Report of Foreign Issuer (6-k)

September 08 2014 - 6:00AM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

Of the Securities Exchange Act of 1934

For the month of April 2012

Commission File Number: 000-13345

CALEDONIA MINING CORPORATION

(Translation of registrant’s name into English)

Suite 1000

36 Toronto Street

Toronto, ON, M5C 2C5

Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F

Form 20-F___x___ Form 40-F _____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ____ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-_______

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

Caledonia Mining Corporation

(Registrant)

By: /s/ Steve Curtis

Name: Steve Curtis

Title: VP Finance, CFO, Director

|

Dated: April 28, 2012

Exhibit Index

Exhibit 99.1

SUBSCRIPTION AGREEMENT

between

FREMIRO INVESTMENTS (PRIVATE) LIMITED

(a company incorporated in Zimbabwe under registration number 5560/2011)

("the Subscriber")

and

BLANKET MINE (1983) (PRIVATE) LIMITED

(a company incorporated in Zimbabwe under registration number 172/69)

("the Company" )

and

CALEDONIA HOLDINGS ZIMBABWE (PRIVATE) LIMITED

(a company incorporated in Zimbabwe under registration number 5/45)

("CHZ")

CONTENTS

No Clause Page No

|

No

|

Clause

|

Page No

|

| |

| |

|

1

|

DEFINITIONS

|

1

|

|

2

|

BACKGROUND

|

2

|

|

3

|

CONDITIONS PRECEDENT

|

2

|

|

4

|

SUBSCRIPTION

|

3

|

|

5

|

PRICE AND PAYMENT

|

3

|

|

6

|

FUNDING

|

4

|

|

7

|

DIRECTORS

|

5

|

|

8

|

MANAGEMENT OF THE COMPANY

|

5

|

|

9

|

CONFIDENTIALITY

|

6

|

|

10

|

SUPPORT

|

6

|

|

11

|

DOMICILIUM CITANDI ET EXECUTANDI

|

7

|

|

12

|

BREACH AND TERMINATION

|

8

|

|

13

|

ARBITRATION

|

9

|

|

14

|

GOVERNING LAW AND JURISDICTION

|

10

|

|

15

|

INTERPRETATION

|

10

|

|

16

|

GENERAL

|

11

|

|

17

|

COSTS

|

11

|

|

18

|

WARRANTY |

12

|

In this Agreement, unless the context indicates otherwise, the words and expressions set out below shall have the meaning assigned to them and cognate expressions shall have a corresponding meaning, namely:

|

1.1

|

Agreement

|

means this subscription agreement;

|

|

1.2

|

Auditors

|

means the Company’s auditors as at the Signature Date or failing that, at the election of the board of directors of the Company, Deloitte, KPMG or Ernst & Young;

|

|

1.3

|

Business Day

|

means any day that is not a Saturday, Sunday or public holiday in Zimbabwe;

|

|

1.4

|

Closing Date

|

means the 5th (fifth) Business Day after the fulfilment of the suspensive conditions in clause 3;

|

|

1.5

|

Directors

|

means the directors of the Company from time to time appointed in accordance with clause 7;

|

|

1.6

|

Indigenisation

|

means the process and objectives contemplated in the Indigenisation Act and the Regulations;

|

|

1.7

|

Indigenisation Act

|

means the Indigenisation and Economic Empowerment Act [Chapter 14.33];

|

|

1.8

|

Interest

|

means interest calculated monthly in arrears at 10 (ten) percentage points above the 12 month LIBOR base rate published by REUTERS from time to time;

|

|

1.9

|

Loan Account

|

means the loan account to be opened in the Subscriber's name in the books of the Company;

|

|

1.10

|

MOU

|

means the memorandum of understanding concluded and signed by Caledonia Mining Corporation, CHZ, the Company, and the Minister of Youth, Development, Indigenisation and Empowerment of the Government of Zimbabwe on 20 February 2012;

|

|

1.11

|

Parties

|

means CHZ, the Company, and the Subscriber and "Party" means any one of them, as the context may indicate;

|

|

1.12

|

Regulations

|

means the Indigenisation and Economic Empowerment (General) Regulations, 2010;

|

|

1.13

|

Signature Date

|

means the date of signature of this Agreement by the Party last in time to do so;

|

|

1.14

|

Subscription Price

|

means the subscription price for the Subscription Shares as set out in clause 5.1; and

|

|

1.15

|

Subscription Shares

|

means 6,420,000 (six million four hundred and twenty thousand) “A” class shares representing 15% (fifteen per cent) of the issued share capital of the Company after the implementation of the transactions envisaged in the MOU which will total 42,800,000 shares.

