Filed Pursuant to Rule 424(b)(5)

Registration No. 333-194296

PROSPECTUS SUPPLEMENT

(To prospectus dated March 14, 2014)

23,076,924 Shares

DHT HOLDINGS, INC.

Common Stock

We are offering 23,076,924 shares of our common stock pursuant to this prospectus supplement and the accompanying prospectus.

Our common stock is quoted on The New York Stock Exchange under the symbol “DHT”. The last reported sale price of our common stock on September 9, 2014 was $6.39 per share.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus are truthful or complete. Any representation to the contrary is a criminal offense.

Investing in our common stock involves risk. Before buying any shares you should carefully read the sections entitled “Risk Factors” beginning on page S-9 of this prospectus supplement and page 5 of the accompanying prospectus.

|

|

|

Per Share

|

|

|

Total

|

|

|

Public offering price

|

|

$ |

6.50 |

|

|

$ |

150,000,006 |

|

|

Placement agent fees(1)

|

|

$ |

0.20 |

|

|

$ |

4,500,000 |

|

|

Proceeds before expenses to DHT Holdings, Inc.

|

|

$ |

6.30 |

|

|

$ |

145,500,006 |

|

|

|

(1)

|

See the section entitled “Plan of Distribution” for more information concerning placement agent compensation.

|

We have retained RS Platou Markets, Inc., RS Platou Markets AS and Fearnley Securities AS to act as our placement agents, for whom RS Platou Markets, Inc. is acting as Lead Manager and Bookrunner and RS Platou Markets AS and Fearnley Securities AS are acting as Placement Agents, for the shares offered by this prospectus supplement in connection with the sale of the shares to certain institutional investors. The placement agents have no commitment to buy any of the shares.

The shares of common stock will be ready for delivery on or about September 15, 2014. The delivery of shares to each investor is not conditioned upon the purchase of shares by any other investors. If one or more investors fail to fund the purchase price of their subscribed shares as required by the applicable subscription agreement, we intend to proceed with delivery on September 15, 2014 of the aggregate number of shares for which the purchase price has been received.

Lead Manager and Bookrunner

RS Platou Markets, Inc.

Placement Agents

| RS Platou Markets AS |

Fearnley Securities AS |

The date of this prospectus supplement is September 10, 2014.

Prospectus Supplement

This prospectus supplement and the accompanying prospectus are part of a registration statement on Form F-3 that we filed with the Securities and Exchange Commission (the “Commission”), using the shelf registration process. Under the shelf registration process, we may sell any combination of common stock, preferred stock, warrants or rights in one or more offerings from time to time. In the accompanying prospectus, we provide you a general description of the securities we may offer from time to time under our shelf registration statement. This prospectus supplement describes the specific details regarding this offering, including the price, the aggregate number of shares of common stock being offered and the risks of investing in our common stock, as well as certain other matters. This prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein include important information about us and our common stock and other information you should know in connection with this offering.

You should rely only on the information contained in this prospectus supplement and the accompanying prospectus. We are responsible only for the information contained in this prospectus supplement or the accompanying prospectus, incorporated by reference into this prospectus supplement or to which we have referred you. We have not authorized anyone to provide you with any other information, and we take no responsibility for any other information that others may provide you. You should assume that the information appearing in this prospectus supplement is accurate as of the date on the front cover of this prospectus supplement only. Our business, financial condition, results of operations and prospects may have changed since that date. We encourage you to consult your own counsel, accountant and other advisors for legal, tax, business, financial and related advice regarding an investment in our securities. The distribution of this prospectus supplement and sale of our common stock in certain jurisdictions may be restricted by law. We are not making an offer to sell our common stock in any jurisdiction where the offer or sale is not permitted.

For further information about us or the common stock offered hereby, you should refer to our shelf registration statement, which you can obtain from the Commission as described in the section entitled “Where You Can Find Additional Information” on page S-48 of this prospectus supplement.

This prospectus supplement summary highlights certain information about us and this offering. Because it is a summary, it may not contain all of the information that you should consider before deciding whether or not you should purchase our common stock. You should carefully read this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein for a more complete understanding of our business, this offering and the other transactions described in this prospectus supplement. You should pay special attention to the sections entitled “Risk Factors” beginning on page S-9 of this prospectus supplement, page 5 of the accompanying prospectus and “Item 3. Key Information—D. Risk Factors” beginning on page 7 of our Annual Report on Form 20-F for the year ended December 31, 2013, filed with the Commission on March 3, 2014 (our “2013 Form 20-F”), our consolidated audited financial statements and the notes thereto in our 2013 Form 20-F and incorporated herein by reference, and our unaudited interim condensed consolidated financial statements as of and for the six-months ended June 30, 2014 and the notes thereto (the “First Half 2014 Financial Statements”) included in Exhibit 99.2 to our Report on 6-K, filed with the Commission on September 9, 2014 (the “September 2014 6-K”) and incorporated herein by reference. Unless we specify otherwise, all references in this prospectus to “we”, “our”, “us”, “DHT” and “our company” refer to DHT Holdings, Inc. and its subsidiaries. All references in this prospectus to “DHT Maritime” refer to DHT Maritime, Inc., one of our subsidiaries. The shipping industry’s functional currency is the U.S. dollar and our company’s functional currency is the U.S. Dollar. All of our revenues and most of our operating costs are in U.S. dollars. All references in this prospectus supplement to “$” and “dollars” refer to U.S. dollars.

Our Company

We operate a fleet of crude oil tankers. As of September 8, 2014, our fleet consisted of eleven crude oil tankers currently in operation, all of which are wholly-owned by our company. The fleet currently in operation consists of seven very large crude carriers or “VLCCs,” which are tankers ranging in size from 200,000 to 320,000 deadweight tons (“dwt”), two Suezmax tankers or “Suezmaxes,” which are tankers ranging in size from 130,000 to 170,000 dwt and two Aframax tankers or “Aframaxes,” which are tankers ranging in size from 80,000 to 120,000 dwt. Seven of the vessels are operating with spot market exposure, either directly, on index-based time charters or in tanker pools. Our fleet principally operates on international routes and our fleet currently in operation had a combined carrying capacity of 2,700,320 dwt and an average age of approximately 11.5 years as of September 8, 2014.

As of September 8, 2014, we have agreements for six newbuilding VLCCs to be constructed at Hyundai Heavy Industries Co. Ltd. (“HHI”), all of which will be wholly-owned by our company. The six newbuildings are expected to be delivered in November 2015, January 2016, April 2016, July 2016, September 2016 and November 2016, respectively. We estimate the newbuilding VLCCs will have a combined carrying capacity of approximately 1,799,400 dwt. We operate out of Oslo, Norway and Singapore through our wholly-owned management companies, DHT Management AS and DHT Ship Management (Singapore) Pte. Ltd. For more information on our company, please see our 2013 Form 20-F.

