.P. |

59,867 |

| York Multi-Strategy Master Fund, L.P. |

580,978 |

| York Credit Opportunities Fund, L.P. |

31,480 |

| York Credit Opportunities Master Fund, L.P. |

67,514 |

| Jorvik Multi-Strategy Master Fund, L.P. |

58,407 |

| Permal York Ltd. |

50,936 |

| Total |

849,182 |

| (2) | Seller shall deliver to Purchaser duly executed irrevocable instructions

from the Seller to the broker holding the Purchased Shares or to the holder registered as holding the Purchased Shares with any

registration company or otherwise, instructing the electronic transfer of the Purchased Shares to the account of the Purchaser,

as previously provided to Seller by Purchaser. |

| (3) | Purchaser shall deliver to Seller duly executed irrevocable instructions

to Purchaser's bank as to the transfer of the Purchase Price to the bank accounts of the respective Seller Entities, as set forth

in Exhibit A attached hereto. The Purchase Price shall be paid in US$ by wire transfer of immediately available funds. |

| 3. | Representations and Warranties. |

| (1) | Ownership of Purchased

Shares. Seller hereby represents and warrants to Purchaser that each Seller Entity is the beneficial and record owner and

holder of the Purchased Shares being sold by it and owns such Purchased Shares free and clear of any and all Encumbrances,

except certain restrictive legends on the Purchased Shares certificates. |

| (2) | Authorization; Binding Authority; Enforceability.

Each Party represents to the other Party that it has full corporate power and authority to execute and deliver this Agreement,

to perform its obligations hereunder and to consummate the transactions contemplated hereby. This Agreement has been duly executed

and delivered by it, and constitutes a legal, valid and binding obligation of such Party, enforceable against it in accordance

with its terms. No authorization, approval or consent of, any third party is required of such Party in connection with the execution

and delivery of this Agreement or the consummation of the transactions contemplated hereby. |

| (3) | Independent Decision. Seller represents and warrants

that it has made an independent decision to sell the Purchased Shares at the agreed price. Seller has determined that it is in

possession of adequate information to make such decision, and confirms that it has not relied on any act, statement or omission

of Purchaser or any information (in any form, whether written or oral) furnished by or on behalf of Purchaser in making that decision.

Purchaser represents and warrants that it has made an independent decision to purchase the Purchased Shares at the agreed price.

Purchaser has determined that it is in possession of adequate information to make such decision, and confirms that it has not

relied on any act, statement or omission of Seller or any information (in any form, whether written or oral) furnished by or on

behalf of Seller in making that decision. |

| (4) | Sophisticated

Investor. Each Party is a sophisticated, knowledgeable and experienced investor and has adequate information

concerning the business and financial condition of the Company. Neither Party has disclosed any material non-public or

confidential information to the other Party, and neither Party has requested that such information be disclosed. Each Party is

capable of evaluating the merits and risks of the sale and of protecting its own interest in connection with the purchase and

sale. Neither Party has given any investment advice or rendered any opinion to the other Party as to whether the purchase or sale

of the Purchased Shares is prudent or suitable. Purchaser represents and warrants that it is acquiring the Purchased Shares for

investment purposes and not with the intent to distribute or resell. |

| (5) | Waiver. Each Party, on its own behalf and on behalf

of its successors and assigns, hereby expressly releases, discharges and dismisses any and all actions, causes of action, suits,

claims, charges, demands, damages and losses of any type whatsoever, whether known or unknown, choate or inchoate, at law, in

equity, by contract or otherwise against the other Party and its successors and assigns in each case arising from or involving

the failure to disclose any or all of the information known to it or in its possession in connection with the sale and purchase

of the Purchased Shares. Each Party waives any and all protections afforded under any applicable statute or regulation that would,

if enforced, have the effect of limiting the enforceability or effectiveness of any of the provisions of this Agreement. |

| (1) | Further Assurances. Each of the Parties hereto shall perform such

further acts and execute such further documents as may reasonably be necessary to carry out and give full effect to the provisions

of this Agreement and the intentions of the Parties as reflected hereby. |

| (2) | Governing Law; Jurisdiction. This Agreement shall be governed by and

construed in accordance with the laws of the State of Israel, without regard to the conflict of laws provisions thereof. Each of

the Parties hereby irrevocably submits to the exclusive jurisdiction of the appropriate court in Tel-Aviv, Israel, and agrees not

to assert any objections to the jurisdiction thereof. |

| (3) | Successors and Assigns; Assignment. Except as otherwise expressly

limited herein, the provisions hereof shall inure to the benefit of, and be binding upon, the successors, assigns, heirs, executors,

and administrators of the Parties hereto. None of the rights, privileges, or obligations set forth in, arising under, or created

by this Agreement may be assigned or transferred without the prior consent in writing of the other Parties to this Agreement. |

| (4) | Entire Agreement; Amendment and Waiver. This Agreement constitutes

the full and entire understanding and agreement between the Parties with regard to the subject matter hereof. Any term of this

