UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 8-K

______________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 10, 2014

______________________________

|

| | | | |

LIFEVANTAGE CORPORATION (Exact name of registrant as specified in its charter) |

______________________________

|

| | | | |

Colorado | | 001-35647 | | 90-0224471 |

(State or other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| |

9785 S. Monroe Street, Suite 300, Sandy, UT 84070 |

(Address of Principal Executive Offices and Zip Code) |

| | | | |

Registrant’s telephone number, including area code: (801) 432-9000 |

______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 2.02 | Results of Operations and Financial Condition. |

On September 10, 2014, LifeVantage Corporation (the “Company”) issued a press release announcing its financial results for the fourth fiscal quarter and fiscal year-ended June 30, 2014. A copy of the Company’s press release is attached as Exhibit 99.1 to this report and incorporated by reference.

The information furnished in this Item 2.02 and the exhibit hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

|

| |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

|

| | | | |

Exhibit No. |

| | | Description |

99.1 |

| | | Press release issued by the Company on September 10, 2014 announcing its financial results for the fourth fiscal quarter and fiscal year-ended June 30, 2014. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| |

Date: September 10, 2014 | LIFEVANTAGE CORPORATION By: /s/ Rob Cutler Name: Rob Cutler Title: General Counsel |

LifeVantage Announces Fourth Quarter and Full Fiscal Year 2014 Results

Fourth Quarter Revenue Increased to Record $56M

Fiscal Year 2014 Operating Income was $19.5M and Net Income was $11.4M

Company Repurchased $46.2M of Stock in Fiscal Year 2014

Company Issues Fiscal Year 2015 Guidance; Expects Diluted EPS to Increase 40% to 60%

Salt Lake City, UT, September 10, 2014, LifeVantage Corporation (NASDAQ: LFVN), a company dedicated to helping people achieve healthy living through a combination of a compelling business opportunity and scientifically validated products, today reported financial results for its fourth quarter and full fiscal year ended June 30, 2014.

Fourth Quarter Fiscal 2014 Highlights:

| |

• | Revenue was $56.0 million, an increase of 8.8% over the prior year period; |

| |

• | Revenue increased in the Americas by 12.3% compared to the prior year period; |

| |

• | Operating income was $4.8 million and net income was $2.4 million; and |

| |

• | Successfully launched the TrueScienceTM Skin Care Regimen. |

Full Year Fiscal 2014 Highlights:

| |

• | Revenue was $214.0 million, an increase of 2.8% over the prior year; |

| |

• | Revenue increased in the Americas by 6.1% over the prior year; |

| |

• | Operating income was $19.5 million and net income was $11.4 million; |

| |

• | Cash from operations grew 13.5%; ended the fiscal year with cash of $20.4 million; |

| |

• | Repurchased $46.2 million in shares and reduced long-term debt by $16.2 million; and |

| |

• | Began Real Salt Lake Major League Soccer marketing sponsorship. |

Douglas C. Robinson, President and Chief Executive Officer of LifeVantage stated, "We are pleased to report revenue growth for the fourth quarter and full fiscal year. Our sales results reflect reignited growth in North America, partially offset by lower sales in Japan caused by continued distractions. We were successful in leveraging our general and administrative infrastructure while making important investments in sales and marketing, product development and geographic expansion initiatives. Throughout fiscal year 2015, we plan to continue focusing on executing and leveraging these strategies.”

Mr. Robinson continued, “Following the successful launch of our new skincare regimen in the fourth quarter, we expect to launch our new energy product line at our October Elite Academy. We believe these new products are consistent with our strategy to expand with scientifically backed, quality products designed to help people feel, look and perform better. Additionally, to enhance our top line growth, we plan to continue investing in additional sales and marketing resources in all our markets, but most particularly in Japan, Hong Kong and the Philippines.”

Fourth Quarter Fiscal 2014 Results

For the fourth fiscal quarter ended June 30, 2014, the Company reported revenue of $56.0 million, an increase of 8.8% compared to $51.5 million for the same period in fiscal 2013. Revenue reflects an increase of 12.3% in the Americas, and an increase in the Asia/Pacific region of 1.1%. Revenue for the quarter was negatively impacted $0.6 million, or 1.2%, by foreign currency fluctuation.