Our Fleet

The following table presents certain information regarding our vessels:

|

Vessel

|

Year Built

|

Yard

|

Dwt

|

Current Flag

|

Technical Manager

|

|

VLCC

|

|

DHT Ann

|

2001

|

Hyundai*

|

309,327

|

Marshall Islands

|

Goodwood****

|

|

DHT Chris

|

2001

|

Hyundai*

|

309,285

|

Marshall Islands

|

Goodwood****

|

|

DHT Phoenix

|

1999

|

Daewoo**

|

307,151

|

Marshall Islands

|

Goodwood****

|

|

DHT Eagle

|

2002

|

Samsung***

|

309,064

|

Marshall Islands

|

Goodwood****

|

|

DHT Falcon

|

2006 |

NACKS***** |

298,971 |

Hong Kong |

Goodwood**** |

|

DHT Hawk

|

2007 |

NACKS***** |

298,293 |

Hong Kong |

Goodwood**** |

|

DHT Condor

|

2004 |

Daewoo** |

320,050 |

Hong Kong |

Goodwood**** |

|

Suezmax

|

|

DHT Target

|

2001

|

Hyundai*

|

164,626

|

Marshall Islands

|

Goodwood****

|

|

DHT Trader

|

2000

|

Hyundai*

|

152,923

|

Marshall Islands

|

Goodwood****

|

|

Aframax

|

|

DHT Cathy

|

2004

|

Hyundai*

|

111,928

|

Marshall Islands

|

Goodwood****

|

|

DHT Sophie

|

2003

|

Hyundai*

|

115,000

|

Marshall Islands

|

Goodwood****

|

| * |

Hyundai Heavy Industries Co., South Korea |

| ** |

Daewoo Heavy Industries Co., South Korea |

| *** |

Samsung Heavy Industries Co., South Korea |

| **** |

Goodwood Ship Management Pte. Ltd., Singapore |

| ***** |

Nantong Cosco KHI Engineering Co. Ltd |

Employment

The following table presents certain features of our charters as of September 8, 2014:

|

Vessel

|

Type of

Employment

|

|

Charter

Rate

($/Day)

|

|

Expiry

|

Extension

Period*

|

Charter Rate in

Extension Period

($/day)

|

|

|

VLCC

|

|

|

DHT Ann

|

Time Charter

|

|

Market related

|

|

July 7, 2015

|

|

|

|

|

DHT Chris

|

Time Charter

|

|

Market related

|

|

January 1, 2015

|

+3 months*

|

|

|

|

DHT Eagle

|

Spot

|

|

|

|

|

|

|

|

|

DHT Phoenix

|

|

|

|

|

|

|

|

|

| DHT Falcon |

Spot |

|

|

|

|

|

|

|

| DHT Hawk |

Spot |

|

|

|

|

|

|

|

| DHT Condor |

Spot |

|

|

|

|

|

|

|

|

Suezmax

|

|

|

DHT Target

|

Time Charter

|

|

$ 14,713 |

|

September 24, 2014

|

|

|

|

|

DHT Trader

|

Time Charter

|

|

$ 14,409 |

|

September 11, 2014

|

|

|

|

|

Aframax

|

|

|

DHT Cathy

|

Time Charter

|

|

$ 12,838 |

|

February 15, 2015

|

|

|

|

|

DHT Sophie

|

Time Charter

|

|

$ 13,282 |

|

December 8, 2014

|

|

|

|

Technical Management of Our Fleet

The following is a summary of how we organize our ship management activities. The summary does not purport to be complete and is subject to, and qualified in its entirety by reference to, all the provisions of the ship management agreements. Because the following is only a summary, it does not contain all information that you may find useful.

We uphold a policy of high quality operations. Our management company in Singapore, DHT Ship Management (Singapore) Pte. Ltd., supervises the third-party technical managers. The third-party technical managers are responsible for the technical operation and upkeep of the vessels, including crewing, maintenance, repairs and dry-dockings, maintaining required vetting approvals and relevant inspections, and ensuring our fleet complies with the requirements of classification societies as well as relevant governments, flag states, environmental and other regulations. Under the ship management agreements, each vessel subsidiary pays the actual cost associated with the technical management and an annual management fee for the relevant vessel. We currently have one ship management provider: Goodwood Ship Management Pte. Ltd. in Singapore (“Goodwood”).

We place the insurance requirements related to our fleet with mutual clubs and underwriters through insurance brokers. Such requirements include, but are not limited to, marine hull and machinery insurance, protection and indemnity insurance (including pollution risks and crew insurances), war risk insurance and loss of hire insurance. Each vessel subsidiary pays the actual cost associated with the insurance placed for the relevant vessel.

Our Credit Facilities

For detail on our credit facilities, please see the section entitled “Secured Credit Facilities” in our 2013 Form 20-F. We are a holding company and have no significant assets other than cash and the equity interests in our subsidiaries. Our subsidiaries own all of our vessels and payments under the charters and from commercial pools are made to our subsidiaries.

The table below illustrates the scheduled repayment structure for our outstanding credit facilities (dollars in thousands) as of August 31, 2014:

|

Year

|

|

RBS

Credit

Facility

|

|

|

Phoenix

Credit

Facility

|

|

|

Eagle

Credit

Facility

|

|

|

Hawk

and

Falcon

Credit

Facility

|

|

|

|

Total Bank

Borrowings

|

|

|

2014

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

|

|

|

|

1,000

|

|

|

2015

|

|

|

–

|

|

|

|

2,437

|

|

|

|

2,500

|

|

|

|

4,000

|

|

|

|

8,937

|

|

|

2016

|

|

|

*

|

|

|

|

15,922

|

|

|

|

22,250

|

|

|

|

|

|

|

|

42,172

|

|

|

Thereafter

|

|

|

113,275

|

|

|

|

–

|

|

|

|

–

|

|

|

|

38,000

|

|

|

|

151,275

|

|

|

Total

|

|

$

|

113,275

|

|

|

$

|

18,359

|

|

|

$

|

24,750

|

|

|

$

|

|

|

|

$ |

203,384 |

|

*Commencing with the second quarter of 2016, installment payments under our secured credit facility, as amended, with The Royal Bank of Scotland plc (the “RBS Credit Facility”) will be equal to free cash flow for DHT Maritime during the preceding quarter capped at $7.5 million per quarter. Free cash flow is defined as an amount calculated as of the last day of each quarter equal to the positive difference, if any, between: the sum of the earnings of the vessels during the quarter and the sum of (1) ship operating expenses, (2) voyage expenses, (3) estimated capital expenses for the following two quarters, (4) general & administrative expenses, (5) interest expenses and (6) change in working capital.

See “Description of Certain Indebtedness” for a description of certain of our existing indebtedness and certain indebtedness that we expect to incur in the near term.

Recent Developments

Concurrent Private Placement

Substantially concurrent with this offering, we are pursuing a private placement of $150.0 million aggregate principal amount of convertible senior unsecured notes due 2019 (the “Convertible Senior Notes”) to a group of institutional accredited investors. Completion of this offering is not contingent upon completion of the private placement of the Convertible Senior Notes (the “Concurrent Private Placement”). This prospectus supplement is not an offer to sell or a solicitation of an offer to buy the securities privately placed in the Concurrent Private Placement. For more information on the securities we anticipate issuing in the Concurrent Private Placement, please see “Description of Certain Indebtedness”.

Samco Acquisition

On September 9, 2014, we entered into a Share Purchase Agreement (the “Share Purchase Agreement”) with the shareholders (the “Sellers”) of Samco Shipholding Pte. Ltd., a private company limited by shares incorporated under the laws of the Republic of Singapore (“Samco”). Pursuant to the terms and subject to the conditions set forth in the Share Purchase Agreement, we will acquire all of the issued and allotted shares of Samco (the “Samco Acquisition”) from the Sellers for a purchase price of $317,005,000 in cash payable at the closing of the Samco Acquisition, less $5,000,000 that will be deposited in an escrow fund pending final determination of any purchase price adjustment following the closing. The purchase price is subject to certain post-closing adjustments in accordance with the terms of the Share Purchase Agreement.