|

|

2.1

|

CHZ and the Company have agreed to the Indigenisation of the Company in accordance with the provisions of the MOU.

|

|

2.2

|

In terms of the MOU, the Company and the Subscriber are required to conclude an agreement in terms of which the Subscriber will subscribe for the Subscription Shares.

|

|

2.3

|

The Parties wish to record the terms on which the Subscriber will subscribe for the Subscription Shares.

|

|

3.1

|

The implementation of this Agreement is, save for the provisions of clauses 1, 6.2 to 17, inclusive, which will be of immediate force and effect, subject to:

|

|

3.1.1

|

receipt by CHZ and the Company of written confirmation from the Ministry of Youth, Development, Indigenisation and Empowerment of the Government of Zimbabwe that the implementation of this Agreement constitutes compliance by CHZ and the Company with the requirements of the Indigenisation Act and the Regulations;

|

|

3.1.2

|

receipt by CHZ and the Company of the approvals, to the extent certified in writing by the Auditors to be required by law, by the Reserve Bank of Zimbabwe of the transactions contemplated in the MOU and any related transactions and/or corporate re-organisation required to give effect to the Indigenisation by CHZ of the Company; and

|

|

3.1.3

|

receipt by CHZ and the Company of written confirmation of the unconditional withdrawal by the Zimbabwean Ministry of Mines and Mining Development of the letter sent by it to the Company dated 13 December 2011 requiring the Company to reach agreement with the Zimbabwean Mining Development Corporation regarding the Indigenisation of the Company.

|

|

3.2

|

The Parties shall use all commercially reasonable endeavours to procure the fulfilment of the conditions precedent stipulated in clause 3.1.

|

|

3.3

|

In the event that CHZ is unable to obtain the confirmation stipulated in 3.1 on or before 30 September 2012, CHZ may at its sole discretion, renegotiate the terms of this agreement.

|

|

4.1

|

The Subscriber hereby subscribes for the Subscription Shares.

|

|

4.2

|

The Company hereby accepts the subscription for the Subscription Shares as set out in clause 4.1, and undertakes to allot and issue the Subscription Shares to the Subscriber on the Closing Date.

|

|

5.1

|

The Subscription Price for the Subscription Shares shall be the sum of US$ 11,008,536 (eleven million and eight thousand five hundred and thirty six dollars ), which amount shall be debited to the Loan Account which Loan Account shall:

|

|

5.1.1

|

bear compound Interest from the Closing Date to the date of repayment, both dates inclusive; and

|

|

5.1.2

|

be paid in instalments on the date of payment of dividends by the Company from time to time, in an amount equal to 80% (eighty percent) of the dividends payable to the Subscriber, after deduction of withholding or any other taxes, in respect of the Subscription Shares. Each such payment shall be credited to the Loan Account in part settlement of Interest in the first instance and thereafter in settlement of capital owing in respect of the Subscription Price. Such payments shall cease once the full loan amount has been settled.

|

|

5.2

|

The remaining 20% (twenty percent) of the dividends payable to the Subscriber shall be paid by the Company to the Subscriber after deduction of any Zimbabwean withholding or other tax or levies that may be applicable on these dividends declared.

|

|

5.3

|

The Subscriber hereby irrevocably authorises the Company to apply dividends declared and becoming due for payment to the Subscriber, in the manner set out in clause 5.1.2.

|

|

5.4

|

For as long as any amounts are owed to the Company by the Subscriber in respect of the Subscription Price in terms of clause 5.1 the Subscriber may not, without prior written consent of CHZ, cede any right, title or interest in, pledge, or otherwise encumber any Subscription Share.

|

|

5.5

|

The amount due in respect of the Subscription Price and Interest shall be payable free of any deduction or set off and any taxes that may be levied thereon, which shall be for the account of the Subscriber.

|

|

6.1

|

If the Directors should at any time resolve to call on the shareholders of the Company to advance capital to the Company, either by way of share capital or loans, the Subscriber shall advance such capital pro rata to its shareholding in the Company at the date on which the Directors determine that the capital is required.

|

|

6.1.1

|

If the Subscriber is unable or unwilling to provide the capital required in terms of clause 6.1, then it shall notify the Company in writing to that effect within 30 (thirty) days of the date on which it is advised in writing (“the Finance Date”) by the Company that capital is required from it.