Operating income for the fourth fiscal quarter of 2014 was $4.8 million, generating an operating margin of 8.5%, compared to $0.2 million, and an operating margin of 0.5%, in the same period last year. Operating income in the fourth fiscal quarter of 2013 included $3.3 million of one-time expenses explained below.

Commission and incentives for the fourth fiscal quarter of 2014 were $27.0 million, or 48.1% of revenue, compared to $27.6 million, or 53.5% of revenue, in the same period last year. Commission and incentives as a percent of revenue were higher in fiscal 2013 due to $1.6 million of one-time expenses associated with the MyLifeVenture program launch. Selling, general and administrative expenses (SG&A) for the fourth fiscal quarter of 2014 were $15.3 million, or 27.4% of revenue, compared to $16.4 million, or 31.9% of revenue, in the same period last year. Prior year SG&A was impacted $1.7 million by a one-time retirement expense.

Interest and other expense in the fourth fiscal quarter of 2014 was $1.2 million, compared to interest and other expense of $0.5 million in the same period last year. The expense incurred in the current quarter is due to interest on the Company’s term loan which did not exist in the prior year.

Net income for the fourth fiscal quarter of 2014 was $2.4 million, or $0.02 per diluted share, calculated on 106 million fully diluted shares. This compares to a net loss in the fourth fiscal quarter of 2013 of $0.2 million, or $0.00 per diluted share, calculated on 112 million fully diluted shares, including the aforementioned after tax impact of one-time expenses.

Fiscal 2014 Full Year Results

For the full year ended June 30, 2014, the Company reported revenue of $214.0 million, compared to $208.2 million in fiscal year 2013. Revenue in the Americas increased 6.1%, but was partially offset by lower sales in Japan. Revenue for fiscal year 2014 was also negatively impacted $10.4 million, or 5.0%, by foreign currency fluctuation.

Operating income for fiscal year 2014 was $19.5 million, generating an operating margin of 9.1%. This compares to operating income of $12.1 million, for an operating margin of 5.8%, in fiscal year 2013. Fiscal year 2013 operating income included approximately $8.3 million of one-time expenses associated with the Company’s product recall, of which $4.8 million impacted costs of sales and $0.2 million effected general and administrative expenses. The remaining $3.3 million of expenses are associated with the aforementioned one-time costs.

Commission and incentives for fiscal year 2014 were $104.5 million, or 48.9% of revenue, compared to $101.7 million, or 48.9% of revenue, in fiscal year 2013. The prior year included $1.6 million of one-time expenses. SG&A expenses for fiscal year 2014 were $56.8 million, or 26.5% of revenue, compared to $57.7 million, or 27.7% of revenue, in fiscal year 2013, inclusive of $1.7 million of one-time expenses.

Interest and other expense in fiscal year 2014 was $2.8 million, compared to interest and other expense of $0.9 million last year. The increased expense incurred in fiscal year 2014 is due to interest on the Company’s term loan which did not exist in the prior year.

Net income for fiscal year 2014 was $11.4 million, or $0.10 per diluted share, calculated on 112 million fully diluted shares, compared to $7.6 million, or $0.06 per diluted share for the prior year, including one-time expenses, calculated on 123 million fully diluted shares.

Balance Sheet & Liquidity

The Company generated $12.1 million of cash flow from operations in fiscal year 2014, compared to $10.7 million in fiscal year 2013. The Company's cash and cash equivalents at June 30, 2014 were $20.4 million, compared to $26.3 million at the end of fiscal year 2013. The Company repaid $16.2 million of debt during the year and throughout the year returned $46.2 million to shareholders in the form of share repurchases.

Fiscal Year 2015 Guidance

The Company expects to generate revenue in the range of $225 million to $235 million in fiscal year 2015 representing a 5% to 10% increase over fiscal year 2014. The Company expects its operating margin to be in the range of 11% to 12% and earnings per diluted share in the range of $0.14 to $0.16, based on an estimated 107 million diluted shares and a 34% effective tax rate.