Following its acquisition by us, Samco will continue to have outstanding indebtedness which, as of June 30, 2014, was $322,418,000 in aggregate amount (including $25,542,000 outstanding with a final maturity date of May 11, 2015, $42,669,000 outstanding with a final maturity date of December 22, 2016, $209,269,000 outstanding with a final maturity date of June 29, 2018, and $44,938,000 outstanding with a final maturity date of November 16, 2021) under the Existing Samco Loan Agreements, as defined in “Description of Certain Indebtedness”. We have obtained all necessary change of control consents in respect of the Existing Samco Loan Agreements, subject to documentation. In addition, we have entered into a firm commitment, subject to documentation, for the refinancing of the Existing Samco Loan Agreements with Nordea Bank Norge ASA and DNB Bank ASA.

For more information on the Samco Acquisition and the Share Purchase Agreement, please see our Report on Form 6-K filed September 9, 2014, which is incorporated by reference into this prospectus supplement, and to which the Share Purchase Agreement is attached as Exhibit 10.1.

Results of Operations for the Six Months Ended June 30, 2014

Our shipping revenues for the first half of 2014 were $43.9 million, a $5.2 million, or 13.4%, increase over the first half of 2013. This increase was mainly due to a larger fleet and improvement in rates and a the final settlement of $1.5 million related to claims filed against various affiliates of Overseas Shipping Group, Inc. which was recorded as shipping revenue in the second quarter of 2014.

Voyage expenses for the first half of 2014 were $11.5 million, compared to voyage expenses of $16.1 million in the first half of 2013. The decrease was mainly due to fewer vessels trading in the spot market. Vessel operating expenses for the first half of 2014 were $17.6 million, compared to $12.5 million in the first half of 2013. The increase was due to an increase in the fleet, vessels undergoing intermediate surveys during the 2014 period as well as upstoring and startup cost related to the delivery of DHT Condor, DHT Hawk and DHT Falcon in the first half of 2014.

We had a net loss in the first half of 2014 of $8.5 million, or $0.13 per diluted share, compared to a net loss of $11.5 million, or $0.74 per diluted share, in the first half of 2013.

At the end of the first half of 2014, our cash balance was $146.2 million, compared to $43.1 million at the end of the first half of 2013.

The First Half 2014 Financial Statements are included in Exhibit 99.2 to the September 2014 6-K, and are incorporated by reference into this prospectus supplement.

HHI Ship Construction Agreements

We have entered into the following agreements with HHI for the construction of six VLCCs (collectively, the “HHI Agreements”):

|

|

●

|

on December 2, 2013 we entered into agreements for the construction of two VLCCs with a contract price of $92.7 million each, including certain additions and upgrades to the standard specification and an estimated capacity of 300,000 dwt;

|

|

|

|

|

|

|

●

|

on January 8, 2014, we exercised an option and entered into a new agreement with HHI to construct a VLCC with a contract price of $92.7 million, including certain additions and upgrades to the standard specification and an estimated capacity of 300,000 dwt; and

|

|

|

|

|

|

|

●

|

on February 14, 2014, we entered into agreements for the construction of three VLCCs at a contract price of $97.3 million each, which includes $2.3 million in additions and upgrades to the standard specification.

|

On March 13, 2014, we announced that we amended two shipbuilding contracts with HHI to advance the scheduled delivery on two VLCCs. We agreed to increase the contract price by $1.5 million for each of the two vessels. The amendment with HHI is attached as Exhibit 10.1 to our report on Form 6-K filed March 13, 2014, and this agreement is incorporated by reference into this prospectus supplement.

As of September 8, 2014, the six newbuildings are expected to be delivered in November 2015, January 2016, April 2016, July 2016, September 2016 and November 2016, respectively. As of August 27, 2014, we have made $171.0 million in predelivery payments related to the six newbuilding contracts entered into in December 2013 and January and February 2014. Of the remaining predelivery payments totaling $114.1 million, $76.5 million are due in 2015 and $37.6 million are due 2016. The final payments at delivery of the vessels totaling $288.1 million is planned to be funded with debt financing of which $190.4 million related to four of the newbuildings has been secured. We intend to pursue debt financing for the remaining two vessels in due course, however, there is no assurance that such financing may be obtained or if obtained, on commercial favorable terms.

We have obtained a financing commitment to fund the acquisition of one VLCC from HHI through a secured term loan facility (the “Danish Ship Finance Term Loan Facility”) that will be between and among Danish Ship Finance A/S, as lender, a special purpose company (a direct wholly-owned subsidiary of us, the “Danish Ship Finance Borrower”), and us, as guarantor. The Danish Ship Finance Borrower will be permitted to borrow up to $49.4 million under the Danish Ship Finance Term Loan Facility. The Danish Ship Finance Term Loan Facility will be for a five-year term. Borrowings will bear interest at a rate equal to a margin of 225 basis points plus LIBOR.

On July 22, 2014 we executed a financing facility to fund the acquisition of three VLCCs from HHI through a secured term loan facility (the “Term Loan Facility”) between and among ABN AMRO Bank N.V. Oslo Branch, DVB Bank London Branch and Nordea Bank Norge ASA or any of their affiliates, each as lenders, three special purpose companies (each, a direct wholly-owned subsidiary of us, collectively, the “Borrowers”), and us, as guarantor. The Borrowers are permitted to borrow up to $141.0 million across three tranches under the Term Loan Facility. The Term Loan Facility will be for a five-year term from the date of the first drawdown, but in any event the final maturity date of the Term Loan Facility shall be no later than December 31, 2021, subject to earlier repayment in certain circumstances. Borrowings for each tranche will bear interest at a rate equal to a margin of 260 basis points plus LIBOR.

Ship Purchase Agreement

On May 7, 2014, we announced that we reached an agreement (the “Ship Purchase Agreement”) to acquire a VLCC built in 2004 from DS-Rendite-Fonds Nr. 127 VLCC Younara Glory GmbH & Co. Tankschiff KG for $49.0 million. This VLCC was delivered on May 28, 2014, and was named the DHT Condor. We financed the acquisition with cash at hand.

Corporate Information

Our principal executive offices are located at Clarendon House, 2 Church Street, Hamilton HM 11, Bermuda and our telephone number at that address is +1 (441) 299-4912. Our website address is www.dhtankers.com. The information on our website is not a part of this prospectus supplement. We own each of the vessels in our fleet through wholly-owned subsidiaries incorporated under the laws of the Republic of the Marshall Islands or the Hong Kong Special Administrative Region of the People’s Republic of China.

|

Issuer

|

DHT Holdings, Inc., a Marshall Islands corporation.

|

|

Common Stock Offered in this

Offering

|

23,076,924 shares.

|

|

Common Stock to be

Outstanding after this Offering

|

92,510,086 shares.

|

|

Use of Proceeds

|

We estimate that the net proceeds from this offering, after deducting the placement agent fees and estimated expenses relating to this offering payable by us, will be approximately $144.7 million. We plan to use the net proceeds from this offering, together with the net proceeds from the Concurrent Private Placement and cash on hand, to fund the Samco Acquisition, the expansion of our fleet, our pending vessel acquisitions and shipbuilding contracts and for other general corporate purposes.

|

|

Listing

|

Shares of our common stock are listed on the New York Stock Exchange under the symbol “DHT”.

|

|

Tax Considerations

|

You are urged to consult your own tax advisor regarding the specific tax consequences to you resulting from your acquisition, ownership and disposition of our common stock. See “Tax Considerations.”

|

|

Transfer Agent and Registrar

|

American Stock Transfer & Trust Company, LLC.

|

|

Fees and Expenses

|

We will pay certain fees and expenses of the placement agents. You are responsible for paying any other commissions, fees, taxes or other expenses incurred in connection with the purchase of our common stock.

|

|

Risk Factors

|

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described under “Risk Factors” beginning on page S-9 of this prospectus supplement, page 5 of the accompanying prospectus and “Item 3. Key Information—D. Risk Factors” beginning on page 7 of our 2013 Form 20-F for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock.

|

Unless we indicate otherwise, all information in this prospectus supplement is based on 69,433,162 shares of our common stock outstanding as of September 8, 2014.