|

|

6.1.2

|

If the Company should receive a notice contemplated in clause 6.1.1, or if the Subscriber should fail to give a notice as contemplated in clause 6.1.1 and should fail to comply with its obligation to advance capital to the Company in terms of this clause 6.1 within 90 (ninety) days from the Finance Date, and if CHZ is prepared to provide the amount of the finance which the Subscriber was required to advance to the Company, then CHZ shall notify the Company in writing to that effect within 10 (ten) Business Days of receipt of the notice referred to in clause 6.1.1, or of failure by the Subscriber to advance capital as required in terms of this clause 6.1.

|

|

6.2

|

If the Subscriber is called upon to advance an amount to the Company in terms of clause 6.1 above, and if the Subscriber has declined or, as the case may be, failed to comply with such request in accordance with the provisions of clauses 6.1.1 and 6.1.2, then, if it shall have exercised the right to advance to the Company the amount which the Subscriber has declined to advance, CHZ shall have the right to call upon the Subscriber to sell to CHZ such number of shares at par as shall, after transfer thereof into the name of CHZ, result in CHZ holding such percentage of the issued voting capital of the Company as shall be equal to the percentage which the aggregate of loan capital and share capital contributed by CHZ to the Company constitutes of the total capital contributed by all shareholders by way of share capital and loan capital

|

|

7.1

|

The board of Directors shall be comprised of a minimum of 8 (eight) Directors.

|

|

7.2

|

The Parties agree that:

|

|

7.2.1

|

the Subscriber shall be entitled to appoint 1 (one) Director who shall be acceptable to the majority of the Board of Directors of the Company whose acceptance shall not be unreasonably withheld; and

|

|

7.2.2

|

CHZ shall be entitled to appoint 4 (four) Directors.

|

|

7.3

|

The Subscriber and CHZ shall have the right, from time to time, by notice in writing to the Company, to remove a Director nominated by it in terms of clause 7.1 as a Director and to nominate, in accordance with clause 7.2 another person in the place of the Director so removed.

|

8 MANAGEMENT OF THE COMPANY

For as long as any amounts are owed to the Company by the Subscriber on the Loan Account, the management of the Company shall continue to be undertaken by Greenstone Management Services (“Greenstone”) in terms of the existing management agreement between Greenstone and the Company on identical terms and conditions. The Parties undertake to vote in favour of all resolutions necessary to give effect to this clause 8 , failing which the vendor funding shall immediately be withdrawn and, the Subscriber asked to settle the outstanding balance in cash within 90 days of such notice, failing which the outstanding principal amount and interest shall automatically be converted into equivalent A shares and issued to CHZ.

|

9.1

|

All communications between the Parties and all information and other materials supplied to or received by a Party from any of the other Parties which relates in any way to this Agreement and to the Company shall be kept confidential by the Parties unless or until the relevant Party can reasonably demonstrate that:

|

|

9.1.1

|

any such communication, information or material is, or part of it is, in the public domain through no fault of its own; or

|

|

9.1.2

|

any such communication, information or material has been lawfully obtained from any third party; or

|

|

9.1.3

|

the information is already lawfully known to the relevant Party at the time that Party receives such information; or

|

|

9.1.4

|

the relevant Party is obliged by law to disclose such information,

|

whereupon this obligation in respect of that information shall cease.

|

9.2

|

The Parties shall use their best endeavours to procure the observance of these restrictions and shall take all reasonable steps to minimise the risk of disclosure of confidential information by ensuring that only they themselves and such of their employees, agents or consultants whose duties will require them to possess any of such information shall have access to such information, and will be instructed to treat the same as confidential.

|

|

9.3

|

The obligation contained in clause 9.2 shall endure, even after the termination of this Agreement, without limit in point of time, except and until such confidential information falls within any of the provisions of clauses 9.1.1 to 9.1.4, and shall be subject to the Company's confidentiality regime at the Signature Date.

|

The Parties undertake at all times to do all such things, perform all such actions and take such steps (including in particular the exercise of their voting rights in the Company) and to procure the doing of all such things, the performance of all such actions and taking of all such steps as may be open to them and necessary for or incidental to the putting into effect the provisions of this Agreement.

