Owens & Minor Announces Closing of New Offering of $550 Million of Senior Notes and Delivery of Notice of Redemption

September 16 2014 - 4:53PM

Business Wire

Owens & Minor, Inc. (NYSE: OMI) announced today that it has

successfully completed its previously announced public offering of

$275 million of 3.875% Senior Notes due 2021 and $275 million of

4.375% Senior Notes due 2024. The new notes were offered pursuant

to an effective shelf registration statement filed with the

Securities and Exchange Commission (SEC). The new notes are

guaranteed on a senior unsecured basis by Owens & Minor

Distribution, Inc. and Owens & Minor Medical, Inc., both

wholly-owned subsidiaries of the company. Owens & Minor intends

to use the proceeds from the offering to fund its previously

announced acquisition of Medical Action Industries Inc., to fund

the redemption of all of its outstanding 6.35% Senior Notes due

2016 (2016 Notes) and for other general corporate purposes.

Owens & Minor also announced today that it has directed the

trustee under the indenture governing the 2016 Notes to issue

notice of redemption to the holders of all outstanding 2016 Notes.

All outstanding 2016 Notes will be redeemed on October 16, 2014 at

a make-whole redemption price, calculated in accordance with the

indenture governing the 2016 Notes.

This press release shall not constitute an offer to sell nor the

solicitation of an offer to buy any of these securities, nor shall

there be any sale of these securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction.

Safe Harbor Statement

Except for historical information, the matters discussed in this

press release may constitute forward-looking statements that

involve risks and uncertainties that could cause actual results to

differ materially from those projected. These risk factors are

discussed in reports filed by Owens & Minor with the SEC. All

of this information is available at www.owens-minor.com.

Owens & Minor assumes no obligation, and expressly disclaims

any such obligation, to update or alter information, whether as a

result of new information, future events, or otherwise, other than

as required by law.

Owens & Minor, Inc.

(NYSE:OMI) is a leading healthcare logistics company dedicated to

Connecting the World of Medical Products to the Point of CareTM by

providing vital supply chain services to healthcare providers and

manufacturers of healthcare products. Owens & Minor provides

logistics services across the spectrum of medical products from

disposable medical supplies to devices and implants. With logistics

platforms strategically located in the United States and Europe,

Owens & Minor serves markets where three quarters of global

healthcare spending occurs. Owens & Minor’s customers span the

healthcare market from independent hospitals to large integrated

healthcare networks, as well as group purchasing organizations,

healthcare products manufacturers and the federal government. A

FORTUNE 500 company, Owens & Minor is headquartered in

Richmond, Virginia, and has annualized revenues exceeding $9

billion. For more information about Owens & Minor, visit the

company website at www.owens-minor.com.

Owens & Minor, Inc.Trudi Allcott, Director, Investor &

Media Relations, 804-723-7555truitt.allcott@owens-minor.comorChuck

Graves, Director, Finance & Investor Relations,

804-723-7556chuck.graves@owens-minor.com

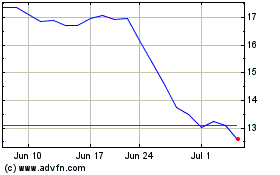

Owens and Minor (NYSE:OMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

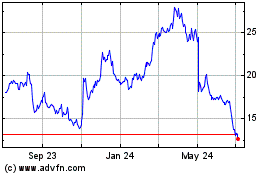

Owens and Minor (NYSE:OMI)

Historical Stock Chart

From Apr 2023 to Apr 2024