An investment in shares of our common stock involves a high degree of risk. You should carefully consider the risk factors below, those appearing under the heading “Risk Factors” in our 2013 Form 20-F, incorporated herein by reference, as well as the other information contained in this prospectus supplement, the accompanying prospectus and the other documents incorporated herein by reference, before making an investment in our common stock. Some of the risks relate principally to us and our business and the industry in which we operate. Other risks relate principally to the securities market and ownership of our shares. If any of the circumstances or events described below, in the 2013 Form 20-F, or elsewhere in this prospectus supplement actually arise or occur, our business, financial condition, results of operations and cash flows could be materially and adversely affected. In such a case, the market prices of our common stock could decline and you could lose all or part of your investment.

Risks Related to Our Business

You should read the section entitled “Item 3. Key Information—D. Risk Factors” in our 2013 Form 20-F, and similar sections in subsequent filings, which are incorporated by reference in this prospectus, for information on risks relating to our business.

Risks Related to Our Industry

You should read the section entitled “Item 3. Key Information—D. Risk Factors” in our 2013 Form 20-F, and similar sections in subsequent filings, which are incorporated by reference in this prospectus, for information on risks relating to our industry.

Risks Related to Our Capital Stock

You should read the section entitled “Item 3. Key Information—D. Risk Factors” in our 2013 Form 20-F, and similar sections in subsequent filings, which are incorporated by reference in this prospectus, for information on risks relating to our capital stock.

There may be future sales or other dilution of our equity, which may adversely affect the market price of our common stock.

Except as described under the heading “Plan of Distribution,” we are not restricted from issuing additional common stock, including securities that are convertible into or exchangeable for, or that represent the right to receive, common stock. Concurrently with this offering, in the Concurrent Private Placement, we expect to place up to $150.0 million aggregate principal amount of our 4.5% Convertible Senior Notes due 2019, which, based on the expected initial conversion rate of 123.0769 shares of common stock per $1,000 aggregate principal amount of notes, would be convertible into a maximum aggregate of 18,461,539 shares of our common stock. The issuance of additional shares of our common stock in connection with conversions of the Convertible Senior Notes to be sold concurrently herewith, or other issuances of our common stock or convertible securities, including options and warrants, or otherwise, will dilute the ownership interest of our common stockholders.

Sales of a substantial number of shares of our common stock or other equity-related securities in the public market, or any hedging or arbitrage trading activity that may develop involving our common stock as a result of the concurrent private placement of Convertible Senior Notes, could depress the market price of our common stock and impair our ability to raise capital through the sale of additional equity securities. We cannot predict the effect that future sales of our common stock or other equity-related securities would have on the market price of our common stock.

Risks Related to Taxation

Certain adverse U.S. federal income tax consequences could arise for U.S. stockholders.

A non-U.S. corporation will be treated as a “passive foreign investment company” (a “PFIC”) for U.S. federal income tax purposes if either (i) at least 75% of its gross income for any taxable year consists of certain types of “passive income” or (ii) at least 50% of the average value of the corporation’s assets are “passive assets” or assets that produce or are held for the production of “passive income”. “Passive income” includes dividends, interest, gains from the sale or exchange of investment property and rents and royalties other than rents and royalties which are received from unrelated parties in connection with the active conduct of a trade or business. For purposes of these tests, income derived from the performance of services does not constitute “passive income”.

We believe it is more likely than not that the gross income we derive or are deemed to derive from our time chartering activities is properly treated as services income, rather than rental income. Assuming this is correct, our income from our time chartering activities would not constitute “passive income”, and the assets we own and operate in connection with the production of that income would not constitute passive assets. Consequently, based on our actual and projected income, assets and activities, we believe that it is more likely than not that we are not currently a PFIC and will not become a PFIC in the foreseeable future.

There is substantial legal authority supporting the position that we are not a PFIC consisting of case law and U.S. Internal Revenue Service (the “IRS”) pronouncements concerning the characterization of income derived from time charters as services income for other tax purposes. Nonetheless, it should be noted that there is legal uncertainty in this regard because the U.S. Court of Appeals for the Fifth Circuit has held that, for purposes of a different set of rules under the U.S. Internal Revenue Code of 1986, as amended (the “Code”) income derived from certain time chartering activities should be treated as rental income rather than services income. However, the IRS has stated that it disagrees with the holding of this Fifth Circuit case, and that income derived from time chartering activities should be treated as services income. We have not sought, and we do not expect to seek, an IRS ruling on this matter. Accordingly, no assurance can be given that the IRS or a court of law will accept this position, and there is a risk that the IRS or a court of law could determine that we are a PFIC. No assurance can be given that this result will not occur. In addition, although we intend to conduct our affairs in a manner to avoid, to the extent possible, being classified as a PFIC with respect to any taxable year, no assurance can be given that the nature of our operations will not change in the future, or that we will be able to avoid PFIC status in the future.

If the IRS were to find that we are or have been a PFIC for any taxable year, our U.S. stockholders will face adverse U.S. federal income tax consequences. In particular, U.S. stockholders who are individuals would not be eligible for the maximum 20% preferential tax rate on qualified dividends. In addition, under the PFIC rules, unless U.S. stockholders make certain elections available under the Code, such stockholders would be liable to pay U.S. federal income tax at the then prevailing income tax rates on ordinary income upon the receipt of excess distributions and upon any gain from the disposition of our common stock, with interest payable on such tax liability as if the excess distribution or gain had been recognized ratably over the stockholder’s holding period of such stock. The maximum 20% preferential tax rate for individuals would not be available for this calculation.

Our operating income could fail to qualify for an exemption from U.S. federal income taxation, which will reduce our cash flow.

Under the Code, 50% of our gross income that is attributable to transportation that begins or ends, but that does not both begin and end, in the United States is characterized as U.S. source gross transportation income and is subject to a 4% U.S. federal income tax without allowance for any deductions, unless we qualify for exemption from such tax under Section 883 of the Code. We do not currently earn a significant amount of U.S. source gross transportation income; however, there can be no assurance that we will not earn a significant amount of such income in the future.

Based on our review of the applicable Commission documents, we believe that we currently qualify for this statutory tax exemption and we will take this position for U.S. federal income tax return reporting purposes with respect to our 2014 taxable year. However, there are factual circumstances beyond our control that could cause us to lose the benefit of this tax exemption in the future, and there is a significant risk that those factual circumstances could arise in 2015 or future years. For instance, we would likely not qualify if holders of our common stock owning a 5% or greater interest in our stock were to collectively own 50% or more of the outstanding shares of our common stock on more than half the days during a taxable year. In this regard, there is a significant possibility that such holders will own 50% or more of the outstanding shares of our common stock following this offering, conversions of the Convertible Senior Notes into additional shares of our common stock or future financing transactions, in which case we would likely not qualify in future tax years.