11 DOMICILIUM CITANDI ET EXECUTANDI

|

11.1

|

Each Party chooses the address set out opposite its name below as its domicilium citandi et executandi at which all notices, legal processes and other communications must be delivered for the purposes of this Agreement:

|

|

11.1.1

|

the Subscriber |

58 Broadlands Road

Emerald Hill,

Harare,

Zimbabwe

Email:july.ndlovu@mweb.co.za

[For attention: July Ndlovu]

|

|

11.1.2

|

the Company |

6th Floor Red Bridge NEEastgate

3rd Street and R. Mugabe Road

Harare

Zimbabwe

Fax: 263 284 23193

Email: CMangezi@blanketmine.com

[For attention: Mr. Caxton Mangezi]

|

|

11.1.3

|

CHZ |

6th Floor Red Bridge NEEastgate

3rd Street and R Mugabe Road

Email: SCurtis@caledoniamining.com

[For attention: Mr. Steven Curtis]

|

|

11.2

|

Any notice or communication required or permitted to be given in terms of this Agreement shall be valid and effective only if in writing, and delivered by hand or sent or transmitted by registered post, telefax or by email.

|

|

11.3

|

Each Party may by written notice to the other Parties change its chosen address and/or its chosen telefax number and/or its email address to another physical address, telefax number or email, provided that the change shall become effective on the fourteenth day after the receipt of the notice by the addressee.

|

|

11.4

|

Any notice to a Party:

|

|

11.4.1

|

sent by prepaid registered post to it at its chosen address;

|

|

11.4.2

|

delivered by hand to a responsible person during ordinary business hours at its chosen address;

|

|

11.4.3

|

transmitted during ordinary office hours by facsimile to its chosen telefax number; or

|

|

11.4.4

|

transmitted during ordinary office hours by email to its chosen email address,

|

unless the contrary is proved, shall be deemed to have been received, in the case of clause 11.4.1, on the 7th (seventh) Business Day after posting and, in the case of clauses 11.4.2, 11.4.3 and 11.4.4, on the day of delivery or transmission as the case may be.

12 BREACH AND TERMINATION

|

12.1

|

Should a Party (“the Defaulting Party”) commit a breach of any provision of this Agreement and fail to remedy such breach within 14 (fourteen) days from the date of written notice from any other Party to this Agreement (“the Aggrieved Party”) calling upon it to do so, the Aggrieved Party shall have the right, without prejudice to any other rights available in law, either:

|

|

12.1.1

|

if the breach complained of can be fully remedied by the payment of money, to take whatever action may be necessary to obtain payment of the amounts required by the Aggrieved Party to remedy such breach; or

|

|

12.1.2

|

if the breach complained of cannot be fully remedied by the payment of money, or, alternatively, if it can be so remedied and payment of any amounts claimed by the Aggrieved Party in terms of clause 12.1.1 is not made to the Aggrieved Party within 7 (seven) days of the date of determination through arbitration or legal process of the amount legally payable, to take whatever action may be necessary to enforce its rights under this Agreement or to terminate this Agreement,

|

and in either event to claim such damages as it may have suffered as a result of such breach of contract.

|

12.2

|

The Defaulting Party shall be liable for all costs and expenses (calculated on an attorney and own client scale) incurred as a result of or in connection with the default.

|

|

12.3

|

Without limiting the generality of this clause 12, if at any time it is or becomes unlawful for the Company to perform or comply with any or all of its obligations under this Agreement or any of its obligations under this Agreement are not or cease to be legal, valid, binding and enforceable, the Company shall be entitled, without prejudice to any other rights or remedies which it may have under this Agreement or otherwise, by written notice to the Subscriber, to claim immediate payment of the balance of the Subscription Price and all Interest accrued in terms thereof regardless of whether or not such amounts are then otherwise due and payable.

|

|

12.4

|

Notwithstanding the aforesaid, should the Subscriber institute and/or cause to be instituted, any legal action of any nature whatsoever against the Company, the Company shall have the right, exercisable by written notice given to the Subscriber at any time after the institution of any such legal action, to terminate this Agreement and purchase from the Subscriber all of the Subscription Shares at a value determined by the Auditors less any amounts owed by the Subscriber to the Company in terms of clause 5.1.

|

|

13.1

|

Any dispute arising out of this Agreement or the interpretation thereof, both while in force and after its termination, shall be submitted to and determined by arbitration in accordance with the provisions of the First Schedule to the Arbitration Act, 6 of 1996, (for the purpose of this clause 13, ("the Act"). Such arbitration shall be held in Harare unless otherwise agreed and shall be held in a summary manner with a view to it being completed as soon as possible.

|

|

13.2

|

There shall be one arbitrator, who shall be, if the question in issue is:

|

|

13.2.1

|

primarily an accounting matter, an independent chartered accountant of not less than 10 (ten) years' standing;

|

|

13.2.2

|

primarily a legal matter, a practising Senior Counsel or commercial attorney of not less than 10 (ten) years' standing; and

|

|

13.2.3

|

any other matter, a suitably qualified independent person.