Conference Call Information

The Company will hold an investor conference call today at 2:30 p.m. Mountain time (4:30 p.m. Eastern time). Investors interested in participating in the live call can dial (888) 452-4030 from the U.S. International callers can dial (719) 457-2081. A telephone replay will be available approximately two hours after the call concludes and will be available through Friday, September 12, 2014, by dialing (877) 870-5176 from the U.S. and entering confirmation code 6171908, or (858) 384-5517 from international locations, and entering confirmation code 6171908.

There also will be a simultaneous, live webcast available on the Investor Relations section of the Company's web site at http://investor.lifevantage.com/events.cfm. The webcast will be archived for approximately 30 days.

About LifeVantage Corporation

LifeVantage Corporation (Nasdaq:LFVN), a leader in Nrf2 science and the maker of Protandim®, the Nrf2 Synergizer® patented dietary supplement, the TrueScienceTM Anti-Aging Skin Care Regimen and LifeVantage® Canine Health, is a science based network marketing company. LifeVantage is dedicated to visionary science that looks to transform wellness and anti-aging internally and externally with products that dramatically reduce oxidative stress at the cellular level. LifeVantage was founded in 2003 and is headquartered in Salt Lake City, Utah.

Forward Looking Statements

This document contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Words and expressions reflecting optimism, satisfaction or disappointment with current prospects, as well as words such as "believe," "hopes," "intends," "estimates," "expects," "projects," "plans," "anticipates," "look forward to" and variations thereof, identify forward-looking statements, but their absence does not mean that a statement is not forward-looking. Examples of forward-looking statements include, but are not limited to, statements we make regarding our future revenue, operating income, operating margins, earnings per share, cash flow from operations, new product launches and future investment and growth. Such forward-looking statements are not guarantees of performance and the Company's actual results could differ materially from those contained in such statements. These forward-looking statements are based on the Company's current expectations and beliefs concerning future events affecting the Company and involve known and unknown risks and uncertainties that may cause the Company's actual results or outcomes to be materially different from those anticipated and discussed herein. These risks and uncertainties include, among others, those discussed in greater detail in the Company's Annual Report on Form 10-K and the Company’s Quarterly Report on Form 10-Q under the caption "Risk Factors," and in other documents filed by the Company from time to time with the Securities and Exchange Commission. The Company cautions investors not to place undue reliance on the forward-looking statements contained in this document. All forward-looking statements are based on information currently available to the Company on the date hereof, and the Company undertakes no obligation to revise or update these forward-looking statements to reflect events or circumstances after the date of this document, except as required by law.

About Non-GAAP Financial Measures

We define Adjusted Gross Profit as Gross Profit as determined in accordance with GAAP excluding certain costs associated with the product recall included in GAAP cost of sales. We define Adjusted Gross Margin as gross margin as determined in accordance with GAAP (gross profit as a percentage of sales, net) excluding the costs associated with the product recall. We define Adjusted Operating Income as Operating Income excluding certain costs associated with the product recall. We define Adjusted Net Income as Net Income excluding certain costs associated with the product recall and the applicable tax impacts associated with these items. Adjusted EPS is calculated based on Adjusted Net Income and the weighted average number of common and potential common shares outstanding during the period. Adjusted Gross Profit, Adjusted Gross Margin, Adjusted Operating Income, Adjusted Net Income and Adjusted EPS may not be comparable to similarly titled measures reported by other companies.

We are presenting Adjusted Gross Profit, Adjusted Gross Margin, Adjusted Operating Income, Adjusted Net Income and Adjusted EPS because management believes that excluding the product recall costs from the relevant GAAP measures, when viewed with our results under GAAP and the accompanying reconciliations provides useful information about our period-over-period growth and profitability and provides additional information that is useful for evaluating our operating performance. Each of Adjusted Gross Profit, Adjusted Gross Margin, Adjusted Operating Income, Adjusted Net Income and Adjusted EPS is presented solely as a supplemental disclosure because: (i) we believe it is a useful tool for investors to assess the operating performance of the business without the effect of these items; and (ii) we use Adjusted Gross Profit, Adjusted Operating Income, Adjusted Net Income and Adjusted EPS internally as a benchmark to evaluate our operating performance or compare our performance to that of our competitors. The use of Adjusted Gross Profit, Adjusted Gross Margin, Adjusted Operating Income, Adjusted Net Income and Adjusted EPS has limitations and you should not consider these measures in isolation from or as an alternative to the relevant GAAP measures, including gross profit, gross margin, operating income, net income or net income per diluted share prepared in accordance with GAAP, or as a measure of profitability or liquidity.