If we are not entitled to this exemption for a taxable year, we would be subject in that year to a 4% U.S. federal income tax on our U.S. source gross transportation income. This could have a negative effect on our business and would result in decreased earnings available for distribution to our stockholders.

We may be subject to taxation in Norway, which could have a material adverse effect on our results of operations and would subject dividends paid by us to Norwegian withholding taxes.

If we were considered to be a resident of Norway or to have a permanent establishment in Norway, all or a part of our profits could be subject to Norwegian corporate tax. We operate in a manner so that we do not have a permanent establishment in Norway and so that we are not deemed to reside in Norway, including by having our principal place of business outside Norway. Material decisions regarding our business or affairs are made, and our board of directors meetings are held, outside Norway and generally at our principal place of business. However, because one of our directors resides in Norway and we have entered into a management agreement with our Norwegian subsidiary, DHT Management AS, the Norwegian tax authorities may contend that we are subject to Norwegian corporate tax. If the Norwegian tax authorities make such a contention, we could incur substantial legal costs defending our position and, if we were unsuccessful in our defense, our results of operations would be materially and adversely affected. In addition, if we are unsuccessful in our defense against such a contention, dividends paid to you would be subject to Norwegian withholding taxes.

The enactment of proposed legislation could affect whether dividends paid by us constitute “qualified dividend income” eligible for the preferential rates.

Legislation has been proposed in the U.S. Senate that would deny the preferential rates of U.S. federal income tax currently imposed on “qualified dividend income” with respect to dividends received from a non-U.S. corporation, unless the non-U.S. corporation either is eligible for benefits of a comprehensive income tax treaty with the United States or is created or organized under the laws of a foreign country which has a comprehensive income tax system. Because the Marshall Islands has not entered into a comprehensive income tax treaty with the United States and imposes only limited taxes on corporations organized under its laws, it is unlikely that we could satisfy either of these requirements. Consequently, if this legislation were enacted in its current form the preferential rates of U.S. federal income tax discussed in “Tax Considerations—U.S. Federal Income Tax Considerations—U.S. Federal Income Taxation of ‘U.S. Holders’—Distributions on our Common Stock” may no longer be applicable to dividends received from us. As of the date of this prospectus supplement, it is not possible to predict with certainty whether or in what form the proposed legislation will be enacted.

Risks Related to the Samco Acquisition

The Samco Acquisition is subject to significant uncertainties and risks and may not be completed within the expected timeframe, if at all, and the pendency of the Samco Acquisition could adversely affect our business, financial conditions, results of operations and cash flows.

Completion of the Samco Acquisition is subject to the satisfaction (or waiver) of a number of conditions, many of which are beyond our control and may prevent, delay or otherwise negatively affect the completion of the Samco Acquisition. We cannot predict when these conditions will be satisfied, if at all. We will not consummate the Samco Acquisition until all required approvals have been obtained. In addition, the closing of the Samco Acquisition is contingent on our ability to obtain the financing.

Further, we or the Sellers could unilaterally terminate the Share Purchase Agreement without the other party’s agreement and without completing the Samco Acquisition if:

|

|

●

|

there has been a breach of the Share Purchase Agreement by the other party of any of its warranties, agreements or covenants under the Share Purchase Agreement, where such breach would constitute a failure of a condition to closing and is not reasonably capable of being cured or is not cured by the breaching party within 30 days after receiving written notice of such breach; or

|

|

|

●

|

the Samco Acquisition is not completed by September 23, 2014.

|

We and the Sellers can also mutually agree to terminate the Share Purchase Agreement without completing the Samco Acquisition. Failure to complete the Samco Acquisition would, and any delay in completing the Samco Acquisition could, prevent us from realizing the anticipated benefits from the Samco Acquisition. Additionally, if we fail to close the Samco Acquisition and are otherwise in breach of our obligations, we could be liable for damages.

Failure to successfully and efficiently integrate Samco’s business into our own may adversely affect our business, operations and financial condition.

The process of integrating the operations of Samco may require a significant amount of resources and management attention. Our future operations and cash flows will depend to a significant degree upon our ability to operate Samco efficiently and achieve the strategic operating objectives for our business. Our management team may encounter unforeseen difficulties in managing the integration. If we fail to successfully integrate the operations of Samco, encounter unanticipated costs in the integration of the two businesses or fail to utilize Samco’s assets to their full capacity, we may not realize the benefits we expect from the Samco Acquisition, and our business, financial condition and results of operations will be adversely affected. In addition, any substantial diversion of management attention or difficulties in operating the combined business could affect our revenues and ability to achieve operational, financial and strategic objectives.

Samco may have liabilities that are not known to us, and the Samco Acquisition may result in unexpected consequences to our business and results of operations.

Although Samco’s business will generally be subject to risks similar to those to which we are subject in our existing operations, we may not have discovered all risks and liabilities applicable to Samco’s business during the due diligence process, and such risks and liabilities may not be discovered prior to the closing of the Samco Acquisition. For example, as we integrate Samco, we may learn additional information about Samco that adversely affects us, such as unknown or contingent liabilities and issues relating to compliance with applicable laws. These risks and liabilities, individually or in the aggregate, could have a material adverse effect on our business, financial condition and results of operations. In addition, Samco may lose the benefit of certain tax incentives as a result of our acquisition of them, which could result in additional tax liability which we would bear.

We may not be able to enforce claims we have against the Sellers, and we are exposed to the credit risk of the Sellers.

In connection with the Samco Acquisition, the Sellers have agreed to compensate us, subject to certain limitations, for certain liabilities. Nonetheless, third parties could seek to hold us responsible for any of the liabilities the Sellers have agreed to retain, and there can be no assurance that we will be able to enforce any claims we may have against the Sellers. Moreover, even if we ultimately succeed in recovering any amounts for which we are held liable from the Sellers, we may be required to temporarily bear these losses ourselves. In addition, our ability to enforce any claims against the Sellers is dependent on the creditworthiness of the Sellers at the time we seek to enforce our claims, and there can be no assurances regarding the financial condition of the Sellers in the future. Any claims we may have against the Sellers will be subject to significant limitations.

Our historical and unaudited pro forma combined financial information may not be representative of our results as a combined company.

The historical financial information and the unaudited pro forma condensed combined financial information incorporated by reference in this prospectus supplement are constructed from the separate financial statements of DHT and Samco for periods prior to the consummation of the Samco Acquisition. In addition, the unaudited pro forma condensed combined financial information incorporated by reference in this prospectus supplement is based in part on certain assumptions regarding the Samco Acquisition. We cannot assure you that our assumptions will prove to be accurate over time. Accordingly, the historical and unaudited pro forma condensed combined financial information incorporated by reference in this prospectus supplement is presented for illustrative purposes only and may not reflect what our results of operations and financial condition would have been had we been a combined entity during the periods presented, or what our results of operations and financial condition will be in the future. The challenge of integrating previously independent businesses makes evaluating our combined business and our future financial prospects as a combined company difficult. Our potential for future business success and operating profitability must be considered in light of the risks, uncertainties, expenses and difficulties typically encountered by recently organized or combined companies.