|

|

13.3

|

The appointment of the arbitrator shall be agreed upon between the Parties, but failing agreement between them within a period of 14 (fourteen) days after the arbitration has been demanded by a Party by notice in writing to the others, a Party shall be entitled to request the High Court of Zimbabwe to make the appointment.

|

|

13.4

|

The arbitrator shall have the powers conferred upon an arbitrator under the Act.

|

|

13.5

|

A Party shall have the right to appeal against the decision of the arbitrator in accordance with the Act. The decision resulting from such appeal shall be final and binding on the Parties, and may be made an order of any court of competent jurisdiction. The Parties hereby submit to the jurisdiction of the High Court of Zimbabwe sitting at Harare should a Party wish to make the arbitrator's decision an order of Court.

|

|

13.6

|

The fact that any dispute has been referred to or is the subject of arbitration in terms of this clause 13, as well as any information submitted or furnished to the arbitrators or in any other manner forming part of the record of any arbitration proceedings, shall be kept confidential by the parties to such arbitration proceedings, and the parties to such proceedings shall use their reasonable endeavours to procure that all their employees, agents or advisers who are involved in or who obtain knowledge of any confidential information disclosed during such proceedings, shall be made aware of, and shall undertake in writing to be bound by, and to comply with, the provisions of this clause 13.

|

14 GOVERNING LAW AND JURISDICTION

|

14.1

|

The interpretation of this Agreement shall be governed by the law of the Zimbabwe in all respects.

|

|

14.2

|

Any Party shall be entitled to institute all or any proceedings against any the other Parties in connection with this Agreement in the High Court of Zimbabwe sitting at Harare.

|

|

15.1

|

In this Agreement, unless the context requires otherwise :

|

|

15.1.1

|

words importing any one gender shall include the other 2 (two) genders;

|

|

15.1.2

|

the singular shall include the plural and vice versa; and

|

|

15.1.3

|

a reference to natural persons shall include created entities (corporate or unincorporated) and vice versa.

|

|

15.2

|

In this Agreement, the headings have been inserted for convenience only and shall not be used for nor assist or affect its interpretation.

|

|

15.3

|

If anything in a definition is a substantive provision conferring rights or imposing obligations on anyone, effect shall be given to it as if it were a substantive provision in the body of this Agreement.

|

|

16.1

|

This Agreement contains the entire agreement between the Parties as to the subject matter hereof.

|

|

16.2

|

No Party shall have any claim or right of action arising from any undertaking, representation or warranty not included in this Agreement.

|

|

16.3

|

No failure by a Party to enforce any provision of this Agreement shall constitute a waiver of such provision or affect in any way that Party’s right to require performance of any such provision at any time in the future, nor shall the waiver of any subsequent breach nullify the effectiveness of the provision itself.

|

|

16.4

|

No agreement to vary, add to, or cancel this Agreement shall be of any force or effect unless reduced to writing and signed on behalf of all of the Parties to this Agreement.

|

|

16.5

|

No Party may cede any of its rights or delegate any of its obligations under this Agreement without the prior written consent of the other Parties to this Agreement.

|

|

16.6

|

This Agreement may be signed in counterparts, in which event the originals together will constitute the entire agreement between the Parties.

|

Each Party shall bear its own costs to be incurred in connection with the drafting and negotiation of this Agreement.

18 WARRANTY

The Company and CHZ warrant that the shareholder of the Company does not at the date of this agreement have any liability for the unlawful conduct of the business and affairs of the Company.

|

|

For:

|

BLANKET MINE (1983) (PRIVATE) LIMITED

|

|

|

_________________________________

Signatory:

Capacity:

Authority:

|

|

|

For:

|

CALEDONIA HOLDINGS ZIMBABWE (PRIVATE) LIMITED

|

|

|

_________________________________

Signatory:

Capacity:

Authority:

|

|

|

For:

|

FREMIRO INVESTMENTS (PRIVATE) LIMITED

|

|

|

_________________________________

Signatory:

Capacity:

Authority:

|

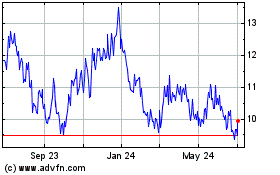

Caledonia Mining (AMEX:CMCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

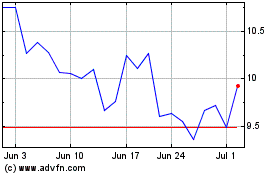

Caledonia Mining (AMEX:CMCL)

Historical Stock Chart

From Apr 2023 to Apr 2024