The tables set forth below present a reconciliation of Adjusted Gross Profit, Adjusted Operating Income, Adjusted Net Income and Adjusted EPS, all of which are non-GAAP financial measures, to Gross Profit, Operating Income, Net Income, and Diluted EPS, our most directly comparable financial measures presented in accordance with GAAP.

Investor Relations Contact:

Cindy England (801) 432-9036

Director of Investor Relations

-or-

John Mills (646) 277-1254

Partner, ICR INC

|

| | | | | | | | |

LIFEVANTAGE CORPORATION AND SUBSIDIARIES |

CONSOLIDATED BALANCE SHEETS |

(Unaudited) |

(In thousands, except per share data) | As of |

ASSETS | June 30, 2014 | | June 30, 2013 |

Current assets | | | |

| Cash and cash equivalents | $ | 20,387 |

| | $ | 26,299 |

|

| Accounts receivable | 1,317 |

| | 1,789 |

|

| Income tax receivable | 4,681 |

| | 2,150 |

|

| Inventory | 8,826 |

| | 10,524 |

|

| Current deferred income tax asset | 158 |

| | 2,885 |

|

| Prepaid expenses and deposits | 4,604 |

| | 2,294 |

|

| Total current assets | 39,973 |

| | 45,941 |

|

| | | | |

Long-term assets | | | |

| Property and equipment, net | 6,941 |

| | 5,692 |

|

| Intangible assets, net | 2,014 |

| | 1,747 |

|

| Deferred debt offering costs, net | 1,353 |

| | — |

|

| Long-term deferred income tax asset | 1,285 |

| | 730 |

|

| Other long-term assets | 2,433 |

| | 1,374 |

|

TOTAL ASSETS | $ | 53,999 |

| | $ | 55,484 |

|

LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

Current liabilities | | | |

| Accounts payable | $ | 2,854 |

| | $ | 5,171 |

|

| Commissions payable | 7,594 |

| | 7,564 |

|

| Other accrued expenses | 7,554 |

| | 7,831 |

|

| Current portion of long-term debt | 4,700 |

| | — |

|

| | | | |

| Total current liabilities | 22,702 |

| | 20,566 |

|

| | | | |

Long-term debt | | | |

| Principal amount | 26,125 |

| | — |

|

| Less: unamortized discount | (1,052 | ) | | — |

|

| Long-term debt, net of unamortized discount | 25,073 |

| | — |

|

| Other long-term liabilities | 2,234 |

| | 973 |

|

| Total liabilities | 50,009 |

| | 21,539 |

|

| | | | |

Stockholders' equity | | | |

| Preferred stock - par value $.001, 50,000 shares authorized; no shares issued or outstanding | — |

| | — |

|

| Common stock - par value $.001, 250,000 shares authorized; 102,173 and 117,088 issued and outstanding as of June 30, 2014 and June 30, 2013, respectively | 102 |