This prospectus supplement contains certain forward-looking statements and information relating to us that are based on beliefs of our management as well as assumptions made by us and information currently available to us. When used in this document, words such as “believe”, “intend”, “anticipate”, “estimate”, “project”, “forecast”, “plan”, “potential”, “will”, “may”, “should” and “expect” and similar expressions are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements. These statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. We may also from time to time make forward-looking statements in our periodic reports that we will file with the Commission, other information sent to our security holders and other written materials. We caution that assumptions, expectations, projections, intentions and beliefs about future events may and often do vary from actual results and the differences can be material. The reasons for this include the risks, uncertainties and factors described under “Risk Factors” on page S-9 of this prospectus supplement, page 5 of the accompanying prospectus as well as those appearing under the heading “Item 3. Key Information—D. Risk Factors” in our 2013 Form 20-F.

These forward-looking statements represent our estimates and assumptions only as of the date of this prospectus supplement and are not intended to give any assurance as to future results. Factors that might cause results to differ include, but are not limited to, the following:

|

|

●

|

future payments of dividends and the availability of cash for payment of dividends;

|

|

|

●

|

future operating or financial results, including with respect to the amount of charter hire and freight revenue that we may receive from operating our vessels;

|

|

|

●

|

statements about future, pending or recent acquisitions (including the Samco Acquisition), business strategy, areas of possible expansion and expected capital spending or operating expenses;

|

|

|

●

|

statements about tanker industry trends, including charter rates and vessel values and factors affecting vessel supply and demand;

|

|

|

●

|

expectations about the availability of vessels to purchase, the time which it may take to construct new vessels or vessels’ useful lives;

|

|

|

●

|

expectations about the availability of insurance on commercially reasonable terms;

|

|

|

●

|

our and our subsidiaries’ ability to comply with operating and financial covenants and to repay their debt under the secured credit facilities;

|

|

|

●

|

our ability to obtain additional financing and to obtain replacement charters for our vessels;

|

|

|

●

|

assumptions regarding interest rates;

|

|

|

●

|

changes in production of or demand for oil and petroleum products, either globally or in particular regions;

|

|

|

●

|

greater than anticipated levels of new building orders or less than anticipated rates of scrapping of older vessels;

|

|

|

●

|

changes in trading patterns for particular commodities significantly impacting overall tonnage requirements;

|

|

|

●

|

our expectations regarding the size and terms of the Concurrent Private Placement, which may not occur;

|

|

|

●

|

changes in the rate of growth of the world and various regional economies;

|

|

|

●

|

risks incident to vessel operation, including discharge of pollutants; and

|

|

|

●

|

unanticipated changes in laws and regulations.

|

We undertake no obligation to publicly update or revise any forward-looking statements contained in this prospectus supplement, whether as a result of new information, future events or otherwise, except as required by law. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this prospectus supplement might not occur, and our actual results could differ materially from those anticipated in these forward-looking statements.

We estimate that the net proceeds from this offering, after deducting the placement agent fees and estimated expenses relating to this offering payable by us, will be approximately $144.7 million. This amount is based on an assumed public offering price of $6.50. We plan to use the net proceeds from this offering, together with the net proceeds from the Concurrent Private Placement and cash on hand, to fund the Samco Acquisition, expansion of our fleet, our pending vessel acquisitions and shipbuilding contracts and for other general corporate purposes.

The following table sets forth our capitalization on June 30, 2014, on:

|

|

·

|

an as adjusted basis to give effect to the following offering adjustments:

|

|

|

(i)

|

the issuance and sale of 23,076,924 shares of our common stock in this offering at the offering price of $6.50 per share, after deducting the estimated offering expenses of $0.8 million and placement agents’ fees, resulting in net proceeds to us of approximately $144.7 million; and

|

|

|

(ii)

|

the Concurrent Private Placement of $150.0 million aggregate principal amount 4.5% Convertible Senior Notes due 2019, after deducting the estimated offering expenses of $0.8 million and placement agents’ fees, resulting in net proceeds to us of approximately $144.7 million; and

|

|

|

·

|

an as further adjusted basis to give effect to the following adjustments related to the Samco Acquisition:

|

|

|

(i)

|

the use of $317,005,000 of proceeds from this offering and the Concurrent Private Placement, together with cash on hand, to fund the Samco Acquisition; and

|

|

|

(ii)

|

$318,666,000 of indebtedness under the Existing Samco Loan Agreements.

|

See “Use of Proceeds”. Other than these adjustments, there have been no material changes in our capitalization between June 30, 2014 and the date of this prospectus supplement.

This table should be read in conjunction with the First Half 2014 Financial Statements included in Exhibit 99.2 to the September 2014 6-K and incorporated herein by reference, and our consolidated audited financial statements and the notes thereto in our 2013 Form 20-F and incorporated herein by reference. See “Where You Can Find Additional Information”.

|

Dollars in thousands

|

|

|

|

As

Adjusted for this

Offering

|

|

|

As Further

Adjusted for the Concurrent Private Placement

|

|

As Further

Adjusted for the Samco

Acquisition |

|

|

Cash and cash equivalents

|

$ |

146.2 |

|

|

|

290.9 |

|

|

|

435.7 |

|

|

118.7 |

|

|

|

|

202.6 |

|

|

|

202.6 |

|

|

|

202.6 |

|

|

202.6 |

|

Existing Samco Loan

Agreements

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

318.7 |

|

|

Convertible Senior Notes due

2019, net of discount

|

|

— |

|

|

|

— |

|

|

|

123.0 |

|

|

123.0 |

|

|

Total long term liabilities

|

|

202.6 |

|

|

|

202.6 |

|

|

|

325.6 |

|

|

644.3 |

|

|

Common stock, par value $0.01 per share; 150,000,000 shares authorized and 69,433,162 shares issued and outstanding at June 30, 2014 on an actual basis; and 150,000,000 shares authorized and 92,510,086 shares issued and outstanding on an as adjusted and on an as further adjusted basis

|

|

0.7 |

|

|

|

0.9 |

|

|

|

0.9 |

|

|

0.9 |

|

|

Additional paid-in capital

|

|

707.4 |

|

|

|

851.8 |

|

|

|

873.6 |

|

|

873.6 |

|

|

Retained earnings/(deficit)

|

|

(222.0 |

) |

|

|

(222.0) |

|

|

|

(222.0) |

|

|

(222.0) |

|

|

Reserves

|

|

2.6 |

|

|

|

2.6 |

|

|

|

2.6 |

|

|

2.6 |

|

|

Total stockholders’ equity

|

|

488.7 |

|

|

|

633.4 |

|

|

|

655.2 |

|

|

655.2 |

|

|

Total capitalization

|

|

691.3

|

|

|

|

836.0 |

|

|

|

980.8 |

|

|

1,299.5 |

|

|

|

(1)

|

Does not reflect the payment of $38.5 million in predelivery installments under the HHI newbuilding contracts in July and August 2014.

|

|

|

(2)

|

All of our existing indebtedness is secured and guaranteed.

|

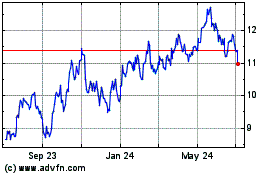

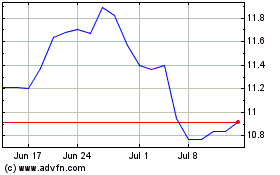

Market Information

Our common stock is listed for trading on the New York Stock Exchange (the "NYSE") and is traded under the symbol “DHT”. As of September 8, 2014, there were 69,433,162 shares of our common stock outstanding.