Agreement may be amended and the observance of any term hereof may be waived (either prospectively or retroactively and either

generally or in a particular instance) only with the written consent of the Parties to this Agreement. |

| (5) | Notices, etc. All notices and other communications required or permitted

hereunder to be given to a Party to this Agreement shall be in writing and shall be facsimiled or mailed by registered or certified

mail, postage prepaid, or otherwise delivered by hand or by messenger, addressed to such Party's address as set forth below or

at such other address as the Party shall have furnished to the other Party in writing in accordance with this provision: |

if

to Seller: c/o York Capital Management

767

Fifth Avenue

17th

floor

New

York, NY 10153

United

States

Tel:

+1-212-300-1300

Email:

rswanson@yorkcapital.com

Attention:

General Counsel

if

to Purchaser: Dov Baharav

c/o

BVL Ventures Ltd.

1 Ha

Shikma St.

Savyon,

Israel, P.O.B. 42

Tel:

+972 3 6039030

Email:

dovb@bv-l.com

or such

other address with respect to a Party as such Party shall notify the other Party in writing as above provided. Any notice sent

in accordance with this Section 4(5) shall be effective (i) if mailed, five (5) business days after mailing, (ii) if sent by messenger,

upon delivery to the above-referenced address, and (iii) if sent via email, on the first business day following transmission and

electronic confirmation of receipt (provided, however, that any notice of change of address shall only be valid upon receipt).

| (6) | Delays or Omissions. No delay or omission to exercise

any right, power, or remedy accruing to any Party upon any breach or default under this Agreement, shall be deemed a waiver of

any other breach or default theretofore or thereafter occurring. Any waiver, permit, consent, or approval of any kind or character

on the part of any Party of any breach or default under this Agreement, or any waiver on the part of any Party of any provisions

or conditions of this Agreement, must be in writing and shall be effective only to the extent specifically set forth in such writing.

All remedies, either under this Agreement or by law or otherwise, afforded to any of the Parties, shall be cumulative and not

alternative. |

| (7) | Severability. If any provision of this Agreement

is held by a court of competent jurisdiction to be unenforceable under applicable law, then such provision shall be excluded from

this Agreement and the remainder of this Agreement shall be interpreted as if such provision were so excluded and shall be enforceable

in accordance with its terms; provided, however, that in such event this Agreement shall be interpreted so as to give effect,

to the greatest extent consistent with and permitted by applicable law, to the meaning and intention of the excluded provision

as determined by such court of competent jurisdiction. |

| (8) | Counterparts. This Agreement may be executed in

any number of counterparts, each of which shall be deemed an original and enforceable against the Parties actually executing such

counterpart, and all of which together shall constitute one and the same instrument. |

| (9) | Expenses. Each Party shall bear its own legal and other expenses in

connection with the transaction contemplated by this Agreement. |

[Remainder of page

intentionally left blank]

IN WITNESS

WHEREOF, the undersigned have caused this Agreement to be executed by their duly authorized representatives as of the date first

written above.

Seller:

______________________________________

York

Capital Management, L.P.

York

Multi-Strategy Master Fund, L.P.

York

Credit Opportunities Fund, L.P.

York

Credit Opportunities Master Fund, L.P.

Jorvik

Multi-Strategy Master Fund, L.P.

Permal

York Ltd.

By:

York Capital Management Global Advisors, LLC, as the investment advisor to the entities

Name:

_______________________

Title:

_______________________

| [Signature Page to York – Dov Baharav Agreement] |

Purchaser:

|

_____________________

Dov Baharav

|

|

| [Signature Page to York – Dov Baharav Agreement] |

Exhibit

A

Seller

Entities Bank Account Information

EXHIBIT

3

AGREEMENT

This Agreement (“Agreement”)

is entered into on September 17, 2014, by and between:

(1) FIMI Opportunity

Fund IV, L.P., a limited partnership formed under the laws of the State of Delaware, FIMI Israel Opportunity Fund IV, Limited Partnership,

a limited partnership formed under the laws of the State of Israel, FIMI Opportunity V, L.P., a limited partnership formed under

the laws of the State of Delaware, and FIMI Israel Opportunity V, Limited Partnership, a limited partnership formed under the laws

of the State of Israel (collectively, “FIMI”); and

(2) York Capital Management,

L.P., a Delaware limited partnership, York Multi-Strategy Master Fund, L.P., a Cayman Islands exempted limited partnership, York

Credit Opportunities Fund, L.P., a Delaware limited partnership, York Credit Opportunities Master Fund, L.P., a Cayman Islands

exempted limited partnership, Jorvik Multi-Strategy Master Fund, L.P., a Cayman Islands exempted limited partnership and Permal

York Ltd., a British Virgin Islands company (collectively, “York”).