| | 121 |

|

| Additional paid-in capital | 115,244 |

| | 110,413 |

|

| Accumulated deficit | (111,240 | ) | | (76,476 | ) |

| Accumulated other comprehensive loss | (116 | ) | | (113 | ) |

| Total stockholders’ equity | 3,990 |

| | 33,945 |

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 53,999 |

| | $ | 55,484 |

|

|

| | | | | | | | | | | | | | | |

LIFEVANTAGE CORPORATION AND SUBSIDIARIES |

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME |

(Unaudited) |

| | | | | | | |

| For the three months ended June 30, | | For the twelve months ended June 30, |

(In thousands, except per share data) | 2014 | | 2013 | | 2014 | | 2013 |

Revenue, net | $ | 56,038 |

| | $ | 51,511 |

| | $ | 213,968 |

| | $ | 208,178 |

|

Cost of sales | 8,982 |

| | 7,909 |

| | 33,194 |

| | 31,845 |

|

Product recall costs | — |

| | (620 | ) | | — |

| | 4,798 |

|

Gross profit | 47,056 |

| | 44,222 |

| | 180,774 |

| | 171,535 |

|

| | | | | | | |

Operating expenses | | | | | | | |

Commission and incentives | 26,968 |

| | 27,568 |

| | 104,525 |

| | 101,737 |

|

Selling, general and administrative | 15,343 |

| | 16,411 |

| | 56,801 |

| | 57,730 |

|

Total operating expenses | 42,311 |

| | 43,979 |

| | 161,326 |

| | 159,467 |

|

Operating income | 4,745 |

| | 243 |

| | 19,448 |

| | 12,068 |

|

| | | | | | | |

Other income (expense), net: | | | | | | | |

Interest expense | (1,181 | ) | | (3 | ) | | (3,177 | ) | | (3 | ) |

Other income (expense), net: | (7 | ) | | (486 | ) | | 384 |

| | (912 | ) |

Total other expense, net | (1,188 | ) | | (489 | ) | | (2,793 | ) | | (915 | ) |

Net income (loss) before income taxes | 3,557 |

| | (246 | ) | | 16,655 |

| | 11,153 |

|

Income tax expense | (1,206 | ) | | 64 |

| | (5,272 | ) | | (3,545 | ) |

Net income (loss) before income taxes | $ | 2,351 |

| | $ | (182 | ) | | $ | 11,383 |

| | $ | 7,608 |

|

Net income per share: | | | | | | | |

Basic | $ | 0.02 |

| | — |

| | $ | 0.11 |

| | $ | 0.07 |

|

Diluted | $ | 0.02 |

| | — |

| | $ | 0.10 |

| | $ | 0.06 |

|

Weighted average shares outstanding: | | | | | | | |

Basic | 100,988 |

| | 112,493 |

| | 105,791 |

| | 112,276 |

|

Diluted | 105,609 |

| | 112,493 |

| | 111,599 |

| | 122,888 |

|

| | | | | | | |

Other comprehensive income (loss), net of tax: | | | | | | | |

Foreign currency translation adjustment | 360 |

| | (68 | ) | | (3 | ) | | (92 | ) |

Other comprehensive income (loss), net of tax | $ | 360 |

| | $ | (68 | ) | | $ | (3 | ) | | $ | (92 | ) |

Comprehensive income | $ | 2,711 |

| | $ | (250 | ) | | $ | 11,380 |

| | $ | 7,516 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

LIFEVANTAGE CORPORATION |

Revenue by Region |

(Unaudited) |

| | | | | | | | | | | | | | | | | |

| | Three months ended June 30, | | | Twelve months ended June 30, |

| | 2014 | | 2013 | | | 2014 | | 2013 |

(In thousands) | | | | | | | | | | | | | | | | | |

Americas | | $ | 39,670 |

| | 71% | | $ | 35,326 |

| | 69% | | | $ | 141,227 |

| | 66% | | $ | 133,046 |

| | 64% |

Asia/Pacific | | 16,368 |

| | 29% | | 16,185 |

| | 31% | | | 72,741 |

| | 34% | | 75,132 |

| | 36% |

Total | | $ | 56,038 |

| | 100% | | $ | 51,511 |

| | 100% | | | $ | 213,968 |

| | 100% | | $ | 208,178 |

| | 100% |

| | | | | | | | | | | | | | | | | |

| | LIFEVANTAGE CORPORATION | | | | | | | | | |

| | Active Independent Distributors(1) | | | | | | | | | |

| | (Unaudited) | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | June 30 | | | | | | | | | |

| | 2014 | | 2013 | | | | | | | | | |

Americas | | 44,000 |

| | 65% | | 43,000 |

| | 64% | | | | | | | | | |

Asia/Pacific | | 24,000 |

| | 35% | | 24,000 |

| | 36% | | | | | | | | | |

Total | | 68,000 |

| | 100% | | 67,000 |

| | 100% | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | LIFEVANTAGE CORPORATION | | | | | | | | | |

| | Active Preferred Customers(2) | | | | | | | | | |

| | (Unaudited) | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | June 30 | | | | | | | | | |

| | 2014 | | 2013 | | | | | | | | | |

Americas | | 107,000 |

| | 84% | | 115,000 |

| | 83% | | | | | | | | | |

Asia/Pacific | | 21,000 |

| | 16% | | 23,000 |

| | 17% | | | | | | | | | |

Total | | 128,000 |

| | 100% | | 138,000 |

| | 100% | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

(1) Active Independent Distributors have purchased product in the prior three months for retail or personal consumption. |