The following table sets forth, for the periods indicated, the high and low sales prices for our common stock, as reported on the NYSE composite transaction tape, and quarterly dividend paid per share of our common stock. The last reported sale price of our common stock on the NYSE on September 9, 2014 was $6.39 per share.

In July 2012, we effected a 12-for-1 reverse stock split whereby each 12 shares of our common stock issued and outstanding as of close of trading on July 16, 2012, automatically and without any action on the part of the respective holders, was converted into one share of common stock (the “Reverse Stock Split”). The Reverse Stock Split affected all issued and outstanding shares of our common stock, as well as common stock underlying stock options and restricted stock awards outstanding prior to the effectiveness of the Reverse Stock Split. The following historical dividend information has been adjusted to account for the Reverse Stock Split.

| |

|

|

| |

|

|

|

Year ended December 31, 2012

|

|

|

|

|

First Quarter

|

18.36

|

8.79

|

0.24

|

|

Second Quarter

|

12.00

|

7.20

|

0.24

|

|

Third Quarter

|

8.46

|

5.36

|

0.02

|

|

Fourth Quarter

|

6.31

|

3.54

|

0.02

|

|

Year ending December 31, 2013

|

|

|

|

|

First Quarter

|

4.90

|

4.01

|

0.02

|

|

Second Quarter

|

5.07

|

4.05

|

0.02

|

|

Third Quarter

|

4.79

|

3.99

|

0.02

|

|

Fourth Quarter

|

6.95

|

4.36

|

0.02

|

|

Year ending December 31, 2014

|

|

|

|

|

First Quarter

|

8.57

|

6.60

|

0.02

|

|

Second Quarter

|

8.12

|

6.73

|

0.02(3)

|

|

Third Quarter (1)

|

7.44

|

6.21

|

—

|

| |

|

| |

|

|

|

Year ended:

|

|

|

|

December 31, 2009

|

84.60

|

40.20

|

|

December 31, 2010

|

58.68

|

39.60

|

|

December 31, 2011

|

62.28

|

7.92

|

|

December 31, 2012

|

18.36

|

3.54

|

|

December 31, 2013

|

6.95

|

3.99

|

| |

|

|

|

Month ended:

|

|

|

|

March 31, 2014

|

8.36

|

7.48

|

|

April 30, 2014

|

8.12

|

7.06

|

|

May 31, 2014

|

8.00

|

7.17

|

|

June 30, 2014

|

7.40

|

6.73

|

| |

|

| |

|

|

|

July 31, 2014

|

7.32

|

6.50

|

|

August 31, 2014

|

7.44

|

6.34

|

|

September 30, 2014 (2)

|

6.99

|

6.21

|

_______________________

|

|

(1)

|

For the period commencing July 1, 2014 through September 9, 2014.

|

|

|

(2)

|

For the period commencing September 1, 2014 through September 9, 2014.

|

|

|

(3)

|

Dividend declared. To be paid on September 17, 2014.

|

The following historical dividend information has been adjusted to account for the Reverse Stock Split. In January 2008, our board of directors approved a dividend policy to provide stockholders of record with an intended fixed quarterly dividend. Commencing with the first dividend payment attributable to the 2008 fiscal year, the dividend was $3.00 per share. The dividends paid related to the four quarters of 2008 amounted to $3.00, $3.00, $3.60 and $3.60 per share, respectively. The dividend paid related to the first quarter of 2009 was $3.00 per share. For the last three quarters related to 2009, we did not pay any dividend. For each of the four quarters related to 2010, we paid a dividend of $1.20 per share. The dividends paid related to the four quarters of 2011 amounted to $1.20, $1.20, $0.36 and $0.36 per share, respectively. The dividends paid related to the four quarters of 2012 amounted to $0.24, $0.24, $0.02 and $0.02 per share, respectively. The dividends paid related to the four quarters of 2013 amounted to $0.02, $0.02, $0.02 and $0.02 per share, respectively. The dividends paid related to the first quarter of 2014 amounted to $0.02 per share and we have declared a dividend of $0.02 per share for the second quarter of 2014, to be paid on September 17, 2014.

The timing and amount of dividend payments will be determined by our board of directors and will depend on, among other things, our cash earnings, financial condition, cash requirements and other factors.

The following is a description of the material terms of our amended and restated articles of incorporation and bylaws that are currently in effect. We refer you to our amended and restated articles of incorporation, a copy of which has been filed as Exhibit 3.1 to a Report on Form 6-K dated January 21, 2014, and our amended and restated bylaws, a copy of which has been filed as Exhibit 3.1 to a Report on Form 6-K dated February 22, 2013, each of which is incorporated by reference into our 2013 Form 20-F.

Purpose

Our purpose, as stated in Article II of our amended and restated articles of incorporation, is to engage in any lawful act or activity for which corporations may now or hereafter be organized under the Business Corporations Act of the Marshall Islands (the “BCA”). Our amended and restated articles of incorporation and bylaws do not impose any limitations on the ownership rights of our stockholders.

Authorized Capitalization

Under our amended and restated articles of incorporation, our authorized capital stock consists of 150,000,000 shares of common stock, par value $.01 per share, and 1,000,000 shares of preferred stock, par value $.01 per share. As of the date of this prospectus supplement, we have outstanding 69,433,162 shares of common stock and no shares of preferred stock, and neither we nor our subsidiaries hold any shares of common stock or preferred stock in treasury.

Description of Common Stock

A description of our common stock can be found in “Item 10.B. Memorandum and Articles of Incorporation” included in our 2013 Form 20-F, incorporated by reference in this prospectus supplement.

Description of Preferred Stock

Our amended and restated articles of incorporation authorize our board of directors to establish one or more series of preferred stock and to determine the terms of and rights attaching to such preferred stock, including with respect to, among other things, dividends, conversion, voting, redemption, liquidation, designation and the number of shares constituting any such series. The issuance of shares of preferred stock may have the effect of discouraging, delaying or preventing a change of control of us or the removal of our management. The issuance of shares of preferred stock with voting and conversion rights may adversely affect the voting power of the holders of shares of our common stock.

Stockholder Meetings

Under our bylaws, annual stockholder meetings will be held at a time and place selected by our board of directors. The meetings may be held in or outside of the Marshall Islands. Special meetings may be called by stockholders holding not less than one-fifth of all the outstanding shares entitled to vote at such meeting. Our board of directors may set a record date between 15 and 60 days before the date of any meeting to determine the stockholders that will be eligible to receive notice and vote at the meeting.

Dissenters’ Rights of Appraisal and Payment

Under the BCA, our stockholders have the right to dissent from various corporate actions, including any merger or consolidation or sale of all or substantially all of our assets not made in the usual course of our business, and receive payment of the fair value of their shares. In the event of any further amendment of our amended and restated articles of incorporation, a stockholder also has the right to dissent and receive payment for his or her shares if the amendment alters certain rights in respect of those shares. The dissenting stockholder must follow the procedures set forth in the BCA to receive payment. In the event that we and any dissenting stockholder fail to agree on a price for the shares, the BCA procedures involve, among other things, the institution of proceedings in the high court of the Republic of the Marshall Islands or in any appropriate court in any jurisdiction in which our shares are primarily traded on a local or national securities exchange.

Stockholders’ Derivative Actions

Under the BCA, any of our stockholders may bring an action in our name to procure a judgment in our favor, also known as a derivative action, provided that the stockholder bringing the action is a holder of common stock both at the time the derivative action is commenced and at the time of the transaction to which the action relates.