Each of FIMI and York

may be referred to herein as a "Party" and collectively as the "Parties".

WHEREAS,

York is the holder of 6,015,530 ordinary shares, par value NIS 0.2 per share, of Gilat Satellite Networks Ltd. (the “Company”),

a public company incorporated under the laws of the State of Israel whose shares are listed on the NASDAQ Global Select Market

and on the Tel Aviv Stock Exchange, constituting on the date hereof approximately 14.2% of the issued and outstanding share capital

of the Company; and

WHEREAS,

FIMI (alone or together with any designees thereof) intends to make a public "special tender offer" (as defined in Part

8, Chapter 2 of the Israeli Companies Law, 1999) on or prior to October 24, 2014, to acquire, in consideration for a cash price

of US$ 4.95 per share (the “Selling Price”), 5,166,348 ordinary shares of the Company (the “Offer”);

and

WHEREAS,

York is supportive of the Offer and is willing to (i) tender 5,166,348 ordinary shares of the Company held by it (the "Shares")

under the Offer and (ii) support FIMI (and its designees) in taking the actions necessary for a successful completion of the

Offer, as further set out in this Agreement.

NOW,

THEREFORE, the Parties agree as follows:

York

represents and warrants that it is the owner of, and has all relevant authority to accept the Offer in respect of, the Shares,

and that the Shares are free and clear of encumbrances of any kind, except certain restrictive legends on the Shares certificates.

York

hereby irrevocably undertakes to (i) accept the Offer in respect of the Shares (whether or not the Offer is made by FIMI alone

or together with its designees), at the cash Selling Price per each accepted Share, (ii) deliver evidence of such acceptance and

tender the Shares to FIMI (or to designees thereof as instructed by FIMI), before the last day of the initial tender period in

accordance with the terms and conditions of the Offer, and (iii) not exercise voting rights pertaining to the Shares in a

manner which may prejudice or frustrate the Offer.

York

hereby irrevocably undertakes that the Shares shall be tendered free from any pledge, charge or other security interest. For the

avoidance of any doubt, and notwithstanding anything to the contrary in this Agreement, it is acknowledged and agreed by the Parties,

that (i) the Shares certificates bear certain restrictive legends under U.S. securities law, (ii) York is not obligated to remove

the legends prior to, during or following the date on which the Offer is made and/or consummated, and (iii) the Shares shall be

tendered and/or transferred by York with their legends and subject to the terms of the restrictions reflected by the legends.

York

hereby irrevocably undertakes not to, as of the date hereof and until the expiration of the Offer period, as may be extended pursuant

to applicable law, but not later than 60 days after the filing of the Offer with the Securities and Exchange Commission (i) offer,

sell, transfer, charge, pledge or grant any option over or otherwise dispose of any of the Shares, whether directly or indirectly,

except to FIMI or its designees, (ii) solicit or accept any other offer (public or private) in respect of any of the Shares,

(iii) take any action or make any statement, which could prejudice the Offer, or (iv) withdraw the acceptance of the

Offer referred to above in respect of any of the Shares regardless of any terms of withdrawal contained in the Offer or any legal

right to withdraw. For the avoidance of any doubt, it is hereby acknowledged and agreed by the Parties, that York is entitled,

in its sole discretion, to execute any of the actions and/or transactions detailed in sub sections (i) and (ii) above, with respect

to all or part of 849,182 shares of the Company held by York which are not part of the Shares.

1A.

Termination

York

may terminate its undertakings in this Agreement:

a. If

the Offer is not made and published on or before October 24, 2014.

b. If

the Offer and purchase of the Shares (or part of them, as applicable) is not consummated on or before a date which is 60 days after

the filing of the Offer with the Securities and Exchange Commission.

| c. | If the Offer does not become effective, lapses or is withdrawn. |

FIMI hereby irrevocably

undertakes to (i) make the Offer (by itself or together with any of its designees), by not later than October 24, 2014 at a cash

price per share equal to the Selling Price, which shall be paid in US$ currency, and (ii) approach York (reasonable time in advance)

and receive York’s prior written consent to the language of any information published by FIMI with respect to or in connection

with York and/or holdings of York in the Company’s ordinary shares and/or this Agreement and/or relationship between the

Parties, whether such information is part of an immediate report, press release, announcement or other publication of FIMI, including

the Offering Documents (מפרט הצעת

רכש) and/or any amendment or supplement

thereto.