(2) Active Preferred Customers have purchased product in the prior three months for personal consumption only. |

|

| | | | | | | | | | | | | | | |

LIFEVANTAGE CORPORATION |

Reconciliation of GAAP Gross Profit to Non-GAAP Adjusted Gross Profit: |

(Unaudited) |

| For the three months ended June 30, | | For the twelve months ended June 30, |

(In thousands) | 2014 | | 2013 | | 2014 | | 2013 |

GAAP Gross profit | $ | 47,056 |

| | $ | 44,222 |

| | $ | 180,774 |

| | $ | 171,535 |

|

| | | | | | | |

Adjustments: | | | | | | | |

Cost of sales associated with product recall | — |

| | (620 | ) | | — |

| | 4,798 |

|

Total adjustments | — |

| | (620 | ) | | — |

| | 4,798 |

|

Non-GAAP Adjusted gross profit | $ | 47,056 |

| | $ | 43,602 |

| | $ | 180,774 |

| | $ | 176,333 |

|

| | | | | | | |

Reconciliation of GAAP Operating Income to Non-GAAP Adjusted Operating Income: |

| | | | | | | |

| For the three months ended June 30, | | For the twelve months ended June 30, |

(In thousands) | 2014 | | 2013 | | 2014 | | 2013 |

GAAP Operating income | $ | 4,745 |

| | $ | 243 |

| | $ | 19,448 |

| | $ | 12,068 |

|

| | | | | | | |

Adjustments: | | | | | | | |

Costs associated with product recall: | | | | | | | |

Cost of sales | — |

| | (620 | ) | | — |

| | 4,798 |

|

Selling, general and administrative | — |

| | 41 |

| | — |

| | 270 |

|

Total adjustments | — |

| | (579 | ) | | — |

| | 5,068 |

|

Non-GAAP Adjusted operating income | $ | 4,745 |

| | $ | (336 | ) | | $ | 19,448 |

| | $ | 17,136 |

|

| | | | | | | |

Reconciliation of GAAP Net Income to Non-GAAP Adjusted Net Income and related Adjusted Earnings Per Share: |

| | | | | | | |

| For the three months ended June 30, | | For the twelve months ended June 30, |

(In thousands) | 2014 | | 2013 | | 2014 | | 2013 |

GAAP Net income | $ | 2,351 |

| | $ | (182 | ) | | $ | 11,383 |

| | $ | 7,608 |

|

| | | | | | | |

Adjustments: | | | | | | | |

Costs associated with product recall: | | | | | | | |

Cost of sales | — |

| | (620 | ) | | — |

| | 4,798 |

|

Selling, general and administrative | — |

| | 41 |

| | — |

| | 270 |

|

Tax impact of adjustments | — |

| | 184 |

| | — |

| | (1,607 | ) |

Total adjustments | — |

| | (395 | ) | | — |

| | 3,461 |

|

Non-GAAP Adjusted net income | $ | 2,351 |

| | $ | (577 | ) | | $ | 11,383 |

| | $ | 11,069 |

|

| | | | | | | |

Diluted shares | 105,609 |

| | 112,493 |

| | 111,599 |

| | 122,888 |

|

| | | | | | | |

Non-GAAP Adjusted diluted net income per share | $ | 0.02 |

| | $ | (0.01 | ) | | $ | 0.10 |

| | $ | 0.09 |

|

| | | | | | | |

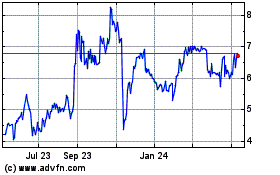

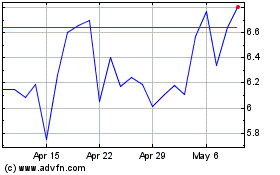

Lifevantage (NASDAQ:LFVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lifevantage (NASDAQ:LFVN)

Historical Stock Chart

From Apr 2023 to Apr 2024