Limitations on Liability and Indemnification of Officers and Directors

The BCA authorizes corporations to limit or eliminate the personal liability of directors and officers to corporations and their stockholders for monetary damages for breaches of directors’ fiduciary duties. Our bylaws include a provision that eliminates the personal liability of directors for monetary damages for actions taken as a director to the fullest extent permitted by law.

Our bylaws provide that we must indemnify our directors and officers to the fullest extent authorized by law. We are also expressly authorized to advance certain expenses (including attorneys’ fees and disbursements and court costs) to our directors and offices and carry directors’ and officers’ insurance providing indemnification for our directors, officers and certain employees for some liabilities. We believe that these indemnification provisions and insurance are useful to attract and retain qualified directors and executive officers.

The limitation of liability and indemnification provisions in our amended and restated articles of incorporation and bylaws may discourage stockholders from bringing a lawsuit against directors for breach of their fiduciary duty. These provisions may also have the effect of reducing the likelihood of derivative litigation against directors and officers, even though such an action, if successful, might otherwise benefit us and our stockholders. In addition, your investment may be adversely affected to the extent we pay the costs of settlement and damage awards against directors and officers pursuant to these indemnification provisions.

There is currently no pending material litigation or proceeding involving any of our directors, officers or employees for which indemnification is sought.

Insofar as indemnification for liabilities arising under the Securities Act of 1933, as amended (the “Securities Act”), may be permitted to directors, officers or persons controlling the registrant pursuant to the foregoing provisions, the registrant has been informed that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Anti-Takeover Effect of Certain Provisions of our Amended and Restated Articles of Incorporation and Bylaws

Several provisions of our amended and restated articles of incorporation and bylaws, which are summarized below, may have anti-takeover effects. These provisions are intended to avoid costly takeover battles, lessen our vulnerability to a hostile change of control and enhance the ability of our board of directors to maximize stockholder value in connection with any unsolicited offer to acquire us. However, these anti-takeover provisions, which are summarized below, could also discourage, delay or prevent (1) the merger or acquisition of our company by means of a tender offer, a proxy contest or otherwise that a stockholder may consider in its best interest and (2) the removal of incumbent officers and directors.

Issuance of Capital Stock

Under the terms of our amended and restated articles of incorporation and the laws of the Republic of the Marshall Islands, our board of directors has authority, without any further vote or action by our stockholders, to issue any remaining authorized shares of blank check preferred stock and any remaining authorized shares of our common stock. Our board of directors may issue shares of preferred stock on terms calculated to discourage, delay or prevent a change of control of our company or the removal of our management.

Classified Board of Directors

Our amended and restated articles of incorporation provide for the division of our board of directors into three classes of directors, with each class as nearly equal in number as possible, serving staggered, three year terms. Approximately one-third of our board of directors will be elected each year. This classified board provision could discourage a third party from making a tender offer for our shares or attempting to obtain control of us. It could also delay stockholders who do not agree with the policies of our board of directors from removing a majority of our board of directors for two years.

Election and Removal of Directors

Our amended and restated articles of incorporation prohibit cumulative voting in the election of directors. Our bylaws require parties other than the board of directors to give advance written notice of nominations for the election of directors. Our articles of incorporation also provide that our directors may be removed only for cause and only upon the affirmative vote of a majority of the outstanding shares of our capital stock entitled to vote for those directors. These provisions may discourage, delay or prevent the removal of incumbent officers and directors.

Our bylaws provide that stockholders are required to give us advance notice of any person they wish to propose for election as a director if that person is not proposed by our board of directors. These advance notice provisions provide that the stockholder must have given written notice of such proposal not less than 90 days nor more than 120 days prior to the anniversary date of the immediately preceding annual general meeting. In the event the annual general meeting is called for a date that is not within 30 days before or after such anniversary date, notice by the stockholder must be given not later than 10 days following the earlier of the date on which notice of the annual general meeting was mailed to stockholders or the date on which public disclosure of the date of the annual general meeting was made.

In the case of a special general meeting called for the purpose of electing directors, notice by the stockholder must be given not later than 10 days following the earlier of the date on which notice of the special general meeting was mailed to stockholders or the date on which public disclosure of the date of the special general meeting was made. Any nomination not properly made will be disregarded.

A director may be removed only for cause by the stockholders, provided notice is given to the director of the stockholders meeting convened to remove the director and provided such removal is approved by the affirmative vote of a majority of the outstanding shares of our capital stock entitled to vote for those directors. The notice must contain a statement of the intention to remove the director and must be served on the director not less than fourteen days before the meeting. The director is entitled to attend the meeting and be heard on the motion for his removal.

Limited Actions By Stockholders

Our amended and restated articles of incorporation and our bylaws provide that any action required or permitted to be taken by our stockholders must be effected at an annual or special meeting of stockholders or by the unanimous written consent of our stockholders. Our amended and restated articles of incorporation and our bylaws provide that, subject to certain exceptions, our chairman or chief executive officer, at the direction of the board of directors or holders of not less than one-fifth of all outstanding shares may call special meetings of our stockholders and the business transacted at the special meeting is limited to the purposes stated in the notice. Accordingly, a stockholder may be prevented from calling a special meeting for stockholder consideration of a proposal over the opposition of our board of directors and stockholder consideration of a proposal may be delayed until the next annual meeting.

Transfer Agent

The registrar and transfer agent for our common stock is American Stock Transfer & Trust Company LLC.

Listing

Our common stock is listed on the NYSE under the symbol “DHT”.

DHT Credit Facilities

As of September 8, 2014, we, together with our subsidiaries, had four outstanding credit facilities, with total bank borrowings of $203,384,000 (including $113,275,000 outstanding with a final maturity date of July 17, 2017, $18,359,000 outstanding with a final maturity date of March 1, 2016, $24,750,000 outstanding with a final maturity date of May 27, 2016, and $47,000,000 outstanding with a final maturity date of March 31, 2019). For more detail on our credit facilities, please see the section entitled “Secured Credit Facilities” in our 2013 Form 20-F.

Existing Samco Loan Agreements

In connection with the Samco Acquisition, we expect to acquire certain subsidiaries of Samco that are borrowers under the Existing Samco Loan Agreements. As of June 30, 2014, the Existing Samco Loan Agreements included outstanding indebtedness in an aggregate amount of $322,418,000, including:

| |

● |

$25,542,000 outstanding with a final maturity date of May 11, 2015 under the loan agreement between Samco Delta Ltd. and Nordea Bank Finland plc dated November 29, 2006, as supplemented on December 16, 2008 (the “2006 Nordea Loan Agreement”); |

| |

● |

$42,669,000 outstanding with a final maturity date of December 22, 2016 under the loan agreement between Samco Gamma Ltd. and Calyon SA dated October 17, 2006, as supplemented on December 16, 2008 (the “Calyon Loan Agreement”);

|

| |

● |

$209,269,000 outstanding with a final maturity date of June 29, 2018 under the loan agreement among and between certain subsidiaries of Samco and Nordea Bank Finland plc and DnB Nor Bank ASA dated April 15, 2011 (the “2011 Nordea Loan Agreement”); and

|

| |

● |

$44,938,000 outstanding with a final maturity date of November 16, 2021 under the loan agreement between and among Samco Epsilon Ltd. and ING Bank N.V. dated November 5, 2012 (the “ING Loan Agreement”).

|