| (1) | Governing Law; Jurisdiction. This Agreement shall be governed by and

construed in accordance with the laws of the State of Israel, without regard to the conflict of laws provisions thereof. Each of

the Parties hereby irrevocably submits to the exclusive jurisdiction of the appropriate court in Tel-Aviv, Israel, and agrees not

to assert any objections to the jurisdiction thereof. |

| (2) | Successors and Assigns; Assignment. Except as otherwise expressly

limited herein, the provisions hereof shall inure to the benefit of, and be binding upon, the successors, assigns, heirs, executors,

and administrators of the Parties hereto. None of the rights, privileges, or obligations set forth in, arising under, or created

by this Agreement may be assigned or transferred without the prior consent in writing of the other Parties to this Agreement. |

| (3) | Entire Agreement; Amendment and Waiver. This Agreement constitutes

the full and entire understanding and agreement between the Parties with regard to the subject matter hereof. Any term of this

Agreement may be amended and the observance of any term hereof may be waived (either prospectively or retroactively and either

generally or in a particular instance) only with the written consent of the Parties to this Agreement. |

| (4) | Notices, etc. All notices and other communications required or permitted

hereunder to be given to a Party to this Agreement shall be in writing and shall be facsimiled or mailed by registered or certified

mail, postage prepaid, or otherwise delivered by hand or by messenger, addressed to such Party's address as set forth below or

at such other address as the Party shall have furnished to the other Party in writing in accordance with this provision: |

if to York:

c/o York Capital Management

767

Fifth Avenue

17th

floor

New

York, NY 10153

United

States

Tel:

+1-212-300-1300

Email:

rswanson@yorkcapital.com

Attention:

General Counsel

if to FIMI: c/o

FIMI V 2012 Ltd.

Electra

Building

98

Yigal Alon St.

Tel-Aviv,

67891, Israel

Tel:

+972-3-565-2244

Email:

fimi@fimi.co.il

or such

other address with respect to a Party as such Party shall notify the other Party in writing as above provided. Any notice sent

in accordance with this Section 3(4) shall be effective (i) if mailed, five (5) business days after mailing, (ii) if sent by messenger,

upon delivery to the above-referenced address, and (iii) if sent via email, on the first business day following transmission and

electronic confirmation of receipt (provided, however, that any notice of change of address shall only be valid upon receipt).

| (5) | Counterparts. This Agreement may be executed in any number of counterparts,

each of which shall be deemed an original and enforceable against the Parties actually executing such counterpart, and all of which

together shall constitute one and the same instrument. |

| (6) | Expenses. Each Party shall bear its own legal and other expenses in

connection with the transactions contemplated by this Agreement. For the avoidance of any doubt, FIMI shall be fully responsible

for all expenses in connection with the Offer and its execution. |

[Remainder of page

intentionally left blank]

IN WITNESS

WHEREOF, the undersigned have caused this Agreement to be executed by their duly authorized representatives as of the date first

written above.

YORK:

_____________________________

York

Capital Management, L.P.

York

Multi-Strategy Master Fund, L.P.

York

Credit Opportunities Fund, L.P.

York

Credit Opportunities Master Fund, L.P.

Jorvik

Multi-Strategy Master Fund, L.P.

Permal

York Ltd.

By:

York Capital Management Global Advisors, LLC, as the investment advisor to the entities

Name:

_______________________

Title:

_______________________

FIMI:

|

_____________________

FIMI

Opportunity Fund IV, L.P.

By: FIMI

IV 2007 Ltd.

Name:

___________________

Title:

____________________

|

_______________________

FIMI

Israel Opportunity Fund IV,

Limited

Partnership

By: FIMI

IV 2007 Ltd.

Name:

_______________________

Title:

_______________________

|

|

_____________________

FIMI

Opportunity V, L.P.

By: FIMI

FIVE 2012 Ltd.

Name:

____________________

Title:

_____________________

|

_______________________

FIMI

Israel Opportunity V,

Limited

Partnership

By: FIMI

FIVE 2012 Ltd.

Name:

______________________

Title:

_______________________

|

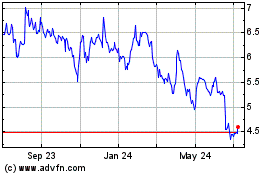

Gilat Satellite Networks (NASDAQ:GILT)

Historical Stock Chart

From Mar 2024 to Apr 2024

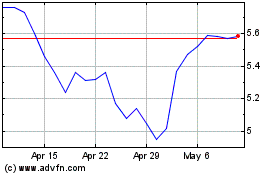

Gilat Satellite Networks (NASDAQ:GILT)

Historical Stock Chart

From Apr 2023 to Apr 2024